Have you ever wondered how to fairly divide resources among individuals or entities in a way that aligns with their contributions or entitlements? Whether you’re dealing with profits, expenses, or benefits, mastering the art of pro rata calculations can provide you with the answers you seek. In this guide, we’ll explore everything you need to know about pro rata, from its fundamental concepts to practical applications and software tools, equipping you with the knowledge and skills to ensure fair and equitable resource allocation in any context.

What is Pro Rata?

Pro Rata is a Latin term that translates to “in proportion.” In the world of finance and resource allocation, it refers to the method used to distribute resources, such as profits, expenses, or benefits, proportionally among participants or stakeholders based on predetermined criteria. The pro rata principle ensures fairness and equitable distribution, making it an essential concept in various industries and scenarios.

Purpose of Pro Rata

The primary purpose of pro rata calculations is to ensure that resources are allocated fairly and in proportion to each participant’s entitlement, contribution, or share. Pro rata serves as a guiding principle to:

- Promote Fairness: Pro rata ensures that individuals or entities receive their fair share based on relevant criteria, such as ownership, usage, or contribution.

- Prevent Bias: It helps eliminate bias or favoritism when distributing resources, ensuring that decisions are objective and transparent.

- Optimize Efficiency: Pro rata calculations streamline resource allocation processes, saving time and reducing the margin of error.

- Facilitate Transparency: By following pro rata principles, organizations can maintain transparency in their allocation decisions, fostering trust among stakeholders.

- Comply with Agreements: Pro rata principles are often embedded in legal contracts, lease agreements, and financial regulations, ensuring compliance and adherence to established terms.

Pro Rata Importance in Various Industries

Pro rata plays a critical role in numerous industries and scenarios, where fairness and equitable resource distribution are paramount. Its importance spans across:

- Finance and Investment: Pro rata is vital in distributing dividends, profits, and losses among shareholders and partners. It also plays a key role in bond coupon payments and interest rate calculations.

- Insurance: In the insurance industry, pro rata is used to determine policy premiums, adjust mid-term policy changes, and settle claims when multiple policies cover the same risk.

- Real Estate: Property owners and tenants rely on pro rata principles to allocate expenses, such as maintenance costs and property taxes, in multi-tenant buildings.

- Legal and Contracts: Pro rata clauses are common in lease agreements, contracts, and legal settlements, ensuring fair payments and benefits distribution.

- Business Partnerships: In partnerships, pro rata calculations help distribute profits, losses, and decision-making authority based on each partner’s contributions and ownership stakes.

- Resource Management: Pro rata is applied in various resource management scenarios, including energy allocation, resource sharing in research collaborations, and government funding distribution.

The importance of pro rata extends to any situation where resource allocation needs to be fair, transparent, and based on established criteria, making it a fundamental concept in modern business and finance.

Conclusion

Pro rata is a powerful tool that simplifies the fair distribution of resources in various aspects of life. Whether you’re dividing profits, calculating insurance premiums, managing real estate expenses, or navigating legal agreements, understanding pro rata calculations empowers you to make equitable decisions. Remember to consider factors like fractions, data accuracy, and ethical principles when using pro rata in practice.

Furthermore, pro rata software and spreadsheets offer efficient ways to streamline these calculations, reducing errors and saving valuable time. By choosing the right tool and following best practices, you can ensure precision and fairness in resource allocation. So, whether you’re a business professional, investor, landlord, or simply someone interested in making equitable decisions, the knowledge and tools provided in this guide will serve you well in your journey towards fair resource allocation.

Get Started With a Prebuilt Template!

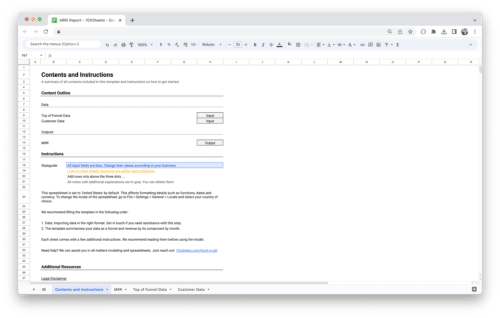

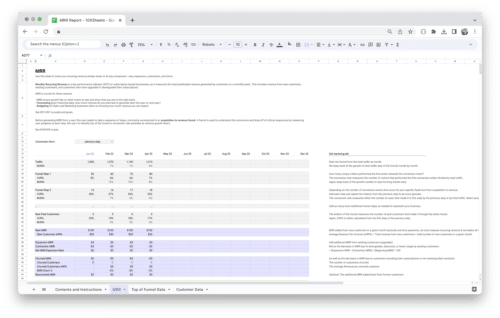

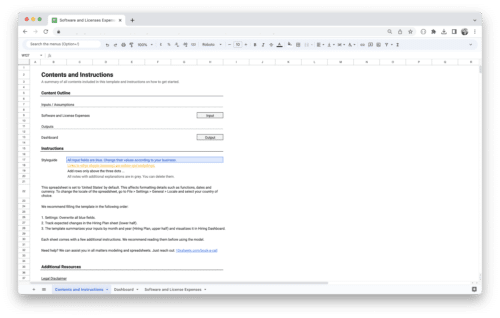

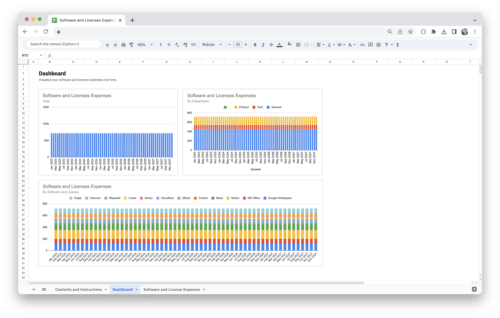

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.