$119.00 Original price was: $119.00.$79.00Current price is: $79.00.

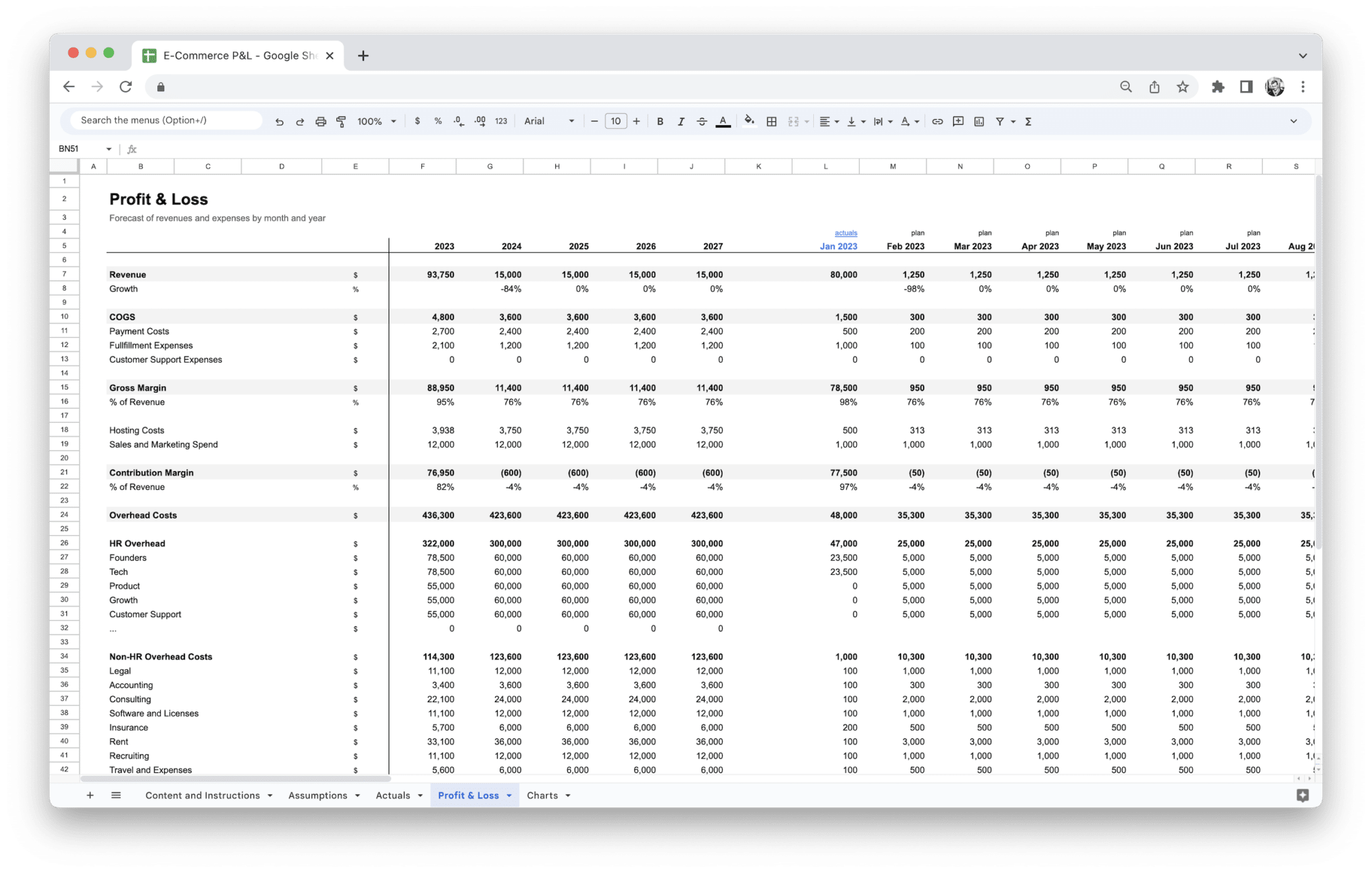

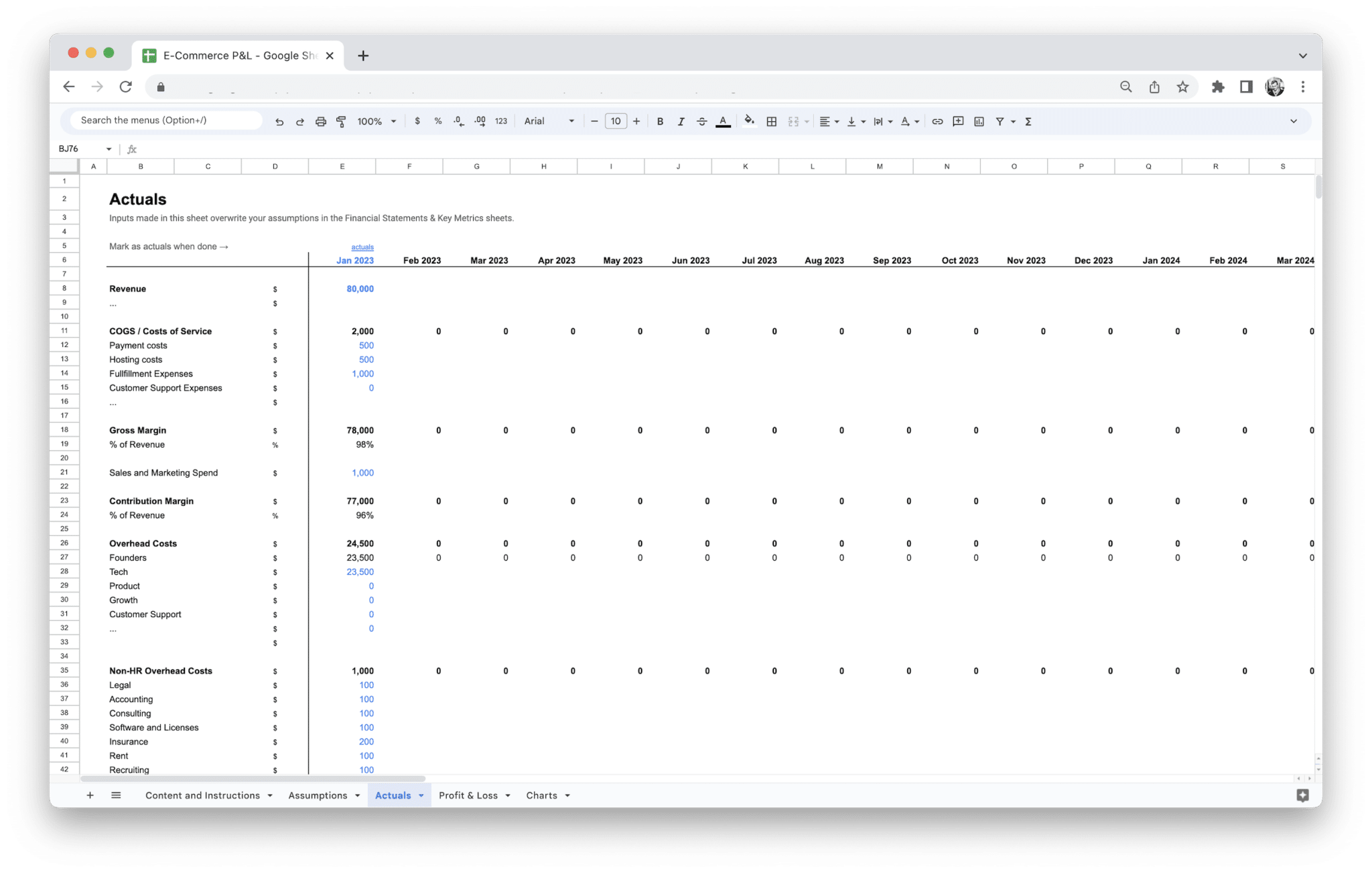

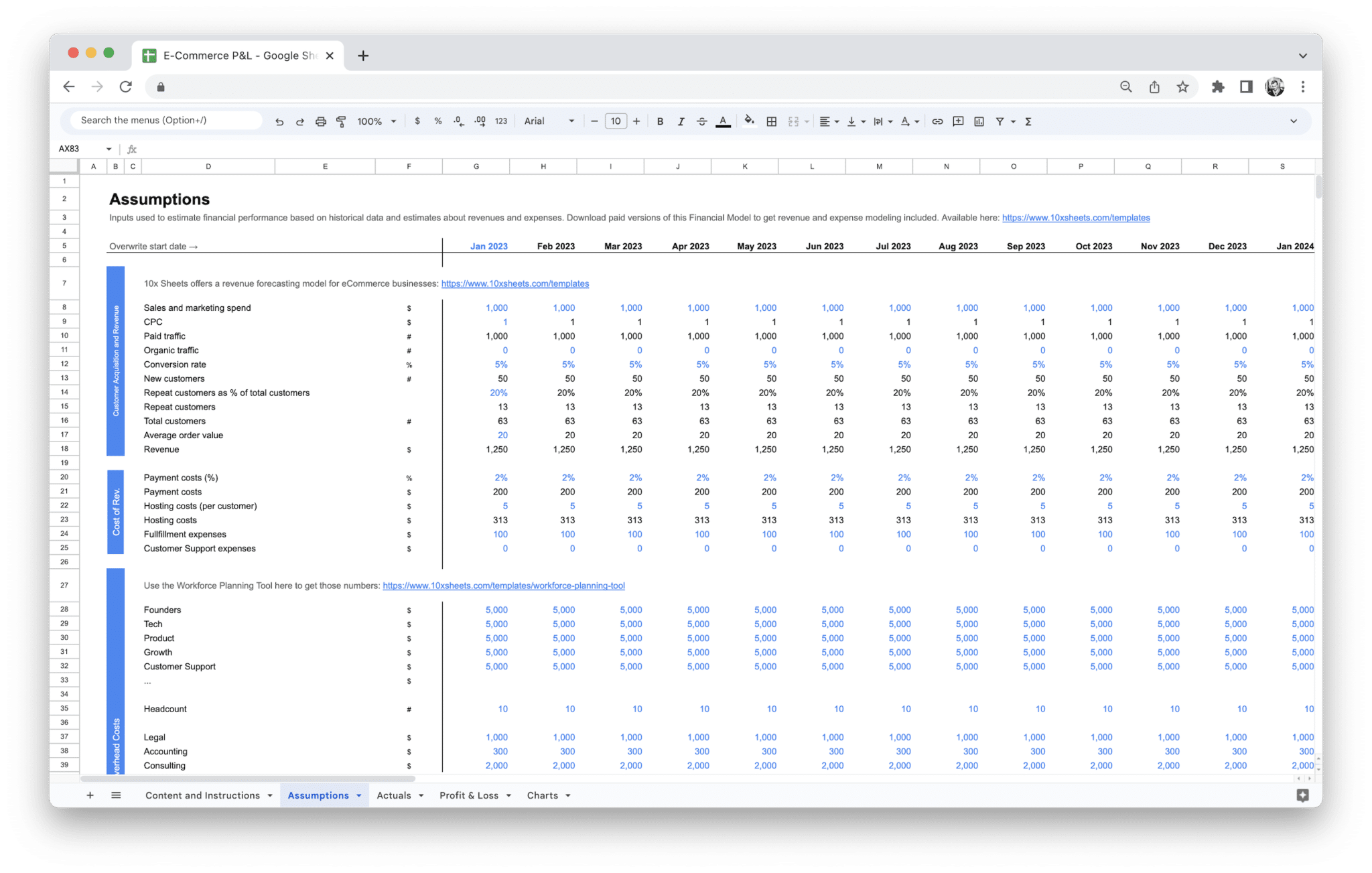

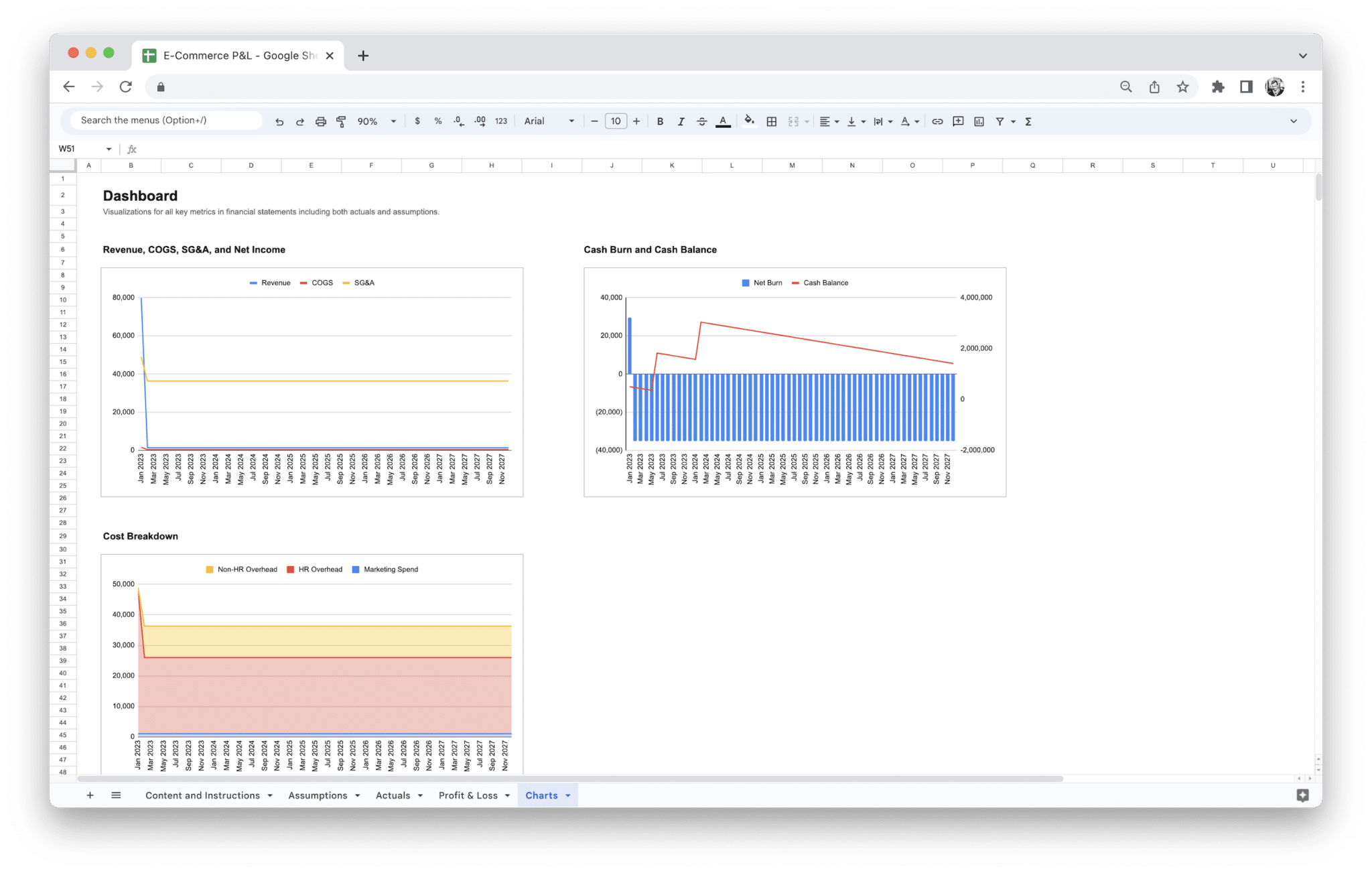

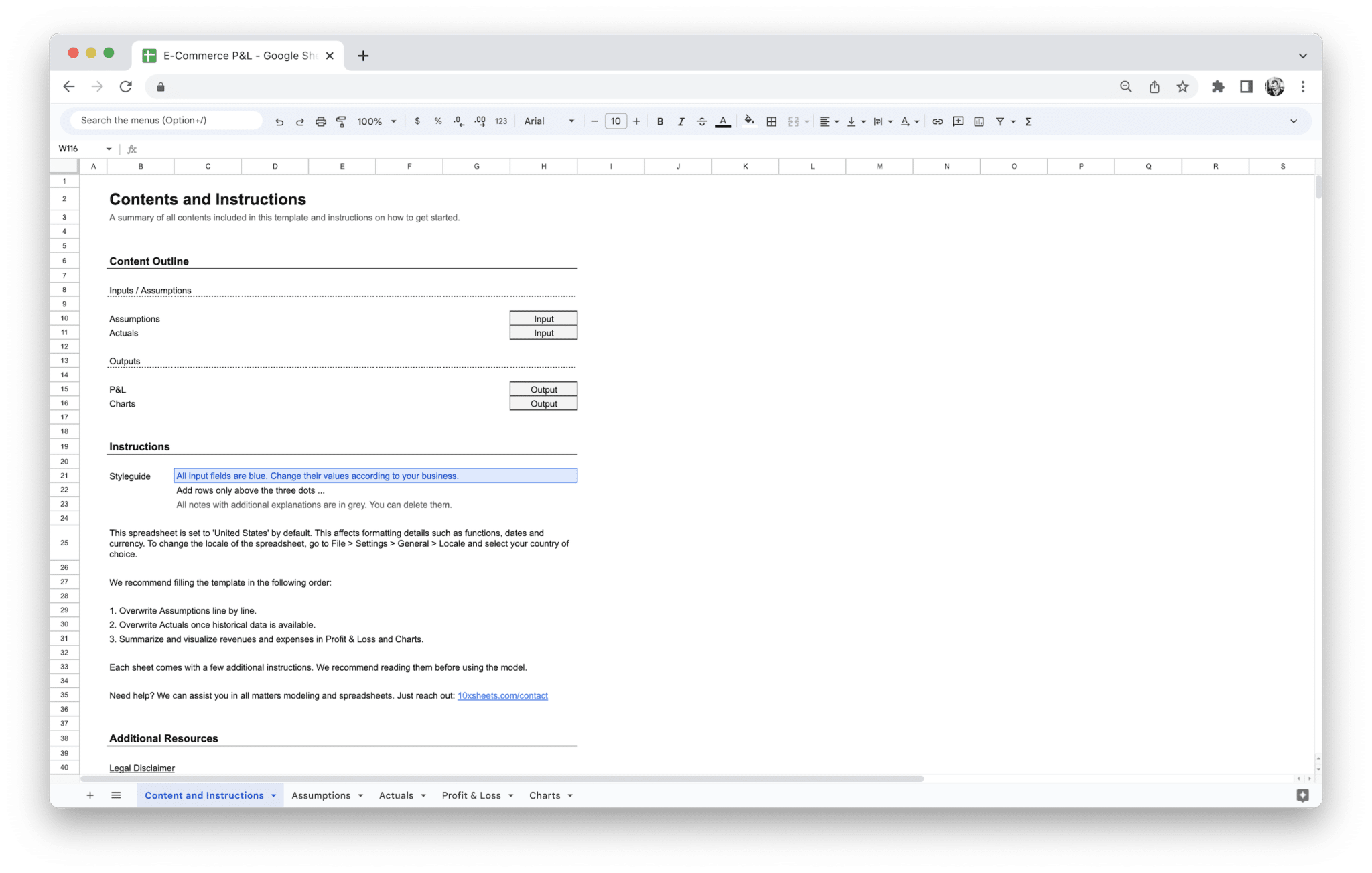

Start modeling your business’s financial performance with ease, and adapt it for any type of business to get ahead of the competition. Plus, get actuals and assumptions sheets, and a dashboard to visualize key metrics!

Description

Managing the financial side of your e-commerce business can be overwhelming. With so many moving parts—product costs, shipping fees, marketing expenses, and more—it can be difficult to keep track of your profits and losses in a way that’s both accurate and easy to understand. Without a clear overview of your financials, you may find yourself overspending, missing key opportunities, or even facing cash flow problems that could hurt your business in the long run.

Our E-Commerce P&L Statement Template solves these challenges by providing you with a simple yet powerful tool to track and manage your finances. This template helps you organize your income, costs, and expenses in a clear, structured format. It automatically calculates your gross and net profit, making it easy to see where your money is going and where you can cut costs. By using this template, you’ll be able to make more informed financial decisions, improve cash flow, and ultimately increase profitability. Say goodbye to the stress of financial management and take control of your business’s financial health with ease.

An E-Commerce Profit and Loss (P&L) statement is a financial document that outlines your business’s revenues, costs, and expenses over a specific period of time, typically monthly, quarterly, or annually. It serves as a summary of the financial performance of your e-commerce business, showing you whether you’re operating at a profit or a loss. A well-prepared P&L statement helps you understand how much money your business is making after deducting the costs and expenses incurred in generating that revenue.

The P&L statement includes various financial metrics, such as revenue from sales, the cost of goods sold (COGS), operating expenses, and taxes. Each of these elements plays a crucial role in giving you a comprehensive picture of your business’s financial health, guiding you toward better management practices and smarter strategic decisions. For e-commerce businesses, the P&L statement becomes even more vital because of the complexity of managing costs like product sourcing, shipping, advertising, and returns.

Purpose of a P&L Statement

A P&L statement is vital for many reasons, and understanding its purpose can help you make informed decisions about your e-commerce business. The key purposes include:

- Tracking Profitability: A P&L statement helps you track whether your e-commerce business is making money or operating at a loss over a specific period. It clearly shows how much revenue you’ve earned compared to your expenses, providing insight into your profit margins.

- Budgeting and Financial Planning: It allows you to set realistic financial goals, compare actual performance against projections, and make adjustments to stay on track.

- Tax Preparation: Your P&L statement is essential for preparing accurate tax filings. It gives you a snapshot of your business’s income and expenses, ensuring you comply with local tax laws.

- Attracting Investment or Loans: Investors, banks, and other funding sources often require a P&L statement to evaluate your business’s financial health before providing capital. It demonstrates your ability to generate profit and manage expenses effectively.

- Evaluating Operational Efficiency: A P&L statement provides valuable insights into where you are spending money, highlighting areas where you can reduce costs or optimize spending to improve profitability.

Importance of Tracking Profitability for E-Commerce Businesses

Tracking profitability is crucial for any business, but it is especially important for e-commerce companies due to the unique challenges they face. These businesses typically deal with fluctuating product costs, seasonality, variable shipping expenses, and marketing budgets, all of which make managing profit margins even more complex. Here’s why keeping track of profitability is essential for your e-commerce business:

- Ensures Financial Sustainability: By regularly assessing your profitability, you can ensure your business remains financially viable. It helps you identify trends and potential cash flow problems early on so you can address them before they become more serious issues.

- Helps Optimize Pricing and Product Strategy: Profitability analysis enables you to adjust your pricing strategy, ensuring that your products are priced to cover costs and generate a profit, while also staying competitive in the market.

- Guides Investment Decisions: Monitoring profitability can help you make smarter decisions about reinvesting in your business, whether it’s expanding your product line, increasing your marketing budget, or upgrading your technology.

- Prevents Overspending: Profitability tracking allows you to keep an eye on your expenses, ensuring that you’re not overspending in areas like marketing or shipping, which can eat into your profits if not carefully managed.

- Supports Long-Term Growth: By continuously tracking and improving profitability, you can create a foundation for sustained growth. Understanding where your profit margins are and how to increase them gives you the roadmap to scale your business effectively.

Key Elements of a P&L Statement in E-Commerce

The components of a P&L statement are designed to give you a clear overview of how your business is performing. Each section of the statement provides insight into different aspects of your operations, from sales revenue to cost management. The key elements of an e-commerce P&L statement typically include:

- Revenue: This represents the total income generated from the sale of goods or services during a specified period. For e-commerce businesses, this includes sales of physical or digital products, along with any additional income like shipping fees or affiliate commissions.

- Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing or acquiring the products you sell. This includes manufacturing costs, wholesale prices, packaging, and shipping fees for goods sold.

- Gross Profit: This is the difference between your revenue and COGS. Gross profit gives you an idea of how well you’re managing the costs directly tied to product creation and sales. A higher gross profit margin indicates that you’re effectively controlling production or procurement costs.

- Operating Expenses: These are the indirect costs necessary for running your business, including marketing expenses, salaries, rent, software subscriptions, utilities, and any other overheads that don’t directly contribute to product production.

- Net Profit: This is the bottom line of your P&L statement. After subtracting all operating expenses, taxes, and interest from your gross profit, the resulting figure is your net profit. It represents the true profit your business has earned after all costs have been considered.

How a P&L Statement Helps with Business Analysis and Decision-Making

A P&L statement is a powerful tool that provides you with the data necessary for effective decision-making. By regularly reviewing your P&L, you gain actionable insights that can guide your business strategies and improve operational efficiency. Here’s how the P&L statement can support business analysis and decision-making:

- Spotting Trends and Patterns: The P&L statement highlights financial trends over time, such as changes in revenue, increasing operating expenses, or rising product costs. Identifying these trends early on allows you to take proactive measures to mitigate issues before they negatively impact profitability.

- Assessing Operational Efficiency: A detailed P&L helps you identify areas where your business might be spending too much, such as high advertising costs or excessive shipping fees. By analyzing these figures, you can adjust your operations, cut unnecessary expenses, and improve profitability.

- Evaluating Profitability by Product: For e-commerce businesses with a large product range, a P&L statement can help you assess the profitability of individual products. If certain products are generating high revenue but low gross profit, it may signal that costs associated with those products need to be reduced or that pricing strategies should be revisited.

- Strategic Planning: Whether you’re planning for seasonal sales, budgeting for a new marketing campaign, or preparing for business expansion, a P&L statement provides the data needed to set realistic goals and allocate resources effectively. You can identify high-performing areas and focus investments there or address underperforming areas before they lead to losses.

- Improving Cash Flow Management: Regularly tracking income and expenses via a P&L statement helps you understand your cash flow position, ensuring that you have enough funds to cover operational expenses, pay taxes, and reinvest in growth opportunities. Managing cash flow effectively is critical to maintaining smooth operations and avoiding disruptions.

By providing you with a clear, data-driven snapshot of your business’s financial health, a P&L statement becomes an indispensable tool for making informed, strategic decisions. It helps you identify profitable areas, manage costs, and adjust your strategies to ensure long-term sustainability and growth for your e-commerce business.

The Profit and Loss (P&L) statement for an e-commerce business serves as the financial backbone of your operations. It details your income, costs, and expenses, allowing you to measure profitability and make informed decisions. By understanding each component of a P&L statement, you can better manage your business finances and pinpoint areas for improvement. Let’s take a closer look at each component and how it impacts your business.

Revenue: Sales of Products, Shipping Fees, and Other Income

Revenue is the first line in any P&L statement and represents the total income your business generates. For an e-commerce company, this figure can come from a variety of sources, primarily product sales, but there can be additional streams of income too. Revenue sets the stage for understanding your business’s financial health and is one of the first indicators that shows whether you’re heading in the right direction.

Product sales are usually the main contributor to your revenue. This includes the sale of both physical and digital products on your website. For example, if you run a clothing store, your revenue will reflect the total amount of money you earn from selling clothes. The same goes for digital products like eBooks, courses, or downloadable software.

Shipping fees are another income source that should be included in your revenue. While you might pass these fees directly onto the customer, they still count as part of your total income. For instance, if you charge customers $5 for shipping, that amount will add to your overall revenue. It’s important to accurately track these fees so they are properly accounted for.

In some cases, there are other sources of income that can contribute to your revenue. This could include things like affiliate marketing commissions, upsell revenue, subscription payments for ongoing services, or even advertising revenue if you have a monetized platform. Every penny that comes into your business from any of these activities should be captured under your revenue.

Cost of Goods Sold (COGS): Direct Costs of Products Sold

The Cost of Goods Sold (COGS) is one of the most important figures on your P&L because it directly impacts your gross profit. COGS includes all the direct costs associated with producing or acquiring the products you sell. This is a critical component because it allows you to measure the efficiency of your business in terms of product cost relative to sales. The lower your COGS, the higher your profitability.

For e-commerce businesses, COGS includes several direct costs:

- Manufacturing Costs: If you’re producing products yourself, these costs include raw materials, labor, and factory overhead associated with the production of your items. For example, if you’re selling custom t-shirts, the cost of fabric, printing, and labor for each shirt would be part of your COGS.

- Wholesale Costs: If you’re sourcing products from other manufacturers or suppliers, the amount you pay them for the goods you resell is part of COGS. For example, if you run an online store that sells electronics, the wholesale cost of each unit you purchase from a supplier should be counted here.

- Shipping and Handling Costs: This includes any fees associated with moving goods from suppliers to your warehouse or fulfillment center. These costs can sometimes be overlooked, but they play an important role in determining your overall profitability.

- Returns and Refunds: E-commerce businesses often face returns, which can directly impact your COGS. If a customer returns a product, the cost associated with processing that return (like restocking fees or shipping costs) should be considered part of your COGS. Understanding this helps you assess how returns affect your profitability.

Accurately calculating COGS is crucial because it helps you understand the cost structure of your business and sets the stage for calculating gross profit. If your COGS is too high compared to revenue, it might indicate inefficiencies in production or procurement that need to be addressed.

Gross Profit: The Difference Between Revenue and COGS

Gross profit is essentially the difference between your revenue and the direct costs associated with producing or purchasing the goods you sell. This is an important metric because it helps you evaluate the profitability of your core business operations without factoring in other expenses like marketing or salaries.

The formula for calculating gross profit is simple:

Gross Profit = Revenue – COGS

For example, if your total revenue from sales in a given period is $10,000 and your COGS is $4,000, your gross profit would be $6,000. This means that after covering the direct costs of the goods you sold, you have $6,000 left before covering other business expenses like marketing, administrative costs, or taxes.

Gross profit is a key indicator of how efficiently your business is operating. A high gross profit margin suggests that you’re managing production costs well and generating a solid return on sales. On the other hand, a low gross profit margin can be a red flag that your direct costs are too high, which could be an indication that you need to renegotiate supplier contracts or streamline production processes.

Operating Expenses: Advertising, Software, and Other Overheads

Operating expenses represent the costs of running your e-commerce business that aren’t directly tied to the production or purchase of your goods. These expenses are necessary for keeping the business running but don’t contribute directly to product manufacturing. Tracking these expenses is essential for understanding how much it costs to maintain operations outside of the direct sales process.

Common operating expenses for e-commerce businesses include:

- Marketing and Advertising Costs: For most e-commerce businesses, advertising is one of the biggest ongoing expenses. Whether you’re running Google Ads, Facebook Ads, or paying influencers for product promotion, these costs add up quickly. It’s important to track how much you’re spending on each marketing channel to ensure you’re getting a positive return on investment (ROI).

- Software and Subscriptions: Running an e-commerce business often requires various software tools, such as e-commerce platforms (like Shopify or WooCommerce), customer relationship management (CRM) systems, email marketing software, and accounting tools. These software costs should be tracked as part of your operating expenses.

- Employee Salaries: If you have employees or contractors, their wages or salaries should be accounted for in this category. This includes everyone from your customer service team to your content creators or warehouse staff. Salaries are a necessary part of running your business, and understanding this expense is crucial for cash flow management.

- Rent and Utilities: If you have a physical location, whether it’s a warehouse, office, or retail space, the costs for rent, electricity, water, and other utilities should be included in operating expenses. While many e-commerce businesses operate primarily online, those with a physical space still need to account for these overheads.

Operating expenses are vital because they impact your overall profitability. They are often necessary for growing your business, but managing them efficiently will ensure that your revenue is spent wisely.

Taxes and Interest: Accounting for Tax Liabilities and Loan Interests

Taxes and interest expenses are unavoidable for most businesses, but they need to be tracked accurately. This section includes everything from the taxes you owe on your business’s income to any interest payments on loans or credit lines you may have.

- Taxes: The taxes your e-commerce business is liable for can vary depending on your location and business structure. Sales tax, income tax, and VAT (Value Added Tax) are some common tax liabilities that e-commerce businesses face. It’s crucial to stay on top of tax requirements to avoid penalties, and this section helps ensure you’re accounting for all taxes you need to pay.

- Interest: If your business has taken out loans or lines of credit, the interest payments on those debts should be included here. For example, if you took out a loan to fund inventory purchases, the interest you pay on that loan each month is considered an operating expense.

Properly accounting for taxes and interest allows you to have a more accurate picture of your net profit and ensures that your business remains compliant with local tax laws.

Net Profit: Final Calculation of Profit After All Expenses

Net profit is the ultimate measure of your business’s profitability and represents what you actually “take home” after all expenses—both direct and indirect—have been accounted for. This is the amount of money left over once you’ve subtracted the costs of producing your goods, your operating expenses, taxes, and interest.

The formula for calculating net profit is:

Net Profit = Gross Profit – Operating Expenses – Taxes – Interest

For instance, if your gross profit is $6,000, your operating expenses are $3,000, taxes and interest total $500, your net profit would be $2,500. This figure is what reflects the actual financial health of your business and shows whether you’re operating sustainably.

Net profit is especially useful when you want to assess the overall financial viability of your e-commerce business. If you’re seeing consistent positive net profit, it indicates that your business is in good shape, and you can reinvest those profits into growth. Conversely, if your net profit is negative, it’s a sign that you need to closely examine your costs, pricing strategy, or sales performance.

Understanding and analyzing each of these components will provide you with a clearer, more accurate picture of your e-commerce business’s financial performance, helping you make more informed and strategic decisions.

Creating a Profit and Loss (P&L) statement for your e-commerce business may seem like a daunting task at first, but breaking it down into simple steps can make the process much more manageable. The key to a successful P&L is accuracy—without it, you can’t make informed decisions about your business. By following the right steps, organizing your data carefully, and leveraging tools that can simplify the process, you’ll have a clear picture of your financial health. Let’s walk through how to build your own P&L statement.

Gathering Data

The first and most important step in creating an accurate P&L statement is gathering all the necessary financial data. You can’t accurately report your profits, losses, or expenses without first collecting every piece of information that reflects your business’s financial activities.

Start by collecting all of your revenue data. This includes any and all income generated through product sales, shipping fees, and additional income streams like affiliate marketing or subscription fees. You’ll need to pull reports from your e-commerce platform (Shopify, WooCommerce, etc.) to get a complete view of your sales. Don’t forget to account for sales that might have been refunded or canceled, as these will affect your revenue total.

Next, gather your COGS data. This should include all costs directly tied to the production or procurement of the products you’re selling. If you’re buying products wholesale, this means pulling invoices from suppliers. If you’re manufacturing your own products, include the costs for raw materials, labor, and production. For shipping and handling costs, make sure to track both the costs to receive the products into your warehouse and the costs to ship them to your customers.

Then, collect your operating expenses. This can include a wide variety of costs, from marketing and advertising to software subscriptions and employee salaries. Many e-commerce businesses also have recurring costs, such as hosting fees for their websites or monthly fees for platforms like Shopify. Be sure to include all of these, and remember that even small costs add up. For instance, your business may be spending money on accounting software or email marketing tools—each of these is important to track.

Once you have all of this data in hand, you can proceed to the next step: organizing and calculating. Keep in mind that the more organized you are at this stage, the easier it will be to build your P&L statement.

Organizing Income and Expenses Correctly

Once you’ve gathered all the data, the next challenge is organizing it in a way that makes sense and allows you to accurately calculate your gross profit and net profit. A clear and systematic organization is key to creating a P&L statement that provides actionable insights.

Start by dividing your data into the key sections of the P&L: Revenue, Cost of Goods Sold (COGS), Operating Expenses, and Other Costs (like taxes and interest). Within each section, break down the various income streams and expenses that fall under them. For example, under Revenue, you might separate income from product sales, shipping fees, and other income (such as affiliate earnings) into their own categories.

With COGS, be sure to separate costs related to production or procurement, shipping/handling, and any returns or restocking fees. By categorizing these elements, you’ll be able to quickly calculate your gross profit later on.

When it comes to operating expenses, it’s important to create categories that reflect your specific business model. For instance, you might have separate categories for marketing expenses, website maintenance, salaries, and administrative costs. These categories will help you track where your money is going and identify areas where you might be able to cut costs.

Finally, include any taxes and interest as a separate section. These aren’t part of your operating expenses, but they need to be tracked carefully to ensure that you’re accurately calculating your final net profit.

Once you’ve categorized everything, use the following formula to calculate your gross profit:

Gross Profit = Revenue – Cost of Goods Sold

Then subtract your operating expenses and taxes to determine your net profit:

Net Profit = Gross Profit – Operating Expenses – Taxes – Interest

This structured approach to organizing your financial data will give you clarity and accuracy when creating your P&L statement.

Tips for Accurate Financial Record-Keeping

Accurate record-keeping is the foundation of any successful P&L statement. If you make errors in tracking your income or expenses, it could lead to miscalculations in your financial statements. Here are some tips to help you keep your records in tip-top shape:

- Use Consistent Categories: Set up clear and consistent categories for your income and expenses. This will make it easier to track trends over time and will help you avoid confusion when pulling data for your P&L statement.

- Track Every Transaction: Whether it’s a $5 fee for a plugin or a $500 ad campaign, every expense matters. Use your accounting software or a manual system to log every transaction as it happens to ensure that nothing gets overlooked.

- Reconcile Your Accounts Regularly: Regularly reconcile your accounts to ensure that your financial records match your bank statements. This helps you catch any discrepancies early on and keeps your records up to date.

- Document Receipts and Invoices: Keep all receipts and invoices for expenses related to your business. Digital copies are fine, but make sure you store them in an organized system. You can refer back to these when calculating your expenses and verifying your financial records.

- Stay Consistent with Dates: It’s easy to get lost in the details, especially when tracking monthly revenue and expenses, but it’s important to be consistent with the date range for each statement. Ensure that your P&L statement reflects the same time period consistently for all the entries.

By implementing these best practices in financial record-keeping, you’ll reduce the chances of mistakes and make the P&L creation process much smoother.

Using Accounting Software for Automation

While creating a P&L statement manually is possible, using accounting software can significantly streamline the process, especially as your business grows. These tools not only save you time, but they also help reduce errors and ensure that your financial data is always up to date.

Accounting software like QuickBooks, Xero, and FreshBooks offers robust tools for tracking revenue, COGS, and operating expenses. These platforms allow you to link your e-commerce platform (e.g., Shopify or WooCommerce) directly to the accounting software, automatically importing sales data. This eliminates the need for manual data entry, reducing the chance of errors.

Many of these platforms also have built-in features to help you categorize and organize your income and expenses. They allow you to set up specific categories for various types of revenue and expenditures, which makes tracking and reporting much more efficient. Some even have automated reports that can generate P&L statements for you based on the data you’ve already entered.

Moreover, accounting software can simplify tax tracking. With real-time data on your income and expenses, it’s much easier to calculate your tax liabilities and ensure compliance with local tax laws. You can even generate tax reports directly from the software, which makes the filing process much easier.

Most importantly, accounting software provides integration with other tools you might be using, such as payroll systems or payment processors, making your overall business management more cohesive. These tools ensure that all of your financial data is in one place, which is key when generating accurate, timely financial statements.

By automating the process with accounting software, you’ll have more time to focus on growing your business and less time spent on tedious data entry and manual calculations. It’s a smart investment that pays off in both time savings and accuracy.

Creating an e-commerce Profit and Loss statement doesn’t need to be complicated. With a clear process, careful organization, and the right tools, you can produce a P&L statement that gives you valuable insights into your business’s financial health. By following these steps and using automation, you’ll have a streamlined way to track profits, identify growth opportunities, and make smarter business decisions.

An E-Commerce Profit and Loss (P&L) template is an essential tool for tracking your business’s financial performance. It provides a structured format to help you categorize and organize your income, expenses, and profits over a specific period of time. Having a well-designed template ensures that you stay on top of your financial data, making it easier to evaluate your business’s profitability and plan for future growth. Rather than starting from scratch, using a template can simplify the process and save you time while ensuring accuracy.

Whether you are a small online store or a large e-commerce company, having a P&L template helps standardize your financial reporting. With the right template, you’ll be able to generate consistent financial statements, gain better visibility into your performance, and make data-driven decisions. Let’s take a closer look at what makes an e-commerce P&L template so useful and how it can benefit your business.

What is an E-Commerce Profit and Loss Template?

An e-commerce Profit and Loss template is a pre-designed spreadsheet or document that outlines the income and expenses of an e-commerce business over a certain time period. It serves as a blueprint for calculating revenue, cost of goods sold (COGS), operating expenses, and ultimately determining whether your business is profitable or facing a loss.

The template typically includes columns for income (like product sales), expenses (like marketing, software subscriptions, and operational costs), and other key financial figures such as taxes and interest payments. It often comes with formulas built in, allowing you to quickly calculate your gross profit, net profit, and other important financial metrics.

For example, the template may ask you to input the total revenue from your sales, the cost of goods sold (COGS), and then automatically calculate the gross profit by subtracting COGS from revenue. It will then allow you to input additional costs like marketing, salaries, and office expenses to calculate your net profit at the bottom.

While templates are often used by businesses of all sizes, they are especially helpful for e-commerce stores that need to manage variable costs and track income sources from multiple channels. A good P&L template can serve as an ongoing financial management tool that you update regularly, whether monthly, quarterly, or annually.

Key Features in an E-Commerce Profit and Loss Template

When you’re looking for a reliable e-commerce P&L template, you want to make sure it has several key features that will help you track your finances effectively. Below are the essential components and functionalities that make a good template stand out:

- Clear Categorization of Income and Expenses: A well-structured template will include sections that separate different categories of income and expenses. Income could be broken down into product sales, shipping income, and other revenue streams, while expenses could be categorized into COGS, marketing costs, salaries, and overhead costs. This makes it easier to track and manage specific financial areas.

- Automatic Calculations: One of the key benefits of using a template is that it will typically come with built-in formulas that help calculate your gross profit, operating profit, and net profit automatically. For example, after inputting your revenue and COGS, the template will calculate your gross profit and allow you to subtract operating expenses to calculate net profit.

- Expense Breakdown: A great P&L template allows you to track different types of expenses, from COGS to operational costs like marketing, rent, and salaries. It will often allow you to further break down your marketing expenses by different channels (Google Ads, social media, influencer marketing, etc.) and track recurring expenses like software subscriptions, hosting fees, and insurance premiums.

- Flexible Time Periods: Some templates allow you to input data for different time periods, such as monthly, quarterly, or yearly reports. This flexibility helps you track your performance over different timeframes, giving you a clearer picture of trends, seasonality, and growth patterns.

- Easy-to-Read Dashboard: An intuitive dashboard or summary section is key for understanding your financial position at a glance. Many templates come with a section that provides a high-level overview of your business’s financial health, showing key metrics like revenue, gross profit, operating profit, and net profit. This feature saves you from having to dig through a lot of data to get an immediate understanding of where you stand financially.

- Customizable Fields: A good e-commerce P&L template should allow for customization based on your unique business needs. For example, if you run a subscription-based e-commerce model, you may want to track recurring revenue streams separately. Custom fields allow you to tailor the template to better reflect the specific nature of your business.

- Multi-Currency and Multi-Language Support: If you’re operating internationally or have customers in different countries, you might need to work with different currencies or languages. Some advanced P&L templates support multi-currency conversion and localization, making it easier to manage a global e-commerce business.

- Visual Analytics: Some templates include built-in charts or graphs to help you visualize key financial metrics. This could include pie charts for expense distribution, line graphs for revenue trends, or bar charts for comparing monthly profit growth. These visuals make it easier to digest the data and spot trends more quickly.

Why Use an E-Commerce Profit and Loss Template?

You might wonder why you need to use a template when you can manually calculate your P&L statement. While it’s true that you could technically create a P&L from scratch, there are several reasons why a template is highly beneficial for e-commerce business owners:

- Time Savings: A P&L template saves you considerable time by offering a structured format and automatic calculations. You don’t have to create formulas or organize data manually—just input your numbers, and the template does the rest. This is especially helpful for busy business owners who need to focus on other aspects of their business.

- Accuracy and Consistency: Manual calculations can easily lead to errors, especially when you’re dealing with complex financial data. Templates help eliminate mistakes by providing accurate formulas and predefined categories. This ensures consistency across all of your P&L statements, making it easier to compare financial performance over time.

- Simplified Financial Analysis: An e-commerce P&L template allows you to focus on the most important financial metrics, such as revenue, gross profit, and net profit. By organizing your data in a simple format, the template helps you identify trends and patterns in your business’s performance, such as rising operational costs or a drop in revenue during a certain period. This makes it easier to make decisions that can help improve profitability.

- Tracking Business Performance: Regularly updating your P&L template allows you to monitor your business performance over time. For example, if you’re seeing a drop in sales, you can use your P&L to figure out whether it’s due to increased COGS, higher marketing costs, or other factors. This kind of tracking is essential for making adjustments and planning future business strategies.

- Tax and Financial Planning: Having a well-organized P&L statement helps during tax season, as it makes it easier to calculate taxable income and report financial data accurately. It also helps you plan your business’s financial future. Knowing where you’re spending money and how much profit you’re generating allows you to set realistic financial goals and allocate resources more effectively.

- Investor and Lender Communication: If you are seeking investment or a loan, having a P&L statement ready can help you present your financial situation to potential investors or lenders. A clear, easy-to-understand template shows that you’re serious about managing your finances and can provide a professional, transparent snapshot of your business’s financial health.

- Scalability: As your e-commerce business grows, so will your financial data. Using a template ensures that as your revenue, expenses, and product offerings expand, your P&L reporting remains organized and manageable. This scalability is crucial for supporting business growth while maintaining financial oversight.

Using an e-commerce P&L template not only simplifies financial management but also helps you keep a tight grip on your business’s performance, costs, and profitability. By leveraging a template, you can optimize your business strategy, improve decision-making, and ensure long-term success.

An e-commerce Profit and Loss (P&L) statement is an invaluable tool for understanding the financial health of your business. It helps you keep a clear record of your revenue, costs, and profits, enabling smarter decision-making. Here are some key benefits you’ll gain from using a P&L statement:

- Improved Financial Visibility: It provides an organized view of all your income and expenses, allowing you to easily track where your money is coming from and where it’s going.

- Better Decision-Making: With a P&L statement, you can identify trends, areas of overspending, and profitable revenue streams, giving you data-driven insights for strategic decisions.

- Informed Budgeting and Forecasting: A P&L statement helps you set realistic financial goals and forecast future cash flow based on historical data, ensuring you’re prepared for changes in revenue or expenses.

- Easier Tax Filing and Compliance: By keeping a well-organized record of your finances, a P&L statement simplifies the tax filing process and helps ensure you’re compliant with relevant tax laws.

- Operational Efficiency: Analyzing your P&L allows you to spot inefficiencies in your business operations—whether it’s high production costs or expensive marketing channels—and adjust accordingly.

- Attracting Investment and Financing: Investors and lenders often require a detailed P&L statement to evaluate the viability and profitability of your business before offering funding. Having one readily available builds credibility.

- Long-Term Business Sustainability: Regularly reviewing your P&L helps you manage cash flow effectively, reduce unnecessary expenses, and reinvest profits to fuel growth, all contributing to long-term business success.

Once you’ve chosen a P&L template for your e-commerce business, it’s time to get started. Here’s how you can make the most out of the template and leverage it to monitor your financial performance effectively:

- Set Up the Template with Your Business Information: Fill in your company’s details at the top of the template, such as business name, reporting period, and the type of revenue you track (sales, shipping income, etc.).

- Input Your Revenue Data: Enter all sources of income, including product sales, shipping fees, and any other income streams you might have, such as subscription models or affiliate commissions.

- Enter Your Cost of Goods Sold (COGS): Include all direct costs of producing or acquiring the products you sell, such as manufacturing costs, wholesale purchases, and shipping/handling fees.

- Track Operating Expenses: Input costs related to running your business, including marketing, software subscriptions, salaries, and other overheads like rent or utilities.

- Update for Returns and Refunds: If any products are returned or refunded, ensure that you adjust your revenue and COGS accordingly to get an accurate picture of your net income.

- Input Taxes and Interest: Be sure to account for any taxes and interest payments to get a true sense of your net profit. This ensures that you’re not overlooking hidden costs.

- Review Your Profit and Loss: After entering all the data, calculate your gross profit, operating profit, and net profit. Use the dashboard to get an at-a-glance view of your business’s performance and profitability.

- Regularly Update the Template: Ensure you update your template regularly with new financial data (monthly, quarterly, or annually) to track trends and make informed decisions.

Keeping your Profit and Loss statement up to date is essential for maintaining an accurate view of your business’s financial health. Here’s how often you should update your P&L statement to keep things on track:

- Monthly: If you’re running a fast-paced business with fluctuating sales and expenses, updating your P&L statement monthly ensures you’re on top of any changes in your financial landscape. This allows you to spot issues early and make adjustments.

- Quarterly: For businesses with steady or slower growth, updating the P&L quarterly may be sufficient. This allows you to evaluate your performance over a three-month period and adjust your strategy accordingly.

- Annually: If you’re operating in a low-variance environment with minimal changes in costs and sales, an annual update may be enough. However, this only works if you’re also tracking key financial metrics more frequently to avoid missing important shifts.

- During Major Business Events: If your business undergoes major events such as product launches, holiday sales, or a sudden change in operating costs, you should update the P&L to reflect these fluctuations. This will give you real-time insights into the financial impact of those events.

- Before Key Financial Decisions: Always update your P&L when preparing for significant business decisions such as securing funding, applying for loans, or planning large investments. Updated financial data will give you the confidence to make informed decisions.

Consistent updates help you avoid surprises, keep your cash flow under control, and allow for timely, data-backed decisions to grow your business. Whether it’s monthly, quarterly, or in response to major events, regular P&L updates are crucial for financial clarity.

Creating a Profit and Loss statement is a critical step in managing your business’s finances. However, there are several common mistakes that can undermine the effectiveness of your P&L and lead to inaccurate financial reporting. Here are the mistakes you should watch out for:

- Misclassifying Expenses: Confusing operating expenses with COGS or mislabeling income sources can lead to inaccurate calculations, affecting the accuracy of your gross and net profit.

- Failing to Track All Income Sources: Overlooking secondary income sources, such as affiliate sales, subscription fees, or upsells, can skew your revenue totals.

- Omitting Variable Costs: Forgetting to account for seasonal costs, such as shipping fees during holiday rush periods or higher production costs during peak sales months, can give you an incomplete financial picture.

- Not Accounting for Returns and Refunds: In e-commerce, product returns are inevitable. Neglecting to adjust your revenue and COGS figures for returns can lead to inflated profit margins.

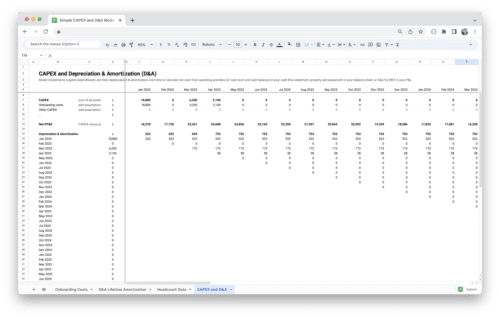

- Ignoring Non-Cash Expenses: Items like depreciation, amortization, or stock obsolescence might not involve direct cash payments but still need to be considered as they affect your profit calculations.

- Overlooking Taxes and Interest: Failing to factor in the taxes owed or the interest on loans can significantly skew your net profit, leaving you with an unrealistic understanding of your profitability.

- Not Updating Regularly: Letting too much time pass before updating your P&L can result in outdated financial data, which may cause poor business decisions.

- Relying Too Much on Estimates: Using approximations for costs or income instead of actual figures can lead to inaccuracies and misinterpretations of your financial standing.

Related products

-

Sale!

SaaS Profit and Loss Statement

$119.00Original price was: $119.00.$79.00Current price is: $79.00. Add to cart -

Sale!

Startup Profit and Loss Statement

$119.00Original price was: $119.00.$79.00Current price is: $79.00. Add to cart -

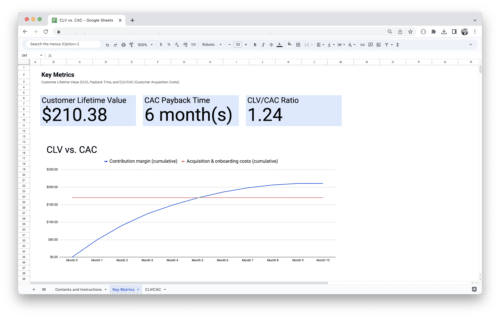

CLV vs. CAC Analysis Template

$0.00 Add to cart -

Capital Expenditure Planning Template

$0.00 Add to cart