Description

Are you struggling to assess whether your customer acquisition efforts are truly paying off? Without the right tools, it’s easy to overspend on marketing and miss opportunities to maximize your profits. If you’re unsure whether your customer acquisition costs are justified by the value each customer brings, it can feel like you’re guessing when making key business decisions.

Our Unit Economics Analysis Template removes the guesswork, providing you with a clear and structured framework to calculate and compare Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC). This powerful tool helps you track your spending, measure profitability, and optimize your customer acquisition strategies. By using this template, you’ll quickly gain insight into your business’s efficiency, identify areas to cut costs, and ensure you’re making smarter, data-driven decisions that drive long-term growth and profitability. With this template, you can easily monitor your key metrics, adjust your strategies as needed, and scale your business with confidence.

Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC) are two fundamental metrics in the world of business, particularly in marketing, sales, and customer retention. CLV represents the total revenue a company expects to earn from a customer over the entire duration of their relationship. In contrast, CAC measures the total cost involved in acquiring a new customer, including all expenses related to marketing, sales, and promotional efforts.

Together, these metrics provide a clear view of your business’s financial health, helping you understand the balance between the money spent on acquiring customers and the value those customers bring in over time. For a business to thrive, particularly in competitive markets, it’s crucial to know how to optimize these metrics. This is where unit economics comes into play, offering a lens through which you can assess the sustainability of your customer acquisition efforts and profitability.

By tracking CLV and CAC, businesses can make more informed decisions that impact both short-term and long-term success. These numbers are not just about measuring current performance—they are predictive of your business’s future. If you’re acquiring customers profitably and retaining them effectively, you’re on a path to sustained growth. If your acquisition costs outweigh the revenue generated from your customers, it signals that changes are needed.

Importance of Unit Economics in Business Decision-Making

Unit economics is the backbone of sustainable business growth. It focuses on understanding the profitability of acquiring and retaining customers, helping you make smarter decisions. Here’s why unit economics is critical for businesses:

- Helps assess profitability: By comparing CLV to CAC, you can determine whether you’re spending too much to acquire customers and if those customers will provide a return on investment in the long run.

- Guides resource allocation: Understanding the financial return on each customer acquisition helps businesses decide how to allocate marketing and sales resources effectively.

- Ensures long-term sustainability: Without strong unit economics, your business could face a situation where customer acquisition is unsustainable, leading to financial strain.

- Drives pricing and marketing strategy: Unit economics can guide decisions related to pricing, marketing strategies, and customer retention efforts, ensuring that every dollar spent aligns with your overall business goals.

- Aids in scaling: If you know that the CLV to CAC ratio is favorable, it becomes easier to scale your business by increasing customer acquisition efforts without risking unsustainable costs.

How CLV and CAC Help Measure Profitability

CLV and CAC are essential in providing a snapshot of how well your business is managing customer acquisition and retention efforts. They work together to offer insights into the overall financial health of your business and its potential for growth. Here’s how these two metrics help measure profitability:

- Determining ROI: By comparing CLV to CAC, you can gauge the return on investment for your customer acquisition efforts. Ideally, your CLV should significantly exceed CAC, indicating a positive return for every dollar spent on acquiring a customer.

- Tracking customer value over time: CLV allows you to forecast how much revenue a customer will generate over their lifetime, helping you understand how your customer base contributes to long-term profitability.

- Assessing marketing effectiveness: The CAC metric highlights how much it costs to bring in a new customer, providing insights into the effectiveness and efficiency of your marketing strategies. If CAC is high, it may indicate a need to optimize marketing channels or rework the sales funnel.

- Evaluating business scalability: A favorable CLV to CAC ratio suggests that your business model is scalable, meaning you can afford to invest more in acquiring customers without harming profitability.

- Ensuring sustainable customer acquisition: If CAC is too high relative to CLV, it might indicate that your business is spending more on customer acquisition than it can earn back, signaling the need for more cost-effective strategies.

Customer Lifetime Value (CLV) is a critical metric used by businesses to determine the total revenue a customer is expected to bring over the course of their relationship with your brand. It provides a long-term perspective on the value of each customer, helping businesses move beyond just looking at individual transactions. Instead, CLV focuses on the bigger picture of what a customer will contribute over time, which can guide your decision-making in terms of customer acquisition, retention strategies, and resource allocation.

Understanding CLV enables you to assess the efficiency of your marketing spend, your customer service efforts, and even product pricing. It can also serve as a performance metric for various teams, from sales to customer support. In essence, CLV is not just about immediate sales but about how you can cultivate lasting relationships with customers that pay off over the long term. By knowing the lifetime value of your customers, you can make more informed decisions and ultimately build a sustainable business model.

Key Components That Contribute to CLV

Several factors contribute to calculating and understanding CLV. While the formula for CLV is relatively simple, the components that make up the value can be much more complex. These include:

- Average Purchase Value: This represents how much, on average, a customer spends each time they make a purchase. It’s the baseline for understanding how much revenue a customer is likely to generate in a single transaction.

- Purchase Frequency: This component refers to how often a customer buys from your business over a given period, such as monthly or yearly. For example, if a customer purchases from you 5 times a year, it’s an indication that they have a good level of engagement with your product or service.

- Customer Lifespan: This is the average length of time a customer stays with your business. It’s essential to estimate the lifetime value accurately because a longer customer lifespan often results in greater revenue, as repeat purchases compound over time. The longer a customer remains loyal, the more you stand to earn from them.

- Retention Rate: A high retention rate can increase CLV, as it indicates that customers are sticking around longer and continuing to purchase. If your customers are continually renewing, buying, or using your services, your CLV will naturally rise.

- Upselling and Cross-Selling Opportunities: Customers who have been with you for a while are prime candidates for upselling (offering them a more expensive product or service) or cross-selling (suggesting complementary products or services). These efforts can significantly raise the value a customer brings during their lifetime.

By closely monitoring these components, you can identify areas where your business can improve and maximize CLV. For example, if purchase frequency is low, you could create loyalty programs or run marketing campaigns to boost repeat purchases.

How to Calculate CLV?

There are several ways to calculate CLV, depending on the type of business and the data you have available. The basic formula involves multiplying the average purchase value by the purchase frequency, and then by the expected customer lifespan.

The simplest CLV formula is:

CLV = Average Purchase Value × Purchase Frequency × Customer Lifespan

For instance, if a customer spends $50 per order, purchases once a month, and stays with your company for 2 years, the calculation would look like this:

CLV = $50 × 12 × 2 = $1,200

This means the average customer will bring in $1,200 over their entire relationship with your business.

However, you might want to use a more refined approach, especially if your business model includes subscription services or other recurring payments. In those cases, you may calculate CLV on a monthly or yearly basis, and use more advanced metrics like customer churn rate (the rate at which customers leave your business) to estimate the average lifespan more accurately.

For subscription-based businesses, such as SaaS companies, CLV is often calculated as:

CLV = Average Monthly Revenue per User (ARPU) × Average Customer Lifespan (in months)

For example, if a customer pays $20 per month and stays for an average of 18 months, the CLV is:

CLV = $20 × 18 = $360

More sophisticated models also factor in the discount rate (present value of future cash flows), which accounts for the time value of money, or the fact that revenue earned today is worth more than revenue earned in the future. These models are typically used by businesses with higher complexities, like large eCommerce stores or subscription services.

Use Cases: Why CLV is Crucial for Businesses

CLV is an invaluable metric for businesses because it drives decisions that directly impact your bottom line. Here are several ways in which CLV can be used in practice:

- Customer Acquisition and Marketing Spend: CLV helps you understand how much you can afford to spend on acquiring a customer. If the CLV is high, you may be able to allocate more resources toward acquisition, knowing that each customer will bring in significant revenue over time. On the other hand, if CLV is low, you might want to optimize your customer acquisition costs to ensure you’re not overspending relative to the revenue you’re generating.

- Segmentation and Targeting: Knowing your CLV can also help you identify your most profitable customer segments. For example, you might discover that customers from a particular demographic or geographic area tend to have a higher CLV. This insight enables you to focus your marketing efforts on acquiring more customers from those segments, leading to greater returns on your marketing investments.

- Retention Strategies: If your CLV is lower than expected, one of the main ways to improve it is by increasing customer retention. CLV allows you to identify the customers who stay the longest and generate the most revenue. With this information, you can create targeted retention strategies, such as loyalty programs, personalized communications, and enhanced customer service, to nurture long-term relationships and increase the lifetime value of your customers.

- Pricing Decisions: Understanding CLV also helps inform pricing strategies. If your CLV is lower than expected, you might need to reconsider your pricing model, introduce higher-tier pricing plans, or offer premium services to increase customer spend. Alternatively, if your CLV is high, you may have more flexibility to experiment with new pricing structures that can attract different customer segments.

- Product and Service Improvement: CLV is a reflection of customer satisfaction and loyalty. If your CLV is low, it might indicate that customers aren’t fully satisfied with your products or services. By examining CLV alongside customer feedback and retention metrics, you can pinpoint areas where your offerings may need improvement, ensuring that you increase the value each customer brings over time.

- Investment and Business Strategy: From an investor’s point of view, a high CLV suggests that a business has a strong foundation for sustainable growth. This is because businesses with high CLV can often scale faster while maintaining healthy profit margins. By monitoring and improving CLV, businesses can show investors that they have a sound long-term strategy for customer retention and growth.

In short, CLV is essential for understanding the value of your customers over time and optimizing everything from marketing to product offerings. By knowing how to calculate it and how to use it effectively, you can make data-driven decisions that lead to long-term profitability and business success.

Customer Acquisition Cost (CAC) is a crucial metric that measures how much a business spends to acquire a new customer. It encompasses all costs associated with acquiring a customer, including marketing, sales, advertising, and any other expenses directly tied to attracting new leads and converting them into paying customers. CAC is an essential metric for understanding the efficiency of your business’s customer acquisition efforts and for determining whether your marketing spend is yielding a profitable return.

If your CAC is too high relative to the value of the customer (as determined by your CLV), it could signal that your acquisition strategy is not efficient. On the flip side, a low CAC might indicate that your acquisition efforts are cost-effective but could also suggest missed opportunities for growth if you’re not investing enough to scale effectively.

Understanding CAC helps businesses determine whether their sales and marketing budgets are being spent wisely. It also provides insight into how much of your resources should be allocated toward acquiring new customers versus retaining existing ones. The goal is always to keep your CAC low enough to ensure that the lifetime value of the customer more than covers the cost of acquisition, leading to long-term profitability.

Key Components That Contribute to CAC

There are several components that go into calculating CAC, as it includes all the costs associated with attracting and converting a new customer. By breaking down these components, you can gain a better understanding of where your money is going and how you can optimize each part of your acquisition process.

- Sales and Marketing Expenses: This is the primary factor in calculating CAC and includes all the costs associated with your sales and marketing teams. These expenses can include:

- Salaries for marketing and sales staff

- Advertising costs (digital, print, TV, etc.)

- Content creation and marketing materials (blog posts, videos, social media ads)

- CRM and sales software subscriptions

- Website and landing page development

- Promotional discounts and offers

- Lead Generation Costs: Lead generation plays a key role in acquisition. This includes all the efforts put into generating awareness and attracting prospects. For example, running Facebook ads, Google AdWords campaigns, or leveraging SEO to drive organic traffic are all costs associated with lead generation.

- Conversion Costs: After generating leads, you need to convert those leads into customers. This part of the cost structure includes:

- Salaries for sales teams who handle customer calls, demos, or consultations

- Software or tools that help track and nurture leads through the sales funnel

- Customer success or account management teams involved in the final conversion stages

- Retention and Support Costs (for new customers): While customer retention usually falls under its own set of expenses, in some businesses, there may be initial customer support or success efforts that help close the deal or ensure the customer sticks with the business. These costs could include onboarding services, customer success team efforts, or the creation of customer-specific materials to ensure they understand the product.

By understanding and breaking down these components, you can better manage your customer acquisition efforts and make more strategic decisions about where to allocate resources for maximum efficiency.

How to Calculate CAC

Calculating CAC is relatively simple, but it requires accurate data on all the associated costs. The general formula for calculating CAC is:

CAC = Total Sales and Marketing Expenses ÷ Number of New Customers Acquired

To illustrate, let’s say your business spent $50,000 in sales and marketing efforts over the last quarter, and during that period, you acquired 1,000 new customers. Your CAC calculation would look like this:

CAC = $50,000 ÷ 1,000 = $50 per customer

This means you are spending $50 to acquire each new customer. Now, this number alone doesn’t tell you whether the cost is good or bad—it’s only useful when you compare it to the customer’s lifetime value (CLV). Ideally, your CAC should be a fraction of the CLV, ensuring a healthy return on investment.

While the basic formula above is great for calculating CAC on a simple level, you can refine the calculation based on your business’s unique needs. For example, if your company runs several marketing campaigns, you can break down CAC by campaign to assess the effectiveness of each channel. Additionally, if you’re working with long sales cycles (for B2B companies, for instance), you might need to calculate CAC over a longer period to get a more accurate picture.

For businesses with subscription models or recurring revenue, CAC may be calculated on a monthly or annual basis. For example, if your business offers a subscription service, you may want to calculate the monthly CAC, which would give you insights into how efficiently you’re acquiring customers each month.

Use Cases: The Role of CAC in Marketing and Sales Strategies

Understanding CAC is integral to making informed decisions about how to allocate resources in marketing and sales. CAC can be used as a key indicator in various aspects of your business strategy. Here’s how it plays a role in shaping marketing and sales efforts:

- Budget Allocation for Marketing and Sales: CAC helps businesses determine how much to spend on customer acquisition. If your CAC is high, you may need to reconsider how much you’re spending on advertising or whether your current marketing channels are cost-effective. Alternatively, a low CAC might indicate that you’re doing a good job at attracting customers efficiently, allowing you to increase your spend without losing profitability.

- Optimizing Marketing Channels: CAC helps evaluate the performance of different marketing channels and campaigns. By calculating CAC for each channel (e.g., Google Ads, social media, content marketing), you can see which channels are delivering the best ROI and which may need further optimization or even cutting. For instance, if you find that your paid ads have a much higher CAC compared to organic search, you might focus on improving your SEO strategy to reduce reliance on paid ads.

- Customer Segmentation: Not all customers are created equal, and understanding your CAC can help you segment your audience more effectively. By examining CAC across different segments (demographics, geographic location, behavior, etc.), you can identify which customer types are more cost-effective to acquire. This insight allows you to focus on acquiring more of the high-value customer segments, potentially lowering your overall CAC while increasing the lifetime value of customers.

- Sales Process Efficiency: CAC also gives insight into the efficiency of your sales process. If your CAC is rising, it could be an indication that the sales team is spending too much time or resources converting leads into customers. This can prompt you to review your sales funnel and identify bottlenecks, whether that’s lead qualification, follow-ups, or closing tactics. A more efficient sales process typically results in a lower CAC.

- Influencing Pricing Strategy: CAC plays an essential role in determining the feasibility of your pricing strategy. If your CAC is high, you may need to reconsider your pricing model to ensure that the cost of acquiring customers doesn’t eat too much into your profits. Alternatively, if your CAC is low and customers are easy to acquire, you may have the flexibility to introduce higher pricing tiers or offer premium services to increase overall revenue.

- Predicting Profitability and Scaling: When you understand how much it costs to acquire a customer, you can predict the potential profitability of scaling your business. If your CAC is relatively low compared to your customer lifetime value, you can safely invest in scaling customer acquisition efforts. However, if your CAC is nearing or exceeding your CLV, it becomes crucial to rethink your strategies to avoid unsustainable growth. This insight into the cost-effectiveness of acquisition is invaluable for decision-makers when considering how aggressively they can expand.

- Determining Customer Acquisition Strategies for Different Business Models: For businesses that operate on a subscription model or have recurring revenue, CAC can be an indicator of whether your business is able to maintain profitable customer acquisition efforts over time. For businesses that rely on one-time transactions, the focus might shift more heavily to repeat purchases or upselling, which in turn can affect CAC calculations. Understanding how CAC influences each model helps to adapt your strategies for optimal results.

Customer Acquisition Cost (CAC) is not just a number—it’s a strategic tool that helps businesses manage their growth and optimize their customer acquisition processes. By carefully calculating and tracking CAC, you gain insight into the efficiency of your marketing and sales efforts, and you can make more informed decisions about where to allocate resources for maximum return on investment. Whether you’re focusing on improving your marketing channels, optimizing your sales funnel, or adjusting your pricing strategy, CAC is central to ensuring the sustainability and profitability of your business.

CLV (Customer Lifetime Value) and CAC (Customer Acquisition Cost) are two fundamental metrics that help determine the financial health of your business. While CLV measures the value that a customer brings to your company over time, CAC tells you how much it costs to acquire that customer. The relationship between these two metrics is crucial for assessing whether your customer acquisition efforts are sustainable and profitable in the long run. When managed properly, a healthy balance between CLV and CAC can drive growth, maximize profitability, and ensure long-term business success.

Understanding the relationship between CLV and CAC enables businesses to make smarter decisions about where to allocate marketing budgets, refine customer acquisition strategies, and optimize pricing models. The balance between these two figures not only tells you how efficiently you’re acquiring customers, but it also reveals the quality of your customer base and the longevity of your business model. When the ratio between CLV and CAC is favorable, it signals that you’re bringing in profitable customers without overspending on acquisition costs.

How CLV and CAC Work Together to Determine Business Sustainability

CLV and CAC work hand in hand to determine whether your business can grow sustainably. These two metrics are directly related because they both affect your company’s cash flow, profitability, and customer acquisition strategy. Together, they provide a complete picture of your customer relationships and whether your business model is financially viable.

When CLV exceeds CAC, you’re essentially earning more revenue from each customer than it costs to acquire them. This means that for every dollar you spend on acquiring a customer, you’re getting back multiple times that amount in revenue over time. In this scenario, your business is on a path to long-term profitability because you are not only covering the costs of acquiring customers but also generating surplus revenue that can be reinvested into growth.

On the other hand, if CAC exceeds CLV, your business will struggle to be profitable in the long run. If you’re spending more to acquire customers than you are earning from them, your business is unsustainable. This could be a sign that your customer acquisition strategy is too expensive, or that you are not retaining customers long enough or getting enough revenue from them to justify the cost.

The key to sustainability lies in ensuring that the revenue generated from each customer (CLV) outweighs the costs associated with acquiring that customer (CAC). This allows for reinvestment in growth, customer experience, and other areas that will continue to scale the business. A profitable CLV to CAC ratio gives businesses the room to expand while maintaining healthy margins.

The Ideal CLV to CAC Ratio for Profitability

The ideal CLV to CAC ratio is one of the key indicators of a business’s health and profitability. Most experts recommend aiming for a 3:1 ratio, meaning that for every dollar spent on customer acquisition, the business should expect to generate three dollars in return over the customer’s lifetime. This ratio reflects a balance where you are spending an appropriate amount to acquire customers but still generating significant profits from each customer over time.

For example, if your CLV is $900 and your CAC is $300, your CLV to CAC ratio is 3:1. This means that for every dollar spent on acquiring a customer, you’re seeing $3 in return, which is a sustainable and profitable situation for most businesses. At this point, you are efficiently acquiring customers without overspending, and you have room for reinvestment into acquiring even more customers or expanding your business.

If the ratio is much higher than 3:1, it could indicate that you’re under-investing in customer acquisition. While this may seem like a good thing in the short term, it might limit your growth potential. If you’re not spending enough to acquire new customers, your customer base might not be growing fast enough to support long-term scalability.

Conversely, a 1:1 ratio or lower is a major warning sign that your business is operating at a loss. If your CAC is equal to or higher than your CLV, you’re spending as much or more to acquire customers than you’re making from them over their lifetime. This means that for every new customer, your business is either breaking even or losing money. The business will need to find ways to reduce customer acquisition costs, increase the lifetime value of customers, or ideally both, to restore profitability.

When CLV Exceeds CAC: Positive Implications

When your CLV exceeds your CAC, it’s a clear indication that your business is operating efficiently and sustainably. This situation is highly desirable because it means that your customers are worth more over time than the cost of acquiring them. The positive implications of this scenario are vast and can fuel growth across multiple areas of your business.

- Scalable Growth: When CLV exceeds CAC, you’re essentially in a position to scale your business with less risk. You can increase your marketing and sales efforts without worrying about the financial sustainability of the business. As you acquire more customers, you’re generating more revenue that will cover your acquisition costs and then some. This creates a positive cycle where growth leads to greater revenue, which can be reinvested into further customer acquisition or expansion.

- Increased Profit Margins: A healthy CLV to CAC ratio contributes directly to higher profit margins. Since the revenue from each customer exceeds your acquisition costs, you have more room to generate profit. This margin can be reinvested into improving the customer experience, developing new products, or enhancing customer retention strategies, all of which help grow your business even further.

- Marketing and Sales Flexibility: When you’re not constrained by high acquisition costs, you have more flexibility in how you approach marketing and sales. You can afford to experiment with new campaigns, refine targeting strategies, or explore higher-cost but potentially more effective marketing channels. This flexibility ensures that you’re continuously optimizing your efforts to acquire the best customers.

- Sustainable Business Model: A favorable CLV to CAC ratio suggests that your business model is sustainable over the long term. You are generating more revenue than you’re spending to acquire customers, which allows your business to weather economic downturns, shifts in market conditions, or unforeseen changes in customer behavior.

- Investor Confidence: A healthy CLV to CAC ratio is often a signal to potential investors that your business is profitable and growing. Investors are more likely to fund businesses that demonstrate strong unit economics, as it shows that the company is generating consistent returns on its investments. This could open doors to additional capital for further expansion.

When CAC Exceeds CLV: Risks and Warning Signs

When CAC exceeds CLV, it’s a red flag that your business may be heading toward financial trouble. This situation occurs when it costs more to acquire a customer than you can earn from them over their lifetime. The risks and warning signs in this scenario are severe, and it’s crucial to address them before they lead to unsustainable losses.

- Unsustainable Growth: If your CAC exceeds your CLV, you’re essentially paying for growth. While you might be acquiring new customers, you’re spending more to get those customers than they’re worth in the long run. This means that even though your customer base is growing, you’re not seeing the revenue required to sustain that growth. Over time, this can deplete your cash reserves and lead to significant financial strain.

- Negative Profit Margins: When the cost of acquisition is higher than the value of the customer, your business will face negative profit margins. For example, if you’re spending $500 to acquire a customer but only making $400 from them over their lifetime, you’re losing money with each new customer. As you scale, this loss compounds, and it becomes increasingly difficult to break even.

- Decreased Marketing ROI: A situation where CAC exceeds CLV often points to inefficiencies in your marketing strategy. If you’re spending more than you’re earning on customer acquisition, your marketing campaigns are not delivering the expected returns. This means you need to critically evaluate your channels, messaging, and targeting to see where you’re overspending and underperforming.

- Cutting Into Customer Lifetime Value: If you’re spending too much on acquiring customers, it may also signal that your customer retention efforts are not working effectively. Even if you are getting customers, you’re not doing enough to retain them or generate long-term value from them. This could be due to a lack of product engagement, poor customer service, or ineffective retention strategies. To restore balance, focus on improving customer experience and maximizing the value you get from each customer.

- Vulnerable to Competitors: In a situation where CAC exceeds CLV, your business is vulnerable to competitors who might have a better balance between the two metrics. If your competitors are acquiring customers at a lower cost and generating more revenue per customer, they will likely outperform you in the long run. This could erode your market share and make it difficult to compete effectively.

In these cases, it’s essential to take immediate action. Reevaluate your acquisition strategy, lower marketing spend where possible, or find ways to increase customer retention and upsell to improve CLV. Reducing CAC and increasing CLV are both necessary for ensuring the sustainability and profitability of your business.

In conclusion, the relationship between CLV and CAC is fundamental to understanding your business’s financial health. A positive CLV to CAC ratio signals a sustainable, profitable business, while an unfavorable ratio warns of inefficiencies and potential losses. Striking the right balance between the two is key to growing a successful and scalable business over time.

Performing a CLV vs. CAC analysis is a powerful way to measure the efficiency of your customer acquisition efforts and assess the long-term profitability of your business. Understanding how much you’re spending to acquire a customer compared to the revenue they will generate over their lifetime allows you to make data-driven decisions, optimize your marketing and sales strategies, and scale your business sustainably. While the analysis itself can be straightforward, the deeper insights come from how you interpret and apply the results.

The process of conducting a CLV vs. CAC analysis involves gathering the right data, calculating each metric accurately, and using the findings to make informed business decisions. Below is a detailed guide on how to perform this analysis, along with the key metrics to track and some useful tools to help you streamline the process.

How to Perform CLV vs. CAC Analysis?

- Define Your Time Period Before diving into the numbers, decide on the time frame you want to analyze. You could look at monthly, quarterly, or annual data, depending on your business model and customer cycle. For subscription-based businesses, an annual analysis might be more appropriate, whereas for eCommerce or transactional businesses, monthly or quarterly assessments might work better. The time period will directly influence the accuracy of your calculations, so make sure it’s aligned with your business’s sales cycle.

- Gather the Required Data The next step is collecting all the data you’ll need to calculate both CLV and CAC. This includes:

- Total Sales and Marketing Expenses: Include all direct costs related to acquiring customers. This might cover advertising, salaries for marketing and sales teams, CRM systems, content creation, lead generation efforts, and any tools used for customer outreach.

- Number of New Customers Acquired: Gather the number of customers you’ve acquired during the time period you’re analyzing. This should include only new customers—not existing ones who have repurchased.

- Average Revenue Per Customer: Determine how much revenue, on average, each customer generates during the chosen time period.

- Customer Retention or Churn Rate: This data helps in determining the average lifespan of a customer, which is a critical factor in calculating CLV.

- Calculate Customer Acquisition Cost (CAC) Use the formula to calculate CAC by dividing your total sales and marketing expenses by the number of new customers acquired during the same time period.CAC = Total Sales and Marketing Expenses ÷ Number of New Customers Acquired

For example, if you spent $50,000 on marketing in a quarter and acquired 1,000 new customers, your CAC would be:

CAC = $50,000 ÷ 1,000 = $50 per customer

This means that, on average, you spent $50 to acquire each new customer.

- Calculate Customer Lifetime Value (CLV) To calculate CLV, start by identifying the average purchase value and the purchase frequency of a customer. Multiply these by the customer lifespan (or retention rate). Here’s the formula for CLV:CLV = Average Purchase Value × Purchase Frequency × Customer Lifespan

For example, if a customer spends $100 per month, buys once a month, and stays with your business for 12 months, the CLV would be:

CLV = $100 × 12 × 1 = $1,200

This means each customer will generate $1,200 in revenue over the course of their one-year relationship with your business.

- Compare CLV to CAC Once you have calculated CLV and CAC, compare them to see how they align. The goal is to have a CLV that is significantly greater than CAC. A healthy ratio is typically 3:1, meaning that for every dollar spent on acquiring a customer, your business should aim to earn at least three dollars in revenue over the customer’s lifetime.If CLV exceeds CAC, you’re in a good position to scale your marketing efforts without compromising profitability. If CAC exceeds CLV, it’s time to take a step back and reassess your acquisition strategies to ensure they’re financially sustainable.

- Analyze the Results After performing the calculations, the next step is interpreting the results. What do the numbers tell you? If the CLV to CAC ratio is healthy, you can confidently scale your acquisition efforts, increase your marketing budget, or invest in product development and customer retention. However, if your CAC is too high, it could indicate that you need to optimize your acquisition process, reduce unnecessary spending, or focus on improving customer retention and lifetime value.This is where deeper analysis comes in. Look beyond the numbers to understand why the ratio is what it is. Are you spending too much on certain marketing channels? Are you losing customers too quickly, or are they not returning to buy again? These insights will inform the next steps in your strategy.

Key Metrics to Track and Analyze During the Process

To ensure you’re getting the most out of your CLV vs. CAC analysis, there are several key metrics you should track regularly. These metrics help provide a clearer picture of your customer acquisition efforts, retention, and overall financial health:

- Churn Rate: The percentage of customers who stop doing business with you over a given period. A high churn rate negatively affects CLV, so it’s critical to track and reduce it through better customer experience and retention strategies.

- Customer Retention Rate: The percentage of customers who continue to buy from you over a given period. High retention increases CLV and is often more cost-effective than constantly acquiring new customers.

- Average Revenue Per User (ARPU): The average amount of revenue generated per customer over a set period (monthly, quarterly, etc.). A higher ARPU means that customers are engaging more with your offerings, which can boost CLV.

- Customer Segmentation: Segmenting your customers by demographics, behavior, or buying habits allows you to identify which groups are the most valuable. This can help refine your acquisition strategy and improve your CLV.

- Cost Per Acquisition (CPA): Similar to CAC, CPA measures the cost to acquire a customer through specific campaigns or channels. Tracking CPA helps you evaluate which marketing tactics are the most cost-effective.

- Sales Conversion Rate: This measures the percentage of leads that convert into paying customers. A low conversion rate can indicate inefficiencies in your sales process, which might be inflating CAC unnecessarily.

- Loyalty Metrics: These metrics assess how loyal your customers are, including how often they repeat purchases or refer others to your business. Loyal customers contribute positively to CLV.

Interpreting the Results and Taking Actionable Steps

Once the analysis is complete, the next step is to interpret the findings and take actionable steps. If your CLV to CAC ratio is healthy (around 3:1 or higher), you can confidently scale your acquisition efforts. Here’s how to proceed:

- Scaling Up: If your CAC is low relative to CLV, it’s time to increase your marketing budget or explore new customer acquisition channels. You can experiment with higher-cost channels (e.g., paid ads) or invest in expanding your team to capture more leads.

- Optimizing Channels: If a particular marketing channel is showing a high CAC, consider reducing spend on it and shifting resources toward more cost-effective channels. Alternatively, you can refine your strategy for the higher-cost channels by improving targeting, messaging, or conversion strategies.

- Improving Customer Retention: If CLV is lower than expected, focus on improving customer retention. This might involve implementing loyalty programs, enhancing customer support, or offering more personalized customer experiences to increase customer lifespan and repeat purchases.

- Reevaluating Pricing: If CAC is too high and you can’t significantly lower it, it might be time to reassess your pricing strategy. Consider whether you’re pricing your products or services appropriately based on the value they provide. Raising prices, adding tiered offerings, or introducing new revenue streams could help balance the equation.

Regularly conducting CLV vs. CAC analysis allows you to stay on top of your business’s financial health, optimize your customer acquisition efforts, and make strategic decisions based on real data. Whether you’re scaling up, optimizing existing processes, or addressing risks, this analysis is a powerful tool for achieving sustainable growth.

Benefits of Using a CLV vs. CAC Analysis Template

When performing a CLV vs. CAC analysis, using a template can make the entire process faster, more accurate, and more insightful. Templates provide a structured framework for gathering, calculating, and analyzing the data, which helps you avoid errors and ensures consistency over time. Instead of starting from scratch every time, a well-designed template automates many of the repetitive tasks, allowing you to focus on the strategic decisions that will drive your business forward. The benefits of using a CLV vs. CAC analysis template go beyond just convenience—they provide clarity, improve decision-making, and allow businesses to scale efficiently.

- Efficiency and Time-Saving: A template streamlines the process, eliminating the need to manually calculate CLV and CAC each time. By entering data into a predefined structure, you can quickly see key metrics and make faster decisions without having to worry about whether the numbers are correct. This is especially important for businesses that need to regularly track these metrics in order to make timely adjustments to their strategies.

- Accuracy and Consistency: With a template, you’re using a tried-and-tested formula, reducing the risk of human error. This consistency is crucial for making reliable comparisons over time. As your business grows, having a standardized approach ensures that you’re comparing “apples to apples,” whether you’re looking at last quarter’s numbers or those from a year ago.

- Actionable Insights: Templates often come with built-in charts, graphs, and visual elements that allow you to quickly interpret the data. This visual representation of your CLV vs. CAC ratio makes it easier to spot trends, recognize problem areas, and make informed decisions. The ability to quickly see patterns in the data can give you an edge in optimizing your marketing, sales, and customer retention strategies.

- Scalability: As your business grows, you’ll likely have more data to analyze and manage. A CLV vs. CAC analysis template allows you to scale your analysis efforts without being overwhelmed by the increasing volume of data. You can add more data points, track multiple time periods, and measure the success of new initiatives without having to reinvent the process every time.

- Strategic Decision Support: The template’s simplicity and organization make it easier to present findings to stakeholders, helping your team or investors understand the state of your business’s customer acquisition efficiency. Whether you’re adjusting marketing budgets, optimizing sales processes, or improving customer retention, having the data clearly laid out in a template provides support for strategic decisions that drive business growth.

Understanding the relationship between Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC) is essential for businesses that want to maintain a healthy financial outlook, scale sustainably, and optimize their customer acquisition strategies. By conducting regular CLV vs. CAC analysis, businesses can make informed decisions about marketing budgets, customer retention efforts, pricing strategies, and more. This analysis doesn’t just provide a snapshot of your customer acquisition efficiency—it offers insights into areas for improvement, potential growth opportunities, and risk factors that could affect long-term sustainability.

In today’s competitive market, focusing on these metrics is more important than ever. Businesses are under constant pressure to acquire customers efficiently while ensuring profitability. If CLV isn’t significantly higher than CAC, a business will struggle to sustain its growth and profitability. By analyzing these two metrics together, you get a complete picture of whether your efforts are paying off and how you can adjust your strategy for better outcomes.

Financial Health and Strategic Decision-Making

CLV vs. CAC analysis plays a pivotal role in ensuring the financial health of a business. When businesses understand their customer acquisition costs in relation to the lifetime value of customers, they can make smarter financial decisions. A favorable CLV to CAC ratio indicates that the business is generating more revenue from each customer than it is spending to acquire them. This surplus revenue can then be reinvested into other areas of the business, such as product development, customer service, and scaling marketing efforts.

Moreover, regular analysis of CLV and CAC provides visibility into the overall financial sustainability of the company. If the CAC starts creeping up while CLV remains stagnant or decreases, it signals a financial red flag. This can indicate inefficiencies in customer acquisition, poor targeting, or overreliance on high-cost marketing channels. Conversely, when CLV is growing and CAC remains stable or decreases, it’s a clear sign that your customer acquisition efforts are working efficiently and that your business has a strong financial foundation.

For example, if your business has an ideal CLV to CAC ratio of 3:1, and you’re seeing a consistent increase in CLV, you can confidently scale your acquisition efforts, knowing that you’re getting a solid return on every dollar spent. On the other hand, if your CAC exceeds CLV, it would be a sign that either your marketing strategy needs to be overhauled or your customer retention needs improvement to ensure long-term profitability.

By continually monitoring these metrics, you can make strategic decisions that will ensure you don’t overspend on customer acquisition or miss out on growth opportunities. It gives you the insights needed to manage cash flow effectively, allocate budgets wisely, and plan for future growth.

Customer Acquisition Strategy Optimization

Understanding how CLV and CAC work together is critical for optimizing your customer acquisition strategy. By constantly evaluating these metrics, businesses can make data-driven decisions about how best to acquire customers. If CAC is too high relative to CLV, businesses must identify ways to lower their acquisition costs, whether it’s by refining targeting efforts, optimizing ad spend, or improving sales conversion rates.

A deep understanding of your CAC can help you identify which marketing channels, tactics, or sales processes are delivering the best returns. If you know that one acquisition channel has a lower CAC and leads to customers with higher CLV, you can focus your efforts on scaling that channel. Alternatively, if you find that certain campaigns are leading to high acquisition costs but low CLV, it’s time to refine your strategy or abandon the unprofitable channels altogether.

For example, you might discover that paid ads on social media have a high CAC but don’t lead to loyal, long-term customers, while organic SEO efforts result in customers with a higher CLV. With this insight, you could allocate more of your budget to SEO, focusing on content creation, keyword optimization, and link-building strategies. On the other hand, if paid ads are leading to high CLV customers, but at a higher initial cost, you might decide to increase your budget there, knowing that over time, the return will more than justify the initial investment.

Regularly analyzing CLV vs. CAC also allows businesses to refine their sales processes. For instance, if your sales team is spending too much time on leads that ultimately don’t convert, you can streamline your lead qualification process to ensure that more time is spent converting high-potential customers, leading to lower CAC and better ROI.

Long-Term Growth and Retention Metrics

The focus of CLV vs. CAC analysis extends far beyond just the acquisition phase. It provides insight into the long-term growth potential of your business by considering how much revenue each customer can generate over time. This allows businesses to shift their focus from short-term profits to long-term sustainability.

When CLV exceeds CAC, it means that your customers are sticking around, returning to buy more, and generally contributing more revenue over time. This points to healthy customer retention and engagement, which are crucial for long-term growth. In fact, customer retention is often more profitable than acquisition. Retaining customers costs far less than acquiring new ones, and loyal customers tend to spend more over time.

By monitoring retention alongside CLV and CAC, you can identify which customer segments are most likely to stay loyal and which are at risk of churning. For example, if a particular segment of customers has a lower CLV but higher churn rates, it might be time to implement retention strategies tailored to that group. This could involve offering loyalty programs, targeted re-engagement campaigns, or enhancing the overall customer experience to foster deeper relationships.

On the other hand, if your CAC is too high relative to CLV and you’re seeing low retention, it could be a sign that the product or service isn’t meeting customer expectations, or that there are issues in post-purchase customer experience. By digging into the details of customer feedback, product usage, and service levels, you can pinpoint why customers aren’t staying longer and take steps to address these issues.

The ability to track long-term growth through the lens of CLV and CAC makes it possible to make proactive decisions that enhance retention. By improving customer experience, implementing feedback loops, and targeting specific pain points, you can increase CLV and decrease churn, leading to a more sustainable business model.

Identifying Areas for Improvement in Marketing, Sales, and Customer Service

The insights gained from CLV vs. CAC analysis are invaluable for pinpointing specific areas in need of improvement within your marketing, sales, and customer service teams. It doesn’t just tell you whether your acquisition efforts are successful—it reveals exactly where changes need to be made.

For example, if you notice that your CAC is disproportionately high in one marketing channel, it’s a sign that your strategy for that channel needs to be reworked. Perhaps the targeting is too broad, or the messaging is not resonating with the right audience. By digging deeper into performance data, you can optimize your campaigns and lower the acquisition cost.

Similarly, if your CLV is lower than expected, it could indicate that customers aren’t finding enough value in your product or service to continue purchasing over time. This signals that you may need to make improvements to customer support, product features, or pricing models. It might also indicate the need for better onboarding processes, customer education, or loyalty programs designed to boost retention.

If the problem lies in the sales process, and CAC is too high due to inefficiencies in closing deals or converting leads, it’s time to refine sales tactics. This could involve investing in training for your sales team, providing them with better tools and resources, or implementing more effective lead qualification methods. Salespeople should focus on high-quality leads that are more likely to convert into profitable long-term customers, reducing unnecessary time spent on low-potential prospects.

Lastly, customer service plays a key role in CLV. A great customer service experience can extend the relationship with a customer, increasing their lifetime value. If customers feel unsupported or are left with unresolved issues, they are more likely to churn early, reducing CLV. By monitoring customer satisfaction metrics, resolving service issues quickly, and consistently delivering value, you can improve the overall customer experience and boost retention.

Overall, CLV vs. CAC analysis doesn’t just tell you if your marketing and sales efforts are working—it helps you continuously improve them. By examining where your business is underperforming in customer acquisition, retention, or experience, you can make informed adjustments that drive long-term growth, reduce costs, and improve customer satisfaction. This holistic approach ensures that every part of your customer journey is optimized, contributing to overall business success.

While CLV vs. CAC analysis is an invaluable tool for measuring customer acquisition efficiency and profitability, there are several common mistakes that businesses often make. These mistakes can lead to inaccurate results and poor decision-making, so it’s crucial to be aware of them. The goal is to ensure that the analysis is both accurate and actionable, so you can make the right adjustments to your marketing, sales, and customer retention strategies.

- Overestimating CLV or Underestimating CAC: One of the most common mistakes is inflating CLV or underestimating CAC. Overestimating CLV can lead to unrealistic expectations about the revenue generated from customers, while underestimating CAC can make your acquisition efforts seem more efficient than they truly are. This can lead to over-spending on customer acquisition or misallocating resources that hurt your bottom line.

- Not Accounting for Customer Churn: Many businesses fail to properly account for churn rate (the rate at which customers leave your business), which directly impacts CLV. If churn is higher than expected, it can drastically reduce your CLV, making your CAC ratio look artificially favorable. To get an accurate picture of your unit economics, it’s critical to factor in how many customers you lose over time.

- Failing to Segment Customers: Treating all customers as the same can distort the results of your CLV vs. CAC analysis. Customers may vary significantly in their purchasing behavior, retention rates, and the amount they spend. By not segmenting your customers based on key factors such as demographics, purchase history, or lifetime value, you miss out on understanding which segments are truly profitable and which ones need improvement.

- Ignoring Long-Term Trends: CLV vs. CAC analysis is not just a snapshot of one quarter or year. Focusing only on short-term results can lead to skewed conclusions. It’s important to track these metrics over time to identify trends and make adjustments accordingly. A one-off CAC spike might seem like an anomaly, but if the trend continues over several months, it’s a sign that your acquisition strategy is becoming less efficient.

- Not Adjusting for Changes in Acquisition Channels: Different marketing and acquisition channels have different costs associated with them. Ignoring the performance of specific channels and lumping them all together can obscure the real reasons behind a high or low CAC. Be sure to evaluate each channel individually to see where you’re getting the most value and where you need to optimize.

- Using Inconsistent Time Periods: For an accurate CLV vs. CAC analysis, it’s crucial to use consistent time periods when comparing these metrics. Mixing data from different timeframes—like comparing monthly CAC with annual CLV—can lead to incorrect conclusions. Make sure that both CLV and CAC are calculated for the same period to get a true comparison.

- Relying on Average Data Without Customization: While using average values (like average revenue per customer or average cost of acquisition) can help in general calculations, it might not reflect the reality of your business’s diverse customer base. Customizing the analysis based on specific customer segments, products, or campaigns can provide more granular insights, leading to better-targeted strategies.

- Neglecting Customer Retention and Upsell Opportunities: CLV often reflects revenue over the life of a customer, including potential upsells, renewals, or loyalty program participation. Ignoring these factors can lead to underestimating how much value a customer can bring over time. Focusing only on initial purchases and ignoring the potential for long-term customer engagement limits your understanding of your true customer value.

- Not Using the Data for Actionable Insights: One of the biggest mistakes businesses make is gathering data but not taking actionable steps based on the analysis. If CLV is low or CAC is high, you need to act on those insights. This could mean refining your marketing strategy, improving customer service, or tweaking your pricing structure. Simply tracking the numbers without making changes won’t help your business improve.

Avoiding these mistakes ensures that your CLV vs. CAC analysis is both accurate and useful, helping you optimize your customer acquisition strategies and ultimately drive profitability and long-term business success.

Get Started With the CLV vs. CAC Analysis Template for SaaS!

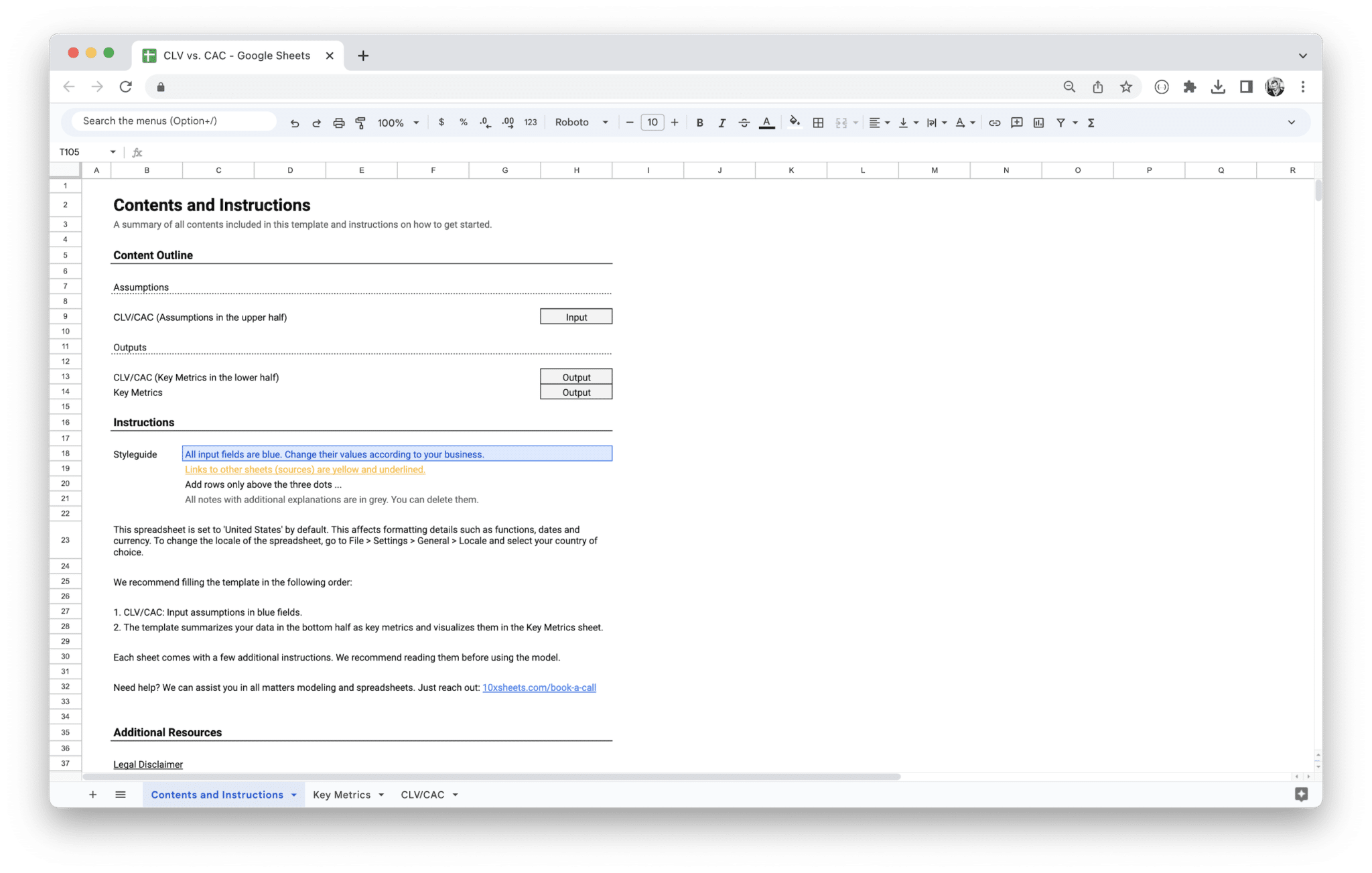

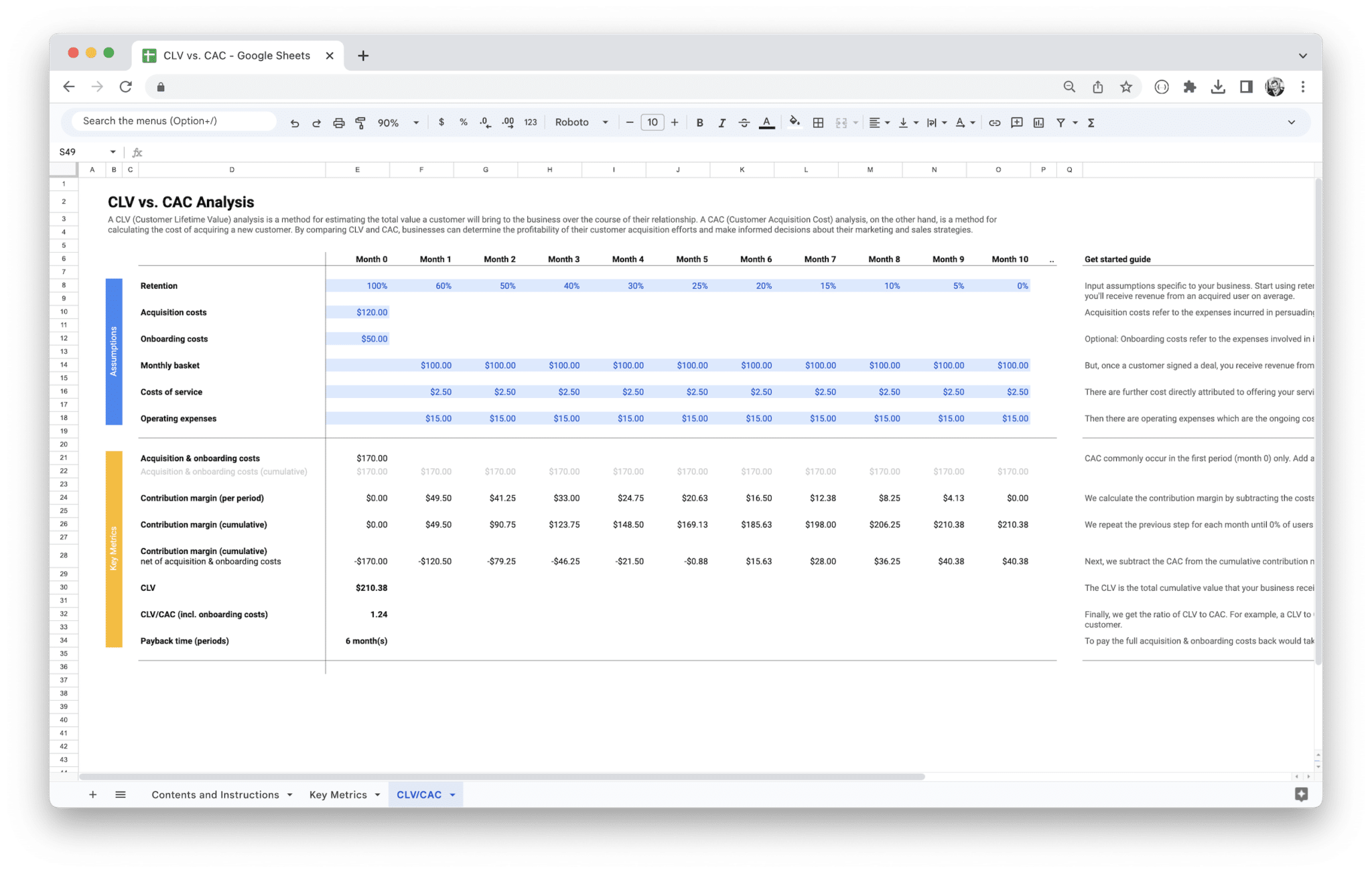

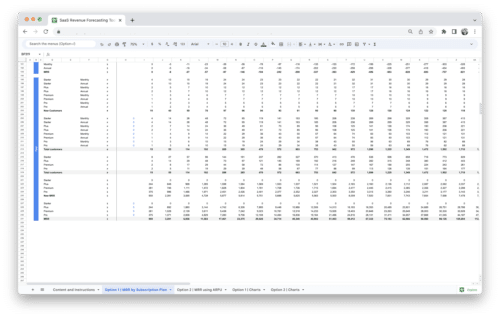

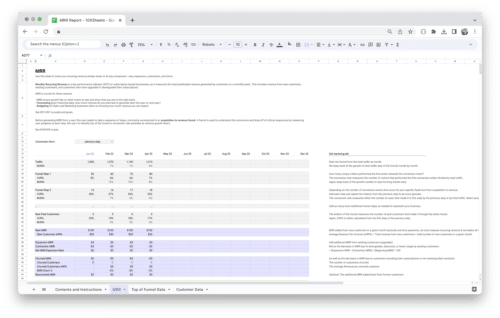

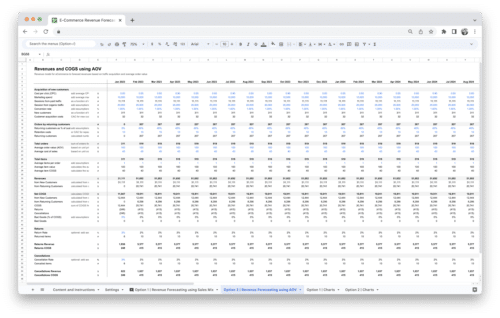

This CLV vs. CAC Template for SaaS and subscription-based businesses helps businesses to calculate their profitability on a per-subscriber basis and make data-driven decisions.

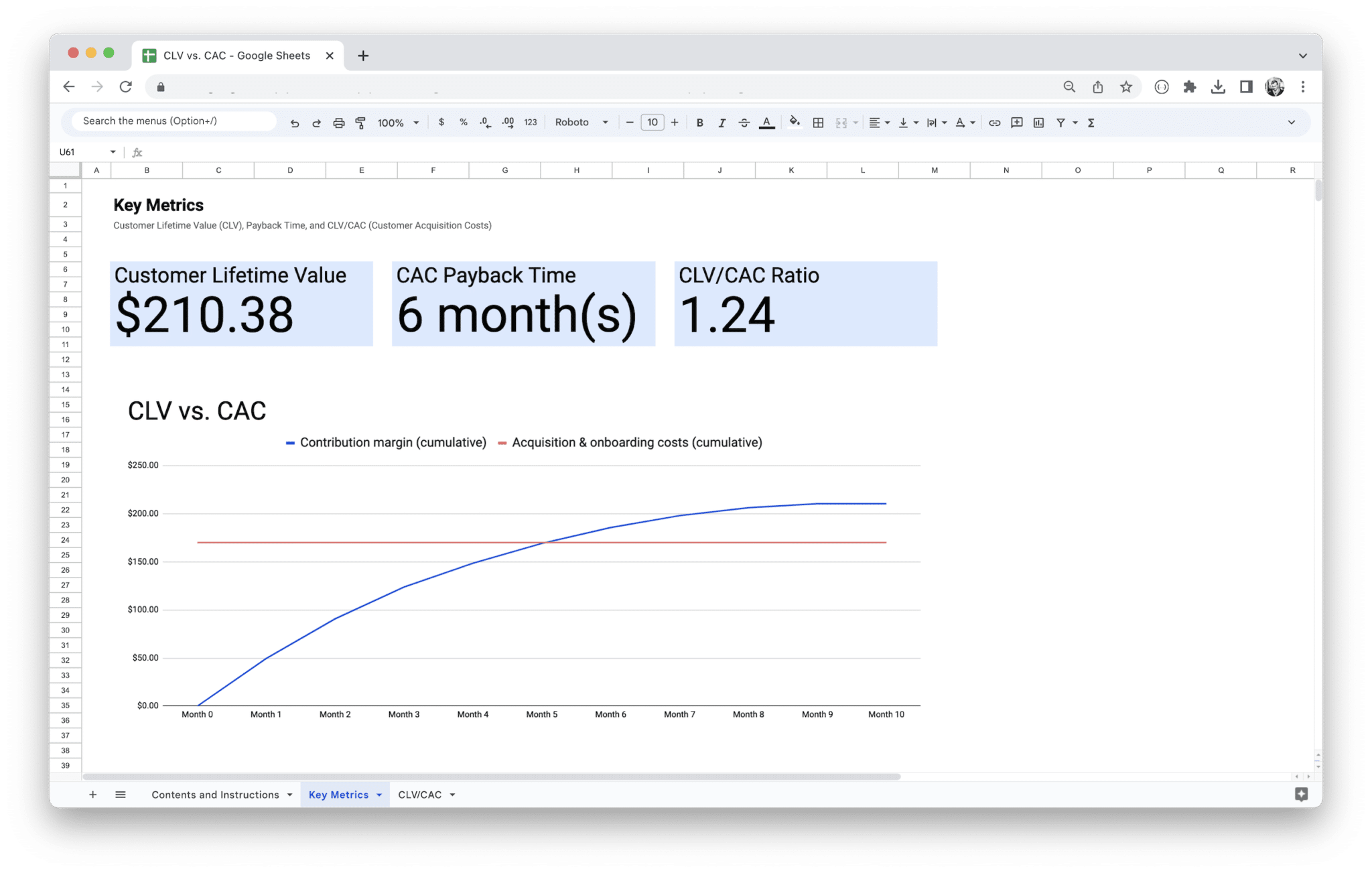

It takes inputs for retention, the average costs per subscriber, and the average revenue per subscriber to return the customer lifetime value, a ration of that lifetime value and the customer acquisition costs, and the payback time that it takes to pay back the full user acquisition costs. By using this template, businesses can determine the profitability of their customer acquisition efforts and make informed decisions about their marketing and sales strategies.

Follow the guide in the template that takes you step-by-step through each sheet and line of this template.

This template is part of our comprehensive SaaS Financial Model. The Financial Model for SaaS contains revenue and expense tracking and forecasting as well as financial statements including a P&L, an optional balance sheet, and an optional cash flow statement. It also includes a dashboard to visualize all key financial metrics in one single view. We recommend it to all SaaS and subscription-based companies.

10XSheets offers Financial Modeling-as-a-service. Book a call if you need a consultation with any matter of financial modeling. We also create custom models specifically tailored to your business needs.

Make a one-time payment and

enjoy your template forever.

No extra costs, no strings attached,

more savings for you.

Keep your templates up-to-date

with free access to regular updates.

Related products

-

Sale!

SaaS Financial Model Template

$219.00Original price was: $219.00.$149.00Current price is: $149.00.