$0.00

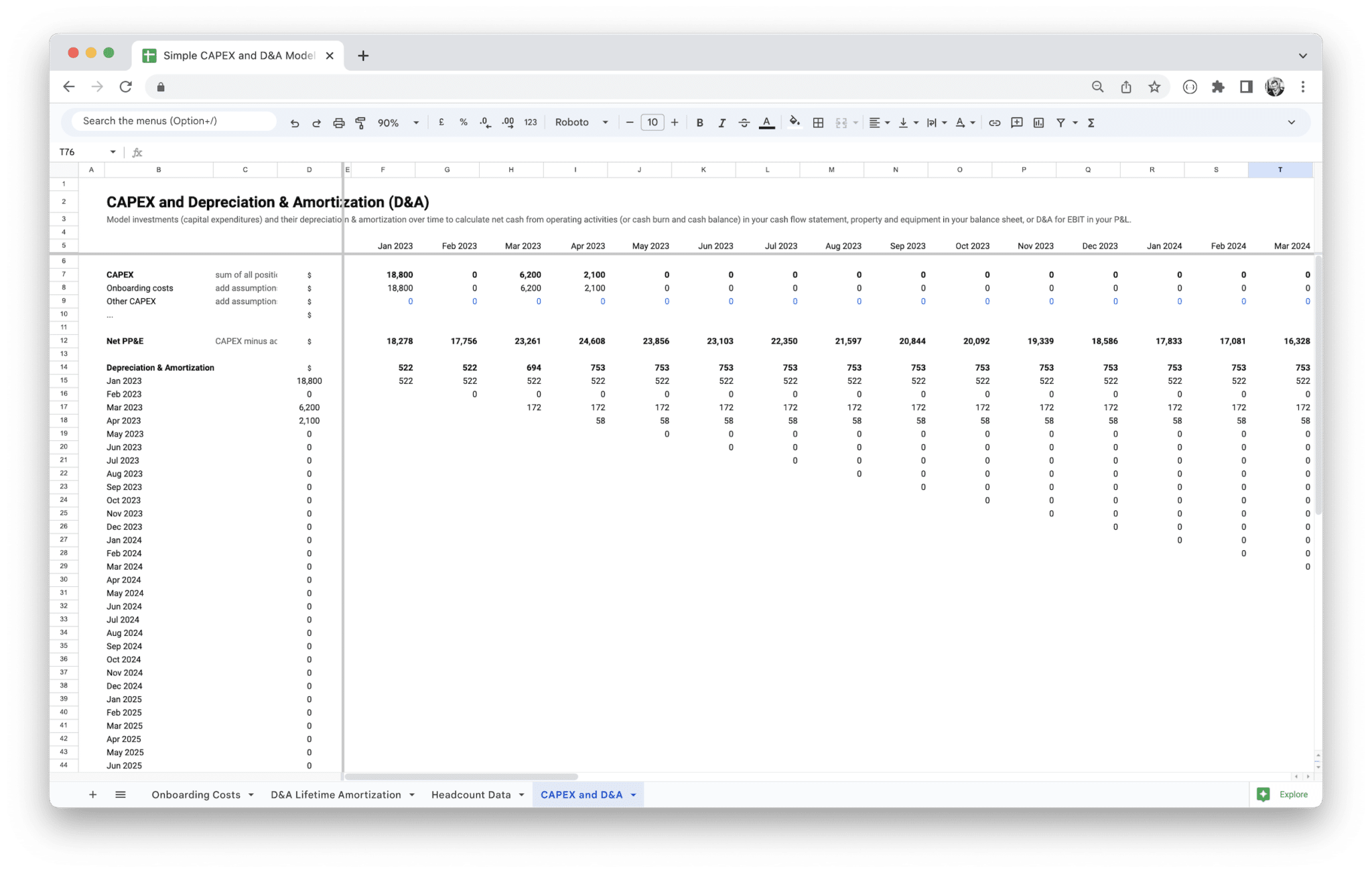

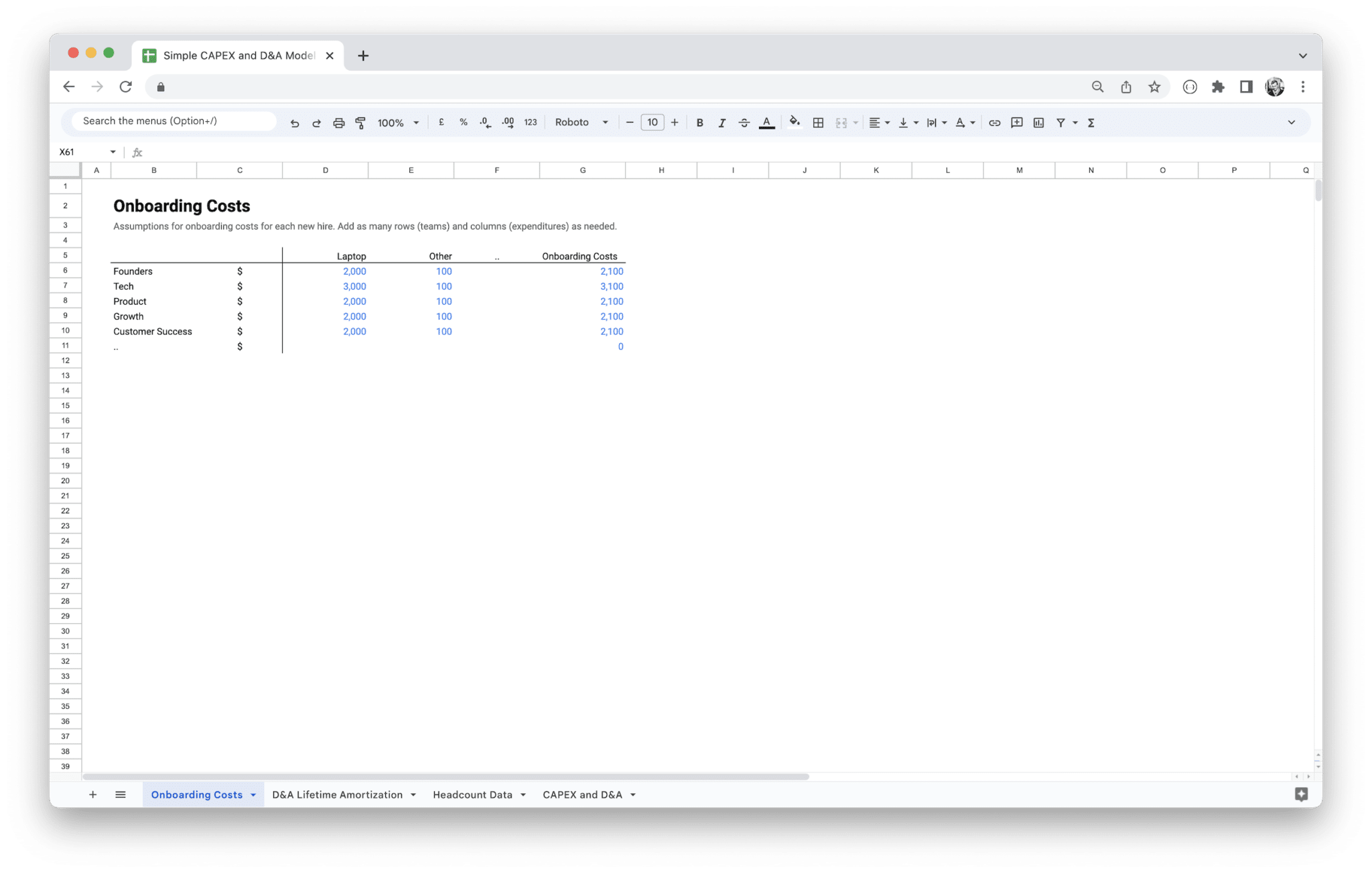

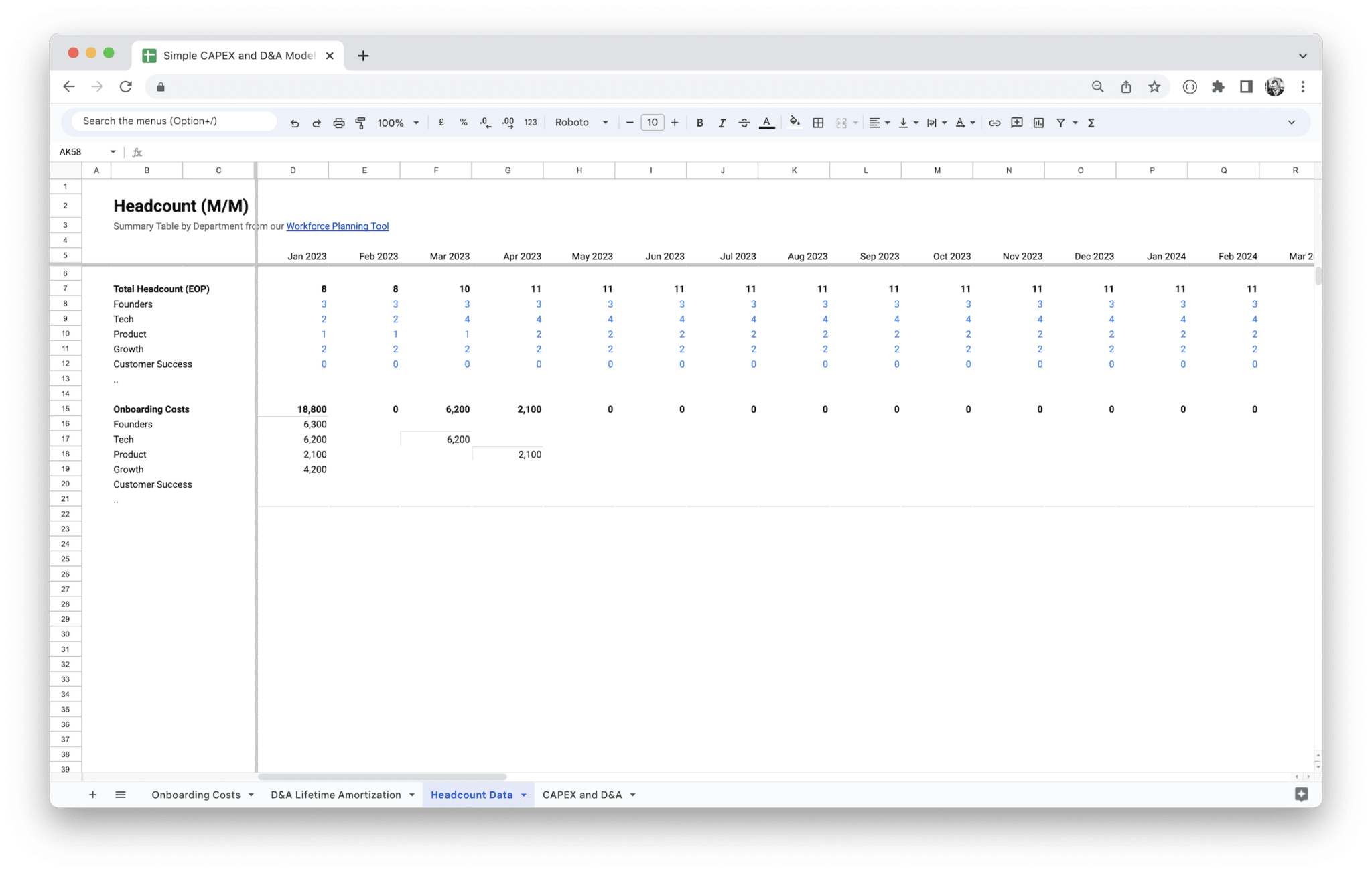

Forecast capital expenditures & boost financial planning with this dynamic model. Calculate depreciation and net PP&E easily using headcount data. Optimize your CapEx planning now!

Description

Managing capital expenditures can be a complex and overwhelming task, especially when you’re juggling multiple projects, budgets, and long-term goals. Without a clear and organized system, it’s easy to miss key details, overspend, or misalign investments with your company’s strategic objectives. This can lead to unnecessary financial strain and missed opportunities for growth.

Our CapEx Planning Template is designed to solve this problem by offering you a simple, structured solution to manage your investments effectively. With this template, you can easily track and prioritize capital expenditures, ensuring that your spending aligns with your business’s financial goals. It allows you to allocate resources wisely, forecast cash flows, and calculate ROI with ease, so you can make confident, informed decisions. Whether you’re managing large projects or just looking to improve financial visibility, this template will help streamline your CapEx process, reduce risks, and drive better results for your business.

Capital Expenditure (CapEx) is a fundamental concept in business finance, referring to the funds used by a company to acquire, upgrade, or maintain physical assets such as buildings, machinery, equipment, and technology. These expenditures are typically large investments that provide value to the company over an extended period. While the exact nature of CapEx projects may vary from one business to another, the underlying principle remains the same: CapEx represents long-term investments that will help generate future revenue, improve operational efficiency, or support strategic growth.

CapEx planning is the process of budgeting, forecasting, and prioritizing these expenditures to ensure they are made in a financially responsible and strategically sound manner. It involves a careful assessment of the business’s current and future needs, considering both the costs and potential returns of investing in long-term assets. Effective CapEx planning is crucial for ensuring that resources are allocated efficiently, risk is managed appropriately, and the investments made today will support the business’s success tomorrow.

The goal of CapEx planning is to ensure that your business makes the right investments at the right time, with the right amount of capital. A well-executed CapEx plan not only helps you manage large expenditures but also ensures that each investment aligns with your company’s long-term strategic objectives, providing a strong foundation for growth and stability.

What is Capital Expenditure (CapEx)?

Capital Expenditure (CapEx) is any expenditure that a company incurs to acquire, upgrade, or improve long-term assets that will provide value over an extended period, typically more than one year. Unlike operating expenses (OpEx), which are recurring and cover the day-to-day costs of running a business, CapEx involves substantial one-time investments designed to improve the company’s operational capabilities or expand its asset base. These investments can include anything from purchasing new machinery, building new facilities, or upgrading technology systems to acquiring land or making strategic acquisitions of other businesses.

The purpose of CapEx is to maintain or enhance the value of the business’s assets and ensure continued business operations. Whether a company invests in machinery to increase production capacity, adopts new technology to improve efficiencies, or acquires real estate for expansion, each of these expenditures plays a role in supporting the company’s growth trajectory.

Capital expenditures can be classified into two types:

- Growth Capital Expenditures: These are investments made to expand the business, such as purchasing new equipment, acquiring new property, or upgrading technology that will allow the company to generate more revenue or improve market competitiveness.

- Maintenance Capital Expenditures: These are necessary investments to keep the business running at its current operational level. They include repairs, upgrades, or replacements of aging machinery, IT infrastructure, or facilities that are crucial to sustaining business operations.

Understanding the nature and scope of CapEx is critical for businesses, as these investments often involve significant financial commitments and long-term financial planning.

Importance of CapEx Planning for Businesses

CapEx planning plays a vital role in a company’s ability to make informed, strategic investments. It ensures that the business can prioritize its spending, manage risks, and align expenditures with long-term objectives. By taking a proactive approach to planning capital expenditures, companies can optimize their use of financial resources, reduce the potential for wasteful spending, and improve operational efficiency. Here are some key reasons why CapEx planning is so important for businesses:

- Helps Allocate Resources Efficiently: Proper planning ensures that the business allocates capital to the most valuable projects, reducing the risk of overspending or underfunding critical investments.

- Supports Long-Term Growth: A well-structured CapEx plan aligns investments with the company’s growth strategy, enabling the business to scale up operations, expand into new markets, or enhance product offerings.

- Minimizes Financial Risk: CapEx projects involve large financial outlays, and poor planning can lead to financial strain. A solid plan helps mitigate risks by ensuring that each investment is thoroughly assessed for return on investment (ROI), feasibility, and long-term sustainability.

- Improves Cash Flow Management: By forecasting capital expenditures and understanding their impact on cash flow, businesses can ensure that they have the necessary funds available to meet both short-term obligations and long-term investment goals.

- Aligns with Business Objectives: CapEx planning ensures that investments are in line with the company’s overall objectives, whether it’s improving efficiency, enhancing customer experience, or supporting innovation. It helps avoid investments that may not directly contribute to the business’s strategic goals.

- Enhances Stakeholder Confidence: When CapEx is properly planned and managed, stakeholders such as investors, banks, and internal teams gain confidence in the company’s financial discipline. This is especially crucial when seeking external financing for large projects.

- Facilitates Effective Communication: A structured CapEx plan provides transparency, making it easier for decision-makers to communicate the rationale behind major investments to stakeholders, including employees, investors, and financial partners.

A business that actively engages in CapEx planning is better positioned to navigate challenges and opportunities, using its capital to enhance competitive advantage and drive sustainable growth.

How a CapEx Planning Template Can Simplify Your Process

A CapEx planning template can be an invaluable tool for businesses, especially when it comes to managing large investments and ensuring that all key considerations are accounted for. Whether you’re a small startup or a large enterprise, a well-designed template can streamline the CapEx planning process, reduce manual work, and help ensure that the planning process is comprehensive and consistent. Here are some ways in which a CapEx planning template can simplify the process for you:

- Organizes Information: A template provides a structured format for organizing all the details of your capital expenditure projects, such as asset types, costs, expected returns, depreciation schedules, and cash flow projections. This centralizes all the relevant data, making it easy to review and adjust as needed.

- Saves Time: With pre-set fields and formulas, a template can automate many aspects of CapEx planning, such as calculating ROI, depreciation, or expected cash flow. This eliminates the need for manual calculations and reduces the risk of errors, freeing up valuable time for analysis and decision-making.

- Improves Accuracy: By providing a standardized framework for inputting data, a template ensures that no critical information is overlooked. This improves the accuracy of financial forecasts, helping to avoid overestimating or underestimating the costs and benefits of capital expenditures.

- Enables Collaboration: With a shared CapEx planning template, multiple team members—such as finance, operations, and project managers—can collaborate more effectively. The template serves as a single reference point for all team members to track progress, update information, and make necessary adjustments.

- Provides Clear Visibility: A template makes it easy to visualize the impact of capital expenditures over time. You can track budget allocation, cash flow, ROI, and other key metrics at a glance, giving you a clearer understanding of the financial health of your business.

- Streamlines Reporting: Whether you need to present your CapEx plan to executives, investors, or other stakeholders, a template allows you to generate clean, concise reports that provide a detailed overview of your planned investments and their expected outcomes. This improves communication and transparency.

- Adapts to Business Needs: CapEx planning templates are often customizable, allowing you to tailor them to the specific needs of your business. Whether you’re in manufacturing, retail, or tech, you can adjust the template to reflect the unique categories and factors relevant to your industry, making it more applicable to your situation.

- Helps Forecast and Track Performance: With built-in financial forecasting features, templates help you predict future cash flows, estimate depreciation, and assess the overall financial impact of your CapEx projects. These features help you track whether your investments are meeting their financial targets over time.

Ultimately, using a CapEx planning template helps you work smarter, not harder. It provides a framework for making informed, strategic decisions, reducing the complexity of managing large capital expenditures, and ensuring that your investments align with your business goals.

Benefits of Using a CapEx Planning Template

Using a Capital Expenditure (CapEx) planning template provides a structured approach to managing and tracking investments, which can be a game-changer for businesses looking to optimize their spending. By leveraging a template, companies can simplify the process of allocating resources, forecasting expenses, and evaluating the return on investments. This tool not only streamlines the financial planning process but also ensures that all stakeholders are aligned on business priorities and budget expectations. Here are some of the key benefits of using a CapEx planning template:

- Improved Budget Management: A CapEx planning template helps you allocate your budget efficiently across different asset categories, reducing the risk of overspending and ensuring that every dollar is accounted for. It makes it easier to compare planned expenditures with actual costs, helping to stay within budget and make adjustments as needed.

- Enhanced Decision-Making: By organizing all your planned capital investments in one place, a CapEx template allows you to evaluate different investment options based on their potential impact. This makes it easier to decide where to allocate capital for the highest return and strategic alignment.

- Greater Visibility and Transparency: Using a template allows all relevant parties, such as executives, managers, and financial teams, to access and understand the CapEx plans. This enhances transparency, making it easier to communicate the rationale behind investment decisions and ensure alignment across departments.

- Streamlined Financial Forecasting: The ability to input estimates for cash flows, ROI, and other financial metrics into a template allows you to forecast the financial impact of your capital expenditures accurately. This predictive capability helps you make data-driven decisions and prepare for any future changes in cash flow or financial requirements.

- Faster Approval Processes: With a clearly structured template, it’s easier to present your CapEx plans to decision-makers or investors. A well-organized template provides all the necessary information in one place, speeding up the approval process and ensuring that investments can be made in a timely manner.

- Risk Mitigation: A well-constructed CapEx plan identifies potential risks and provides a clear path for monitoring asset performance over time. By tracking metrics such as ROI, depreciation, and lifecycle costs, a template helps mitigate the risks associated with large capital investments and ensures better long-term financial stability.

- Efficiency and Time Savings: Templates are pre-formatted to include all necessary categories and calculations, which saves time during the planning phase. With reusable, customizable fields, templates reduce the need for repetitive manual work, allowing teams to focus on analyzing and improving the plan rather than setting it up from scratch.

- Support for Strategic Planning: CapEx planning templates allow businesses to align their capital expenditures with their long-term strategic objectives. They enable a clear connection between financial planning and business goals, helping to prioritize investments that directly support growth and innovation.

When creating a Capital Expenditure (CapEx) plan, it’s essential to break the process down into manageable, organized components. Each of these elements contributes to making well-informed decisions that benefit the long-term growth of your business. By carefully evaluating assets, budgeting effectively, forecasting cash flows, and assessing risks, you ensure that your business can allocate capital efficiently and responsibly. Let’s explore each key component in detail.

Understanding Capital Assets

Capital assets are tangible or intangible investments that are expected to generate value for your business over an extended period—typically more than one year. These assets often come with a high upfront cost but are essential for supporting the operational and strategic growth of your company. Understanding these assets is the first step in forming a robust CapEx plan.

Common examples of capital assets include:

- Buildings and Real Estate: Whether it’s purchasing office space, a warehouse, or land, these assets have long-term value and can appreciate over time. They also require regular maintenance and care.

- Machinery and Equipment: For manufacturers, construction companies, or any industry reliant on machinery, these assets are crucial for production and service delivery. Equipment like computers, industrial machines, and vehicles fall into this category.

- Technology and Software Systems: Investments in technology, such as software tools, databases, and IT infrastructure, can drastically enhance business operations and efficiency. These assets, like a new customer relationship management (CRM) system or an enterprise resource planning (ERP) platform, tend to depreciate quickly but are indispensable.

- Vehicles and Fleet Management: If your business relies on transportation, capital expenditure might go towards acquiring or leasing vehicles. This is particularly important for delivery services, logistics companies, or field service businesses.

It’s important to understand that these assets play different roles within your business. Some are integral to day-to-day operations, while others might be necessary for future growth. Properly accounting for these capital assets in your CapEx plan ensures you make informed decisions about which assets will provide the greatest return on investment (ROI) in the long run.

Budget Allocation for Capital Expenditures

Once you’ve identified the capital assets you need, the next crucial step is budgeting. Proper budget allocation ensures that your capital expenditures are in line with your business’s financial capacity and strategic goals. This step requires a thorough understanding of both your immediate needs and your long-term objectives.

The process begins by evaluating your available financial resources. What funds do you have to allocate toward CapEx, and how do you ensure that these funds are spent wisely? A well-thought-out budget allows you to:

- Prioritize Projects: Not all CapEx projects are of equal importance. Some investments might be essential for immediate operational needs, while others may be part of a long-term strategic goal. For example, upgrading a CRM system might be urgent, whereas buying new office space could be something that can be deferred until later.

- Factor in Unexpected Costs: Every CapEx project should include a contingency for unforeseen costs. Unexpected expenses are common, so it’s important to leave room in your budget for things like delays in delivery, price fluctuations for materials, or unexpected maintenance costs for assets that aren’t quite up to par.

- Consider Financing Options: Sometimes, businesses don’t have enough capital readily available to fund large CapEx projects. In these cases, you might need to explore financing options such as loans, leases, or external investors. Your budget should account for the terms and conditions of any financing arrangements and how they impact your cash flow.

One key aspect of budget allocation is ensuring that the projects you fund today are in line with the overall strategic direction of your business. Over-committing to a single project at the expense of others could hurt your ability to respond to changing market conditions, which is why the budgeting process should be flexible and dynamic.

Estimating Future Cash Flows

Estimating future cash flows is one of the most important aspects of CapEx planning. You’ll need to forecast how each capital investment will contribute to your business’s cash flow over time. This forecasting allows you to evaluate the return on each asset and determine whether it’s worth the financial commitment.

Cash flow estimates include a variety of factors:

- Revenue Generation: How much additional revenue will the new asset generate? For example, buying new machinery may enable you to produce more goods and increase sales. If you’re investing in software, it might improve productivity and reduce time spent on manual tasks, which ultimately leads to higher sales.

- Cost Savings: In many cases, capital expenditures lead to reduced costs. For instance, purchasing energy-efficient equipment can lower utility bills, or investing in automated systems may reduce the need for human labor. Identifying these savings in your cash flow estimates helps you measure the true financial benefit of each investment.

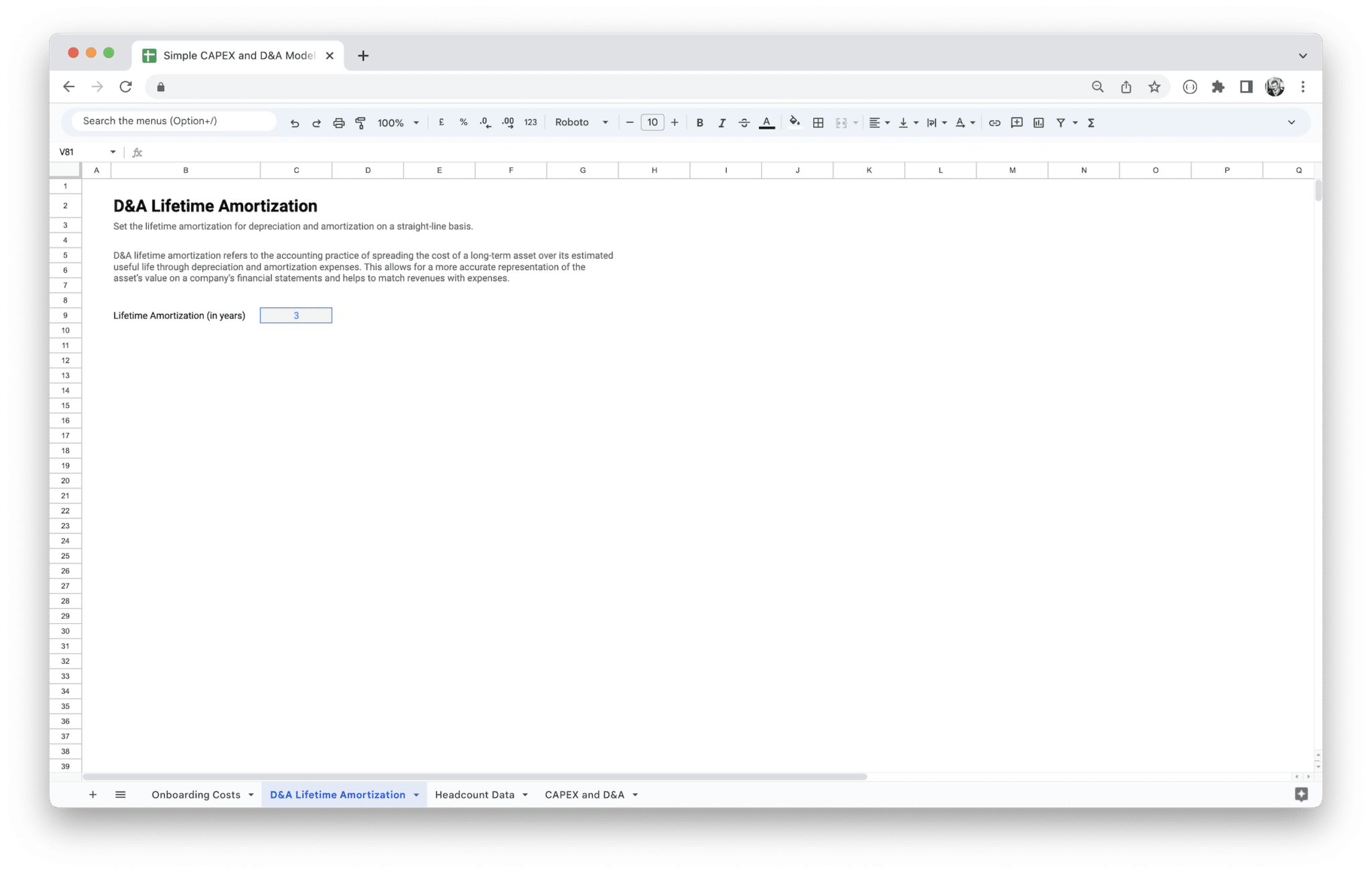

- Depreciation: Capital assets lose value over time. Depreciation impacts your business’s financial statements, as well as your tax obligations. Estimating depreciation is essential for projecting the long-term financial performance of each asset and understanding its future cash impact.

- Tax Implications: Certain investments can also offer tax benefits, such as depreciation deductions. Your CapEx plan should account for how your assets will impact your taxes, helping you avoid any surprises when it comes time to file.

A key element of estimating future cash flows is creating a balance between accuracy and flexibility. Although you can use historical data, market research, and expert estimates to make projections, it’s important to revisit these estimates regularly. Changes in the market or unforeseen disruptions can alter your cash flow expectations, and your plan should reflect those fluctuations.

Evaluating Risks in CapEx Projects

Every investment involves a degree of risk, and CapEx projects are no exception. Evaluating the risks associated with each capital expenditure is a critical part of the planning process. By identifying these risks early on, you can implement strategies to minimize their impact on your business.

Several types of risks should be considered when planning capital expenditures:

- Market Risk: The business environment is always shifting. Market trends, economic conditions, or sudden shifts in consumer demand can drastically affect the success of your capital expenditures. For example, if you invest in new manufacturing equipment, but the market for your products declines, you may not see the return you anticipated. Monitoring market conditions and adjusting your CapEx plan as needed helps mitigate this risk.

- Operational Risk: Any new asset introduces operational complexities. This could involve training staff, implementing new systems, or coordinating logistics. These factors can cause delays or added costs if not properly planned for. Ensuring that your team is prepared for the operational changes that come with new assets is crucial.

- Technological Risk: With rapid advances in technology, assets like IT systems or machinery can quickly become obsolete. For example, an expensive piece of software might seem like a good investment, but if a better, cheaper version is released soon after, your investment could lose its value. To mitigate technological risk, it’s essential to stay up to date with industry trends and evaluate whether an investment will stand the test of time.

- Financial Risk: Acquiring capital assets often involves a significant financial commitment. If cash flows don’t meet expectations, your business may struggle to cover costs. Financial risks can also include borrowing money to fund CapEx projects, which may lead to debt obligations that your business is unable to meet. A thorough financial analysis and a well-diversified CapEx plan can help manage these risks.

Mitigating these risks often requires a combination of strategies. Diversification, for instance, involves spreading your investments across different asset classes, thus minimizing the impact of any one project failing. Creating contingency plans, budgeting for unexpected costs, and considering how flexible your investments are will also help protect your business from unforeseen risks.

By addressing and planning for these potential risks, you make your business more resilient in the face of uncertainty. A comprehensive risk evaluation ensures that you are ready to take on new assets while minimizing any negative impact they may have on your operations.

When it comes to measuring the success of your capital expenditures (CapEx), it’s essential to rely on data-driven metrics. These key performance indicators (KPIs) not only help you determine whether your investments are providing the desired returns but also allow you to make informed decisions about future expenditures. By regularly tracking these metrics, you gain deeper insights into your business’s financial health and can adjust your strategies accordingly.

Return on Investment (ROI)

Return on Investment (ROI) is one of the most widely used metrics for evaluating the performance of capital expenditures. Essentially, ROI helps you measure how much profit or benefit you’re receiving from an investment relative to its cost. It’s a straightforward way to determine if the money you’re putting into a project or asset is yielding adequate returns.

To calculate ROI, you simply subtract the cost of the investment from the expected gain or benefit and then divide it by the initial cost of the investment. The result is usually expressed as a percentage. A positive ROI indicates that the investment is generating more value than it cost, while a negative ROI suggests that the expenditure isn’t worthwhile.

For example, if you invest $100,000 in new manufacturing equipment, and the equipment leads to a $120,000 increase in revenue, your ROI calculation would look like this:

ROI = (Gain from Investment - Cost of Investment) / Cost of Investment ROI = (120,000 - 100,000) / 100,000 = 0.20 = 20%

This means you’re earning a 20% return on your initial investment. Understanding ROI allows you to prioritize high-return projects and avoid sinking resources into ventures that fail to deliver financial value.

It’s worth noting that ROI isn’t just about immediate financial returns. It can also include qualitative benefits like enhanced brand recognition, customer loyalty, or process improvements. For example, investing in software that streamlines internal operations might not provide direct financial returns in the short term, but it could drastically improve efficiency and productivity, leading to significant long-term value.

Payback Period

The payback period is another important metric used to evaluate capital expenditures. It answers a simple yet crucial question: “How long will it take for an investment to pay for itself?” This metric focuses on the time it takes for the cash inflows generated by an investment to cover its initial cost. The shorter the payback period, the quicker your investment begins generating positive cash flow, making it easier to reinvest in future projects.

Let’s break down how to calculate the payback period. First, you need to determine the annual or monthly cash inflows associated with the investment. Then, divide the initial investment by the expected annual cash inflows to find the number of years or months it will take to recover your investment.

For instance, if you invest $200,000 in a new piece of equipment, and it’s expected to generate $50,000 in additional revenue each year, the payback period would be:

Payback Period = Cost of Investment / Annual Cash Inflows Payback Period = 200,000 / 50,000 = 4 years

The payback period for this investment would be four years, meaning you’ll recover the initial investment within that timeframe. A shorter payback period is generally preferred because it indicates that the investment can start generating returns sooner.

While the payback period is a useful metric, it does have some limitations. For instance, it doesn’t take into account the time value of money (which we’ll address with NPV and IRR later), and it doesn’t consider any cash flows that occur after the payback period. Therefore, it’s essential to use the payback period alongside other metrics to get a more comprehensive view of an investment’s potential.

Net Present Value (NPV)

Net Present Value (NPV) is one of the most powerful and sophisticated metrics used to evaluate capital expenditures. NPV accounts for the time value of money, which means it recognizes that money today is worth more than the same amount of money in the future. The concept behind NPV is that future cash flows must be discounted to their present value to reflect their true worth.

When calculating NPV, you subtract the present value of cash outflows (such as the initial cost of the investment) from the present value of expected future cash inflows. The result helps you determine whether an investment will increase the value of your business.

To calculate NPV, you need to estimate the expected cash inflows over the life of the investment and apply a discount rate to them. The discount rate is typically the company’s required rate of return, which represents the opportunity cost of capital (the return you could earn elsewhere).

The formula for NPV is as follows:

NPV = Sum of (Cash Inflows / (1 + Discount Rate)^n) - Initial Investment

Where:

- Cash inflows are the expected future revenue from the investment.

- Discount rate is the rate used to discount future cash flows to their present value.

- n represents the period in which the cash inflows are expected.

If the NPV is positive, it means that the investment will add value to the business and is considered a good opportunity. If the NPV is negative, the investment is expected to decrease the business’s value and should likely be avoided.

For example, imagine you’re considering an investment that costs $100,000 and will generate $30,000 annually for five years. If your company’s required rate of return is 10%, the NPV calculation would be:

NPV = 30,000 / (1 + 0.10)^1 + 30,000 / (1 + 0.10)^2 + 30,000 / (1 + 0.10)^3 + 30,000 / (1 + 0.10)^4 + 30,000 / (1 + 0.10)^5 - 100,000

The result of the calculation will give you a figure that helps you assess whether the investment is worthwhile. A positive NPV signals a go-ahead for the investment, while a negative NPV suggests reconsidering.

NPV is especially useful when comparing multiple investment options, as it gives you a direct sense of which project will generate the most value over time. However, calculating NPV requires accurate cash flow projections and a reasonable discount rate, which can be challenging in some cases.

Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) is closely related to NPV and is another essential metric for evaluating capital expenditures. Essentially, IRR is the discount rate at which the NPV of an investment becomes zero. In other words, it’s the rate of return that makes the present value of all future cash flows equal to the initial investment.

IRR is an excellent metric because it provides a single percentage that tells you how attractive an investment is. The higher the IRR, the more favorable the investment. It’s useful for comparing multiple CapEx projects, as it gives you a sense of which one is likely to generate the highest return relative to its cost.

The formula for calculating IRR involves solving for the discount rate that makes the NPV of future cash flows equal to zero. It’s a bit more complex than calculating NPV directly, often requiring trial and error or the use of financial software or spreadsheets to solve.

In practical terms, if a project has an IRR higher than your company’s required rate of return (or cost of capital), it’s considered a good investment. If the IRR is lower than the cost of capital, the investment is likely not worth pursuing.

For example, if you invest $100,000 in a project and expect annual cash inflows of $30,000 for five years, you can use the IRR calculation to determine the rate of return that makes the NPV zero. If the IRR turns out to be 15%, and your company’s cost of capital is 10%, this suggests that the investment is worthwhile because it exceeds the required rate of return.

IRR can be a more intuitive measure than NPV, as it provides a clear percentage that you can use to compare different projects. However, it also has its limitations, especially in cases where cash flows fluctuate over time or when there are multiple changes in the direction of cash flows.

A Capital Expenditure (CapEx) planning template is a powerful tool that can help you organize and manage your investments in a way that aligns with your business’s strategic objectives. However, just using a template isn’t enough; you need to know how to set it up, customize it for your business, and track progress over time. With the right approach, you can unlock the full potential of your CapEx planning template, ensuring that your resources are allocated wisely and that you’re on track to meet your financial goals.

1. Set Up a CapEx Plan in the Template

Setting up a CapEx plan in your template requires a structured approach. You need to account for all the components of your business’s capital expenditures, from identifying the required assets to forecasting cash flows. A well-organized setup ensures that your template can serve as a central hub for all the financial decisions related to CapEx projects.

Start by listing all potential capital assets that your business may need to invest in. This includes both essential investments, such as machinery upgrades or office space, and any potential long-term projects like new technology systems or large-scale infrastructure investments. These assets will form the foundation of your CapEx plan.

Next, categorize these assets into groups based on their function or impact. For example, you could have categories such as:

- Production Equipment: Machines or tools that directly impact your output.

- Real Estate and Infrastructure: Office spaces, buildings, or land purchases.

- Technology: Software, IT systems, or digital tools that enhance business efficiency.

Once your assets are grouped, allocate a portion of your budget to each category. This is where your knowledge of financial capacity and priority comes into play. Consider the urgency of each expenditure and the potential return on investment. Some expenses may require immediate attention, while others can be phased in over time.

Once budget allocation is complete, you can input these numbers into your template. This is a simple process if the template is well-structured, with predefined fields for each category and cost estimates. The template should allow for flexible entries, so if new expenses arise, they can be added with ease.

A CapEx plan template will also include a section for forecasting the expected lifespan of the asset and its impact on cash flow over time. Whether you’re calculating depreciation or estimating the ongoing savings or revenue generated by the asset, entering this information upfront helps you track the long-term financial implications of each investment.

2. Customize the Template for Your Business Needs

While a generic CapEx planning template can give you a solid starting point, the real value comes from tailoring it to fit your specific business context. Every company has unique needs, and customizing your template ensures that you’re capturing the full picture of your capital expenditure requirements.

Begin by reviewing the pre-set categories in your template. Do they cover all areas of your business? If you work in a niche industry or have a complex set of assets, you may need to add new categories or subcategories that reflect the specific types of capital expenditures your company makes. For example, if you’re a tech startup, you may want to add categories for software subscriptions or R&D equipment, while a manufacturing company may need to focus more on heavy machinery and factory upgrades.

Customization should also extend to the way you forecast future cash flows. Some businesses may have consistent, predictable revenue streams, while others may experience seasonal fluctuations or rely on project-based income. Your template should be flexible enough to reflect these differences. For instance, you might want to input revenue estimates month by month or set up quarterly cash flow projections that are more in line with how your business operates.

You can also tailor the template to align with your company’s financial goals and processes. For example, if your business prioritizes sustainability, you might include a section to evaluate the environmental impact of each investment and whether it contributes to your long-term green goals. Similarly, if you’re working with external stakeholders like investors or auditors, you can modify the template to include additional reporting categories that ensure transparency and compliance.

Another important customization aspect is integrating your CapEx template with other business systems, such as your financial software, CRM, or project management tools. Many templates allow for data import and export, which helps reduce manual data entry and ensures that your CapEx planning aligns seamlessly with your broader financial and operational strategies. This integration can help automate updates, track budget performance in real-time, and provide more accurate financial forecasting.

3. Track Progress and Make Adjustments Over Time

The success of your CapEx planning doesn’t end once the template is set up and populated. To truly get the most out of your investment, you need to track the progress of your projects and make adjustments as circumstances change. This requires regularly revisiting your CapEx plan, updating it based on actual performance, and modifying your approach when necessary.

Start by regularly monitoring the cash flows associated with your capital expenditures. How are the new assets performing in terms of revenue generation or cost savings? For example, if you’ve invested in new machinery, are you seeing the expected increase in production efficiency? If not, it may be worth revisiting the budget allocation or adjusting timelines to ensure that you’re making the most out of the investment.

It’s also important to track how actual spending compares to your initial projections. A good CapEx template should include a comparison tool that allows you to review your projected vs. actual costs over time. If you’re spending more than expected on a particular asset, this may signal the need for a revision of the project scope, a reassessment of funding, or changes in vendor contracts. On the other hand, if you’re under budget, it could be an opportunity to reallocate funds to other areas or accelerate investments that will drive growth.

Over time, businesses face shifts in market conditions, technology, and other external factors that can impact the relevance or effectiveness of their capital expenditures. As such, your CapEx plan should remain flexible. For example, if a major competitor introduces a game-changing product, your business might need to accelerate its technology investments. Alternatively, economic downturns may force you to slow down or even cancel planned expenditures.

Regularly revising the template based on updated forecasts and business goals helps you stay aligned with your overall strategy. In addition, maintaining an open line of communication with key stakeholders—such as department heads, CFOs, or external financial advisors—ensures that everyone is on the same page and can contribute insights that refine the CapEx plan.

Another key element of progress tracking is keeping a pulse on the return on investment (ROI) of each asset. As time progresses, you’ll have more data on whether or not your investments are paying off. For example, an IT system that promised improved efficiency may initially have high implementation costs, but over time, its ROI might become clearer through reduced operational costs or time savings. Being able to adjust your plans based on the ROI data ensures that your CapEx strategy remains relevant and results-driven.

Effective tracking also means considering the lifecycle of each asset. What’s the depreciation schedule? When is it time to replace or upgrade assets? Your CapEx planning template should help you set clear timelines and milestones to ensure that you make timely decisions about asset maintenance, replacements, or upgrades.

In short, the key to making your CapEx planning template work effectively is treating it as a living document. Set it up with the right information, customize it to your business needs, and then commit to regularly reviewing and adjusting it as circumstances evolve. This proactive approach will help you maintain control over your capital expenditures, ensuring that your investments continue to drive value for your business in both the short and long term.

CapEx planning is a critical part of long-term financial strategy, and following best practices can make all the difference in ensuring that your investments are efficient, cost-effective, and aligned with your business’s goals. By adhering to proven practices, you can minimize risk, optimize spending, and maximize return on investment. Here are some of the best practices to follow for successful CapEx planning:

- Align CapEx Investments with Business Strategy: Ensure that each investment directly supports the company’s long-term objectives. Whether it’s expanding production capabilities, improving technology infrastructure, or enhancing customer experience, all CapEx projects should tie back to strategic goals.

- Prioritize High-Impact Projects: Given that capital resources are often limited, focus on the projects that will have the greatest long-term impact on your business. Prioritize investments based on their potential to drive revenue, reduce costs, or improve operational efficiency.

- Regularly Review and Adjust the Plan: CapEx planning is not a one-time task. Regularly revisit and update your plan to reflect changes in the market, business operations, and financial performance. This helps ensure that your investment strategy remains relevant and effective.

- Incorporate Risk Assessment and Contingency Plans: Every CapEx project carries some level of risk. Perform thorough risk assessments to identify potential issues, such as market volatility, equipment failures, or unexpected maintenance costs, and plan for contingencies to mitigate those risks.

- Use Clear and Detailed Forecasts: A successful CapEx plan requires accurate forecasts of future cash flows, including expected revenue generation, cost savings, and tax impacts. Be as detailed as possible in estimating both direct and indirect financial benefits to ensure more accurate planning.

- Monitor Performance and ROI Regularly: After the investments are made, continuously track the performance of each asset using ROI, payback period, and other financial metrics. This helps determine whether the capital expenditure is meeting expectations and provides valuable insights for future projects.

- Maintain Flexibility: While it’s important to have a structured CapEx plan, it’s equally important to stay flexible. Changes in the business environment, new opportunities, or unforeseen challenges may require adjustments to the plan. A flexible approach allows for quick pivots when necessary.

- Engage Stakeholders in the Planning Process: Include key stakeholders from various departments—finance, operations, HR, and IT—when creating your CapEx plan. Involving different perspectives helps ensure that all aspects of the business are considered, making your investments more effective and strategic.

- Track Depreciation and Asset Lifecycles: Account for depreciation and the overall lifecycle of your assets in your plan. This helps you understand when assets may need to be replaced or upgraded and ensures that future capital expenditures are properly anticipated.

- Leverage Technology for Better Planning: Utilize financial modeling software, CapEx management tools, or integrated planning platforms to improve the accuracy and efficiency of your planning process. These tools allow you to track, analyze, and report on capital expenditures more effectively.

Despite the best intentions, businesses can still make mistakes when planning their capital expenditures. These errors can lead to wasted resources, missed opportunities, and costly financial consequences. Understanding and avoiding these common pitfalls can help you execute a more effective CapEx strategy. Here are some of the most common mistakes to watch out for:

- Overestimating Revenue or Benefits: One of the biggest mistakes in CapEx planning is overestimating the potential revenue or cost savings that a new asset will generate. Overly optimistic forecasts can lead to overinvestment and disappointment when returns don’t meet expectations. To avoid this, ensure that all projections are based on realistic data and historical performance.

- Neglecting to Factor in Maintenance and Operating Costs: It’s easy to focus on the initial costs of acquiring new assets but forget to account for ongoing maintenance, repairs, and operational costs. These expenses can quickly add up and erode the anticipated return on investment. Always include these costs in your forecast to get a true picture of the asset’s financial impact.

- Failing to Consider Long-Term Depreciation: Depreciation can have a significant impact on the value of capital assets over time, but many businesses fail to factor this into their long-term financial planning. Without considering depreciation, you may be overestimating the asset’s remaining value or its ability to generate revenue over time. Incorporate accurate depreciation schedules to get a more accurate view of the asset’s total cost.

- Not Aligning CapEx with Strategic Objectives: Sometimes, businesses make investments simply because they’re available or because they appear to offer short-term benefits. However, without aligning capital expenditures with the company’s overall strategic goals, these investments can end up being wasted or misdirected. Always ensure that your CapEx investments support long-term business objectives.

- Ignoring External Market Factors: Market shifts, technological advances, and regulatory changes can have a major impact on the success of CapEx projects. Failing to account for these external factors when planning your investments can lead to unforeseen risks and lost opportunities. Conduct thorough market research and stay updated on industry trends to make better-informed decisions.

- Underestimating the Time to Realize Returns: Many CapEx projects take time to start generating returns. Underestimating how long it will take to see a positive cash flow or ROI can result in unrealistic expectations and pressure on the business. Set realistic timelines for each project and track progress over time.

- Lack of Stakeholder Involvement: Capital expenditures often require the involvement of multiple departments or teams, but some businesses make the mistake of handling the planning process in isolation. Not involving key stakeholders—such as finance, operations, and IT—can lead to missing critical insights and misaligned goals. Ensure that all relevant parties are consulted during the planning phase.

- Overlooking the Importance of Flexibility: A rigid CapEx plan can hinder your ability to adapt to changing circumstances. Whether it’s a sudden market shift or a new business opportunity, a lack of flexibility can prevent you from making adjustments when needed. Build flexibility into your plan to allow for changes as needed without derailing your overall strategy.

- Not Tracking Post-Investment Performance: Once a capital expenditure is made, many businesses fail to continue tracking its performance. Without ongoing monitoring, it’s difficult to assess whether the investment is delivering the expected results. Regularly track the performance of your CapEx investments and make adjustments as necessary to improve returns.

- Underestimating the Need for Contingency Plans: Unexpected events, such as supply chain disruptions, project delays, or economic downturns, can impact your CapEx plans. Failing to set aside contingency funds or strategies can leave your business vulnerable. Always plan for the unexpected by incorporating contingency funds or backup plans into your CapEx strategy.

Related products

-

Software License Management Tool

$0.00 Add to cart -

Sale!

Marketplace Profit and Loss Statement

$119.00Original price was: $119.00.$79.00Current price is: $79.00. Add to cart -

Sale!

Startup Profit and Loss Statement

$119.00Original price was: $119.00.$79.00Current price is: $79.00. Add to cart -

Sale!

E-Commerce Profit and Loss Statement

$119.00Original price was: $119.00.$79.00Current price is: $79.00. Add to cart