$49.00

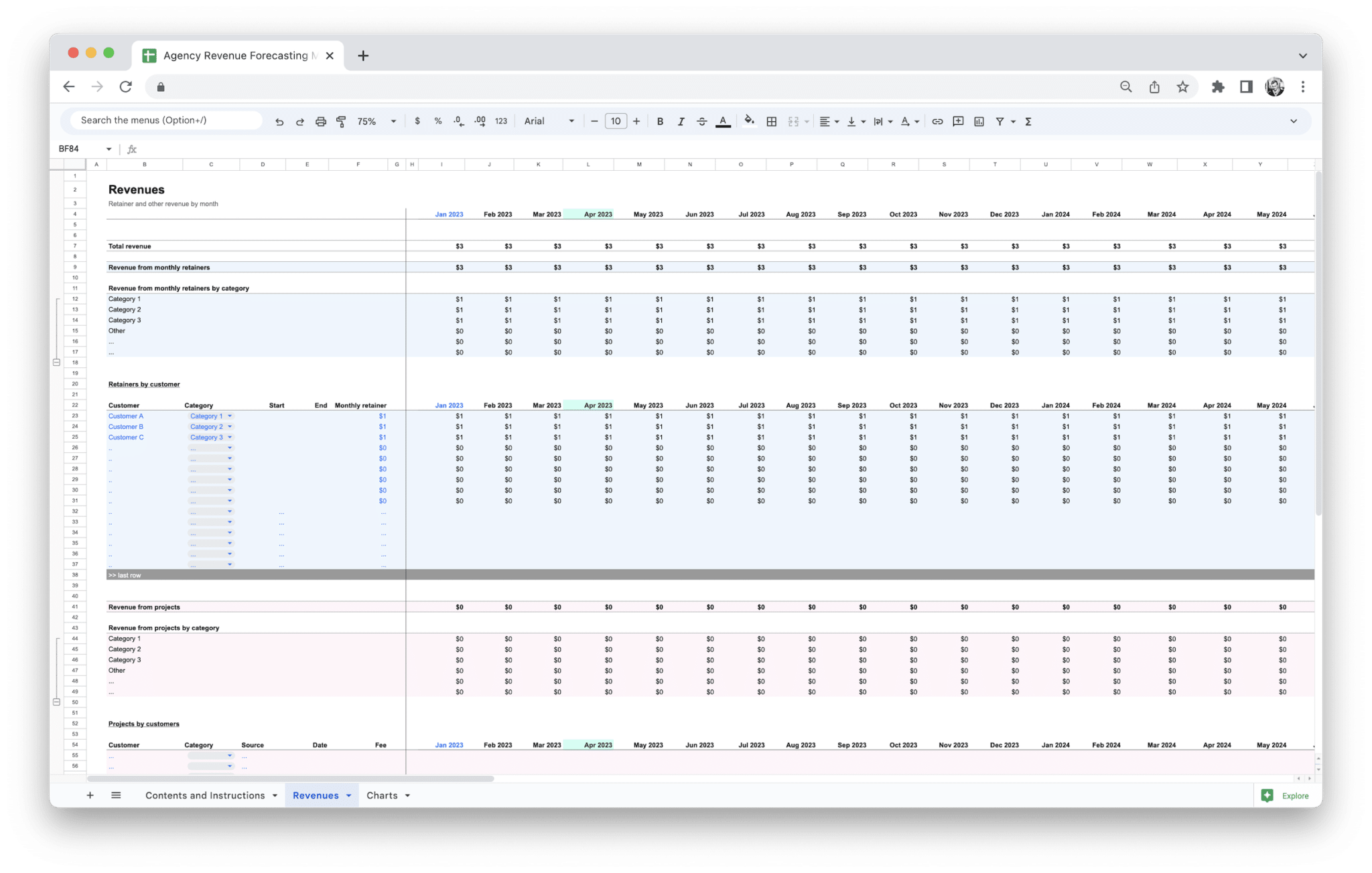

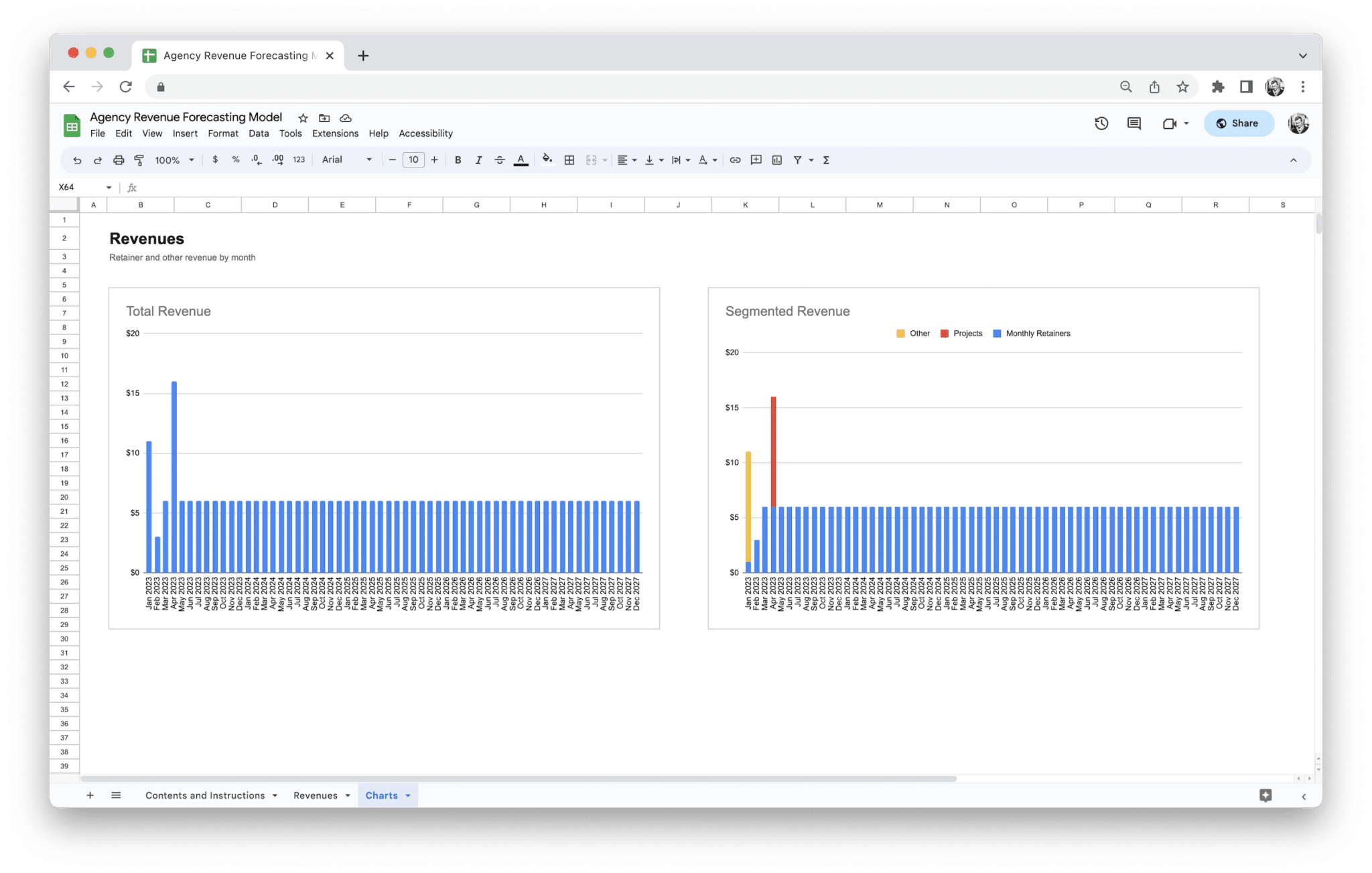

Transform your agency’s financial planning. Predict monthly retainer and project revenues with customizable revenue inputs. Visualize key revenue metrics with built-in charts for a more profitable future!

Description

Running an agency means juggling multiple clients, projects, and revenue streams, which can make it difficult to predict future income and manage cash flow effectively. Without a clear financial overview, it’s easy to overspend, miss opportunities, or even face unexpected shortfalls. You need a way to forecast your revenue with confidence, so you can make informed decisions about budgeting, hiring, and growth. That’s where the Agency Revenue Forecasting Tool Template comes in.

This template is designed to simplify your forecasting process by giving you a clear and organized way to predict your agency’s income based on real data. Whether you’re tracking project-based income, retainer clients, or recurring revenue, this tool consolidates all your data into one easy-to-use spreadsheet. You can quickly input your historical revenue, set realistic growth projections, and identify trends that impact your cash flow. With this tool, you can plan for busy and slow periods, manage resources more effectively, and ensure you’re always on top of your agency’s financial health. It’s the perfect solution for agencies looking to improve their financial planning and make smarter business decisions.

Agency revenue forecasting is the process of estimating future income based on a combination of historical data, client contracts, market trends, and internal business strategies. It helps you plan for the future by predicting how much money your agency will make over a specific period, typically monthly, quarterly, or annually. Revenue forecasting isn’t about making perfect predictions; it’s about creating a solid, data-driven estimate that allows you to make informed business decisions.

Revenue forecasting involves taking stock of all the different income streams your agency has, including recurring income from retainers, project-based income from one-time contracts, and other revenue sources like workshops or product sales. By examining these sources and understanding the factors that affect them, you can create a realistic revenue projection that aligns with your agency’s goals.

The process of forecasting isn’t static—it’s an ongoing activity. Regular updates and adjustments to your forecasts are crucial for keeping track of your agency’s financial health. It helps you manage cash flow, optimize your budget, and make better strategic decisions.

Why Accurate Forecasting is Essential for Agencies

Accurate revenue forecasting is vital for agencies, as it provides a clear picture of future financial health and supports strategic decision-making. Here’s why it’s so important:

- Informs budgeting and cash flow management: Forecasting helps ensure your agency has enough cash on hand to cover operating costs and fund growth initiatives.

- Improves resource allocation: By predicting busy and slow periods, you can allocate resources more effectively, hiring staff or scaling back operations as needed.

- Aids in decision-making: Whether it’s hiring, expanding services, or making investments, accurate forecasts guide decision-making by providing a data-driven approach.

- Helps manage risk: Forecasting helps you identify potential revenue shortfalls ahead of time, allowing you to take proactive measures to mitigate risks.

- Supports business growth: By understanding where revenue is coming from and projecting future growth, agencies can focus their efforts on high-performing revenue streams and pursue expansion opportunities.

- Enhances client relationship management: Knowing when your agency’s income might dip or spike helps you plan for fluctuations in client budgets, giving you a better chance to build long-term relationships and retain clients.

- Tracks business performance: By comparing actual performance to forecasts, you can identify where your agency is excelling and where improvements are needed.

What is an Agency Revenue Forecasting Tool?

An agency revenue forecasting tool is a system or platform designed to help agencies predict their future revenue by consolidating and analyzing various data sources. It’s a practical solution that helps agency owners and managers plan ahead by providing insights into income projections based on historical data, ongoing projects, and potential future business.

These tools often come in the form of spreadsheets, templates, or software platforms, but regardless of the format, the goal is the same: to give you a comprehensive view of your agency’s financial future. They allow you to input data about existing clients, new leads, pricing models, payment terms, and seasonal trends, then use that information to generate revenue projections.

By using a forecasting tool, agencies can avoid guesswork and use actual data to make more accurate and informed decisions about staffing, budget allocation, and growth planning. The tool can help streamline and simplify what would otherwise be a complex and time-consuming process, saving you time and providing clarity for future planning.

Key Features of an Agency Revenue Forecasting Tool

The key features of a revenue forecasting tool make it an indispensable resource for any agency looking to streamline its financial planning. Here are some of the most important features:

- Customizable templates: Tools often come with templates that can be customized to match your agency’s revenue streams and business model.

- Real-time data integration: The ability to pull in real-time data from CRMs, accounting software, or project management tools, allowing you to automatically update forecasts based on current information.

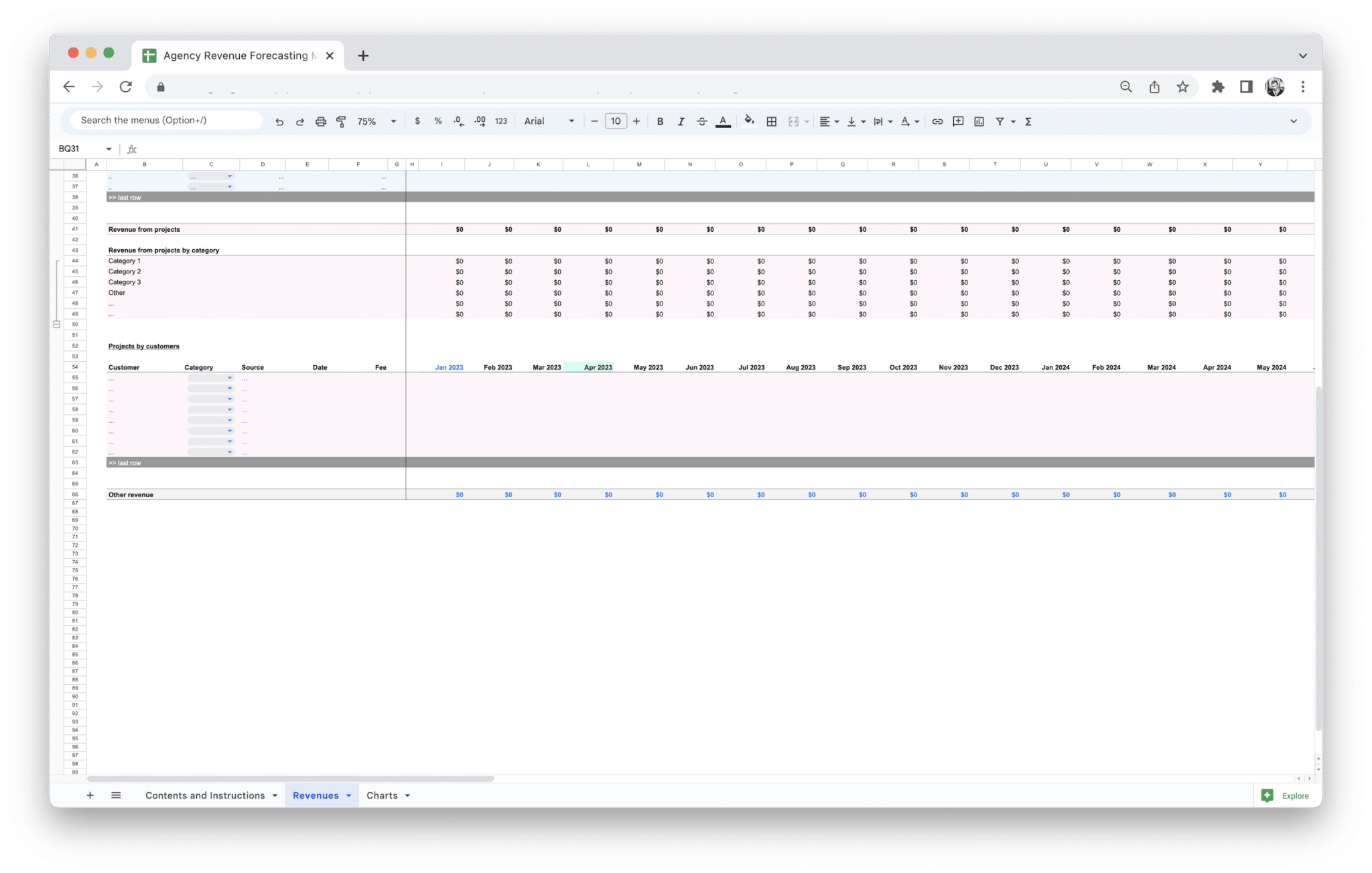

- Multi-revenue stream support: A good tool will support multiple types of revenue streams, such as retainer income, project-based work, and recurring revenue, allowing you to forecast each separately.

- Scenario planning: Many forecasting tools allow you to run different scenarios (best case, worst case, and most likely), so you can plan for a variety of outcomes.

- Growth projections: These tools often include built-in features that allow you to model different growth rates and factor in expected changes in your business.

- Budget and cash flow tracking: Forecasting tools can often track both revenue and expenses, providing a complete financial picture for your agency.

- Client-specific projections: Some tools allow you to forecast revenue from specific clients, helping you see how each client or project contributes to your agency’s income.

- Collaborative features: The ability to share your forecast with team members and collaborate in real-time, making it easier to align different departments on financial goals.

- User-friendly interface: Whether you’re using a simple template or a complex platform, the tool should have an intuitive interface that makes it easy to input and analyze data.

Benefits of Using a Template for Revenue Forecasting

Using a revenue forecasting template can offer a wide range of benefits that help agencies plan their financial future with confidence. Whether you’re using an Excel spreadsheet or a Google Sheets template, these tools can save time and effort while providing valuable insights. Here are some of the main benefits:

- Time-saving: Pre-built templates are ready to use and easy to customize, which means you can get started right away without building your forecast from scratch.

- Simplicity: Templates simplify the forecasting process by organizing data in a clear, structured way. This makes it easier to input data and interpret the results.

- Cost-effective: Templates are often free or low-cost compared to advanced software solutions, making them an ideal choice for agencies with limited budgets.

- Scalability: As your agency grows, you can easily expand or adjust your template to accommodate new revenue streams, clients, or markets.

- Accuracy: Templates typically include built-in formulas that help you calculate totals, averages, and growth rates automatically, reducing the risk of human error.

- Customization: Templates can be easily customized to fit your agency’s specific revenue model, ensuring that your forecast reflects the realities of your business.

- Ease of sharing: Cloud-based templates, such as those created in Google Sheets, make it easy to collaborate with team members and share your forecast with key stakeholders.

- Actionable insights: Templates often include visual elements like charts and graphs, making it easier to understand trends and patterns in your revenue and plan accordingly.

Types of Agencies That Benefit Most from Revenue Forecasting

While every agency can benefit from revenue forecasting, some types of agencies are particularly well-suited to use these tools regularly. The nature of your agency’s work and the diversity of your revenue streams can significantly influence how valuable forecasting is for your business. Here are the types of agencies that benefit the most:

- Marketing and advertising agencies: Agencies with fluctuating workloads and client budgets, such as marketing firms, can use revenue forecasting to predict changes in income based on client cycles, marketing campaigns, and seasonal fluctuations.

- Creative agencies (design, branding, and development): Creative agencies that work on a project basis benefit from revenue forecasting tools to predict income from large, one-off projects and recurring clients.

- Consulting agencies: Consulting firms, which often rely on a mix of retainers and one-off projects, use revenue forecasting to plan for varying income streams and manage cash flow.

- Software development agencies: Agencies that work on long-term software projects or provide SaaS (Software as a Service) products can use forecasting tools to predict recurring revenue from subscriptions or licensing.

- Public relations agencies: PR agencies often deal with project-based revenue alongside retainer contracts, making forecasting essential to balance short-term revenue surges with long-term commitments.

- Event planning and production agencies: For agencies that rely on event-based work, forecasting can help predict busy periods and manage income fluctuations tied to large events or seasonal trends.

- Freelancer-heavy agencies: Agencies that rely on freelancers for project work benefit from forecasting to better manage cash flow and ensure that they can pay contractors and meet overhead costs during lean periods.

By using a forecasting tool, agencies in these industries can optimize their revenue predictions, minimize financial surprises, and make more informed decisions about hiring, resource allocation, and growth.

When it comes to revenue forecasting, the quality and relevance of the data you include can significantly affect the accuracy of your projections. As an agency, you’re dealing with various revenue sources, fluctuating client acquisition rates, and seasonal market changes. To ensure you’re on the right track, you need to track and incorporate several key metrics into your revenue forecast. These metrics provide a comprehensive view of your agency’s financial health and help you anticipate potential fluctuations or growth opportunities.

Revenue Streams

For most agencies, revenue isn’t just coming from one source. In fact, tracking your various revenue streams is one of the most crucial aspects of accurate forecasting. Agencies often have a diverse mix of income, each with its own pattern, volatility, and timeline.

- Retainer Revenue: Retainers are fixed, recurring fees that clients pay for ongoing services. This could include services like consulting, digital marketing management, or content creation. Retainer revenue is the most stable stream and provides a predictable income source. It’s important to track when these contracts will renew or expire so you can forecast the continuation of these revenue streams.

- Project-Based Revenue: Unlike retainers, project-based revenue comes from one-off contracts or tasks. For example, designing a website or creating a marketing campaign could be a one-time fee. These projects are often more variable and harder to predict. However, tracking past project income can help you understand the patterns. For instance, if you know that certain months tend to have higher project revenue, you can account for that in your forecast.

- Recurring Revenue: This type of revenue typically comes from subscriptions, long-term service contracts, or ongoing products that clients purchase regularly. It might include things like software subscriptions, maintenance fees, or monthly content delivery. This is another stable revenue stream, but you should factor in customer churn—how many clients are likely to discontinue the service. Recurring revenue is an excellent metric for long-term growth planning, and because it can grow predictably over time, it’s an essential part of your overall forecast.

By understanding and categorizing your revenue streams, you can identify which ones are growing, which are stagnant, and which may be on the decline. This allows you to make more informed business decisions, such as diversifying your income streams or focusing on high-growth areas.

Client Acquisition Rates

Client acquisition is a fundamental metric for revenue forecasting. It’s essential to know how many new clients you’re bringing in during any given period and the conversion rate of those leads into paying clients. If you’re able to accurately forecast the number of new clients you expect to acquire, you can better anticipate future revenue.

- Lead Conversion Rate: This metric helps you track the effectiveness of your sales funnel. If you know how many leads it typically takes to close a deal, you can forecast how many leads you need to generate to meet your revenue goals. For example, if it takes 10 leads to acquire one client and you want to bring in 10 new clients, then you’ll need to plan for generating 100 leads.

- Sales Cycle Length: Understanding how long it takes to close a deal will help you estimate when your new clients will start contributing to your revenue. Agencies with long sales cycles (for example, those dealing with large, complex contracts) need to consider the delay between acquiring a lead and realizing revenue from that lead.

Client acquisition doesn’t just involve getting new customers, though. You also need to account for client retention rates. If you’re losing more clients than you’re acquiring, it could signal problems in your service offering, client relationships, or overall business model. By tracking your client acquisition alongside retention, you get a more complete picture of your future revenue trajectory.

Seasonal Trends and Market Adjustments

One of the most significant challenges in agency revenue forecasting is factoring in seasonal changes and market conditions. Just as retail businesses experience spikes during holiday shopping seasons, agencies may see fluctuations in demand based on time of year or external factors. Understanding and anticipating these patterns can make a huge difference in your forecasting accuracy.

- Historical Seasonal Trends: Many agencies experience higher or lower revenue during certain months. For example, a digital marketing agency may experience a boom in business during the holiday season when companies are ramping up their advertising budgets. A creative agency might see a slowdown in the summer when many companies take vacations or reduce marketing spend. By looking at previous years’ data, you can better anticipate these seasonal shifts and build them into your forecasts.

- Market Conditions: External factors such as economic conditions, industry trends, or competitor activity can affect your revenue. For example, if a competitor launches a new product that captures your market share, you may need to adjust your forecast downward. Alternatively, if you’re entering a booming market or capitalizing on a new trend, you might want to increase your revenue projections.

Understanding how external factors like seasonal trends and market changes affect your business will allow you to adjust your revenue forecast more realistically. While you can never predict the future with 100% certainty, incorporating these variables into your planning helps you prepare for both the highs and lows.

Profit Margins and Projected Expenses

Revenue forecasting isn’t just about predicting income—it’s also about understanding how that revenue will translate into profits. You need to account for all your costs, both fixed and variable, to ensure you’re projecting realistic profits.

- Profit Margins: Your profit margin is the percentage of revenue that remains after covering the costs of goods sold (COGS) and operating expenses. Different types of services may have different margins. For instance, creative services like copywriting may have a higher margin than technical services like software development because the latter often requires more specialized talent or resources. By calculating your profit margins across different revenue streams, you can get a better sense of how much money you’ll retain from each contract or client.

- Operational Costs: These are the ongoing costs that support your business, such as office rent, software tools, salaries, and other administrative expenses. Some of these costs are fixed (like rent), while others may vary depending on your business activity. For example, as you acquire more clients, you may need to hire additional staff or outsource tasks to freelancers, increasing your costs. Be sure to project these expenses into your forecast to get a more realistic picture of your profitability.

- Variable Costs: These costs change with the volume of work or clients you take on. For example, the more projects you undertake, the higher your expenses for project management, design, or technology usage will be. Tracking these variable costs allows you to assess your profitability as your business scales.

When creating your revenue forecast, be sure to include all anticipated costs, both direct (like contractor fees) and indirect (like marketing and utilities). Forecasting your expenses alongside your revenue gives you a more accurate view of your bottom line and helps ensure that your agency remains profitable.

By incorporating these key metrics—revenue streams, client acquisition rates, seasonal trends, and profit margins—into your revenue forecasting process, you’ll be able to create a more detailed and realistic forecast. These metrics not only allow you to project your future revenue more accurately but also give you the insights you need to make informed decisions about where to focus your energy, which clients to target, and how to manage costs as you grow your agency.

A well-designed revenue forecasting template can be an invaluable tool for agency owners and managers. It simplifies the complex task of predicting future revenue by helping you organize and visualize your expected income. Whether you’re using a ready-made Excel or Google Sheets template or building one from scratch, understanding how to effectively use the template is key to ensuring your forecasts are accurate and actionable.

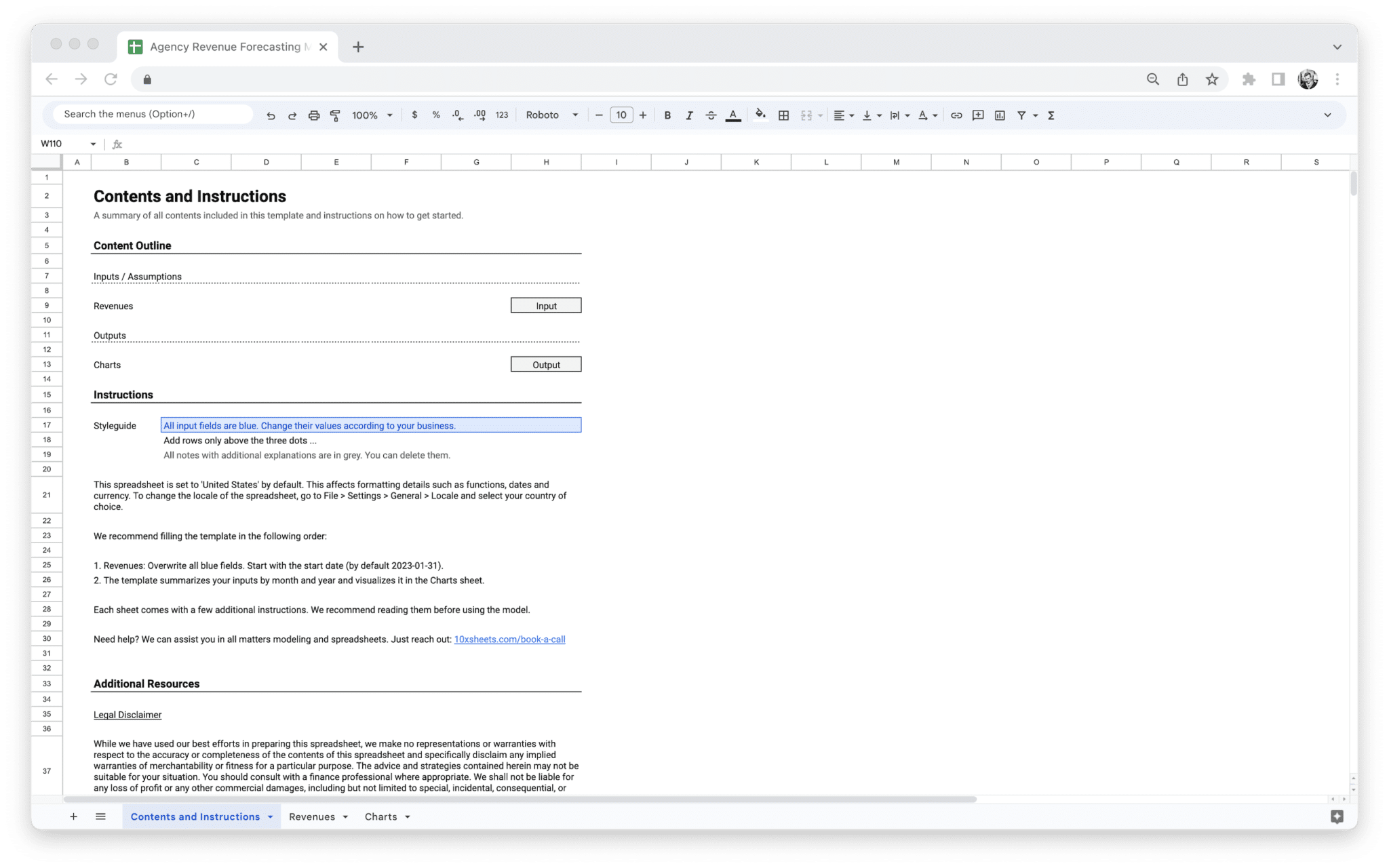

1. Set Up the Template

Setting up a revenue forecasting template is a relatively straightforward process, but it requires careful planning and input to make sure it reflects your agency’s business model and revenue streams. Here’s a comprehensive guide to help you set it up.

Start by determining the timeframe for your forecast. Depending on the needs of your agency, this could be a monthly, quarterly, or annual forecast. If you’re new to forecasting, monthly intervals are a great way to get started since they provide a more granular view of your business’s financial health. Once you decide on your timeframe, set up columns for each month (or quarter, if that’s what you prefer) so you can input and track your projections over time.

Next, you need to define your revenue categories. Your template should include separate rows for each type of income stream your agency generates. Typical categories might include:

- Retainer revenue

- Project-based income

- Recurring revenue

- Other revenue sources (e.g., workshops, licensing, or products)

Once your revenue streams are set up, it’s time to input your baseline data. This is the historical data or actual figures from previous periods that give your forecast a solid foundation. You’ll need to know your average revenue per client, how many clients you typically secure, and any patterns related to project work or recurring payments. For instance, if your agency usually brings in $50,000 a month from retainers, you would input this as your baseline for retainer income.

The final step in setting up your template is to add formulas for calculating projected revenue. Once you’ve input all the relevant data, you can set up formulas to calculate totals, averages, or growth rates. Many templates will already have basic formulas in place, but it’s helpful to know how to tweak them if your agency’s needs change.

2. Customize the Template for Your Agency’s Needs

While there are plenty of pre-built revenue forecasting templates available online, it’s important to make sure yours is tailored specifically to your agency. Every agency has unique revenue structures, client types, and business models. To create a truly effective forecast, you’ll need to adjust the template to fit your specific needs.

One of the first things to customize is your revenue categories. As mentioned, most agencies have at least three types of revenue: retainer, project-based, and recurring. However, your agency might also have other unique revenue sources that should be included, such as affiliate marketing income, product sales, or even joint ventures. Your template should reflect these specific streams to give you a complete picture of your financial outlook.

You also need to account for client variations. Your agency may have clients with very different contract structures or service requirements. For example, some clients might be long-term retainers, while others may only engage for one-off projects. If this is the case, customize the template to reflect these differences. Create separate rows for each client type, and include relevant details like contract start and end dates, payment schedules, or milestone-based payments for project clients.

Another important aspect to customize is the growth projections. If your agency has specific goals for increasing revenue, such as acquiring new clients, upselling services to existing clients, or expanding into new markets, these projections should be clearly reflected in your template. Many templates have a “growth rate” input field where you can enter an expected growth percentage based on your goals. This is crucial for scaling and provides an estimate of what your future revenue will look like under different scenarios.

Finally, make sure that seasonality and market conditions are taken into account. If your business is heavily impacted by certain seasons or external factors, such as holidays or economic downturns, reflect this in your forecast by adjusting figures for those periods. For instance, if you expect a dip in sales in the summer, reduce your revenue estimates for those months and compensate with a higher forecast for your busier periods.

3. Integrate Data and Assumptions into the Template

Now that your template is set up and customized, the next step is integrating data and assumptions that will shape your forecast. The more data you can integrate, the more accurate and reliable your revenue projections will be. Here’s how to approach it.

Start with your historical data. Historical data provides the foundation for your forecast. This data should include actual revenue figures from previous periods, as well as client acquisition rates, retention rates, and the average deal size or contract value. The key here is to take into account not just your total revenue but also the individual performance of your different income streams. For example, you may notice that your project-based income grows faster than your retainer revenue, which should influence how you project future revenue growth.

Once your historical data is integrated, you’ll need to make assumptions about future trends. These assumptions are based on things like your planned marketing efforts, sales initiatives, and expected client behavior. Here are some assumptions to consider when building your forecast:

- Client acquisition assumptions: How many new clients do you expect to acquire in the forecast period? Use past data on lead generation and sales conversions to project new business.

- Client retention assumptions: What is the likelihood of retaining existing clients? Consider churn rates based on previous experiences or industry benchmarks.

- Market conditions: Are there any factors that could significantly impact your revenue, like new competitors entering the market, changes in demand, or economic downturns? Make sure these assumptions are reflected in your revenue projections.

You’ll also need to account for expected growth rates. If your agency is targeting aggressive growth, you should increase your revenue expectations accordingly. Conversely, if you’re expecting a slow year, you may want to dial back your forecasts and plan for tighter margins. This is where forecasting gets a little bit subjective—you need to input assumptions based on what you believe will happen in the market and within your agency.

Another aspect to consider is profitability assumptions. For example, if you’re forecasting a higher number of clients, ensure that you account for the costs associated with managing more clients, such as staffing or additional resources. Similarly, if you’re planning to increase your prices, this should be reflected in the expected revenue per client.

Finally, consider automation and tool integrations. If your agency uses specific tools like CRMs, accounting software, or project management platforms, see if your template can integrate with them to pull real-time data. This integration reduces manual data entry, keeps your forecast up-to-date, and ensures that you’re always working with the most accurate information.

By carefully integrating these data points and assumptions, you’ll be able to produce a revenue forecast that not only aligns with your agency’s goals but also accounts for potential challenges and opportunities. These factors ensure that your forecast remains dynamic and adaptable as the business environment evolves.

Using an agency revenue forecasting template isn’t just about filling out numbers in a spreadsheet. It’s about understanding your business, leveraging past performance, and projecting realistic growth. With the right data, assumptions, and customization, your forecast will become a valuable tool for making informed decisions, managing risks, and staying on track to hit your financial goals.

A well-developed revenue forecasting tool is more than just a spreadsheet for tracking income. It’s a powerful decision-making tool that can help guide the direction of your agency. By analyzing your forecast regularly, you can make strategic choices about how to allocate resources, invest in growth, and optimize your business processes. Here are some ways to use your forecasting tool to make better decisions for your agency.

- Budgeting and resource allocation: A detailed revenue forecast allows you to plan your budget more effectively, ensuring you have enough funds to cover operational costs, invest in marketing, or hire additional staff. By predicting when revenue will peak or dip, you can adjust your spending to avoid financial strain.

- Hiring and staffing decisions: Accurate forecasting helps you determine when to expand your team. If your forecast predicts a busy quarter ahead, you can hire additional staff or freelancers to handle the increased workload. On the other hand, if you’re expecting slower months, you can adjust staffing levels accordingly to avoid unnecessary costs.

- Cash flow management: Forecasting helps you predict when cash flow may become tight, enabling you to take proactive steps to manage your finances. For example, if you see a dip in expected revenue during a particular period, you can plan to negotiate better payment terms with clients or arrange short-term financing to cover operating costs.

- Growth planning: By analyzing the projected growth in your revenue streams, you can determine where to invest your efforts to foster expansion. If one revenue stream (such as recurring income) is expected to grow significantly, you might want to focus on expanding that area. Alternatively, if project-based income is expected to slow down, you could explore ways to pivot or diversify your offerings.

- Evaluating marketing ROI: With a forecast in hand, you can analyze how your marketing campaigns are impacting revenue. If you’ve invested in a particular marketing channel, your forecast will help you understand whether the increase in revenue aligns with your expectations, allowing you to adjust your marketing strategy for maximum ROI.

- Adjusting pricing and service offerings: If your revenue projections are consistently below expectations, your forecasting tool can help you determine whether it’s time to revisit your pricing strategy. This might involve adjusting prices, introducing new service offerings, or refining your sales processes to better align with market demand.

- Risk management: With a clear understanding of potential revenue fluctuations, you can identify risks and develop mitigation strategies. For instance, if your forecast shows that a key client is expected to scale back its budget, you can prepare by identifying new clients or securing backup contracts to mitigate the risk of a revenue drop.

- Performance tracking and accountability: Using a forecasting tool allows you to track the agency’s performance against your projected revenue. If your actual revenue is consistently falling short of projections, it could indicate problems with client acquisition, project pricing, or operational inefficiencies, which you can then address in real-time.

- Strategic decision-making in uncertain times: During periods of uncertainty—such as economic downturns or major industry disruptions—a revenue forecasting tool helps you make strategic decisions about which areas of your business to prioritize. By simulating different scenarios in your forecast, you can test potential outcomes and make more informed decisions.

- Optimizing client relationships: By understanding your future revenue projections, you can prioritize efforts to nurture relationships with your most valuable clients. If you foresee a decline in revenue from one client or sector, you can take proactive steps to maintain and grow existing relationships, offering them additional services or ensuring contract renewals.

Revenue forecasting isn’t a one-and-done task. As your business grows, your market changes, and unexpected factors come into play, it’s important to adjust your forecasts regularly to stay on track. A static forecast can quickly become outdated and lead to misguided business decisions. Adjusting your forecast allows you to maintain accuracy, stay adaptable, and make informed decisions that keep your agency on the right path. Here are some key strategies for adjusting your revenue forecasts over time.

- Regularly review actual performance: Compare actual revenue against your forecasted figures on a monthly or quarterly basis. If you’re consistently under or over-performing, investigate why. Adjust your forecast to reflect any changes in client behavior, new revenue streams, or shifts in market conditions.

- Update for new data: As new data becomes available—whether it’s from current contracts, client renewals, or new market trends—incorporate this into your forecast. Be sure to adjust for any new contracts signed, price changes, or changes in client budgets.

- Factor in external influences: Keep an eye on external factors like industry shifts, economic conditions, and regulatory changes that might affect your business. If new competitors emerge or your key clients make strategic changes, update your forecast to reflect those impacts.

- Incorporate changes in strategy: If you implement new strategies, such as expanding into new markets, launching new services, or changing your sales process, adjust your forecast to account for their potential impact. Any strategic shift that could influence revenue should be reflected in your projections.

- Revise for unexpected events: Life doesn’t always go according to plan. Whether it’s a global pandemic, a sudden economic recession, or a major client loss, be prepared to revise your forecast based on unexpected events. When these events occur, reassess your projections and make the necessary adjustments to stay realistic about future revenue.

- Account for changes in client behavior: Clients may scale up or down their spending with your agency based on their own business needs. Track any changes in client budgets or cancellations, and adjust your forecast accordingly to ensure you’re prepared for fluctuations in revenue.

- Monitor cash flow: Even if revenue appears to be on track, changes in payment terms, delayed invoices, or cash flow cycles may create discrepancies between actual and projected income. Adjust your forecast for any delays or shifts in when you expect to receive payments.

- Refine assumptions and growth rates: If your agency is experiencing higher-than-expected growth or slower-than-expected performance, adjust your growth rate assumptions to reflect more accurate expectations. This ensures that your forecast remains aligned with the reality of your business’s performance.

- Test different scenarios: Instead of relying on a single forecast, consider testing multiple scenarios based on best-case, worst-case, and expected outcomes. This allows you to prepare for different possibilities and adjust your plans as conditions evolve.

- Revisit pricing and cost assumptions: If your pricing strategy changes or your operational costs increase, revise your forecast to incorporate these adjustments. Price increases, cost-cutting measures, or shifts in overhead expenses should all be reflected in updated projections.

By regularly adjusting your revenue forecast based on actual performance, new data, and external factors, you can ensure that your forecast remains relevant and actionable. This ongoing process helps you stay agile and responsive to the changing business environment, making sure your agency is always prepared for what’s ahead.

Historical data plays a crucial role in revenue forecasting for agencies. It provides a foundation of real-world performance that helps you make informed predictions about future revenue. When you leverage historical data, you are grounding your forecasts in facts rather than assumptions, which can significantly improve the accuracy and reliability of your projections. However, it’s important to understand how to use this data effectively, as relying solely on past performance can be limiting. By combining historical data with current insights, market trends, and your agency’s growth goals, you can create a comprehensive and realistic forecast.

How to Leverage Past Revenue Data

Leveraging past revenue data is a critical step in building an accurate revenue forecast. By looking at how your agency has performed in the past, you can begin to identify patterns and make predictions about future income.

Start by collecting all relevant data from previous periods, whether it’s monthly, quarterly, or annual data. This will include both total revenue and revenue broken down by each income stream (e.g., retainer, project-based, recurring). It’s essential to include all your income streams, as some may have more predictability than others, and this data will help you project how each stream will contribute to overall revenue.

The next step is to calculate averages. For example, you may want to know how much you typically earn from each revenue stream each month or each quarter. This gives you a baseline from which you can build your projections. If your retainer revenue has been consistently growing by 10% year-over-year, you can use this growth rate as an assumption for future revenue.

Once you’ve calculated averages, look deeper into client behavior and performance trends. If you’re an agency that relies heavily on recurring contracts, identifying how long clients typically stay with you and how often they renew can give you a more accurate prediction of future recurring income. If your project-based income fluctuates seasonally, historical data can help you predict those cycles with greater accuracy.

For example, if you’ve seen consistent dips in project income during the summer months, you can plan accordingly and avoid overestimating revenue during that time. Similarly, if you know that your agency experiences a boom in business during the final quarter of the year, historical data will allow you to adjust your forecasts and ensure that you are prepared to handle a higher volume of work.

The key is not just to rely on raw figures but also to look for patterns in how clients behave. This could include looking at how the timing of contracts or project launches aligns with overall business growth. Understanding the life cycle of a typical client engagement—how long it lasts, when payments are made, and when renewals happen—will help you predict future cash flow more effectively.

Understanding Trends and Patterns

Understanding trends and patterns in your historical data is where you can start to see a bigger picture. This goes beyond just looking at numbers on a spreadsheet and starts to consider seasonal variations, market shifts, and internal growth cycles.

A trend can be as simple as noticing that your agency’s revenue tends to dip during certain months (e.g., the summer) or that certain services (like digital marketing or web design) bring in more revenue in the winter months. By understanding these patterns, you can factor them into your revenue forecast, ensuring it’s more aligned with reality.

For example, if your agency works primarily with clients in the retail sector, you might see a significant revenue increase during the holiday shopping season. This can help you predict higher demand for your services and adjust your resource allocation accordingly. On the other hand, if you find that your industry experiences a slowdown due to economic factors—such as a downturn or shifting industry regulations—you can incorporate this knowledge into your forecast and make adjustments early.

It’s also important to identify cyclical trends. Many agencies, especially those in fields like consulting, marketing, or software development, will experience cyclical growth and decline depending on external factors. Understanding these patterns allows you to create a more nuanced forecast that accounts for expected periods of low activity.

For example, if your business traditionally experiences a slower revenue period after a major industry event, such as a trade show or product launch, recognizing this pattern will help you adjust expectations. Similarly, you can predict when a surge in demand is likely, helping you proactively prepare for the busy periods.

Also, pay attention to client lifetime value (CLV). Understanding how long clients tend to stay with your agency and how much they typically spend during that time gives you a clearer picture of future income. For example, if clients renew contracts at higher rates over time or purchase more services, this can contribute to more reliable revenue growth. Monitoring CLV helps you maintain a sustainable revenue model by predicting client retention trends.

Once you’ve identified these trends, consider incorporating advanced forecasting methods. Some agencies use statistical methods like regression analysis to predict future revenue based on historical trends. Tools like moving averages or exponential smoothing can also help smooth out short-term fluctuations, providing a clearer view of long-term trends.

Avoiding Over-reliance on Historical Data

While historical data is incredibly valuable for forecasting, it’s important not to rely on it exclusively. Markets evolve, client needs change, and external factors can drastically affect the trajectory of your business. Over-relying on historical data can lead to unrealistic projections that fail to account for the dynamic nature of the business world.

A key limitation of using only historical data is that it assumes the future will follow the same path as the past. This is often not the case. For instance, if your agency was heavily dependent on a single large client that accounted for a significant portion of your revenue, you cannot automatically assume that your future growth will follow the same pattern if that client decides to leave or reduce their engagement with your agency.

Market disruptions are another factor that can make past data less reliable. For example, economic recessions, technological advancements, or global events (like the COVID-19 pandemic) can completely alter the demand for certain services. An agency that thrived in the event planning sector may find its revenue streams shrinking dramatically when public gatherings are restricted, regardless of past success.

To avoid over-relying on historical data, incorporate current market trends and future predictions into your forecast. This might include industry shifts, changes in consumer behavior, new competitors, or emerging technologies. For example, if you anticipate that AI-driven services will become a dominant force in your field, plan for how this might impact your revenue. By considering both past performance and current conditions, you can create a more balanced and forward-thinking forecast.

You should also account for changes in your agency’s operations, such as new service offerings, adjustments to pricing, or a shift in your target market. While your historical data can provide a solid foundation, changes in your business model or service portfolio can impact future revenue, so it’s crucial to account for those shifts.

Lastly, regularly update your forecast based on real-time data. It’s easy to make forecasts at the start of the year and then forget about them, but markets and circumstances evolve constantly. Your revenue forecast should be a living document that you revisit monthly or quarterly to make adjustments as needed. By keeping it updated with fresh data and market insights, you ensure that your forecast remains relevant and actionable.

Incorporating historical data into your revenue forecasting is essential for creating a well-grounded and reliable forecast. However, it’s equally important to recognize the limitations of relying too heavily on past performance. By understanding trends and patterns, while also factoring in the potential for change, you can create a more dynamic and future-proof revenue forecast that can adapt to market shifts and business growth.

Creating a revenue forecast is a critical exercise, but it’s also easy to make mistakes. The process requires attention to detail and a realistic understanding of your business, the market, and the external factors that influence both. Agencies often make common errors when forecasting, which can lead to inaccurate projections and poor decision-making. Here are some of the most frequent mistakes you should be mindful of when building your revenue forecast.

- Underestimating seasonal variations: Many agencies overlook the impact of seasonal fluctuations on their revenue, leading to overly optimistic forecasts. Failing to adjust for slow periods or seasonal trends can result in revenue shortfalls and missed opportunities to plan for lean months.

- Overlooking client churn: It’s easy to assume that your clients will stay with you indefinitely, but neglecting to account for client churn can lead to inflated revenue projections. Losing clients or failing to renew contracts can dramatically impact revenue, especially if they form a large portion of your income.

- Overly optimistic projections: Agencies often create forecasts based on best-case scenarios, assuming that growth will continue at an accelerated pace. This can lead to unrealistic expectations, especially if your agency is dealing with a saturated market or unpredictable demand.

- Neglecting expenses: Revenue forecasting is not just about predicting income—it’s also about understanding costs. Failing to account for rising operational costs or staffing requirements can result in an inaccurate forecast, causing cash flow problems.

- Using outdated or incomplete data: If you’re relying on old data or not factoring in recent market shifts, your forecast may be irrelevant or misleading. For example, using past performance data without incorporating market changes or new business strategies could skew your projections.

- Ignoring external factors: Focusing too much on internal data and trends without considering external market conditions can be detrimental. Changes in the economy, regulatory shifts, or new competitors can impact your revenue in ways that historical data alone cannot predict.

- Failing to update the forecast: Many agencies make the mistake of creating a forecast at the start of the year and then never revisiting it. Revenue forecasting should be a dynamic process, adjusted regularly to account for new data, changes in the market, or shifts in your agency’s strategy.

- Not distinguishing between gross and net revenue: Agencies often make the mistake of forecasting based only on gross revenue, not accounting for the operational costs that reduce profitability. Understanding the difference between gross and net revenue is key to accurate financial forecasting and planning.

- Relying too heavily on historical data: While historical data is useful, over-relying on it without considering current trends or future changes in your business can result in unrealistic projections. The future is rarely a carbon copy of the past, and your forecast should reflect both past performance and expected future conditions.

- Not accounting for cash flow cycles: Revenue doesn’t always equate to immediate cash in hand. If your clients are on extended payment terms or your agency relies heavily on milestone-based payments, cash flow may not align with revenue projections. Ignoring this distinction can lead to financial difficulties, even if your revenue looks healthy on paper.

Related products

-

Sale!

SaaS Financial Model Template

$219.00Original price was: $219.00.$149.00Current price is: $149.00. Add to cart -

Sale!

SaaS Profit and Loss Statement

$119.00Original price was: $119.00.$79.00Current price is: $79.00. Add to cart -

Sale!

Marketplace Financial Model Template

$219.00Original price was: $219.00.$149.00Current price is: $149.00. Add to cart -

Sale!

E-Commerce Financial Model Template

$219.00Original price was: $219.00.$149.00Current price is: $149.00. Add to cart