- What is Sales Tax and VAT Compliance?

- Key Features of Sales Tax and VAT Compliance Software

- Top Sales Tax and VAT Compliance Software Solutions

- How to Evaluate Sales Tax and VAT Compliance Software?

- Industry-Specific Tax Compliance Considerations

- Best Practices for Implementing Compliance Software

- Common Tax Compliance Software Challenges

- Conclusion

Are you struggling to keep up with the ever-changing rules and regulations of sales tax and VAT? Managing tax compliance can be a daunting task, especially as your business grows and operates across multiple jurisdictions. With varying tax rates, complex reporting requirements, and frequent updates to tax laws, having the right software can make all the difference.

This guide offers a comprehensive look at top sales tax and VAT compliance software solutions designed to simplify your tax management, ensure accuracy, and keep you compliant with regulations. From automated calculations and real-time updates to seamless integration and powerful reporting tools, the right software can streamline your processes and reduce the stress of tax compliance. Dive in to discover which solutions best fit your needs and how they can transform your approach to managing taxes.

What is Sales Tax and VAT Compliance?

Sales tax and VAT compliance involves adhering to the rules and regulations that govern the collection and remittance of sales tax or VAT on goods and services. Both sales tax and VAT are crucial for funding government operations and public services, but they operate differently depending on the jurisdiction.

Sales tax is a consumption tax imposed on the sale of goods and services at the point of sale. The responsibility to collect and remit sales tax usually falls on the seller. Rates and regulations vary by state or locality, making it essential for businesses to understand the specific requirements in each area where they operate.

VAT (Value-Added Tax) is a consumption tax levied on the value added at each stage of production or distribution. Unlike sales tax, VAT is collected at each stage of the supply chain, with businesses passing the tax on to the final consumer. VAT systems are common in many countries outside the United States, including the European Union and Canada. VAT compliance involves not only collecting the tax but also filing regular reports and maintaining detailed records.

Adhering to sales tax and VAT regulations is crucial for avoiding legal issues and financial penalties. It requires accurate calculation, timely reporting, and thorough documentation of all taxable transactions.

Importance of Compliance Software

Implementing compliance software is essential for managing sales tax and VAT effectively. Here’s why it’s crucial:

- Accuracy in Tax Calculation: Compliance software automates the calculation of sales tax and VAT, ensuring that the correct amount is collected and remitted. This reduces the risk of errors and the potential for costly penalties.

- Efficient Reporting: The software streamlines the process of generating and submitting tax reports, which can be complex and time-consuming. Accurate and timely reports help avoid late fees and maintain regulatory compliance.

- Real-Time Updates: Tax laws and rates frequently change. Compliance software provides real-time updates to ensure that your business remains compliant with the latest regulations across various jurisdictions.

- Reduced Administrative Burden: Automation reduces the need for manual data entry and calculations, freeing up time for your team to focus on other important tasks. This efficiency also minimizes the risk of human error.

- Enhanced Data Management: Compliance software helps in maintaining comprehensive records of all transactions, tax calculations, and reports. This detailed documentation is essential for audits and regulatory reviews.

- Scalability: As your business grows or expands into new markets, compliance software can scale to handle increased transaction volumes and additional jurisdictions, ensuring ongoing compliance.

- Integration with Other Systems: Effective compliance software integrates with accounting, ERP, and e-commerce platforms, providing a seamless flow of tax-related data and ensuring consistency across all systems.

Key Features of Sales Tax and VAT Compliance Software

Sales tax and VAT compliance software are designed to handle complex tax calculations and reporting, making it easier for businesses to meet their tax obligations. Understanding the key features of these tools will help you select the right solution for your needs.

Automated Tax Calculation

Automated tax calculation is a fundamental feature of compliance software. This functionality eliminates manual calculations, which can be prone to errors. Instead, the software performs tax calculations automatically based on the details of each transaction.

With automated tax calculation, you benefit from:

- Precision: Automated systems use up-to-date tax rates and rules to calculate the exact amount of tax due. This reduces the risk of errors that could lead to penalties or compliance issues.

- Efficiency: Transactions are processed quickly without manual intervention, which speeds up the checkout process and enhances overall efficiency.

- Scalability: Automated systems can handle large volumes of transactions seamlessly, which is particularly useful for growing businesses or those with high transaction volumes.

Real-Time Tax Rate Updates

Tax laws and rates can change frequently, making real-time updates a critical feature of compliance software. This functionality ensures that your business is always using the most current tax rates, helping you avoid costly mistakes.

Key aspects of real-time tax rate updates include:

- Automatic Updates: The software automatically updates tax rates as new legislation is enacted, so you don’t have to manually adjust rates or monitor changes.

- Comprehensive Coverage: Ensure that the software covers all jurisdictions where you operate. This is especially important for businesses that deal with multiple states or countries.

- Error Reduction: By using the most current rates, the software reduces the risk of miscalculation, ensuring that you collect and remit the correct amount of tax.

Integration with Accounting Systems

Integration with your existing accounting systems is crucial for seamless financial operations. Compliance software should work well with your current accounting platforms to ensure that tax data flows smoothly and accurately.

Benefits of integration include:

- Consistency: Integration ensures that tax data is synchronized across all financial systems, reducing discrepancies between tax records and accounting books.

- Streamlined Workflows: Automate data transfer between systems, minimizing manual entry and potential errors.

- Enhanced Reporting: Integrated systems provide comprehensive financial and tax reports, making it easier to manage your financials and comply with regulations.

Compliance Reporting and Documentation

Compliance reporting and documentation features are essential for meeting regulatory requirements and preparing for audits. The software should generate accurate reports that meet the needs of tax authorities.

Features to look for:

- Customizable Reports: Generate reports tailored to your business needs and the requirements of different tax jurisdictions. Customization helps you focus on relevant data and streamline your reporting processes.

- Detailed Documentation: Maintain thorough records of transactions, tax calculations, and adjustments. This documentation is crucial for audits and for ensuring transparency in your tax practices.

- Automated Filing: Some software solutions offer automated filing features that submit tax returns directly to the relevant authorities, reducing the administrative burden.

Audit Support and Data Security

Robust audit support and data security features are vital for protecting sensitive financial information and ensuring compliance during audits.

Consider these features:

- Audit Trails: Comprehensive audit trails track all changes and transactions, providing a clear history that can be reviewed during audits. This transparency helps in verifying compliance and identifying any issues.

- Secure Data Storage: Data security is crucial for protecting your financial information. Look for software that uses encryption and secure access controls to safeguard your data from unauthorized access.

- Support During Audits: The software should provide tools and support for managing audits, including access to detailed records and assistance in preparing for audit inquiries. This can help streamline the audit process and reduce stress.

By focusing on these key features, you can choose compliance software that simplifies tax management, ensures accuracy, and supports your business in meeting its tax obligations efficiently.

Top Sales Tax and VAT Compliance Software Solutions

Choosing the right sales tax and VAT compliance software can significantly impact your business’s efficiency and accuracy in managing tax obligations. Here’s an overview of some of the leading solutions available today, each offering unique features and benefits tailored to different needs.

Xero Tax

Xero Tax is a comprehensive tax software solution designed for accounting professionals and businesses. It offers robust features for managing sales tax and VAT compliance, including automated tax calculations, detailed reporting, and document management. Xero Tax integrates with Xero’s broader suite of accounting and business management tools, providing a seamless experience for handling tax-related tasks alongside other financial processes. Its focus on user-friendly design and efficient workflow management makes it a strong choice for accounting firms and businesses seeking integrated tax solutions.

Avalara

Avalara is a prominent name in the sales tax and VAT compliance space, known for its robust and scalable solutions. It offers a comprehensive suite of tools designed to automate tax calculations, manage exemptions, and generate detailed reports. Avalara’s software integrates seamlessly with a variety of ERP and e-commerce platforms, ensuring smooth data flow and accurate tax management. One of its standout features is its vast tax rate database, which is continually updated to reflect the latest tax rates and rules across numerous jurisdictions. This ensures that businesses are always compliant with the most current regulations. Avalara also offers features such as automated filing and payment solutions, which streamline the compliance process even further.

Vertex

Vertex provides a powerful sales tax and VAT compliance solution tailored for larger businesses and enterprises. Its software is known for its flexibility and depth, offering extensive customization options to fit diverse business needs. Vertex’s solutions integrate with a wide range of ERP systems, allowing for seamless tax calculations and reporting across different business processes. The software supports both transactional and jurisdictional tax compliance, which is crucial for companies operating in multiple regions. Vertex also features advanced analytics and reporting tools that help businesses gain insights into their tax obligations and identify potential savings opportunities.

TaxJar

TaxJar is a popular choice among e-commerce businesses and small to mid-sized companies. It simplifies sales tax management with user-friendly software that automates tax calculations and reporting. TaxJar is particularly noted for its easy integration with major e-commerce platforms like Shopify, WooCommerce, and Amazon. This integration allows businesses to calculate sales tax in real-time and generate accurate reports without manual intervention. TaxJar’s AutoFile feature is another key benefit, as it automates the filing of sales tax returns, saving businesses time and reducing the risk of errors. The software also offers a comprehensive dashboard that provides insights into sales tax liabilities and compliance status.

Sovos

Sovos offers a broad range of tax compliance solutions, including sales tax, VAT, and other indirect taxes. Known for its global reach, Sovos provides tools designed to meet the needs of businesses operating across multiple countries and regions. Its software supports complex tax scenarios and integrates with various ERP systems, enabling accurate tax calculations and compliance management. Sovos is recognized for its strong focus on regulatory compliance, offering solutions that help businesses stay up-to-date with changing tax laws. Features such as automated reporting, tax determination, and document management make Sovos a comprehensive choice for businesses with international operations.

Quaderno

Quaderno is a modern tax compliance solution tailored to digital businesses, including online sellers, freelancers, and subscription-based services. It simplifies VAT and sales tax management with features designed to handle the unique needs of digital transactions. Quaderno’s software automates tax calculations, provides real-time tax rate updates, and generates compliant invoices and receipts. It integrates with popular e-commerce platforms and payment gateways, ensuring that tax calculations are accurate and up-to-date. Quaderno’s user-friendly interface and automation features are designed to reduce the complexity of tax compliance for digital businesses and streamline their operations.

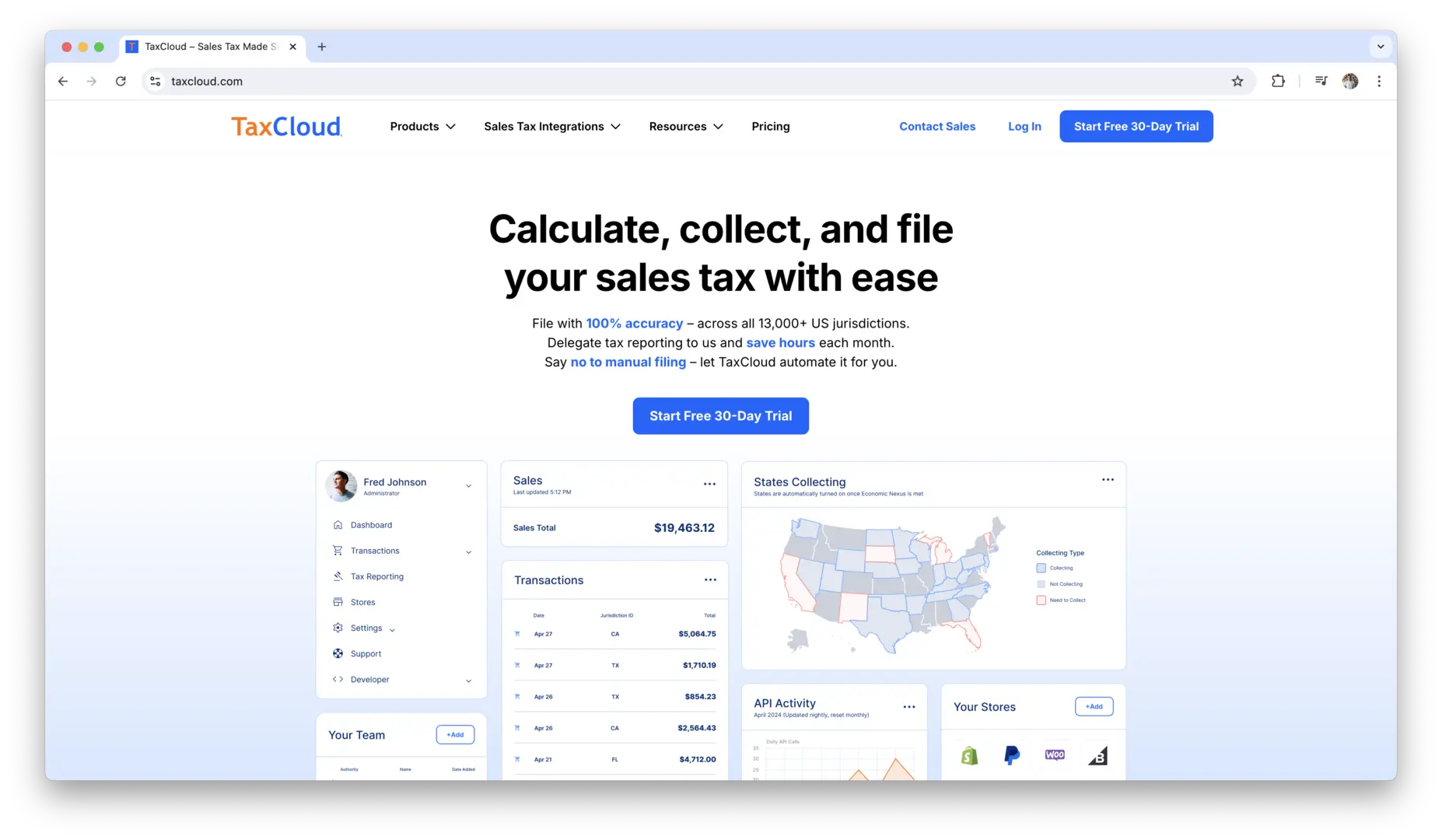

TaxCloud

TaxCloud is a cloud-based sales tax management solution designed for businesses of all sizes. It offers robust features for tax calculation, exemption management, and compliance reporting. One of its notable features is its free tax calculation service, which is particularly appealing for small to mid-sized businesses. TaxCloud integrates with popular e-commerce platforms and accounting systems to provide seamless tax management. Its comprehensive reporting capabilities help businesses stay on top of their tax obligations and ensure accurate filings.

Wolters Kluwer CCH Axcess Tax

Wolters Kluwer’s CCH Axcess Tax is a comprehensive cloud-based tax software solution geared towards tax professionals and firms. It offers a suite of tools for managing both sales tax and VAT, including advanced tax calculation, compliance reporting, and document management. The software’s cloud-based nature allows for real-time collaboration and access to tax data from anywhere. CCH Axcess Tax is known for its strong analytics and workflow management features, which can enhance efficiency and accuracy in tax preparation and filing.

Avalara CertCapture

Avalara CertCapture is a specialized solution designed to manage sales tax exemptions and certifications. It helps businesses collect, store, and manage exemption certificates from customers to ensure compliance with tax laws. CertCapture integrates with Avalara’s broader tax compliance suite, providing a seamless experience for managing tax exemptions alongside other tax functions. This tool is particularly useful for businesses with significant sales tax exemption needs, such as those dealing with non-profit organizations or government entities.

Taxify by Sovos

Taxify, a Sovos brand, offers a cloud-based sales tax solution designed for small to medium-sized businesses. It provides automated sales tax calculations, reporting, and filing. Taxify integrates with major e-commerce platforms and accounting systems to ensure accurate and up-to-date tax management. Its user-friendly interface and straightforward setup make it a popular choice for businesses looking for an efficient and scalable tax solution. The software also includes features for managing sales tax exemptions and generating compliance reports.

ClearTax

ClearTax is an emerging tax compliance solution tailored to the needs of businesses in India and other regions with complex VAT and GST requirements. It provides tools for tax calculation, filing, and reporting, with a strong emphasis on GST compliance. ClearTax integrates with various accounting systems and offers features for managing input tax credits, generating GST returns, and ensuring adherence to local tax regulations. Its localized focus and comprehensive GST features make it a valuable tool for businesses operating in regions with stringent GST requirements.

OneSource Indirect Tax

OneSource Indirect Tax, from Thomson Reuters, is a powerful solution designed for large enterprises with complex tax compliance needs. It offers advanced features for managing sales tax and VAT, including automated tax determination, compliance reporting, and audit support. OneSource Indirect Tax integrates with various ERP and financial systems, providing a seamless experience for managing indirect taxes across different business processes. Its extensive functionality and scalability make it a strong choice for multinational corporations and businesses with intricate tax requirements.

Avalara TrustFile

Avalara TrustFile is a solution designed to simplify the sales tax filing process. It offers automated filing and reporting features that help businesses manage their sales tax returns efficiently. TrustFile integrates with Avalara’s tax calculation tools, providing a comprehensive solution for managing both tax calculation and filing. Its focus on automating the filing process reduces administrative burden and ensures timely and accurate submissions. This tool is particularly useful for businesses seeking to streamline their tax filing processes and maintain compliance with minimal effort.

GoSimpleTax

GoSimpleTax is a user-friendly tax compliance software solution aimed at small businesses and self-employed individuals. It offers tools for managing sales tax and VAT, including automated calculations, reporting, and filing. GoSimpleTax is known for its straightforward interface and ease of use, making it accessible for users without extensive tax expertise. Its features include real-time tax calculations, compliance reporting, and integration with accounting systems, helping small businesses manage their tax obligations efficiently.

Taxware

Taxware provides a comprehensive suite of sales tax and VAT compliance solutions designed for businesses of all sizes. Its software offers features for tax calculation, reporting, and compliance management, with a focus on accuracy and scalability. Taxware’s solutions integrate with various ERP and accounting systems, ensuring seamless tax management across different business functions. The software is known for its robust tax rate database and advanced reporting capabilities, making it a reliable choice for businesses seeking a flexible and powerful tax compliance solution.

These software solutions each offer unique features and benefits, making it essential to evaluate them based on your specific business needs, size, and geographical reach. By selecting the right compliance software, you can enhance your tax management processes, ensure regulatory compliance, and focus on growing your business with confidence.

How to Evaluate Sales Tax and VAT Compliance Software?

Choosing the right sales tax and VAT compliance software is crucial for ensuring smooth financial operations and maintaining regulatory compliance. To make an informed decision, you need to evaluate several key criteria that determine how well the software will meet your needs and integrate with your existing systems.

Scalability and Customization

Scalability and customization are critical factors to consider when evaluating compliance software. As your business grows, the software should be able to handle increased transaction volumes and adapt to changing requirements.

Scalability ensures that the software can grow with your business. Whether you’re expanding into new markets, increasing transaction volumes, or adding new product lines, the software should be able to manage these changes without compromising performance. Look for solutions that offer:

- Flexible plans that accommodate different sizes and types of businesses.

- Capacity to handle higher transaction volumes as your business scales up.

Customization allows you to tailor the software to fit your specific needs. This can include customizing tax rates, reporting formats, and user interfaces. Customizable software helps you:

- Adapt to unique business processes and regulatory requirements.

- Create reports and dashboards that provide relevant insights for your business.

User-Friendliness and Ease of Implementation

User-friendliness and ease of implementation are essential to ensure that your team can quickly and effectively use the software. A solution that is intuitive and easy to integrate will minimize disruptions and streamline your tax management processes.

User-friendliness involves an intuitive interface that simplifies the learning curve for new users. Key aspects to consider include:

- Clean and navigable design: The software should have a straightforward layout that makes it easy to find and use various features.

- Help resources: Look for tools like tutorials, guides, and FAQs that assist users in getting up to speed.

Ease of implementation refers to how smoothly the software integrates with your existing systems and processes. To facilitate a smooth implementation:

- Assess integration capabilities: Ensure the software can connect seamlessly with your current accounting and ERP systems.

- Consider support options: Check if the provider offers setup assistance and training to help with the initial deployment.

Cost and Value for Money

Cost and value for money are pivotal when evaluating compliance software. While it’s important to stay within budget, the software should also offer a good return on investment by delivering substantial benefits.

Cost encompasses both the initial purchase price and any ongoing expenses. When evaluating cost:

- Examine pricing structures: Understand whether the cost is based on a subscription model, a one-time fee, or usage-based pricing.

- Identify hidden costs: Be aware of additional fees for upgrades, support, or extra features.

Value for money refers to the benefits the software provides in relation to its cost. Assess how the software:

- Enhances efficiency: Consider time savings and error reduction as factors that contribute to overall value.

- Improves compliance: Evaluate how well the software helps you meet regulatory requirements and avoid penalties.

Customer Support and Service

Effective customer support and service are crucial for resolving issues and ensuring that you get the most out of your compliance software. Reliable support can significantly impact your experience with the software.

Customer support involves the assistance provided to help you resolve issues and answer questions. Look for:

- Availability: Ensure support is available during your business hours and offers timely responses.

- Support channels: Check for multiple contact options, such as phone, email, and live chat.

Service includes the additional resources and help available from the software provider. Key factors include:

- Training resources: Access to training materials and webinars can help users become proficient with the software.

- Implementation assistance: Professional services to aid with the initial setup and integration.

Software Updates and Maintenance

Regular software updates and maintenance are essential for keeping your compliance tools effective and up-to-date. As tax regulations change and technology evolves, your software needs to stay current.

Software updates ensure that the tool remains compliant with new tax laws and incorporates the latest features. Important considerations include:

- Update frequency: Check how often the software is updated and how these updates are applied.

- Regulatory changes: Ensure the provider addresses tax law changes promptly with relevant updates.

Maintenance involves ongoing support to ensure the software functions correctly. Look for:

- Scheduled maintenance: Regular checks and updates to prevent issues and enhance performance.

- Bug fixes and enhancements: Timely resolution of problems and improvements to software features.

By carefully evaluating these criteria, you can select compliance software that not only meets your immediate needs but also supports your business’s growth and adapts to changing requirements.

Industry-Specific Tax Compliance Considerations

Different industries face unique challenges and requirements when it comes to sales tax and VAT compliance. Understanding these industry-specific needs can help you select the most appropriate compliance software for your business.

Retail and E-Commerce

For retail and e-commerce businesses, managing sales tax and VAT can be complex due to the variety of tax rates across different regions and the need for real-time processing.

Retail and e-commerce businesses often need:

- Multi-Jurisdictional Tax Management: Retailers and online sellers may operate across multiple states or countries, each with its own tax regulations. Compliance software should handle varying tax rates and rules seamlessly, applying the correct rate based on the customer’s location.

- Integration with E-Commerce Platforms: To streamline operations, your compliance software should integrate with major e-commerce platforms like Shopify, Magento, or WooCommerce. This ensures automatic tax calculations at checkout and smooth reconciliation with sales data.

- Real-Time Tax Calculation: The software must calculate tax rates accurately at the point of sale to avoid discrepancies and ensure correct tax collection. Real-time updates are crucial for reflecting current tax rates and rules.

- Sales Tax Exemption Handling: For retail businesses that deal with tax-exempt transactions, such as sales to non-profit organizations or government entities, the software should manage exemptions efficiently.

Manufacturing and Wholesale

Manufacturing and wholesale businesses deal with a unique set of tax challenges, including the application of tax exemptions and the handling of bulk transactions.

Manufacturing and wholesale sectors often require:

- Exemption Management: Many manufacturing businesses qualify for tax exemptions on raw materials or machinery. Your software should be capable of managing and applying these exemptions correctly to avoid unnecessary tax liabilities.

- Complex Transaction Handling: Wholesale transactions often involve bulk sales and may include special pricing or discounts. The software should handle these complex transaction types and ensure accurate tax calculations.

- Integration with Inventory Systems: Effective tax management in manufacturing and wholesale businesses requires integration with inventory and supply chain management systems to accurately track and report on taxable items.

- Cross-Jurisdiction Compliance: For businesses operating across state or country lines, the software needs to manage different tax jurisdictions and comply with local regulations efficiently.

Professional Services

Professional services firms, such as consulting, legal, and accounting practices, have specific tax compliance needs that differ from product-based businesses.

Professional services firms often need:

- Service-Based Tax Rules: Tax rules for services can vary significantly from those for goods. Your software should support the application of different tax rates based on the type of service provided and the location of the service.

- Client-Specific Tax Requirements: Some professional services clients may have unique tax considerations, such as different billing arrangements or tax-exempt status. The software should accommodate these needs and ensure accurate billing and tax reporting.

- Accurate Invoicing: Professional services often involve detailed invoicing. The software should support customizable invoicing with precise tax calculations and comprehensive reporting features to manage and track client payments effectively.

- Regulatory Compliance: Ensure the software helps you stay compliant with industry-specific regulations and reporting requirements, which can vary depending on the services provided and the jurisdictions served.

International Trade and Cross-Border Transactions

Businesses involved in international trade and cross-border transactions face additional complexities in managing sales tax and VAT due to varying regulations across countries.

International trade and cross-border businesses require:

- Multi-Country VAT Management: Handling VAT for multiple countries involves managing different rates and compliance rules. The software should support VAT calculations and reporting for each jurisdiction where your business operates.

- Currency and Language Support: For global transactions, the software should handle multiple currencies and languages, ensuring accurate tax calculations and reporting across different regions.

- Customs and Import/Export Compliance: Managing customs duties and import/export taxes is crucial for international trade. The software should integrate with customs systems and support the calculation and reporting of these taxes.

- Cross-Border Integration: The software should facilitate seamless integration with international sales platforms, financial systems, and logistics tools to ensure accurate tax management and compliance throughout the global supply chain.

By addressing the specific needs of each industry, compliance software can help you navigate complex tax requirements, streamline operations, and ensure accurate and efficient tax management.

Best Practices for Implementing Compliance Software

Implementing compliance software effectively can significantly enhance your tax management processes. To ensure a smooth deployment and optimal use of the software, consider the following best practices:

- Thoroughly Assess Your Needs: Before selecting and implementing software, evaluate your specific business requirements, including transaction volumes, jurisdictional needs, and integration requirements. This assessment helps you choose software that aligns with your operational demands and compliance goals.

- Plan for Integration: Ensure the software integrates seamlessly with your existing systems, such as accounting, ERP, and e-commerce platforms. Proper integration minimizes disruptions and ensures accurate data flow across systems.

- Engage in Comprehensive Training: Provide thorough training for your team to ensure they understand how to use the software effectively. Training should cover all relevant features and functionalities, and include hands-on practice to build familiarity.

- Implement Gradually: Consider a phased implementation approach to manage the transition smoothly. Start with a pilot phase, where the software is used in a controlled environment before a full rollout, allowing you to address any issues and make adjustments.

- Regularly Monitor and Evaluate: Continuously monitor the software’s performance and evaluate its effectiveness in meeting your compliance needs. Regularly review reports, track user feedback, and assess whether the software is helping you achieve your compliance objectives.

- Stay Updated on Changes: Keep abreast of updates and new features provided by the software vendor. Ensure that the software remains current with changes in tax regulations and technology advancements to maintain compliance and efficiency.

- Leverage Support and Resources: Utilize available support services and resources, such as customer support, knowledge bases, and user communities. These resources can assist with troubleshooting, learning about new features, and optimizing software use.

- Ensure Data Accuracy: Regularly check and reconcile tax data to ensure accuracy. Implement processes for verifying data inputs and outputs to prevent errors that could lead to compliance issues or financial discrepancies.

Common Tax Compliance Software Challenges

Despite the advantages of compliance software, businesses may face several challenges during implementation and use. Addressing these challenges proactively can help ensure a smoother experience and maintain effective tax management.

- Integration Difficulties: Problems integrating the compliance software with existing systems can disrupt workflows and lead to data inconsistencies. Ensuring compatibility and thorough testing during the integration process is crucial to address these issues.

- User Adoption Issues: Resistance to change or lack of familiarity with the new software can hinder user adoption. Comprehensive training and clear communication about the benefits of the software can help overcome these challenges.

- Data Accuracy Concerns: Inaccurate tax calculations or data entry errors can lead to compliance issues and financial discrepancies. Implementing rigorous data validation processes and regularly reviewing tax reports can help maintain accuracy.

- Cost Overruns: Unexpected costs related to software updates, additional features, or integration can strain budgets. Carefully reviewing pricing structures and planning for potential expenses can help manage costs effectively.

- Regulatory Changes: Keeping the software updated with evolving tax regulations and ensuring it remains compliant can be challenging. Regularly reviewing software updates and working with the provider to address regulatory changes is essential.

- Scalability Issues: As your business grows, the software needs to scale accordingly. Inadequate scalability can affect performance and compliance. Choosing software with flexible scalability options can help manage growth effectively.

- Support and Service Gaps: Inadequate customer support or lack of timely assistance can lead to unresolved issues and delays. Ensure that the software provider offers robust support services and resources to address any problems that arise.

Conclusion

Choosing the right sales tax and VAT compliance software is crucial for effectively managing your tax obligations and ensuring accuracy in your financial operations. With the variety of options available, each offering unique features and benefits, it’s important to match the software with your specific business needs. From automating complex calculations to integrating seamlessly with your existing systems, the right solution can simplify the tax process, reduce errors, and save valuable time. By understanding the key features and evaluating your options carefully, you can find a solution that not only meets your current requirements but also scales with your business as it grows.

Investing in the right compliance software is more than just a practical decision; it’s a strategic move that can enhance your overall efficiency and provide peace of mind. With accurate tax calculations, up-to-date regulatory compliance, and streamlined reporting, you’ll be better equipped to handle the demands of tax management without getting bogged down by the complexities. As you review the various software solutions, consider how they align with your operational needs and growth plans to ensure you choose a tool that supports your long-term success.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.

-

Sale!

Marketplace Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

E-Commerce Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

SaaS Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

Standard Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

E-Commerce Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

SaaS Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Marketplace Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Startup Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Startup Financial Model Template

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart