Have you ever wondered how to manage your investments efficiently without needing deep financial expertise or spending countless hours tracking the market? Robo-advisory software offers a straightforward and accessible solution by automating the investment process using advanced algorithms and technology. These platforms create and manage personalized investment portfolios based on your financial goals and risk tolerance, making it easier for anyone to invest wisely.

Whether you are new to investing or looking to streamline your existing strategy, robo-advisors provide a range of features such as automated rebalancing, tax optimization, and diversified asset allocation. With lower fees compared to traditional financial advisors and user-friendly interfaces, robo-advisory services make investing more affordable and convenient. This guide will introduce you to the top robo-advisory software available today, detailing their key features, benefits, and what sets each one apart.

Introduction to Robo-Advisory Software

Navigating the complex world of investments can be challenging, especially for those new to the financial landscape. Robo-advisory software has emerged as a game-changer, offering automated solutions that simplify investment management. Understanding the fundamentals of robo-advisory is essential for anyone looking to optimize their financial strategy with the help of technology.

What is Robo-Advisory?

Robo-advisory refers to the use of automated platforms that provide financial planning and investment management services with minimal human intervention. These platforms leverage sophisticated algorithms and data analysis to create and manage personalized investment portfolios tailored to your individual financial goals and risk tolerance. Unlike traditional financial advisors, robo-advisors operate primarily online, offering a more accessible and cost-effective alternative for managing investments.

Key aspects of robo-advisory include:

- Automation: Automated processes handle portfolio creation, rebalancing, and tax optimization without the need for manual input.

- Accessibility: Lower minimum investment requirements make robo-advisors accessible to a broader audience, including beginners.

- Customization: Advanced algorithms assess your financial situation and preferences to tailor investment strategies specifically for you.

By removing the barriers associated with traditional investment management, robo-advisors democratize access to sophisticated financial tools, enabling more individuals to participate in the investment market.

Evolution of Automated Investing

The concept of automated investing has evolved significantly over the past few decades, driven by advancements in technology and changes in investor behavior. Here’s a look at how automated investing has progressed:

- Early Beginnings: The roots of automated investing can be traced back to the 1990s with the introduction of online brokerage accounts and basic algorithm-driven investment tools. These early platforms offered limited automation, primarily focusing on executing trades based on predefined criteria.

- Rise of Robo-Advisors: The launch of platforms like Betterment and Wealthfront in the late 2000s marked the true emergence of robo-advisory services. These platforms introduced fully automated portfolio management, leveraging modern portfolio theory to optimize asset allocation and risk management.

- Technological Advancements: The integration of machine learning, artificial intelligence, and big data analytics has significantly enhanced the capabilities of robo-advisors. These technologies enable more accurate risk assessments, predictive analytics, and personalized investment strategies.

- Expansion of Services: Initially focused on investment management, robo-advisors have expanded their offerings to include comprehensive financial planning tools, retirement planning, and even access to human financial advisors for more personalized guidance.

- Increased Adoption: As awareness and trust in robo-advisors have grown, so has their adoption among a diverse range of investors. Today, robo-advisors cater to both novice investors seeking simplicity and seasoned investors looking for efficient portfolio management solutions.

The evolution of automated investing reflects a broader trend towards leveraging technology to make financial services more efficient, transparent, and accessible.

What is Robo-Advisory Software?

Robo-advisory software is the backbone of modern automated investment platforms. It encompasses the suite of technologies and algorithms that power robo-advisors, enabling them to deliver personalized financial advice and manage investment portfolios autonomously.

Core components of robo-advisory software include:

- Algorithmic Portfolio Management: At its core, robo-advisory software uses algorithms based on financial theories and models to construct and manage diversified investment portfolios. These algorithms consider factors such as risk tolerance, investment horizon, and financial goals to determine the optimal asset allocation.

- User Interface (UI): An intuitive and user-friendly interface allows clients to interact with the platform easily. This includes setting up accounts, inputting financial information, and accessing investment reports and performance metrics.

- Data Integration: Robo-advisory software integrates with various financial data sources to provide real-time updates on market conditions, asset performance, and economic indicators. This data is crucial for making informed investment decisions and adjusting portfolios dynamically.

- Automation Features: Key functionalities like automatic rebalancing, tax-loss harvesting, and dividend reinvestment are automated within the software, ensuring that portfolios remain aligned with client goals without requiring constant manual oversight.

- Security Protocols: Robust security measures are embedded within the software to protect sensitive financial data. This includes encryption, multi-factor authentication, and compliance with regulatory standards to ensure data privacy and integrity.

- Scalability: The software is designed to handle a growing number of users and increasing amounts of data without compromising performance. Scalability ensures that the platform can expand its services and capabilities as demand increases.

Robo-advisory software transforms complex financial processes into streamlined, automated workflows, making sophisticated investment strategies accessible to a wider audience.

Benefits of Using Robo-Advisors

Robo-advisors offer a multitude of advantages that make them an attractive option for both new and experienced investors. Here are the key benefits:

- Cost-Effective: Lower management fees compared to traditional financial advisors, making investment management more affordable.

- Accessibility: Lower minimum investment requirements allow individuals with limited capital to start investing.

- Convenience: Automated processes handle portfolio management tasks like rebalancing and tax optimization, saving you time and effort.

- Personalization: Tailored investment strategies based on your financial goals, risk tolerance, and investment horizon.

- Transparency: Clear and straightforward fee structures with no hidden costs, providing full visibility into how your money is being managed.

- Diversification: Access to a wide range of asset classes and investment options, helping to spread risk and optimize returns.

- Real-Time Monitoring: Continuous tracking and adjustment of your portfolio to respond to market changes and maintain alignment with your goals.

- Educational Resources: Many robo-advisors offer educational materials and tools to help you make informed investment decisions.

- Scalability: Suitable for a wide range of investment amounts, from small portfolios to larger, more complex investment strategies.

- Security: Robust security measures protect your financial data and investments from unauthorized access and cyber threats.

These benefits collectively make robo-advisors a compelling choice for individuals seeking efficient, affordable, and personalized investment management solutions.

Key Features to Evaluate in Robo-Advisory Platforms

Selecting the right robo-advisory platform involves assessing several critical features to ensure it aligns with your investment goals and preferences. Understanding these features will help you make an informed decision and optimize your investment experience.

User Interface and Experience

A seamless and intuitive user interface can significantly enhance your interaction with a robo-advisory platform. When evaluating the user experience, consider the following aspects:

- Intuitive Navigation: The platform should be easy to navigate, allowing you to access different sections effortlessly. Clear menus and logical layout contribute to a smooth user experience.

- Visual Design: A clean and visually appealing design can make managing your investments more enjoyable. Look for platforms that use clear charts, graphs, and visual aids to represent your portfolio performance.

- Mobile Accessibility: In today’s fast-paced world, having access to your investments on the go is essential. Ensure the platform offers a robust mobile app with full functionality, enabling you to monitor and adjust your portfolio from anywhere.

- Customization Options: Personalizing your dashboard to display the information most relevant to you can enhance your experience. Features like customizable widgets and personalized notifications allow you to tailor the platform to your specific needs.

Investment Strategies and Customization

Robo-advisors offer a variety of investment strategies to cater to different financial goals and risk appetites. Understanding the level of customization available is crucial for aligning the platform with your personal investment strategy.

- Diversified Portfolios: A good robo-advisor provides access to a wide range of asset classes, including stocks, bonds, ETFs, and alternative investments. Diversification helps mitigate risk and optimize returns.

- Risk Assessment Tools: Effective platforms offer tools to assess your risk tolerance accurately. By understanding your comfort with market fluctuations, the robo-advisor can recommend an appropriate investment strategy.

- Automated Rebalancing: Maintaining your desired asset allocation is essential for long-term success. Look for platforms that offer automated rebalancing to ensure your portfolio stays aligned with your investment goals without requiring constant manual adjustments.

- Thematic Investing: Some robo-advisors allow you to invest based on specific themes or sectors, such as technology, healthcare, or sustainable energy. This feature provides an additional layer of customization, enabling you to invest in areas that align with your interests or values.

Fee Structures and Pricing

Understanding the fee structure of a robo-advisory platform is vital to ensure that you are getting value for your investment. Fees can vary widely between platforms, impacting your overall returns.

- Management Fees: Most robo-advisors charge a management fee based on a percentage of your assets under management (AUM). Lower fees can lead to higher net returns, especially over the long term.

- Additional Costs: Be aware of any extra fees for services such as tax-loss harvesting, premium account features, or withdrawals. These costs can add up and affect your investment performance.

- Transparency: A transparent fee structure is crucial. Ensure that the platform clearly outlines all potential costs upfront, so there are no surprises down the line.

- Minimum Investment Requirements: Some platforms require a minimum investment to get started. Understanding these requirements can help you choose a platform that fits your current financial situation.

Security Measures and Data Protection

Protecting your financial information is paramount when selecting a robo-advisory platform. Robust security measures ensure that your data and investments are safe from unauthorized access and cyber threats.

- Encryption Standards: Look for platforms that use advanced encryption technologies to safeguard your personal and financial data. Strong encryption prevents unauthorized parties from accessing your sensitive information.

- Regulatory Compliance: Ensure that the platform complies with relevant financial regulations and standards. Regulatory oversight adds an extra layer of security and accountability.

- Insurance and Protection: Check if the platform offers insurance coverage, such as SIPC (Securities Investor Protection Corporation) protection, which safeguards your investments in case of broker-dealer failure.

- Secure Authentication: Features like multi-factor authentication (MFA) add an extra layer of security by requiring multiple forms of verification before granting access to your account.

Customer Support and Resources

Reliable customer support and comprehensive educational resources can significantly enhance your experience with a robo-advisory platform. Effective support ensures that you can resolve any issues quickly and efficiently.

- Availability: Access to customer support around the clock can be invaluable, especially if you encounter issues outside regular business hours. Look for platforms that offer 24/7 support through various channels such as live chat, email, and phone.

- Educational Materials: A wealth of educational resources, including articles, webinars, and tutorials, can help you improve your financial literacy and make informed investment decisions. These resources are especially beneficial for beginners.

- Personalized Assistance: Some robo-advisors offer access to human financial advisors for personalized guidance. This feature can provide additional support when you need expert advice tailored to your specific financial situation.

- Community and Forums: Platforms that host community forums or user groups can offer valuable peer support and insights. Engaging with other investors can enhance your understanding and provide different perspectives on investment strategies.

By carefully evaluating these key features, you can select a robo-advisory platform that not only meets your investment needs but also provides a secure, user-friendly, and supportive environment for managing your financial future.

Top Robo-Advisory Software Solutions

Choosing the right robo-advisor can make a significant difference in your investment journey. Below, we explore some of the leading robo-advisors in the market, highlighting their unique strengths and the types of investors they best serve.

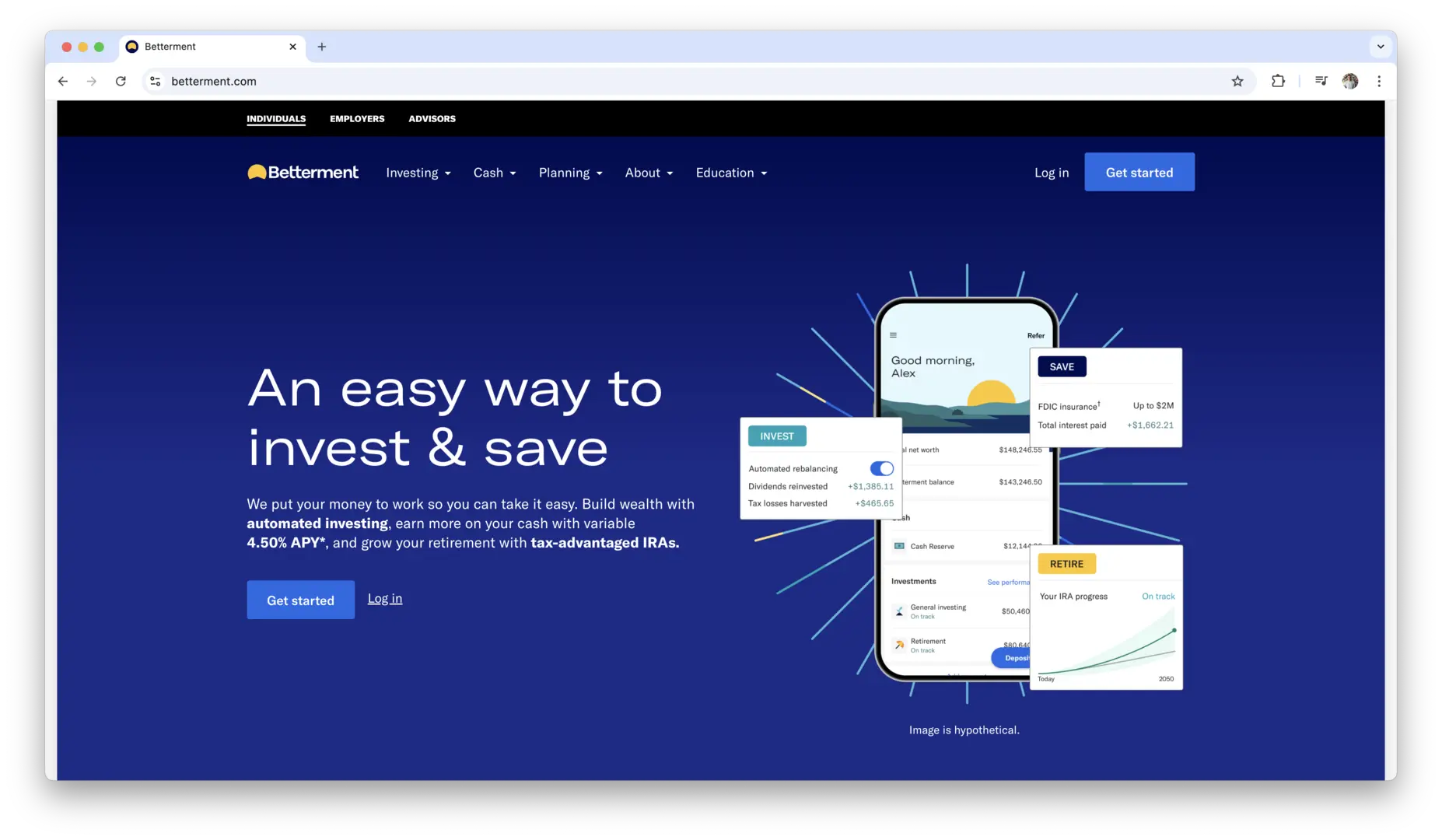

Betterment

Betterment is one of the pioneers in the robo-advisory space, renowned for its user-friendly platform and comprehensive financial planning tools. Founded in 2008, Betterment has grown to manage billions in assets, catering to a wide range of investors from beginners to those with more sophisticated financial needs.

Betterment offers a variety of features designed to optimize your investment strategy. Its goal-based investing approach allows you to set specific financial objectives, such as saving for retirement or purchasing a home, and the platform automatically adjusts your portfolio to help you achieve these goals. The platform also provides automated tax-loss harvesting, which helps minimize your tax liabilities by offsetting gains with losses.

One of Betterment’s standout features is its personalized advice. While it operates primarily through automation, Betterment offers access to human financial advisors for an additional fee, providing a hybrid model that combines the efficiency of robo-advisors with the personalized touch of traditional advisors. Additionally, Betterment offers socially responsible investing options, allowing you to align your portfolio with your ethical values.

Investors appreciate Betterment for its transparency and low fees. The platform charges a straightforward management fee, which is competitive compared to traditional financial advisors. However, some users have noted that the platform’s advanced features may come at a higher cost, which might be a consideration for those with larger portfolios.

Betterment is ideal for individuals seeking a balance between automated investment management and access to human financial advice. Its robust feature set and commitment to transparency make it a strong choice for both novice investors and those looking to enhance their investment strategies with professional guidance.

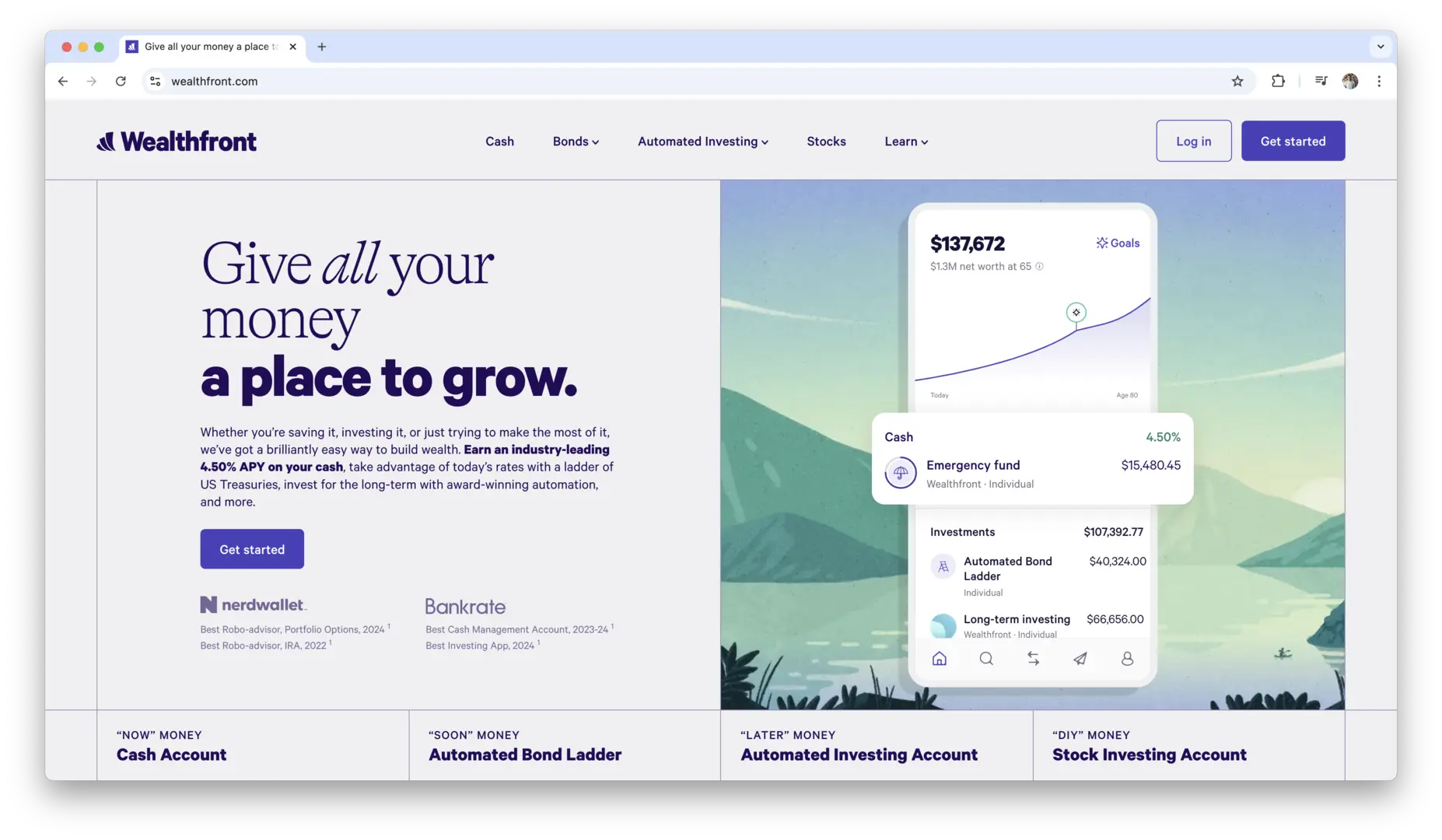

Wealthfront

Wealthfront has established itself as a top contender in the robo-advisory market, particularly appealing to tech-savvy investors who value automation and comprehensive financial planning tools. Since its inception in 2008, Wealthfront has focused on leveraging technology to provide sophisticated investment solutions at an affordable price.

Wealthfront’s platform is built around a holistic approach to financial management. Beyond just managing your investment portfolio, Wealthfront offers tools for retirement planning, education savings, and even home ownership. The platform’s Path tool provides personalized financial planning advice, helping you map out your financial future based on your unique goals and circumstances.

One of Wealthfront’s key features is its Tax-Loss Harvesting Plus, which not only offsets gains with losses but also intelligently maximizes your tax benefits by managing your portfolio’s tax efficiency. Additionally, Wealthfront offers direct indexing, allowing you to own individual securities within an index, which can further enhance tax efficiency and customization.

Wealthfront’s fee structure is transparent and competitive, with management fees that are among the lowest in the industry. The platform also requires a relatively low minimum investment, making it accessible to a broad range of investors. However, some users may find the lack of human advisor access limiting, especially if they prefer more personalized financial advice.

Wealthfront is best suited for investors who prioritize comprehensive financial planning and advanced tax optimization features. Its robust suite of tools and emphasis on automation make it an excellent choice for those looking to manage their finances holistically while benefiting from low-cost investment management.

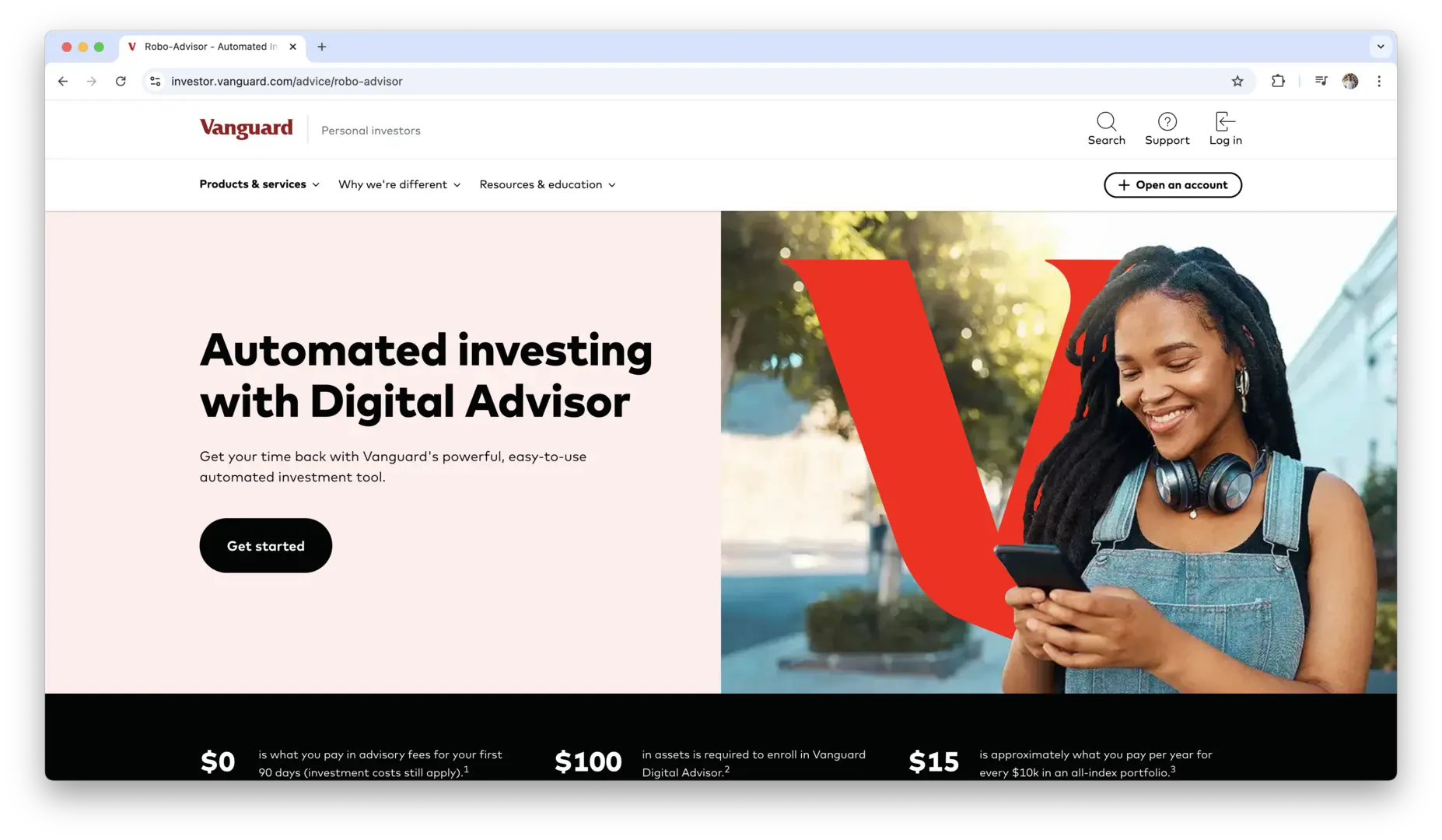

Vanguard Digital Advisor

Vanguard Digital Advisor combines Vanguard’s longstanding reputation for low-cost, high-quality investment management with the convenience of digital automation. As part of Vanguard’s extensive suite of investment services, Vanguard Digital Advisor offers a trusted platform for investors who value Vanguard’s investment philosophy and cost-effective strategies.

Vanguard Digital Advisor focuses on providing a straightforward, no-frills investment experience. The platform leverages Vanguard’s extensive range of low-cost index funds and ETFs to build diversified portfolios tailored to your financial goals and risk tolerance. By utilizing Vanguard’s proprietary algorithms, the Digital Advisor ensures that your portfolio remains aligned with your investment objectives through automated rebalancing and tax-efficient strategies.

One of the main advantages of Vanguard Digital Advisor is its integration with Vanguard’s broader ecosystem. Investors who already hold Vanguard accounts or prefer Vanguard’s investment products will find the Digital Advisor particularly appealing. The platform offers a seamless experience for managing multiple Vanguard accounts in one place, simplifying your overall financial management.

Vanguard Digital Advisor’s fee structure is highly competitive, reflecting Vanguard’s commitment to keeping costs low for investors. However, the platform may lack some of the advanced features and customization options found in other robo-advisors, which could be a drawback for investors seeking more personalized investment strategies.

Vanguard Digital Advisor is ideal for investors who are already familiar with Vanguard’s investment products and seek a low-cost, reliable platform for automated portfolio management. Its integration with Vanguard’s extensive range of funds and commitment to low fees make it a strong choice for cost-conscious investors looking for simplicity and reliability.

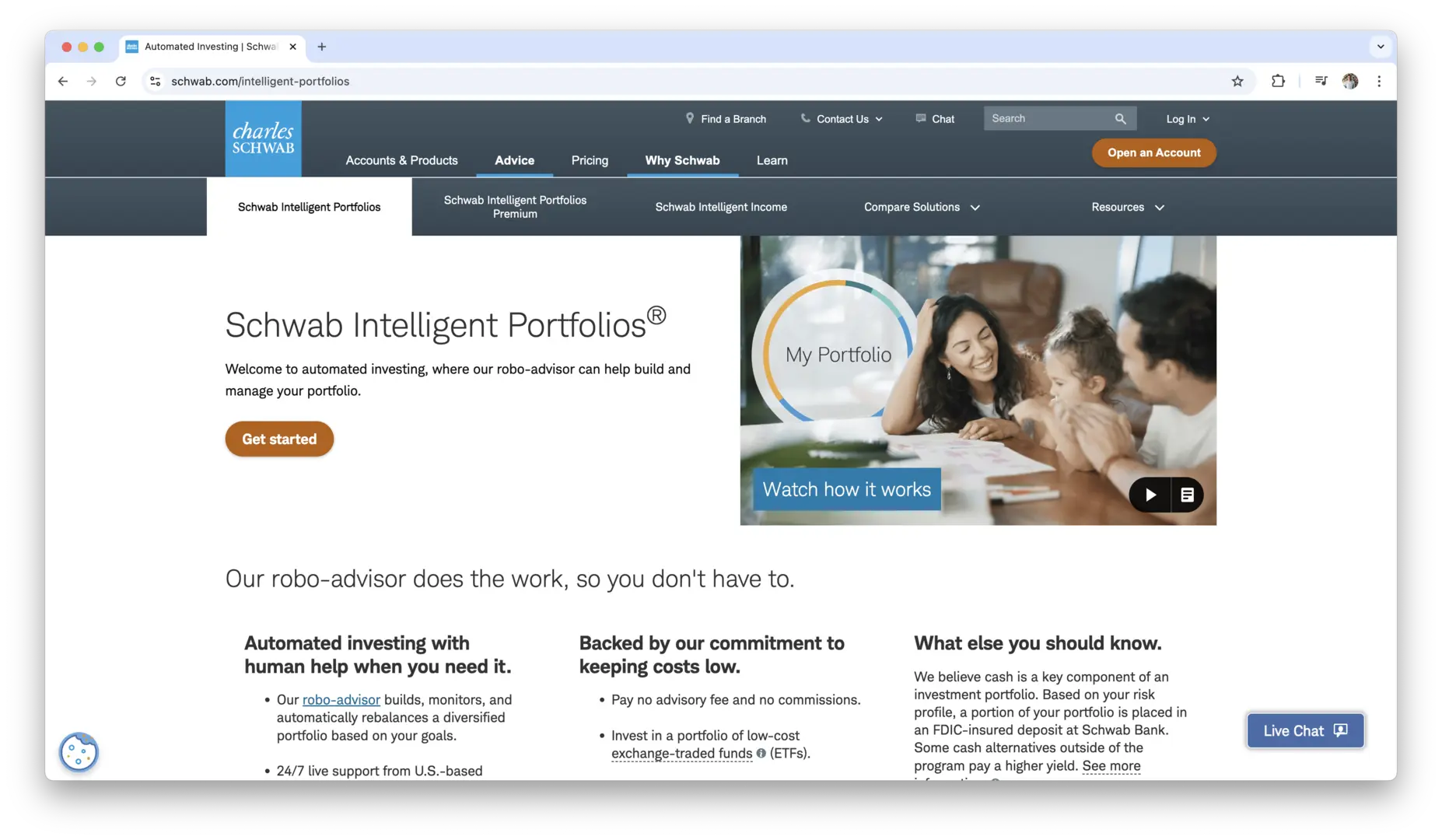

Schwab Intelligent Portfolios

Schwab Intelligent Portfolios offers a comprehensive robo-advisory solution backed by the financial expertise and resources of Charles Schwab. Launched to provide a seamless, automated investment experience, Schwab Intelligent Portfolios combines robust technology with the reliability of a well-established financial institution.

The platform is designed to cater to a wide range of investors, from beginners to those with more advanced investment needs. Schwab Intelligent Portfolios offers diversified portfolios constructed from ETFs across various asset classes, ensuring a balanced approach to risk and return. The platform also includes automatic rebalancing to maintain your desired asset allocation as market conditions change.

One of the standout features of Schwab Intelligent Portfolios is its integration with other Schwab services. Investors can easily link their brokerage accounts, IRAs, and other Schwab accounts, providing a unified view of their financial landscape. Additionally, the platform offers access to Schwab’s extensive research and educational resources, empowering investors with the knowledge they need to make informed decisions.

Schwab Intelligent Portfolios stands out for its fee structure, which is highly competitive and often more affordable than traditional financial advisors. Notably, the platform does not charge advisory fees, though there are underlying ETF expense ratios to consider. This cost-effective approach makes Schwab Intelligent Portfolios an attractive option for cost-conscious investors seeking comprehensive automated investment management.

Schwab Intelligent Portfolios is best suited for investors who value the integration of automated investment management with the broader suite of Schwab’s financial services. Its robust feature set, combined with Schwab’s reputation for reliability and low costs, makes it an excellent choice for those looking to manage their investments efficiently within a trusted financial ecosystem.

Vanguard Personal Financial Advisor

Vanguard Personal Financial Advisor bridges the gap between traditional robo-advisors and human financial advisors, offering a hybrid approach to investment management. Combining automated portfolio management with access to dedicated human advisors, Vanguard Personal Advisor Services provides a comprehensive solution for investors seeking both convenience and personalized guidance.

Vanguard Personal Advisor Services offers a personalized financial planning experience, starting with an in-depth assessment of your financial goals, risk tolerance, and investment preferences. Based on this information, the platform constructs a customized portfolio using Vanguard’s renowned low-cost index funds and ETFs. The automated system ensures that your portfolio remains aligned with your objectives through regular rebalancing and strategic adjustments.

One of the key differentiators of Vanguard Personal Advisor Services is the access to human financial advisors. Clients can consult with these advisors to receive personalized financial advice, helping to refine their investment strategies and address specific financial concerns. This hybrid model combines the efficiency and cost-effectiveness of robo-advisors with the personalized touch of traditional advisory services.

Vanguard Personal Advisor Services is known for its transparent fee structure, which is based on a percentage of assets under management. While the fees are competitive, they may be higher than some purely automated platforms, reflecting the added value of human advisory services. Additionally, there is a minimum investment requirement, which may be a barrier for some investors.

This platform is ideal for investors who seek a blend of automated investment management and personalized financial advice. Vanguard Personal Advisor Services caters to those who value both the efficiency of robo-advisors and the expertise of human advisors, making it a suitable choice for individuals looking for a more tailored and comprehensive investment experience.

Empower

Empower, formerly Personal Capital, stands out in the robo-advisory market by offering a robust combination of automated investment management and comprehensive financial planning tools. Founded with the goal of providing a holistic view of your financial life, Empower integrates investment management with tools for budgeting, retirement planning, and tracking your net worth.

Empower’s investment management services are powered by advanced algorithms that construct diversified portfolios tailored to your financial goals and risk tolerance. The platform offers features like automatic rebalancing and tax-efficient strategies to keep your investments aligned with your objectives. Additionally, Personal Capital provides detailed performance analytics and reporting, giving you clear insights into your portfolio’s performance.

One of the unique aspects of Empower is its emphasis on comprehensive financial planning. The platform’s dashboard allows you to monitor various aspects of your financial life in one place, from investments to expenses and cash flow. This holistic approach helps you make informed decisions by providing a complete picture of your financial health.

Empower offers both free tools and premium advisory services. The free tools are highly regarded for their depth and usability, making them valuable resources for anyone looking to manage their finances more effectively. For those seeking more personalized investment management and financial planning, Empower offers premium services with dedicated financial advisors.

While Empower, previously Personal Capital, provides a wealth of features and tools, its fee structure for premium services may be higher compared to some other robo-advisors. Additionally, the platform’s comprehensive approach may be more suitable for investors who have more complex financial situations and are looking for an integrated financial management solution.

Empower is ideal for investors who want a comprehensive view of their financial life combined with automated investment management. Its robust suite of tools and emphasis on holistic financial planning make it a strong choice for those seeking both detailed financial insights and effective investment strategies.

Acorns

Acorns is a micro-investing platform designed to make investing simple and accessible, especially for beginners. Launched in 2014, Acorns has garnered popularity for its unique approach to saving and investing by rounding up your everyday purchases and investing the spare change.

Acorns offers several investment options through its diversified portfolios, which include ETFs across various asset classes. The platform automatically rebalances your portfolio and provides features like Found Money, where select retailers invest in your Acorns account when you shop with them. Additionally, Acorns offers retirement accounts and a feature called Acorns Later, which helps you save for retirement.

One of Acorns’ standout features is its seamless integration with everyday banking activities. By linking your debit or credit card, Acorns automatically rounds up your purchases to the nearest dollar and invests the difference, making saving effortless. The platform also provides educational content to help users understand investing basics and make informed decisions.

Acorns is praised for its ease of use and minimal barriers to entry, making it an excellent choice for those new to investing or looking to start small. However, some users may find the fees relatively high for the limited range of investment options, especially for accounts with smaller balances.

Acorns is ideal for individuals who want a hands-off, automated approach to saving and investing, particularly those who prefer to start with small, incremental investments without the need for extensive financial knowledge.

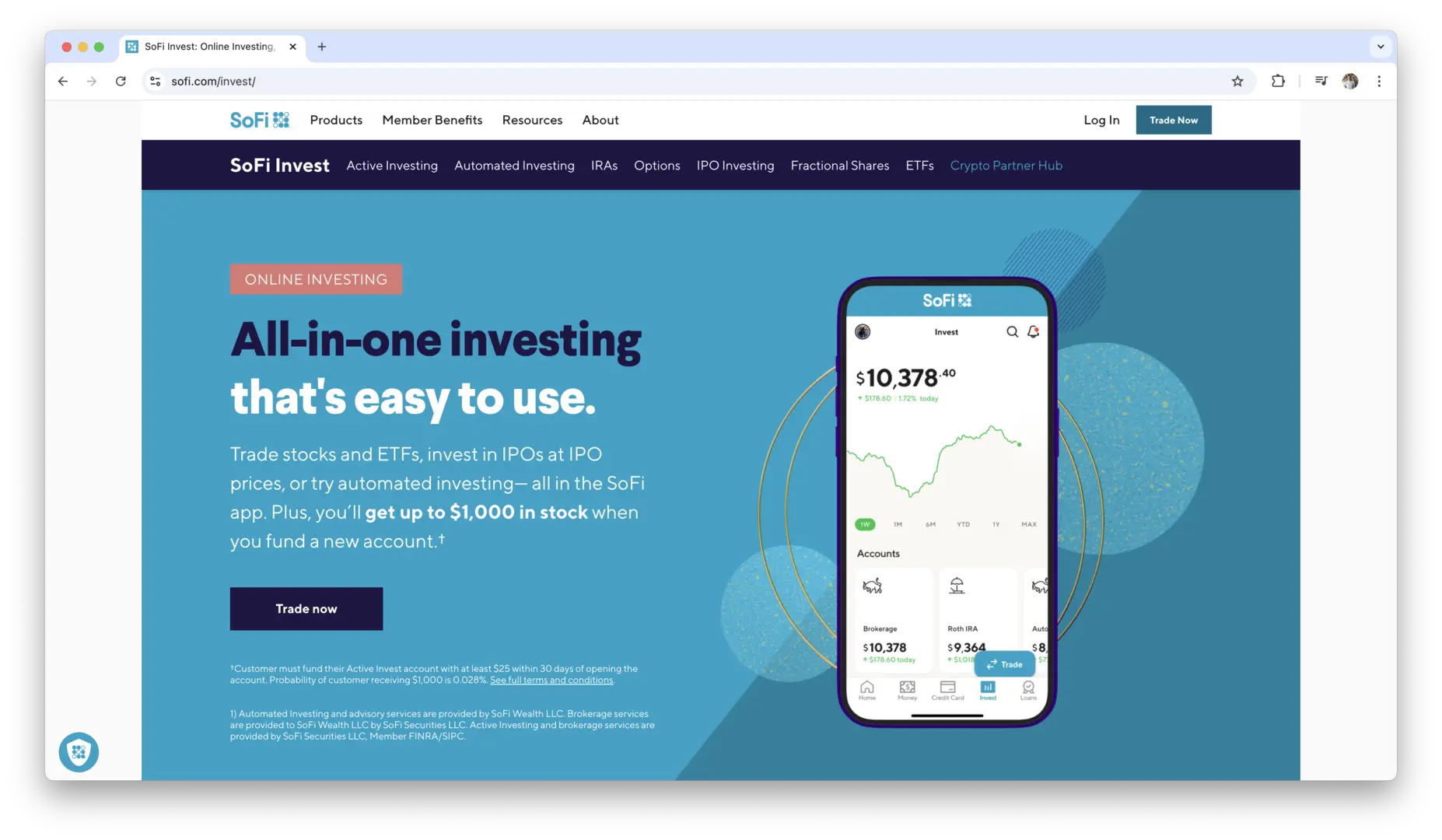

SoFi Invest

SoFi Invest is part of the larger SoFi (Social Finance) ecosystem, offering a comprehensive suite of financial products, including student loan refinancing, personal loans, and banking services. Launched in 2011, SoFi Invest has become a popular choice for investors seeking a versatile and integrated financial platform.

SoFi Invest offers both active and automated investing options. Its robo-advisory service provides diversified portfolios tailored to your risk tolerance and financial goals. Additionally, SoFi offers automated trading, allowing you to invest in stocks and ETFs without the need for manual management. The platform also includes features like fractional shares, enabling you to invest in high-priced stocks with smaller amounts of money.

One of the key advantages of SoFi Invest is its community-driven approach. Members gain access to educational resources, career coaching, and networking events, fostering a supportive environment for financial growth. The platform also offers no management fees for its robo-advisory service, making it an attractive option for cost-conscious investors.

While SoFi Invest excels in providing a holistic financial experience, it may lack some of the advanced investment tools and customization options found in other robo-advisors. Nonetheless, its user-friendly interface and integration with other SoFi services make it a strong contender for those seeking an all-in-one financial solution.

SoFi Invest is best suited for individuals looking for a comprehensive financial platform that combines automated investing with additional financial services and community support.

M1 Finance

M1 Finance offers a unique blend of robo-advisory services and self-directed investing, providing a flexible platform for investors who want both automation and control. Founded in 2015, M1 Finance has quickly become a favorite among investors who value customization and low fees.

M1 Finance’s standout feature is its “Pie” system, which allows you to create a personalized investment portfolio by dividing it into slices representing different assets. This visual and intuitive approach makes portfolio management straightforward and engaging. The platform offers a wide range of investment options, including individual stocks, ETFs, and M1’s own expert pies curated by investment professionals.

Automation is a key component of M1 Finance. The platform handles automatic rebalancing to maintain your desired asset allocation and offers features like fractional shares, enabling you to invest precise amounts without worrying about whole-share pricing. Additionally, M1 Finance provides automated dividends reinvestment, ensuring that your earnings continue to work for you.

M1 Finance is known for its transparent fee structure, with no management fees for basic accounts. Premium features, such as M1 Plus, offer additional benefits like lower borrowing rates, higher trading limits, and access to exclusive investment opportunities for a monthly fee.

While M1 Finance offers extensive customization and flexibility, it may not provide the same level of personalized financial advice as some other robo-advisors. However, for investors who prefer a hybrid approach with both automated and self-directed investing capabilities, M1 Finance is an excellent choice.

M1 Finance is ideal for investors who seek a customizable and flexible investment platform that combines automated portfolio management with the ability to handpick individual investments.

Ellevest

Ellevest is a robo-advisory platform specifically designed to cater to the unique financial needs of women. Founded in 2014 by Sallie Krawcheck, Ellevest focuses on addressing the gender investment gap by offering tailored investment strategies and financial planning tools.

Ellevest’s investment portfolios are designed with a focus on factors that disproportionately affect women, such as career breaks and longer lifespans. The platform uses a goal-based investing approach, allowing you to set specific financial objectives like buying a home, saving for education, or planning for retirement. Ellevest also offers personalized career coaching and financial planning services to support your overall financial well-being.

One of Ellevest’s key features is its commitment to sustainable and socially responsible investing. The platform allows you to choose portfolios that align with your values, incorporating ESG (Environmental, Social, Governance) criteria into its investment strategies. Additionally, Ellevest provides educational resources and tools to help women build confidence in their financial decisions and investment strategies.

Ellevest’s fee structure is transparent, with different pricing tiers based on the level of service and customization you require. While the platform may have higher fees compared to some general robo-advisors, the specialized focus and additional resources make it a worthwhile investment for those seeking a tailored financial experience.

Ellevest is best suited for women who are looking for an investment platform that understands and addresses their unique financial challenges and goals, providing both automated investing and personalized financial guidance.

Ally Invest Managed Portfolios

Ally Invest Managed Portfolios is part of Ally Financial’s suite of investment services, offering a robust robo-advisory solution backed by the reliability and resources of a well-established financial institution. Known for its customer-friendly approach, Ally Invest Managed Portfolios caters to a wide range of investors seeking automated investment management.

The platform provides diversified portfolios constructed from low-cost ETFs, ensuring a balanced approach to risk and return. Ally Invest Managed Portfolios offers automatic rebalancing and tax-loss harvesting, helping to maintain your investment strategy without manual intervention. Additionally, the platform integrates seamlessly with other Ally financial products, such as banking and lending services, providing a unified financial management experience.

One of the notable features of Ally Invest Managed Portfolios is its transparent fee structure. The platform charges a straightforward management fee based on a percentage of assets under management, with no hidden costs. Ally also offers a low minimum investment requirement, making it accessible to a broad spectrum of investors.

Ally Invest Managed Portfolios is praised for its user-friendly interface and comprehensive customer support. Investors can access educational resources, financial tools, and responsive customer service to assist with their investment journey. However, the platform may lack some of the advanced customization options and personalized advice available with other robo-advisors.

Ally is ideal for investors who value a straightforward, cost-effective robo-advisory solution integrated with a trusted financial institution, offering automated portfolio management with the convenience of comprehensive financial services.

SigFig

SigFig is a versatile robo-advisory platform known for its seamless integration with existing brokerage accounts. Founded in 2011, SigFig aims to make investment management more accessible by providing automated portfolio management and optimization services.

SigFig offers a range of features designed to enhance your investment experience. The platform automatically analyzes your current investment portfolio, identifying opportunities for diversification and optimization. SigFig provides personalized investment recommendations based on your financial goals, risk tolerance, and investment horizon. Additionally, the platform offers automatic rebalancing to maintain your desired asset allocation over time.

One of SigFig’s standout features is its ability to integrate with a variety of brokerage accounts, including those from major financial institutions like Fidelity, Vanguard, and Charles Schwab. This integration allows you to manage and optimize all your investments in one place without the need to transfer funds or close existing accounts. SigFig also provides detailed performance tracking and reporting, giving you clear insights into your portfolio’s progress.

SigFig’s fee structure is transparent, with management fees based on a percentage of assets under management. The platform offers a free portfolio analysis tool, making it accessible for individuals who want to evaluate their investment strategy before committing to a paid service.

While SigFig excels in portfolio optimization and integration, it may lack some of the advanced financial planning tools and personalized advice offered by other robo-advisors. Nonetheless, its ease of use and comprehensive integration capabilities make it a strong choice for investors looking to optimize their existing portfolios.

SigFig is ideal for individuals who already have investments with other brokerage firms and seek an automated solution to optimize and manage their entire investment portfolio from a single platform.

Wealthsimple

Wealthsimple is a leading robo-advisory platform known for its user-friendly interface and commitment to socially responsible investing. Founded in 2014, Wealthsimple has grown rapidly, attracting a diverse clientele with its comprehensive investment services and innovative features.

Wealthsimple offers a variety of investment options, including diversified portfolios constructed from low-cost ETFs. The platform provides automated rebalancing and tax-loss harvesting, ensuring that your portfolio remains aligned with your financial goals and risk tolerance. Wealthsimple also offers a premium service called Wealthsimple Black, which includes additional benefits like financial planning, unlimited rebalancing, and lower fees for high-net-worth individuals.

One of Wealthsimple’s key strengths is its focus on socially responsible investing. The platform allows you to choose portfolios that align with your values, incorporating ESG criteria into its investment strategies. Additionally, Wealthsimple provides educational resources and tools to help users understand the importance of ethical investing and make informed decisions.

Wealthsimple’s fee structure is competitive, with management fees that scale based on your investment amount. The platform also offers a commission-free trading option, making it an attractive choice for cost-conscious investors. However, Wealthsimple may not offer the same level of customization and personalized financial advice as some other robo-advisors.

Wealthsimple is best suited for individuals who value a user-friendly platform with a strong emphasis on ethical investing and automated portfolio management, making it an excellent choice for socially conscious investors seeking simplicity and transparency.

Stash Automated Investing

Stash Automated Investing combines robo-advisory services with educational resources to help users build and manage their investment portfolios. Founded in 2015, Stash aims to empower individuals to take control of their financial future through easy-to-use investment tools and personalized guidance.

Stash offers a range of investment options, including ETFs and individual stocks, allowing users to create diversified portfolios tailored to their financial goals and risk tolerance. The platform provides automated rebalancing to maintain your desired asset allocation and offers features like fractional shares, enabling you to invest in high-priced stocks with smaller amounts of money.

One of Stash’s unique features is its focus on financial education. The platform offers a wealth of educational content, including articles, videos, and interactive tools, to help users understand the basics of investing and make informed decisions. Stash also provides personalized investment advice based on your financial goals and preferences, making it an excellent resource for both beginners and experienced investors.

Stash’s fee structure includes a monthly subscription fee, which varies based on the level of service you choose. While the fees may be higher compared to some other robo-advisors, the platform compensates with its extensive educational resources and personalized investment guidance.

Stash is ideal for individuals who are new to investing and seek a platform that combines automated portfolio management with comprehensive educational support, helping them build confidence and knowledge as they grow their investments.

Scalable Capital

Scalable Capital is a global robo-advisory platform known for its advanced technology and data-driven investment strategies. Founded in 2014, Scalable Capital has expanded its presence across multiple countries, offering a sophisticated investment management solution tailored to both individual and institutional investors.

Scalable Capital’s platform leverages artificial intelligence and machine learning to provide personalized investment strategies based on your financial goals, risk tolerance, and investment horizon. The platform offers a range of diversified portfolios constructed from ETFs, ensuring a balanced and optimized approach to risk and return. Additionally, Scalable Capital provides automatic rebalancing and tax-efficient strategies to keep your portfolio aligned with your objectives.

One of Scalable Capital’s key features is its risk management technology, which continuously monitors market conditions and adjusts your portfolio to mitigate risks. This proactive approach helps protect your investments during market volatility and ensures that your portfolio remains resilient against unforeseen economic changes.

Scalable Capital offers a transparent fee structure, with management fees based on a percentage of assets under management. The platform also provides a comprehensive suite of financial planning tools and educational resources, empowering users to make informed investment decisions.

While Scalable Capital excels in providing advanced risk management and technology-driven investment strategies, it may not offer the same level of personalized financial advice as some other robo-advisors. However, its focus on data-driven decision-making and robust security measures make it a strong choice for tech-savvy investors seeking a sophisticated investment management solution.

Scalable Capital is best suited for investors who prioritize advanced technology and risk management in their investment strategies, seeking a data-driven approach to portfolio management.

Zacks Advantage

Zacks Advantage is a robo-advisory platform developed by Zacks Investment Research, a renowned name in financial analysis and stock research. Launched to provide automated investment management services, Zacks Advantage leverages Zacks’ extensive research capabilities to offer informed and data-driven investment strategies.

Zacks Advantage offers diversified portfolios constructed from low-cost ETFs, ensuring a balanced approach to risk and return. The platform provides automated rebalancing to maintain your desired asset allocation and offers tax-loss harvesting to optimize your after-tax returns. Additionally, Zacks Advantage integrates seamlessly with other Zacks services, providing a unified financial management experience.

One of the key advantages of Zacks Advantage is its access to Zacks’ proprietary research and investment insights. The platform utilizes Zacks’ Stock Rank system to identify high-potential investment opportunities, enhancing portfolio performance through informed stock selection. This research-driven approach helps investors make data-backed decisions and stay ahead of market trends.

Zacks Advantage’s fee structure is competitive, with management fees based on a percentage of assets under management. The platform also offers a low minimum investment requirement, making it accessible to a wide range of investors. However, some users may find the platform’s focus on stock selection less aligned with those seeking purely passive investment strategies.

Zacks Advantage is ideal for investors who value access to high-quality financial research and data-driven investment strategies, seeking an automated solution that leverages expert insights to enhance portfolio performance.

How to Choose the Best Robo-Advisor for Your Needs?

Selecting the perfect robo-advisor involves more than just comparing features and fees. It requires a thoughtful evaluation of your personal financial situation, goals, and preferences. Here’s how you can navigate this important decision to find a platform that truly aligns with your investment journey.

Assessing Your Financial Goals

Understanding your financial objectives is the foundation of selecting the right robo-advisor. Clearly defined goals will guide your investment strategy and help you choose a platform that supports your aspirations.

- Short-Term Goals: Identify what you aim to achieve in the near future, such as saving for a vacation, building an emergency fund, or making a significant purchase. Short-term goals often require more conservative investment strategies to preserve capital.

- Long-Term Goals: Consider your aspirations for the distant future, like retirement planning, buying a home, or funding your children’s education. Long-term goals typically benefit from more aggressive investment approaches that capitalize on growth over time.

- Investment Horizon: Determine the timeframe you have to reach each of your goals. A longer investment horizon allows for greater risk-taking and potential returns, while a shorter horizon may necessitate more cautious strategies to protect your investments.

- Specific Milestones: Break down your goals into specific, measurable milestones. For example, if your goal is retirement, decide at what age you want to retire and how much you need to save annually to achieve that target.

Understanding Your Risk Tolerance

Your comfort with risk plays a crucial role in shaping your investment strategy. Assessing your risk tolerance ensures that the robo-advisor you choose aligns with how much volatility you can comfortably withstand.

- Risk Assessment Tools: Many robo-advisors offer questionnaires or tools to evaluate your risk tolerance. These assessments consider factors like your investment experience, financial situation, and emotional response to market fluctuations.

- Investment Allocation: Based on your risk tolerance, a robo-advisor will recommend an appropriate asset allocation. Conservative investors might have a higher proportion of bonds and cash, while aggressive investors may lean towards stocks and alternative investments.

- Behavioral Factors: Reflect on your past investment experiences and how you reacted to market downturns. Understanding your behavioral tendencies can help you choose a platform that offers strategies suited to your temperament.

- Adjusting Over Time: Your risk tolerance may change as your financial situation and life circumstances evolve. Choose a robo-advisor that allows you to easily update your risk preferences and adjust your portfolio accordingly.

Evaluating Platform Features and Services

Different robo-advisors offer a variety of features and services. Evaluating these aspects ensures that the platform you choose provides the tools and support you need to manage your investments effectively.

- Investment Options: Look for platforms that offer a diverse range of asset classes, including stocks, bonds, ETFs, and alternative investments. A broad selection allows you to build a well-diversified portfolio tailored to your preferences.

- Financial Planning Tools: Comprehensive financial planning tools can help you manage not just your investments but also other aspects of your financial life, such as budgeting, debt management, and retirement planning.

- Tax Optimization: Features like tax-loss harvesting and tax-efficient investing strategies can enhance your after-tax returns. Ensure the robo-advisor provides these options if minimizing tax liability is important to you.

- Integration with Other Financial Services: Seamless integration with your bank accounts, retirement plans, and other financial services can streamline your financial management. This connectivity allows for easier tracking and a more holistic view of your financial health.

- Educational Resources: Access to a wealth of educational materials, such as articles, webinars, and tutorials, can empower you to make informed investment decisions. These resources are especially valuable for those who are new to investing.

- Customization and Flexibility: The ability to customize your investment strategy and make adjustments as your goals or preferences change is essential. Choose a platform that offers flexibility in how you manage and adjust your portfolio.

Considering Fees and Long-Term Costs

Fees can significantly impact your investment returns over time. Understanding the fee structure of a robo-advisor is crucial to ensure that you are getting value for your money.

- Management Fees: Most robo-advisors charge a management fee based on a percentage of your assets under management (AUM). Compare these fees across different platforms to find one that offers competitive pricing without compromising on essential features.

- Additional Fees: Be aware of any extra costs that may apply, such as fees for premium features, withdrawals, account closures, or accessing human advisors. These additional charges can add up and affect your overall returns.

- Fee Transparency: A transparent fee structure is vital. Ensure that the platform clearly outlines all potential costs upfront, so there are no hidden surprises that could erode your investment gains.

- Minimum Investment Requirements: Some robo-advisors have minimum investment thresholds. Make sure the platform you choose aligns with your current financial situation and investment capacity.

- Value for Money: Assess whether the fees you are paying are justified by the services and features provided. A slightly higher fee might be worth it if the platform offers superior performance, better customer support, or additional financial planning tools.

- Long-Term Impact: Consider how fees will compound over the years. Even small differences in management fees can lead to significant variations in your portfolio’s growth over the long term. Use the following formula to understand the impact:

For example, a 0.25% difference in annual fees can lead to hundreds or thousands of dollars in additional returns over decades.

By carefully considering these aspects—your financial goals, risk tolerance, platform features, and fee structures—you can choose a robo-advisor that not only meets your immediate investment needs but also supports your long-term financial well-being. Taking the time to evaluate these factors will help you make a confident and informed decision, setting you on the path to achieving your financial aspirations with the right automated investment partner.

Conclusion

Choosing the right robo-advisory software can transform the way you manage your investments, making the process more efficient and accessible. Throughout this guide, we’ve explored various top robo-advisors, each with its unique features and benefits tailored to different types of investors. From platforms like Betterment and Wealthfront that offer comprehensive financial planning tools, to specialized services like Ellevest that focus on empowering women investors, there’s a robo-advisor to fit every need. Understanding the key features such as user interface, investment strategies, fee structures, security measures, and customer support is essential in making an informed decision that aligns with your financial goals and risk tolerance.

As you consider incorporating a robo-advisor into your investment strategy, remember that the best choice depends on your individual circumstances and preferences. Whether you’re looking for low-cost investment management, advanced tax optimization, or personalized financial advice, the right robo-advisor can provide the tools and support you need to achieve your financial objectives. Take the time to evaluate each platform’s offerings, compare their strengths, and assess how they fit into your overall financial plan. With the right robo-advisory software, managing your investments can become simpler, more transparent, and more effective, helping you build a secure financial future with confidence.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.