Are you looking for a way to simplify and streamline how you manage your subscription-based revenue? With so many businesses moving towards recurring revenue models, finding the right software to handle billing, revenue recognition, and customer management can make all the difference. Whether you’re a startup or an established company, the right recurring revenue management software can automate complex processes, improve accuracy, and enhance customer satisfaction.

This guide will explore the top solutions available, breaking down their key features, benefits, and what sets them apart. By understanding these options, you’ll be better equipped to choose the software that aligns perfectly with your business needs and helps you manage your recurring revenue with ease.

What is Recurring Revenue Management Software?

Recurring revenue management software is a specialized tool designed to handle the complexities associated with subscription-based business models. It automates and streamlines the processes involved in managing recurring revenue streams, ensuring that billing, financial reporting, and customer interactions are handled efficiently and accurately.

At its core, this type of software provides functionality for:

- Subscription Billing: Automates the creation and management of recurring invoices based on various billing cycles, including monthly, quarterly, or annually. It often includes features for handling complex billing scenarios, such as prorated charges or usage-based billing.

- Revenue Recognition: Ensures that revenue is recognized in compliance with accounting standards like ASC 606 or IFRS 15. The software automatically allocates revenue over time or based on performance obligations, providing accurate financial reporting.

- Customer Management: Maintains detailed profiles of customers, including subscription history, payment information, and communication records. It often includes self-service portals for customers to manage their subscriptions and access billing information.

- Reporting and Analytics: Offers tools for generating customizable reports and real-time analytics. This helps businesses track key metrics such as revenue growth, churn rates, and customer acquisition costs.

- Integration Capabilities: Connects with other business systems, such as accounting software and CRM platforms, to ensure seamless data flow and operational efficiency.

Overall, recurring revenue management software is essential for businesses with subscription models, as it facilitates accurate financial management, enhances customer experiences, and supports scalable growth.

Importance of Recurring Revenue Management

Managing recurring revenue effectively is crucial for several reasons:

- Steady Cash Flow: Reliable revenue streams ensure consistent cash flow, which is vital for sustaining business operations and planning for growth.

- Revenue Accuracy: Accurate billing and revenue recognition help maintain financial integrity and compliance with accounting standards.

- Customer Retention: Efficient management of subscriptions and customer interactions enhances satisfaction and reduces churn.

- Operational Efficiency: Automation of billing and reporting processes reduces manual work and minimizes errors, freeing up resources for strategic activities.

- Informed Decision-Making: Access to detailed analytics and reporting provides insights that guide business strategy and financial planning.

- Scalability: Effective management supports business growth by handling increased transaction volumes and adapting to evolving business needs.

Features to Look for in Recurring Revenue Management Software

When evaluating recurring revenue management software, identifying the features that will best support your business operations is crucial. Each feature contributes to a more streamlined, efficient, and accurate management of your subscription-based revenue streams.

Subscription Billing Capabilities

One of the core functions of recurring revenue management software is its ability to handle subscription billing efficiently. This includes several key aspects:

- Flexible Billing Cycles: The software should accommodate various billing intervals, such as monthly, quarterly, and annually. Additionally, it should support customizable billing schedules to fit unique business needs.

- Automatic Renewals: A seamless renewal process helps in retaining customers by ensuring their subscriptions are automatically renewed without requiring manual intervention.

- Prorated Charges: When customers upgrade, downgrade, or change their subscription plans mid-cycle, the software should calculate prorated charges automatically to ensure accurate billing and prevent revenue loss.

For example, if a customer switches from a basic plan to a premium plan halfway through the billing period, the software should prorate the charge for the remaining period, ensuring fair billing and accurate revenue capture.

Automated Revenue Recognition

Revenue recognition is crucial for financial reporting and compliance with accounting standards. Automated revenue recognition features include:

- Compliance with Accounting Standards: The software should align with standards like ASC 606 or IFRS 15, which dictate how and when revenue should be recognized based on the delivery of services and performance obligations.

- Automated Revenue Allocation: It should automatically allocate revenue across different periods or performance obligations, ensuring that financial statements reflect the true economic performance of your business.

For instance, if you collect $1,200 for an annual subscription, automated revenue recognition will spread this revenue across the 12-month period, recognizing $100 each month, thus maintaining accurate financial records.

Customer Management Tools

Effective customer management is essential for maintaining good relationships and optimizing customer experiences. Key tools to look for include:

- Detailed Customer Profiles: The software should provide comprehensive profiles that include subscription history, payment methods, and interaction records. This helps in managing customer interactions and resolving issues more efficiently.

- Self-Service Portals: Allowing customers to manage their own subscriptions through a self-service portal can enhance their experience by providing easy access to billing information, subscription changes, and payment updates.

For example, a self-service portal enables customers to pause or cancel their subscriptions without needing to contact customer support, reducing administrative overhead and improving customer satisfaction.

Reporting and Analytics

Robust reporting and analytics capabilities are vital for making informed business decisions. Look for features that offer:

- Customizable Reports: Ability to generate reports tailored to your needs, such as revenue summaries, churn rates, and subscription growth. Customizable reporting helps in tracking performance metrics that matter most to your business.

- Real-Time Analytics: Access to real-time data allows you to monitor current performance and make timely adjustments. Real-time dashboards can display key metrics such as active subscriptions, revenue growth, and customer acquisition rates.

For example, real-time analytics might reveal a spike in churn rates, allowing you to investigate and address the underlying causes promptly, thus preventing further customer loss.

Integration with Other Systems

Seamless integration with other business systems enhances the functionality and efficiency of your software. Important integrations to consider include:

- Accounting Software: Integration with accounting systems like QuickBooks or Xero helps synchronize financial data, making it easier to manage invoicing, payments, and financial reporting.

- CRM Systems: Connecting with Customer Relationship Management (CRM) systems ensures that customer data is consistent across platforms, facilitating better customer insights and more personalized communication.

For example, integrating with a CRM system allows you to pull up a customer’s complete history and interactions from within your revenue management software, enabling more informed decision-making and improved customer service.

Scalability and Flexibility

As your business grows, your recurring revenue management software should be able to scale and adapt. Key aspects include:

- Scalable Architecture: The software should handle increased transaction volumes and user activity as your business expands. Look for solutions that can scale without performance degradation.

- Flexible Configuration: It should offer flexibility to accommodate different business models, billing scenarios, and growth strategies. This includes the ability to configure various pricing models, subscription plans, and revenue recognition rules.

For example, a scalable system will continue to perform efficiently as you add new customers or introduce new subscription tiers, ensuring that growth does not compromise the quality of your revenue management processes.

Top Recurring Revenue Management Software Solutions

Choosing the right recurring revenue management software is a pivotal decision for businesses relying on subscription models. The market offers several robust solutions, each with its unique strengths and features designed to cater to different needs. Here’s a detailed look at some of the top software options available today:

1. Chargebee

Chargebee is widely recognized for its comprehensive suite of subscription management tools. It provides a flexible billing system that supports various billing cycles and complex scenarios such as proration and usage-based billing. Chargebee’s automated revenue recognition aligns with accounting standards like ASC 606, ensuring accurate financial reporting. The platform also features a user-friendly interface and extensive integration capabilities with other business systems such as CRM and accounting software. Chargebee’s customer management tools, including detailed profiles and self-service portals, enhance the customer experience by allowing users to manage their subscriptions and access billing information independently.

2. Zuora

Zuora stands out for its enterprise-level capabilities and scalability. It is designed to handle complex subscription models and large volumes of transactions, making it ideal for growing businesses and large enterprises. Zuora offers advanced features for revenue recognition and financial reporting, ensuring compliance with accounting standards and providing detailed insights into revenue performance. The software supports a wide range of billing scenarios and integrates seamlessly with major ERP systems. Zuora’s reporting and analytics tools are highly customizable, allowing businesses to track key metrics and make data-driven decisions.

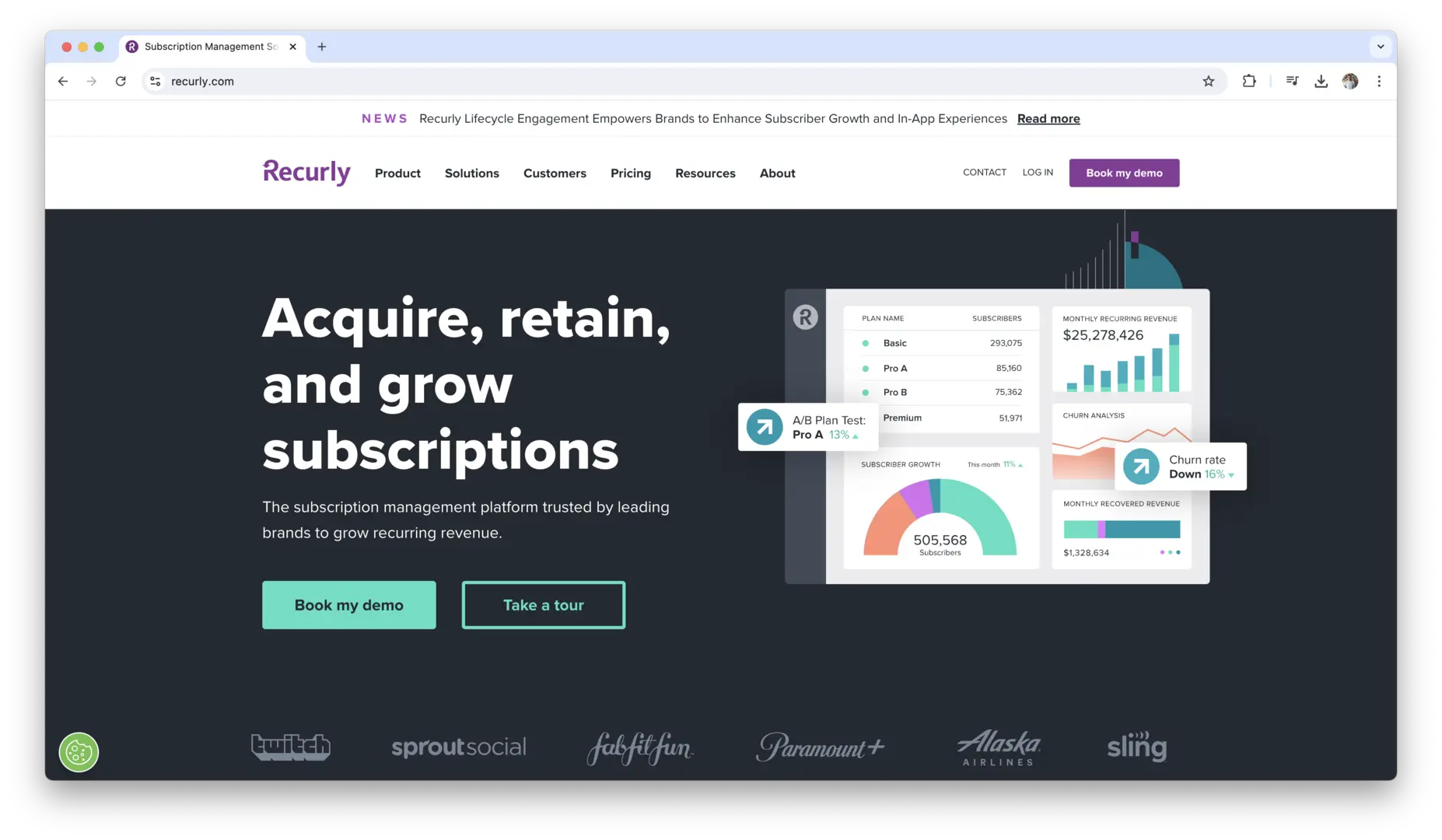

3. Recurly

Recurly is known for its intuitive user interface and powerful subscription management features. It provides automated billing and revenue recognition processes, ensuring accurate and timely financial management. Recurly’s flexible billing options cater to various subscription models, including recurring, usage-based, and one-time charges. The software offers robust analytics and reporting capabilities, allowing businesses to monitor performance and identify trends. Recurly also excels in customer management, with features such as self-service portals and detailed customer profiles that improve user experience and streamline subscription management.

4. Stripe Billing

Stripe Billing is a versatile solution that integrates seamlessly with Stripe’s payment processing platform. It offers flexible billing options, including recurring payments and one-time charges, and supports various subscription models. Stripe Billing provides automated invoicing and revenue recognition, helping businesses maintain financial accuracy and compliance. The software is known for its ease of use and rapid deployment, making it a good choice for startups and small to medium-sized businesses. Stripe Billing’s integration with other Stripe services, such as fraud prevention and international payments, adds additional layers of functionality.

5. Maxio

Maxio, previously Chargify, is tailored for businesses with complex billing requirements and offers a range of features designed to manage subscription lifecycles effectively. It provides advanced billing options, such as metered billing and multi-dimensional pricing, and supports a variety of subscription models. Maxio’s automated revenue recognition ensures compliance with accounting standards and simplifies financial reporting. The platform also includes robust customer management tools, including self-service portals and detailed analytics, which help businesses optimize their subscription management processes and improve customer satisfaction.

6. Aria Systems

Aria Systems provides a cloud-based platform for managing complex subscription billing and revenue management. It supports various billing models, including subscription, usage-based, and one-time charges. Aria Systems offers advanced revenue recognition capabilities, ensuring compliance with accounting standards. The software features real-time analytics and reporting tools that help businesses gain insights into revenue performance and customer behavior. Its flexibility and scalability make it suitable for enterprises with diverse and evolving subscription needs.

7. Stax Bill

Stax Bill, previously Fusebill, is designed to simplify the management of subscription billing and recurring revenue. It offers comprehensive features for automating billing, invoicing, and revenue recognition. Stax Bill supports multiple billing frequencies and pricing models, including tiered and usage-based billing. The platform’s advanced analytics and reporting tools provide visibility into key metrics such as churn rates and customer lifetime value. Stax Bill’s user-friendly interface and integration capabilities with other business systems enhance its effectiveness for managing complex subscription environments.

8. ChurnZero

ChurnZero focuses on customer success and retention, providing tools to manage and optimize the customer lifecycle. While it is primarily a customer success platform, it integrates with recurring revenue management systems to offer features like automated renewal management and churn prediction. ChurnZero’s real-time customer engagement tools help businesses identify at-risk customers and implement strategies to improve retention and reduce churn. Its integration with CRM and billing systems ensures that customer insights are effectively utilized to enhance subscription management.

9. Zuora Revenue

Zuora Revenue Recognition Software is a specialized solution for revenue recognition and compliance, designed to work in conjunction with Zuora’s core subscription management platform. It provides advanced features for automating revenue recognition in accordance with ASC 606 and IFRS 15. Zuora Revenue’s detailed reporting and analytics tools offer insights into revenue performance and support financial audits. This solution is ideal for businesses with complex revenue recognition requirements that need a dedicated tool to ensure accuracy and compliance.

10. Brightback

Brightback, a Chargbee company, specializes in improving customer retention and reducing churn. It offers features for managing subscription renewals, handling customer feedback, and implementing retention strategies. Brightback integrates with recurring revenue management systems to provide a seamless approach to managing customer interactions and subscription lifecycles. Its advanced analytics tools help businesses identify trends and patterns related to customer churn, enabling proactive measures to enhance retention and customer satisfaction.

11. Cleeng

Cleeng is tailored for media and content businesses, providing solutions for subscription management and content monetization. It offers flexible billing options, including metered and usage-based billing, and supports various subscription models. Cleeng’s platform includes advanced features for managing paywalls, content access controls, and customer authentication. Its integration capabilities with content management systems and payment processors make it a suitable choice for companies in the media and entertainment industry.

12. Avangate

Avangate, now part of 2Checkout, is designed for managing subscriptions and digital commerce. It provides a range of features for billing automation, revenue recognition, and customer management. Avangate supports various billing models, including recurring, usage-based, and one-time payments. Its global payment capabilities and integration with other business systems enhance its effectiveness for managing international subscription businesses. The platform’s analytics and reporting tools offer insights into sales performance and customer behavior.

13. Pabbly Subscriptions

Pabbly Subscriptions offers a comprehensive solution for managing subscription billing and recurring revenue. It features automated billing, invoicing, and revenue recognition capabilities. Pabbly supports various billing cycles and pricing models, including recurring and one-time payments. The platform’s user-friendly interface and affordable pricing make it a good choice for small to medium-sized businesses. Pabbly’s integration with other tools, such as payment gateways and CRM systems, enhances its functionality for managing subscriptions and customer interactions.

14. Rebill

Rebill provides a subscription billing and management platform with a focus on automation and flexibility. It offers features for handling recurring payments, invoicing, and revenue recognition. Rebill supports various billing models, including subscription-based, usage-based, and metered billing. The platform’s customizable reporting and analytics tools help businesses track performance metrics and make data-driven decisions. Rebill’s integration capabilities with other business systems and payment processors enhance its utility for managing complex subscription environments.

15. Subbly

Subbly is a subscription management platform designed for businesses of all sizes. It provides features for billing automation, revenue recognition, and customer management. Subbly supports various billing frequencies and pricing models, including one-time and recurring payments. The platform’s intuitive interface and flexible configuration options make it easy to set up and manage subscriptions. Subbly also offers integration with popular payment gateways and e-commerce platforms, making it a versatile choice for managing recurring revenue.

Each of these software solutions offers unique features and benefits, catering to different aspects of recurring revenue management. Evaluating these options based on your specific business needs and goals will help you select the solution that best aligns with your subscription management requirements and enhances your overall operational efficiency.

Benefits of Using Recurring Revenue Management Software

Adopting recurring revenue management software brings a multitude of benefits that can transform how you handle your subscription-based business operations. From increasing efficiency to enhancing customer satisfaction, these advantages are crucial for sustaining and growing your business.

Increased Efficiency

Recurring revenue management software automates and streamlines various processes, leading to significant efficiency improvements. By reducing the need for manual intervention in billing, invoicing, and revenue recognition, you can allocate resources more effectively and reduce the risk of errors. Automated workflows, such as generating invoices, processing payments, and managing renewals, save time and minimize administrative overhead. This increased efficiency allows your team to focus on strategic activities, such as growing your customer base and improving your product offerings.

Improved Financial Accuracy

Accurate financial reporting is critical for making informed business decisions and maintaining compliance with accounting standards. Recurring revenue management software ensures that financial data is consistently and accurately recorded. Automated revenue recognition aligns with accounting principles, reducing the likelihood of errors in financial statements. This accuracy not only supports internal decision-making but also facilitates audits and regulatory compliance, ensuring that your financial reporting is transparent and reliable.

Enhanced Customer Experience

A seamless customer experience is vital for retention and satisfaction. With features such as self-service portals, automated communication, and flexible billing options, recurring revenue management software improves how customers interact with your business. Self-service portals allow customers to manage their subscriptions, update payment information, and view billing history without needing to contact support. Automated communication tools ensure that customers receive timely notifications about renewals, payment confirmations, and other important updates, contributing to a smoother and more satisfying customer experience.

Better Financial Forecasting

Effective financial forecasting relies on accurate data and insightful analysis. Recurring revenue management software provides robust reporting and analytics capabilities, enabling you to track key performance indicators such as revenue growth, churn rates, and customer acquisition costs. With access to real-time data and customizable reports, you can make informed predictions about future revenue, assess the impact of different business strategies, and plan for growth more effectively. This data-driven approach helps in setting realistic financial goals and adjusting strategies based on current performance trends.

Streamlined Compliance

Compliance with financial regulations and accounting standards is essential for maintaining credibility and avoiding legal issues. Recurring revenue management software helps streamline compliance by automating processes that adhere to standards such as ASC 606 or IFRS 15. Automated revenue recognition and detailed financial reporting reduce the risk of non-compliance and simplify the preparation of necessary documentation. This ensures that your business operates within legal guidelines and maintains the trust of investors, auditors, and regulatory bodies.

How to Choose the Best Recurring Revenue Management Software?

Selecting the right recurring revenue management software is a critical decision that impacts your business’s efficiency and financial accuracy. To make an informed choice, you need to consider several factors to ensure the software aligns with your business needs and goals.

Assessing Your Business Needs

Understanding your specific business requirements is the first step in choosing the right software. Start by evaluating the complexity of your subscription model and the unique features you need:

- Subscription Types and Billing Frequencies: Determine the types of subscriptions you offer (e.g., monthly, quarterly, annually) and any special billing requirements. Choose software that supports your billing cycles and can handle complex scenarios like proration or usage-based billing.

- Revenue Recognition Requirements: Consider whether your business needs to comply with specific accounting standards like ASC 606 or IFRS 15. Ensure the software can automate revenue recognition to meet these standards accurately.

- Customer Management Needs: Assess the level of customer management required. If you need detailed customer profiles, self-service portals, or advanced CRM integration, make sure the software provides these capabilities.

Evaluating Software Options

With a clear understanding of your needs, you can evaluate different software options to find the best fit. Focus on the following aspects during your evaluation:

- Core Features: Compare the core functionalities of each software, such as billing automation, revenue recognition, and reporting capabilities. Ensure that the software covers all the essential features required for your operations.

- Ease of Use: Consider the user interface and overall usability. The software should be intuitive and easy to navigate to minimize the learning curve for your team.

- Scalability: Ensure the software can scale with your business growth. It should handle increased transaction volumes and adapt to evolving business requirements without performance issues.

- Integration Capabilities: Check how well the software integrates with your existing systems, such as accounting software, CRM platforms, and other business tools. Seamless integration can enhance efficiency and data accuracy.

Considering Budget Constraints

Budget is a significant factor in choosing the right software. Evaluate the cost of each option relative to your budget and the value it provides:

- Pricing Models: Software pricing can vary widely, from subscription-based models to one-time fees. Understand the pricing structure and what is included in each tier.

- Total Cost of Ownership: Consider not only the initial cost but also ongoing expenses, such as maintenance, support, and any additional fees for upgrades or extra features.

- Return on Investment: Assess the potential ROI by considering how the software will improve efficiency, accuracy, and customer satisfaction. Weigh these benefits against the cost to determine the overall value.

Implementation and Training

Successful implementation and training are crucial for maximizing the benefits of your chosen software. Focus on these aspects to ensure a smooth transition:

- Implementation Support: Check if the software provider offers assistance with the implementation process. This includes setting up the system, migrating data, and configuring settings to meet your needs.

- Training Resources: Look for comprehensive training resources, such as tutorials, webinars, and documentation. Effective training will help your team become proficient with the software and ensure you can fully utilize its features.

- Ongoing Support: Ensure that the software provider offers reliable customer support for troubleshooting and addressing any issues that arise. Access to responsive support can help you resolve problems quickly and minimize disruptions to your business operations.

By thoroughly assessing your needs, evaluating software options, considering your budget, and planning for implementation and training, you can make a well-informed decision that aligns with your business goals and enhances your recurring revenue management processes.

Conclusion

Choosing the right recurring revenue management software is crucial for any business relying on subscription models. As you navigate through various options, remember that the best software should align with your specific needs, from flexible billing and automated revenue recognition to seamless integration with your existing systems. Whether you prioritize advanced analytics, customer management, or scalability, understanding each solution’s strengths and capabilities will help you make an informed decision. The right tool can significantly enhance your operational efficiency, financial accuracy, and customer satisfaction, ultimately contributing to your business’s growth and success.

As you evaluate the different software solutions, consider how each one fits into your current operations and future plans. Look for a platform that not only meets your immediate requirements but also adapts to your evolving needs as your business grows. Investing in the right recurring revenue management software will streamline your processes, reduce manual errors, and provide valuable insights into your financial performance. By making a thoughtful choice, you’ll position your business to manage recurring revenue more effectively and focus on driving growth and delivering exceptional value to your customers.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.

-

Sale!

Marketplace Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

E-Commerce Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

SaaS Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

Standard Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

E-Commerce Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

SaaS Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Marketplace Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Startup Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Startup Financial Model Template

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart