- What is Legal Billing Software?

- Benefits of Using Legal Billing Software

- Top Legal Billing Software Solutions

- Legal Billing Software Features to Look For

- How Legal Billing Software Enhances Financial Transparency

- How to Choose the Best Legal Billing Software for Your Firm?

- Best Practices for Implementing Legal Billing Software

- Conclusion

Are you looking for a better way to manage your law firm’s billing and time tracking? Legal billing software can help you streamline your processes, reduce errors, and improve cash flow. With the right tool, you can automate invoicing, track billable hours accurately, and ensure that clients receive clear, professional invoices every time. Whether you’re a solo practitioner or part of a larger firm, finding the right legal billing software can save you time, reduce administrative work, and make managing finances a lot easier. In this guide, we’ll walk you through the top solutions available, so you can choose the one that fits your needs best.

What is Legal Billing Software?

Legal billing software is a specialized tool designed to streamline and automate the billing process for law firms. It helps legal professionals manage their time tracking, invoicing, and payment collection more efficiently. The software enables law firms to accurately capture billable hours, generate invoices, and track client payments—all while maintaining compliance with legal billing standards.

Unlike generic billing systems, legal billing software is tailored specifically to the needs of law firms. It takes into account the complexities of legal work, such as hourly rates, flat fees, retainers, and case-specific billing. With features that simplify administrative tasks and ensure financial accuracy, legal billing software empowers firms to improve their cash flow, reduce errors, and enhance client satisfaction.

Importance for Law Firms to Streamline Billing Processes

Efficient billing is crucial for the smooth operation of any law firm. A streamlined billing process not only saves time but also improves financial accuracy, making it easier to track client payments and maintain profitability. Here are a few key reasons why it’s essential for law firms to streamline their billing processes:

- Reduced administrative burden: Automating billing tasks allows staff to focus on client work rather than administrative tasks, improving overall productivity.

- Minimized errors: Accurate tracking of billable hours and expenses ensures that invoices are correct, reducing the risk of disputes.

- Faster payment collection: Streamlined billing systems make it easier to send invoices promptly and track payments, which helps improve cash flow.

- Improved client relationships: Transparency and accuracy in billing enhance trust and satisfaction with clients, leading to long-term business relationships.

- Better financial management: With automated reports and insights, law firms can track revenue, expenses, and outstanding payments, making it easier to make informed financial decisions.

What Makes Legal Billing Software Essential for Firms of All Sizes

Legal billing software is indispensable for law firms, regardless of their size. It offers tailored features that meet the unique challenges of legal billing, ensuring that even the most complex billing scenarios are managed smoothly. Whether you are a solo practitioner or part of a large firm, the benefits of using legal billing software are significant.

For small firms or solo practitioners, legal billing software offers a straightforward solution to manage time tracking, invoicing, and payments with minimal overhead. It ensures that clients are billed accurately and on time, which is essential when working with limited resources.

Larger firms, on the other hand, benefit from more advanced features such as integration with case management software, customizable billing templates, and the ability to handle a high volume of clients and cases. Legal billing software scales with your firm, making it easier to track complex billing arrangements and manage multiple users, all while ensuring compliance with industry standards.

In essence, legal billing software provides firms of all sizes with the tools they need to streamline their operations, reduce administrative workload, and improve the accuracy and speed of their billing processes. It’s a key asset for ensuring financial transparency and maintaining strong client relationships.

Benefits of Using Legal Billing Software

Legal billing software offers numerous advantages that go beyond just automating time tracking and invoicing. By streamlining your billing processes, these tools can significantly improve your firm’s efficiency, client satisfaction, and profitability. Here’s a look at the primary benefits:

- Increased accuracy: Automates time tracking and invoicing, reducing human error and ensuring you only bill for the actual time worked.

- Improved efficiency: Saves time by automating repetitive tasks like invoice generation, reminders, and reporting, allowing your team to focus on billable work.

- Faster payments: Clients can easily pay online or via integrated payment systems, speeding up the payment process and reducing overdue invoices.

- Better financial insights: Generates real-time financial reports that give you a clear view of your firm’s revenue, expenses, and outstanding payments.

- Customization for client needs: Tailors billing templates to different client preferences, offering transparency and building trust.

- Compliance with regulations: Ensures your billing practices adhere to industry regulations, minimizing the risk of legal complications.

- Scalability: Grows with your firm, allowing you to add new users, integrate additional features, and manage a larger volume of clients and cases seamlessly.

- Enhanced client experience: Clients receive clear, detailed invoices that reduce confusion and improve satisfaction with your services.

- Cost savings: Reduces administrative costs by automating manual tasks, streamlining workflows, and cutting down on billing errors.

- Improved cash flow: Streamlined processes and faster payment collection help maintain a steady cash flow and reduce time spent chasing overdue payments.

Top Legal Billing Software Solutions

Choosing the right legal billing software can be a game-changer for law firms looking to optimize their billing processes. There are a variety of tools available, each offering unique features designed to simplify time tracking, invoicing, and payment collection. Below are some of the top legal billing software solutions that stand out for their capabilities, user experience, and popularity within the legal industry.

Sage Timeslips

Sage Timeslips is a powerful legal billing and time tracking software solution used by many firms of various sizes. It offers extensive customization options, enabling firms to tailor their invoices and billing structure to meet their specific needs. With features like detailed reporting, billing templates, and support for multiple billing models (hourly, fixed-rate, contingency), Sage Timeslips provides a flexible billing solution for law firms. It also allows firms to track billable hours and expenses in real time, which enhances the accuracy and timeliness of billing. Sage Timeslips is known for its robust reporting capabilities, helping firms monitor their financial performance and improve cash flow.

Clio

Clio is widely regarded as one of the best legal practice management platforms available. It offers comprehensive billing features integrated within its broader case and document management system. Clio’s billing tools are designed to automate many aspects of the invoicing process, making it easier for law firms to generate accurate invoices quickly. With Clio, users can track time, create customizable invoices, and manage trust accounting with ease. It also offers integrations with a variety of other tools, making it an excellent choice for firms looking for an all-in-one solution. Clio’s ease of use, strong customer support, and scalability make it a top choice for firms of all sizes, from solo practitioners to larger enterprises.

Bill4Time

Bill4Time is a robust legal billing software that focuses on providing simplicity and flexibility. This tool is ideal for firms of all sizes, offering strong time-tracking features and a variety of billing methods including hourly, flat-rate, and contingency billing. Bill4Time also allows for quick generation of invoices, with customizable templates that can be adjusted to fit each client’s needs. One standout feature of Bill4Time is its mobile application, allowing users to track time and create invoices on the go, which is particularly useful for busy attorneys who are constantly on the move. The software integrates with popular accounting tools like QuickBooks, making it a great option for firms looking to streamline both their billing and accounting processes.

Rocket Matter

Rocket Matter is a cloud-based legal billing software solution that provides a user-friendly interface while offering a full suite of features to help law firms manage their billing, time tracking, and payments. Rocket Matter stands out for its intuitive design and ease of use, making it ideal for smaller firms that need a simple yet powerful solution. The software includes time tracking, billing, and invoicing tools that are easy to set up and customize. It also offers a secure client portal where clients can view invoices and make payments online, which helps streamline payment collection and improve cash flow. Rocket Matter is known for its great customer service, ensuring that law firms can get the support they need whenever issues arise.

CosmoLex

CosmoLex is an all-in-one practice management software that includes billing and accounting tools tailored specifically to the needs of law firms. Unlike other legal billing solutions, CosmoLex offers integrated accounting features, allowing law firms to handle both billing and trust accounting within a single platform. This makes it an excellent choice for firms that need a complete financial solution. The software also includes time tracking, invoicing, and expense tracking, making it easy to stay organized. CosmoLex is known for its strong compliance features, ensuring that firms meet regulatory requirements and avoid potential legal pitfalls. It also offers a secure client portal for easy communication and payment management.

CARET Legal

CARET Legal, previously Zola Suite, offers a comprehensive suite of tools, including time tracking, billing, document management, and client communication. It is designed to provide a seamless experience across all aspects of practice management, with billing as a central feature. CARET allows law firms to easily track billable hours, create invoices, and manage payments. The software also supports multiple billing models, including hourly, flat-fee, and contingency billing. CARET Legal stands out for its deep integration with other practice management functions, making it a great choice for firms that want to manage their entire operation from one platform. The software also includes robust reporting tools to track revenue, expenses, and outstanding payments, giving firms a complete view of their financial performance.

MyCase

MyCase is a versatile cloud-based software that integrates billing and case management, making it a powerful tool for law firms. MyCase allows for seamless time tracking, invoice generation, and payment collection. It offers customizable invoices with detailed billing options, such as hourly and flat-rate billing, and allows for automatic payment reminders. One of its standout features is the client portal, which provides a secure space for clients to view invoices, track the progress of their cases, and make payments online. MyCase is particularly praised for its intuitive design and strong customer support.

PracticePanther

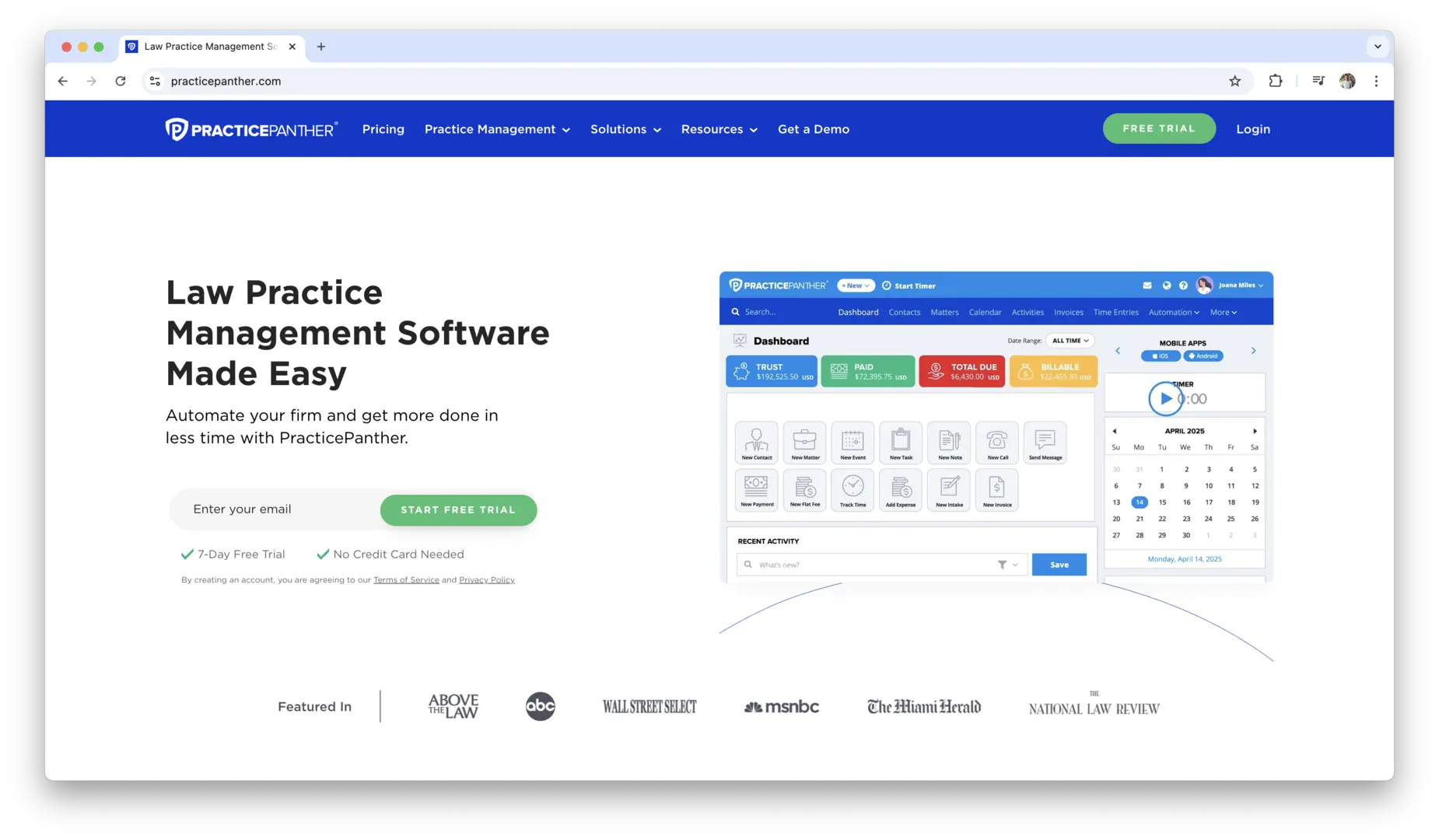

PracticePanther is an all-in-one law practice management software with a comprehensive set of tools for time tracking, billing, and invoicing. It offers a simple yet powerful billing system that allows for the customization of invoices based on hourly, flat-rate, or contingency billing models. PracticePanther also automates payment reminders, making it easier for law firms to get paid on time. The software integrates with various accounting tools, such as QuickBooks, and provides detailed financial reporting to track revenue and outstanding payments. It also offers secure client communication through a dedicated portal, further streamlining billing and case management.

Bill.com

Bill.com is a financial automation software that simplifies invoicing, payments, and accounts receivable. While not specifically built for law firms, Bill.com has gained popularity in the legal industry due to its ease of use and advanced automation features. It allows firms to send invoices, track payments, and manage expenses all in one place. Bill.com also supports automated workflows, reducing manual tasks and making it easier to maintain a steady cash flow. It integrates with major accounting platforms like QuickBooks and Xero, making it a great solution for firms looking for a simple yet effective billing tool.

TimeSolv

TimeSolv is a time tracking and billing solution designed specifically for lawyers and legal professionals. It allows law firms to track billable hours, expenses, and create detailed invoices in an easy-to-use interface. TimeSolv supports multiple billing models, including hourly, flat-fee, and retainer billing, and allows users to generate invoices with customizable templates. One of its key features is the project management aspect, which enables firms to track time spent on individual cases and tasks. TimeSolv also offers integration with accounting software, helping firms streamline their financial workflows.

FreshBooks

FreshBooks is an intuitive and widely popular cloud-based accounting software that offers solid billing features for law firms. It’s best known for its simplicity and ease of use, making it an ideal choice for small law firms or solo practitioners. FreshBooks allows users to track time, manage expenses, and create customizable invoices. It also offers automated reminders and client communication features, which help improve payment collection. FreshBooks integrates seamlessly with a variety of tools, such as PayPal and Stripe, allowing clients to pay invoices online easily. While not specifically designed for legal professionals, it can be a good solution for firms that need straightforward billing and invoicing capabilities.

These top legal billing software solutions offer a range of features that cater to different firm sizes and needs. Whether you’re looking for an all-in-one practice management system, a specialized billing tool, or something in between, there is a solution that can help streamline your billing processes and improve your firm’s efficiency.

Legal Billing Software Features to Look For

When choosing the right legal billing software for your firm, it’s essential to focus on the features that will maximize your efficiency, minimize errors, and ensure a seamless experience for both your team and your clients. Below, we’ll dive into the key features that will make your billing process smoother and more effective.

Time Tracking Capabilities

Accurate time tracking is at the core of any legal billing process. As a law firm, your ability to capture billable hours directly impacts your revenue. The right legal billing software should provide a robust time tracking feature that allows you to track time efficiently and accurately, without requiring manual input for every task.

Look for tools that offer automatic tracking, where the software logs time in the background based on your activities. This way, you don’t have to rely on remembering every detail of the day’s work. Many software solutions also offer manual timers that let you start and stop time when you’re actively working on a task. Additionally, some software provides integrated time tracking, allowing you to track time for different clients or cases and then automatically link that data to the relevant invoices.

Beyond just tracking, the software should offer the ability to categorize time entries by client, task, or project. This makes it easier to generate accurate invoices and ensures no billable time is lost. A clear breakdown of time spent on specific tasks also helps foster transparency with clients, showing them exactly how their fees are being calculated.

Automated Invoicing and Billing

Legal billing software should help streamline the invoicing process to save time and reduce errors. Automated invoicing is a crucial feature that enables the software to generate invoices on your behalf, based on the billable hours and expenses tracked within the system.

The software should allow you to customize invoice templates to match your firm’s branding and preferences. This includes adjusting fonts, logos, and the level of detail included on each invoice. You should be able to create both one-time invoices and recurring invoices for clients who are on retainer or have ongoing needs.

A significant benefit of automated billing is that it can be triggered by specific milestones, such as completing a case, reaching a set number of billable hours, or at regular intervals. You’ll also want the software to allow for expense tracking and the inclusion of costs like filing fees, travel expenses, and court costs, all of which can be automatically added to invoices for a more comprehensive billing statement.

Moreover, the software should also support automated reminders to help clients stay on track with payments. With automated invoicing, you can avoid delays, reduce administrative work, and maintain consistent cash flow.

Customization for Legal Services

Every law firm operates differently, and your billing software should be adaptable to your specific needs. Whether you’re focused on corporate law, family law, or any other specialty, customization is crucial.

Legal billing software should allow you to set custom billing rates for different clients, services, or even specific team members. For example, you might have one rate for a senior partner and a different one for junior associates. Similarly, you should be able to set flat rates, hourly rates, or even contingency-based billing based on the nature of your work.

Additionally, the software should enable you to create custom billing models. For example, in personal injury cases, you may opt for a percentage of the settlement, whereas, in corporate matters, you might use a retainer model. Customization can extend to payment terms as well, allowing you to offer clients flexible options such as discounts for early payment, installment plans, or extended due dates.

Customizing your billing system ensures that you align it with how your firm operates and creates a more personalized experience for clients.

Integration with Other Tools

In today’s fast-paced legal environment, your firm likely uses various tools to manage cases, track progress, and handle finances. That’s why integration with other systems is essential. A great legal billing software solution should be able to seamlessly integrate with your existing tools, such as accounting software and case management platforms.

For example, integrating with accounting tools like QuickBooks, Xero, or FreshBooks allows your billing system to sync with financial records, making the transfer of payment data smooth and error-free. This integration can save time, reduce duplication of data entry, and make your financial reporting more accurate.

Similarly, integration with case management software enables you to automatically pull case details into your billing system, including time entries, task descriptions, and client information. This streamlined flow of data eliminates the need for manual input and ensures everything is up-to-date, saving you valuable time.

If your firm uses a CRM system, integration can help you track client interactions and generate reports on client history, which can be valuable for setting appropriate billing rates or payment terms.

Security and Compliance Features

Law firms handle sensitive information every day, making security a top priority. Your legal billing software should offer robust security features to protect both your firm’s and your clients’ data. Look for systems that use encryption to safeguard financial and client data from unauthorized access.

Compliance with regulations is another important consideration. If you handle client data in certain industries, such as healthcare or finance, ensure that the software is HIPAA-compliant or adheres to any other relevant regulations. Many legal billing software providers offer SOC 2 Type II certification, which means they meet stringent security standards.

Additionally, features like audit trails can track any changes made to financial records, ensuring that you can quickly identify and rectify any issues. This is especially important if you’re subject to legal or ethical auditing requirements.

By choosing a solution that is both secure and compliant, you protect not only your clients but also your firm from potential legal risks.

User-Friendly Interface

One of the key aspects of successful legal billing software is its usability. A user-friendly interface helps reduce training time and ensures that your team can quickly adapt to the new system. Software that is intuitive and easy to navigate will also reduce the likelihood of errors when creating invoices or tracking billable hours.

Look for software with a clean, organized dashboard that displays key metrics such as total billable hours, outstanding payments, and recent activity. The interface should be simple enough that even non-technical staff members can use it without difficulty, yet powerful enough to meet the needs of your attorneys and accountants.

Additionally, it should offer customizable settings, allowing you to personalize the layout and functionality to suit your firm’s unique workflow. Whether you prefer a simple, minimalistic interface or a more detailed dashboard with real-time data, the software should offer flexibility to accommodate your preferences.

A great user experience leads to faster adoption, fewer mistakes, and a smoother billing process across the board.

How Legal Billing Software Enhances Financial Transparency

Financial transparency is vital in building trust between a law firm and its clients. When clients can easily understand how their money is being spent and the value they’re receiving, it fosters better relationships and minimizes billing disputes. Legal billing software can play a crucial role in ensuring that all financial transactions are transparent, accurate, and accessible. Let’s explore how these tools can help improve financial transparency across your firm’s operations.

Clear Breakdown of Charges for Clients

A major factor in maintaining financial transparency is providing clients with detailed invoices that clearly outline all charges. Legal billing software allows you to generate invoices that offer a comprehensive breakdown of all costs, helping clients understand exactly what they’re paying for. Rather than receiving a vague or generalized invoice, clients will see precisely what services they’ve been charged for and the corresponding costs.

This breakdown can include:

- Hourly fees: Detailing the specific tasks or phases worked on, and the attorney or team member responsible for the work.

- Flat fees: If your firm charges a fixed amount for certain services, the invoice can clearly show which services are covered by this flat rate.

- Additional expenses: Travel costs, filing fees, photocopying, or any other out-of-pocket expenses can be included in a separate section of the invoice. This ensures that clients know exactly what’s being charged and why.

- Taxes and surcharges: Any applicable taxes, fees, or surcharges should also be visible on the invoice, allowing clients to review the charges with confidence.

Providing this level of clarity not only improves client trust but also minimizes the chances of disputes over billing. It demonstrates that your firm is organized, transparent, and committed to fair practices.

Real-Time Tracking of Billable Hours

Legal billing software enhances financial transparency by enabling real-time tracking of billable hours. With automated time-tracking features, you don’t have to worry about forgetting to log your hours or manually recording time at the end of the day. Real-time tracking ensures that every billable minute is accounted for as you work, which is essential for maintaining accuracy in your invoices.

Additionally, real-time tracking provides clients with up-to-date information about how their case is progressing and how much time has been spent on their behalf. This allows for a more dynamic, transparent approach to billing, as clients can see exactly what they are paying for throughout the duration of the case or project.

For law firms, this means there’s no delay in capturing time worked, and the entire billing process becomes smoother and more reliable. When hours are tracked in real time, both your team and your clients are better informed about the progress and associated costs, which reduces confusion or disputes at later stages.

Automated Reports for Financial Insight

Generating regular, automated financial reports is another key way legal billing software enhances financial transparency. With built-in reporting features, you can easily access financial insights that provide a clear picture of your firm’s performance.

These automated reports can include:

- Revenue tracking: See exactly how much money your firm has earned in a given period, broken down by client, case, or attorney. This helps identify high-performing clients or practice areas and gives insight into your firm’s overall financial health.

- Outstanding balances: Track which invoices are still unpaid, along with the number of days they’ve been overdue. This provides transparency into any financial gaps and allows you to follow up accordingly.

- Billable hours reports: View the total number of billable hours worked for each client or project, ensuring that the work aligns with the invoices generated. This can help you spot inconsistencies or errors before sending invoices to clients.

- Client payment history: Review the payment patterns of clients, whether they tend to pay on time or consistently delay payments. This helps in managing accounts receivable and identifying clients who may need payment reminders.

By having these reports automatically generated, you can make better-informed decisions about pricing, client management, and cash flow without having to manually compile data from multiple sources.

Customizable Billing Templates for Different Clients or Cases

Every client and every case is unique, and your billing software should be flexible enough to handle these differences. Customizable billing templates allow you to tailor invoices and billing structures based on each client’s needs or the specifics of a case, ensuring that you maintain clarity and transparency across a variety of scenarios.

For instance, some clients may prefer a detailed, itemized bill that breaks down every small task, while others might prefer a more generalized overview. Legal billing software should allow you to create different templates for different types of work, from hourly billing for complex litigation cases to flat-rate fees for more straightforward matters.

Additionally, the software should allow you to adjust the level of detail on invoices, ensuring that each client gets the appropriate amount of information based on their preference or the nature of the service. Customization options can include:

- Billing rate adjustments: Set different rates for various types of services or team members.

- Case-specific expenses: Include case-related expenses or costs unique to that client.

- Payment terms: Create custom payment schedules for clients who prefer monthly installments or need extended payment deadlines.

This ability to create tailored billing templates ensures that your firm’s invoices meet the unique needs of each client while maintaining a consistent level of transparency, regardless of the case or client type.

How to Choose the Best Legal Billing Software for Your Firm?

Selecting the right legal billing software is crucial for your firm’s financial health and operational efficiency. With numerous options available, it’s easy to get overwhelmed. The key to making the right choice is understanding your firm’s specific needs, budget, and long-term goals. Below, we’ll guide you through the most important factors to consider to help you choose the best legal billing software for your firm.

Assessing Firm Size and Needs

Before you begin evaluating software, it’s essential to understand your firm’s size and unique requirements. Different software solutions cater to firms of varying sizes and specialties, so the right choice depends on what your firm requires both now and in the future.

For a small firm, you may need a simple, user-friendly system that handles time tracking and invoicing with minimal setup. These tools should allow you to manage client accounts, create professional invoices, and track payments without overwhelming your team. Small firms often benefit from software that’s affordable and straightforward, offering essential features at a lower cost.

On the other hand, larger firms with multiple practice areas or offices may need more complex software that can handle a higher volume of clients and cases. A large firm typically requires advanced features like customizable billing templates, integration with other enterprise-level tools, and robust reporting capabilities. You may also need additional security features to protect sensitive client information and ensure compliance with industry regulations.

Think about the number of users who will access the software and the types of features your firm needs to operate efficiently. A solo practitioner might only need basic invoicing features, while a firm with several attorneys or support staff might require full case management, time tracking, and reporting features integrated into the billing platform.

Considering Scalability and Future Growth

As your firm grows, your software needs will likely evolve. Choosing a solution that can scale with your firm’s future needs is essential to avoid having to switch systems later on, which can be disruptive and costly.

When evaluating software, ensure that it offers the flexibility to grow with your firm. Look for cloud-based solutions that allow you to easily add new users or features as needed. As your team expands, the software should be able to accommodate new clients, increase transaction volumes, and support new practice areas without compromising performance or user experience.

Scalability is also about customization. As your firm becomes more complex, you may need more customized features, such as specific billing rules, reporting structures, or integration with additional tools. Opt for software that allows you to tailor its functionality to meet the changing demands of your practice.

Additionally, consider the long-term vision of your firm. If you plan to expand your services or open new offices, your billing software should be adaptable to these changes. A scalable solution ensures that you don’t outgrow your software and that your firm remains efficient as it grows.

Balancing Cost with Functionality

Cost is always a crucial consideration when choosing legal billing software, but it’s important to balance cost with functionality. While it might be tempting to go for the cheapest option available, focusing solely on price may lead to missing out on valuable features that could ultimately save time, reduce errors, or improve client satisfaction.

Start by determining your budget and considering how much you are willing to invest in your billing system. For small firms or solo practitioners, budget-friendly software that covers the basics might be sufficient. However, larger firms or those with more complex needs should be prepared to allocate more funds for a robust solution that offers advanced features, greater scalability, and better customer support.

It’s important to evaluate the ROI of the software. A more expensive system that automates processes, integrates with other tools, and provides better insights into your finances might pay for itself over time by increasing efficiency and reducing billing errors. Consider the long-term costs as well, such as software upgrades, training, and any additional support or customization services.

Most billing software providers offer tiered pricing models based on the features and services included, so it’s crucial to assess which features are essential for your firm and avoid paying for unnecessary extras. Always ensure that the software provides good value for the investment, whether that’s through time savings, increased accuracy, or enhanced client communication.

Customer Support and Training Options

When it comes to software, customer support and training options can make a significant difference in how well your team adapts to the system and resolves any issues that arise. You’ll want to choose software that offers excellent customer service to ensure that any questions or problems can be addressed quickly and effectively.

Look for providers that offer 24/7 support, especially if your firm operates across different time zones or has irregular working hours. A solid support team can help resolve technical issues, troubleshoot errors, and guide you through any complexities in the system.

Training options are equally important. A good legal billing software provider will offer comprehensive onboarding and training materials to help your team get up to speed quickly. This might include live training sessions, video tutorials, written guides, and user manuals. Some providers also offer one-on-one support for more personalized training or when you encounter challenges in the implementation process.

Additionally, consider how easy it is to access ongoing support. Having a dedicated account manager or a direct line to a support team can save valuable time when issues arise. Check whether the software provider offers self-service options like a knowledge base or community forums, where your team can find answers to common questions without having to reach out for help.

A combination of excellent customer support and effective training resources will ensure a smooth implementation and continued success with your billing software. This support is especially important as your team becomes more familiar with the software and begins using it more extensively.

Best Practices for Implementing Legal Billing Software

Successfully implementing legal billing software involves more than just installing the system. It requires careful planning, training, and ongoing management to ensure it aligns with your firm’s needs. Here are the best practices for a smooth and effective implementation:

- Assess firm needs: Take the time to understand your firm’s specific requirements and ensure the software can meet those needs before implementation.

- Set clear goals: Identify what you want to achieve with the software, whether it’s reducing billing errors, improving cash flow, or increasing time tracking accuracy.

- Train your team: Provide comprehensive training for all users to ensure they’re comfortable with the system and know how to maximize its features.

- Integrate with existing tools: Ensure the software integrates smoothly with your firm’s other systems, such as case management, accounting, and payment processing tools.

- Test the system: Run tests before fully rolling out the software to identify any issues, verify configurations, and ensure everything works as expected.

- Customize templates: Set up customizable billing templates that reflect your firm’s practices and the preferences of your clients.

- Monitor and evaluate: Regularly assess the software’s effectiveness by gathering feedback from your team and clients, and make adjustments as needed.

- Automate processes: Take full advantage of automation features, such as automatic invoice generation, reminders, and payment tracking, to reduce administrative workload.

- Ensure data security: Verify that the software meets security standards and complies with industry regulations, protecting sensitive client and financial data.

- Stay up-to-date: Keep the software updated with the latest features, security patches, and improvements to ensure it continues to meet your firm’s needs.

Conclusion

Choosing the right legal billing software is essential for any law firm looking to streamline their financial processes and improve overall efficiency. Whether you need to track billable hours, generate invoices, or stay compliant with industry regulations, the right software can help you manage all of these tasks in one place. With so many options available, it’s important to consider your firm’s size, the features you need, and your budget. From simple time-tracking tools to comprehensive, all-in-one practice management solutions, there’s a software solution for every type of firm.

Ultimately, the best legal billing software for your firm will be the one that suits your specific needs while providing a user-friendly experience and powerful features. The tools highlighted in this guide offer a range of options, each designed to help you work more efficiently and accurately. By choosing the right solution, you’ll not only simplify billing but also improve client relationships, reduce errors, and boost your firm’s cash flow. Take the time to assess your needs, and find the software that fits best—your firm’s finances will thank you.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.