- What are High-Yield Savings Accounts?

- What Makes a Savings Account “High-Yield”?

- Top High-Yield Savings Accounts

- High-Yield Savings Accounts Features to Look For

- How to Maximize Earnings with High-Yield Savings Accounts?

- High-Yield Savings Accounts Pitfalls to Avoid

- How to Open and Manage a High-Yield Savings Account?

- Alternatives to High-Yield Savings Accounts

- Conclusion

Are you looking for a way to make your savings work harder for you? High-yield savings accounts are a great option for growing your money faster than a regular savings account. These accounts offer much higher interest rates, allowing you to earn more on your deposits with minimal effort. Whether you’re saving for an emergency fund, a big purchase, or just want to grow your cash over time, a high-yield savings account can be a smart choice.

In this guide, we’ll break down the best high-yield savings accounts available, what to look for, and how to choose the right one for your financial goals. Let’s dive in and find out how you can start earning more today.

What are High-Yield Savings Accounts?

A high-yield savings account is a type of deposit account that offers a much higher interest rate compared to traditional savings accounts. These accounts are typically offered by both online banks and traditional financial institutions, with the primary goal of helping your savings grow faster over time. While standard savings accounts may offer a paltry interest rate, high-yield savings accounts provide competitive annual percentage yields (APYs), sometimes offering rates that are several times higher than what you would find with a typical bank.

The higher interest rates associated with high-yield savings accounts come with the added benefit of compounded interest, meaning that the interest earned on your balance gets added to your account and then earns interest itself. This process accelerates the growth of your savings, especially if you leave your funds in the account for a longer period.

High-yield savings accounts are also known for their safety. Like traditional savings accounts, they are usually FDIC-insured (up to $250,000 per depositor) for banks or NCUA-insured for credit unions, providing peace of mind that your money is secure. These accounts are an excellent option for savers who want a low-risk investment opportunity but still want to earn more than what a basic savings account would provide.

Importance of Choosing the Right Account for Financial Growth

When choosing a high-yield savings account, selecting the right one can significantly impact how quickly your savings grow. Some accounts may appear to offer attractive rates, but hidden fees or other restrictions can undermine your earning potential. It’s crucial to take the time to evaluate key features such as interest rates, fees, withdrawal limits, and any minimum balance requirements before you make your decision.

- Maximize your earnings: By choosing an account with a high APY and favorable compounding terms, you ensure your savings grow faster over time.

- Avoid hidden costs: Some accounts come with fees that can diminish the interest you earn, so it’s important to choose an account with minimal or no fees.

- Adapt to your needs: Your financial goals might require an account with certain flexibility, like easy access to funds or the ability to automate deposits, so it’s essential to find an account that fits your unique situation.

- Long-term growth: A carefully chosen account can become a powerful tool in building your wealth over time, especially if you commit to regular deposits and allow compound interest to work in your favor.

Benefits of High-Yield Savings Accounts Over Traditional Accounts

High-yield savings accounts provide several advantages over traditional savings accounts, particularly when it comes to growing your savings and improving your financial strategy.

- Higher interest rates: The most significant benefit of a high-yield savings account is its higher interest rate. With traditional savings accounts offering low rates (often less than 0.10% APY), a high-yield account can provide returns several times higher, allowing your savings to grow more rapidly.

- Compounding interest: High-yield savings accounts often compound interest more frequently than traditional savings accounts. This means your money earns interest on both the initial deposit and the interest that has been added to your balance.

- No risk to principal: Unlike stocks or mutual funds, high-yield savings accounts are low-risk investments. Your deposits are typically FDIC-insured, so you don’t have to worry about losing your principal due to market fluctuations.

- Easy access to funds: High-yield savings accounts offer easy access to your funds, just like traditional savings accounts. You can usually transfer money or make withdrawals quickly and conveniently, though there may be some limitations on the number of withdrawals per month.

- Convenience of online banking: Many high-yield accounts are offered by online banks, which provide digital tools to easily manage your account, track your savings, and set up automatic transfers—all of which can help you stay on track with your financial goals.

What Makes a Savings Account “High-Yield”?

When you’re comparing savings accounts, you’ll often see the term “high-yield” thrown around. But what does it really mean? A high-yield savings account is essentially a savings account that offers a much higher interest rate than traditional savings accounts. These accounts are designed to help you grow your money faster, especially when compared to the low-interest offerings that you might find at your typical brick-and-mortar bank.

A high-yield savings account typically provides an annual percentage yield (APY) that is several times greater than the interest rates you’ll see on traditional savings accounts. The main attraction of these accounts is the opportunity for better returns on your deposits. It’s a low-risk way to grow your savings with minimal effort, unlike riskier investments like stocks or bonds. But there’s a catch: while high-yield savings accounts offer better rates, the rates can fluctuate based on several factors.

A high-yield savings account is a deposit account offered by banks or credit unions that pays a significantly higher interest rate than a traditional savings account. What sets it apart is the interest rate—often several times higher than what you would earn in a regular savings account. This higher rate is typically due to the bank’s intention to attract more customers, especially in competitive markets where savings accounts are a common product.

What makes this account “high-yield” isn’t just the rate, but also how interest is compounded. Most high-yield savings accounts compound interest frequently, such as monthly or even daily, which accelerates your earnings over time. The more often the interest compounds, the faster your balance grows.

Unlike investment accounts like stocks or mutual funds, which involve risk, high-yield savings accounts are safe and reliable. They are generally insured by the FDIC (Federal Deposit Insurance Corporation) or the NCUA (National Credit Union Administration), which means your deposits are protected up to $250,000 per depositor, per bank.

How Interest Rates Differ: Traditional vs. High-Yield Savings Accounts

Interest rates are the backbone of savings accounts, and they play a crucial role in how much you earn. A traditional savings account typically offers an interest rate that ranges between 0.01% and 0.10%, depending on the bank and the current economic conditions. These low rates often don’t even keep up with inflation, meaning the real value of your savings might decrease over time if your account is earning too little.

On the other hand, a high-yield savings account can offer much better rates, often ranging from 0.50% to 4% APY, or even higher in some cases. Banks and credit unions offer these higher rates as an incentive for customers to keep their money with them, especially in a highly competitive market. These rates allow you to grow your savings at a much faster rate, especially when you take advantage of compound interest.

The key difference lies in the interest rate itself. Higher interest rates mean you earn more money over time, but it’s essential to understand that rates for high-yield accounts can fluctuate based on the economic climate and decisions made by central banks like the Federal Reserve. When the economy is performing well, interest rates tend to rise, which benefits savers. However, during economic slowdowns, rates may fall, reducing your earnings.

Factors That Influence Yield: Economic Climate, Bank Type, and More

Several factors can impact the yield on your savings, meaning the return you get on your deposits. These factors include the economic climate, the type of bank or credit union offering the account, and even the specific terms of the account itself.

The economic climate plays a major role in determining interest rates. When the Federal Reserve raises or lowers the benchmark interest rate, banks typically adjust their rates accordingly. In periods of economic growth or inflation, banks may increase interest rates to offer better returns to savers. Conversely, in times of economic downturn or recession, interest rates may decrease as central banks try to stimulate spending and investment in other areas.

The type of bank you choose also influences your rate. Online-only banks often offer better rates than traditional brick-and-mortar banks because they have lower overhead costs. Without physical branches, online banks can pass on the savings to customers in the form of higher interest rates. Credit unions, which are member-owned, may also offer competitive rates compared to traditional banks because they’re typically focused on serving their members’ needs.

In addition to the broader economic and bank type factors, certain account terms can affect the yield. Some high-yield accounts offer introductory rates that are initially high but drop after a certain period. Others may offer tiered interest rates, where the rate increases if you maintain a higher balance. It’s important to understand how rates are structured so you can ensure you’re getting the best deal over the long term.

Understanding the factors that influence interest rates will help you make more informed decisions when choosing a high-yield savings account. Always stay informed about the current economic conditions and evaluate your options carefully before committing your money to an account.

Top High-Yield Savings Accounts

Finding the right high-yield savings account can be overwhelming, especially with so many options available. However, certain accounts stand out due to their attractive interest rates, low fees, and user-friendly features. In this section, we’ll explore some of the best high-yield savings accounts available today, comparing their benefits to help you make an informed decision. While rates and terms may fluctuate, these accounts consistently offer great value to savers.

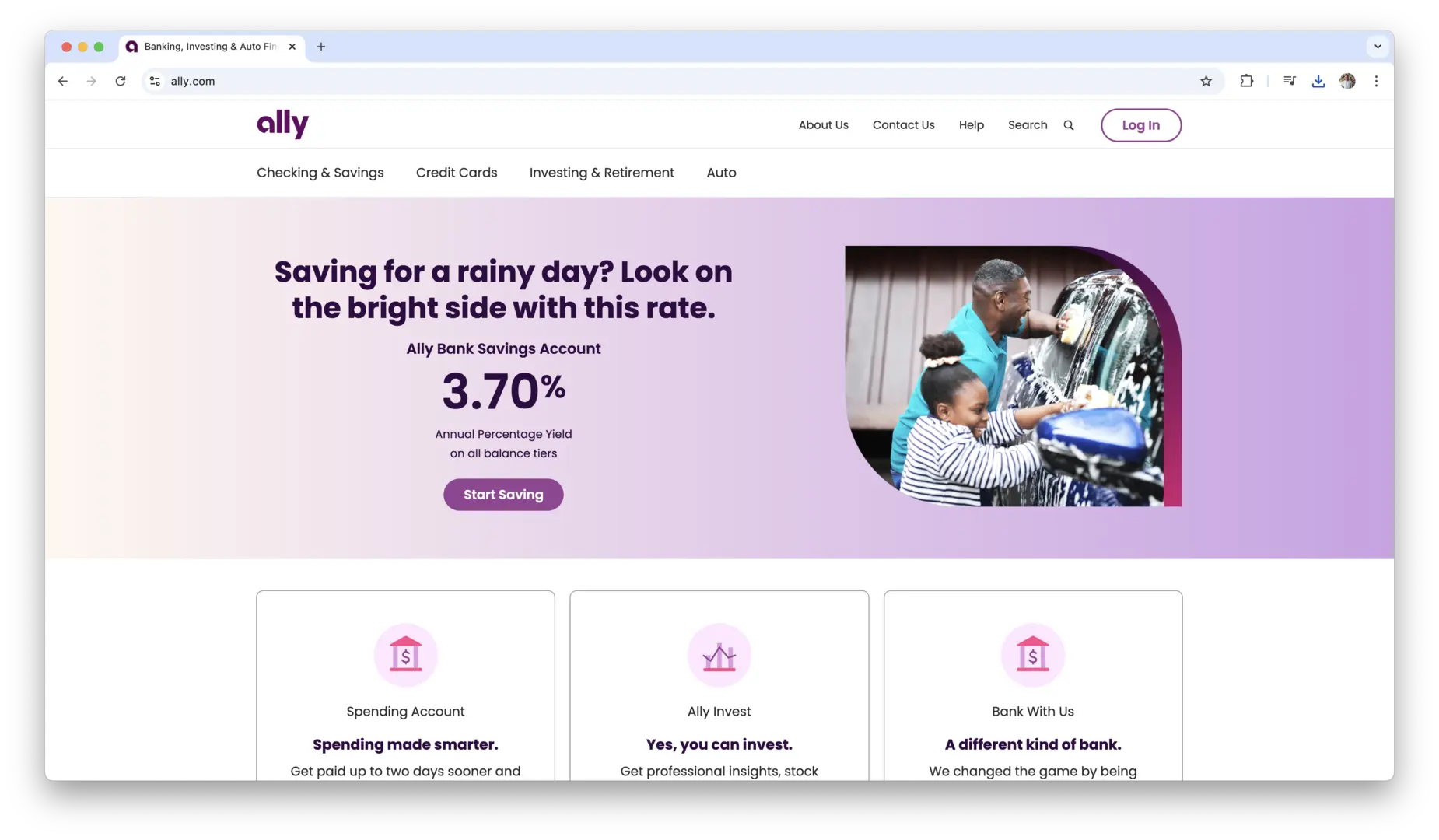

Ally Bank

Ally Bank has long been a favorite among high-yield savings account holders, thanks to its combination of competitive interest rates, no fees, and excellent customer service. Their high-yield savings account offers a high APY with no minimum deposit required and no monthly maintenance fees.

- APY: 3.70%

- Fees: No monthly fees, no maintenance fees

- Minimum Deposit: $0

- Features: Ally offers easy-to-use mobile and online banking with features like automatic transfers, online bill pay, and access to 24/7 customer support. They also provide free access to over 43,000 ATMs nationwide.

Ally’s mobile app allows you to manage your account, set up automatic savings goals, and easily transfer money to and from linked accounts. Additionally, with compounding interest on a daily basis, you can maximize your savings quickly.

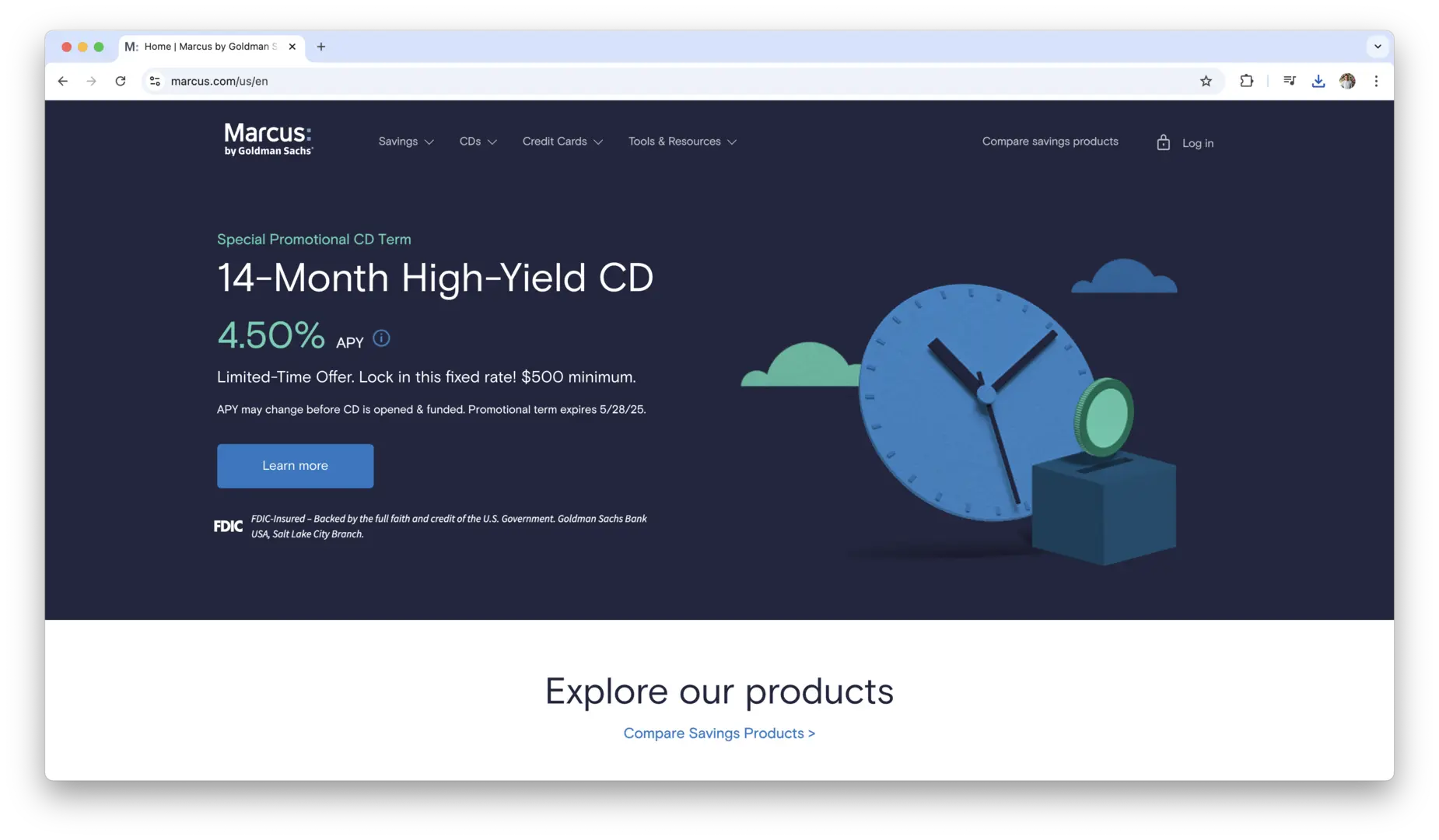

Marcus by Goldman Sachs

Marcus by Goldman Sachs is known for its simplicity and reliability, offering one of the best high-yield savings accounts available. With a competitive APY and a reputation for strong customer service, Marcus is a solid choice for anyone looking to grow their savings.

- APY: 4.50%

- Fees: No fees, no minimum balance requirements

- Minimum Deposit: $0

- Features: Marcus offers a straightforward, easy-to-navigate online experience, and their app is user-friendly. They provide high interest with no tiers, meaning everyone earns the same APY regardless of their balance. Although Marcus doesn’t provide ATM access, it’s ideal for savers who don’t need immediate access to their funds.

The simplicity of Marcus, combined with the high APY and no fees, makes it a great option for savers who prefer a set-it-and-forget-it approach to growing their money.

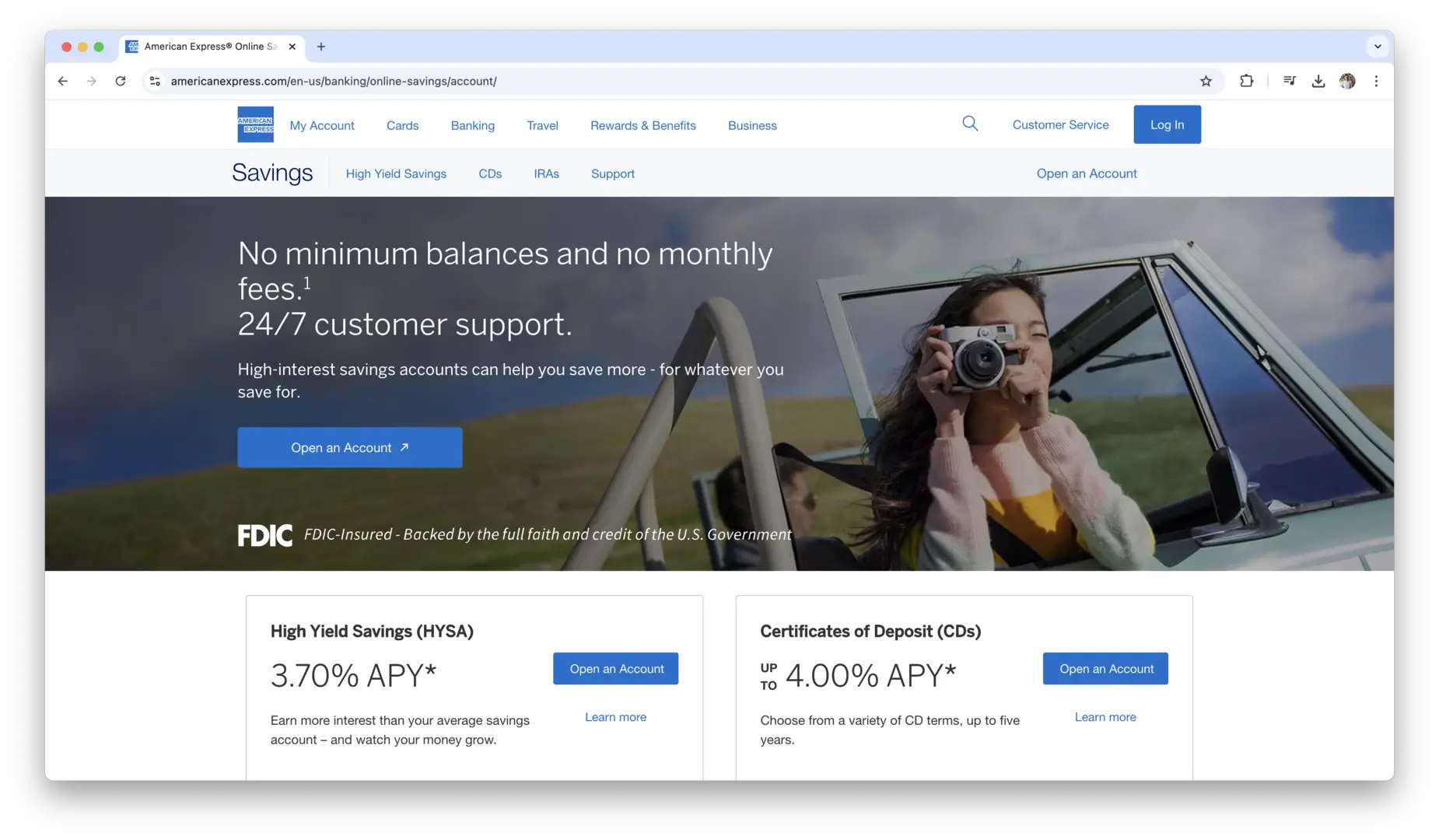

American Express National Bank

American Express National Bank offers an attractive high-yield savings account with one of the highest APYs available. Their reputation for customer service and their reliable banking experience make them a popular option for savers who want both a high return and ease of use.

- APY: 3.70%

- Fees: No monthly fees, no balance fees

- Minimum Deposit: $0

- Features: American Express offers a robust online banking platform and mobile app for managing your account. Their savings account has no minimum balance requirement, making it accessible for all levels of savers. However, unlike some other banks, American Express does not offer ATM access, so it’s best suited for savers who don’t need frequent withdrawals.

Their daily compounding interest allows you to accumulate more in interest faster than accounts with less frequent compounding.

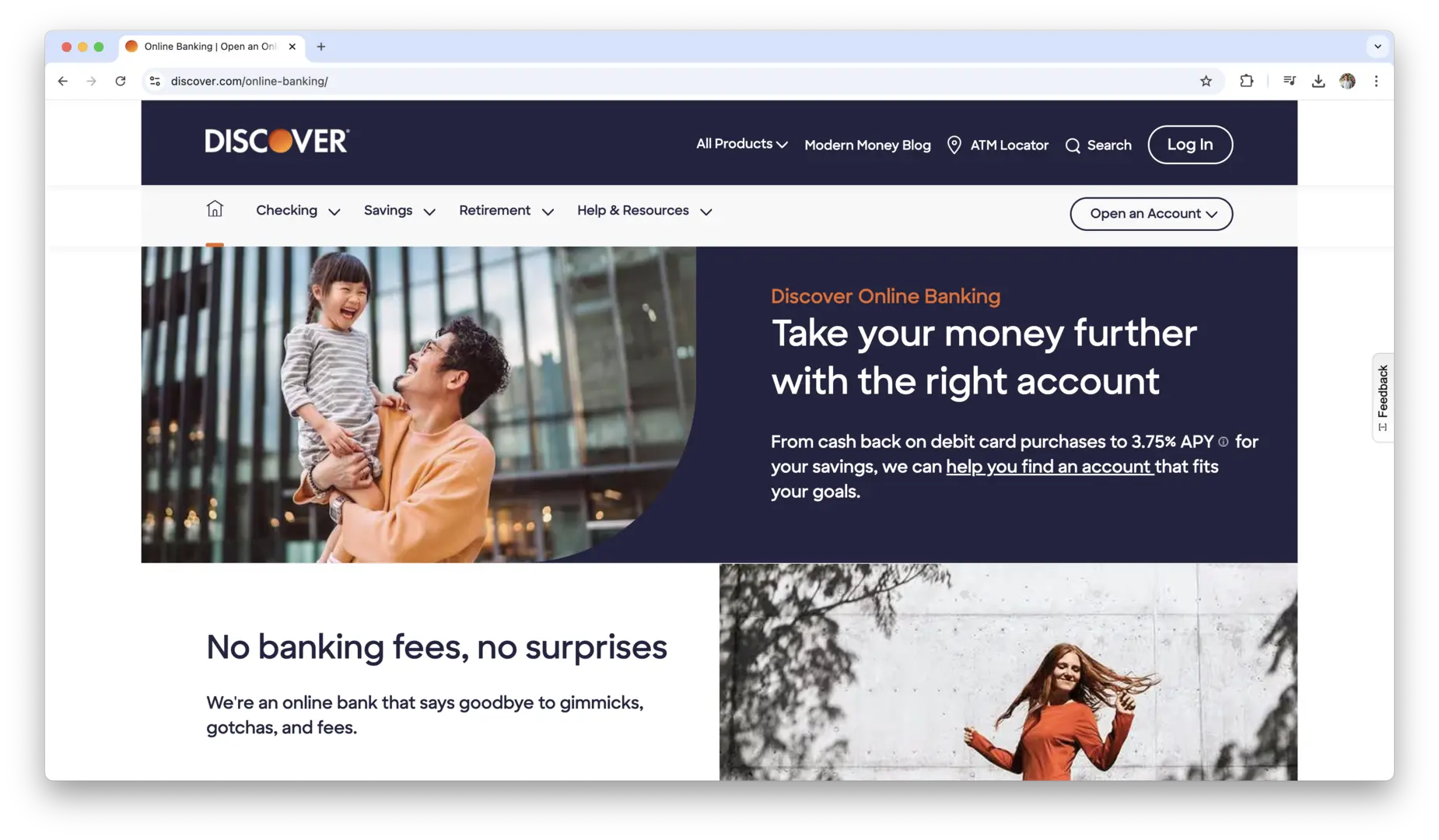

Discover Bank

Discover is another strong contender in the high-yield savings account space. They offer a competitive APY, solid customer support, and the flexibility of a traditional bank. One of Discover’s key benefits is its easy-to-use mobile app and access to ATMs.

- APY: 3.75%

- Fees: No fees, no balance requirements

- Minimum Deposit: $0

- Features: Discover offers access to over 60,000 ATMs nationwide, making it an excellent option if you want to be able to withdraw cash from your savings without penalty. Their online platform allows for easy transfers and access to account management tools, and they also offer a $0 minimum deposit requirement.

Discover also offers great customer service and an easy-to-navigate mobile app, ensuring you can manage your account on-the-go.

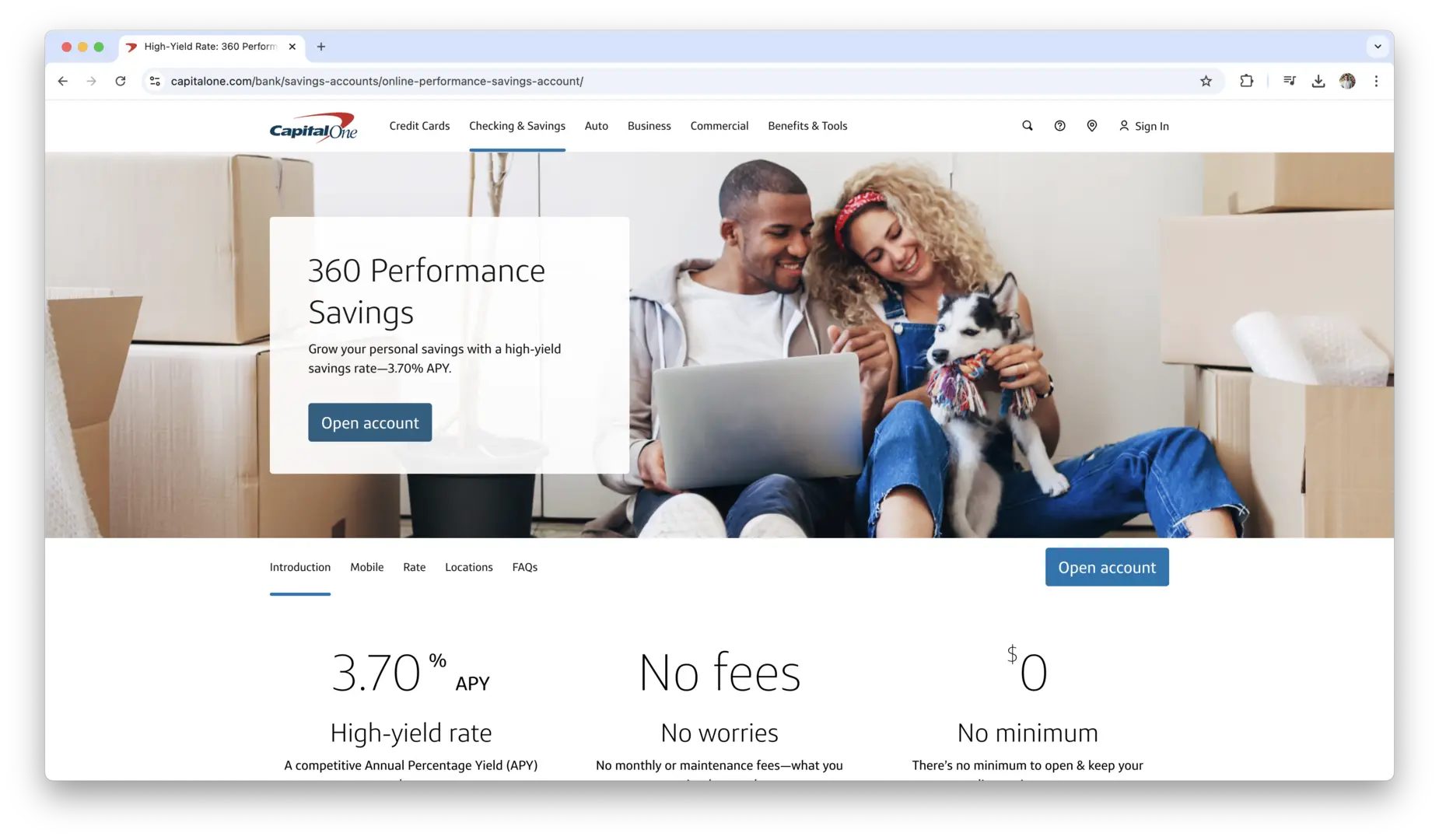

Capital One 360 Performance Savings

Capital One offers a strong online savings account with a high APY and no fees. Their 360 Performance Savings account is known for its flexibility, ease of use, and integration with their other banking products, making it ideal for anyone who already uses Capital One for other financial needs.

- APY: 3.70%

- Fees: No monthly fees, no maintenance fees

- Minimum Deposit: $0

- Features: Capital One’s 360 Performance Savings account provides a solid APY and the added benefit of access to thousands of physical branches and ATMs nationwide. Their online interface and mobile app make it easy to set up automatic transfers and track your savings progress.

Capital One also offers strong customer support, which makes managing your account more convenient and reliable. It’s a great choice for people who want a high yield with the added convenience of a well-established financial institution.

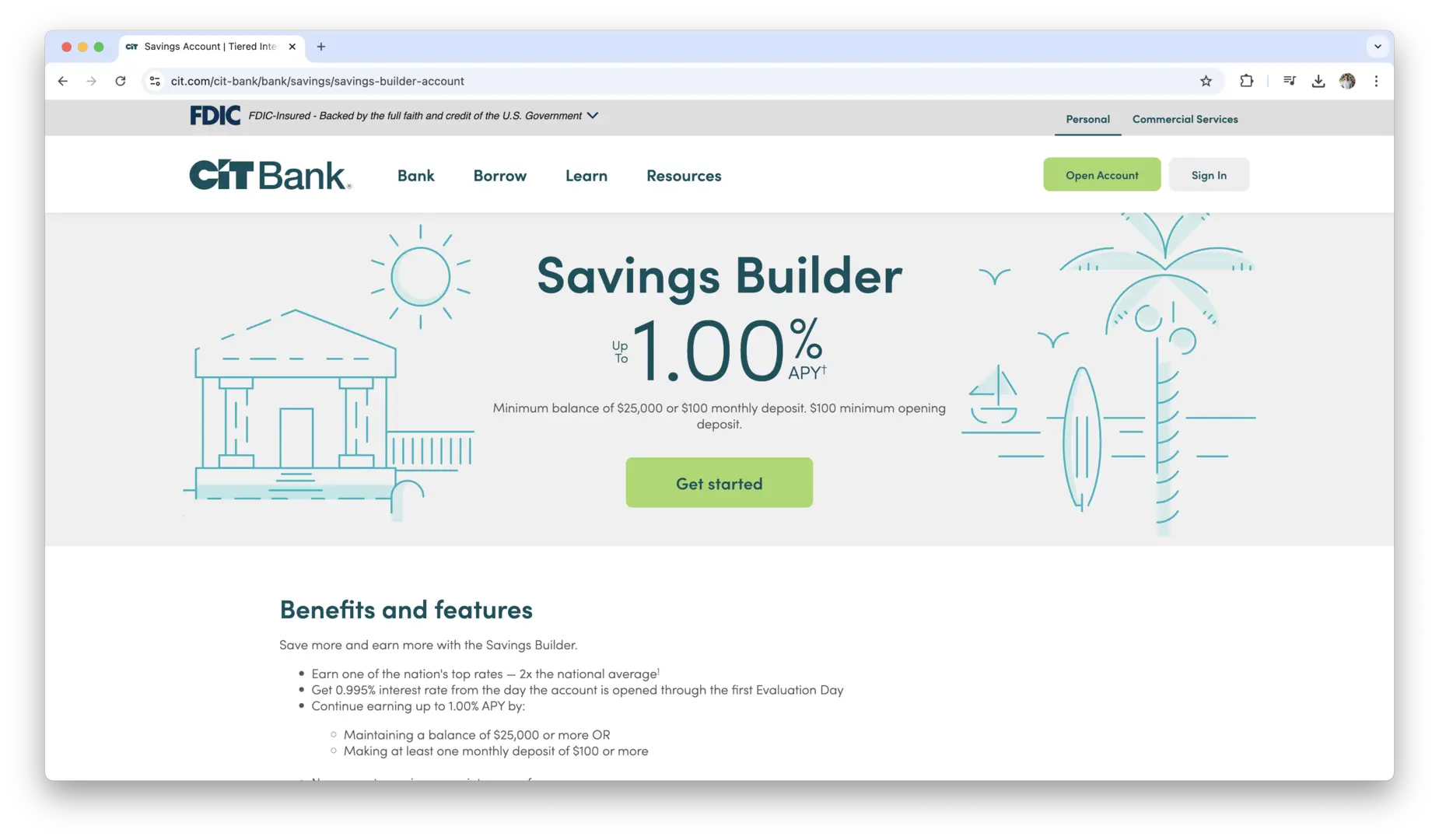

CIT Bank Savings Builder Account

CIT Bank’s Savings Builder Account is a great choice for savers looking to earn high interest with minimal effort. To earn the advertised top APY, you must either maintain a minimum monthly deposit or have a minimum balance.

- APY: 1.00%

- Fees: No monthly fees

- Minimum Deposit: $100 to open; $100 monthly deposit required to earn the highest APY

- Features: CIT Bank’s savings account compounds interest daily, and they offer access to easy-to-use online banking. While there’s a requirement for regular monthly deposits to earn the highest interest rate, this is a great option for consistent savers who are looking to build a solid savings habit.

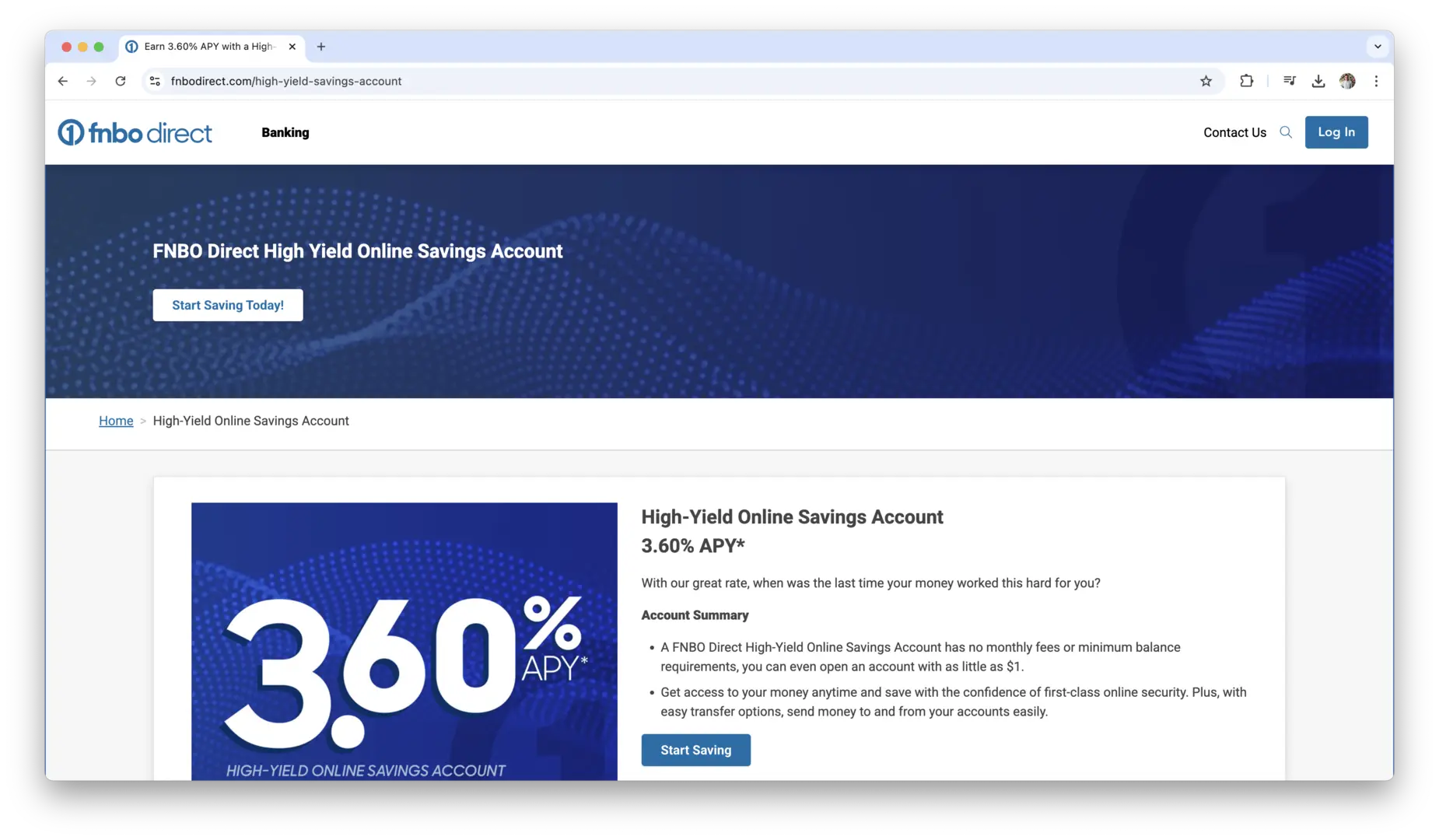

FNBO Direct Online Savings

FNBO Direct offers a straightforward high-yield savings account with a competitive APY. Known for its ease of use and low barriers to entry, FNBO Direct provides solid returns with no fees.

- APY: 3.60%

- Fees: No monthly fees

- Minimum Deposit: $1

- Features: FNBO Direct offers daily compounding interest, and it requires a low minimum deposit to open, making it accessible for all levels of savers. While the account doesn’t offer ATM access, the online platform is easy to navigate and ideal for those who prefer managing their savings digitally.

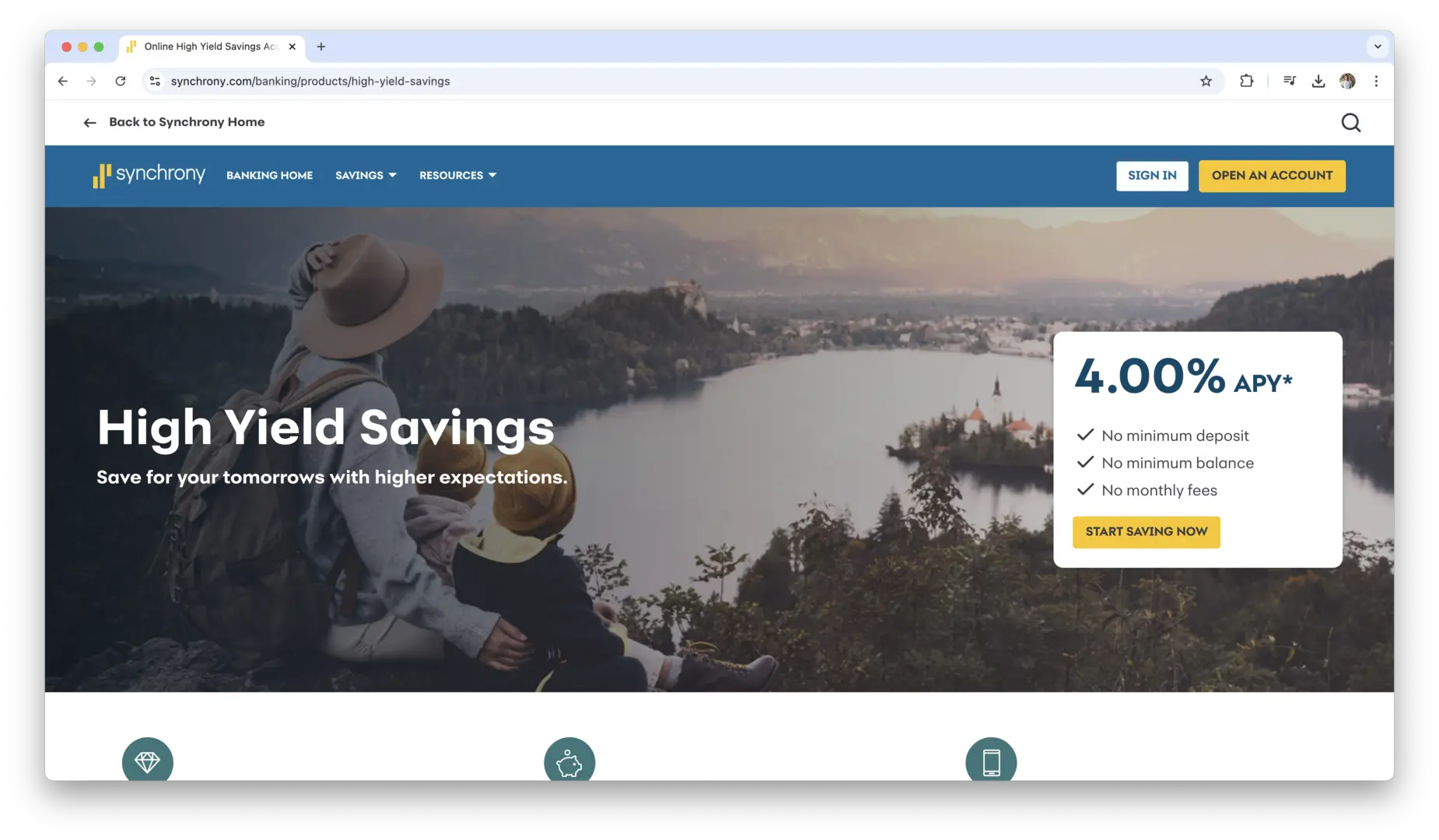

Synchrony Bank High Yield Savings

Synchrony Bank offers a highly competitive APY with no fees and no minimum balance requirement. They are known for excellent customer service and a solid online platform.

- APY: 4.00%

- Fees: No monthly fees

- Minimum Deposit: $0

- Features: Synchrony offers a mobile app and online banking that makes it easy to manage your account. With daily compounding interest, your balance grows faster, and the absence of monthly fees ensures that all of your earnings go directly to your savings.

UFB Direct High Yield Savings

UFB Direct offers one of the highest APYs in the market, with no fees or minimum deposit requirements. They also provide easy access to funds via ATMs and online banking.

- APY: 4.01%

- Fees: No monthly fees

- Minimum Deposit: $0

- Features: UFB Direct offers a high APY with a compounding interest feature that helps your balance grow quickly. The online banking experience is smooth, and the bank provides access to ATMs nationwide through the Allpoint Network, making it ideal for savers who need flexibility.

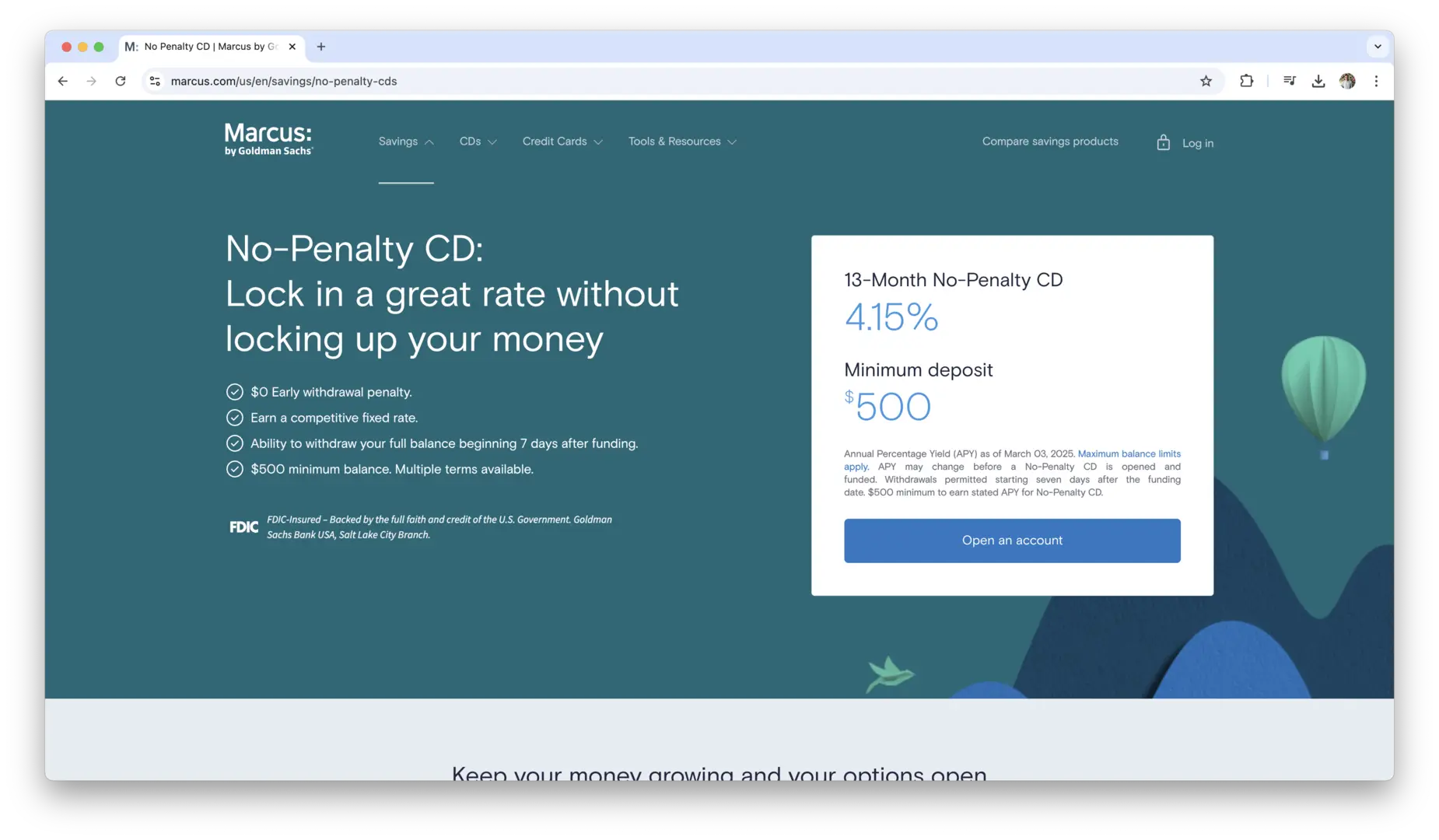

Marcus by Goldman Sachs No-Penalty CD

Marcus also offers a No-Penalty Certificate of Deposit (CD), which gives you a fixed interest rate without the usual penalties for early withdrawal. This is a great alternative for those who want to lock in higher returns but still need flexibility.

- APY: 4.15%

- Fees: No monthly fees

- Minimum Deposit: $500

- Features: The No-Penalty CD allows you to access your funds early without facing the usual withdrawal penalties. With a competitive interest rate, it provides both safety and higher returns than traditional savings accounts.

Lake Michigan Credit Union High Yield Savings

Lake Michigan Credit Union offers a high-yield savings account with impressive rates and excellent customer service. As a credit union, they provide competitive rates and access to a range of member benefits.

- APY: 3.75%

- Fees: No monthly fees

- Minimum Deposit: $0

- Features: Lake Michigan Credit Union offers compounding interest, online banking, and a user-friendly app. The account is accessible to anyone, and being part of a credit union allows you to take advantage of member-only benefits and services.

American Heritage Credit Union High Yield Savings

American Heritage Credit Union offers a high-yield savings account that competes well with the best options in the market. Credit unions like American Heritage tend to offer competitive rates and lower fees, making them a great choice for savers.

- APY: 3.35%

- Fees: No monthly fees

- Minimum Deposit: $25

- Features: With no fees and competitive APY, American Heritage offers daily compounding interest and an easy online banking platform. Additionally, being part of a credit union provides you with access to member benefits and additional financial services.

Each of these banks offers a competitive high-yield savings account with distinct benefits. Ally, Marcus by Goldman Sachs, American Express National Bank, Discover, and Capital One all provide solid options with no fees, flexible terms, and high interest rates. When choosing the right account for you, consider factors like your need for ATM access, customer service preferences, and whether you want daily or monthly compounding. Regardless of the account you choose, a high-yield savings account is a great way to make your money work harder for you.

High-Yield Savings Accounts Features to Look For

When you’re choosing a high-yield savings account, it’s important to look beyond just the interest rate. While a competitive interest rate is crucial, other features can make a big difference in your overall experience and earnings. Here’s what to consider when comparing high-yield savings accounts.

Interest Rates: What to Expect

The interest rate is the main factor driving the growth of your savings, so it’s essential to understand what to expect when it comes to APYs (annual percentage yields). High-yield savings accounts typically offer APYs ranging from 0.50% to 4% or higher, depending on the financial institution and the current economic climate. The best accounts will offer interest rates that are significantly higher than the national average for savings accounts, often by multiple percentage points.

Keep in mind that the interest rate you’re offered may depend on a variety of factors. Some high-yield accounts offer introductory rates that are higher for the first few months or even a year before dropping to a lower, regular rate. Make sure you’re aware of the fine print and the duration of any promotional rates. Additionally, some accounts offer tiered interest rates, where you earn a higher interest rate if you maintain a larger balance. This means that if you keep a substantial amount of money in the account, your rate could increase.

One important thing to note is the way interest is compounded. Ideally, you want an account that compounds interest frequently, whether it’s daily, monthly, or quarterly. The more often interest is compounded, the quicker your balance grows, as interest is added to your balance and starts earning interest itself.

Fees and Minimum Balance Requirements

While interest rates are a significant factor, fees can eat into your earnings, so always check for hidden fees before you commit. Some high-yield savings accounts come with no monthly maintenance fees, which is ideal, but others might charge fees for certain activities like exceeding the withdrawal limit, falling below the minimum balance, or maintaining the account without making any deposits.

It’s essential to fully understand the fee structure before opening an account. For example, if an account charges $10 a month in fees and you only maintain a small balance, those fees could negate any gains from the high interest rate. Look for accounts that have low or no fees, especially for services that you’ll likely use, such as transfers or ATM withdrawals.

In addition to fees, many high-yield savings accounts require a minimum deposit to open the account, and sometimes a minimum balance to maintain the highest interest rate. The minimum deposit might be anywhere from $1 to $100 or more, so choose an account that fits your financial situation. Some accounts will also penalize you if you dip below a certain balance, so make sure to choose an account where the minimum balance requirement aligns with your savings goals.

Access and Withdrawal Options

One of the advantages of a high-yield savings account is that it gives you easy access to your funds while earning a better return than a traditional savings account. However, not all accounts are the same when it comes to how easily you can access your money.

Many high-yield savings accounts are offered by online-only banks, which generally provide digital access to your account through mobile apps or websites. This can be very convenient, allowing you to transfer funds between accounts, view transactions, and monitor your balance from anywhere. When you’re choosing an account, make sure the online interface is user-friendly and works well on mobile devices.

However, there are limitations on withdrawals. According to federal regulations, savings accounts are often subject to a limit on the number of transactions you can make each month. Traditionally, there was a rule known as Regulation D, which limited transfers and withdrawals from savings accounts to six per month. While the Federal Reserve relaxed this rule in 2020, some banks still impose limits on how often you can access your funds.

Before you open an account, check the terms to see if there are any withdrawal restrictions or penalties for exceeding the limit. Some accounts may allow unlimited transfers or free ATM withdrawals, while others might charge fees for excessive withdrawals. If you need frequent access to your funds, look for an account that allows for easy transfers and doesn’t limit how often you can move your money.

Customer Service and Digital Features

When you’re managing your finances, excellent customer service can make a big difference. This is especially true for high-yield savings accounts, as you may encounter issues like incorrect charges, account lockouts, or difficulties making transfers. Good customer service ensures that you get prompt and reliable assistance whenever you need it.

Check for accounts that offer 24/7 customer support, especially if you plan on managing your account primarily online. Many online banks offer phone support, email help, and even chatbots for quick answers. Read reviews or ask for feedback from current customers to gauge how effective and helpful the customer service team is.

In addition to customer service, pay attention to the digital features that come with your high-yield savings account. In today’s digital age, many banks offer mobile apps that make managing your account more convenient. These apps should allow you to check balances, transfer money, set up automatic transfers, and receive real-time notifications for any changes to your account.

Look for features that can make managing your savings easier, such as budgeting tools, goal-setting options, or ways to track interest growth over time. These tools can help you stay on top of your savings goals and ensure you’re making the most of your high-yield account.

When choosing an account, make sure the digital experience aligns with your needs and expectations. For instance, if you’re someone who likes to see your transactions at a glance, look for an app that provides clear, detailed statements. If you plan on setting up regular contributions, make sure there’s an easy way to automate your deposits from checking to savings. Ultimately, the combination of customer service and digital tools should make managing your account seamless and efficient.

How to Maximize Earnings with High-Yield Savings Accounts?

A high-yield savings account offers the potential to grow your money faster than a traditional savings account. However, simply opening one isn’t enough to ensure maximum growth. To truly make the most of your high-yield savings account, you’ll need to adopt certain strategies that focus on increasing your earnings potential and leveraging the power of compound interest. Let’s explore how you can do that.

How to Increase Your Earnings Potential?

To increase the growth of your savings, consider more than just the interest rate. There are several strategies that can help you boost your earnings over time. One of the most effective ways is by choosing the right high-yield account to start with. Look for an account that offers a competitive APY and allows for frequent compounding, which will make your balance grow faster. Additionally, always be mindful of any fees that may eat into your returns. Opting for an account with no monthly fees or low maintenance charges will help you keep your earnings intact.

Another way to increase your earnings is by consistently depositing more money into your account. The larger the balance, the more interest you’ll earn. Set up automatic transfers from your checking account to ensure regular deposits, whether weekly, bi-weekly, or monthly. This will not only increase your savings over time but also take advantage of the compounding effect. The more frequently you deposit, the more you’ll benefit from interest on a higher balance.

Consider also tiered interest rates that some high-yield accounts offer. These accounts offer higher interest rates as your balance grows, meaning you can earn a better return as your savings increase. If you have the ability to keep a higher balance, look for accounts that offer these tiered benefits to earn a greater APY.

Importance of Regular Contributions and Compound Interest

When you open a high-yield savings account, one of the best ways to grow your balance is by making regular contributions. The more frequently you add money to your account, the more you’ll benefit from compound interest, which is essentially the interest earned on interest.

Compound interest is a powerful tool. It means that your interest gets added to your balance, and future interest is calculated on the new total, rather than just the original deposit. This creates a snowball effect: the more time you leave your money in the account, the more your savings will grow, even without additional deposits. However, regular contributions ensure that the money you’re earning interest on keeps increasing, which speeds up the compounding process.

For example, let’s say you start with a balance of $5,000 and your account offers an APY of 3%. If you don’t add any more money, the amount you earn each year will be based only on your $5,000 balance. But if you contribute $100 every month, that $100 is added to the balance each time, increasing the total amount earning interest. Over time, the more often you add to your account, the faster your money will grow.

It’s also important to remember that compound interest works best over the long term. If you plan on using the account for short-term savings, you might not see the maximum benefit of compounding. But if you’re saving for long-term goals like a retirement fund or a large purchase, consistently adding funds and allowing interest to accumulate will result in significant growth over the years.

Evaluating Different Interest Compounding Methods

The way interest is compounded in a high-yield savings account can have a huge impact on how much your money grows. Compound interest occurs when the interest earned on your balance is added to the principal, and future interest is calculated on that new balance. But not all accounts compound interest in the same way. Some accounts compound annually, quarterly, monthly, or even daily.

The frequency of compounding is important because the more often interest is compounded, the more interest you’ll earn. Here’s a quick breakdown of how different compounding methods compare:

- Daily Compounding: This is the most favorable method when it comes to maximizing your earnings. With daily compounding, interest is added to your balance every single day, and you start earning interest on that additional interest right away.

- Monthly Compounding: With monthly compounding, interest is added to your balance at the end of each month. While it still allows for growth, it’s not as powerful as daily compounding since you’re only benefiting from compound interest once a month.

- Quarterly or Annual Compounding: These methods have less frequent compounding periods. If your account compounds quarterly or annually, your interest is added to the balance less often, meaning it takes longer for your savings to grow.

To illustrate the difference, imagine you have $5,000 in an account with a 3% APY, and it compounds daily versus monthly. The daily-compounding account would provide you with slightly more in interest at the end of the year, even though both accounts have the same APY.

When choosing a high-yield savings account, always check how frequently interest is compounded. Accounts with daily compounding will help your money grow faster, so they are typically the better choice for those who want to maximize their returns over time.

By using regular contributions and selecting an account with favorable compounding, you can ensure that your high-yield savings account is working as hard as possible for you. The earlier you start saving and the more consistent your deposits are, the more powerful compound interest becomes in helping you reach your financial goals.

High-Yield Savings Accounts Pitfalls to Avoid

While high-yield savings accounts are a great way to grow your money, there are several common pitfalls that can reduce your earnings or cause unnecessary frustration. Being aware of these potential issues will help you avoid costly mistakes and make the most of your account.

- Ignoring fees: Even though high-yield savings accounts tend to have higher interest rates, some come with fees that can eat into your earnings. These may include monthly maintenance fees, excessive withdrawal fees, or penalties for falling below a certain balance. Be sure to read the fine print before opening an account and choose one with minimal or no fees.

- Overlooking withdrawal limits: Many high-yield accounts impose limits on the number of withdrawals you can make per month. Going over the limit can result in fees or even account restrictions. Make sure you understand the terms around withdrawals, especially if you expect to need access to your funds frequently.

- Falling for introductory rates: Some accounts offer high initial interest rates for a limited time, but these rates often drop after the introductory period ends. Always check the long-term APY rather than just the promotional rate to avoid disappointment once the rate decreases.

- Not regularly contributing: Simply opening a high-yield savings account isn’t enough. If you’re not adding to your balance regularly, you’re missing out on the power of compound interest. Set up automatic transfers to ensure you consistently contribute to your savings.

- Choosing low-compounding accounts: Not all high-yield savings accounts compound interest the same way. Accounts that compound monthly or annually will grow your balance more slowly than those that compound daily. Make sure the account you choose offers frequent compounding to maximize your earnings.

How to Open and Manage a High-Yield Savings Account?

Opening and managing a high-yield savings account is relatively simple, but there are a few key steps to follow to ensure you’re making the right choice and getting the most out of your account.

- Choose a reputable bank or credit union: Research different financial institutions offering high-yield savings accounts. Look for competitive interest rates, good customer reviews, and low or no fees. Online banks often offer better rates than traditional banks.

- Check for minimum deposit requirements: Some high-yield accounts require a minimum deposit to open. Make sure you can meet this requirement before proceeding. If you plan on maintaining a lower balance, look for an account with no minimum deposit.

- Review the account terms: Understand the APY, compounding frequency, fees, and withdrawal limits before opening an account. Ensure that the terms align with your financial goals.

- Set up your account: Opening the account typically involves completing an online application, providing identification, and linking your external bank account for transfers. You’ll also need to fund the account with your initial deposit.

- Automate contributions: Set up automatic transfers to ensure you’re regularly adding money to your savings. This can help you take full advantage of compound interest and keep your balance growing steadily.

- Monitor your account: Regularly check your account to track interest earned, ensure there are no hidden fees, and verify that your interest rate remains competitive. If your account’s terms change, be prepared to shop around for better options.

Alternatives to High-Yield Savings Accounts

While high-yield savings accounts offer a safe and reliable way to earn interest, there are several other options to consider, depending on your financial goals and risk tolerance. These alternatives can offer higher returns, but they may come with more risk or less liquidity.

- Money Market Accounts: Money market accounts typically offer a higher interest rate than traditional savings accounts and sometimes even higher than high-yield savings accounts. These accounts may also offer check-writing privileges and ATM access, but they often require a higher minimum deposit.

- Certificates of Deposit (CDs): A CD locks your money in for a specified period, such as six months, one year, or longer, with a fixed interest rate. In exchange for this commitment, CDs generally offer higher interest rates than savings accounts. However, early withdrawal penalties can make them less flexible if you need access to your funds before the term ends.

- Treasury Bonds and Bills: U.S. Treasury bonds and bills are low-risk investments that offer interest payments over a set period. They can provide higher returns than a savings account, but they require a longer investment horizon and may not be as liquid.

- Investments in Stocks and Mutual Funds: If you’re willing to accept more risk in exchange for higher potential returns, you can consider investing in the stock market or mutual funds. While these come with the possibility of losing money, they offer the potential for significant gains over the long term.

- Robo-Advisors: Robo-advisors are automated investment platforms that build and manage a diversified portfolio based on your risk tolerance. While they tend to have higher risk than high-yield savings accounts, they may offer higher returns over time through a mix of stocks, bonds, and other assets.

Conclusion

When choosing the best high-yield savings account, it’s important to focus on what matters most to you—whether that’s the highest interest rate, low fees, or easy access to your money. The accounts listed in this guide offer a variety of benefits, from no fees and competitive rates to the flexibility of online banking and mobile apps. Depending on your personal preferences and savings goals, you’ll want to carefully review each option and select one that fits your needs. Whether you’re looking to maximize your returns or simply want a reliable place to grow your savings, there’s an account out there that’s right for you.

By picking the right high-yield savings account, you can take full advantage of compounding interest and watch your savings grow faster over time. While these accounts might not provide the huge returns that some investment options do, they are a safe, low-risk way to earn more than traditional savings accounts offer. Remember, the key is consistency—depositing regularly and letting your money work for you. With the right account in place, you’ll be in a strong position to reach your financial goals and build a solid financial foundation for the future.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.

-

Sale!

Marketplace Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

E-Commerce Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

SaaS Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

Standard Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

E-Commerce Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

SaaS Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Marketplace Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Startup Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Startup Financial Model Template

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart