- What is Freelance Tax Software?

- Benefits of Using Freelance Tax Software

- Top Freelance Tax Software Options

- Freelance Tax Software Features to Look For

- How to Choose the Best Freelance Tax Software for You?

- Common Mistakes Freelancers Make with Taxes and How Software Helps Avoid Them

- How Freelance Tax Software Integrates with Other Tools?

- Conclusion

Are you a freelancer struggling to keep track of your taxes? Managing taxes as a freelancer can be overwhelming, especially when you’re juggling multiple clients, fluctuating income, and numerous business expenses. Luckily, the right freelance tax software can make all the difference. These tools are designed to simplify the process, help you stay organized, and ensure you’re not missing out on important deductions.

Whether you’re filing taxes for the first time or looking to streamline your process, this guide will walk you through the top freelance tax software options that can save you time, reduce stress, and keep you on track with the IRS.

What is Freelance Tax Software?

Freelance tax software is a specialized tool designed to help freelancers and self-employed individuals manage their taxes more efficiently. It simplifies the process of calculating, filing, and keeping track of taxes by automating many of the tasks that would otherwise be time-consuming and prone to error. These tools typically include features like income and expense tracking, tax filing assistance, and reports that make tax preparation easier and more accurate.

The Importance of Tax Software for Freelancers

Freelancers often juggle multiple clients, projects, and income streams, making it more challenging to stay on top of tax obligations. Freelance tax software is essential because it helps reduce the complexity of managing taxes, allowing freelancers to focus more on their work rather than their finances.

- Freelancers are responsible for their own tax filings and payments, making accurate tracking and documentation crucial.

- Tax software automates much of the process, reducing the risk of human error and missed deadlines.

- It ensures freelancers can claim all eligible deductions, potentially reducing their tax liability.

- The software helps stay compliant with constantly changing tax laws and regulations.

- It saves time by organizing financial information and automatically generating tax forms.

Common Tax Challenges Faced by Freelancers

Freelancers face a unique set of tax-related challenges that can make managing finances more complex. Without the structure of traditional employment, handling taxes can often feel like an uphill battle. These are some of the common obstacles freelancers often encounter:

- Estimated taxes: Freelancers need to pay estimated taxes quarterly, which can be difficult to calculate and manage without proper tools.

- Tracking multiple income sources: Freelancers often have income from different clients, payment platforms, or even side projects, making it harder to keep accurate records.

- Deductions: Freelancers are eligible for various business-related deductions, such as home office expenses, travel, and equipment costs, but knowing which deductions to claim and keeping track of them can be overwhelming.

- Self-employment taxes: Freelancers are responsible for paying both the employer and employee portion of Social Security and Medicare taxes, which can be a significant burden without clear guidance.

- State-specific taxes: Freelancers working in multiple states or countries may face complex tax rules and filing requirements that differ from one jurisdiction to another.

- Record-keeping: Maintaining organized, up-to-date financial records throughout the year is challenging but necessary for accurate tax reporting.

How Tax Software Can Simplify and Streamline the Tax Filing Process

Freelance tax software is a powerful tool that helps reduce the complexity of tax filing by automating various aspects of the process. From tracking expenses to filing your tax return, these tools are designed to streamline the process, making it much more manageable. Here’s how tax software can make a significant difference:

- Automatic tracking of income and expenses: Tax software can link directly to your bank accounts, payment platforms (like PayPal or Stripe), and accounting tools to track income and expenses in real time.

- Expense categorization: It automatically categorizes expenses into relevant categories, such as business supplies, meals, and travel, ensuring that you never miss a potential deduction.

- Tax calculation: The software calculates your tax obligations based on your income and expenses, helping you avoid the stress of manually figuring out what you owe.

- Estimated tax reminders: Many tax software options offer reminders for quarterly estimated tax payments, helping you avoid late fees or penalties.

- E-filing: Instead of worrying about mailing your tax forms, tax software allows you to file electronically, speeding up the process and ensuring your documents are submitted correctly.

- Tax form generation: The software generates necessary tax forms like Schedule C and 1099s, so you don’t have to worry about formatting or missing required information.

- Year-round tracking and reporting: Tax software allows you to track your income and expenses year-round, so by the time tax season rolls around, your information is already up to date and ready to go.

Benefits of Using Freelance Tax Software

Freelance tax software provides several advantages that make managing your taxes easier, more efficient, and less stressful. Whether you’re new to freelancing or have been self-employed for years, these tools offer crucial support in staying organized and compliant with tax laws. Here’s why using tax software can be a game-changer for freelancers:

- Streamlined tax filing process that saves you time and reduces stress

- Increased accuracy, minimizing the risk of errors that could lead to penalties or audits

- Automation of tedious tasks, such as tracking expenses, categorizing receipts, and calculating deductions

- Maximized tax deductions by identifying all eligible business expenses

- Real-time income and expense tracking to keep you organized throughout the year

- Easy generation of forms like Schedule C, 1099s, and other relevant tax documents

- Convenient e-filing options that allow for faster tax submissions and quicker refunds

- Ongoing updates to tax laws, ensuring compliance with the latest regulations

- Enhanced record-keeping for easier access to financial data when needed

Top Freelance Tax Software Options

When it comes to managing your taxes as a freelancer, choosing the right software can make a world of difference. There are several options available, each designed to meet the specific needs of freelancers. The best freelance tax software provides not only accuracy but also ease of use, integration with other financial tools, and the ability to handle complex tax filings. Below are some of the top options on the market today, each with unique features that can help streamline your tax filing process.

Xero

Xero is an accounting software designed for small businesses, but it’s also an excellent tool for freelancers. Known for its simple interface and powerful features, Xero helps freelancers track their income and expenses, create invoices, and even manage payroll for contractors. When tax season arrives, Xero automatically categorizes expenses and generates tax reports, making it easier to track deductions and prepare for filing. The software integrates well with other tax tools and accounting platforms, providing a seamless experience for freelancers who need to file taxes with minimal hassle.

Xero’s scalability is another key benefit, making it an excellent choice for freelancers who expect to grow their business over time.

Wave Accounting

Wave Accounting offers a free, user-friendly accounting solution with features that suit freelancers and small businesses alike. It helps users manage invoices, track expenses, and generate reports. When it comes to taxes, Wave makes it easy to organize financial data, categorize transactions, and prepare the necessary documents for tax season. Though it doesn’t provide direct tax filing, it does integrate with other tax filing tools like TaxJar and offers tax-related reports to simplify the filing process.

For freelancers on a budget who still need a comprehensive accounting and tax management tool, Wave Accounting offers an excellent free option without sacrificing functionality.

TurboTax Self-Employment Tax Hub

TurboTax Self-Employment Tax Hub is a highly popular choice for freelancers due to its comprehensive features and ease of use. It is tailored specifically to the needs of self-employed individuals and freelancers, guiding you step-by-step through the tax filing process. TurboTax helps freelancers identify business-related tax deductions, including home office, travel, and vehicle expenses. The software’s intuitive interface allows users to upload receipts, track expenses automatically, and integrate directly with QuickBooks, making it ideal for freelancers already using accounting software.

One of the standout features of TurboTax Self-Employent Tax Hub is the access to live tax professionals. This feature gives you peace of mind knowing that, if needed, you can consult with a tax expert for personalized advice. Furthermore, the software offers a dedicated section for handling 1099 forms, which are common for freelancers. If you’re looking for a well-known and reliable software that simplifies tax filing while maximizing deductions, TurboTax Self-Employed is a solid option.

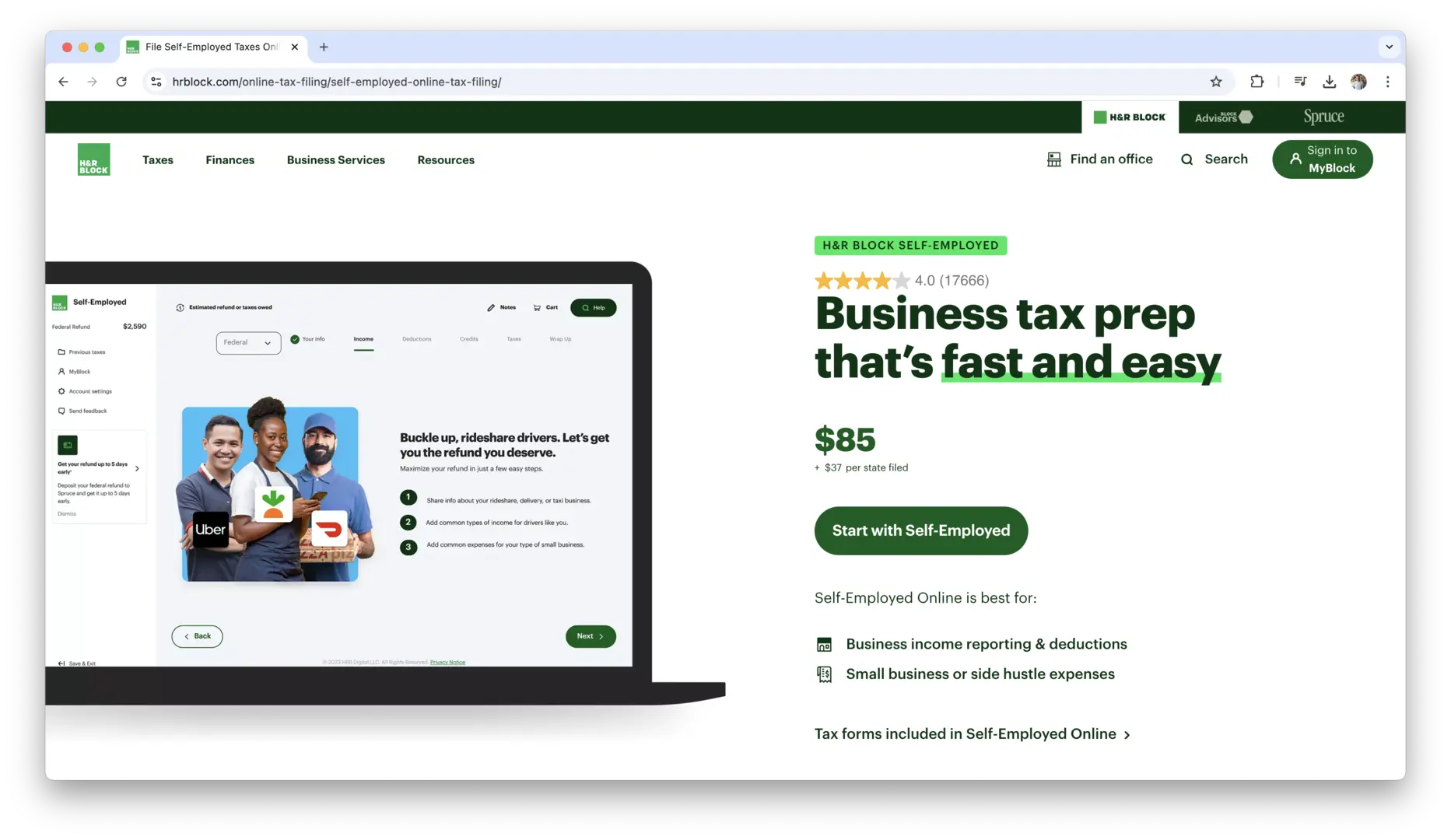

H&R Block Self-Employed

H&R Block Self-Employed offers a robust set of tools for freelancers, with features designed to simplify the tax process and ensure accuracy. Like TurboTax, H&R Block’s software is tailored to self-employed individuals, providing specific forms like Schedule C for reporting income and expenses, and it helps maximize business deductions. The software walks users through the process with straightforward prompts and offers a smooth e-filing experience.

One of the benefits of using H&R Block is their live chat and phone support. If you encounter any confusion while filing, you can easily get expert help. Additionally, H&R Block offers an extensive knowledge base and tax tips that can help freelancers better understand their tax situation. The software also integrates with major accounting tools and payment platforms like PayPal, making it easy to import income data. If you need a reliable, comprehensive solution with strong customer support, H&R Block Self-Employed is a top contender.

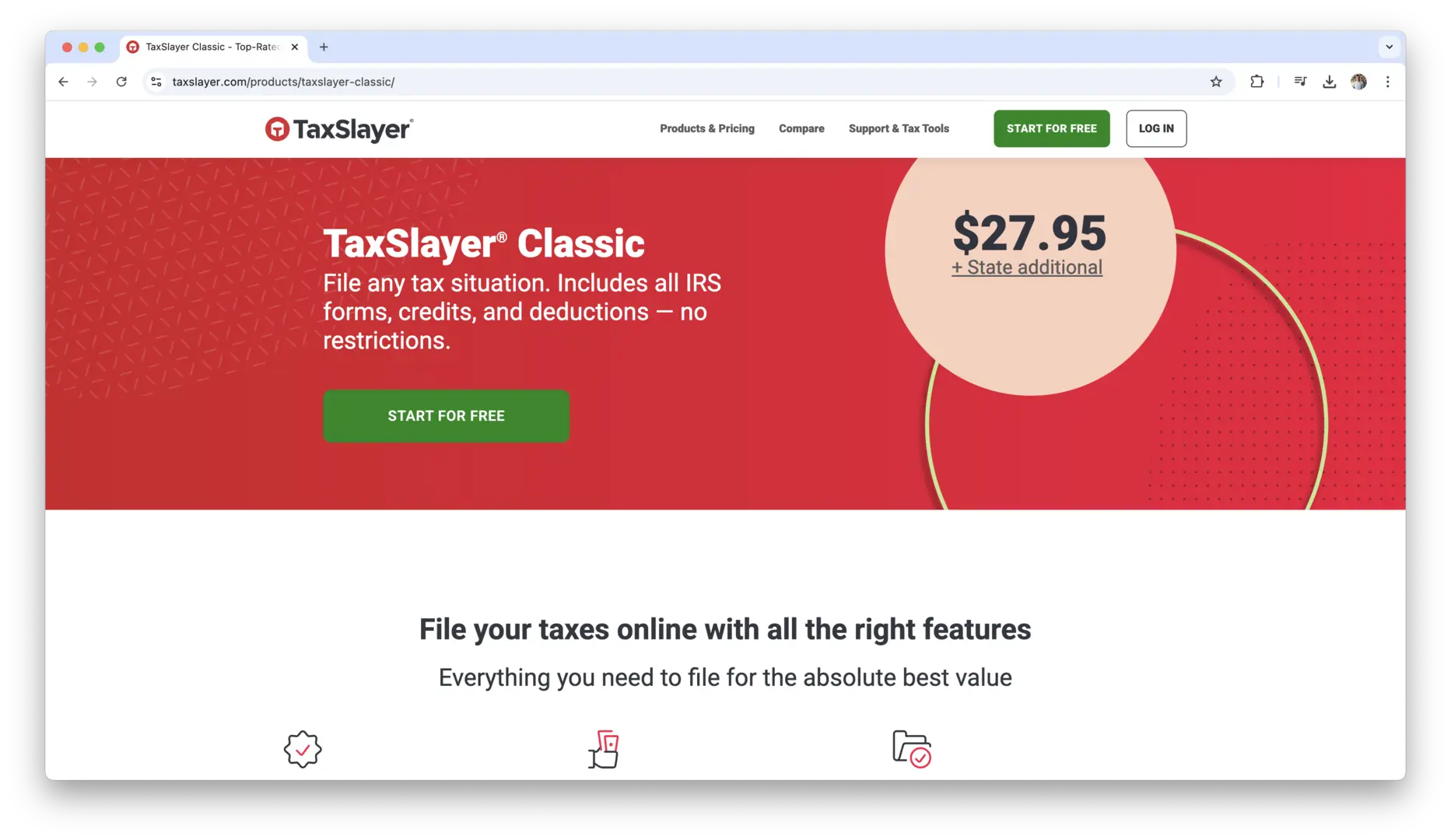

TaxSlayer Classic

TaxSlayer Classic is an affordable option for freelancers who are looking for basic tax filing assistance without the premium price tag. While it doesn’t offer as many bells and whistles as TurboTax or H&R Block, TaxSlayer provides all the essentials needed for filing taxes as a freelancer. The software allows you to easily report self-employment income, calculate your tax liability, and file electronically with the IRS.

What makes TaxSlayer Classic particularly appealing is its simplicity. It’s an excellent choice for freelancers who don’t need advanced features or live support but want a straightforward, cost-effective way to file taxes. TaxSlayer also supports the filing of 1099 forms and includes helpful deductions for self-employed workers. If you’re looking for a no-frills tax software that gets the job done efficiently and affordably, TaxSlayer Classic is a good option.

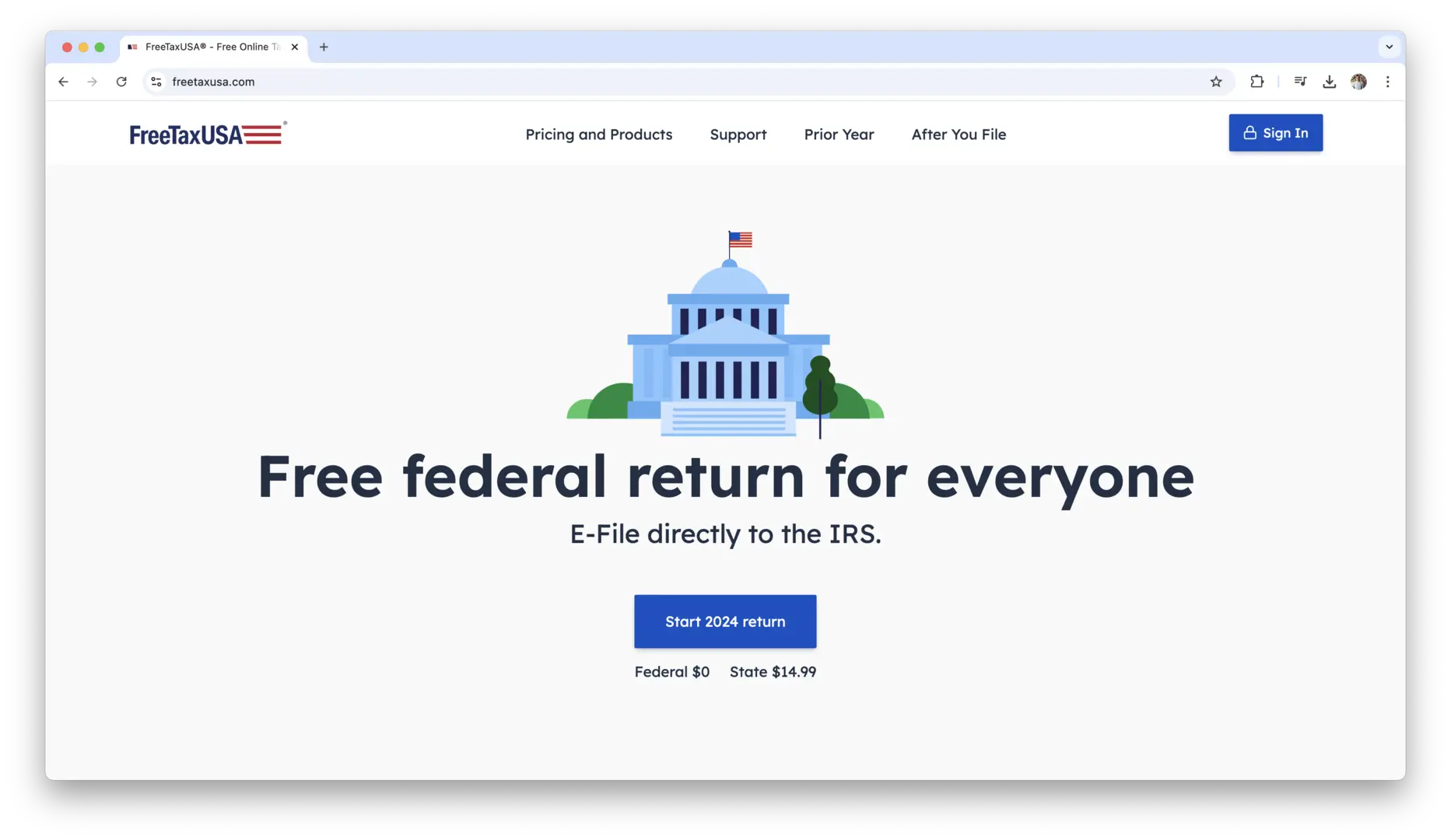

FreeTaxUSA

FreeTaxUSA is a solid choice for freelancers who want a free, no-cost option with an upgrade for more advanced features. The free version offers the ability to file federal taxes, including self-employment income and deductions, which is ideal for freelancers just starting out or those with relatively simple tax needs. The software also includes support for 1099 forms and automatic deduction suggestions for freelancers.

While FreeTaxUSA doesn’t have the robust customer service options found in some of the higher-end software, it does provide helpful tax resources and a simple, user-friendly interface. For freelancers who want to minimize their tax software costs while still getting the basic functionality they need, FreeTaxUSA is an excellent option. If you need to file state taxes or access additional support features, you can easily upgrade to the paid version, which is still relatively affordable.

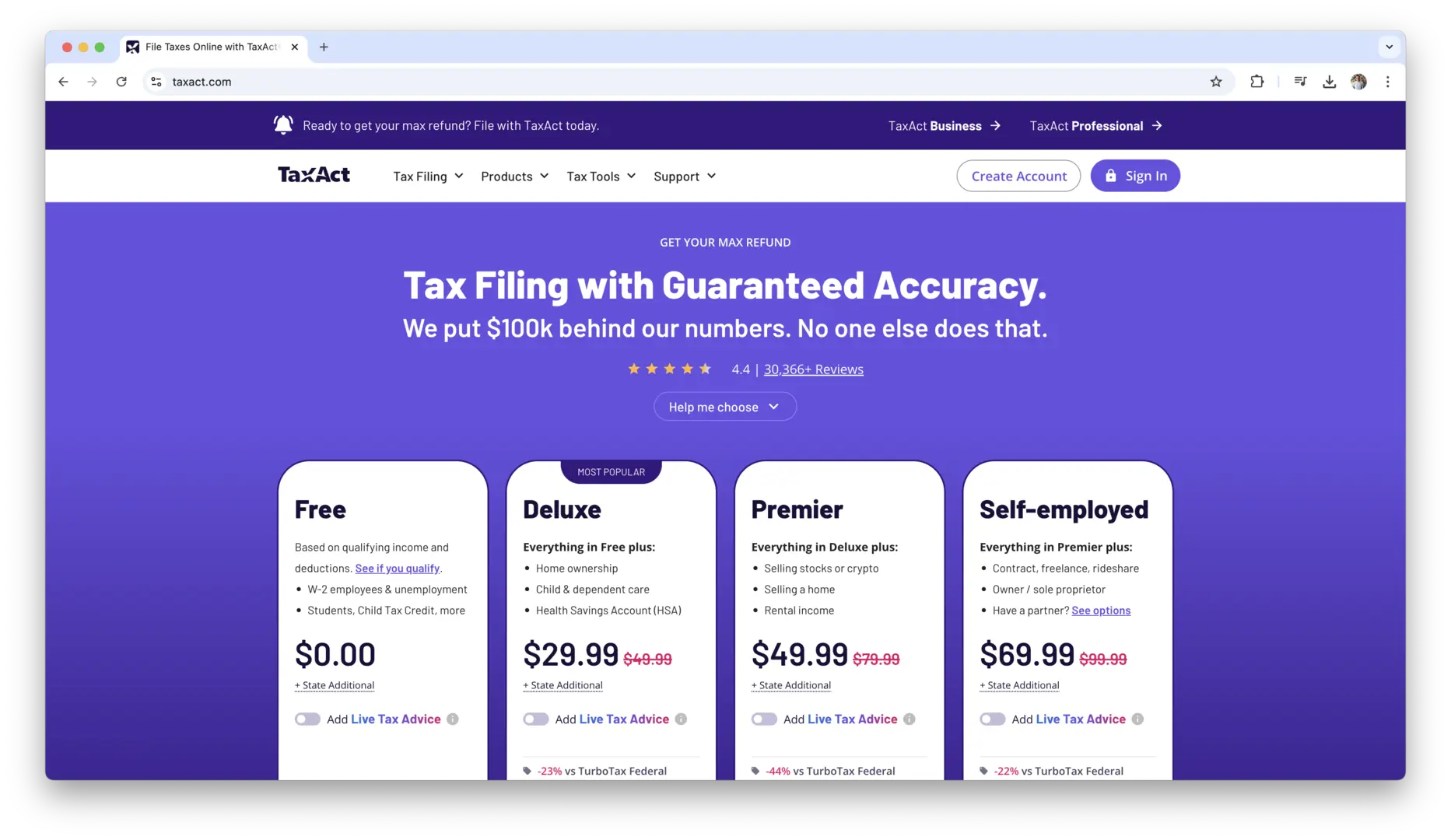

TaxAct Self-Employed

TaxAct Self-Employed is a comprehensive tax software solution that is designed for freelancers, contractors, and small business owners. The software helps you easily track and report income, manage deductions, and file taxes with confidence. TaxAct offers step-by-step guidance and includes a dedicated section for self-employment taxes, which is essential for freelancers who need to calculate and pay their Social Security and Medicare taxes.

One of the key advantages of TaxAct is its ability to file both federal and state taxes, which is a crucial feature for freelancers who work in multiple states. TaxAct also provides helpful audit defense options, which is an added benefit for freelancers concerned about potential issues with the IRS. With its balance of affordability and comprehensive features, TaxAct Self-Employed is a great choice for freelancers looking for an all-in-one tax solution.

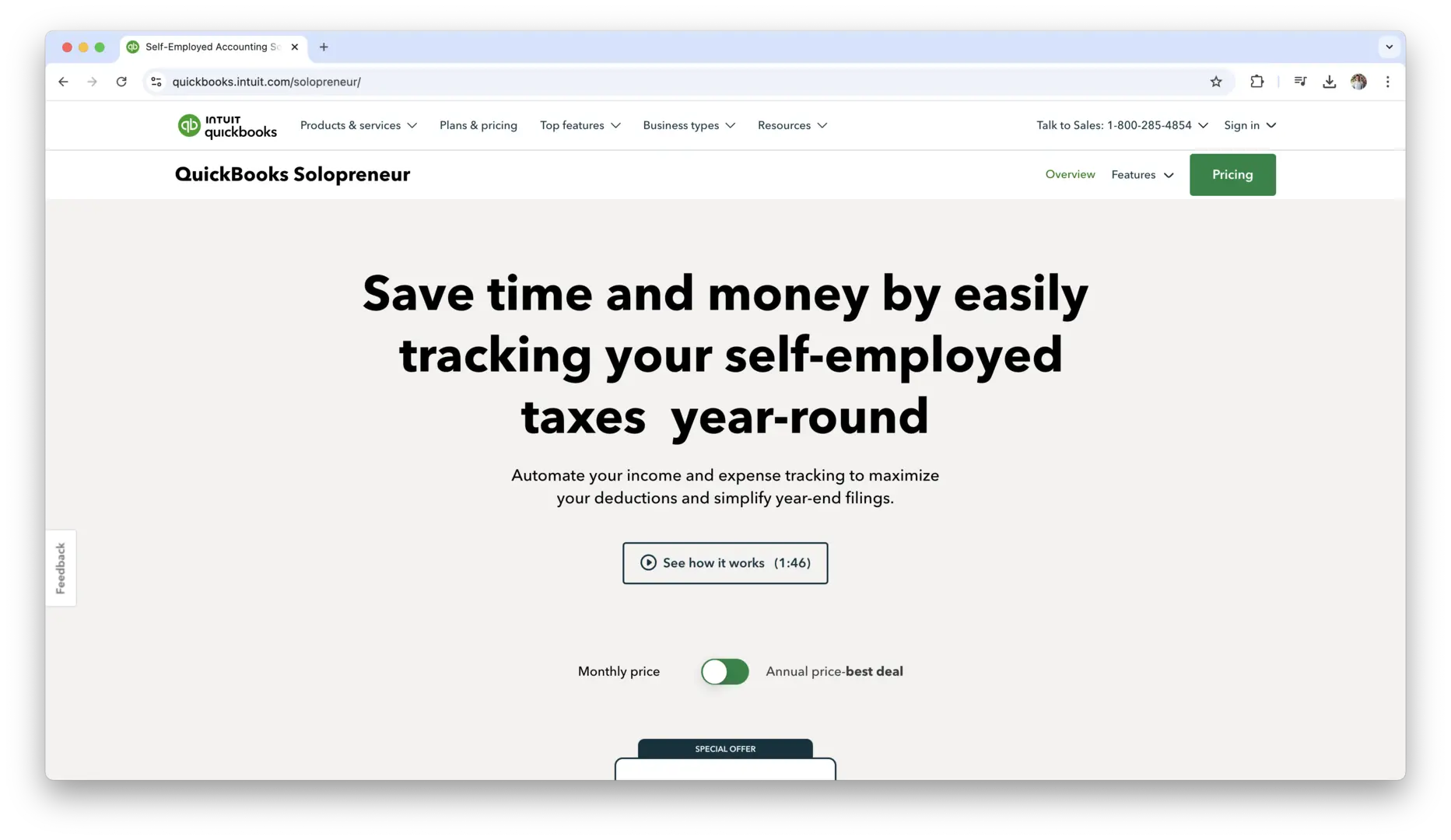

QuickBooks Self-Employed

QuickBooks Self-Employed Accounting Software for Solopreneurs is more than just a tax software—it’s also a powerful accounting tool that helps freelancers track income, expenses, and mileage year-round. The software is designed for freelancers who want to keep their business finances in check throughout the year and then seamlessly prepare their taxes when it’s time to file. QuickBooks Self-Employed automatically tracks your expenses by connecting to your bank accounts and credit cards, making it easier to categorize your spending.

For tax filing, QuickBooks Self-Employed provides the ability to generate tax reports that are optimized for freelancers. It also includes tools for calculating estimated taxes and sending 1099 forms directly to clients. While QuickBooks Self-Employed is ideal for freelancers who need both accounting and tax filing tools, it’s important to note that the tax filing feature is a bit basic compared to dedicated tax software like TurboTax or H&R Block. However, if you need ongoing financial tracking combined with tax filing, QuickBooks Self-Employed is a solid option.

FreshBooks

FreshBooks is a robust accounting platform that’s especially popular with freelancers and small business owners. While it’s primarily an accounting tool, FreshBooks also offers comprehensive tax filing capabilities. The software helps freelancers track their time, manage expenses, and create invoices—all while automatically categorizing expenses for tax reporting. FreshBooks also integrates with third-party platforms like PayPal, making it easy to track income from various sources. When tax season arrives, FreshBooks provides simple tools to prepare your taxes by generating reports and offering insights into tax-deductible expenses.

The ability to seamlessly manage both business finances and taxes makes FreshBooks a fantastic all-in-one tool for freelancers looking for both ease and precision in their tax filings.

Kashoo

Kashoo is another affordable accounting and tax software that’s ideal for freelancers. It offers an intuitive interface with a focus on simplicity, helping you track income, expenses, and taxes effortlessly. Kashoo automatically categorizes transactions and generates tax reports, including those for self-employment and quarterly tax estimates. Additionally, it integrates with PayPal, Stripe, and other popular payment processors, making it easy to track payments and organize your finances.

Kashoo is perfect for freelancers who need a straightforward tool for managing both their accounting and tax responsibilities without a steep learning curve.

QuickBooks Online

QuickBooks Online is one of the most well-known and widely used accounting solutions for small businesses and freelancers. It provides a comprehensive suite of tools for managing business finances, including invoicing, expense tracking, and tax preparation. QuickBooks Online integrates directly with your bank accounts and payment platforms, automatically categorizing income and expenses. When it’s time to file taxes, QuickBooks provides detailed reports that make it easier to calculate deductions and estimate quarterly payments.

With its powerful features and scalability, QuickBooks Online is a go-to choice for freelancers who want both accounting and tax filing in one platform.

Bonsai

Bonsai is a freelancer-centric tool that combines project management, invoicing, and accounting in one platform. Its tax features help freelancers organize their expenses and track billable hours, making it easier to prepare for tax season. Bonsai helps users separate personal and business expenses, which is crucial for tax reporting. With Bonsai’s automated expense tracking and reporting tools, freelancers can prepare financial reports and generate tax documents in minutes. The software also helps freelancers estimate their taxes and provides reminders for estimated payments.

If you’re looking for a tool that integrates your freelance business management with tax reporting, Bonsai is an excellent choice.

Each of these freelance tax software options offers unique features that cater to different aspects of freelancing. Whether you need basic tax filing, detailed expense tracking, or expert advice, there’s a software solution out there to help you streamline your taxes and ensure accuracy. Choosing the right one depends on your business needs, the complexity of your taxes, and your budget, so it’s worth evaluating each option carefully to find the best fit for you.

Freelance Tax Software Features to Look For

When selecting freelance tax software, certain features can make or break your experience. Freelancers often juggle multiple clients, varying income streams, and a wide range of expenses, so the software you choose needs to be tailored to handle these complexities smoothly. Below are the key features to consider that will not only simplify your tax filing process but also save you time and maximize your deductions.

Ease of Use and User-Friendly Interface

The primary goal of tax software is to streamline the process for you, and that starts with how easy it is to navigate. Tax filing can be overwhelming on its own, so software should alleviate this by offering a clean, intuitive interface. A user-friendly platform will guide you through the tax preparation process step-by-step, with clear instructions and an easy-to-follow flow.

Look for software that allows you to quickly input your financial information, categorize expenses, and view your progress. If it’s intuitive and minimizes the number of clicks or actions you need to take, it will make your life much easier. Many tools even offer drag-and-drop features, simplifying the uploading of documents and receipts. You should feel confident that you can enter all your data correctly without needing a manual for every step.

Integration with Accounting and Financial Tools

One of the most valuable aspects of modern tax software is the ability to integrate with other accounting tools and platforms. As a freelancer, you’re likely using accounting software to track income, invoices, and expenses. It’s crucial that your tax software can integrate seamlessly with these systems, eliminating the need for manual data entry.

Look for software that can sync with popular tools like QuickBooks, Xero, or FreshBooks. This connection ensures that your financial data flows directly into your tax software, automatically populating forms with accurate income and expense figures. This not only saves you time but also reduces the chances of human error in transcribing data, ensuring that your taxes are filed accurately.

Additionally, integrations with payment platforms like PayPal or Stripe are useful, as many freelancers rely on these services for client payments. Having everything in one place allows for better tracking and ensures that nothing is left out during the filing process.

Deduction Tracking and Expense Management

As a freelancer, you’re eligible for a variety of tax deductions that help lower your taxable income. However, keeping track of these deductions manually can be tricky. The right tax software will simplify this process by offering automatic tracking of expenses and deductions, ensuring that you don’t miss out on potential savings.

Look for software that automatically categorizes your expenses—whether it’s for office supplies, travel, or subscriptions related to your business. Some advanced tools can even suggest deductions based on your activities, such as home office deductions, mileage, or even health insurance premiums. This helps ensure that you’re not leaving any money on the table and that you are maximizing every opportunity to reduce your tax liability.

Moreover, the software should allow you to add receipts and organize them for easy reference. Having a clear and comprehensive overview of your business expenses will make your tax filing process not only more accurate but also faster.

Tax Filing Support for Freelancers

Freelancers need tax software that is designed with self-employed individuals in mind. Whether you are a sole proprietor, run an LLC, or have a different business structure, your tax filing needs are unique. Freelance tax software should be equipped to handle the appropriate forms, such as Schedule C (for sole proprietors) or Schedule E (for LLCs and partnerships), and guide you through each step of the filing process.

Some tax software is tailored specifically for freelancers and even offers tools like self-employment tax calculators. These calculators help you determine your tax obligations, such as Social Security and Medicare taxes, which are a major consideration for self-employed individuals. Additionally, the software should support quarterly estimated tax payments, which are crucial for freelancers who don’t have taxes automatically withheld from their earnings.

Many freelancers also have varying income streams, and the software should be able to handle multiple 1099 forms (for freelance income) in addition to regular income, so you don’t have to manually enter every detail. Look for tax software that offers e-filing, allowing you to submit your forms electronically and avoid the hassle of paper filing.

Customer Support and Educational Resources

Navigating freelance taxes can be complicated, especially for first-timers. That’s why customer support and educational resources are vital features in tax software. When you run into a roadblock, whether it’s about a specific deduction or a tax form, you’ll need access to responsive support. Some software options offer live chat, email support, or even phone consultations with tax professionals.

In addition to support, educational resources can help you better understand the ins and outs of tax law as it pertains to freelancers. Look for software that provides online tutorials, articles, and FAQs to guide you through common tax-related issues. Some tools also offer video content, webinars, or in-app tips to help demystify complex tax topics.

For freelancers who want to stay informed about tax changes or best practices, some software offers tax webinars and tax guides, which can be incredibly valuable. Having these resources at your disposal ensures that you feel confident about your tax filing and have the help you need when questions arise.

How to Choose the Best Freelance Tax Software for You?

Selecting the right tax software is a crucial step for managing your freelance business. With so many options available, it’s easy to feel overwhelmed by the choices. To help you make an informed decision, consider your unique needs and evaluate key factors that will affect your tax filing process, both now and as your business grows. Here’s how to approach choosing the best freelance tax software for you.

1. Assess Your Specific Freelance Business Needs

The first step in selecting the right tax software is understanding the nature of your freelance business. Your specific needs will guide your decision-making process and ensure that the software you choose is equipped to handle your requirements. Consider the following:

- Business Structure: Are you a sole proprietor, freelancer with an LLC, or running a different business entity? Some tax software is designed to handle only basic self-employed tax filings, while others cater to more complex business structures like LLCs or partnerships. Choose software that supports your particular structure and tax needs.

- Income Complexity: Freelancers with multiple income streams (e.g., project-based work, passive income, or client contracts) should look for software that can handle various income forms, including 1099s and other freelance-specific tax documents. Make sure it can handle all sources of income, whether domestic or international.

- Tax Filing Frequency: Do you file quarterly taxes or just annually? Many freelancers must file estimated taxes every quarter. Choose software that can track and manage quarterly payments to help you stay on top of your obligations.

- Type of Deductions: Depending on your industry, you may be eligible for unique deductions, such as home office expenses, travel, equipment, or software subscriptions. Ensure the software you choose allows for detailed tracking and categorization of these deductions to maximize your tax savings.

2. Compare Pricing and Subscription Plans

Pricing is a significant factor in your decision-making process, especially for freelancers who are often mindful of their budget. Freelance tax software varies in price depending on the level of functionality, support, and scalability. It’s important to evaluate both the cost and the value you’ll receive from the software.

- Free vs. Paid Versions: Some software options offer free versions that are great for basic tax filings. However, these may not include features like advanced deductions or the ability to file business taxes. Paid versions often come with premium features like enhanced reporting tools, multi-state tax filing, and priority support.

- Subscription Tiers: Many tax software providers offer multiple pricing tiers, depending on the features you need. Make sure to choose a plan that fits your current business needs while leaving room for future growth. For example, if you’re just starting out, a lower-tier subscription may work, but as your business expands, you might need more comprehensive tools for handling complex tax situations.

- One-Time Fees vs. Subscription: Consider whether you prefer a one-time fee or a subscription-based pricing model. While one-time fees may seem appealing, they often come with limited updates and support. A subscription model often ensures that you’ll receive regular updates to reflect changes in tax laws and ongoing customer support.

- Free Trials and Money-Back Guarantees: Many tax software platforms offer free trials or money-back guarantees. Take advantage of these options to test out the software before committing to a paid plan. This will give you a sense of how well the software meets your needs and if the interface is user-friendly.

3. Evaluate Customer Feedback and Expert Reviews

When choosing tax software, it’s helpful to read reviews from both experts and other freelancers who have used the product. This will give you a clearer idea of its reliability, functionality, and ease of use.

- User Reviews: Freelancers like you are the best source of feedback about tax software. Check user reviews on trusted platforms like Trustpilot, Google Play, and Apple’s App Store. Pay attention to comments about the software’s ease of use, customer support, and the ability to handle complex tax scenarios. Look for patterns in the reviews, both positive and negative, to understand the pros and cons.

- Expert Reviews: In addition to user feedback, expert reviews from tax professionals or well-established review sites like CNET or PCMag can offer in-depth analyses of the software’s features, pricing, and overall performance. Expert reviews often provide a detailed breakdown of how well the software meets the needs of freelancers and small business owners.

- Trial Feedback: Take advantage of free trials to get a first-hand experience with the software. While reviews provide valuable insights, nothing beats trying the product yourself. Evaluate its functionality during a test run and see if it meets your needs before you commit.

- Social Media and Communities: Platforms like Reddit or online forums dedicated to freelancing often have threads discussing the best tax software. You can ask fellow freelancers about their experiences and get recommendations based on real-world use.

4. Consider Scalability for Growing Businesses

As a freelancer, your business is likely to evolve. As you expand, your tax needs may become more complex, and you’ll want software that can grow with you. Scalability is an important consideration, particularly if you’re planning on expanding your client base or transitioning into a larger business structure, such as an LLC or corporation.

- Business Expansion: When evaluating tax software, think about your future needs. Will the software be able to handle multiple revenue streams, larger volumes of invoices, and more complicated tax filings as your business grows? Choosing a platform that offers scalability ensures that you won’t outgrow your tax software as your business evolves.

- Additional Features: Some tax software providers offer advanced features for growing businesses, such as payroll management, multi-user access, or tools for managing employees. If you plan to hire staff or contractors, look for software that integrates payroll functions and handles tax filings for employees.

- State and Federal Filing: As your business expands, you may begin working across state lines or internationally. Choose software that supports multi-state tax filing and can handle complex tax scenarios, like sales tax, international tax laws, or multiple state tax returns.

- Automation and Customization: As your business grows, the volume of transactions and tax-related tasks will increase. Look for software that offers automation tools to handle recurring tasks such as expense categorization, invoice generation, and tax payments. Software that provides customizable options for tax reports, forms, and filing preferences will allow you to adjust your approach as your business scales.

Selecting the right freelance tax software is about aligning the features of the platform with your specific needs, evaluating how well it fits into your budget, and ensuring that it supports your growth. By considering these factors, you’ll be equipped to choose software that simplifies your tax filings today and evolves with your business in the future.

Common Mistakes Freelancers Make with Taxes and How Software Helps Avoid Them

Freelancers often face unique challenges when it comes to taxes, and there are several common mistakes that can lead to costly errors. Thankfully, tax software can help avoid these pitfalls by offering tools and guidance to ensure compliance. Here are some of the most common mistakes freelancers make and how software can assist in avoiding them:

- Failing to track all business expenses and deductions, leading to missed opportunities for tax savings

- Underestimating quarterly tax payments, resulting in penalties for late or insufficient payments

- Not setting aside enough funds for taxes throughout the year, leading to cash flow issues at tax time

- Misclassifying business expenses, which can trigger audits or cause deductions to be disallowed

- Forgetting to file quarterly taxes, which can result in fines or interest charges from the IRS

- Confusing personal and business expenses, making it difficult to accurately calculate taxable income

- Overlooking state-specific tax laws and requirements, resulting in errors on state tax returns

- Neglecting to keep proper records of receipts and transactions, complicating the filing process

How Freelance Tax Software Integrates with Other Tools?

One of the key features of modern tax software is its ability to integrate with other tools you may already be using in your business. This connectivity streamlines your workflow, saves time, and ensures data consistency across platforms. Here are some ways freelance tax software integrates with other tools to enhance your productivity:

- Seamless syncing with accounting software like QuickBooks, Xero, and FreshBooks to ensure accurate income and expense tracking

- Integration with invoicing platforms such as PayPal, Stripe, or Square for easy import of client payments and earnings

- Automatic import of bank transactions to categorize and track expenses without manual data entry

- Connection with payroll systems to handle employee or contractor payments and tax filings

- Integration with payment processors to simplify income reporting and deductions based on payment histories

- Syncing with financial management apps to maintain a clear overview of business finances in real-time

- Sharing data with other business management tools, ensuring consistency across your financial operations

Conclusion

Choosing the right tax software for your freelance business doesn’t have to be complicated. With the right tool, you can save time, reduce errors, and ensure you’re maximizing deductions while staying compliant with tax laws. The software options we’ve covered each offer unique features that cater to freelancers’ specific needs. Whether you’re looking for ease of use, robust support, or advanced accounting tools, there’s a solution out there that fits your business. Be sure to consider what matters most to you—whether it’s affordability, customer support, or the ability to handle complex tax scenarios—and choose a software that will make your tax filing process smooth and stress-free.

Once you’ve selected the best tax software for your needs, you’ll have more time to focus on what you do best—running your freelance business. Remember that tax software isn’t just for filing taxes; it’s also a powerful tool for ongoing expense tracking, invoicing, and planning ahead for quarterly tax payments. By using the right software, you can keep your finances organized year-round and avoid any surprises when tax season comes around. Take the time to evaluate your options, try out free trials, and choose the tool that fits your workflow. With the right tax software, managing your taxes can be simple and efficient.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.

-

Sale!

Marketplace Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

E-Commerce Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

SaaS Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

Standard Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

E-Commerce Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

SaaS Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Marketplace Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Startup Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Startup Financial Model Template

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart