Are you struggling to find the right financial audit software to streamline your auditing processes and ensure compliance with regulatory standards? Look no further! In today’s fast-paced business environment, selecting the best financial audit software is crucial for optimizing efficiency, accuracy, and transparency in your audit operations. With a myriad of options available on the market, navigating through the choices can be overwhelming. That’s why we’ve created this guide to help you make informed decisions and choose the best financial audit software solution for your organization’s needs.

From understanding the fundamentals of audit software to exploring key features, types, and implementation best practices, this guide covers everything you need to know to harness the power of technology and elevate your audit practices to new heights. Whether you’re a small business owner, a seasoned auditor, or a finance professional, this guide will equip you with the knowledge and insights to navigate the complex landscape of financial audit software and unlock its full potential for your organization. So, let’s dive in and discover the top financial audit software solutions that can revolutionize the way you conduct audits and drive success in your organization.

What is Financial Audit Software?

Financial audit software is a specialized digital tool designed to streamline and automate various aspects of the audit process within organizations. It leverages technology to facilitate tasks such as data analysis, risk assessment, documentation, and reporting, ultimately enhancing the efficiency, accuracy, and effectiveness of audit engagements.

At its core, financial audit software serves as a centralized platform for auditors to manage and execute audit procedures, enabling them to gather, analyze, and interpret financial data more efficiently than traditional manual methods. By automating repetitive tasks and providing advanced analytics capabilities, audit software empowers auditors to focus their efforts on value-added activities such as risk identification, process improvement, and strategic decision-making.

Financial audit software comes in various forms, ranging from on-premise solutions installed within an organization’s infrastructure to cloud-based platforms accessed via the internet. Regardless of the deployment model, the primary goal of audit software is to help organizations conduct audits more effectively, comply with regulatory requirements, and mitigate financial risks.

Importance of Using Financial Audit Software

Using financial audit software offers numerous benefits for organizations across various industries. Here are some key reasons why financial audit software is essential:

- Improved Efficiency: Audit software automates many manual and time-consuming tasks, such as data entry, analysis, and report generation, leading to significant time savings for auditors. By streamlining workflows and reducing administrative overhead, audit software allows auditors to focus their efforts on higher-value activities, such as data interpretation, risk assessment, and strategic planning.

- Enhanced Accuracy: Manual audit processes are prone to errors and inconsistencies, which can compromise the reliability and integrity of audit findings. Financial audit software helps minimize errors by standardizing procedures, enforcing compliance with audit standards, and providing built-in validation checks. By ensuring data accuracy and consistency, audit software enhances the credibility and reliability of audit reports.

- Greater Compliance: Regulatory compliance is a critical consideration for organizations in highly regulated industries such as finance, healthcare, and government. Financial audit software helps organizations comply with regulatory requirements by providing tools and templates for documenting audit procedures, tracking compliance activities, and generating regulatory reports. By automating compliance tasks and ensuring adherence to audit standards, audit software reduces the risk of non-compliance and associated penalties.

- Enhanced Data Analysis: With the growing volume and complexity of financial data, auditors need advanced analytics tools to uncover insights, identify patterns, and detect anomalies effectively. Financial audit software provides powerful data analysis capabilities, such as trend analysis, variance analysis, and predictive modeling, enabling auditors to gain deeper insights into financial performance, risks, and opportunities. By leveraging data analytics, audit software helps auditors make informed decisions and recommendations based on objective evidence and analysis.

- Improved Risk Management: Effective risk management is essential for safeguarding organizational assets, preserving stakeholder trust, and ensuring long-term sustainability. Financial audit software facilitates risk management by providing tools for assessing audit risks, identifying control weaknesses, and implementing mitigation strategies. By identifying and addressing risks proactively, audit software helps organizations minimize the likelihood and impact of adverse events, such as fraud, errors, and compliance violations.

Financial Audit Software Features and Functionality

The functionality of financial audit software extends across multiple dimensions, offering a comprehensive array of features to meet the diverse needs of auditors and financial professionals. Some of the key features include:

- Data Import and Integration: Seamless integration with accounting systems and data sources to import financial data for analysis.

- Risk Assessment Tools: Algorithms and methodologies for assessing audit risks, identifying areas of concern, and prioritizing audit procedures.

- Workflow Automation: Automation of repetitive audit tasks, such as data sampling, testing controls, and generating audit reports, to improve efficiency and reduce manual effort.

- Document Management: Centralized storage and management of audit documentation, workpapers, and supporting evidence, ensuring data integrity and accessibility.

- Analytics and Reporting: Advanced data analytics capabilities to analyze financial data, detect anomalies, and generate customizable reports and dashboards for stakeholders.

Types of Financial Audit Software

Financial audit software comes in various forms, each offering distinct advantages in terms of deployment model and functionality. The primary types of audit software include:

- On-premise Software: Installed and operated on local servers or computers within the organization’s premises, offering greater control and security over data but requiring upfront investment in hardware and IT infrastructure.

- Cloud-based Software: Hosted on remote servers and accessed via the internet, providing scalability, accessibility, and flexibility without the need for onsite hardware maintenance.

- Hybrid Solutions: Combining elements of both on-premise and cloud-based solutions, hybrid audit software offers the flexibility to choose the deployment model that best aligns with the organization’s requirements and preferences.

Common Components and Modules

Financial audit software typically consists of a set of common components and modules, each serving a specific function within the audit process. These components include:

- Audit Planning Module: Facilitates the definition of audit objectives, scope, and procedures, laying the groundwork for the audit engagement.

- Data Analysis Tools: Enable auditors to analyze financial data, detect patterns, trends, and anomalies, providing valuable insights into the financial health and performance of an organization.

- Risk Assessment Module: Helps auditors assess and prioritize audit risks, allowing them to focus their efforts on high-risk areas and allocate resources effectively.

- Document Management System: Provides a centralized repository for storing and managing audit documentation, workpapers, and supporting evidence, ensuring data integrity, accessibility, and compliance.

- Reporting Module: Enables auditors to generate customizable audit reports and dashboards, presenting audit findings, conclusions, and recommendations to stakeholders in a clear and concise manner.

Understanding these key components and functionalities is essential for selecting the right financial audit software that aligns with your organization’s needs and objectives. Whether you’re looking for a cloud-based solution for enhanced flexibility or an on-premise software for greater control, choosing the right audit software can significantly impact the efficiency and effectiveness of your audit processes.

Top Financial Audit Software

Selecting the right financial audit software is crucial for ensuring the success of your audit processes. With a plethora of options available on the market, it’s essential to identify the top solutions that best meet your organization’s needs and requirements. Here are some of the leading financial audit software solutions renowned for their robust features, reliability, and user satisfaction:

1. ACL Robotics

ACL Robotics is a Diligent product that contains analytics, robots, results, and storyboards. ACL Robotics is a powerful audit software solution designed to streamline data analysis, risk assessment, and compliance monitoring. With its advanced analytics capabilities and user-friendly interface, ACL Robotics enables auditors to extract insights from large volumes of financial data, identify anomalies, and detect fraudulent activities efficiently. The software offers a range of features, including data import/export, workflow automation, customizable reporting, and audit trail tracking, making it an ideal choice for organizations seeking to enhance audit efficiency and effectiveness.

2. TeamMate+ Audit

TeamMate+ Audit is a comprehensive audit management platform trusted by organizations worldwide for its scalability, flexibility, and ease of use. With its intuitive interface and robust feature set, TeamMate+ Audit enables auditors to streamline audit planning, execution, and reporting processes seamlessly. The software offers a range of functionalities, including risk assessment, workpaper management, issue tracking, and integrated analytics, empowering auditors to conduct audits more efficiently and effectively. Additionally, TeamMate+ Audit provides customizable templates, built-in best practices, and industry-specific solutions to meet the unique needs of various sectors, including finance, healthcare, and government.

3. Wolters Kluwer TeamMate Analytics

Wolters Kluwer TeamMate Analytics is a powerful data analysis tool designed to enhance audit efficiency, accuracy, and insight generation. Leveraging advanced analytics techniques and predefined tests, TeamMate Analytics enables auditors to extract valuable insights from financial data, identify trends, anomalies, and outliers, and detect potential risks and control weaknesses. The software offers a user-friendly interface, customizable dashboards, and a vast library of audit tests, making it an indispensable tool for auditors seeking to improve audit quality and effectiveness.

4. Caseware IDEA

Caseware IDEA is a leading audit software solution trusted by auditors, accountants, and finance professionals worldwide for its robust data analysis capabilities and intuitive interface. With its powerful analytics engine and built-in automation features, Caseware IDEA allows auditors to perform complex data analysis tasks, such as trend analysis, sampling, and stratification, with ease. The software offers a range of functionalities, including data import/export, workflow automation, customizable reporting, and visualization tools, making it a valuable asset for organizations seeking to enhance audit efficiency and effectiveness.

5. AuditBoard

AuditBoard is a cloud-based audit management platform designed to streamline audit processes, enhance collaboration, and ensure compliance with regulatory requirements. With its intuitive interface and robust feature set, AuditBoard enables auditors to manage audit planning, execution, and reporting tasks efficiently. The software offers a range of functionalities, including risk assessment, workpaper management, issue tracking, and integrated analytics, making it an ideal choice for organizations seeking to modernize their audit practices and drive continuous improvement.

6. Thomson Reuters Checkpoint Engage

Thomson Reuters Checkpoint Engage is a cloud-based audit solution designed to streamline audit workflows, enhance collaboration, and improve efficiency. With its intuitive interface and robust feature set, Checkpoint Engage enables auditors to perform risk assessments, plan audits, document findings, and generate reports seamlessly. The software offers advanced analytics capabilities, customizable templates, and integration with leading accounting platforms, making it a preferred choice for organizations seeking to elevate their audit practices.

7. SAP Audit Management

SAP Audit Management is an integrated audit solution that enables organizations to manage the entire audit lifecycle efficiently. With its comprehensive suite of features, SAP Audit Management empowers auditors to plan audits, execute audit procedures, and track audit findings in real-time. The software offers advanced reporting capabilities, workflow automation, and integration with SAP’s enterprise resource planning (ERP) systems, providing organizations with a centralized platform for managing audit activities and ensuring compliance with regulatory requirements.

8. Workiva Wdesk

Workiva Wdesk is a cloud-based platform that offers a wide range of solutions, including financial reporting, compliance management, and audit preparation. With its intuitive interface and collaborative features, Wdesk enables auditors to streamline audit processes, improve transparency, and enhance accountability. The software offers advanced data visualization tools, workflow automation, and integration with leading ERP systems, making it a preferred choice for organizations seeking to modernize their audit practices and drive digital transformation.

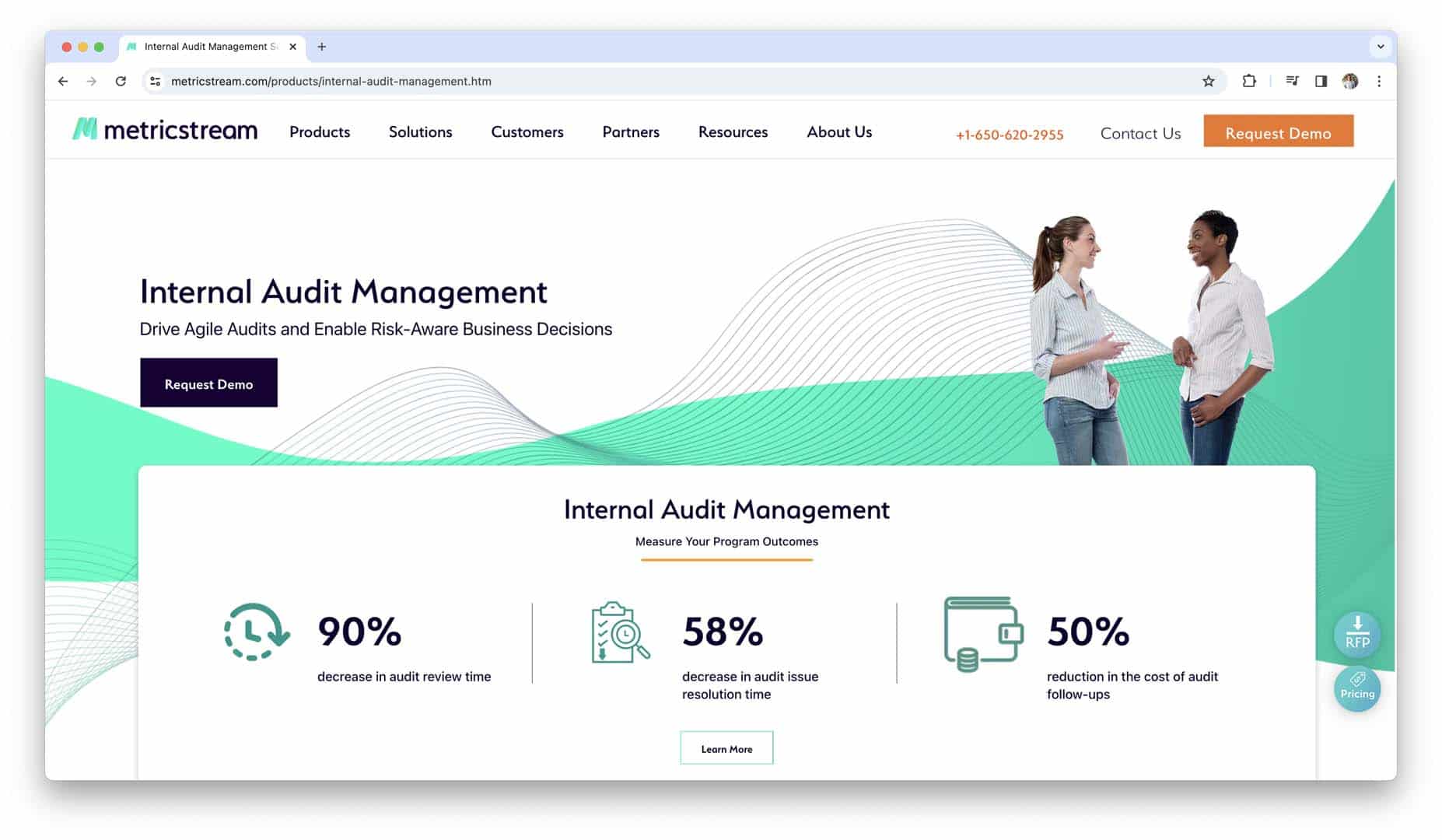

9. MetricStream Audit Management

MetricStream Audit Management is a comprehensive audit solution that helps organizations manage the entire audit lifecycle effectively. With its user-friendly interface and configurable workflows, MetricStream Audit Management enables auditors to plan audits, conduct fieldwork, and track audit findings with ease. The software offers advanced analytics capabilities, risk assessment tools, and integration with enterprise systems, providing organizations with the insights and visibility they need to drive audit excellence and improve business performance.

10. Microsoft Dynamics 365 Finance and Operations

Microsoft Dynamics 365 Finance and Operations is an integrated business management solution that includes audit management capabilities. With its robust feature set and seamless integration with Microsoft Office 365, Dynamics 365 Finance and Operations enable auditors to streamline audit processes, automate repetitive tasks, and improve collaboration. The software offers advanced analytics, workflow automation, and role-based access controls, making it a preferred choice for organizations seeking to enhance audit efficiency and compliance.

How to Choose a Financial Audit Software?

Selecting the right financial audit software is a critical decision that can significantly impact the efficiency, accuracy, and compliance of your audit processes. Before making a choice, there are several key factors you should consider to ensure that the software aligns with your organization’s needs and objectives.

Compliance Requirements

Compliance with regulatory standards and requirements is paramount in the audit process, especially in highly regulated industries such as finance and healthcare. Before choosing audit software, assess the specific compliance requirements relevant to your organization, including regulatory standards such as Generally Accepted Auditing Standards (GAAS), International Standards on Auditing (ISA), and industry-specific regulations. Ensure that the software you select is capable of supporting compliance efforts and facilitating adherence to regulatory guidelines.

Scalability and Flexibility

As your organization grows and evolves, your audit software needs may change. It’s essential to choose a solution that is scalable and flexible enough to accommodate future growth and adapt to changing business requirements. Consider factors such as the number of users, volume of transactions, and expansion into new markets or business lines. Look for audit software that can scale seamlessly to meet your organization’s evolving needs without disrupting existing workflows or requiring significant investments in additional infrastructure.

Integration Capabilities

Integration with other systems and software applications is crucial for seamless data flow and process efficiency. Evaluate the integration capabilities of audit software solutions to ensure compatibility with your existing technology stack, including accounting systems, ERP software, and other relevant tools. Look for software that offers robust APIs, data connectors, and integration frameworks to facilitate seamless data exchange and interoperability across different platforms. By integrating audit software with your existing systems, you can streamline data sharing, eliminate manual data entry, and improve overall process efficiency.

User Interface and Ease of Use

The usability and intuitiveness of the software interface play a significant role in user adoption and productivity. Choose audit software with a clean, user-friendly interface and intuitive navigation to minimize the learning curve for auditors and other stakeholders. Look for features such as customizable dashboards, drag-and-drop functionality, and role-based access controls to enhance usability and efficiency. Conduct user testing and gather feedback from potential users to ensure that the software meets their needs and preferences in terms of usability and user experience.

Security Features

Data security is a top priority when it comes to audit software, given the sensitivity and confidentiality of financial information. Evaluate the security features offered by audit software solutions to ensure protection against unauthorized access, data breaches, and cyber threats. Look for software that employs robust encryption techniques, access controls, audit trails, and regular security updates to safeguard sensitive data and ensure compliance with data protection regulations. Additionally, consider factors such as data residency requirements and the vendor’s security certifications and compliance frameworks to ensure that your data is stored and managed securely.

Cost and Budgetary Considerations

Budgetary constraints are an important consideration when selecting audit software for your organization. Evaluate the total cost of ownership, including upfront license fees, implementation costs, ongoing maintenance fees, and any additional expenses such as training and support. Consider your organization’s budgetary constraints and ROI expectations to ensure that the chosen software solution delivers value for money. Compare pricing plans, licensing models, and subscription options offered by different vendors to find a solution that aligns with your budget and provides the features and functionality you need without unnecessary overhead costs.

Customer Support and Training Options

Effective customer support and comprehensive training options are essential for maximizing the value of audit software and ensuring a smooth implementation process. Look for vendors that offer responsive customer support services, including email, phone, and live chat support, to address any technical issues or questions that may arise during the use of the software. Additionally, inquire about training options, user documentation, and online resources provided by the vendor to support users in learning how to use the software effectively. Consider factors such as vendor reputation, response times, and availability of dedicated support channels to ensure that you have access to the assistance and resources you need to succeed with your audit software implementation.

How to Implement a Financial Audit Software?

Implementing financial audit software is a pivotal step in enhancing the efficiency and effectiveness of your organization’s audit processes. A successful implementation requires careful planning, thorough execution, and ongoing evaluation to ensure that the software meets your organization’s needs and delivers the intended benefits. Let’s explore the key steps involved in implementing financial audit software.

Pre-Implementation Preparation

Before embarking on the implementation of financial audit software, it’s essential to engage in thorough pre-implementation preparation to set the stage for success.

- Assessing Current Processes: Conduct a comprehensive review of your organization’s existing audit processes, workflows, and technology infrastructure to identify areas for improvement and optimization. Gain a clear understanding of the current pain points, challenges, and inefficiencies that the new software solution aims to address.

- Defining Objectives and Goals: Clearly define the objectives, goals, and success criteria for the implementation of financial audit software. Determine the specific outcomes you aim to achieve, such as improved efficiency, enhanced data accuracy, increased compliance, or cost savings. Align these objectives with your organization’s strategic priorities and long-term vision.

- Selecting a Vendor: Research and evaluate different audit software vendors to identify the solution that best aligns with your organization’s needs and requirements. Consider factors such as functionality, scalability, integration capabilities, security features, pricing, and vendor reputation. Engage with potential vendors through product demos, consultations, and reference checks to ensure a good fit for your organization.

Implementation Process

The implementation process involves the actual deployment and configuration of the financial audit software within your organization.

- Installation and Configuration: Install the audit software according to the vendor’s instructions and configure it to align with your organization’s specific requirements and preferences. Customize settings, workflows, and user permissions to optimize the software for your audit processes and organizational structure.

- Data Migration: Transfer existing audit data, documentation, and workpapers from legacy systems or manual processes to the new audit software. Ensure data integrity, accuracy, and completeness throughout the migration process to avoid discrepancies or data loss. Conduct thorough testing and validation to verify the accuracy and consistency of migrated data.

- Training and Onboarding: Provide comprehensive training and onboarding programs to familiarize audit staff and stakeholders with the new software solution. Offer hands-on training sessions, user guides, tutorials, and online resources to ensure that users understand how to effectively use the software to perform their roles and responsibilities. Encourage active participation, feedback, and continuous learning to promote user adoption and proficiency.

Post-Implementation Considerations

Once the financial audit software has been successfully implemented, it’s essential to transition into the post-implementation phase to monitor performance, address any issues or challenges, and optimize the software for continued success. This phase involves several key considerations, including:

- Monitoring and Evaluation: Continuously monitor the performance and effectiveness of the audit software in achieving the desired outcomes and objectives. Track key metrics, such as audit cycle time, error rates, compliance levels, and user satisfaction, to assess the impact of the software on audit processes and organizational performance. Identify areas for improvement and optimization based on feedback from users and stakeholders.

- Continuous Improvement Strategies: Implement ongoing improvement initiatives to enhance the functionality, usability, and value of the audit software over time. Regularly review and update audit processes, workflows, and configurations to incorporate best practices, address evolving business needs, and capitalize on new features or capabilities introduced by the software vendor. Foster a culture of innovation, collaboration, and continuous learning to drive ongoing improvement and innovation in audit practices.

By following these steps and considerations, you can ensure a smooth and successful implementation of financial audit software within your organization, leading to improved efficiency, accuracy, and compliance in your audit processes.

Financial Audit Software Best Practices

Implementing financial audit software is just the first step towards enhancing your organization’s audit processes. To truly maximize the benefits of the software and drive continuous improvement, it’s essential to adopt best practices that optimize its usage and effectiveness.

- Establish Standard Operating Procedures: Develop standardized audit procedures and workflows within the software to ensure consistency, efficiency, and compliance across audit engagements. Clearly define roles, responsibilities, and expectations for audit staff, and document best practices for conducting audits, documenting findings, and generating reports.

- Regular Software Updates and Maintenance: Stay current with software updates, patches, and enhancements released by the vendor to ensure that your audit software remains up-to-date with the latest features, bug fixes, and security patches. Establish a schedule for regular maintenance activities, such as database optimization, performance tuning, and data backups, to keep the software running smoothly and prevent downtime or data loss.

- Utilize Advanced Features: Take advantage of advanced features and capabilities offered by the audit software to enhance audit efficiency and effectiveness. Explore features such as advanced analytics, artificial intelligence, machine learning, and predictive modeling to gain deeper insights into financial data, detect patterns, trends, and anomalies, and identify areas for improvement or risk mitigation.

- Data Security Measures: Implement robust data security measures to protect sensitive financial information stored within the audit software. Encrypt data in transit and at rest, enforce access controls and user permissions, and monitor user activity to prevent unauthorized access, data breaches, and cyber threats. Regularly review and update security policies, procedures, and controls to address emerging threats and vulnerabilities.

- Staff Training and Development: Invest in ongoing training and professional development programs to empower audit staff with the knowledge, skills, and expertise needed to leverage the full potential of the audit software. Provide opportunities for hands-on training, certifications, and skill-building workshops to enhance technical proficiency, audit methodology, and industry knowledge. Encourage collaboration, knowledge sharing, and peer learning to foster a culture of continuous improvement and innovation.

By adopting these best practices, you can unlock the full potential of your financial audit software and drive tangible improvements in audit efficiency, accuracy, and compliance. As technology continues to evolve and audit practices evolve, staying abreast of emerging trends, best practices, and industry standards will be essential for maximizing the benefits of audit software and maintaining a competitive edge in today’s dynamic business landscape.

Conclusion

Selecting the right financial audit software is a critical decision that can have a profound impact on the efficiency, accuracy, and compliance of your audit processes. By understanding the key features, types, and factors to consider, you can make informed decisions and choose the best software solution that aligns with your organization’s needs and objectives. Whether you opt for a cloud-based platform or an on-premise solution, the goal remains the same: to streamline audit workflows, enhance data analysis, and improve risk management. With the right financial audit software in place, you can unlock new levels of efficiency, transparency, and effectiveness in your audit operations, empowering your organization to thrive in today’s dynamic business environment.

In today’s digital age, leveraging technology is essential for staying ahead of the curve and driving success in your organization. Financial audit software offers a powerful suite of tools and capabilities to help you navigate the complexities of modern auditing and achieve your business objectives with confidence. By embracing innovation, adopting best practices, and investing in the right software solution, you can elevate your audit practices to new heights and position your organization for long-term growth and sustainability. So, whether you’re a small business looking to streamline your audit processes or a large enterprise seeking to enhance compliance and risk management, the journey to success begins with choosing the best financial audit software that meets your unique needs and empowers you to achieve your goals.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.