Are you looking for a reliable way to process payments online? Whether you’re starting a new business or looking to improve your existing payment system, choosing the right payment gateway is crucial for ensuring smooth transactions. Payment gateways are the backbone of any online business, securely handling customer payments and making it easy for you to get paid.

With so many options out there, it can be overwhelming to decide which one is best for your needs. This guide will walk you through the top payment gateways available, explaining their features, benefits, and what makes them stand out, so you can make an informed decision and keep your business running smoothly.

What is a Payment Gateway?

A payment gateway is a technology that facilitates the secure processing of online transactions between customers and businesses. It acts as the bridge between the buyer, their bank, and the merchant’s bank, ensuring that sensitive payment data is transferred securely while allowing payments to be approved and processed in real-time. In simpler terms, a payment gateway enables businesses to accept payments online and ensures that transactions are carried out smoothly, safely, and efficiently.

What do Payment Gateways do?

The primary function of a payment gateway is to securely transmit payment information between the customer and the payment processor. When a customer decides to make a purchase, the payment gateway encrypts sensitive data, such as credit card information, and sends it to the payment processor. The processor then communicates with the customer’s bank to verify the payment. If everything checks out, the funds are transferred to the merchant’s account.

Payment gateways also help prevent fraud by incorporating security measures such as encryption, fraud detection, and compliance with industry standards like PCI-DSS (Payment Card Industry Data Security Standard).

Importance of Payment Gateways

- Secure Transactions: Payment gateways ensure that sensitive customer information, like credit card details, is encrypted and transmitted safely.

- Instant Transaction Approval: They enable real-time approval of payments, allowing customers to quickly complete their purchases.

- Global Reach: Payment gateways support transactions in multiple currencies and payment methods, enabling businesses to serve international markets.

- Convenience: They streamline the checkout process, reducing friction and improving customer satisfaction.

- Business Growth: By enabling online payments, payment gateways allow businesses to tap into e-commerce, opening new revenue streams.

How Payment Gateways Contribute to Business Success and Customer Experience

- Higher Conversion Rates: A seamless and secure checkout process minimizes friction, leading to more completed transactions and fewer abandoned carts.

- Building Customer Trust: A trusted and secure payment gateway boosts consumer confidence, encouraging repeat business and improving overall customer loyalty.

- Speed and Efficiency: Payment gateways process transactions almost instantly, improving cash flow and ensuring that businesses don’t experience delays in receiving funds.

- Scalability: As businesses grow, payment gateways provide the flexibility to handle increasing transaction volumes and expand to new markets without added complexity.

- Enhanced Customer Experience: By offering multiple payment options (credit cards, digital wallets, etc.), gateways make the payment process more convenient, catering to the preferences of diverse customers.

Payment Gateways vs Payment Processors

While the terms “payment gateway” and “payment processor” are often used interchangeably, they refer to different components in the payment processing ecosystem.

Payment Gateway: The gateway is responsible for securely transmitting transaction data between the customer and the merchant. It encrypts sensitive information, such as credit card details, and communicates with the payment processor to initiate a transaction. It’s essentially the point of entry for a transaction.

Payment Processor: The payment processor is responsible for managing the transaction once the data is sent by the payment gateway. It facilitates communication between the customer’s bank (or card issuer) and the merchant’s bank. The processor handles the actual movement of funds from the customer’s account to the merchant’s account.

In short, the payment gateway is the digital “front door” to the transaction, while the payment processor is the system that ensures the transfer of funds is successful after the gateway has handled the secure transmission of data.

Benefits of Using the Right Payment Gateway

Choosing the right payment gateway for your business can lead to several important benefits that directly affect your bottom line, customer experience, and overall efficiency. Here’s why getting it right is so crucial:

- Higher Conversion Rates: A smooth, secure, and easy checkout process reduces cart abandonment and encourages more customers to complete their purchases.

- Improved Customer Trust: Customers are more likely to trust your business if they see that you use a reputable and secure payment gateway, enhancing your brand’s credibility.

- Seamless User Experience: A payment gateway that integrates well with your platform ensures that customers enjoy a frictionless experience, leading to higher satisfaction and loyalty.

- Increased International Reach: Supporting a variety of payment methods, including international currencies, opens the door to a broader audience, especially if you’re looking to expand your global customer base.

- Reduced Risk of Fraud: With built-in fraud detection tools and encryption methods, a secure payment gateway helps protect your business and customers from potential security breaches.

- Better Cash Flow: A payment gateway that offers faster payment processing and quick payouts ensures that your business has steady cash flow, allowing you to manage your finances more effectively.

- Scalability: The right payment gateway can scale with your business as it grows, handling higher transaction volumes and expanding to support new payment methods and regions.

- Reduced Administrative Burden: Payment gateways often come with detailed reporting and automated tools for managing refunds, chargebacks, and transaction logs, reducing the amount of manual work for your team.

- Ongoing Support: Quality customer support ensures that any issues are resolved quickly, minimizing downtime and potential lost revenue.

Top Payment Gateways

Choosing the right payment gateway can make a significant difference in how your business handles transactions and interacts with customers. The top payment gateways offer a combination of security, ease of use, flexibility, and features that cater to businesses of all sizes. Below, we’ll explore some of the most well-known payment gateways and what they bring to the table.

PayPal

PayPal is one of the most widely recognized and used payment gateways globally. It’s a go-to solution for many businesses, especially those just starting out or those operating internationally. With over 200 million active users, PayPal offers a level of trust and recognition that can boost consumer confidence, which is crucial for increasing conversion rates.

PayPal allows businesses to accept payments from a variety of sources, including credit and debit cards, PayPal accounts, and even e-checks. One of the key benefits of PayPal is its simplicity. Setting up an account is straightforward, and integrating it into your website or e-commerce platform doesn’t require any advanced technical skills. For businesses selling internationally, PayPal’s support for over 100 currencies and its global reach make it an excellent choice.

While PayPal’s fees can be a bit higher than some other payment gateways, especially for international transactions, the trade-off is the reliability and ease of use it offers, making it a strong option for small and medium-sized businesses looking for quick, efficient solutions.

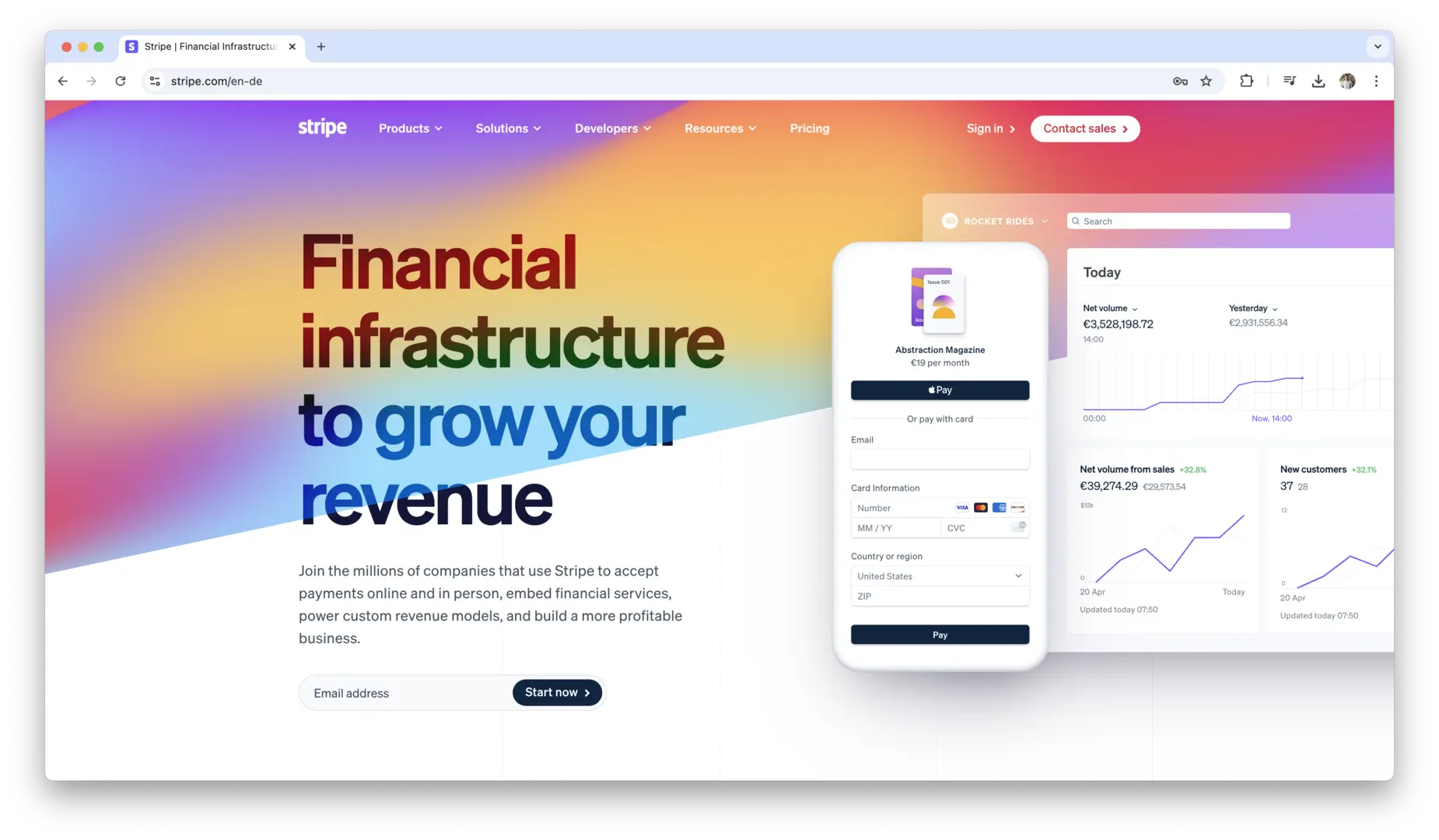

Stripe

Stripe is another hugely popular payment gateway that is especially favored by developers and businesses with specific customization needs. Unlike PayPal, which is primarily focused on simplicity, Stripe is designed to offer more flexibility for businesses that want to build a tailored payment experience. It provides extensive developer tools, APIs, and support for custom integrations, which makes it a great option for tech-savvy businesses or those with complex needs.

Stripe supports a wide variety of payment methods, including credit and debit cards, Apple Pay, Google Pay, and even cryptocurrency payments. Its international capabilities are also robust, supporting payments in over 135 currencies. Stripe’s transparent pricing model (a flat percentage per transaction) is appealing for businesses that prefer a straightforward fee structure.

One standout feature of Stripe is its Radar fraud prevention system, which uses machine learning to detect and block fraudulent transactions in real time. It also integrates seamlessly with many popular e-commerce platforms and offers additional services like Stripe Atlas for setting up international businesses and Stripe Connect for managing payments in marketplaces.

Square

Square is particularly well-known for providing an all-in-one solution for both online and offline transactions. If you run a brick-and-mortar store and need a payment gateway that can handle both in-person and online payments, Square is an excellent choice. Square has made its name with a simple, transparent pricing model—there are no monthly fees for its basic payment services, and it charges a flat rate per transaction.

Square offers a free point-of-sale (POS) system that includes everything a physical store might need: a card reader, a mobile app, and the ability to track inventory. Its online payment gateway is also robust, with features like custom checkout pages, mobile payment acceptance, and the ability to support various payment methods such as credit cards, debit cards, and digital wallets like Apple Pay.

While Square is ideal for small businesses, particularly in the retail and food service industries, its growing suite of tools—including payroll management and e-commerce features—also make it a viable choice for larger businesses looking for a scalable payment solution.

Authorize.Net

Authorize.Net has been around for over 20 years, making it one of the most established names in the payment gateway industry. This long track record means that businesses can trust Authorize.Net to handle their transactions securely and efficiently. Authorize.Net offers a full suite of payment services, including recurring billing, invoicing, and fraud prevention tools, making it a great fit for businesses with a diverse range of needs.

One of the standout features of Authorize.Net is its ability to accept payments through multiple channels—whether that’s online, in-person, or over the phone. This flexibility makes it an ideal solution for businesses that have both an e-commerce presence and physical locations. It also supports a wide range of payment methods, including credit cards, debit cards, digital wallets, and e-checks.

Pricing is generally competitive, but Authorize.Net’s setup fees and monthly costs may make it less appealing for small businesses compared to some other payment gateways. However, for larger businesses or those needing advanced features like fraud prevention, recurring billing, or detailed reporting, Authorize.Net is a solid choice.

Braintree

Braintree, a PayPal service, is a powerful payment gateway that caters to businesses of all sizes, from startups to large enterprises. Known for its ease of integration and flexible payment options, Braintree allows merchants to accept payments via credit cards, PayPal, Apple Pay, Google Pay, and even Venmo (in the U.S.). Braintree stands out for its ability to accept mobile and web payments, particularly for subscription-based businesses or marketplaces.

Braintree offers a seamless checkout experience, providing features like One-Touch payments, which allow customers to complete transactions quickly using saved payment information across mobile apps. It also has strong fraud protection tools, including advanced fraud protection and machine learning tools that help identify and block fraudulent transactions.

What makes Braintree unique is its focus on international payment processing, allowing businesses to accept payments from over 130 currencies. Additionally, Braintree is known for its developer-friendly tools, making it an attractive choice for businesses looking for a highly customizable and scalable solution.

Adyen

Adyen is a global payment gateway that’s particularly strong in the enterprise sector. It offers a unified platform that supports a wide range of payment methods, including credit cards, debit cards, and local payment methods like iDEAL in the Netherlands or Alipay in China. Adyen is especially popular with large businesses and multinational corporations due to its ability to handle high-volume transactions and complex payment needs.

Adyen provides a single solution for accepting payments both online and in-store, which is appealing for businesses looking to manage all of their payment processes in one place. Its dashboard gives merchants deep insights into their transaction data, allowing them to optimize their payment strategies and reduce friction in the customer checkout experience.

The platform also offers advanced fraud prevention, multi-currency support, and the ability to handle chargebacks, making it a great choice for businesses looking for a high level of control and security over their transactions. However, due to its focus on larger businesses, Adyen’s pricing model and features may not be the best fit for smaller companies.

2Checkout (now Verifone)

2Checkout, now rebranded as Verifone, is a global payment gateway that supports transactions in over 200 countries and accepts more than 45 currencies. It’s an ideal choice for businesses looking to sell internationally, with a strong focus on simplifying the process for both merchants and customers.

2Checkout offers multiple payment methods, including credit and debit cards, PayPal, and local payment methods like Alipay. It also includes features like recurring billing, subscriptions, and an affiliate management system to help businesses manage recurring payments and commission-based models. One of its standout features is its easy integration with a wide variety of shopping carts and platforms.

For larger businesses or those with a global customer base, 2Checkout provides advanced reporting tools and a fraud detection system to protect both merchants and customers.

Razorpay

Razorpay is a payment gateway that is quickly gaining popularity, especially in India and other emerging markets. It supports payments in multiple currencies and provides businesses with a wide range of payment options, including credit cards, debit cards, net banking, and UPI (Unified Payments Interface) for the Indian market.

One of Razorpay’s standout features is its ability to integrate seamlessly with both online and offline systems. The gateway is highly scalable, making it a great option for businesses that plan to grow. Razorpay also provides customized solutions, such as RazorpayX, which is designed for businesses that need advanced financial features like managing accounts and payroll.

WePay

WePay, owned by JPMorgan Chase, is a strong contender in the payment gateway space, especially for platform businesses like marketplaces, crowdfunding sites, and software providers. It offers robust white-label payment solutions, allowing businesses to provide a seamless payment experience without the customer ever seeing the gateway’s branding.

WePay’s primary advantage is its ability to handle complex transaction flows, including split payments and payouts, making it perfect for businesses that need to manage payments between multiple parties. The platform also supports recurring billing and fraud prevention tools, which help protect businesses from chargebacks and unauthorized transactions.

Worldpay

Worldpay is a leading payment gateway with a global reach, processing payments in over 120 countries. The gateway supports a wide variety of payment methods, including credit and debit cards, digital wallets, and local payment methods in several regions.

Worldpay stands out for its versatility and scalability, making it ideal for businesses of all sizes. The platform also offers advanced fraud protection, recurring billing, and integration with over 40 different shopping carts. Its global presence is especially valuable for businesses looking to expand internationally, as it offers solutions tailored to local markets and currencies.

Payoneer

Payoneer is a popular payment gateway for global businesses and freelancers. It allows businesses to send and receive payments from clients and customers worldwide, supporting cross-border transactions in multiple currencies.

Payoneer provides a multi-currency e-wallet that lets users hold and convert funds in over 150 currencies. It’s particularly useful for businesses that need to deal with international customers and vendors, making it a strong choice for B2B transactions. Payoneer also offers a global payout service, which helps businesses streamline cross-border payments to suppliers or affiliates.

Skrill

Skrill is another global payment gateway that offers a range of services, including sending and receiving payments, storing funds in an e-wallet, and making international transfers. It supports a variety of payment methods, including credit and debit cards, bank transfers, and Skrill’s e-wallet.

Skrill is particularly attractive to digital merchants, as it supports digital goods, cryptocurrency payments, and instant transactions. It’s a solid choice for businesses that want to expand their international reach while offering customers a wide range of payment options. Skrill also offers a robust fraud prevention system, ensuring transactions are secure and reducing the risk of chargebacks.

Mollie

Mollie is a payment gateway that emphasizes simplicity and ease of use. It is ideal for businesses in the EU and has grown rapidly due to its ability to offer fast, secure payment solutions. Mollie supports all major payment methods, including credit and debit cards, digital wallets, and local European payment methods like SEPA and iDEAL.

Mollie’s easy-to-understand pricing model and user-friendly interface make it a great option for small and medium-sized businesses that need a straightforward, reliable solution for processing payments. It also offers advanced features like recurring billing, multi-currency support, and integrations with popular e-commerce platforms.

Checkout.com

Checkout.com is a leading payment gateway that specializes in providing high-performance payment processing for both businesses and enterprises. With a global reach and robust features, Checkout.com supports payments in over 150 currencies and offers flexible solutions for a range of industries, including retail, travel, and digital services.

Checkout.com integrates seamlessly with a variety of platforms and offers advanced features like real-time payment tracking, fraud prevention, and subscription billing. Its focus on global payments and flexibility makes it an ideal choice for businesses that want to scale rapidly and reach customers worldwide.

Shopify Payments

Shopify Payments is the native payment solution offered by the popular e-commerce platform Shopify. It’s an integrated payment gateway that simplifies the payment process for Shopify merchants by eliminating the need for third-party payment providers. Shopify Payments supports credit and debit cards, Apple Pay, and Google Pay and integrates seamlessly with Shopify’s storefront.

One of the biggest advantages of Shopify Payments is that it provides no transaction fees for Shopify merchants who use the platform’s native payment gateway. This makes it a cost-effective solution for e-commerce businesses. Shopify Payments also offers robust fraud prevention tools, automated chargeback protection, and multi-currency support, which is particularly useful for merchants who sell internationally.

BlueSnap

BlueSnap is a versatile payment gateway that provides businesses with a global payments platform capable of handling a wide variety of transactions, including one-time payments, recurring billing, and subscription services. It supports over 100 currencies and a broad range of payment methods, including credit and debit cards, PayPal, and Apple Pay.

BlueSnap is an excellent choice for businesses looking for a comprehensive solution with built-in fraud protection and a variety of reporting tools. It also integrates with e-commerce platforms and provides a simple API for businesses that need custom solutions. BlueSnap’s merchant dashboard provides insights into customer behavior, helping businesses optimize their payment strategies.

These payment gateways represent the best of the best in terms of features, security, and ease of use. When selecting a payment gateway for your business, it’s important to consider the specific needs of your business model, customer preferences, and the countries or regions you operate in. Whether you’re a small business owner looking for simplicity or an enterprise needing advanced payment solutions, there’s a payment gateway that can fit your needs perfectly.

How to Choose the Best Payment Gateway?

Selecting the right payment gateway for your business is a crucial decision that can influence not just how you handle transactions but also how you interact with your customers. There are several key factors that will help you determine which payment gateway is the best fit. These include security features, supported payment methods, ease of integration, transaction fees, and customer support. Let’s break each of these down in more detail.

Security Features and Compliance

When it comes to handling payments online, security should be your top priority. Payment gateways are responsible for processing sensitive customer data, including credit card information, addresses, and sometimes even personal identification numbers. Therefore, you must choose a payment gateway that complies with stringent security standards to ensure customer data is protected.

The most widely recognized standard is PCI DSS (Payment Card Industry Data Security Standard). This is a set of guidelines designed to protect cardholder data from fraud, hacking, and data breaches. A payment gateway that is PCI DSS compliant guarantees that they meet the industry’s highest security standards, which include secure encryption and proper data storage techniques.

Additionally, many payment gateways offer fraud detection tools, including machine learning algorithms that can identify suspicious transactions in real-time. These tools analyze patterns of transactions to detect fraud, preventing unauthorized payments before they even occur. Look for features like 3D Secure, a protocol that adds an extra layer of authentication when customers make payments. This process helps ensure that the person making the payment is the legitimate cardholder.

Payment Methods Supported

Another important factor to consider is the range of payment methods supported by the gateway. The more options you provide your customers, the more convenient their experience will be. A diverse payment method offering helps cater to different customer preferences, especially in today’s global market.

The most common types of payment methods include:

- Credit and Debit Cards: Visa, Mastercard, American Express, and Discover are the main players in this category.

- Mobile Wallets: As digital wallets like Apple Pay, Google Pay, and Samsung Pay become more popular, it’s important for your payment gateway to integrate with these services. These wallets offer convenience and security for customers who prefer not to enter their card details every time they make a purchase.

- Bank Transfers: Some customers prefer paying directly from their bank accounts. Look for gateways that support this, especially if you have a B2B model where customers may place large orders.

- Alternative Payments: Depending on your market, you might also want to offer payment methods such as PayPal, Alipay, or even cryptocurrencies like Bitcoin. As alternative payment methods grow in popularity, especially in international markets, it’s a good idea to offer these options when possible.

Having a payment gateway that supports a wide range of payment methods can help increase your conversion rates, reduce cart abandonment, and expand your reach to customers across the world.

Integration Ease with Existing Platforms

Once you’ve selected a payment gateway, integrating it into your business infrastructure should be a seamless process. Whether you’re using an e-commerce platform like Shopify, WooCommerce, or Magento, or have a custom-built website, you’ll want a payment gateway that integrates effortlessly with your platform.

Some payment gateways offer plugins or pre-built integrations with popular platforms, which significantly reduce the complexity of setup. For instance, Stripe and PayPal are often built into platforms like WooCommerce and Shopify, allowing you to simply add your account information and start processing payments almost immediately.

If your business is more complex or uses a custom-built website, you may require a payment gateway that offers APIs (Application Programming Interfaces) for deeper customization. APIs allow developers to modify the gateway’s functionality to suit specific needs, whether it’s adjusting the checkout process or integrating it with your CRM or accounting system.

It’s also worth considering the quality of the documentation provided by the payment gateway. Well-written, clear documentation can make the integration process smoother and faster, saving time for both developers and business owners.

Transaction Fees and Pricing Models

The cost of using a payment gateway is another major factor in your decision. Payment gateways typically charge transaction fees, which are either a flat rate or a percentage of the transaction amount. These fees can range from 2% to 3% per transaction for credit card payments, and some gateways charge additional fees for features like currency conversion or chargebacks.

Besides transaction fees, many payment gateways also charge monthly fees, setup fees, or annual fees. It’s crucial to evaluate the full pricing structure to ensure there are no hidden costs that could eat into your profits. Some payment gateways also offer tiered pricing models where the cost per transaction decreases as your sales volume increases, which can be beneficial for businesses with high transaction volumes.

When comparing pricing, consider factors like volume discounts, free trials, or per-transaction pricing. Some gateways may offer competitive rates for low-volume businesses, but those same fees may increase as your transaction volume grows, so it’s important to look at long-term costs and scalability.

Lastly, be mindful of refund and chargeback fees, as these can add up quickly, especially if your business has a higher number of returns. Some gateways may charge a flat fee or percentage for each refund or chargeback, while others may have specific policies in place to minimize those costs.

Customer Support and Reliability

The reliability of your payment gateway is paramount—especially when handling sensitive financial transactions. You need a gateway that processes payments smoothly, every time. Any issues with downtime or transaction errors could result in lost sales and frustrated customers.

Look for payment gateways that offer 24/7 customer support. Ideally, the support should be available via multiple channels, including phone, email, and live chat. Check customer reviews and testimonials to gauge how responsive and helpful the support team is in resolving issues quickly.

Some payment gateways also offer detailed reporting and analytics, which can be useful for tracking transactions, monitoring performance, and identifying potential problems before they escalate. Having access to real-time data on transaction status and payment processing can help you address issues proactively and ensure smooth operation.

Reliability also extends to uptime. A payment gateway with frequent downtime or slow processing speeds can hurt your business, especially if it disrupts the customer checkout experience. Before committing to a provider, research their reputation for reliability and check their uptime guarantees.

In addition to reliability, the level of customer support offered can make a huge difference. Choose a payment gateway that is responsive, knowledgeable, and able to provide quick resolutions if something goes wrong with a transaction or integration. The quicker issues are resolved, the better your overall business performance and customer satisfaction will be.

By considering these factors—security, payment methods, ease of integration, pricing, and customer support—you can confidently select the payment gateway that fits your business needs. Making a smart choice here will ensure smooth transactions, happier customers, and a more efficient business operation.

How to Integrate a Payment Gateway into Your Website?

Integrating a payment gateway into your website might seem like a daunting task, but most payment providers offer straightforward steps to guide you through the process. With the right tools and a bit of attention to detail, you can start processing payments in no time. The integration method varies depending on the payment gateway you choose, but here’s an overview of the general steps involved:

- Sign up for a payment gateway account and obtain your API keys or merchant credentials.

- Choose a payment gateway that integrates easily with your website platform (such as WooCommerce, Shopify, or Magento) or a custom solution.

- If using a plugin or integration, install and activate it on your website platform.

- Input your merchant credentials or API keys into the integration settings on your platform.

- Customize the payment experience to match your branding and user experience.

- Test the payment process to ensure everything works as expected, making test transactions to check for any issues.

- Go live by enabling real payments and monitoring for any unexpected issues.

Once you’ve completed the setup, be sure to monitor the payment gateway regularly for any downtime or issues. It’s also wise to periodically test transactions to ensure that everything is working smoothly and that your customers are enjoying a seamless checkout process.

Conclusion

Choosing the right payment gateway for your business is an important decision that directly impacts your ability to process payments smoothly and securely. Whether you’re a small business owner or managing a large enterprise, the ideal payment gateway should align with your business needs, such as supporting the payment methods your customers prefer, offering competitive fees, and integrating easily with your website. Each of the gateways we’ve discussed offers different advantages, from global reach and scalability to ease of use and advanced security features. The right choice ultimately depends on the type of business you run, the volume of transactions, and the regions you serve.

No matter which payment gateway you choose, it’s essential to prioritize security, customer experience, and reliable support. A seamless and secure payment process not only ensures that your customers feel confident purchasing from you but also helps you keep track of your transactions and manage your finances efficiently. As your business grows, your payment needs will evolve, so selecting a gateway that can scale with you is key. By considering the factors we’ve outlined and understanding the strengths of each payment gateway, you’ll be equipped to make a smart decision that supports your business now and in the future.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.