Are you looking for the best credit card to fit your lifestyle? With so many options available, it can be tough to figure out which one is right for you. Whether you’re aiming to earn rewards, save on interest, or enjoy exclusive perks, choosing the right credit card can help you make the most of your spending.

In this guide, we’ll break down the top credit card options for different needs, from travel rewards to cash back, and help you understand what factors to consider when making your decision. The goal is to help you find a card that not only suits your spending habits but also adds value to your financial life.

What is a Credit Card?

A credit card is a financial tool that allows you to borrow money from a lender, usually a bank or credit card company, to make purchases or withdraw cash. When you use a credit card, you’re essentially borrowing money up to a certain credit limit, with the agreement that you’ll repay the lender later, either in full or through monthly installments. Credit cards provide you with the flexibility to make payments over time, and many cards also offer additional perks such as rewards, travel benefits, and purchase protections.

In simple terms, a credit card gives you access to short-term credit, which means you can buy something now and pay for it later. However, if you don’t pay off the balance by the due date, you’ll incur interest charges. Credit cards also have fees associated with late payments, foreign transactions, and cash advances. Despite these potential costs, when used responsibly, credit cards can be an incredibly useful tool for managing finances, building credit, and earning rewards.

Benefits of Credit Cards

- Ability to make purchases now and pay later, providing short-term financial flexibility.

- Earning rewards such as cash back, points, or miles on purchases.

- Establishing and building a credit history, which is crucial for future loans and financial products.

- Consumer protections like fraud detection, purchase protection, and extended warranties.

- Emergency access to funds, especially when dealing with unexpected expenses or large purchases.

- Access to travel benefits like lounge access, free checked bags, and travel insurance (depending on the card).

- Opportunity to take advantage of introductory offers like 0% APR for a set period or large sign-up bonuses.

Importance of Choosing the Right Credit Card

Selecting the right credit card is an important decision that can significantly impact your financial health. It’s not just about choosing the card with the highest rewards or the best perks—it’s about finding one that aligns with your spending habits, financial goals, and personal needs. Using the wrong credit card can lead to unnecessary fees, higher interest rates, and missed opportunities to earn rewards. The right card, however, can help you manage your expenses, build your credit score, and even save money in the long run.

The credit card you choose can also influence how quickly you reach financial milestones, such as buying a home or qualifying for an auto loan. For example, a card that helps you build your credit score through responsible usage could open up more favorable loan terms in the future. On the other hand, using a credit card irresponsibly—like consistently carrying a balance or missing payments—can have the opposite effect, leading to higher interest rates and damaging your credit.

Factors to Consider When Selecting a Credit Card

Choosing the right credit card involves considering several factors to ensure you get the most value while minimizing costs. Keep these factors in mind as you make your decision:

- Your spending habits: Determine where you spend the most (e.g., travel, dining, groceries) to find a card that rewards those categories.

- Credit score: Different cards have different credit score requirements, so choose one that matches your credit profile.

- Interest rates: Look for cards with low APRs if you plan on carrying a balance to avoid high interest charges.

- Fees: Consider annual fees, foreign transaction fees, balance transfer fees, and other costs that could affect your overall value.

- Rewards program: Choose a card with a rewards structure that aligns with your preferences (e.g., cash back, points, miles).

- Introductory offers: Take advantage of 0% APR offers or sign-up bonuses, but be sure to understand the terms and conditions.

- Perks and benefits: Some cards offer travel benefits, purchase protection, or extended warranties that could be valuable depending on your lifestyle.

- Customer service: Opt for a card issuer known for excellent customer service in case issues arise.

Types of Credit Cards

When it comes to credit cards, one size definitely doesn’t fit all. Different types of credit cards cater to various financial needs, whether you’re looking to earn rewards, save on interest, or build your credit. Below, I’ll walk you through the most common types of credit cards and explain what makes each of them unique.

Rewards Credit Cards

Rewards credit cards are an excellent option if you’re looking to earn something back on your everyday purchases. These cards typically offer points, miles, or cashback for every dollar you spend. The best part? You can redeem your rewards for a wide range of benefits, from travel perks to gift cards and merchandise.

The appeal of rewards cards lies in their flexibility and the potential to accumulate significant benefits, especially for individuals who have specific spending habits. For example, some cards offer bonus rewards on categories like dining, travel, or groceries, allowing you to earn more on purchases you make regularly. Many rewards cards come with a sign-up bonus as well, often worth hundreds of dollars if you meet a spending threshold in the first few months.

However, these cards may come with higher annual fees or interest rates, so it’s important to evaluate whether the rewards will outweigh the costs for you. They’re best suited for people who make frequent purchases in the bonus categories and can pay off their balances in full each month to avoid interest charges.

Cash Back Credit Cards

Cash back credit cards are among the most straightforward and easy-to-understand cards available. These cards allow you to earn a percentage of your spending back in cash, which can be applied as a statement credit or deposited into your bank account. You can typically expect to earn between 1% and 5% back on most purchases, depending on the card and your spending categories.

Cash back credit cards usually fall into two categories: flat-rate cards and rotating-category cards. With flat-rate cards, you earn the same percentage back on all purchases, making them ideal for those who want simplicity. On the other hand, rotating-category cards offer higher cash back rates for certain categories, such as gas stations or dining, but these categories change every quarter, and you have to opt in to maximize your benefits.

These cards are perfect for people who want an easy way to earn rewards without the complexity of managing points or miles. They also tend to have lower annual fees than rewards cards, making them an attractive option for those who want to earn rewards without paying a high fee.

Travel Credit Cards

If you’re someone who loves to travel, a travel credit card can be a game-changer. These cards allow you to earn miles or points that can be redeemed for flights, hotel stays, car rentals, and more. Travel cards often partner with specific airlines or hotel chains, providing special perks such as priority boarding, free checked bags, and access to airport lounges.

For frequent travelers, the benefits don’t stop at rewards. Many travel credit cards offer travel insurance, which can include coverage for trip cancellations, lost luggage, and emergency medical expenses. Some cards also provide no foreign transaction fees, making them an excellent choice for international travel. Plus, you might also receive bonus points for purchases made through the card’s travel portal, allowing you to get more value for your miles.

Keep in mind that travel credit cards can have high annual fees, and you may need to spend in certain categories to get the most out of the rewards. However, the right travel card can significantly reduce the costs of your travel, making it an ideal option if you travel often.

Balance Transfer Credit Cards

If you’re carrying high-interest debt from other credit cards, a balance transfer card can provide some relief. These cards allow you to transfer your existing credit card balances to a new card, often with a 0% introductory APR for a set period, typically 12 to 18 months. This gives you time to pay down your balance without accruing additional interest, making it easier to manage your debt.

Balance transfer credit cards often come with a fee, usually between 3% and 5% of the amount you transfer, but the savings on interest can outweigh the cost of the fee, especially if you’re able to pay off the balance within the introductory period. It’s important to have a clear repayment plan in place, as the interest rate will typically jump significantly after the introductory period ends.

These cards are a great tool for consolidating debt, but they require discipline. If you’re not careful, you could end up accumulating more debt, especially if you continue to use the card for new purchases while trying to pay off the old balance.

Business Credit Cards

Business credit cards are designed for entrepreneurs and business owners who need to separate their personal and business finances. These cards offer higher credit limits and come with perks specifically tailored to businesses, such as expense management tools, free employee cards, and business-related rewards.

One of the main advantages of business credit cards is the ability to earn rewards on business expenses, such as office supplies, advertising, and travel. Many cards also offer valuable business-specific benefits like access to exclusive business events, discounts on software tools, and other resources that can help you run your business more effectively.

Business credit cards can also help you build business credit, which is separate from your personal credit. This can be helpful when it comes to applying for business loans or lines of credit. However, business cards can come with higher fees and interest rates, and it’s essential to keep personal and business expenses separate to avoid confusion or tax issues.

Student Credit Cards

Student credit cards are designed for young adults who are just starting to build their credit history. These cards typically have lower credit limits and may come with fewer benefits than other types of cards. However, they offer a valuable opportunity to establish good credit habits early on.

Most student credit cards offer a simple rewards structure, such as 1% cash back on all purchases or 2% on specific categories. In addition to earning rewards, students can take advantage of financial education resources, which help them understand how to manage credit responsibly. Some student cards even offer bonus rewards for activities like paying on time or maintaining good grades, making them a great way for students to build credit while benefiting from their spending.

Because student cards often come with relatively low credit limits, it’s important to use them responsibly and avoid carrying large balances. This is a great way for students to start building their credit score and lay the foundation for future financial success.

Secured Credit Cards

Secured credit cards are a great option for individuals who are new to credit or looking to rebuild their credit score. Unlike traditional credit cards, which are based on your creditworthiness, secured cards require a cash deposit that serves as your credit limit. For example, if you deposit $500, your credit limit will be $500.

Secured cards allow you to demonstrate your ability to manage credit responsibly. By making timely payments and keeping your credit utilization low, you can improve your credit score, which may help you qualify for unsecured credit cards in the future. Many secured cards also offer rewards, but they usually have fewer benefits compared to unsecured cards.

The main advantage of a secured credit card is that it gives you a chance to rebuild or establish your credit. However, since it requires an upfront deposit, it’s important to choose a card with a reasonable fee structure and ensure that the card issuer reports to the credit bureaus, so your positive credit behavior can be reflected on your credit report.

Best Rewards Credit Cards

Rewards credit cards are designed to give you something back for every purchase you make. Whether it’s points, miles, or cash back, these cards provide an opportunity to accumulate valuable rewards based on your spending habits. The right rewards card can turn your everyday purchases into something much more exciting, like free flights, travel upgrades, or gift cards. Let’s dive into some of the best rewards credit cards available today, each catering to different needs and preferences.

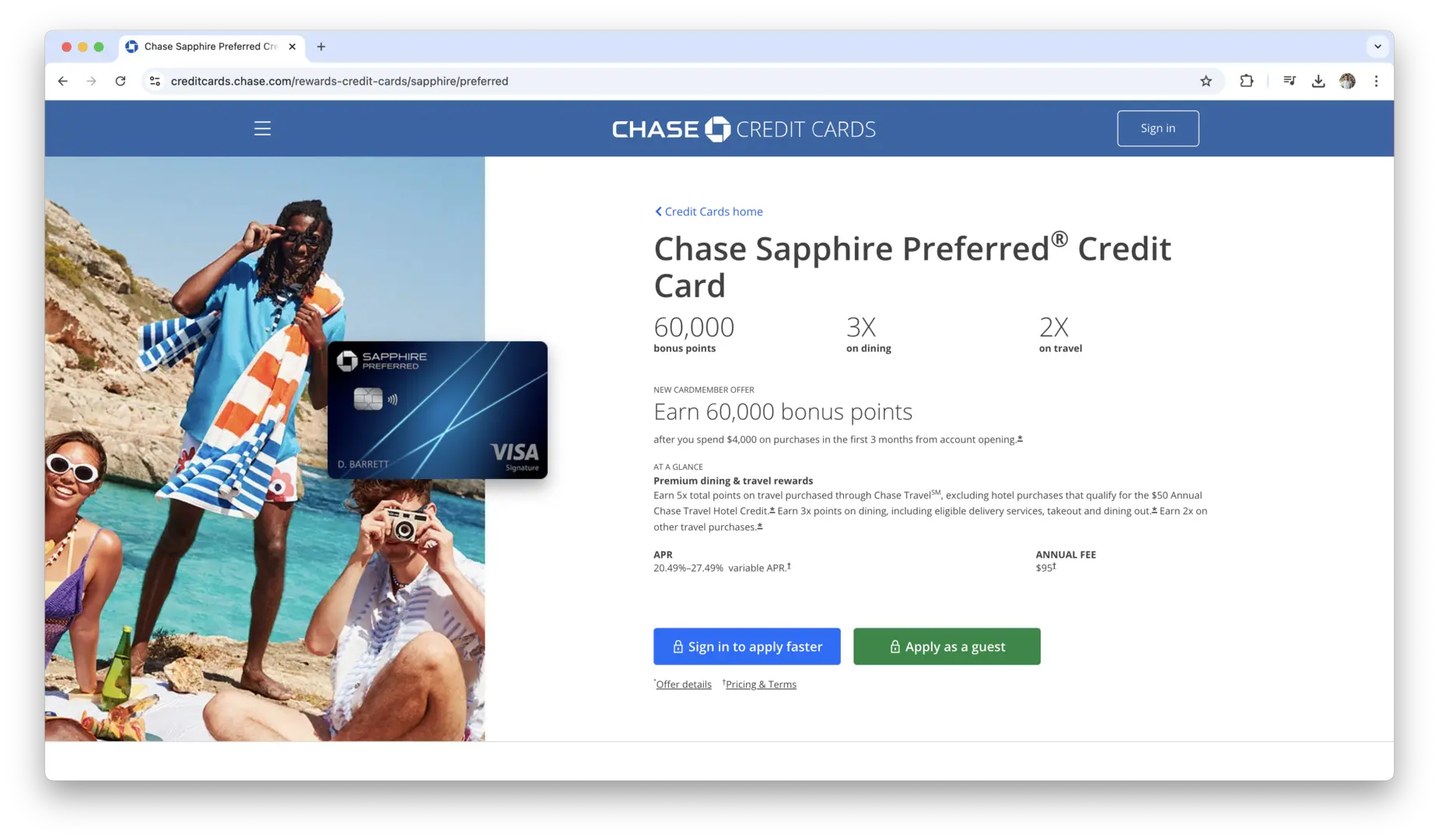

Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card is a standout when it comes to travel rewards. It offers 2x points on travel and dining, which are two categories that many people spend a significant amount of money on. Plus, it comes with a large sign-up bonus: 60,000 points if you spend $4,000 in the first three months. These points can be redeemed for travel through the Chase Ultimate Rewards program, and if you book through the Chase portal, you can get 25% more value for your points.

One of the best features of this card is its travel flexibility. You can transfer your points to over 10 airline and hotel partners, including popular options like United Airlines, Southwest Airlines, and Hyatt, giving you more options for how to use your rewards. Additionally, the card offers access to trip cancellation insurance, car rental insurance, and other travel protections, making it a great option for frequent travelers.

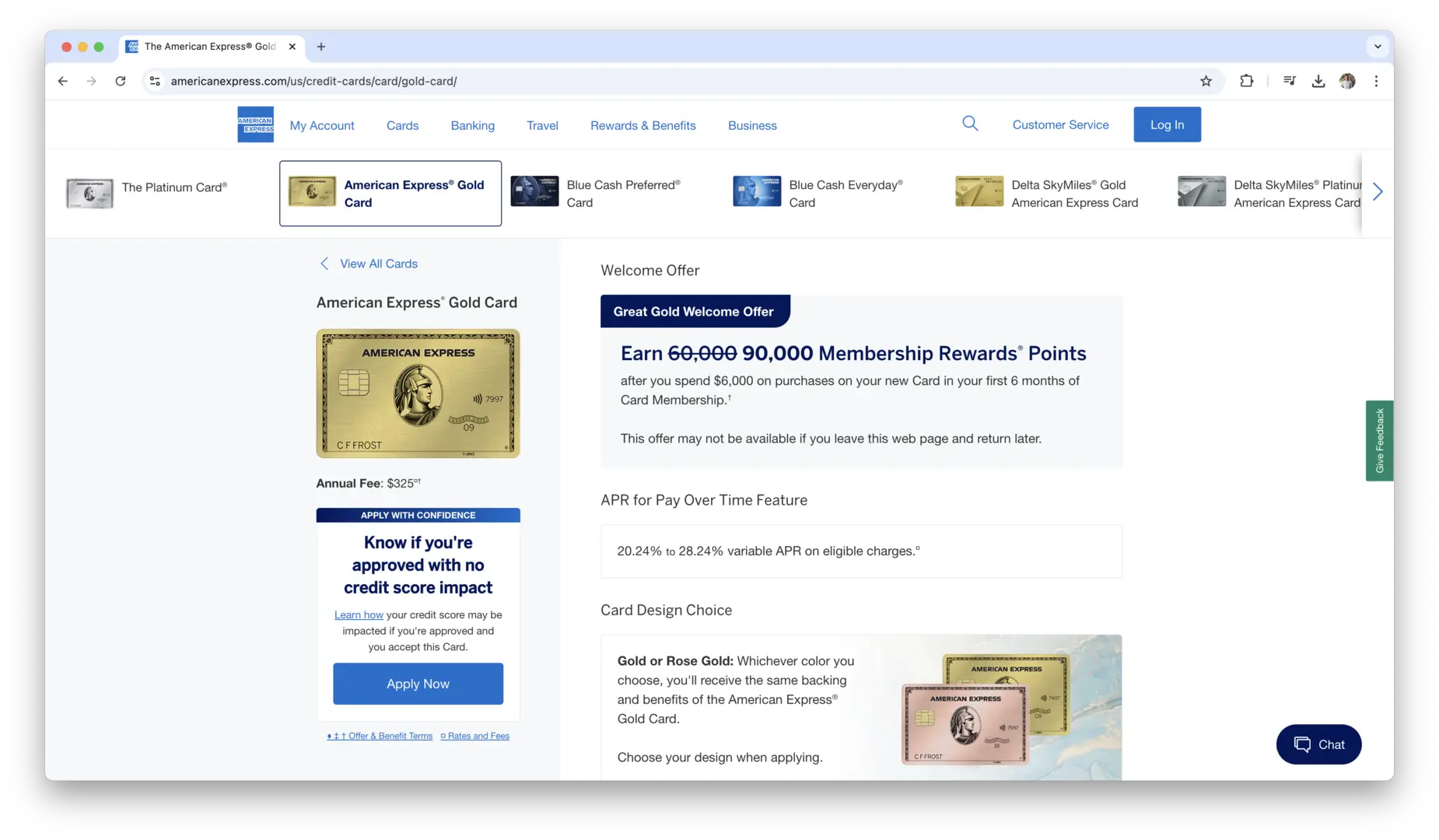

American Express Gold Card

If dining out is an important part of your lifestyle, the American Express Gold Card might be your ideal companion. This card offers 4x points at restaurants worldwide, including takeout and delivery, and 3x points on flights booked directly with airlines. Additionally, you’ll earn 1 point per dollar on all other purchases. The card also comes with an impressive sign-up bonus of 60,000 points if you spend $4,000 in the first 6 months.

What makes this card stand out is its unique bonus categories. The 4x points on dining make it a top choice for food lovers, and the 3x points on airfare make it ideal for frequent flyers. On top of that, the card offers up to $120 in dining credits at select restaurants, and if you enjoy making purchases at places like Whole Foods or select streaming services, you’ll be able to redeem the points for even more value.

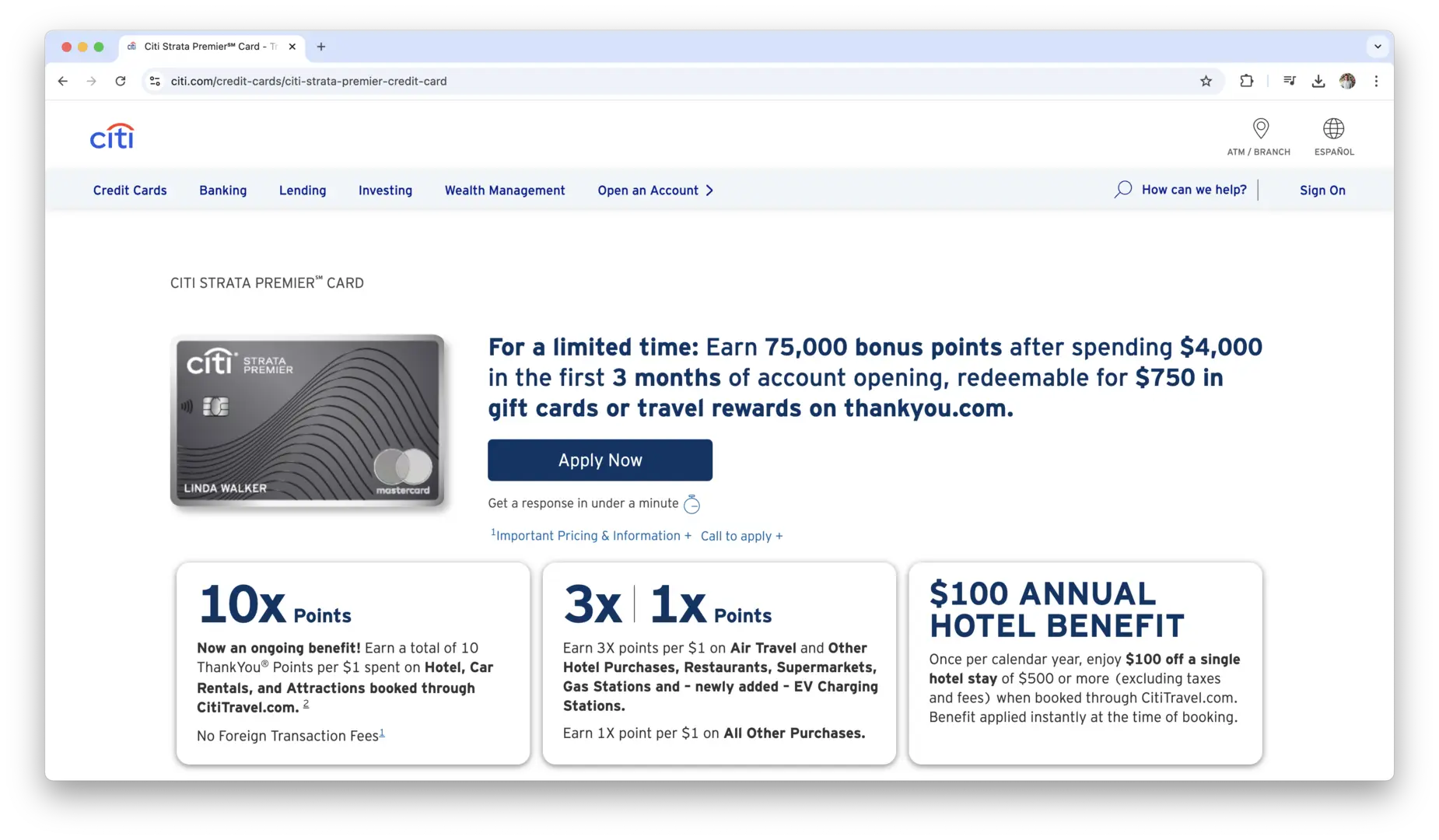

Citi Premier Card

For those who want a well-rounded rewards card that delivers high points in multiple categories, the Citi Premier Card offers 3x points on travel, including gas stations, 2x points on dining and entertainment, and 1 point per dollar on all other purchases. Its sign-up bonus is a hefty 60,000 points after spending $4,000 in the first 3 months, which can be redeemed for $600 in gift cards or used to book travel through the Citi ThankYou Rewards program.

The Citi Premier Card’s rewards structure is great for individuals who spend across a variety of categories, and with no foreign transaction fees, it’s also a solid option for those who like to travel internationally. Additionally, the card offers protections like travel accident insurance, trip interruption coverage, and baggage delay insurance, making it a great choice for frequent travelers.

Best Cash Back Credit Cards

Cash back credit cards are straightforward, offering you a percentage of your spending back in the form of cash. Whether you’re a person who likes simplicity or prefers direct financial rewards, cash back cards are an excellent way to earn rewards without the complexities of points or miles. They offer value for everyday spending and typically have lower fees and fewer restrictions than their rewards counterparts.

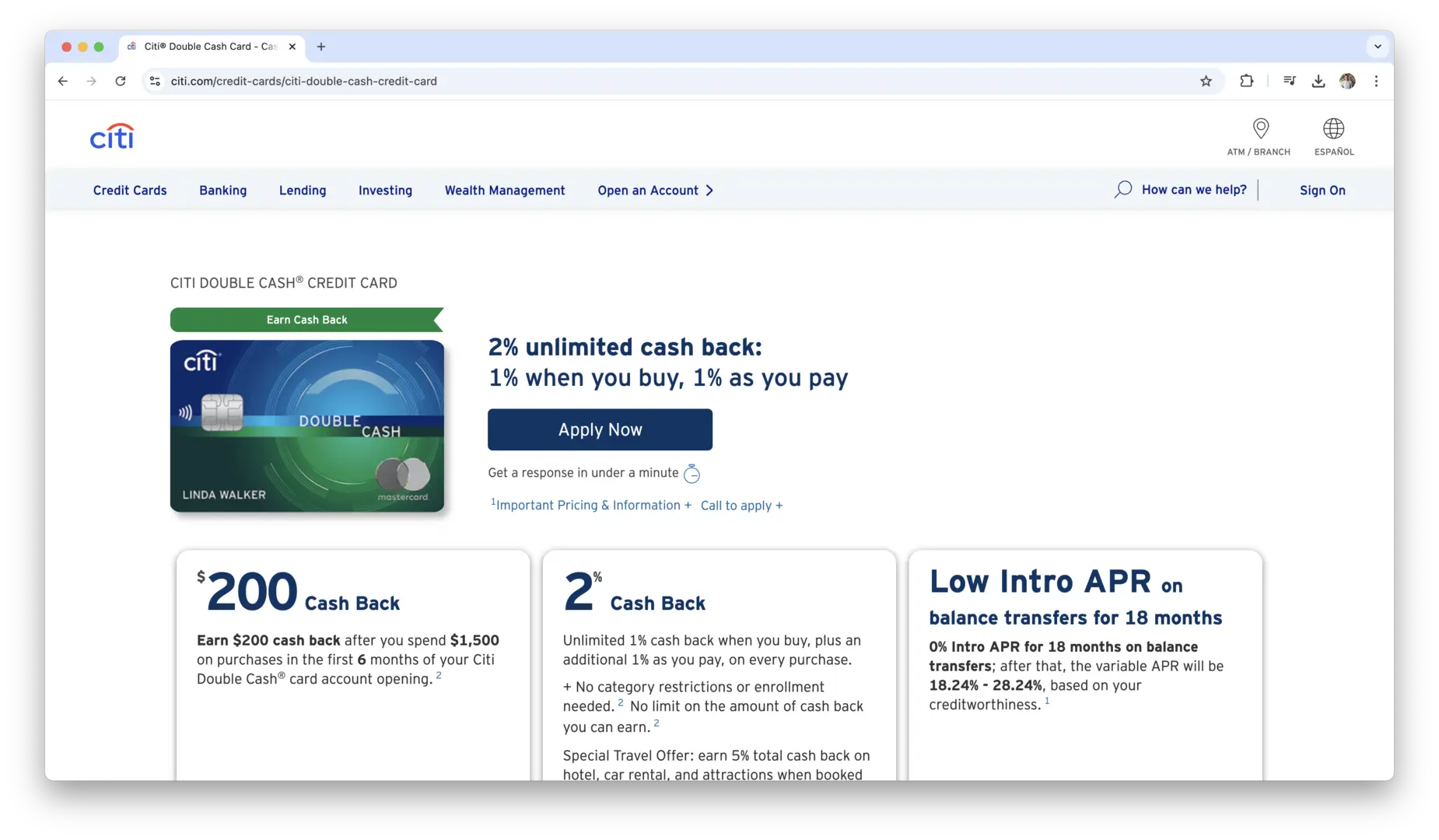

Citi Double Cash Card

The Citi Double Cash Card is one of the best options for those who prefer simplicity in their cash back rewards. It offers a flat 2% cash back on every purchase—1% when you buy, and an additional 1% when you pay your bill. This straightforward approach means you don’t have to keep track of rotating categories or sign-up bonuses, making it an excellent option for people who want to earn consistent cash back on all their purchases.

There is no annual fee for the Citi Double Cash Card, and you can redeem your cash back as a statement credit, a check, or even a direct deposit into your bank account. Its simplicity and ease of use make it one of the best cash back cards for people who don’t want to deal with complicated rewards systems. Plus, the card offers 0% APR on balance transfers for the first 18 months, making it a great choice if you’re looking to pay off high-interest credit card debt.

Blue Cash Preferred Card from American Express

The Blue Cash Preferred Card from American Express is a great choice if you spend heavily in certain categories, like groceries or gas. It offers 6% cash back on the first $6,000 spent per year at U.S. supermarkets (then 1%), 3% on transit and gas station purchases, and 1% on all other purchases. The sign-up bonus of $250 is earned after spending $1,000 in the first 3 months, which can be a nice bonus on top of the ongoing rewards.

This card also has a $95 annual fee, but if you spend a lot on groceries or gas, it can quickly pay for itself. The 6% cash back on groceries is especially valuable for families or anyone who spends a lot in this category. Additionally, the Blue Cash Preferred Card comes with other benefits, like purchase protection and extended warranties on eligible items, making it a solid all-around card for earning cash back on everyday expenses.

Discover it Cash Back

If you like the idea of earning more cash back in rotating categories, the Discover it Cash Back card is an excellent option. It offers 5% cash back on rotating categories each quarter (up to the quarterly maximum, which is typically $1,500), and 1% on all other purchases. Categories change every three months, so you’ll need to pay attention to the card’s bonus categories, which could include things like grocery stores, gas stations, or restaurants.

The Discover it Cash Back card doesn’t charge an annual fee, and one of its best features is that at the end of your first year, Discover will match all the cash back you’ve earned. So if you’ve earned $200, you’ll get an additional $200, effectively doubling your rewards for the first year. It’s an excellent way to boost your cash back in your first year of using the card.

These cash back cards are ideal for individuals who want simplicity, flexibility, and the opportunity to earn rewards on their everyday spending. Whether you prefer flat-rate cash back or like to take advantage of rotating categories, there’s a card out there that can help you maximize your rewards.

Best Travel Credit Cards

For those who travel frequently or aspire to explore the world more, travel credit cards are an excellent tool for earning points or miles that can be redeemed for flights, hotel stays, car rentals, and more. These cards often come with additional travel perks such as lounge access, travel insurance, and priority boarding. Choosing the right travel card can make your trips more rewarding and save you money on travel-related expenses. Here are some of the best travel credit cards available, designed to maximize the value of every mile or point you earn.

Chase Sapphire Reserve

The Chase Sapphire Reserve card is often hailed as one of the best travel credit cards due to its generous rewards and comprehensive travel benefits. It offers 3x points on travel and dining, 1 point per dollar on all other purchases, and a sign-up bonus of 50,000 points if you spend $4,000 within the first 3 months. These points can be redeemed for travel through the Chase Ultimate Rewards portal at a 50% higher value or transferred to one of over 14 airline and hotel partners.

Beyond the rewards, the Chase Sapphire Reserve offers a wide range of perks that are ideal for frequent travelers. You get access to over 1,000 airport lounges worldwide through the Priority Pass Select membership, a $300 annual travel credit, and travel protections like trip cancellation/interruption insurance and primary car rental insurance. The card also waives foreign transaction fees, which makes it a perfect companion for international travel.

Platinum Card from American Express

The Platinum Card from American Express is designed for travelers who want premium benefits. It offers 5x points on flights booked directly with airlines or through American Express Travel, and 1 point per dollar on all other purchases. Additionally, new cardholders can earn a large sign-up bonus, which is typically around 60,000 points after spending $5,000 in the first 3 months.

What sets the Platinum Card apart is its luxury travel benefits. Cardholders receive access to Centurion Lounges and Priority Pass lounges, elite status with Hilton Honors and Marriott Bonvoy, and up to $200 in airline fee credits per year. The card also offers $200 in Uber credits annually, travel accident insurance, and concierge services that can assist with booking travel, securing reservations, or handling any special requests.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is a great option for travelers who want a straightforward rewards structure with flexibility. It offers 2x miles on every purchase and a sign-up bonus of 60,000 miles if you spend $3,000 in the first 3 months. These miles can be redeemed for travel expenses, such as flights, hotels, or car rentals, or transferred to over 15 travel partners for even more value.

What makes the Capital One Venture Rewards card attractive is its simplicity. You don’t have to worry about rotating categories or complex point systems; you earn 2x miles on everything you buy. It also comes with no foreign transaction fees, making it an excellent card for international travel.

Best Balance Transfer Credit Cards

If you have existing credit card debt with high interest rates, a balance transfer credit card can help you save money by allowing you to transfer your debt to a card with a lower or 0% introductory APR for a set period. These cards are designed to make it easier for you to pay off existing balances without accumulating additional interest. Here are some of the best balance transfer credit cards to consider.

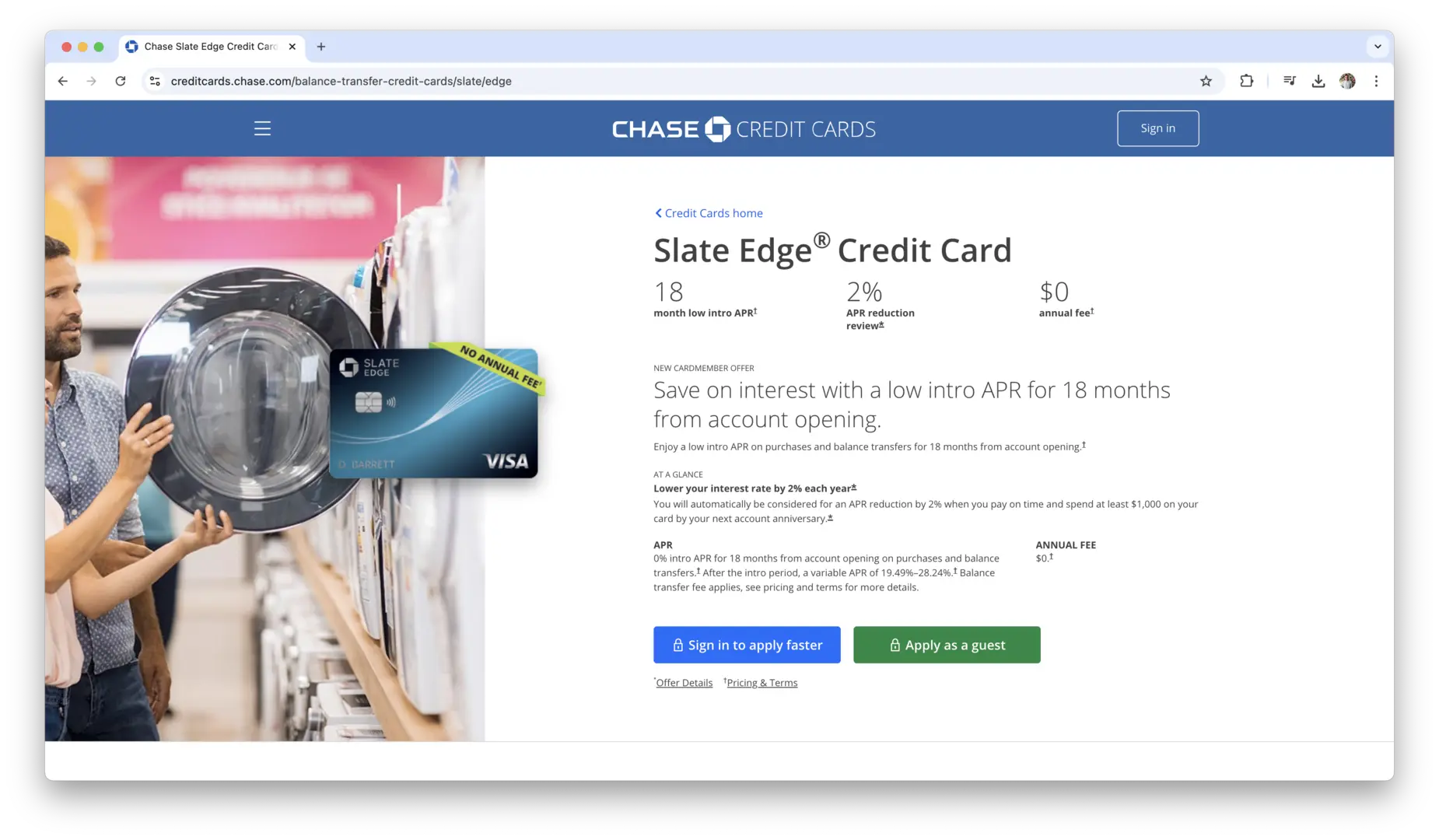

Chase Slate Edge

The Chase Slate Edge card is one of the most popular balance transfer options because it offers 0% APR on balance transfers for the first 18 months, which is a long introductory period compared to most cards. During this time, you can pay off your balance without paying interest, which can make a significant difference in how quickly you pay down your debt. Additionally, the card has no annual fee, which is a bonus for those who want to avoid extra charges.

After the introductory period ends, the APR reverts to a variable rate, but if you pay off your balance within the 18-month window, you’ll save a considerable amount of money on interest. The Chase Slate Edge also offers a range of other benefits, like access to your FICO credit score and the ability to track your spending, making it a solid option for individuals who want to manage their finances more effectively.

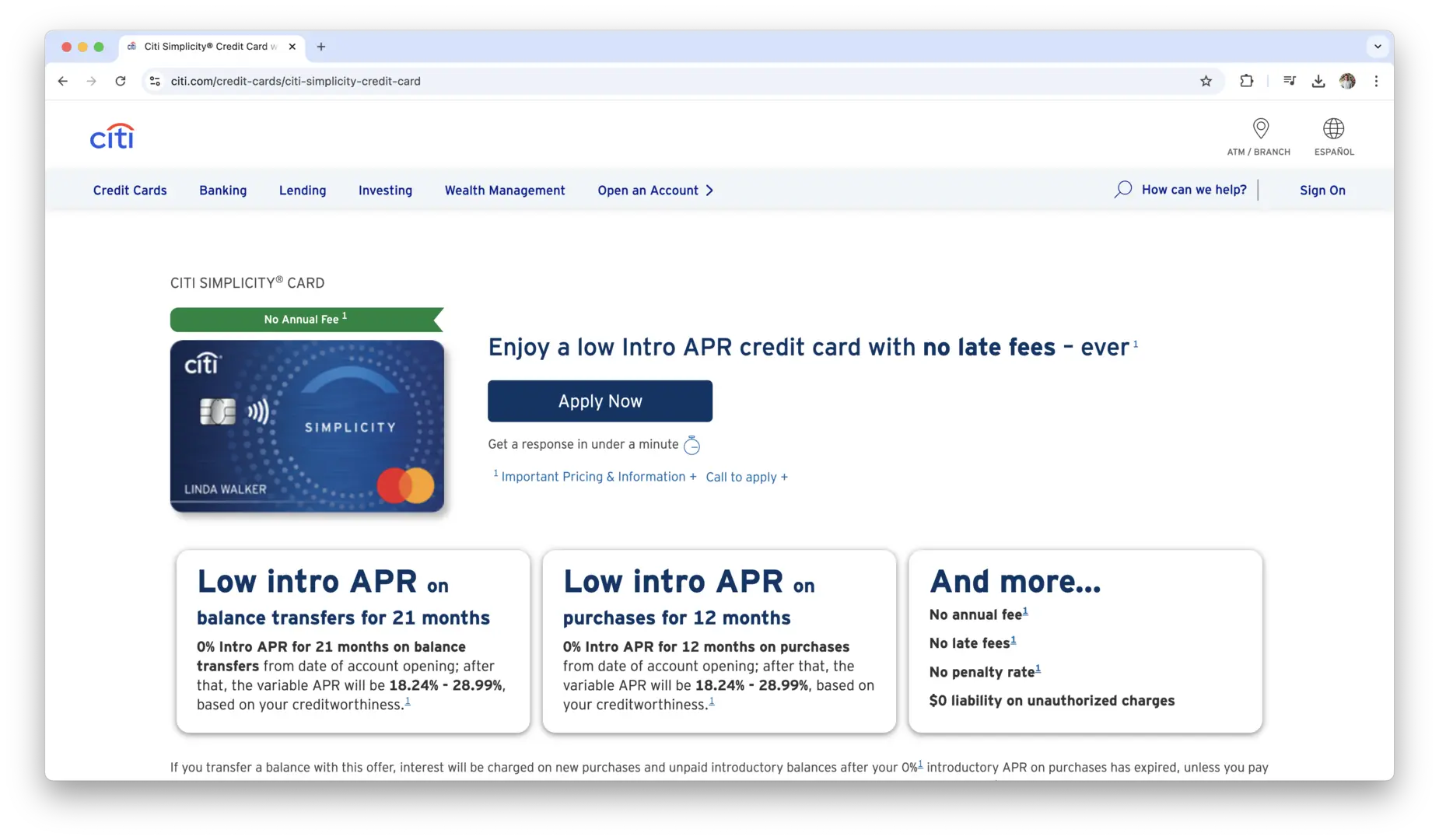

Citi Simplicity Card

For those looking for a balance transfer card that is simple and straightforward, the Citi Simplicity Card offers 0% APR on balance transfers for 18 months (with a 3% balance transfer fee) and no late fees or penalty APRs. This makes it a great choice for individuals who want to avoid surprise fees and focus entirely on paying down their debt without interest.

After the 18-month introductory period ends, the card’s APR will revert to a standard variable rate, so it’s important to have a plan in place to pay off the balance within that timeframe. The Citi Simplicity Card doesn’t charge an annual fee, and it offers a smooth, hassle-free experience for those who want to consolidate debt.

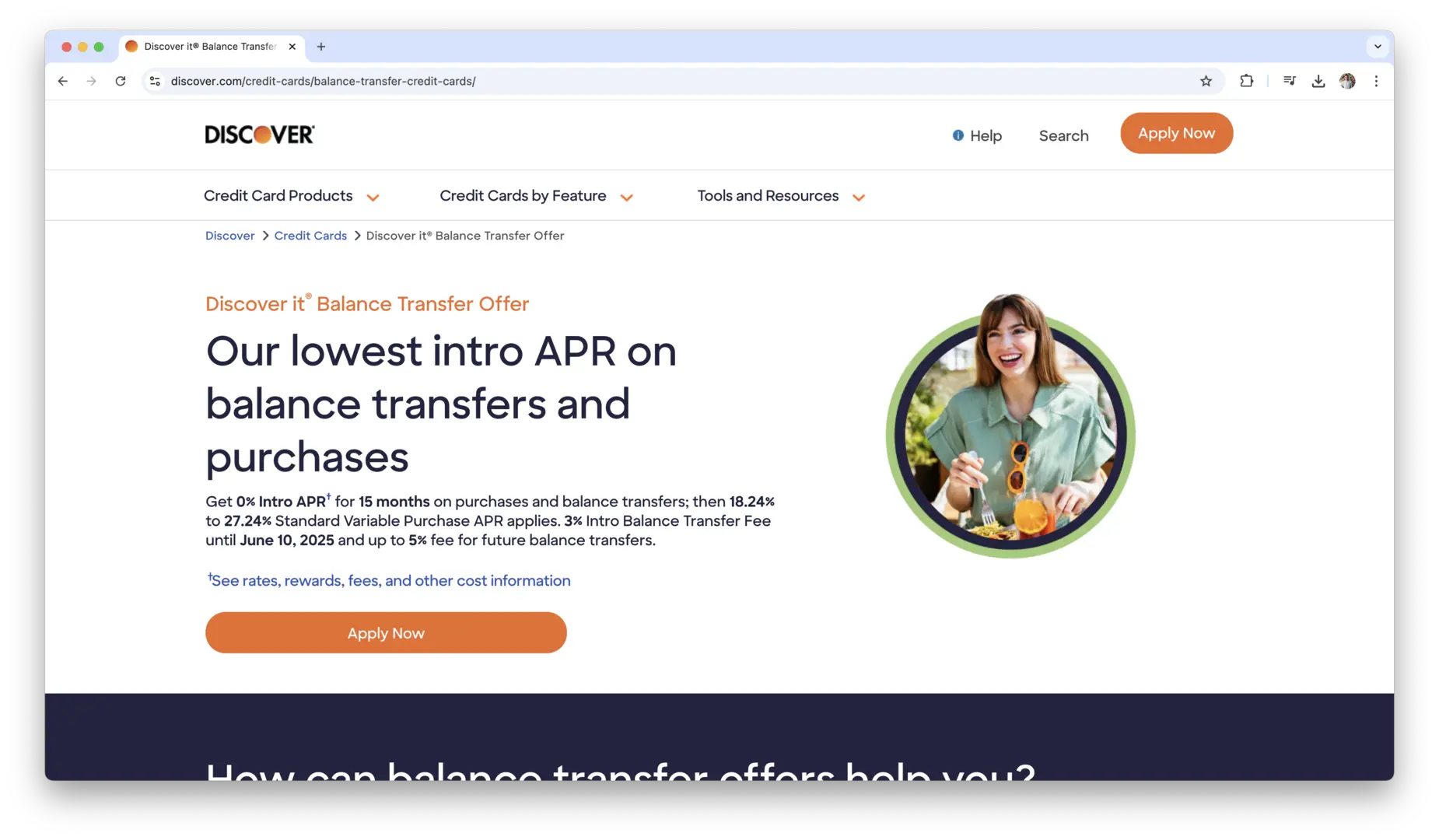

Discover it Balance Transfer

The Discover it Balance Transfer card offers 0% APR on balance transfers for 18 months, along with a 3% balance transfer fee. What sets this card apart is that Discover will match all the cash back you earn during your first year, doubling your rewards for the first year of card ownership. This card gives you the opportunity to not only transfer existing debt without interest but also earn cash back on new purchases. Plus, it has no annual fee.

After the introductory period ends, the APR increases, but if you can pay off your balance before then, you’ll save money on interest while simultaneously earning cash back. The Discover it Balance Transfer card also offers free access to your FICO credit score, so you can monitor your progress as you pay down debt.

Best Business Credit Cards

Business credit cards are designed to help entrepreneurs and companies manage expenses, streamline accounting, and earn rewards for business-related purchases. These cards often come with higher credit limits and more robust rewards programs tailored to business needs. Here are some of the top business credit cards for small business owners and entrepreneurs.

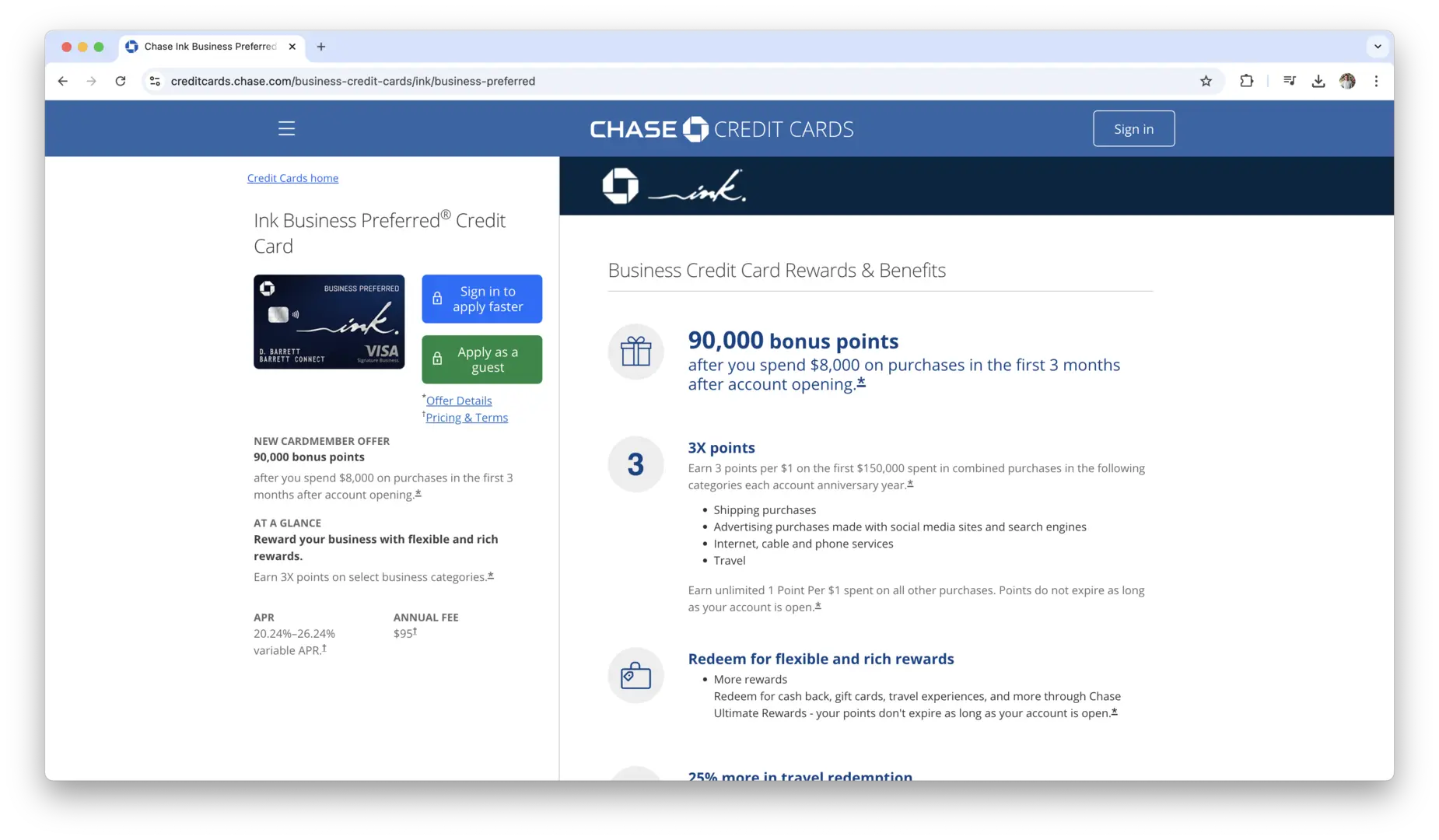

Ink Business Preferred Credit Card

The Ink Business Preferred Credit Card is one of the top choices for business owners who want to earn rewards on a variety of business-related expenses. It offers 3x points on the first $150,000 spent on travel, shipping, internet, cable, and phone services each year, 1 point per dollar on all other purchases, and a generous sign-up bonus of 100,000 points if you spend $15,000 in the first 3 months.

These points can be redeemed through the Chase Ultimate Rewards program or transferred to one of Chase’s 13 travel partners for even more value. The card also comes with travel protections such as trip cancellation insurance, primary car rental insurance, and purchase protection. It’s an excellent card for businesses that incur a lot of travel and communication-related expenses.

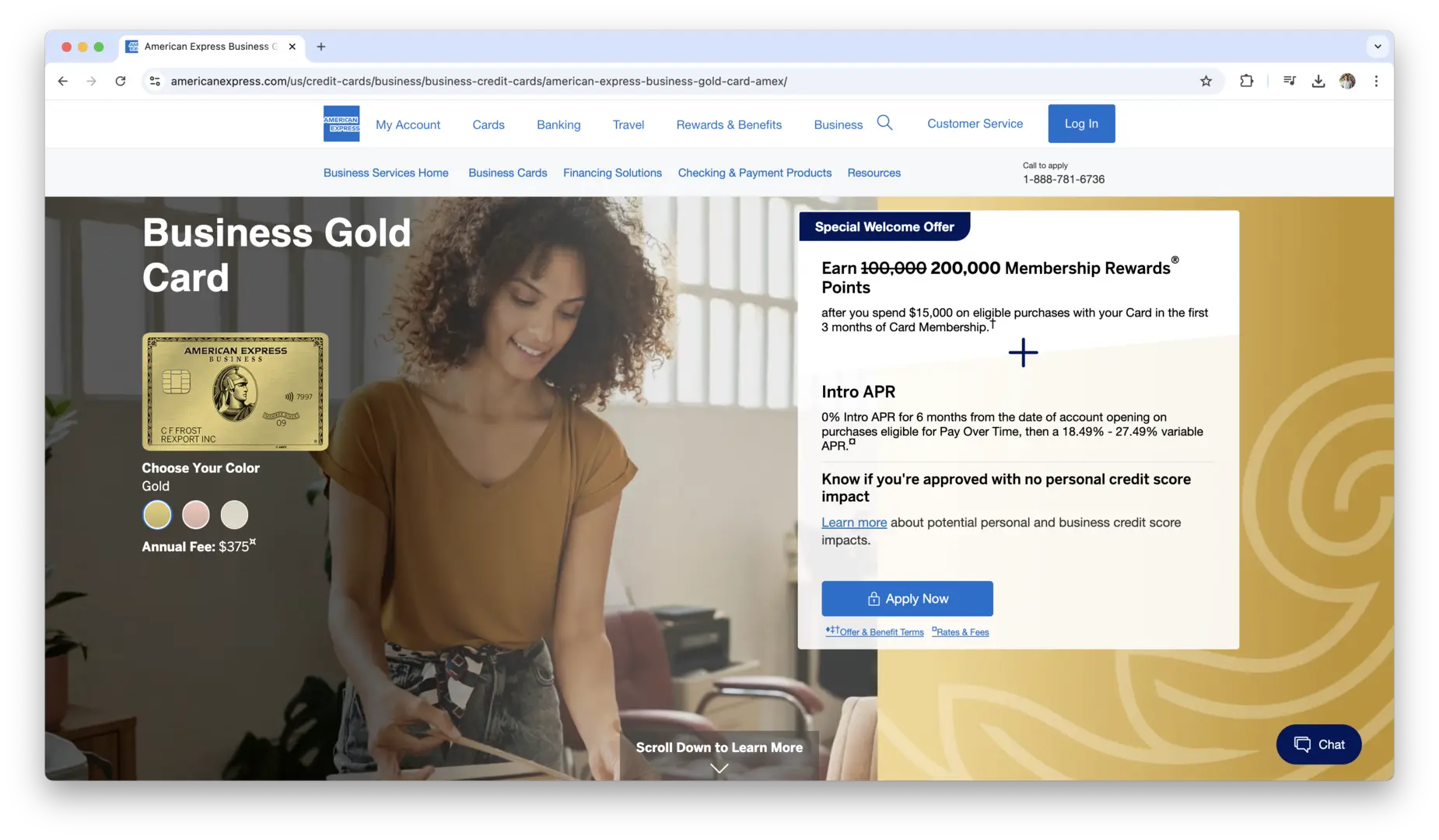

American Express Business Gold Card

The American Express Business Gold Card is a great option for business owners who want to earn high rewards in specific categories based on their spending patterns. This card offers 4x points on the two categories where your business spends the most each month (from a list of 6 categories including advertising, gas, and shipping), and 1 point per dollar on all other purchases. New cardholders can also earn 35,000 Membership Rewards points if they spend $5,000 in the first 3 months.

The American Express Business Gold Card also provides a range of additional benefits, including access to the American Express Open network of discounts and offers, along with protections such as purchase protection, extended warranties, and travel insurance. This card is perfect for businesses that need flexibility and want to earn high rewards on their specific types of spending.

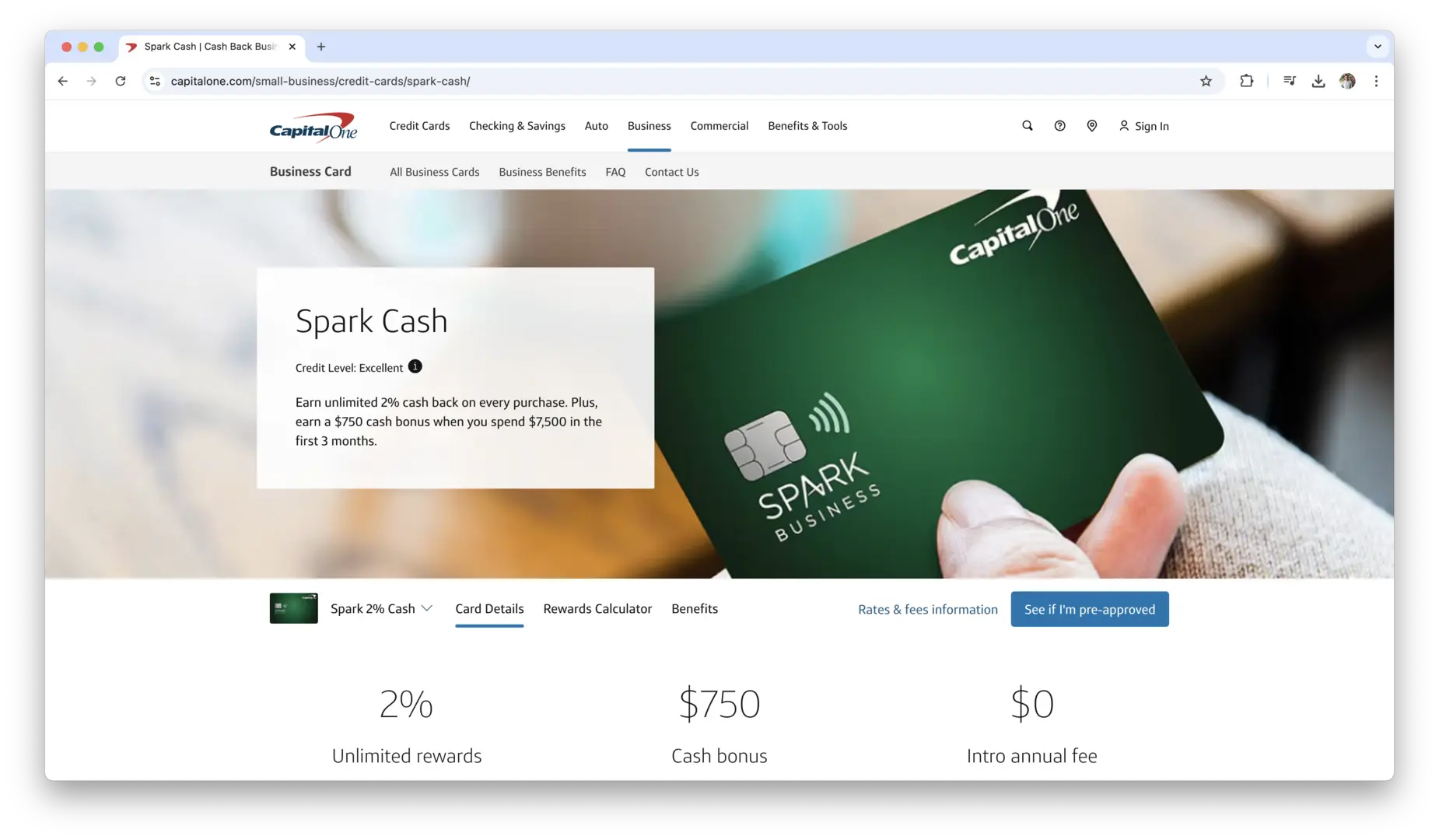

Capital One Spark Cash for Business

The Capital One Spark Cash for Business is ideal for business owners who prefer a simple and straightforward cash-back rewards structure. This card offers 2% cash back on every purchase, making it easy to earn rewards without worrying about rotating categories or complex point systems. New cardholders can earn a $500 cash bonus if they spend $4,500 in the first 3 months.

This card also comes with no annual fee for the first year, making it a good choice for businesses that want to save on upfront costs. After the first year, there is a $95 annual fee, but the straightforward 2% cash back on every purchase can easily offset this cost. The Capital One Spark Cash for Business card is a great option for businesses that want reliable rewards with no fuss.

These business credit cards offer rewards, cash back, and valuable perks tailored to the needs of business owners. Whether you’re looking for flexible spending, high rewards in specific categories, or straightforward cash back, there’s a card out there to help you manage your business expenses effectively.

How to Choose the Best Credit Card for You?

Choosing the right credit card involves a mix of understanding your financial habits, evaluating your goals, and weighing the benefits each card offers. Not all credit cards are created equal, so it’s important to select one that fits your needs and lifestyle. Here’s a breakdown of the key factors to consider when choosing the best credit card for you.

1. Assess Spending Habits and Lifestyle

Before selecting a credit card, take a close look at your spending patterns. What do you spend the most money on each month? Is it groceries, dining out, travel, or entertainment? Understanding where your money goes will help you choose a card that offers the most value based on your lifestyle.

For example, if you travel frequently, a travel rewards card may be a good option for you. These cards typically offer miles or points for every dollar you spend, often with extra points for travel-related purchases like flights and hotels. On the other hand, if dining out or groceries make up a large portion of your spending, consider a cash-back card that offers higher rewards in those categories.

If you’re someone who prefers simplicity, a flat-rate rewards card might be a better fit. These cards offer a consistent cash-back percentage or reward points for every dollar spent, regardless of the category. But if you’re someone who enjoys optimizing your rewards and can keep track of rotating bonus categories, a card with quarterly bonus rewards can help you earn even more.

2. Understand Interest Rates and Fees

When choosing a credit card, it’s crucial to understand the interest rates and fees that come with it. The APR (Annual Percentage Rate) is the rate you’ll pay if you carry a balance on your card. If you plan on paying off your balance in full each month, the APR may not be as important to you, but it’s still something to keep in mind in case you ever carry a balance. A higher APR can lead to high interest charges if you’re not careful.

Some credit cards also come with an introductory 0% APR for a set period, which can be an attractive feature if you’re planning a large purchase or need time to pay down existing credit card debt. However, keep in mind that once the introductory period ends, the APR will increase to the card’s standard rate, which could be much higher.

In addition to the APR, make sure to check for annual fees, foreign transaction fees, and any other potential charges. While some cards offer high rewards or perks, they may come with significant annual fees. For example, a premium travel card may charge an annual fee of $450, but if you travel often and use the card’s benefits (like airport lounge access or travel insurance), it might be worth it. If you don’t think you’ll use the card enough to justify a high fee, there are plenty of no-annual-fee cards that still offer great benefits.

3. Evaluate Rewards Programs and Perks

Rewards programs are one of the biggest draws of many credit cards, but not all rewards are created equal. Before choosing a card, make sure to evaluate how the rewards program works and whether it aligns with your spending habits.

Look for a card that offers the best rewards in categories where you spend the most. For instance, if you travel a lot, a travel rewards card with extra points for airline purchases or hotel bookings might be ideal. Alternatively, if you’re a frequent shopper, a cash-back card that offers a higher percentage back on everyday purchases like groceries and gas could be more beneficial.

Another thing to consider is how you can redeem your rewards. Some cards let you redeem points or miles for travel, merchandise, or gift cards, while others may offer statement credits or even cash deposited directly into your account. If you’re looking for flexibility, you might prefer a card with more redemption options. Some cards even allow you to transfer points to travel partners (like airline frequent flyer programs), which can help you maximize your rewards for flights and hotel stays.

In addition to rewards, it’s important to consider the perks and benefits that come with the card. Many premium credit cards offer valuable perks like free travel insurance, extended warranties, purchase protection, and access to exclusive events. If you’re someone who enjoys perks like airport lounge access or concierge services, you may want to opt for a card that offers these kinds of benefits.

4. Consider Credit Score Requirements

Credit cards are typically categorized based on the credit score needed to qualify. Your credit score plays a significant role in determining which cards you can apply for and what terms you’ll receive. If you have a high credit score, you’ll have access to cards with better rewards, lower APRs, and more perks. However, if you have a lower credit score, your options may be limited, and you may face higher interest rates or smaller credit limits.

Before applying for a credit card, check your credit score to get an idea of which cards you’re likely to be approved for. There are many tools available online that offer free access to your credit score, and this will give you a good understanding of where you stand.

If your credit score is on the lower end, consider applying for cards that are designed for individuals with fair or poor credit. Secured credit cards, for example, are a great way to rebuild or establish your credit score. These cards require a deposit, which serves as your credit limit, and they can help you demonstrate responsible credit use to improve your credit score over time.

On the other hand, if you have excellent credit, you can aim for premium credit cards with high rewards and perks. Just remember, even if you have excellent credit, it’s important to still choose a card that fits your needs and lifestyle rather than simply choosing a card with the best rewards or perks.

Choosing the best credit card for you is all about aligning the card’s features with your financial goals and spending habits. By understanding your needs and evaluating the factors above, you can confidently select a card that will help you earn rewards, save on interest, and make the most of your spending.

Credit Card Features to Look For

When choosing a credit card, it’s important to understand not only the rewards and perks but also the features that can impact your overall experience. The best credit cards come with a variety of built-in benefits that can help you maximize your spending, minimize your fees, and provide peace of mind during everyday transactions. Here are some of the most important features to consider when evaluating credit cards.

Sign-up Bonuses and Promotions

One of the most attractive features of many credit cards is the sign-up bonus. These bonuses are often offered to entice new cardholders to apply and start using their cards. The bonuses usually come in the form of points, miles, or cash back, and the value can range anywhere from a few hundred to thousands of dollars, depending on the card.

To earn a sign-up bonus, most cards require you to spend a certain amount within the first few months of account opening. For example, a travel card might offer a bonus of 50,000 miles if you spend $3,000 within the first three months. These bonuses can be extremely valuable, especially if you’re able to use them to book flights or hotels for your travels, or redeem them for cash back or other rewards.

When evaluating sign-up bonuses, keep in mind that some cards may have higher spending requirements to earn the bonus, while others may have lower thresholds. Consider how much you typically spend in a few months and whether the bonus is worth the effort of meeting the spending target. Also, remember that sign-up bonuses can often be one-time offers, so after you’ve earned the bonus, you’ll want to continue to get value from the card in other ways.

Annual Fees and How to Justify Them

Many credit cards charge an annual fee, and while some cards offer no-fee options, others charge a yearly fee that can be substantial. For example, premium travel cards can charge upwards of $400 per year. The key question when it comes to annual fees is whether the benefits of the card outweigh the cost of that fee.

To justify an annual fee, you need to consider the value of the card’s perks and rewards. For example, a travel card with an annual fee of $450 might seem steep, but if it offers benefits like airport lounge access, free checked bags, and travel insurance, the value can easily exceed the cost, especially for frequent travelers. Additionally, many cards with high annual fees also offer large sign-up bonuses that can help offset the cost of the fee in the first year.

If you’re hesitant about a card with an annual fee, look at how the rewards program aligns with your spending habits. For instance, a card that offers higher rewards in categories you spend heavily on, like dining or groceries, could help you earn back the value of the fee through points or cash back. Alternatively, if you only travel once or twice a year, a card with a lower fee or no fee at all might be a better fit.

APR (Annual Percentage Rate) and Introductory Offers

The APR is one of the most important numbers to watch when choosing a credit card, as it determines how much interest you’ll pay if you carry a balance from month to month. Credit cards typically have variable APRs, which means the rate can change over time based on market conditions. If you plan to carry a balance, it’s essential to choose a card with a low APR to minimize interest charges.

However, if you’re someone who typically pays off your balance in full each month, the APR may not be as critical to you. Even if you don’t pay attention to the APR, it’s still worth checking the rate because if you do need to carry a balance at some point, the APR can significantly impact how much you owe.

Many credit cards offer introductory 0% APR for purchases or balance transfers for an initial period, usually 12 to 18 months. These offers can be extremely helpful if you have a large purchase you need to make or if you’re transferring debt from a high-interest card. With a 0% APR offer, you can avoid paying interest for the promotional period, allowing you to pay down your balance more efficiently.

Once the introductory period ends, however, the APR will usually revert to a much higher standard rate, so it’s important to pay off your balance before that happens to avoid paying significant interest charges.

Foreign Transaction Fees and International Benefits

If you plan to use your credit card while traveling abroad, it’s important to check whether the card charges foreign transaction fees. These fees typically range from 1% to 3% of each purchase made outside the country, which can add up quickly if you’re making several transactions on your trip.

To avoid these fees, look for credit cards that waive foreign transaction fees altogether. Many travel-focused cards, especially those aimed at frequent flyers or travelers, don’t charge foreign transaction fees, allowing you to save money while using your card internationally. Additionally, these cards may offer other international benefits, such as travel insurance, emergency assistance services, or access to global networks like Visa or Mastercard, which can provide added peace of mind when you’re traveling.

Aside from foreign transaction fees, some credit cards offer special benefits for international travel, such as concierge services, priority airport security, and access to VIP airport lounges. These perks can make your travels more comfortable and enjoyable, especially if you travel frequently or internationally.

Insurance Benefits (Travel, Purchase Protection, etc.)

Credit cards can come with a wide range of built-in insurance benefits, which can provide extra protection and peace of mind during your everyday purchases or when you’re traveling. For example, many travel credit cards include travel insurance, which can cover things like trip cancellations, lost luggage, and emergency medical expenses while you’re traveling.

Purchase protection is another valuable feature found on many credit cards. This benefit typically covers the cost of items you’ve purchased if they’re lost, stolen, or damaged within a certain period, usually 90 days. This can be particularly useful if you’re buying high-ticket items or electronics, as it offers an added layer of security beyond what’s typically offered by the retailer.

Other types of insurance benefits that can be found on credit cards include extended warranties on eligible purchases, car rental insurance, and even coverage for delayed or canceled flights. These benefits can save you a significant amount of money in case something goes wrong with your purchase or trip, and they often come at no additional cost beyond the annual fee.

When evaluating a credit card, make sure to review the insurance benefits it offers and see how they align with your lifestyle. If you travel often or make big-ticket purchases, these insurance benefits could be incredibly valuable and worth considering when choosing a card.

How to Maximize Credit Card Benefits?

To make the most of your credit card, you’ll want to use it strategically to earn rewards, avoid unnecessary fees, and take full advantage of the perks it offers. By being mindful of how you use your card, you can easily turn your everyday spending into valuable rewards and save money. Here are some strategies to maximize your credit card benefits:

- Pay attention to rotating categories and bonus categories to ensure you’re earning the most rewards on your purchases.

- Use your credit card for all your regular purchases, from groceries to gas, to rack up points or cash back.

- Take advantage of sign-up bonuses by meeting the spending requirements within the first few months.

- Use the card’s additional perks, like travel insurance, extended warranties, and purchase protection, to get more value.

- Avoid interest by paying off your balance in full each month to maintain a zero balance and avoid the high APR.

- Combine multiple cards to maximize rewards in different categories, such as using a travel rewards card for flights and a cash-back card for dining.

- Set reminders to track your card’s benefits, like the time frame for using travel credits or redeeming rewards points before they expire.

By implementing these strategies, you can get the maximum benefit from your credit card, whether that’s through rewards, travel perks, or money-saving features.

How to Maintain a Good Credit Score with Credit Cards?

Your credit score is an important part of your financial health, and using credit cards responsibly plays a big role in maintaining or improving that score. The key is to understand how your credit card usage affects your credit score and to practice habits that help you stay on top of it. Here are some simple strategies for maintaining a good credit score with credit cards:

- Pay your credit card bill on time, every time, to avoid late fees and negative marks on your credit report.

- Keep your credit utilization ratio (credit used versus total credit available) under 30% to prevent damaging your score.

- Make more than the minimum payment to reduce your balance faster and avoid paying excessive interest charges.

- Monitor your credit report regularly to check for any errors or unauthorized activity that could hurt your score.

- Avoid opening too many new accounts in a short period, as this can lower your credit score due to hard inquiries.

- Keep old accounts open, even if you’re not using them, to lengthen your credit history and positively affect your score.

- Be mindful of the total amount of debt you’re carrying across all credit cards, and try to pay down debt strategically.

By following these habits, you’ll keep your credit score in good standing, which will give you access to better credit opportunities, lower interest rates, and greater financial flexibility.

Common Credit Card Myths and Misconceptions

There are many myths about credit cards that can lead to confusion or poor financial decisions. Understanding the truth behind these misconceptions can help you make more informed decisions about how you use your cards. Here are some common credit card myths and the facts that debunk them:

- Carrying a balance on your credit card helps build your credit score. In reality, carrying a balance can hurt your credit score due to high interest and increased credit utilization.

- Closing old credit card accounts will improve your credit score. Actually, keeping old accounts open can improve your credit score by increasing your available credit and lengthening your credit history.

- You need to carry a balance to earn rewards. You can earn rewards without carrying a balance—just be sure to pay off your balance each month to avoid interest charges.

- Credit cards are only for people with excellent credit. There are credit cards available for people with all types of credit scores, including secured cards and cards for those with limited or bad credit histories.

- The credit card issuer will automatically raise your credit limit if you maintain a good payment history. While some issuers may increase your credit limit based on your history, you often need to request a limit increase or meet specific criteria.

- Using your credit card too much will lower your score. It’s how much of your available credit you use, not how often you use it. Keeping your credit utilization under 30% is key to maintaining a healthy credit score.

Understanding these myths and the reality behind them helps you manage your credit cards effectively, leading to better financial health and more rewards.

Conclusion

Choosing the right credit card is more than just finding one with the best rewards or lowest interest rate. It’s about finding a card that fits your spending habits, financial goals, and lifestyle. Whether you’re looking to maximize your travel rewards, earn cash back on everyday purchases, or consolidate debt, there’s a card out there that will work for you. By understanding the different types of credit cards and considering factors like interest rates, fees, and rewards programs, you can make an informed decision that helps you save money, earn benefits, and manage your finances better.

Remember that credit cards are a tool—how you use them can make a big difference in the value you get. Paying off your balance in full each month, keeping your credit utilization low, and being mindful of annual fees and APRs are key to using your credit card responsibly. With the right card, you can make the most of every purchase, earn valuable rewards, and enjoy the added perks that come with being a cardholder. The best credit card for you is one that aligns with your goals and helps you get the most out of your spending.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.

-

Sale!

Marketplace Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

E-Commerce Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

SaaS Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

Standard Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

E-Commerce Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

SaaS Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Marketplace Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Startup Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Startup Financial Model Template

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart