Are you looking for an easier way to manage your finances? With so many budgeting apps available, it can be hard to know which one will actually help you take control of your money. Whether you’re trying to track your spending, save for a big goal, or simply keep an eye on your daily expenses, the right budgeting app can make a huge difference.

The good news is, there’s an app out there for every type of budgeter—whether you need something simple and easy to use, or a more advanced tool with plenty of features. This guide will help you explore the best budgeting apps, so you can find the one that fits your financial needs and lifestyle.

What are Budgeting Apps?

Budgeting apps are digital tools designed to help individuals manage their finances by tracking income, expenses, savings, and investments. These apps typically link to your bank accounts, credit cards, and other financial institutions, automatically categorizing your transactions and giving you an overview of your financial health. Whether you’re aiming to pay down debt, save for a major purchase, or simply track your spending, a budgeting app serves as a central hub to help you manage your money.

Budgeting apps are more than just calculators—they offer intuitive interfaces, goal-setting features, and real-time updates to ensure you stay on top of your financial goals. By providing insights into your spending habits and offering suggestions for improvement, these apps can be transformative in building a healthier financial future. They simplify the complex process of money management, making it easier to make informed decisions and create sustainable financial habits.

Importance of Budgeting Apps in Personal Finance

- Helps individuals maintain control over their financial situation by providing a clear picture of income, expenses, and savings goals.

- Prevents overspending by setting budget limits and providing alerts when approaching those limits.

- Assists in achieving long-term financial goals, such as saving for retirement, a home, or an emergency fund.

- Encourages accountability by tracking progress and highlighting areas where improvements can be made.

- Provides insight into financial patterns, allowing individuals to identify unnecessary expenditures and make better choices moving forward.

Why Budgeting Apps are Useful in Today’s Fast-Paced, Digital World

- Offers real-time tracking and updates, which is crucial in a world where financial transactions are constantly happening.

- Eliminates the need for manual tracking, saving time and reducing the chances of human error.

- Accessible on mobile devices, allowing users to manage their finances from anywhere at any time.

- Integrates with other financial tools, like bank accounts and credit cards, for a seamless experience.

- Automates repetitive tasks such as bill payments, savings transfers, and expense categorization, reducing mental load and improving financial efficiency.

Variety of Apps Available Based on Individual Needs

There is a wide range of budgeting apps available, each catering to different financial needs and preferences. Whether you’re someone who wants a simple app to track your spending or someone who needs a comprehensive personal finance solution, there is an app designed for you. Some apps specialize in goal-setting, while others are geared toward families or people with complex financial portfolios. With options for minimalistic users as well as those looking for detailed reports and financial analysis, you can find an app that fits your financial habits and goals.

Top Budgeting Apps

There’s no shortage of budgeting apps available today, each offering unique features to cater to various needs. Whether you’re looking for an app to help with day-to-day expenses or one to track long-term financial goals, you’ll find a wide range of options. Some apps focus on simplicity and ease of use, while others offer in-depth tools for financial planning and investment tracking. Here’s a look at some of the top budgeting apps of 2025 that have gained popularity for their effectiveness, user experience, and array of features.

Mint

Intuit Mint is one of the most widely used budgeting apps, known for its comprehensive set of features that help users track their spending, create budgets, and plan for financial goals. Mint automatically syncs with your bank accounts, credit cards, and other financial institutions, providing a seamless view of your entire financial life. It categorizes your expenses into pre-set categories like groceries, dining, and transportation, making it easy to see where your money is going. Additionally, Mint offers credit score monitoring, bill tracking, and even provides alerts for upcoming bills and overspending.

Mint’s real-time updates and detailed reports make it a powerful tool for users who want a high-level view of their finances without too much complexity. However, the app’s free version does include ads, which can be a bit distracting for some users. The app’s ease of use and accessibility make it a popular choice, especially for beginners or people looking for an all-in-one solution to manage their money.

YNAB (You Need a Budget)

YNAB is a budgeting app focused on helping users take control of their finances with a proactive, goal-oriented approach. Unlike many budgeting apps, YNAB encourages a zero-based budgeting method, where every dollar you earn is assigned a job, such as paying bills, saving, or investing. This helps you prioritize your spending, create realistic budgets, and track your progress toward financial goals.

YNAB is highly customizable, allowing users to tailor categories and goals to fit their individual needs. The app’s educational resources also set it apart, with detailed workshops, videos, and articles designed to help users master the art of budgeting. The paid subscription model may be a deterrent for some, but many users find that the app’s robust features and personalized support are well worth the investment. YNAB is ideal for users who want a more hands-on, strategic approach to budgeting, and it works particularly well for those looking to pay down debt or build significant savings.

PocketGuard

PocketGuard is a budgeting app that focuses on simplicity and ease of use, making it a great option for people who want to quickly manage their finances without diving into too many complicated features. The app links to your bank accounts, credit cards, and other financial institutions, automatically categorizing your transactions and showing you how much money you can safely spend after accounting for bills and savings goals. PocketGuard’s “In My Pocket” feature helps users visualize how much money is available to spend, reducing the risk of overspending.

The app also includes options for setting financial goals and monitoring progress toward savings targets. While the free version offers a good set of basic tools, PocketGuard’s premium version unlocks additional features like custom categories and more detailed reports. This app is best for users who want to keep things simple and don’t need the complexity of a more robust budgeting tool like YNAB or Mint.

EveryDollar

EveryDollar, created by financial expert Dave Ramsey, is designed for users who want to follow a strict zero-based budgeting method. The app helps you assign a specific purpose for every dollar you earn, ensuring that you stay on track with your financial goals and avoid overspending. EveryDollar provides easy-to-use budgeting templates that help you categorize your spending and track your expenses. The app also allows you to set up savings goals and track your progress toward them.

While EveryDollar offers a free version, users who want to link their bank accounts for automatic transaction syncing will need to upgrade to the premium version. EveryDollar’s user-friendly interface and focus on helping users create and stick to a budget make it ideal for people who want to take a disciplined, hands-on approach to managing their money. The app’s simplicity and commitment to Ramsey’s financial philosophy make it a top choice for anyone looking to implement his “Financial Peace” approach.

GoodBudget

GoodBudget is a versatile envelope budgeting app that helps users track and manage their spending using virtual “envelopes.” Each envelope is designated for a specific spending category, like groceries, entertainment, or transportation. The app allows you to set aside money in each envelope for future expenses, ensuring that you stay within your budget. GoodBudget also features syncing between devices, allowing families or groups to track their finances together.

This app is particularly useful for people who prefer the envelope method of budgeting, where cash is set aside for specific expenses. While it doesn’t connect directly to your bank accounts like some other apps, it gives users full control over how they allocate their money. GoodBudget is available for free, with an optional premium version that offers additional features, such as more envelopes and syncing for multiple devices. It’s great for individuals, families, or groups who want a simple, hands-on approach to budgeting that doesn’t rely on bank integration.

Qapital

Qapital is a savings-focused budgeting app that combines goal-setting with automatic savings tools. The app allows you to create savings goals for things like vacations, emergencies, or big purchases. You can set up automatic transfers to your savings account, including features like round-up transactions (where your purchases are rounded up to the nearest dollar, and the difference is saved). Qapital makes saving fun and easy with its visually appealing interface and engaging features like “Gifts” and “Dreams.”

The app’s goal-setting features are its strongest point, making it ideal for users who want to save for specific goals without a lot of effort. While Qapital’s main focus is on saving, it also offers budgeting features like expense tracking and financial insights. The app’s premium version offers even more tools, such as customized savings plans, making it a great option for anyone who wants to build savings over time while staying on top of their spending.

Empower

Empower, previously Personal Capital, is a comprehensive financial app that combines budgeting with wealth management. It allows users to track their spending while also providing insights into their investments and retirement planning. Empower’s strength lies in its investment tracking capabilities, offering an easy-to-understand dashboard that consolidates your bank accounts, retirement funds, credit cards, and investment portfolios.

With Empower, you can easily monitor your net worth, set savings goals, and track progress toward long-term financial objectives like retirement. This app is ideal for users looking for a more holistic view of their financial situation, especially those who want to include their investment portfolio and future planning in the same tool.

Tiller Money

Tiller Money is a unique budgeting app that connects with Google Sheets or Microsoft Excel, allowing you to create a highly customizable budget in a familiar format. With Tiller Money, you can automatically import transactions from your bank accounts and categorize them based on your preferences. It’s ideal for users who enjoy working with spreadsheets and want more flexibility in their budgeting process.

While it does require a bit more hands-on effort than other apps, Tiller Money’s integration with Google Sheets makes it an excellent option for those who want to track their finances in a customizable format without being locked into the rigid structure of most budgeting apps.

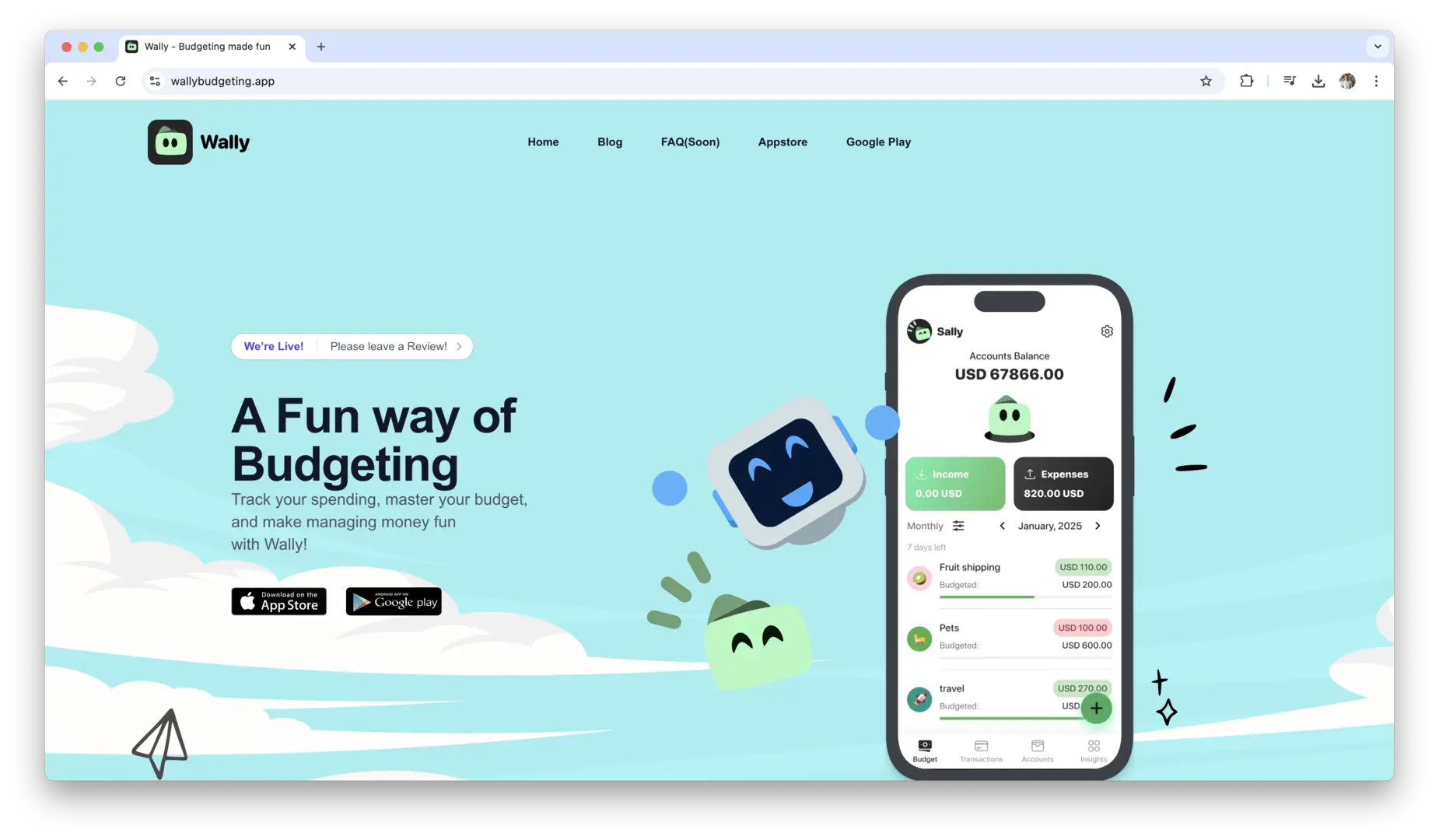

Wally

Wally is a sleek budgeting app that allows users to track their expenses manually or automatically by syncing with bank accounts and credit cards. The app’s main appeal is its simplicity, making it ideal for people who want to keep a close eye on their finances without overwhelming features. Wally offers a clean, user-friendly interface and allows users to create budget categories, set savings goals, and monitor their progress.

With Wally, you can scan receipts and categorize expenses easily, making it a great app for people who need a straightforward solution for managing their daily spending. While the free version offers plenty of features, Wally’s premium subscription unlocks additional functionality like multi-currency support and additional budget categories.

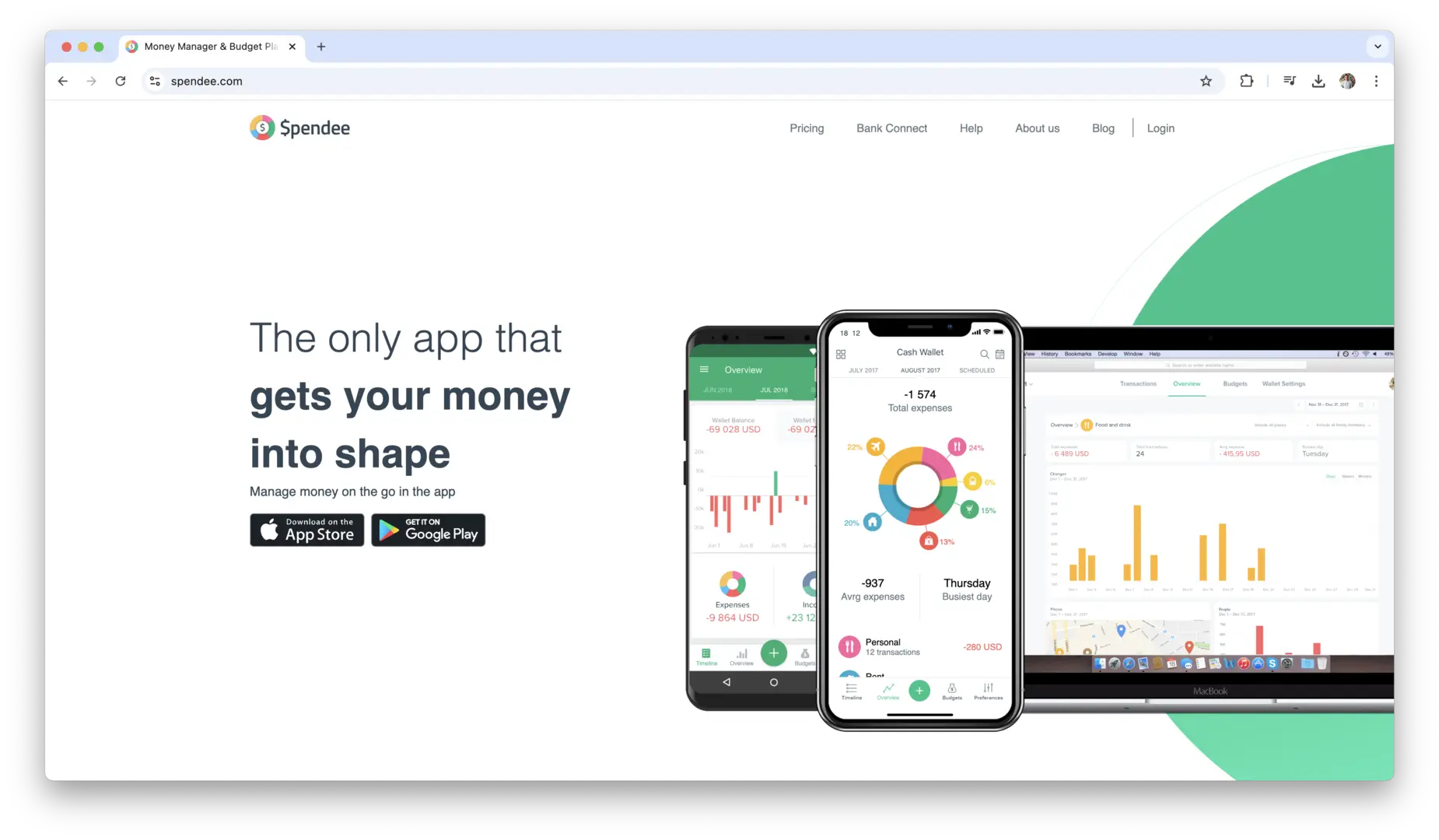

Spendee

Spendee is a colorful, intuitive budgeting app that allows you to easily track your expenses and manage your finances. It offers both automatic syncing with your bank accounts and manual entry of expenses. One of Spendee’s standout features is its ability to create shared wallets, making it an excellent option for families or groups who need to manage shared expenses.

Spendee’s visual reports and detailed spending insights help you stay on top of your finances, while its collaborative features make it ideal for users who need a simple, yet effective, tool for group or family budgeting.

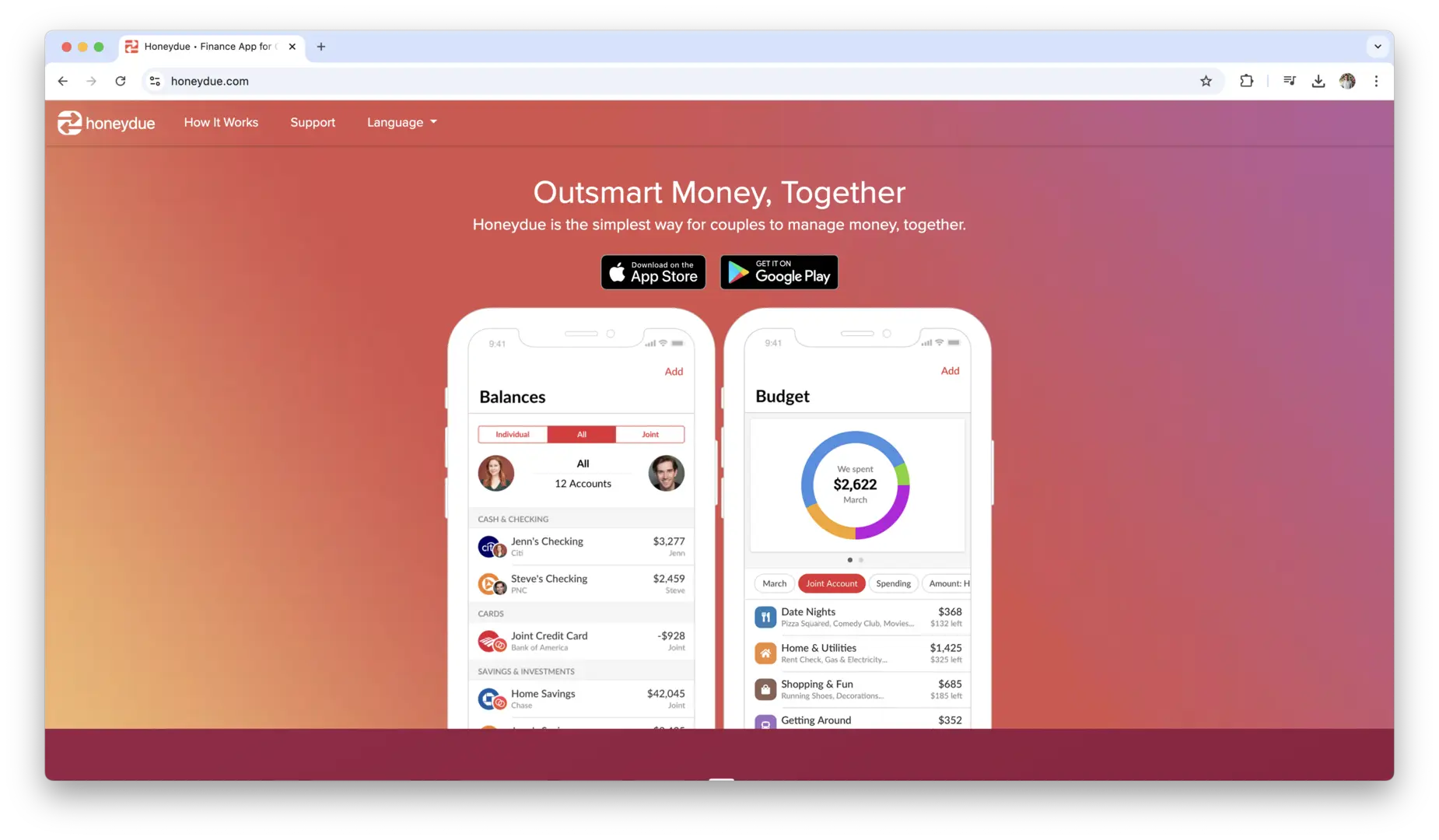

Honeydue

Honeydue is a budgeting app designed specifically for couples. It allows both partners to track shared expenses, set financial goals together, and stay on top of bills. Honeydue makes it easy to divide expenses, track who’s responsible for paying what, and ensure that both people are contributing to the household budget.

The app allows both partners to have separate logins, but still provides visibility into each other’s financial activity. Honeydue is a great solution for couples who want to streamline their finances, improve communication around money, and achieve their financial goals together.

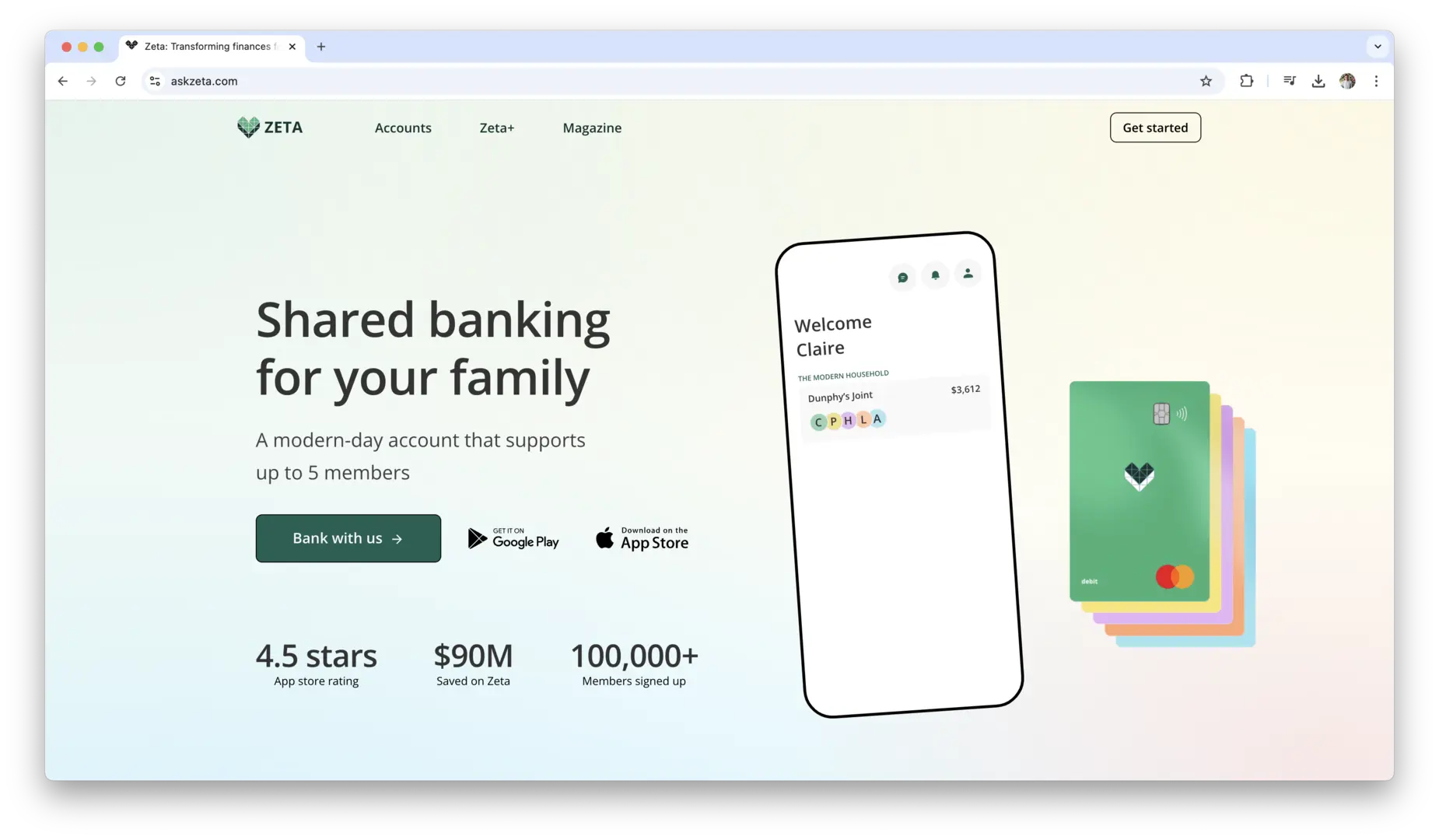

Zeta

Zeta is a budgeting app built for couples and families, offering the ability to manage shared expenses while maintaining separate accounts. The app’s strength lies in its ability to help couples collaborate on their financial goals. Zeta allows users to track both joint and individual accounts, divide expenses, and create custom financial goals.

Zeta’s user-friendly interface and collaborative features make it a perfect tool for couples looking to improve financial communication and teamwork. The app is especially useful for managing household budgets and setting savings targets together.

Buxfer

Buxfer is a personal finance app designed for users who want to track their spending, manage their budget, and plan for future expenses. The app offers features like bill reminders, debt management, and financial goal tracking. One of Buxfer’s standout features is its ability to generate detailed reports and offer insightful analysis based on your spending habits.

Buxfer integrates with bank accounts and credit cards, allowing for automatic transaction syncing. It’s an excellent choice for people who want a simple budgeting tool with advanced reporting features, without the complexity of a full-blown financial planning tool.

CountAbout

CountAbout is a budgeting app that focuses on simplicity and customization. It allows users to track their income, expenses, and savings goals, while offering the ability to categorize spending and create custom budget categories. CountAbout’s integration with both Mint and Quicken makes it easy to transfer data between platforms, making it an excellent option for users who have been using other budgeting tools and want to switch without losing their data.

CountAbout is ideal for users who appreciate a straightforward, customizable budgeting app that allows them to have full control over their financial information. With features like recurring transaction support and detailed reporting, CountAbout offers a simple solution for managing personal finances.

Each of these top budgeting apps offers unique features that cater to different financial needs. Whether you’re looking for a simple way to track spending, a tool to help you pay down debt, or a solution to save for a specific goal, there’s an app on this list that can help you take control of your finances. By selecting the right app for your personal goals and financial habits, you’ll be able to streamline your budgeting process and work toward your financial objectives more effectively.

Budgeting Apps Features to Look For

When you’re looking for the perfect budgeting app, there are several features that can make a big difference in how well the app helps you manage your finances. The right app can simplify your money management, saving you time and frustration. These are the key features you should focus on as you evaluate different budgeting apps to ensure they match your needs.

User-Friendly Interface

A budgeting app’s interface plays a huge role in how easy it is to use. If the app is complicated, you’ll find yourself avoiding it, which defeats the purpose of tracking your spending. You want an app that is easy to navigate, with a clean design that doesn’t overwhelm you with information.

Look for apps that provide an intuitive layout, so you can jump right in without needing a tutorial. The main dashboard should offer a snapshot of your financial health—things like current balance, upcoming bills, and the remaining budget for each category—without clutter. Also, consider whether the app allows you to personalize how the information is displayed, like adjusting the font size or customizing your categories. The goal is to make managing your finances feel effortless, not like a chore.

Expense Tracking and Categorization

Expense tracking is at the core of budgeting, and an effective budgeting app should automatically track and categorize your expenses. This feature is essential because it eliminates the need to manually enter each transaction, saving you time and effort.

The best apps don’t just track expenses; they categorize them too. Categories like groceries, dining out, utilities, and entertainment can give you valuable insight into where your money is going. Additionally, some apps allow you to customize these categories to reflect your unique spending habits. For example, you might want a specific category for “Coffee” or “Fitness.” Automatic categorization can also help you spot trends in your spending, showing you where you might be able to cut back or make adjustments.

Integration with Bank Accounts and Credit Cards

One of the most important features in a budgeting app is its ability to integrate with your bank accounts, credit cards, and other financial institutions. When the app syncs directly with your financial accounts, you don’t have to worry about manually entering transactions, which can be time-consuming and error-prone.

Look for apps that support bank-level security and work with a wide variety of banks, credit cards, and payment services. This allows you to track all of your transactions in real-time, ensuring you have up-to-date information on your financial status. For instance, if you’re getting close to overspending in a particular category, you’ll be alerted immediately, which can help you stay on track. Plus, some apps offer features like bill reminders and automatic transaction imports, so you never miss a payment or get caught off guard by an unexpected expense.

Customization and Goal Setting

The ability to customize your budget and set personal financial goals is crucial for long-term success. Whether you want to save for a vacation, pay off debt, or create an emergency fund, a good budgeting app should let you set up goals and track your progress over time.

Customization allows you to create a budget that reflects your lifestyle, spending habits, and financial goals. This could mean setting custom spending limits for each category or creating specific savings goals. For example, if you’re saving for a down payment on a house, you can set that goal in your app and watch your progress. Many apps also let you adjust your goals as your financial situation changes, so you’re not locked into one set of parameters.

Some apps even go a step further by offering features like automated savings, where the app can round up your transactions and put the extra change into a savings account. This feature helps you save without even thinking about it.

Reporting and Analysis Features

Detailed reports and analysis are vital if you want to take a deeper look at your finances. A budgeting app that provides visual reports—such as pie charts, bar graphs, and spending trends—makes it easier to understand where your money is going and what areas need improvement.

The best apps give you monthly or quarterly breakdowns of your spending habits. You can see how much you’re spending in each category and identify trends or unexpected expenses. Some apps even offer predictive features that show you where your finances will be in the coming months based on your current spending. For instance, you might see a forecast for how much you’ll spend on groceries in the next 30 days, which can help you make more informed financial decisions.

These reporting tools can be especially helpful if you’re trying to improve your financial situation, whether it’s reducing debt or increasing savings. Tracking your spending is the first step toward financial freedom, and these detailed reports give you the insight you need to make meaningful changes.

Security and Privacy

Since you’ll be connecting your bank accounts and credit cards to your budgeting app, security and privacy should be top priorities. The best apps use bank-level encryption to keep your financial data safe and ensure that only you can access it.

When you’re evaluating budgeting apps, check if the app offers two-factor authentication (2FA) for an added layer of security. 2FA requires you to verify your identity through a secondary method, like a text message or an app, in addition to your password. This helps prevent unauthorized access to your data, even if your password is compromised.

Privacy policies are also essential. Make sure the app has a clear and transparent privacy policy, outlining how your data is used and whether it’s shared with third parties. You should be able to make an informed decision about whether you’re comfortable with how your information is handled. Apps with strong security measures and transparent privacy policies will give you peace of mind, knowing your sensitive data is protected.

These features—user-friendliness, expense tracking, customization, goal setting, reporting, and security—are the backbone of an effective budgeting app. When you find an app that checks all these boxes, you’re well on your way to mastering your finances.

Types of Budgeting Apps

When it comes to budgeting apps, one size doesn’t fit all. Depending on your financial goals, habits, and the level of complexity you’re comfortable with, there are different types of budgeting apps that can suit your needs. Some apps are designed to handle every aspect of your financial life, while others focus on specific areas like saving or debt reduction. Understanding the different types of budgeting apps will help you find the right one to simplify your financial management and make budgeting a more manageable task.

All-in-One Personal Finance Apps

All-in-one personal finance apps are ideal for users who want to keep track of every aspect of their financial life in one place. These apps typically combine budgeting tools with features for managing investments, tracking bills, monitoring credit scores, and even planning for retirement. If you want a comprehensive solution that covers all your financial needs, this is the type of app to look for.

These apps usually link directly to your bank accounts, credit cards, and other financial institutions, allowing you to sync all your transactions automatically. This means you don’t have to manually enter data, which saves you time and effort. All-in-one apps also provide detailed reports and insights into your financial health, helping you see where you’re spending, where you can cut back, and how you can grow your savings.

A standout feature of all-in-one apps is their versatility. They are perfect for people who want a holistic view of their finances. For example, Mint is a popular all-in-one app that tracks everything from daily spending to investments, credit scores, and retirement funds. With these apps, you can plan for future goals while also staying on top of your day-to-day expenses. The trade-off is that they can sometimes be a bit overwhelming if you’re new to budgeting, as they offer a lot of features and tools.

Simplified Expense Trackers

If you’re someone who prefers a minimalist approach to budgeting, simplified expense trackers might be your best bet. These apps focus mainly on tracking and categorizing your daily expenses, without the added complexity of investment management, retirement planning, or credit score monitoring. They’re ideal for users who just want a straightforward way to monitor spending, stay within budget, and avoid overspending.

Simplified expense trackers tend to have a clean, easy-to-use interface that requires little effort to set up. You don’t need to link all your bank accounts and investment portfolios to these apps—just connect your credit cards or checking account, and the app will automatically track and categorize your transactions. They usually have a few basic features like setting a monthly budget, getting alerts when you’re about to overspend in a category, and viewing a simple report on your spending habits.

These apps are great for those who don’t need all the bells and whistles but still want a reliable tool for staying on top of their finances. Examples of these types of apps include PocketGuard and Wally. These apps are often free or come with a low-cost premium version, making them perfect for anyone on a tight budget who wants to start budgeting without a lot of complexity.

Apps Focused on Specific Goals (e.g., Saving, Debt Reduction)

Sometimes, your financial goals are very specific—whether you’re trying to pay off debt, save for a down payment on a house, or build an emergency fund. If your primary focus is on achieving one or two financial milestones, apps that focus on specific goals might be the best option for you.

These apps give you the tools you need to stay focused on one key objective at a time. For example, if you’re working on paying down debt, an app like Debt Payoff Planner can help you track your debt, calculate your paydown schedule, and determine how much extra you should pay each month to reach your goal faster. On the other hand, if saving for something like a vacation or a new car is your top priority, an app like Qapital can help you set up separate savings goals, automate contributions, and track your progress.

One of the major benefits of goal-focused apps is that they simplify your journey toward a specific financial target. By narrowing your focus, you can see exactly how much progress you’re making and where you need to adjust your budget. Many of these apps also offer automation features, such as rounding up purchases to the nearest dollar and depositing the change into your savings goal or debt repayment fund.

Whether you’re tackling student loan debt, saving for a special occasion, or building a rainy-day fund, these apps help you stay motivated and organized by breaking your goal into manageable steps and giving you a clear picture of how close you are to achieving it.

Apps for Families or Group Budgeting

Managing a family or shared household budget can be challenging, especially when multiple people are contributing to the finances. Apps designed for families or group budgeting help streamline this process by allowing multiple users to track shared expenses, set joint goals, and stay on the same page when it comes to finances.

These apps often allow each family member to create their own account while still contributing to a central budget. For example, if you’re living with roommates or a partner, you can easily split expenses like rent, utilities, and groceries, and assign tasks or payments to each person. The app will automatically track the payments, so there’s no confusion about who owes what.

One great feature of family and group budgeting apps is the ability to create shared savings goals. Whether you’re saving for a vacation, home renovation, or a big purchase, everyone can contribute and see the progress in real-time. Some apps also allow for bill-splitting, where you can quickly calculate each person’s share of a bill and track who has paid. This helps prevent arguments about who paid what and ensures that everyone is contributing fairly.

Popular apps in this category include Honeydue and GoodBudget. Honeydue, for example, is specifically designed for couples, enabling them to sync their accounts, set up shared goals, and stay on top of household expenses. For families with children or households with multiple roommates, apps like GoodBudget can help coordinate individual contributions and keep everyone in the loop.

These apps are perfect for households where budgeting requires collaboration and communication, ensuring that everyone is on the same page when it comes to managing shared expenses and financial goals.

With so many different types of budgeting apps available, it’s important to choose one that aligns with your unique needs and financial goals. Whether you’re looking for a comprehensive all-in-one solution, a simple tracker, a goal-specific tool, or an app for managing group finances, there’s an option out there to help you stay organized and take control of your money. Understanding the different types of apps ensures you’ll find one that suits your lifestyle, helping you manage your finances with ease.

How to Choose the Best Budgeting App for You?

Choosing the right budgeting app is a decision that can significantly impact your financial journey. With so many options available, it can be overwhelming to know where to start. The best budgeting app for you will not only help you manage your money effectively but will also fit into your lifestyle and financial goals. To make the right choice, it’s essential to consider several key factors that can make or break your budgeting experience. Here’s a guide to help you narrow down the options and find the one that suits your needs.

Consider Your Financial Goals and Habits

Before you even begin exploring different budgeting apps, it’s important to take a step back and think about your specific financial goals. Are you looking to save for a down payment on a house, pay off credit card debt, or simply track your day-to-day spending? Identifying your primary financial goals will help you choose an app that aligns with your needs.

If your primary goal is to reduce debt, apps that focus on debt repayment, like Debt Payoff Planner, may be ideal. These apps allow you to track your debt, create a paydown schedule, and set reminders to stay on track. On the other hand, if your goal is to build savings for the future, apps that emphasize saving, like Qapital, are better suited. These apps let you set up specific savings goals and automate deposits, making it easier to stay committed.

Additionally, think about your financial habits. Are you someone who spends impulsively or do you stick to a strict budget? If you tend to spend more than you plan, an app that offers automatic categorization and spending alerts might help you stay on top of your budget. For those who already have a well-established financial routine, a more advanced app that offers customization and detailed reporting may be more beneficial.

Assess Your Preferred User Experience

The user experience of an app can greatly affect how often and how effectively you use it. If the app is difficult to navigate or cluttered with unnecessary features, you may find yourself abandoning it after a short time. To ensure long-term success with your budgeting, consider how you prefer to interact with the app—whether on your phone, tablet, or desktop—and the design that feels most comfortable for you.

Some apps are optimized for mobile use, offering sleek, easy-to-navigate interfaces that make budgeting on the go simple and fast. If you’re someone who prefers managing finances while commuting or traveling, a mobile-first app like Mint or PocketGuard might be ideal for you. These apps are designed to work seamlessly on smartphones, providing easy access to your financial information whenever you need it.

On the other hand, if you prefer a larger screen and more in-depth analysis of your finances, desktop versions of budgeting apps may be more to your liking. Desktop apps often offer more complex features like advanced reporting and a wider array of customization options, giving you greater control over your budget.

Also, consider the design of the app. A clean, intuitive layout can make a world of difference in terms of how you engage with the app. Look for apps that offer clear dashboards, well-organized categories, and easy access to essential tools like transaction tracking, goal setting, and reports. An app with a simple yet attractive design can make managing your finances more enjoyable, helping you stay motivated to budget consistently.

Evaluate the App’s Privacy and Security Features

When it comes to budgeting apps, security and privacy are of the utmost importance. After all, you’ll be linking sensitive financial information, including bank accounts, credit cards, and investment details. The last thing you want is to put your personal data at risk. As you evaluate different apps, make sure you choose one that offers robust security measures and a clear privacy policy.

Look for apps that provide bank-level encryption to protect your financial data. This ensures that your information is safely stored and transmitted, keeping it secure from hackers. Many reputable budgeting apps also use two-factor authentication (2FA), which adds an extra layer of security by requiring you to verify your identity through a secondary method, such as a text message or authentication app.

Additionally, pay attention to the app’s privacy policy. Reputable apps will be transparent about how they use your data, whether they share it with third parties, and how long they store it. Some apps may use your information for marketing purposes, while others may sell data to third-party partners. If this concerns you, look for apps that allow you to opt out of data sharing or provide a strict “no-sharing” policy. Be sure to read through the app’s privacy terms to understand exactly how your personal information is handled.

If you’re concerned about privacy, prioritize apps that offer minimal data sharing and give you full control over your information. You should never have to sacrifice your privacy for convenience.

Take Pricing and Value for Money Into Account

Budgeting apps come in a variety of pricing structures, from free to subscription-based models. While many apps offer free versions with basic features, others charge a monthly or yearly fee in exchange for more advanced tools and functionalities. The key to choosing the right app is understanding what you get for your money and whether it provides good value based on your needs.

Free apps like Mint and PocketGuard are great if you’re just starting to budget or need a simple way to track your spending. However, these free versions often come with limitations, such as ads or fewer customization options. If you’re looking for more advanced features, such as goal setting, investment tracking, or in-depth reporting, you might want to consider a paid app like YNAB or EveryDollar. These apps offer premium features that can help you take your budgeting to the next level.

When evaluating pricing, also consider the long-term value the app provides. For example, an app that helps you reduce debt or build savings faster might justify the cost, even if it comes with a subscription fee. Conversely, if you’re only using a handful of features, it may not be worth paying for a premium version.

Before committing to a paid plan, see if the app offers a free trial or a money-back guarantee. This gives you the opportunity to test the app and decide whether it truly meets your needs without any financial risk. If you find that the app doesn’t offer the features or functionality you were hoping for, you can cancel before the subscription kicks in.

In the end, the best app for you is the one that provides the right balance of features, user experience, and value for the price. Take the time to evaluate your options and determine whether the app’s premium features are worth the cost based on your unique financial goals.

Choosing the best budgeting app for your needs is an important step in taking control of your finances. By considering your financial goals, preferred user experience, security needs, and the app’s pricing, you can find the perfect tool to help you manage your money efficiently. With the right budgeting app, you’ll be better equipped to track your expenses, save for future goals, and achieve financial success.

How to Get the Most Out of Your Budgeting App?

To truly maximize the benefits of your budgeting app, consistency and engagement are key. Using your app regularly, and taking full advantage of its features, can help you stay on track and ensure you’re meeting your financial goals. A budgeting app is only effective if you use it as a tool for real-time financial management and decision-making. Below are some strategies to help you get the most out of your app:

- Regularly update your account balances and transactions to keep your budget accurate. Set aside a few minutes every day or week to check your transactions and update categories.

- Take full advantage of the app’s reporting tools. Review your spending trends, and identify areas where you might be overspending or where you could cut back.

- Set realistic financial goals within the app, and use the progress tracking features to keep yourself motivated. Break your goals down into manageable steps, and regularly review your progress.

- Use the automation features to your advantage, such as setting up automatic savings transfers or bill payments, to ensure you never miss a due date or fall short on your savings goals.

- Sync your budgeting app with all your financial accounts (bank accounts, credit cards, loans, etc.) to ensure you’re tracking everything in one place.

- Customize the app to suit your needs. Create budget categories that reflect your unique lifestyle and financial priorities, whether it’s setting a category for pet expenses or a specific savings goal.

- Take advantage of any alerts or notifications that the app provides to warn you about upcoming bills or when you’re close to exceeding your budget limits.

Using your app as a proactive tool and engaging with it regularly will make budgeting feel less like a chore and more like an essential part of your financial routine.

Common Mistakes to Avoid When Using Budgeting Apps

While budgeting apps are incredibly helpful, it’s easy to make mistakes that can derail your efforts. To ensure your budgeting app works for you, it’s important to avoid some common pitfalls. Recognizing these mistakes ahead of time can help you make smarter financial decisions and stick to your goals with confidence.

- Failing to update your account balances regularly, leading to outdated or inaccurate budgeting data.

- Not categorizing transactions properly or leaving transactions uncategorized, which can skew your overall spending picture.

- Ignoring subscription services and recurring expenses that may seem small but add up over time, causing you to overspend without realizing it.

- Setting unrealistic budgets or financial goals that are difficult to stick to, leading to frustration and a lack of motivation.

- Overlooking bills or expenses that are due, especially if you don’t set up automatic reminders or bill payments within your app.

- Using too many financial apps and not syncing them together, which can lead to confusion and inconsistent data across platforms.

- Not taking advantage of automated savings or bill payment features, which can simplify your financial life and ensure you never miss a payment or savings transfer.

- Focusing too much on short-term goals and ignoring long-term financial planning, such as retirement savings or emergency funds.

- Avoiding reviewing your spending reports and analysis regularly, which can prevent you from identifying areas where you could improve.

- Not factoring in irregular income or expenses, such as seasonal changes in your earnings or special one-time purchases.

By avoiding these common mistakes, you’ll be able to use your budgeting app more effectively and keep your financial management on track. The goal is to create a budget that works for you, one that is flexible enough to adapt to your needs and accurate enough to help you make informed decisions.

Conclusion

Choosing the right budgeting app doesn’t have to be complicated. With so many options available, it’s all about finding the one that fits your financial habits and goals. Whether you’re looking for something simple to track your daily spending or a more robust tool to manage savings and investments, there’s an app that can help you stay organized and in control of your money. Each app offers unique features, so it’s important to prioritize what matters most to you, whether it’s ease of use, goal tracking, or investment monitoring.

Ultimately, the best budgeting app is the one you’ll actually use. No matter how advanced the features are, consistency is key when it comes to budgeting. By choosing an app that aligns with your financial goals and feels comfortable to use, you’ll be more likely to stick with it and achieve better financial results. Take the time to explore your options, and don’t hesitate to try out a few different apps to see which one works best for your needs. The right app can make managing your finances feel a lot easier and more straightforward.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.