Looking for the best airline credit card but feeling overwhelmed by all the options? With so many cards available, choosing the right one can be tricky, but it doesn’t have to be. Whether you’re looking to rack up miles for a free flight, enjoy perks like free checked bags, or save on travel expenses, the right airline credit card can make a huge difference. This guide breaks down the best cards based on your needs, from frequent flyer rewards to flexible travel options. We’ll help you understand the key features to look for and which cards offer the most value for your lifestyle and travel habits.

What is an Airline Credit Card?

An airline credit card is a financial product designed specifically to help travelers earn rewards, such as frequent flyer miles, through everyday spending. These cards are typically issued in partnership with a specific airline or group of airlines, offering benefits and perks tailored to travelers who frequently book flights or make travel-related purchases. Airline credit cards not only allow you to accumulate miles for flights, but they also offer a range of additional benefits that enhance your travel experience, including airport perks, travel protections, and discounts on travel-related expenses.

While these cards are often associated with frequent flyers, they can also be valuable for occasional travelers who want to maximize rewards on everyday purchases. Airline credit cards can offer significant advantages, especially if you’re loyal to a particular airline or if you fly often enough to take full advantage of the benefits they provide.

The Importance of Airline Credit Cards

- Earn rewards for travel: Airline credit cards help you earn frequent flyer miles or points for your everyday purchases, which can be redeemed for flights, upgrades, and other travel-related rewards.

- Maximize travel perks: Many cards offer valuable benefits like airport lounge access, priority boarding, free checked bags, and complimentary upgrades, making your travel experience more comfortable and enjoyable.

- Save on travel costs: Airline credit cards can help offset the cost of your trips by offering rewards, sign-up bonuses, and discounts on flights and travel-related purchases.

- Specialized benefits for frequent flyers: For those who travel regularly, these cards offer exclusive perks that make flying more convenient, such as expedited security screening and additional baggage allowances.

- Flexible redemption options: With the right airline credit card, you can redeem miles for flights, hotel stays, car rentals, or even travel experiences, offering flexibility in how you use your rewards.

Benefits of Choosing the Right Airline Credit Card

- Earn miles for every dollar spent: Airline credit cards offer the opportunity to earn miles for both travel-related and non-travel purchases, allowing you to accumulate rewards with every purchase.

- Sign-up bonuses: Many cards offer generous sign-up bonuses that can give you a substantial number of miles upfront, helping you start earning rewards immediately.

- Access to airport lounges: Many premium airline credit cards grant you access to exclusive airport lounges, offering a more comfortable and relaxing experience before your flight.

- Priority boarding and free checked bags: These perks can save you time and money, allowing you to board earlier and check your luggage at no extra cost.

- Travel insurance and protections: Airline credit cards often come with built-in travel protections, such as trip cancellation insurance, lost baggage reimbursement, and rental car coverage.

- Exclusive discounts and partner offers: Certain cards offer discounts on airline tickets, in-flight purchases, and even vacation packages, making it easier to save on travel expenses.

- Upgrades and companion tickets: Premium cards may offer the chance to receive upgrades to higher-class seating or companion tickets that let you bring a travel partner at a discounted rate.

- Foreign transaction fee waivers: Many airline credit cards waive foreign transaction fees, which can save you money when traveling abroad.

Best Airline Credit Cards

Selecting the best airline credit card for your needs depends on a variety of factors, such as how often you travel, which airline you prefer, and the types of perks that matter most to you. With so many options available, it’s important to choose a card that aligns with your travel habits and financial goals. The best airline credit cards offer a combination of great rewards, travel perks, and low fees, making them ideal for both frequent flyers and occasional travelers.

Here are some of the best airline credit cards available, each offering unique benefits to suit different types of travelers.

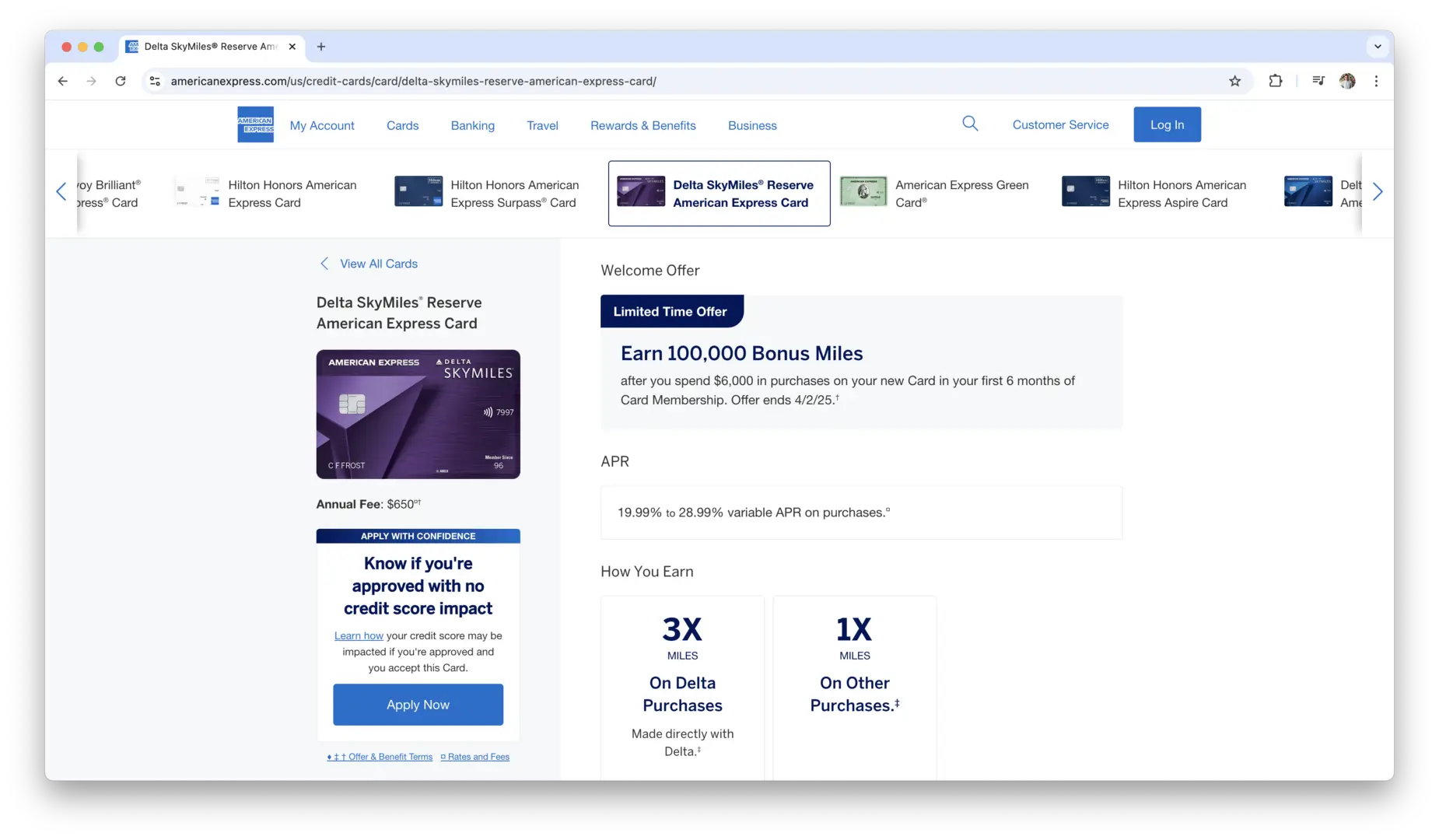

Best for Frequent Flyers: Delta SkyMiles Reserve American Express Card

If you’re a frequent Delta flyer, the Delta SkyMiles Reserve American Express Card is one of the top choices. This premium card offers a host of benefits tailored to make your travel experience more comfortable and rewarding. With an annual fee of $550, it’s on the higher end, but it provides extensive perks, including:

- 3 miles per dollar on Delta purchases: Earn a higher rate of miles for every dollar spent directly with Delta.

- Complimentary Delta Sky Club access: Enjoy access to over 50 Delta Sky Club locations when flying Delta, providing a relaxing pre-flight experience.

- Annual Companion Certificate: Receive a certificate for a companion to fly with you at no additional cost (subject to availability).

- Priority boarding: Skip the lines and enjoy priority boarding when you fly with Delta, so you can settle into your seat faster.

- Upgrade possibilities: Members may receive complimentary upgrades to first-class seating, depending on availability and status.

This card is best for those who travel with Delta regularly and want to maximize their miles, earn high rewards on Delta purchases, and access premium airport benefits.

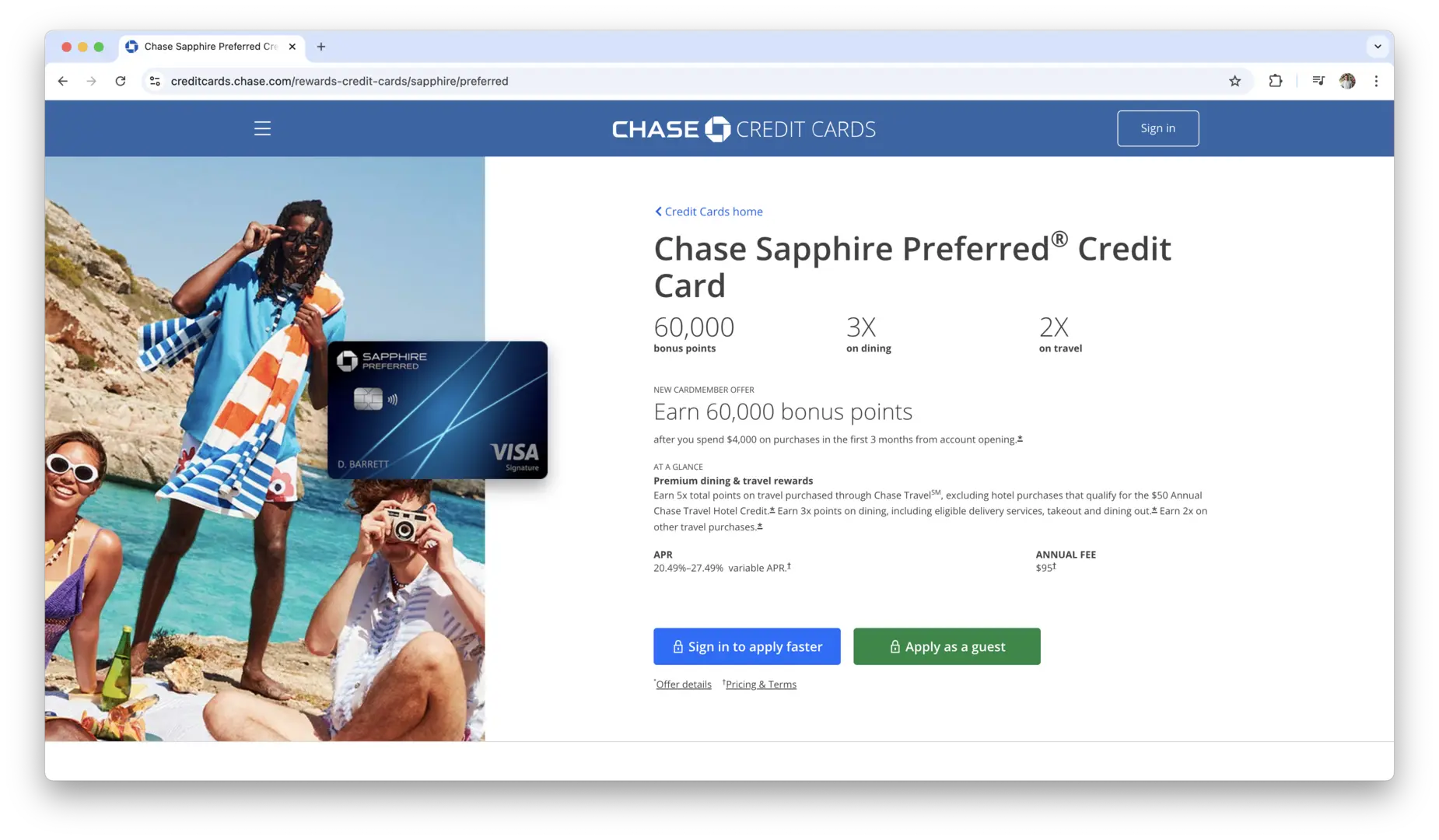

Best for Flexible Travel: Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card is an excellent option for travelers who want flexibility. Unlike airline-specific cards, this general travel card offers 2 points per dollar on travel and dining, and 1 point on all other purchases. It also allows you to transfer your points to more than 10 airline and hotel partners, including United, Southwest, and British Airways, giving you a wide range of options when redeeming your rewards. Additional perks include:

- 60,000 bonus points: After spending $4,000 in the first 3 months, you can earn a sizable bonus, which can be redeemed for travel or transferred to partners.

- No foreign transaction fees: Use this card when traveling internationally without the added cost of foreign transaction fees.

- Primary car rental insurance: Coverage for car rentals, which can save you money on insurance when renting a vehicle abroad.

- Travel protections: Includes trip cancellation, delay, and lost baggage insurance, providing peace of mind during your travels.

If you want a flexible card that can help you earn travel rewards for both flights and hotels across various providers, the Chase Sapphire Preferred Card is a great choice.

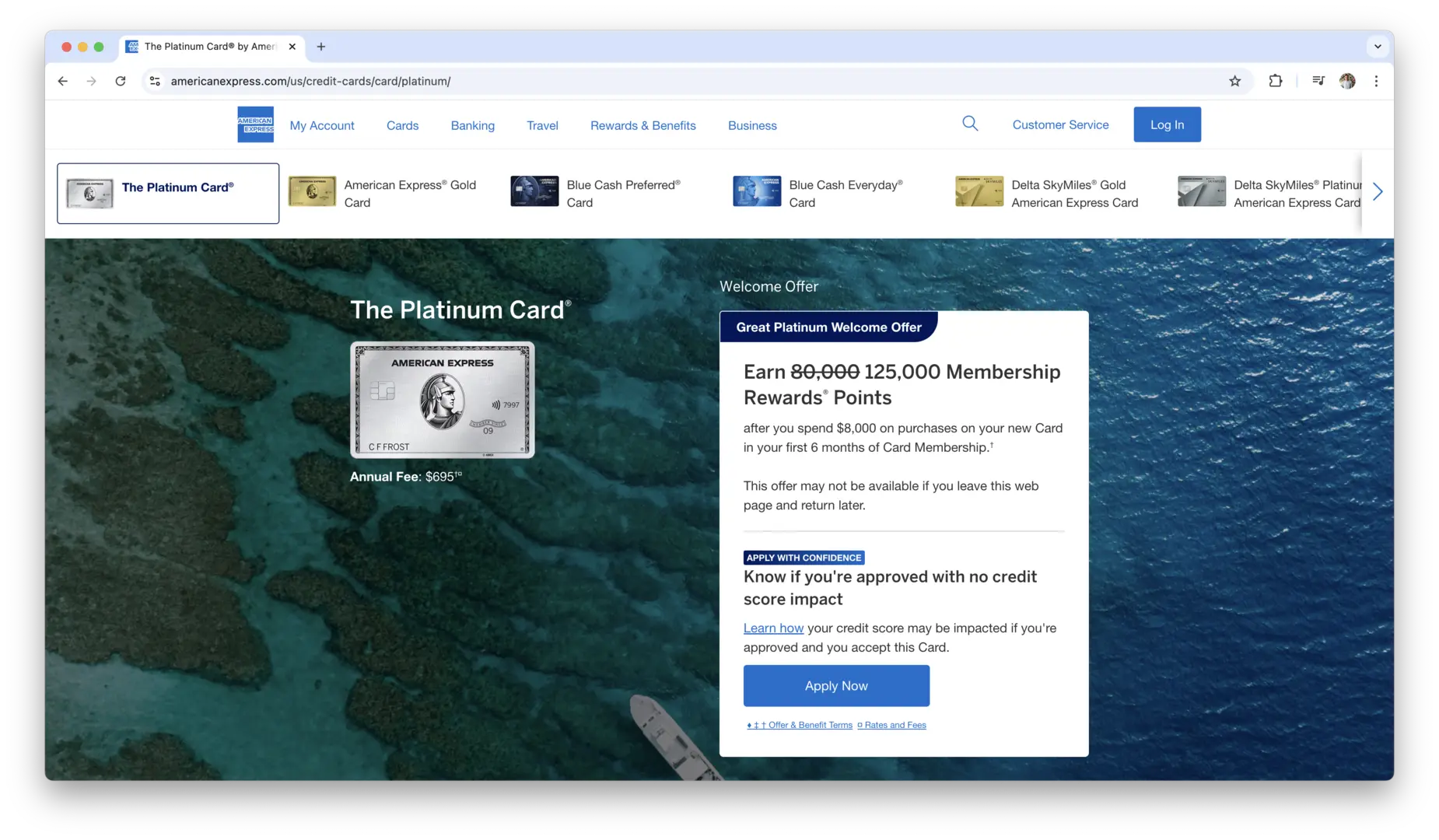

Best for International Travelers: Platinum Card from American Express

For those who travel internationally frequently, the Platinum Card from American Express stands out. With an annual fee of $695, it’s a premium card, but the benefits and perks are extensive, making it worthwhile for frequent travelers who can utilize its offerings. Key features include:

- 5 points per dollar on flights booked directly with airlines or through Amex Travel, and 2 points per dollar on other travel purchases.

- Access to over 1,200 airport lounges worldwide, including Centurion Lounges, Priority Pass, and more.

- $200 airline fee credit: Get up to $200 per year to cover incidental fees such as baggage fees, in-flight meals, and upgrades with a selected airline.

- No foreign transaction fees: Save on purchases abroad with no added costs.

- Complimentary upgrades: Enjoy potential upgrades at hotels and resorts through the Fine Hotels & Resorts program.

- Travel protections: Includes trip cancellation, lost luggage reimbursement, and emergency medical assistance.

This card is perfect for international travelers looking for premium benefits, especially those who travel often enough to justify the high annual fee.

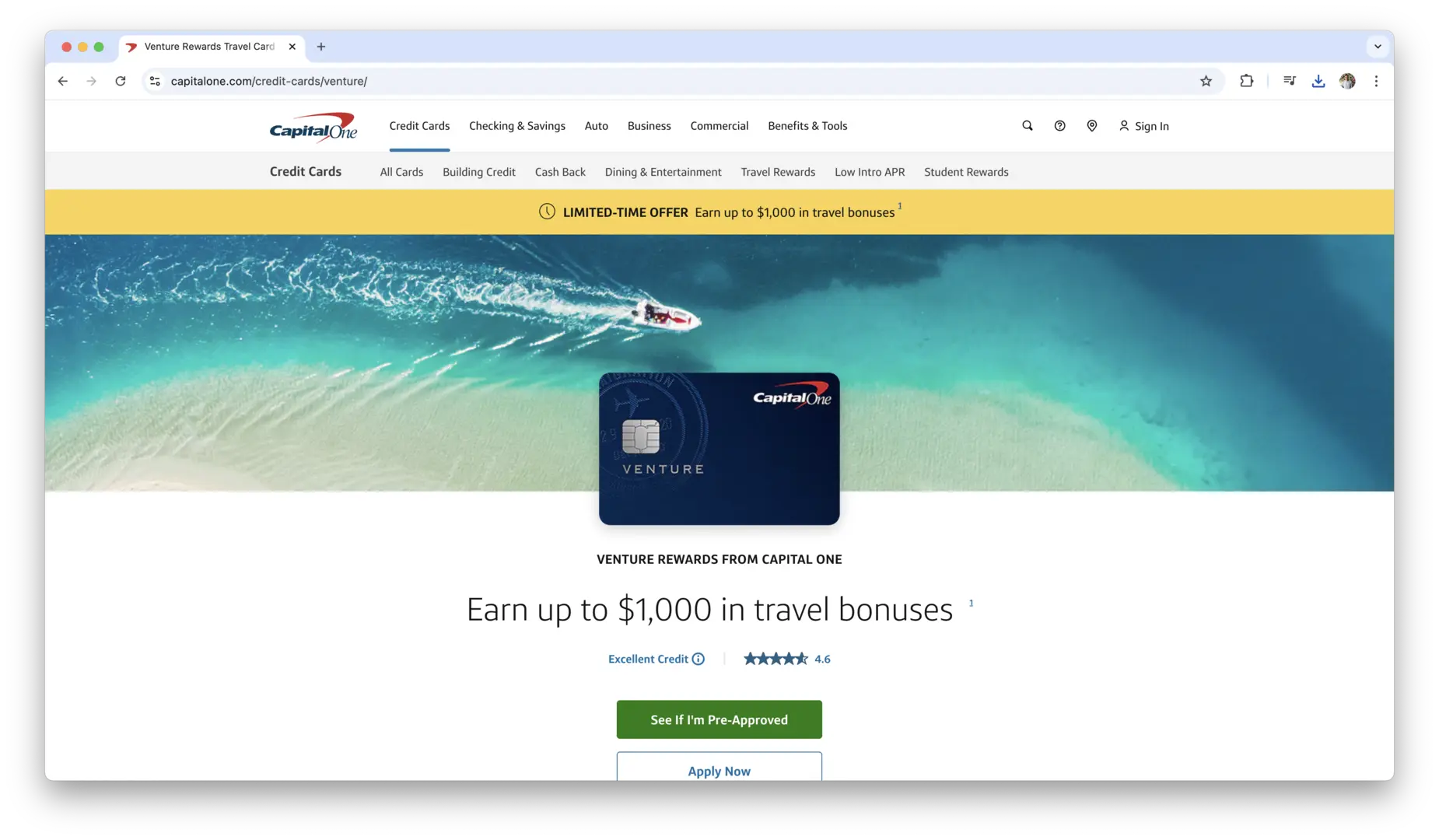

Best for Occasional Travelers: Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is an ideal choice for occasional travelers who want to earn rewards without being tied to a specific airline. With an annual fee of $95, this card offers straightforward rewards and benefits. Key features include:

- 2 miles per dollar on every purchase: Earn flat-rate rewards on all spending, making it easy to accumulate miles for any purchase, not just travel-related ones.

- 50,000-mile sign-up bonus: After spending $3,000 in the first 3 months, you’ll earn 50,000 miles, enough for a round-trip flight.

- No foreign transaction fees: Perfect for travelers who go abroad, as it allows you to use your card without worrying about additional charges.

- Flexible redemption options: You can use your miles for travel purchases, such as flights, hotels, and car rentals, or transfer them to one of Capital One’s airline partners for even more flexibility.

- Travel protections: Includes rental car insurance, travel accident insurance, and 24-hour travel assistance services.

For travelers who want a simple and flexible rewards program without the hassle of tracking categories, the Capital One Venture Rewards Credit Card is a solid option.

Best for Southwest Flyers: Southwest Rapid Rewards Priority Credit Card

If Southwest Airlines is your go-to carrier, the Southwest Rapid Rewards Priority Credit Card offers fantastic value. With an annual fee of $149, this card provides excellent benefits for Southwest customers. Features include:

- 2 points per dollar on Southwest purchases: Earn extra points when booking flights or purchasing services through Southwest.

- Up to 4,000 bonus points: Earn 3,000 points annually when you renew your card, plus 1,000 points on your cardmember anniversary.

- $75 annual Southwest travel credit: Use this credit to cover any Southwest-related purchases, such as in-flight purchases or seat upgrades.

- Free checked bags: Enjoy two free checked bags on each Southwest flight, which can save you a significant amount on baggage fees.

- Earn companion pass qualification: Reach the Southwest Companion Pass faster by earning points through the card, allowing you to bring a companion on flights for free.

If you fly Southwest frequently, this card offers great perks and an easy way to rack up points toward future flights and companion tickets.

Best for American Airlines Flyers: AAdvantage Aviator Red World Elite Mastercard

For those who fly regularly with American Airlines, the AAdvantage Aviator Red World Elite Mastercard offers a robust set of benefits at a reasonable annual fee of $99. This card is perfect for loyal American Airlines passengers who want to earn miles quickly and access a wide range of travel perks. Key features include:

- 2 miles per dollar on American Airlines purchases: Get double miles on every dollar spent with American Airlines, making it easy to rack up rewards on flights, seat upgrades, and in-flight purchases.

- Sign-up bonus: Earn a generous 60,000 miles after making a qualifying purchase and paying the annual fee within the first 90 days.

- First checked bag free: Save on baggage fees by receiving one free checked bag for yourself and up to four travel companions on the same reservation.

- Preferred boarding: Board your flight early with preferred boarding, allowing you to settle in quickly and get a good seat.

- Companion certificate: Get a discounted companion ticket on qualifying flights when you renew your card, making it a great choice for those who often travel with a partner.

This card is a great fit for those who fly with American Airlines and want to earn miles while enjoying travel perks like free checked bags and preferred boarding.

Best for United Airlines Flyers: United Club Infinite Card

The United Club Infinite Card is a premium option for those who fly frequently with United Airlines. For an annual fee of $525, this card offers high-value benefits, especially for travelers who are loyal to United Airlines. Key features include:

- 4 miles per dollar on United purchases: Earn 4 miles per dollar on United Airlines flights, including tickets, seat upgrades, and in-flight purchases.

- Access to United Club lounges: Enjoy access to United’s airport lounges, providing you with a comfortable space to relax and enjoy food and beverages before your flight.

- $100 Global Entry or TSA PreCheck statement credit: Receive a statement credit for the application fee of Global Entry or TSA PreCheck, helping you expedite the airport security process.

- 2 miles per dollar on dining and hotel stays: Earn additional miles on dining and hotel purchases, making it easy to accumulate miles outside of just United Airlines flights.

- First and second checked bags free: Save on baggage fees for yourself and a companion by receiving two free checked bags when flying with United.

The United Club Infinite Card is perfect for United Airlines loyalists who value lounge access and high rewards on United purchases.

Best for International Travel with British Airways: British Airways Visa Signature Card

The British Airways Visa Signature Card is ideal for travelers who frequently fly internationally with British Airways. With an annual fee of $95, this card offers excellent rewards and benefits, especially for those who fly transatlantic routes. Key features include:

- 3 Avios per dollar on British Airways purchases: Earn 3 Avios for every dollar spent on British Airways purchases, making it easier to earn rewards on flights and upgrades.

- 2 Avios per dollar on hotel stays and car rentals: Earn extra Avios on travel-related purchases like hotels and car rentals, maximizing your rewards when booking accommodations or renting a vehicle.

- Sign-up bonus: Earn 75,000 Avios after spending $5,000 in the first 3 months, which can be redeemed for flights, upgrades, and more.

- Travel benefits: Enjoy 10% off British Airways flights and receive 2 for 1 companion tickets when you redeem Avios for flights, allowing you to bring a companion at no additional charge.

- No foreign transaction fees: Perfect for international travelers, as you won’t incur additional charges when using your card abroad.

For international travelers who regularly fly with British Airways or its partners, this card provides a great way to earn and redeem Avios for a variety of rewards.

Best for Alaska Airlines Flyers: Alaska Airlines Visa Signature Credit Card

The Alaska Airlines Visa Signature Credit Card is ideal for those who fly frequently with Alaska Airlines. This card offers great benefits for travelers who enjoy flying to destinations across the West Coast, Alaska, and international locations. Key features include:

- 3 miles per dollar on Alaska Airlines purchases: Earn 3 miles for every dollar spent on Alaska Airlines flights and in-flight purchases.

- Sign-up bonus: Earn 40,000 bonus miles after spending $2,000 in the first 90 days, which is enough for a round-trip flight to many destinations.

- Free checked bag: Enjoy a free checked bag for you and up to six companions on the same reservation, saving you money on luggage fees.

- 50% discount on in-flight purchases: Get a 50% discount on food, beverages, and Wi-Fi when you fly with Alaska Airlines.

- Alaska’s Famous Companion Fare: Once a year, you can earn a Companion Fare certificate for a discounted round-trip ticket on Alaska Airlines, making it easier to travel with a companion.

For those who love flying with Alaska Airlines, this card offers great rewards on Alaska Airlines purchases and significant savings on baggage and in-flight services.

Best for Luxury Travel: Emirates Skywards Premium World Mastercard

For those seeking a luxury experience with one of the world’s top airlines, the Emirates Skywards Premium World Mastercard offers outstanding perks for Emirates passengers. With an annual fee of $450, it’s tailored to travelers who want to experience world-class service. Key features include:

- 3 Skywards Miles per dollar on Emirates purchases: Earn 3 Skywards Miles on all Emirates-related purchases, including flights, upgrades, and in-flight services.

- 1.5 miles per dollar on all other purchases: Earn miles on everyday spending, making it easy to accumulate rewards for non-travel purchases as well.

- Complimentary access to Emirates lounges: Get access to exclusive lounges at Emirates hub airports, allowing you to relax in comfort before your flight.

- Exclusive upgrades and offers: Enjoy priority boarding, complimentary seat upgrades, and special offers on flights.

- Sign-up bonus: Earn 50,000 Skywards Miles after spending $3,000 in the first 3 months, which can be redeemed for flights or upgrades on Emirates.

This card is ideal for travelers who want to enjoy luxury travel with Emirates and its partners, offering exclusive benefits for those who want the best possible travel experience.

The best airline credit card for you will depend on your travel habits and which airline or reward structure suits you the most. For frequent flyers, cards like the Delta SkyMiles Reserve or Platinum Card from American Express offer premium benefits. For occasional travelers or those who value flexibility, the Capital One Venture Rewards Credit Card or Chase Sapphire Preferred are top picks. If you’re loyal to a specific airline, cards like the Southwest Rapid Rewards Priority Credit Card are tailored to maximize your rewards. Choose the one that aligns with your travel goals to get the most value out of your spending.

Why Choose an Airline Credit Card?

Airline credit cards offer a wide range of benefits that go beyond just earning rewards. These cards can significantly improve your travel experience, whether you’re a frequent flyer or someone who flies occasionally. Understanding these benefits will help you see how the right card can transform your travel habits and make each trip more enjoyable and cost-effective.

The Perks of Frequent Flyer Miles

One of the main reasons people choose airline credit cards is the opportunity to earn frequent flyer miles. Every dollar you spend on eligible purchases earns you miles, which can be redeemed for a variety of rewards, most notably free or discounted flights. For frequent travelers, these miles can add up quickly, turning everyday spending into valuable points toward your next trip.

Many airline credit cards offer bonus miles for specific categories, such as airline purchases or dining, allowing you to earn miles faster. For example, if your card offers 3 miles per dollar on airline purchases, you can rack up miles on things like flight tickets, in-flight meals, and even baggage fees. Over time, these miles can lead to significant savings, especially if you take advantage of special promotions or sign-up bonuses.

Earning and Redeeming Rewards for Travel

Airline credit cards aren’t just about accumulating miles; they also offer convenient and flexible redemption options. Earning miles for everyday purchases such as groceries, dining, and even bills means that you don’t have to focus only on travel-related expenses to build up your balance. Some cards even offer bonus categories that let you maximize your rewards, allowing you to earn extra miles for things like hotel bookings, car rentals, or travel purchases.

When it comes time to redeem your miles, there are usually a few different options available. You can use your miles for flights, seat upgrades, or even non-flight travel expenses like hotels or car rentals. Many cards offer the flexibility to transfer miles to partner airlines, which can open up even more options for booking your next vacation. It’s important to understand the best way to redeem your miles to get the most value, as some methods can offer greater returns than others.

Access to Exclusive Airport Lounges and Upgrades

For frequent travelers, airport lounges can be a lifesaver, offering a quiet and comfortable place to relax before your flight. Many premium airline credit cards offer access to exclusive lounges, even for those flying economy. Lounges often feature comfortable seating, complimentary food and drinks, and amenities like Wi-Fi, making the airport experience much more pleasant.

In addition to lounge access, some cards also provide benefits like priority boarding and the possibility of receiving complimentary upgrades to business or first class. These perks can elevate your travel experience, ensuring that you’re well taken care of from the moment you arrive at the airport. The added comfort and convenience make these cards especially attractive for those who travel regularly.

Travel Protection Benefits

Travel can be unpredictable, and things don’t always go as planned. Airline credit cards offer various protections that can give you peace of mind while you’re on the road. Many cards come with travel insurance benefits, including trip cancellation or interruption coverage, lost baggage reimbursement, and emergency medical assistance.

Some airline cards also offer rental car insurance, providing protection in case of accidents while you’re driving abroad. These protections can save you money on additional insurance policies and help mitigate the financial risks associated with travel mishaps. If your plans are disrupted, the security of knowing that you have coverage can make a big difference in how you handle those unexpected challenges.

Benefits for Both Casual Travelers and Frequent Flyers

Airline credit cards are often seen as a perk for frequent travelers, but they can offer valuable benefits to casual travelers as well. Even if you only fly a couple of times a year, you can still earn miles for your everyday purchases, giving you a head start on your next trip. Some cards come with low annual fees or even waive the fee for the first year, making them an affordable option for those who don’t travel regularly but want to start earning travel rewards.

For more frequent flyers, these cards are an excellent way to maximize every trip. With perks like lounge access, priority boarding, and higher miles earnings on travel-related purchases, these cards can significantly enhance your flying experience. Whether you’re a frequent flyer or a casual traveler, an airline credit card can add value to your journey by offering rewards and benefits tailored to your travel style.

Choosing the right card depends on your travel habits and preferences, but with the wide array of perks available, there’s a card for every type of traveler.

Types of Airline Credit Cards

Choosing the right type of airline credit card depends on your travel needs, preferences, and how often you fly. There are different kinds of airline credit cards, each offering a unique set of benefits. To help you navigate through your options, it’s essential to understand the distinctions between co-branded airline cards and general travel cards, as well as the differences between premium and standard options. Let’s explore how these choices can impact your rewards, benefits, and overall experience.

Co-branded Airline Credit Cards vs General Travel Credit Cards

When choosing between co-branded airline credit cards and general travel credit cards, the decision often comes down to how loyal you are to a specific airline and how flexible you want your rewards to be.

Co-branded Airline Credit Cards are credit cards issued in partnership with a specific airline. These cards are designed to help you earn frequent flyer miles more quickly when flying with that airline or making related purchases, such as booking flights, checking in baggage, or even dining at certain partner restaurants. For example, a United MileagePlus Card or a Delta SkyMiles Card is co-branded with the respective airline, and each provides specific benefits tied to that airline, such as priority boarding, free checked bags, and access to airport lounges. Co-branded cards typically offer the highest rewards for purchases made with the airline and often include special offers such as annual companion tickets or milestone bonuses.

On the other hand, General Travel Credit Cards offer greater flexibility and can be redeemed with a variety of airlines and travel partners. These cards don’t tie you to a single airline, meaning you can use the points for flights across different airlines, hotels, car rentals, or even travel experiences. A Chase Sapphire Preferred Card or American Express Gold Card falls into this category. These cards usually offer rewards in the form of points (instead of miles), which can be transferred to multiple travel partners, including airlines, hotel chains, and car rental companies. This flexibility can be especially useful for people who don’t stick to one airline but want to take advantage of the best deals or reward systems.

The trade-off with general travel credit cards is that they may not offer the same deep benefits when booking directly with a particular airline as a co-branded card does. For example, you may miss out on benefits like waived baggage fees or higher mile-earning rates when booking through a specific airline.

Premium vs Standard Cards

Airline credit cards come in two broad categories: premium cards and standard cards. The primary difference lies in the level of benefits, the annual fees, and the types of travelers each is designed for.

Premium Cards typically have higher annual fees but offer richer benefits, making them ideal for frequent flyers who are looking to maximize their rewards. These cards often come with perks like access to exclusive airport lounges, priority boarding, free checked bags, and complimentary upgrades to first or business class. Premium cards also tend to offer higher earning rates on travel-related purchases, and you may earn additional miles for things like dining or hotel bookings. Examples include the Platinum Card from American Express or the Delta SkyMiles Reserve American Express Card. These cards can be very valuable if you fly often enough to make use of the premium perks, such as the lounge access or the ability to earn extra miles.

Standard Cards, on the other hand, usually have a lower annual fee and offer more basic benefits, such as earning miles on travel purchases or receiving occasional bonuses. While they might not come with luxury perks like lounge access or priority boarding, standard cards still offer a great way to earn rewards for occasional flyers. They may also come with introductory offers, like a bonus miles opportunity after meeting a minimum spending requirement. A card like the American Airlines AAdvantage MileUp Card or Southwest Rapid Rewards Plus Card is a good example of a standard card. While these may not offer the plush benefits of a premium card, they still allow cardholders to earn miles and receive useful travel benefits without the hefty annual fee.

Premium cards are ideal if you travel frequently enough to take advantage of their perks and if the rewards you’ll earn justify the higher annual fees. Standard cards are best for people who fly occasionally or want a simpler card that still offers travel rewards without a high fee.

Airline-Specific Cards vs Flexible Travel Cards

When deciding between airline-specific cards and flexible travel cards, think about how loyal you are to a specific airline, how much you travel, and whether you want flexibility in redeeming your rewards.

Airline-Specific Cards are perfect for people who are loyal to a particular airline or who travel frequently with a specific carrier. These cards offer excellent benefits with the airline they are co-branded with, such as priority boarding, access to lounges, and additional miles when booking flights directly with the airline. If you always fly with the same airline for your travels, you’ll likely maximize the value of the rewards offered by these cards. For example, if you often fly with American Airlines, a co-branded card like the AAdvantage Platinum Select World Elite Mastercard could earn you bonus miles on American Airlines purchases and provide valuable perks like preferred boarding and free checked bags.

On the other hand, Flexible Travel Cards are ideal if you fly with different airlines or prefer to have the freedom to redeem your points for a variety of travel-related expenses, not just flights. Cards like the Chase Sapphire Preferred or American Express Gold Card offer rewards that can be used across multiple airlines and hotel chains. They allow you to redeem points in a variety of ways, such as booking flights, renting cars, or staying at hotels, all without being locked into one particular airline. These cards are great for travelers who value flexibility and want to earn rewards for different aspects of travel, not just flights.

The best choice ultimately depends on your personal preferences. If you have a specific airline you prefer or a frequent flyer program that you’re heavily invested in, an airline-specific card might be the way to go. However, if you travel often but fly with different airlines or want more flexibility, a flexible travel card offers better versatility for your rewards.

When choosing between these two options, consider how often you travel, which airlines you use, and whether the added flexibility or airline-specific perks will benefit you the most. Either option can help you earn valuable rewards, but the best choice for you will depend on your travel habits and goals.

Airline Credit Cards Features to Look For

When selecting an airline credit card, it’s important to focus on the features that will provide the most value for your specific travel habits. Different cards offer different perks, and understanding the key features can help you choose the card that fits your needs. Whether you’re focused on earning rewards, saving money on travel-related expenses, or getting the most out of travel benefits, the right features can make all the difference.

Rewards Structure (Miles per Dollar, Categories of Spending)

One of the most important factors when choosing an airline credit card is the rewards structure. How many miles you can earn per dollar spent directly impacts the value you’ll get from the card. Many cards offer bonus miles for purchases made in specific categories such as travel, dining, or groceries. For example, some cards may offer 2 miles per dollar on travel-related purchases and 1 mile per dollar on all other purchases, while others may offer bonus miles on dining or hotel stays as well.

Some airline credit cards are more generous in their rewards structure, offering higher miles per dollar on airline purchases. If you tend to spend a lot on flights, check-in baggage, or in-flight purchases, a card with 3 or 5 miles per dollar spent in these categories can significantly accelerate your rewards. On the other hand, general travel cards might offer flexibility but with lower earning rates on non-airline purchases.

It’s also important to consider how many miles you can earn from non-travel purchases, especially if you don’t travel frequently. A card that gives you bonus miles for dining or other regular expenses could be beneficial even if you’re not flying every month. The more flexible and generous the rewards structure, the more you can get out of your card in the long run.

Sign-Up Bonuses and How to Maximize Them

Most airline credit cards offer sign-up bonuses to attract new customers. These bonuses can provide a significant head start in earning miles, often ranging from 30,000 to 100,000 miles, depending on the card. These miles can often be redeemed for flights or upgrades, which can be a great way to kickstart your travel goals.

To maximize the value of the sign-up bonus, make sure you meet the spending requirement within the specified time frame (usually 3 months). For example, a card might offer 50,000 miles if you spend $3,000 within the first 3 months. If the card offers bonus miles for certain types of purchases, such as dining or travel, consider putting those types of expenses on the card to reach the spending target without going beyond your usual budget.

Before applying for a card, it’s essential to carefully read the terms and conditions to understand what counts toward the minimum spending requirement and what doesn’t. Often, you’ll be able to earn bonus miles on purchases like groceries or restaurant bills, which could help you reach the target faster.

Annual Fees and How to Offset Them

One of the major considerations when choosing an airline credit card is the annual fee. Premium cards generally come with higher fees, ranging from $95 to over $500, but they also offer a wider range of benefits, such as increased miles earning, airport lounge access, and free checked bags. Standard cards, however, tend to have lower annual fees but come with fewer perks.

The key to getting the most value from your airline card is to offset the annual fee with the benefits that come with it. For example, if a premium card costs $450 per year but offers free checked bags, lounge access, and a companion ticket, you’ll need to calculate how much you’d normally spend on these services to determine if the card will save you more than its fee. If the card provides $500 worth of perks in value, the annual fee essentially becomes free.

Additionally, some cards offer benefits like annual travel credits, which can help offset the cost of the fee. For instance, a card might offer a $200 credit toward airline incidentals or travel purchases, which can significantly reduce the overall annual cost. If you’re able to take full advantage of the benefits, the annual fee might feel less like an expense and more like an investment in your travel experience.

Foreign Transaction Fees

If you travel internationally, foreign transaction fees are something you’ll want to keep an eye on. Many credit cards charge a fee of 2.5% to 3% on purchases made outside of your home country. This can add up quickly, especially if you’re booking hotels, dining out, or making purchases during your travels.

When choosing an airline credit card, opt for one that waives foreign transaction fees, especially if you frequently travel abroad. Many premium cards, such as the Chase Sapphire Preferred or The Platinum Card from American Express, do not charge foreign transaction fees, which can save you a significant amount of money over time. Eliminating these fees is a small but impactful way to get more out of your card without any additional cost.

For travelers who spend a lot of time abroad, this feature is non-negotiable. A card without foreign transaction fees will provide more value and ensure that your purchases are not penalized when you’re using the card in another country.

Companion Tickets and Upgrades

One of the most coveted benefits offered by some premium airline credit cards is the ability to earn companion tickets or receive complimentary upgrades. Companion tickets allow you to bring a friend or family member on your flight for free or at a heavily discounted rate. These are often available after meeting a minimum spending requirement or earning a set number of miles in a year.

In addition to companion tickets, some cards also offer complimentary or discounted upgrades to business or first class. This can make your travel experience significantly more enjoyable, offering perks like extra legroom, priority boarding, and access to airport lounges.

These benefits can often justify the higher annual fees associated with premium airline cards. If you frequently travel with a companion or enjoy upgrading to a more comfortable class, the cost of the card might pay for itself over time. Just be sure to check the terms and conditions of these perks, as there are often restrictions or blackout dates when you can’t use companion tickets or get upgrades.

Travel Protections and Insurance

Travel-related issues can arise unexpectedly, from missed flights to lost luggage, and airline credit cards are equipped with a variety of travel protections and insurance to help cover these challenges. Many cards offer trip cancellation insurance, which reimburses you for non-refundable trip costs if you have to cancel due to illness or other covered reasons.

Some airline credit cards also include lost baggage reimbursement, so if your checked bags are lost or delayed, you can be reimbursed for essential items. Additionally, cards may offer travel accident insurance and emergency medical coverage when you’re traveling outside your home country.

These travel protections can save you from expensive situations, particularly if something goes wrong while you’re abroad. It’s important to read through the insurance details of the card before you apply, as coverage can vary greatly. For frequent travelers, these protections add a layer of safety and peace of mind, ensuring that you’re covered if things don’t go as planned. The extra protection often justifies the additional costs associated with premium airline credit cards.

Ultimately, the right combination of rewards, benefits, and protections can make a huge difference in your travel experience, whether you’re flying for business or pleasure. Be sure to evaluate the specific features that will bring the most value to your trips and lifestyle.

How to Maximize the Value of Your Airline Credit Card?

To get the most out of your airline credit card, you need to leverage its features fully. Airline credit cards often come with a range of rewards, benefits, and perks, but to truly maximize their value, you’ll need to use them strategically. Simply using your card for the bare minimum will not unlock its full potential. Here are several ways you can make the most of your card’s offerings:

- Take full advantage of bonus categories: Use your card for purchases that earn extra miles, such as dining, travel, or airline purchases. This will accelerate your miles accumulation and help you earn rewards faster. For example, if your card offers 3 miles per dollar on dining, ensure you use it whenever you eat out or order food delivery.

- Maximize sign-up bonuses: Meet the minimum spending requirements to earn the sign-up bonus as quickly as possible. Focus on spending in categories that earn bonus miles, like travel or dining, to reach your target faster without exceeding your usual spending habits.

- Use the card for travel-related purchases: Since many cards offer enhanced rewards for travel-related purchases, make sure to use your card when booking flights, hotels, car rentals, or excursions. Even paying for airport parking or meals during your trip can add up to significant rewards.

- Benefit from travel protections: Always utilize the travel insurance and protections offered by your card, such as trip cancellation insurance, baggage coverage, and rental car insurance. These protections can save you money and provide peace of mind while traveling.

- Leverage companion tickets and upgrades: If your card offers companion tickets or upgrades, use them on your travels. These perks can save you hundreds of dollars per trip and elevate your flying experience. Be sure to understand any restrictions, such as blackout dates, so you can use these benefits effectively.

- Pay off your balance in full: Avoid interest charges by paying off your card balance in full each month. Interest can quickly erode the value of the rewards you’ve earned, so paying your bill on time will ensure that the miles you’ve accumulated are pure value, without any hidden costs.

By consistently utilizing these strategies, you’ll ensure that you’re getting the most from your airline credit card and enjoying all the benefits that come with it.

Things to Consider Before Applying

Before applying for an airline credit card, there are several factors you should consider to ensure that the card you choose aligns with your travel habits and financial goals. Understanding these aspects will help you avoid unnecessary fees and ensure that the rewards and benefits you’re signing up for are truly worth it.

- Evaluate your travel frequency: Consider how often you travel and whether the card’s rewards and perks justify the annual fee. If you travel only occasionally, a standard card with lower fees might be more suitable than a premium card.

- Assess the rewards structure: Make sure the card rewards align with your spending habits. If you dine out frequently, choose a card that offers bonus miles for dining. If you travel often, a card with higher rewards on travel purchases will be more beneficial.

- Check for annual fees: Understand the annual fee associated with the card and evaluate whether the benefits you’ll receive outweigh this cost. Premium cards with higher fees often provide more benefits, but ensure that you’ll use them enough to make the fee worthwhile.

- Look at the sign-up bonus: Consider how attainable the sign-up bonus is based on your normal spending habits. A high sign-up bonus can be a great incentive, but only if you’re able to meet the minimum spending requirements without overspending.

- Review the interest rates and fees: Be aware of the interest rates, foreign transaction fees, and any other additional charges associated with the card. High-interest rates can offset the value of your rewards if you carry a balance, so aim to pay off your card each month.

- Understand the redemption options: Check how you can redeem your miles or points, and if the redemption process is flexible enough to suit your travel plans. Some cards restrict how you can use your rewards, so be sure the redemption methods fit your preferences.

- Consider credit score requirements: Ensure that your credit score meets the requirements for the card you’re interested in. Applying for a card that you’re not eligible for can result in a hard inquiry on your credit report, which may temporarily affect your score.

- Look at additional benefits and perks: Consider the extra perks offered by the card, such as airport lounge access, free checked bags, and travel protections. These can enhance your overall travel experience and provide additional value. Make sure you’ll use these benefits to justify the annual fee and other costs.

Taking the time to evaluate these factors will help you choose the right card for your needs and ensure that you’re getting the best possible value from your airline credit card.

Conclusion

Choosing the right airline credit card doesn’t have to be complicated. It all comes down to understanding your travel habits, how often you fly, and what types of perks matter most to you. Whether you’re loyal to one airline, want a card that offers flexibility, or you’re looking for top-notch travel benefits, there’s a card that’s a perfect fit for your needs. From cards that offer lounge access to those that give you the best miles per dollar, each card has something unique to offer, and picking the right one can make your travels more rewarding and stress-free.

At the end of the day, the best airline credit card is the one that works for you and helps you save time, money, and effort. Don’t forget to take into account the rewards structure, sign-up bonuses, annual fees, and any additional travel perks when making your decision. By considering these factors carefully, you can ensure you’re making a smart choice that will maximize your benefits and suit your personal travel style. The right card is out there, so take the time to find it and enjoy all the perks that come with it.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.

-

Sale!

Marketplace Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

E-Commerce Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

SaaS Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

Standard Financial Model Template

Original price was: $219.00.$149.00Current price is: $149.00. Add to Cart -

Sale!

E-Commerce Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

SaaS Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Marketplace Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Startup Profit and Loss Statement

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart -

Sale!

Startup Financial Model Template

Original price was: $119.00.$79.00Current price is: $79.00. Add to Cart