Are you looking for a way to reduce high-interest credit card debt? A balance transfer card might be the solution you need. These cards allow you to move your existing debt from high-interest credit cards to a new card with a much lower or even 0% introductory interest rate. This can help you save money on interest and pay off your balance more quickly.

With so many balance transfer options available, it can be hard to know which one is best for you. In this guide, we’ll walk through some of the top balance transfer cards out there, highlighting their features, benefits, and what to look for, so you can make the best choice to fit your financial needs.

What is a Balance Transfer Card?

A balance transfer card is a credit card designed specifically to help individuals consolidate and pay down existing high-interest debt. By transferring the balances of your current credit cards or loans to a new card, often at a much lower interest rate or even 0% for an introductory period, you can save money and pay off your debt faster. The primary advantage of a balance transfer card is the ability to reduce or eliminate interest payments, allowing your monthly payments to go further toward reducing the principal balance.

How Balance Transfer Cards Work

Balance transfer cards work by allowing you to transfer existing credit card debt from one or more of your cards onto a new card. Many balance transfer cards offer 0% APR for a promotional period, typically ranging from 6 to 21 months, during which you won’t incur any interest charges. This gives you a grace period to pay off the transferred balance without having to worry about interest piling on top of the principal.

To initiate the process, you would apply for a balance transfer card and, once approved, request that the balances from your existing cards be transferred to the new card. The balance transfer card will pay off those existing balances on your behalf, and you’ll now owe that amount to the new card issuer. The key is to pay down the transferred balance before the promotional 0% APR period ends to avoid high interest rates afterward.

Benefits of Balance Transfer Cards

Balance transfer cards offer several key benefits, especially for individuals dealing with high-interest debt:

- Interest savings: The 0% APR for the introductory period allows you to pay down your balance without the added burden of interest charges.

- Simplified payments: By consolidating multiple balances into a single card, you only need to keep track of one monthly payment.

- Faster debt repayment: Without interest piling up, more of your monthly payment goes toward reducing the principal balance, allowing you to become debt-free faster.

- Improved cash flow: The lower interest rates mean more of your money goes directly to debt reduction, freeing up cash for other needs.

- No impact on credit score (if used wisely): When used responsibly, a balance transfer card can improve your credit utilization ratio and potentially raise your credit score.

Features to Look for in a Balance Transfer Card

When shopping for a balance transfer card, it’s important to keep an eye on these features to find the best option for your financial situation:

- 0% APR introductory period: The longer the introductory period, the more time you have to pay off your debt without accruing interest.

- Balance transfer fee: Most cards charge a fee, usually 3% to 5% of the amount transferred. Look for cards with low or no balance transfer fees.

- Ongoing APR: After the introductory period ends, the APR can increase significantly, so ensure the ongoing rate is manageable if you aren’t able to pay off the balance in time.

- Credit limit: Ensure the card has a high enough credit limit to accommodate the amount you plan to transfer.

- Rewards program: Some cards offer cashback or points on purchases, which can add value beyond the balance transfer feature.

- No annual fee: Many balance transfer cards come without an annual fee, but always double-check this aspect before committing.

- Flexible payment terms: Cards that offer a range of payment methods, such as online or mobile payments, make managing your account more convenient.

When and Why to Consider Using a Balance Transfer Card

Balance transfer cards are a good option for individuals looking to manage existing credit card debt or consolidate loans with high interest rates. If you’re struggling with multiple balances and high APRs, transferring your debt to a balance transfer card with a 0% introductory period can save you a significant amount of money in interest.

These cards are ideal when:

- You have high-interest credit card debt that you want to pay off faster without accruing additional interest.

- You need debt consolidation but don’t want to take out a personal loan or use a home equity line of credit.

- You’re looking for a way to simplify your payments by consolidating multiple credit card balances into one monthly payment.

- You have a plan to pay off your balance before the promotional period ends to avoid interest charges on any remaining balance.

By transferring your debt, you give yourself a better chance of becoming debt-free sooner and at a lower cost. Just be sure to pay off the balance within the promotional period to take full advantage of the savings.

Best Balance Transfer Cards

When you’re looking to transfer debt to a new credit card, it’s important to choose one that offers the best balance transfer terms to fit your needs. The ideal balance transfer card will have a long 0% APR introductory period, low or no transfer fees, and a reasonable ongoing interest rate. Below, I’ve highlighted some of the best balance transfer cards currently available, offering a combination of these features to help you save money and pay down your debt faster.

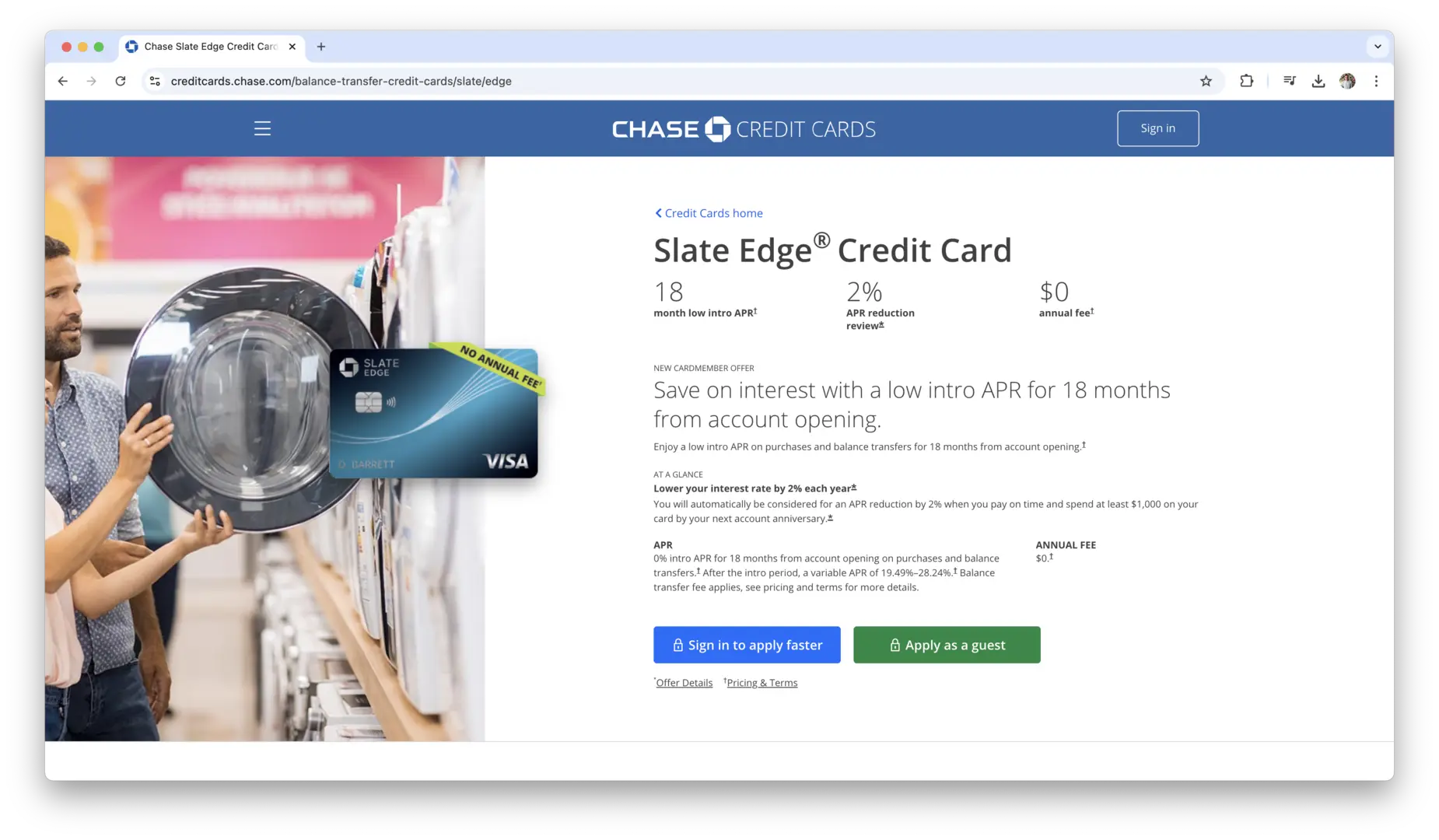

Chase Slate Edge

The Chase Slate Edge card offers a 0% APR on balance transfers for the first 18 months, giving you ample time to pay off your transferred balances without interest. The balance transfer fee is 3% for transfers made in the first 60 days, then it jumps to 5% after that. This card also comes with a $100 bonus if you spend $500 within the first three months.

Another benefit is the card’s credit limit increase feature: after making your first five monthly payments on time, you may be eligible for a credit limit increase with no additional hard inquiry. This can be beneficial if you’re trying to transfer larger balances.

Pros:

- 0% APR for 18 months on balance transfers

- No annual fee

- Credit limit increase after making timely payments

Cons:

- Balance transfer fee of 3% for the first 60 days, then 5%

- No rewards program

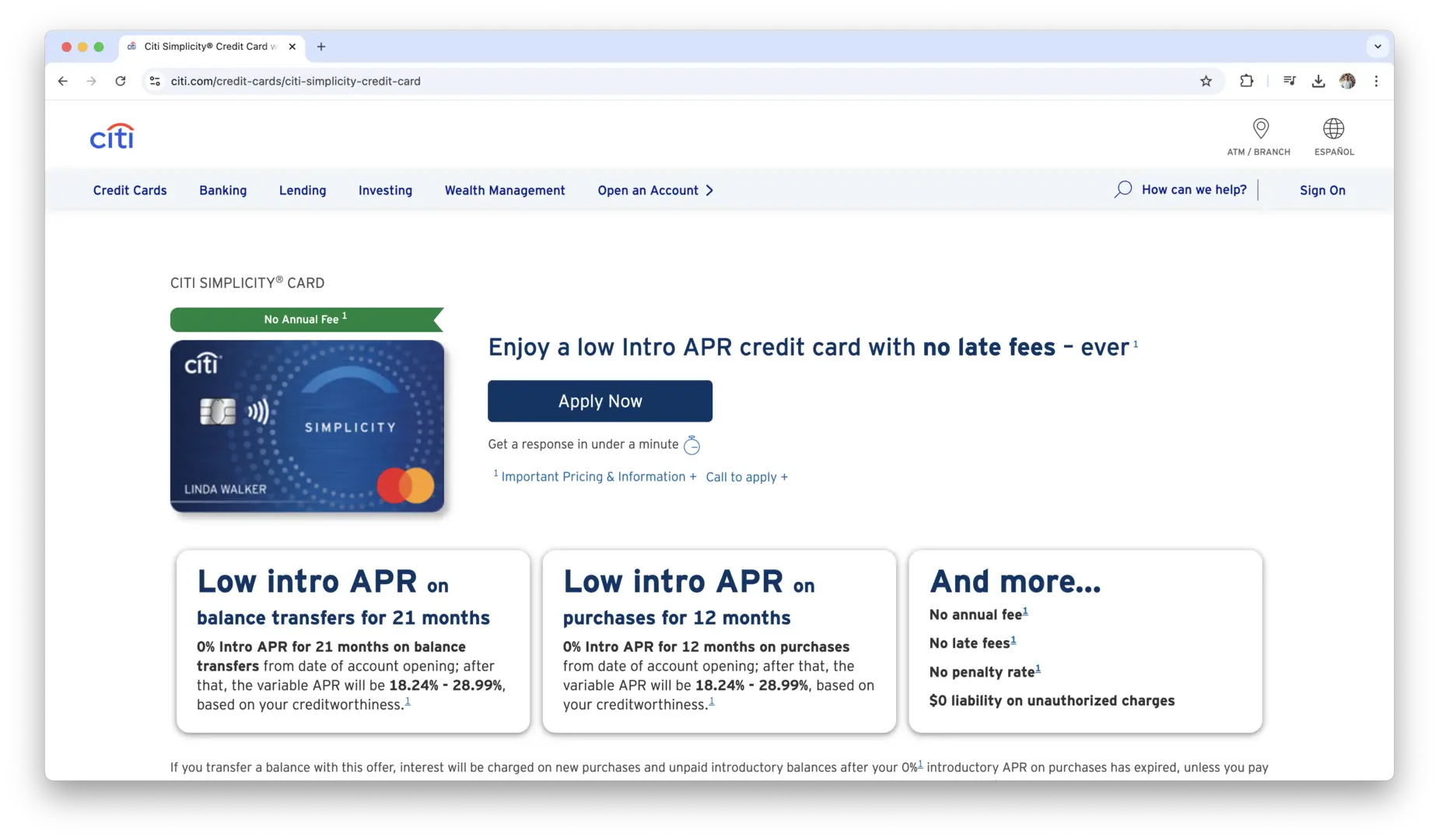

Citi Simplicity Card

The Citi Simplicity Card offers one of the longest 0% APR periods available—21 months on balance transfers. This is ideal if you need an extended period to pay off your debt. The balance transfer fee is 5%, but with the longer promotional period, you’ll have more time to pay off the balance without worrying about high interest.

The card also offers no late fees or penalty APRs, which makes it a great choice if you occasionally miss payments. While there are no rewards with this card, the long 0% APR period and lack of fees make it an attractive option for those working to reduce debt.

Pros:

- 0% APR for 21 months on balance transfers

- No annual fee

- No late fees or penalty APRs

Cons:

- Balance transfer fee of 5%

- No rewards program

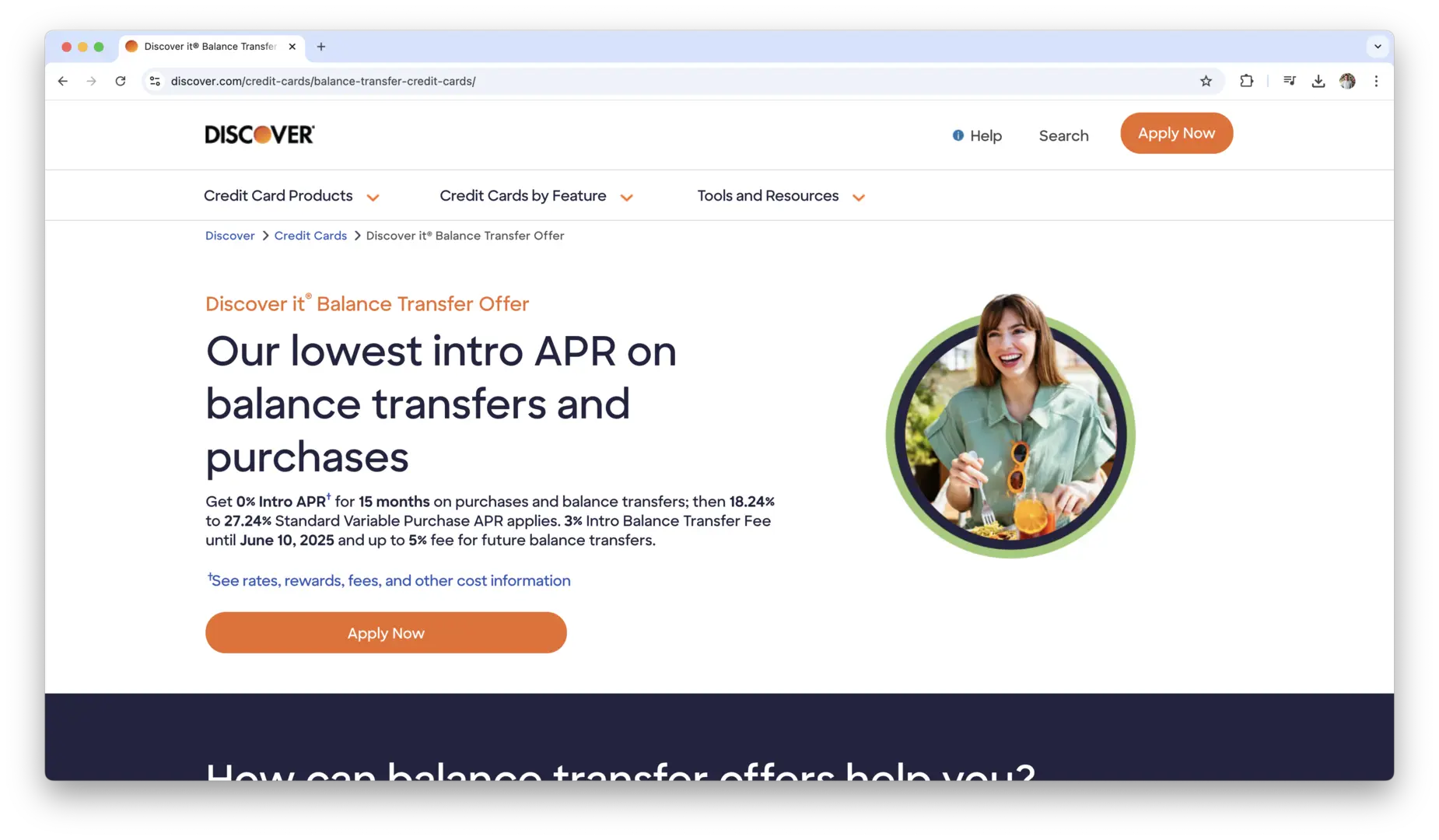

Discover it Balance Transfer

The Discover it Balance Transfer card offers 0% APR for 18 months on balance transfers, along with a 3% balance transfer fee for the first 3 months (then 5%). What sets this card apart is its cashback rewards program, which allows you to earn 5% cashback on rotating categories each quarter (up to a limit), and 1% on all other purchases. At the end of your first year, Discover will match all the cashback you earn, essentially doubling your rewards for the first year.

With no annual fee and strong cashback rewards, this card is a solid option if you plan to make purchases after your balance transfer is completed. It’s ideal for those who want to pay off their debt and still earn cashback on their spending.

Pros:

- 0% APR for 18 months on balance transfers

- 5% cashback on rotating categories and 1% on other purchases

- Discover matches cashback earned in the first year

Cons:

- Balance transfer fee of 3% for the first 3 months, then 5%

- No introductory 0% APR for purchases (only for balance transfers)

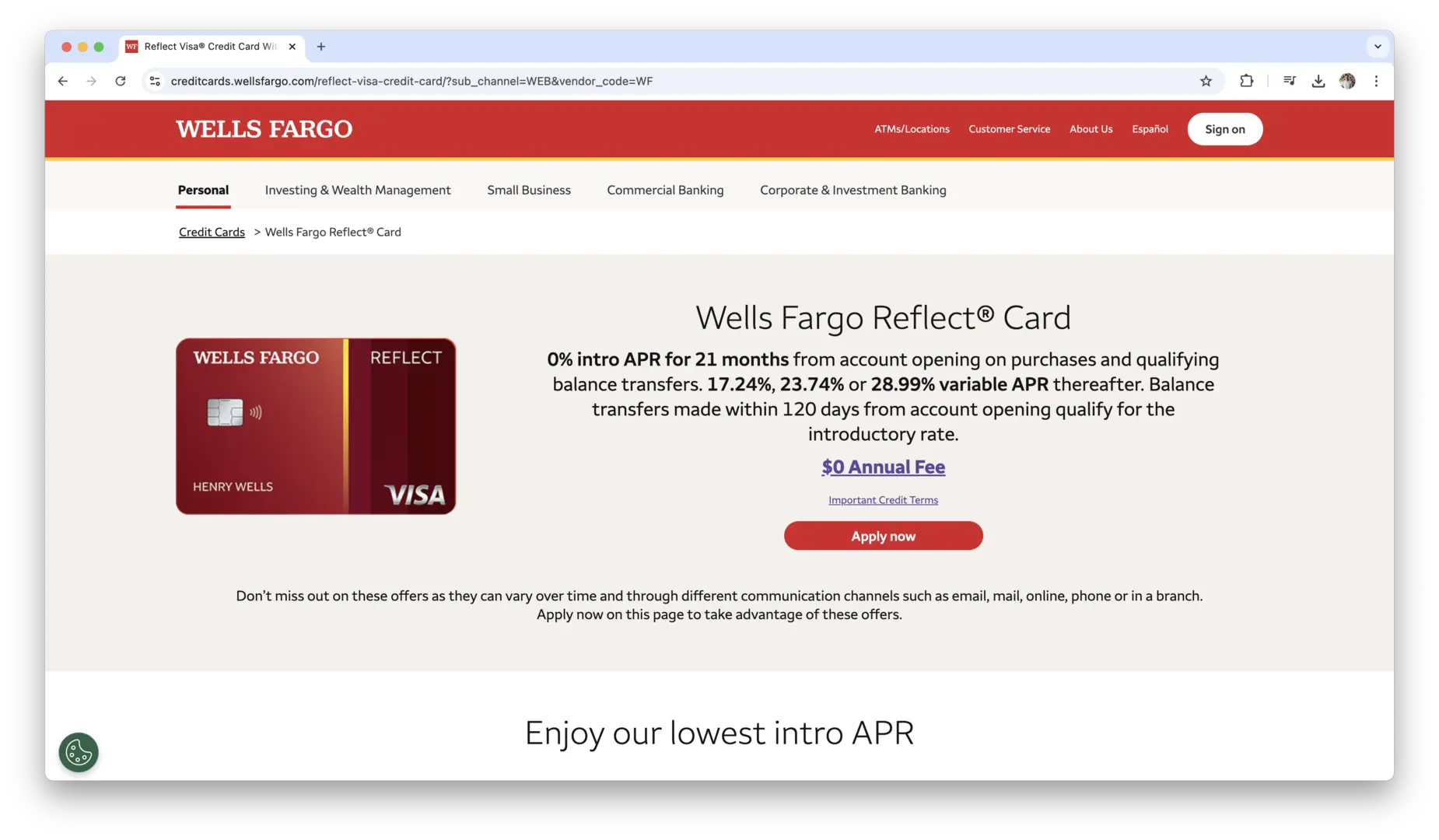

Wells Fargo Reflect Card

The Wells Fargo Reflect Card offers a 0% APR for 18 months on balance transfers, with the potential to extend the 0% APR period by an additional 3 months if you make the required minimum payments during the initial 18-month period. The card charges a 3% balance transfer fee for transfers made within the first 120 days, and 5% thereafter.

While the card doesn’t offer any rewards, the long promotional period (up to 21 months) and the possibility of extending the 0% APR period make it a great choice for those who need extra time to pay off a large balance.

Pros:

- 0% APR for up to 21 months on balance transfers (if requirements are met)

- No annual fee

- Flexible promotional period extension

Cons:

- Balance transfer fee of 3% for the first 120 days, then 5%

- No rewards program

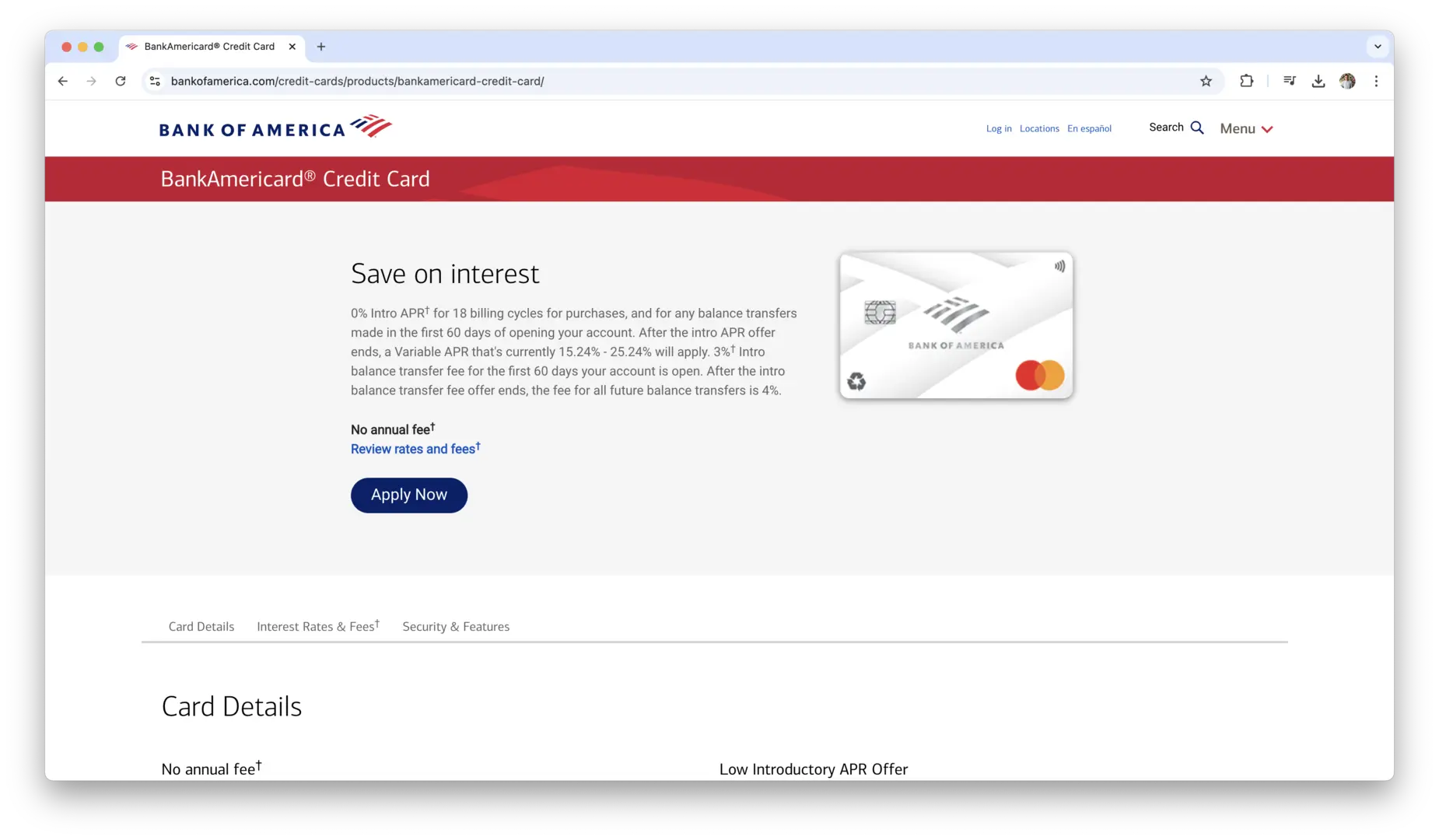

BankAmericard Credit Card

The BankAmericard Credit Card offers 0% APR for 18 billing cycles on balance transfers, and a balance transfer fee of 3% (if done within the first 60 days). After the promotional period ends, the APR jumps to a standard rate of 16.49% to 26.49%. While this card doesn’t offer rewards, it’s a solid choice for those looking for a straightforward balance transfer card with a long 0% APR period and no annual fee.

This card also has the added benefit of being a no-annual-fee option, which means that even if you’re not actively using it for purchases, you won’t have to worry about extra charges.

Pros:

- 0% APR for 18 months on balance transfers

- No annual fee

- Low balance transfer fee of 3%

Cons:

- Balance transfer fee of 3% for transfers within the first 60 days, then 5%

- No rewards program

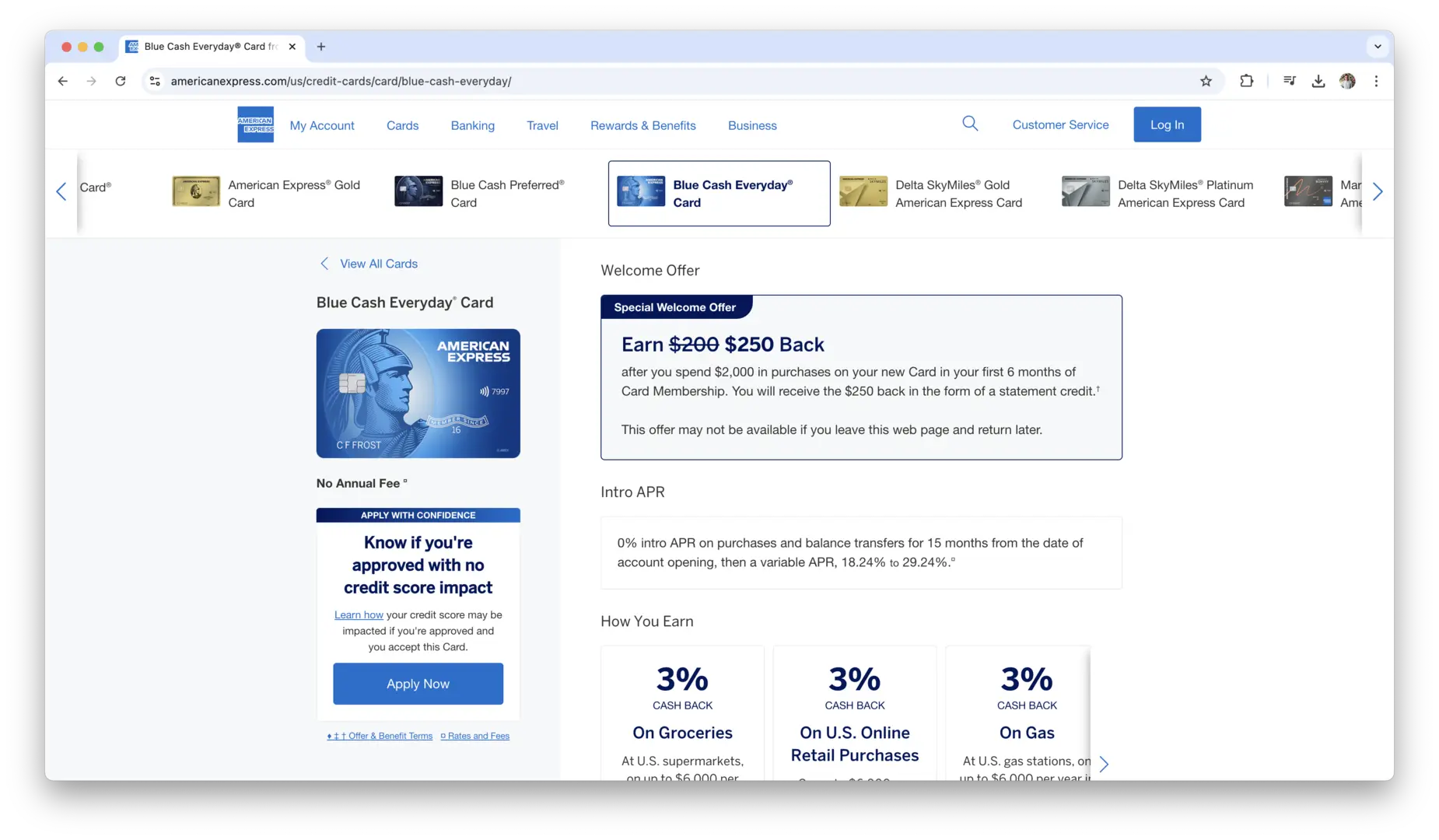

American Express Blue Cash Everyday Card

The American Express Blue Cash Everyday Card offers a 0% APR for 15 months on balance transfers, with a balance transfer fee of 3% for the first 60 days (then 5%). In addition to the 0% APR for balance transfers, this card also gives you cashback rewards on purchases: 3% on groceries (up to $6,000 per year), 2% on gas, and 1% on everything else. It’s an excellent choice for those who plan to use the card for both balance transfers and everyday spending.

Pros:

- 0% APR for 15 months on balance transfers

- Cashback rewards on everyday spending

- No annual fee

Cons:

- Balance transfer fee of 3% for the first 60 days, then 5%

- High regular APR after the promotional period

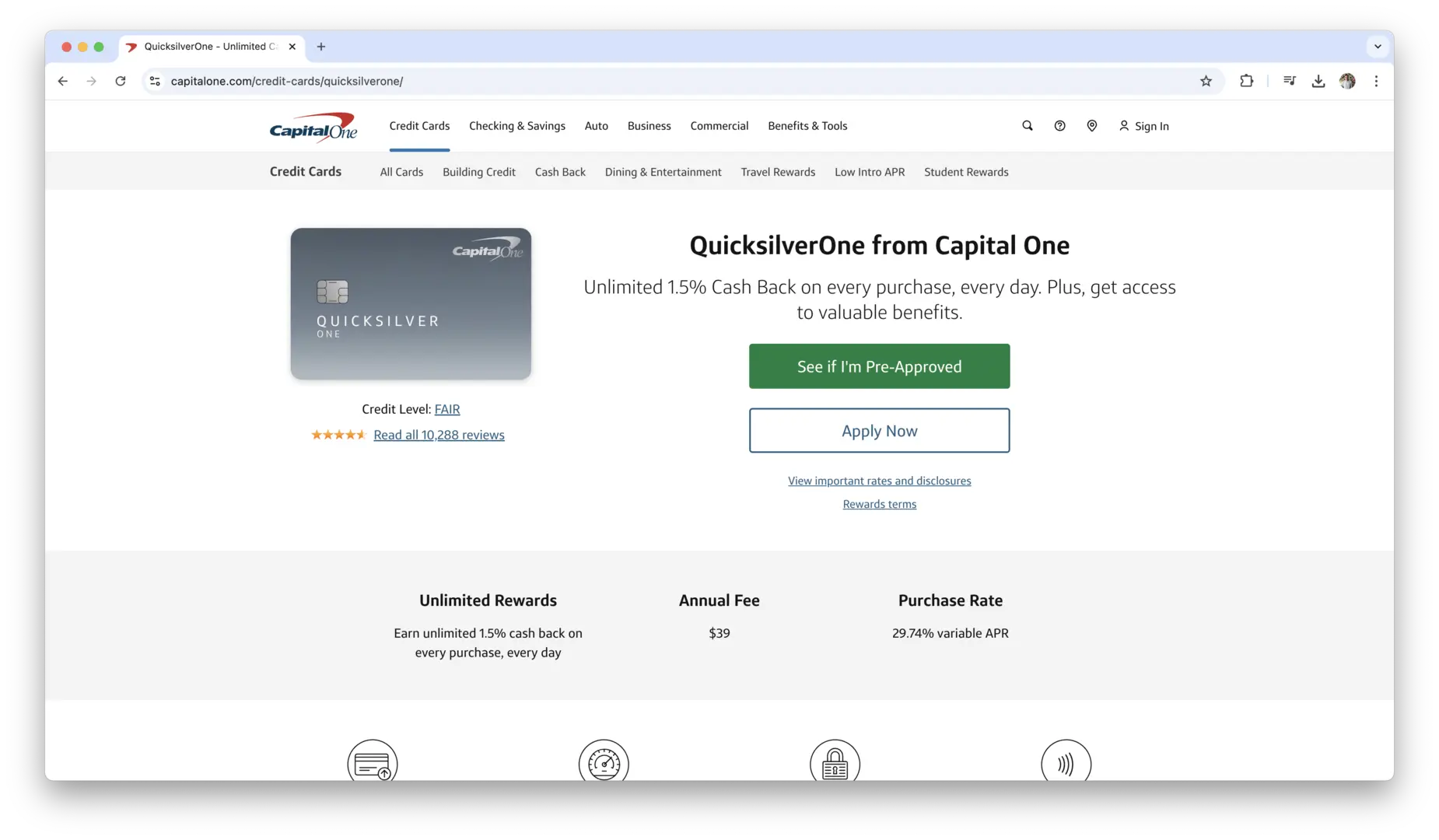

Capital One QuicksilverOne Cash Rewards Credit Card

The Capital One QuicksilverOne Cash Rewards Credit Card offers 0% APR for 15 months on balance transfers, making it a great choice for those who need extra time to pay off existing balances. The balance transfer fee is 3%, and the card also provides 1.5% cashback on every purchase, which is perfect for those who want to earn rewards while paying down their debt. It’s especially beneficial for those with average credit looking for a straightforward balance transfer option.

Pros:

- 0% APR for 15 months on balance transfers

- 1.5% cashback on all purchases

- No annual fee

Cons:

- Balance transfer fee of 3%

- High APR after the introductory period

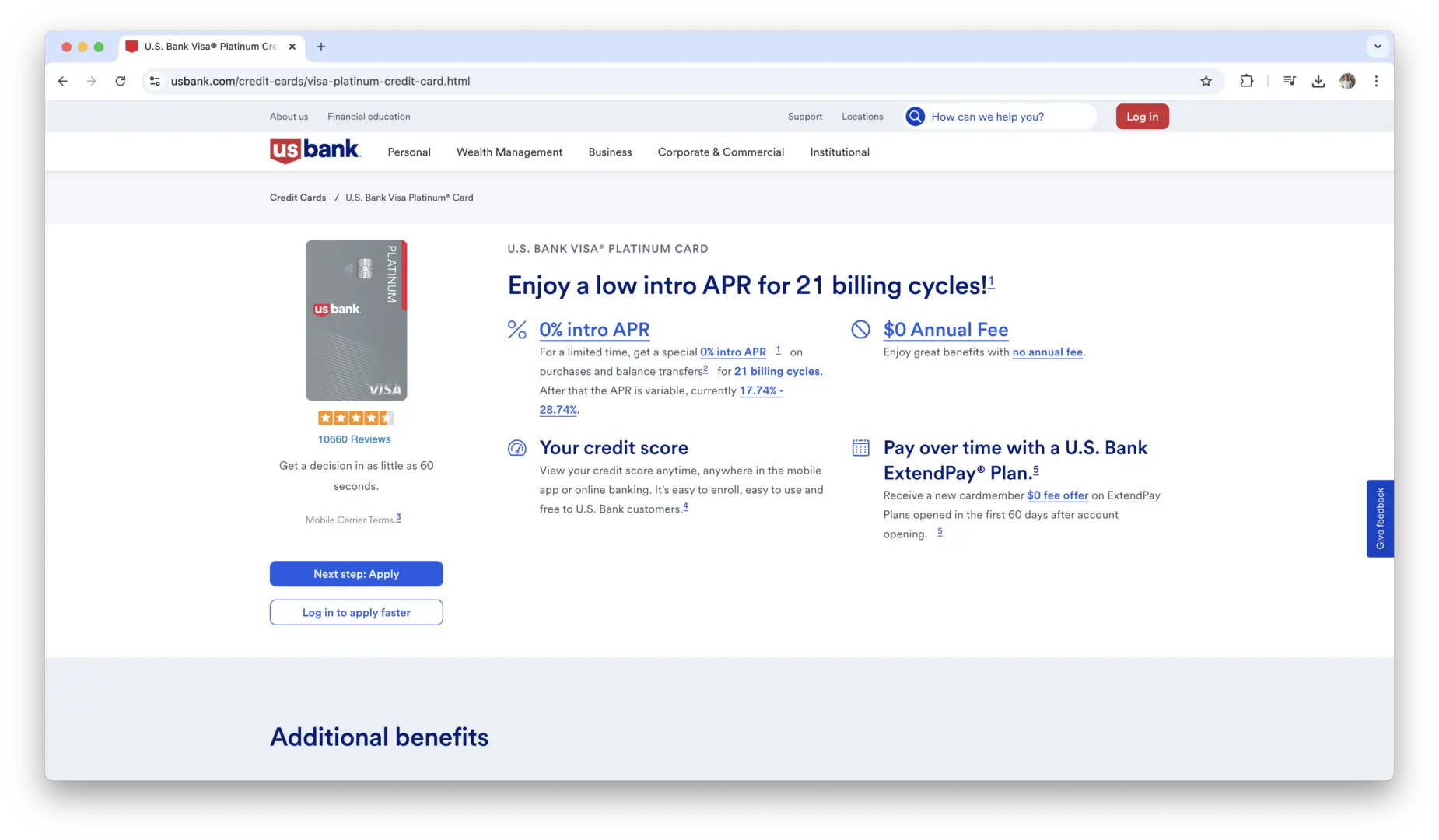

U.S. Bank Visa Platinum Card

The U.S. Bank Visa Platinum Card offers one of the longest 0% APR introductory periods for balance transfers—20 months. It also comes with a balance transfer fee of 3% (or $5, whichever is greater). This card is ideal for those who need extended time to pay down large balances. While it doesn’t offer rewards, the lengthy 0% APR period makes it one of the best choices for long-term debt management.

Pros:

- 0% APR for 20 months on balance transfers

- No annual fee

- Low balance transfer fee of 3%

Cons:

- No rewards program

- High APR after the promotional period ends

Wells Fargo Active Cash Card

The Wells Fargo Active Cash Card offers a 0% APR for 15 months on balance transfers, with a balance transfer fee of 3%. This card also comes with a 2% cashback on all purchases, making it a great option for those looking to earn rewards while managing their debt. After the promotional APR period ends, the card’s regular APR is competitive, and it has no annual fee.

Pros:

- 0% APR for 15 months on balance transfers

- 2% cashback on all purchases

- No annual fee

Cons:

- Balance transfer fee of 3%

- Higher APR after the promotional period

Bank of America Cash Rewards Credit Card

The Bank of America Cash Rewards Credit Card offers 0% APR for 15 billing cycles on balance transfers, and a 3% balance transfer fee. The card also allows you to earn 3% cashback on categories like dining, gas, or online shopping (up to a certain limit) and 1% cashback on all other purchases. While the balance transfer fee is reasonable, the cashback rewards make this card a standout option for those who want to earn rewards while consolidating debt.

Pros:

- 0% APR for 15 billing cycles on balance transfers

- 3% cashback on selected categories

- No annual fee

Cons:

- Balance transfer fee of 3%

- Limited 3% cashback categories

Citi Double Cash Card

The Citi Double Cash Card offers a 0% APR for 18 months on balance transfers, with a balance transfer fee of 3% for the first 4 months (after that, the fee increases to 5%). While the card doesn’t have an introductory offer for purchases, it stands out for its 2% cashback—1% on purchases and another 1% when you pay your bill. This makes it a great choice for those looking to transfer balances and earn rewards at the same time.

Pros:

- 0% APR for 18 months on balance transfers

- 2% cashback on all purchases

- No annual fee

Cons:

- Balance transfer fee of 3% for the first 4 months, then 5%

- Higher APR after the promotional period ends

Discover it Miles

The Discover it Miles card offers 0% APR for 14 months on balance transfers, with a balance transfer fee of 3% for the first 3 months. After the 14-month 0% APR period ends, the APR jumps to a variable rate. In addition to balance transfers, this card earns 1.5 miles for every dollar spent—a useful feature for those who want to earn travel rewards while paying off debt.

Pros:

- 0% APR for 14 months on balance transfers

- 1.5 miles for every dollar spent

- Discover matches your miles earned in the first year

Cons:

- Balance transfer fee of 3% for the first 3 months

- Travel rewards program may not appeal to everyone

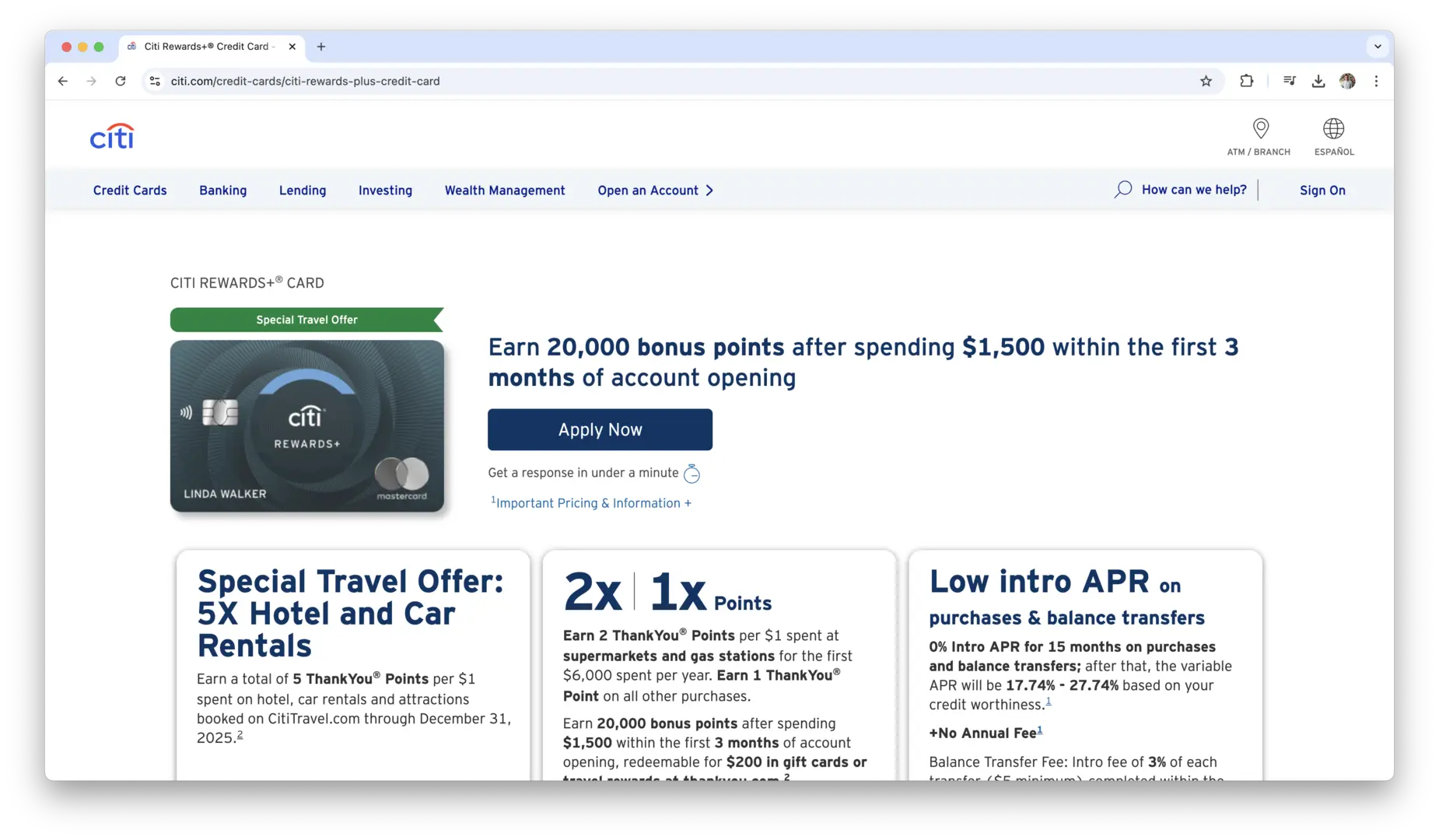

Citi Rewards+ Card

The Citi Rewards+ Card offers 0% APR for 15 months on balance transfers, with a balance transfer fee of 3% for the first 4 months (after that, the fee increases to 5%). The card provides 2x points on supermarket purchases (on the first $6,000 per year) and 1x points on other purchases. While it’s primarily a rewards card, the 0% APR offer is perfect for transferring balances while earning rewards for future purchases.

Pros:

- 0% APR for 15 months on balance transfers

- 2x points on supermarket purchases

- No annual fee

Cons:

- Balance transfer fee of 3% for the first 4 months, then 5%

- Lower rewards rate on non-supermarket purchases

Choosing the right balance transfer card largely depends on your specific financial needs. If you need the longest period to pay off your debt, the Citi Simplicity Card offers the best extended 0% APR period of 21 months. However, if you’re looking for rewards while paying down your balance, the Discover it Balance Transfer card provides cashback and a 0% APR period, making it an excellent choice for those who still want to earn while tackling their debt.

Be sure to compare the balance transfer fees, APR periods, and any rewards or extra perks when selecting a card to ensure it aligns with your financial goals and helps you save money on interest.

Why Choose a Balance Transfer Card?

A balance transfer card is a smart financial tool for anyone struggling with high-interest debt. It offers a simple solution to help reduce your interest payments and clear your debt faster. By moving your existing balances to a new credit card that offers a 0% APR for a promotional period, you can get a fresh start. Here’s why you might want to consider a balance transfer card:

Advantages of Transferring Debt

Transferring debt to a balance transfer card can significantly improve your financial situation. One of the biggest advantages is the ability to consolidate multiple high-interest credit card balances into one payment. Instead of managing several accounts with varying interest rates, you can focus on a single payment.

Not only does this reduce the stress of managing multiple bills, but it also helps you save money in the long term. When you transfer your balance, you’re typically not charged any interest during the introductory period (usually between 6 and 21 months). This gives you the breathing room to pay down your debt without worrying about adding more interest charges on top of the existing balance.

For example, if you’ve been carrying a $5,000 balance on a credit card with a 20% APR, you’re paying about $1,000 annually in interest alone. By transferring that balance to a card with a 0% APR, you can avoid those interest charges for the promotional period, giving you more money to apply directly toward your debt. Over time, this can add up to significant savings, helping you become debt-free faster.

Potential Savings on Interest Rates

One of the most attractive features of balance transfer cards is the potential savings on interest. If you’re paying high-interest rates on existing credit card debt, a balance transfer card can offer a 0% APR for a set time—sometimes as long as 21 months. This means that every dollar you pay will go directly toward reducing your debt, not toward interest payments.

Let’s say you have a $5,000 balance at 18% APR. Over the course of a year, you could end up paying about $900 in interest. However, if you transfer that balance to a card offering 0% APR for 12 months, you’ll have a full year to pay off your balance without paying any interest at all. In this case, you could save $900 in just one year.

Even after factoring in the balance transfer fee (typically 3% to 5%), you’ll still likely save money in the long run, especially if you pay down the majority of your debt during the promotional period. With the right strategy, you can make a significant dent in your overall balance and avoid the hefty interest charges that would otherwise accumulate.

Impact on Credit Score and Financial Health

Using a balance transfer card wisely can also have a positive impact on your credit score and overall financial health. When you transfer your debt to a single card, you reduce your credit utilization ratio, which is a key factor in determining your credit score. Your credit utilization ratio is the amount of credit you’re using relative to your total available credit. By lowering this ratio, you can improve your credit score over time.

For instance, if you have a $5,000 credit limit and owe $4,000 across several cards, your credit utilization ratio is 80%. Transferring that debt to a balance transfer card with a $10,000 limit would drop your credit utilization ratio to 40%, which could improve your credit score.

Additionally, transferring your balance to a lower-interest card helps you pay down your debt faster, which improves your overall financial health. As you eliminate debt, you free up more of your income to save, invest, or spend on other priorities. If you make your payments on time and avoid accruing new debt, you’ll find that your financial situation improves, reducing the stress of high-interest debt and allowing you to regain control of your finances.

Top Considerations Before Applying for a Balance Transfer Card

Choosing the right balance transfer card requires careful thought. There are several factors to consider before applying for a card that will best serve your financial goals. While the promise of 0% APR during the promotional period is tempting, you need to make sure you understand the card’s terms and conditions to avoid costly surprises. Here are some essential considerations to keep in mind before applying for a balance transfer card.

Credit Score Requirements

Your credit score plays a significant role in determining whether you’ll be approved for a balance transfer card, as well as the terms you’ll receive. Most balance transfer cards with the best features—such as long 0% APR periods and low fees—require a good to excellent credit score (typically 670 or higher). If your score is below this range, you might still qualify for a card, but you may face higher interest rates or shorter promotional periods.

Before applying, it’s a good idea to check your credit score to gauge your chances of approval. If your score is lower than desired, consider improving it before applying for a balance transfer card. You can do this by paying down existing debt, avoiding new credit inquiries, and ensuring your credit reports are accurate.

In addition, keep in mind that balance transfer cards often come with credit limits, and if your available credit is too low compared to the amount you want to transfer, the card might not be suitable. A higher credit score not only improves your chances of approval but can also help secure a larger credit limit, giving you more flexibility when transferring balances.

Introductory 0% APR Periods

One of the key features of a balance transfer card is the introductory 0% APR period, which allows you to pay off your balance without interest for a set period of time. These periods usually last anywhere from 6 months to 21 months, but the length can vary between credit card issuers.

The longer the 0% APR period, the more time you’ll have to pay down your debt without incurring additional interest charges. Ideally, you should aim for a card with the longest introductory APR period available, as this gives you more breathing room to pay off your balance. If you can pay off your balance in full before the introductory period ends, you’ll avoid interest altogether, maximizing your savings.

However, it’s important to note that not all cards offer long 0% APR periods. Some might offer shorter periods, such as 6 months or 12 months, which may not be sufficient if you’re carrying a large balance. To ensure the card fits your needs, compare the introductory APR periods of several cards before making a decision.

Balance Transfer Fees

Most balance transfer cards charge a balance transfer fee, typically ranging from 3% to 5% of the amount you transfer. While this fee may seem small, it can add up quickly, especially if you’re transferring a large balance. For example, if you transfer $5,000 to a card with a 3% fee, you’ll end up paying an additional $150 on top of the balance you’re transferring.

Some cards, however, offer no balance transfer fee during the promotional period. This can be an attractive option, particularly if you’re transferring a significant amount of debt. If the card you’re considering charges a fee, calculate how much the fee will cost and factor it into your overall debt repayment strategy. You should also weigh the fee against the potential savings in interest. In many cases, even with the fee, transferring your balance to a 0% APR card will still save you money over time.

Ongoing Interest Rates After the Introductory Period

After the introductory 0% APR period ends, the interest rate on your balance will increase to the card’s regular APR, which can range from 14% to 24%, depending on the card. This is one of the most important factors to consider before applying for a balance transfer card.

The high ongoing APR can significantly increase the cost of carrying a balance after the introductory period ends, so it’s crucial to pay off as much of the balance as possible during the promotional period. If you’re unable to pay off the entire balance before the introductory period expires, be prepared to face higher interest rates, and understand that those interest charges will start to accumulate quickly.

Some balance transfer cards offer relatively low ongoing APRs, while others may charge higher rates once the promotion ends. If you anticipate carrying a balance beyond the promotional period, it’s worth comparing the ongoing APR rates of different cards. Choose one that offers a rate that is manageable for your long-term financial situation.

Ultimately, the goal is to eliminate your balance during the introductory period to avoid paying high interest once the promotion ends. However, it’s still important to be aware of the ongoing APR and plan accordingly if you can’t pay off your debt in time.

How to Choose the Best Balance Transfer Card?

Choosing the best balance transfer card can feel overwhelming with so many options available, each offering different features, benefits, and fees. To make the right choice, it’s important to consider your financial goals, your current debt situation, and the features that align best with your needs. Here are the key factors you should evaluate when deciding which balance transfer card is right for you.

Factors to Consider: Fees, Interest Rates, and Rewards

When choosing a balance transfer card, you’ll want to compare fees, interest rates, and additional benefits such as rewards programs. Each of these elements will impact the overall cost and benefits of the card over time.

Fees are one of the most important factors to keep in mind. Almost all balance transfer cards charge a fee for transferring balances, typically between 3% and 5% of the amount you transfer. For example, if you’re transferring $3,000 to a card with a 3% fee, you’ll pay an additional $90 upfront. While this might seem small, the fee can add up quickly if you’re transferring a large amount of debt. Some cards, however, offer no-fee balance transfers during the introductory period, which can be an excellent option for those looking to maximize their savings.

Interest rates should also be considered carefully. The most attractive feature of balance transfer cards is the 0% APR introductory offer, but that period is only temporary. Once the promotional period ends, the card will revert to a standard APR, which can be quite high (anywhere from 14% to 24%). If you’re unable to pay off your debt during the introductory period, you’ll end up paying substantial interest on the remaining balance. Therefore, it’s important to choose a card with a long introductory period and a manageable ongoing APR.

Many balance transfer cards also offer rewards programs. While rewards may not be the primary reason for using a balance transfer card, they can still be a valuable bonus if you can earn points or cashback on everyday purchases. For example, cards like the Discover it Balance Transfer offer rewards on everyday spending, such as 5% cashback on rotating categories and 1% on other purchases. If you can transfer your balance and still earn rewards on your purchases, you can maximize the value of your card while paying down your debt.

Understanding the Fine Print and Terms

Once you’ve found a card with the right features for your needs, it’s crucial to read the fine print and fully understand the terms and conditions. This includes knowing how long the 0% APR introductory period lasts, how long it will take for your balance transfer to be processed, and what the card’s regular APR will be once the introductory period ends.

Many cards also have balance transfer limits—the maximum amount of debt you can transfer to the new card. Some cards may not allow you to transfer your entire balance if it exceeds a certain limit. For example, if your available credit limit on the new card is lower than your existing balance, you may only be able to transfer part of your debt, leaving you with some debt on your old cards that still accrues interest.

Pay close attention to late payment penalties as well. If you miss a payment on a balance transfer card, not only will you incur a late fee, but the card issuer may end the promotional 0% APR period early, and you could be stuck with a high-interest rate. Some cards also have foreign transaction fees if you plan to use them for purchases abroad, so be sure to check if this applies.

Understanding the fine print helps ensure that there are no surprises and that you can manage your balance transfer with confidence, without being caught off guard by hidden fees or unfavorable terms.

Comparing Offers from Different Providers

Once you’ve identified the factors that matter most to you—whether it’s a long introductory period, low fees, or the potential for rewards—it’s time to compare offers from different credit card providers. Each issuer will have its own set of terms, and some may be more generous than others in key areas like introductory APR periods or balance transfer fees.

Use comparison tools available online to streamline the process. Websites like NerdWallet, Credit Karma, and Bankrate allow you to quickly compare multiple balance transfer cards side by side, helping you assess the different features of each card, including APR, fees, promotional periods, and credit limits.

Don’t forget to consider the long-term costs as well. For example, while one card might offer a longer 0% APR period, it might charge a higher balance transfer fee or have a higher ongoing APR. Weighing these aspects together can help you make a more informed decision based on your specific financial situation. Be sure to also check if the card has any annual fees. While some balance transfer cards come with no annual fee, others might charge you a yearly fee, which could offset the benefits of the promotional APR period.

Finally, consider your credit limit. If the balance you want to transfer exceeds the credit limit offered by the card, you won’t be able to transfer the entire balance. In this case, it may be worthwhile to apply for a card with a higher limit, or look for other options that may allow for larger transfers.

By thoroughly comparing offers from different providers and understanding the fine print, you can confidently choose the balance transfer card that best fits your financial needs, helping you save money and manage your debt more effectively.

How to Apply for a Balance Transfer Card?

Applying for a balance transfer card is a relatively simple process, but it’s important to follow the right steps to ensure you’re eligible, prepared, and able to get approved for the best card possible. From understanding the eligibility requirements to preparing the necessary documentation, here’s a detailed guide on how to apply for a balance transfer card.

Eligibility and Documentation Required

Before you start the application process, it’s essential to determine whether you meet the eligibility requirements for a balance transfer card. Credit card issuers usually require that you have a good to excellent credit score, typically around 670 or higher. However, some cards may accept applicants with lower scores, though you may not be able to access the best terms or introductory offers.

To improve your chances of approval, check your credit score before applying. If your score is below the threshold for the card you want, it might be worth waiting and improving your score first by paying down existing debt or ensuring that your credit report is accurate. Also, keep in mind that issuers may consider factors beyond just your credit score, such as your income, debt-to-income ratio, and your payment history.

In addition to your credit score, issuers will require documentation during the application process. This may include your:

- Personal information such as your name, address, and date of birth

- Income information, including your employment details and annual salary or wages

- Social Security number or another form of identification for verification

- Details about your existing debt, including your current credit card balances and monthly payments

Having these documents and information on hand before starting the application will help speed up the process and ensure you can provide accurate details if needed.

Application Process Explained

Once you’ve confirmed that you meet the eligibility requirements and gathered the necessary documents, you can proceed with the application process. The steps are usually straightforward:

- Choose a Card: Based on your credit score and financial needs, choose the balance transfer card that suits you best. Consider factors like the 0% APR introductory period, balance transfer fees, and ongoing APR once the promotional period ends.

- Fill Out the Application: You can apply for a balance transfer card online or in person, depending on the issuer. Most online applications are quick and easy, and you’ll be required to fill out basic personal and financial information. This includes your name, address, income, and details about your current credit situation.

- Submit the Application: After completing the application form, submit it for review. Most issuers will process your application and provide an instant decision. In some cases, if they need more information or verification, you may receive a response in a few days or weeks.

- Review the Terms and Conditions: After receiving approval, you’ll be sent a credit card agreement outlining the card’s terms and conditions, including interest rates, fees, and the length of the introductory APR period. Make sure you read this carefully before accepting the offer.

- Receive the Card: Once you accept the offer, the card issuer will send you the physical card, which can take anywhere from a few days to a couple of weeks to arrive. In the meantime, you’ll likely be able to start using your card for balance transfers right away, often through the online portal or mobile app.

- Initiate the Balance Transfer: Once you have your card, you can initiate the balance transfer by either calling the issuer or doing it online. Provide the details of the debt you want to transfer, such as the account numbers and amounts, and be prepared to pay any associated transfer fees (if applicable). The process of transferring balances can take anywhere from a few days to a few weeks, so be patient while the transfer is being processed.

Tips for Getting Approved

To increase your chances of approval and secure the best terms, consider the following tips:

- Maintain a Healthy Credit Score: Ensure your credit score is within the required range for the card you’re applying for. If your score is low, work on improving it before applying by reducing your credit utilization, paying down debt, and avoiding late payments.

- Don’t Apply for Multiple Cards at Once: Applying for several cards in a short period can negatively impact your credit score and make you appear desperate for credit. It’s better to focus on one application at a time and apply for a card that fits your needs.

- Be Honest About Your Income: Card issuers will often verify the income you report. If your reported income is inaccurate or inflated, it could lead to denial of the application. Always provide accurate information about your earnings to ensure the process goes smoothly.

- Consider a Lower Credit Limit: If you’re worried about being approved for a high credit limit, consider requesting a lower limit when applying. Some applicants find it easier to get approved for cards with lower limits, and this can help manage your finances more responsibly by preventing you from accumulating too much debt.

- Review Your Credit Report: Check your credit report for any errors or discrepancies before applying. You’re entitled to one free credit report per year from each of the major credit bureaus (Equifax, Experian, and TransUnion), and correcting any mistakes could improve your chances of approval.

- Pay Down Existing Debt: If possible, reduce your outstanding credit card balances before applying for a balance transfer card. This not only lowers your debt-to-income ratio but also gives you a better chance of qualifying for a higher credit limit and more favorable terms.

By following these steps and tips, you’ll be in a strong position to apply for a balance transfer card and take advantage of the 0% APR offer, helping you pay off your debt more efficiently and save money on interest.

How to Maximize Your Savings with a Balance Transfer Card?

When you transfer your debt to a balance transfer card, the goal is to pay off your balance before the 0% APR promotional period expires. Here are some strategies to help you make the most of this opportunity and maximize your savings.

- Pay more than the minimum payment to reduce your balance faster.

- Prioritize paying off the highest-interest balances first if you have multiple transfers.

- Avoid adding new purchases to your balance transfer card to prevent accruing additional interest charges.

- Set up automatic payments to ensure you never miss a due date and avoid late fees.

- Monitor your balance transfer progress regularly to stay on track and adjust your payments if necessary.

- Try to pay off your balance well before the 0% APR period ends, so you don’t get stuck with high interest rates afterward.

- Consider using windfalls, such as tax refunds or bonuses, to make lump-sum payments and reduce your balance more quickly.

Common Balance Transfer Cards Mistakes to Avoid

While balance transfer cards are an excellent way to manage debt, there are a few common pitfalls that can reduce the effectiveness of this strategy. Avoid these mistakes to ensure you’re getting the most out of your balance transfer.

- Not paying off the entire balance before the promotional APR period ends, leading to interest charges.

- Failing to account for balance transfer fees, which can eat into your potential savings.

- Using the balance transfer card for new purchases, increasing your debt and potentially triggering interest charges.

- Missing payments, which can result in late fees or cause the APR to revert to a higher rate earlier than expected.

- Transferring balances to multiple cards without considering the total fees and credit limits, leading to unnecessary complexity.

- Not checking the terms and conditions, including the length of the promotional period and the card’s regular APR after the intro offer ends.

Balance Transfer Cards Alternatives

If you find that a balance transfer card isn’t the right fit for your financial situation, there are several other options to help manage and reduce your debt. Each alternative has its own set of pros and cons, so consider what works best for you.

- A personal loan can consolidate multiple credit card balances into one loan with a fixed interest rate and payment schedule.

- Debt consolidation loans combine multiple debts into a single loan, often with a lower interest rate, simplifying your payments.

- Home equity loans or lines of credit allow you to borrow against the equity in your home, often with lower interest rates, but they carry the risk of using your home as collateral.

- Debt management plans (DMPs) offered by credit counseling agencies help you negotiate with creditors to lower your interest rates and consolidate your payments into one monthly bill.

- Snowball method and avalanche method are strategies where you focus on paying off smaller debts first (snowball) or the debts with the highest interest rates (avalanche), to reduce overall debt more effectively.

Conclusion

Choosing the right balance transfer card can make a huge difference in how quickly you can pay down your debt and save money on interest. Whether you’re looking for the longest 0% APR period, the lowest balance transfer fees, or the ability to earn rewards while paying down your balance, there are options available to fit your needs. The key is to compare the features of each card, consider your own financial situation, and choose the one that will help you pay off your debt most effectively. Be sure to factor in the balance transfer fee, the introductory APR period, and the regular APR once the promo period ends.

Once you’ve selected a balance transfer card, it’s important to have a clear plan for how you’ll use it. To make the most of the 0% APR period, try to pay down as much of your balance as possible before the regular APR kicks in. Avoid using the card for new purchases, as that can quickly add to your debt. By staying on top of your payments and making smart use of your balance transfer card, you can significantly reduce your debt and improve your financial situation. Take the time to choose wisely, and you’ll be in a better position to tackle your financial goals with confidence.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.