Are you looking to get the most out of your spending while traveling? A great travel credit card can help you do just that, offering valuable rewards and perks that can make your trips more enjoyable and cost-effective. Whether you’re a frequent flyer, a casual traveler, or someone who loves dining out, there’s a card designed to match your needs.

The best travel credit cards come with benefits like bonus rewards on travel-related purchases, access to airport lounges, and even travel protections like trip cancellation insurance. This guide will walk you through some of the top travel credit cards available, so you can find the one that works best for your lifestyle and make your spending go further.

What is a Travel Credit Card?

A travel credit card is a financial product designed to reward cardholders for travel-related purchases, offering points, miles, or cashback on spending. These cards typically come with a suite of travel-specific benefits, such as airline miles, hotel discounts, and travel insurance, making them a popular choice for those who travel regularly. While some cards are affiliated with specific airlines or hotel chains, others offer more general rewards that can be redeemed with various travel partners or through travel portals.

Travel credit cards are essentially a way to earn rewards for your travel and other expenses, which can be redeemed for flights, hotel stays, car rentals, and other travel-related services. Depending on the card, you can also enjoy added perks such as concierge services, airport lounge access, and free checked bags.

The Importance of Travel Credit Cards

Travel credit cards play a significant role in how travelers manage their finances while maximizing the value of their trips. They not only provide a means to earn rewards on everyday spending, but they also offer a variety of benefits that can save you money and enhance your travel experience. The rewards, insurance, and added perks make these cards an essential tool for frequent travelers. Here are some reasons why travel credit cards are important:

- They help you earn rewards for every purchase, which can be redeemed for travel-related expenses, making travel more affordable.

- Travel cards often come with additional travel perks like priority boarding, free checked bags, and access to airport lounges, enhancing your experience.

- They can provide travel protection benefits, such as trip cancellation insurance, baggage loss coverage, and emergency medical assistance, offering peace of mind while traveling.

- Some travel cards allow you to earn and use rewards across a variety of airlines, hotels, and travel brands, giving you flexibility and freedom in how you book your trips.

- They can save you money on foreign transaction fees, making them ideal for international travelers.

What Makes a Great Travel Credit Card?

A great travel credit card doesn’t just offer rewards; it provides value through a combination of benefits that cater to your specific travel needs and spending habits. The best travel cards balance earning potential with flexibility, offering easy ways to maximize rewards while also providing valuable travel-related perks. A strong travel credit card should excel in the following areas:

- A rewarding earning structure that fits your travel and spending habits, with bonus categories that allow you to earn more points or miles for common purchases.

- Low or no foreign transaction fees, making it ideal for international travel.

- High-quality travel benefits, including things like airport lounge access, free checked bags, and rental car insurance.

- Flexible redemption options that allow you to transfer points to travel partners or book through a travel portal for maximum value.

- A reasonable annual fee, where the benefits outweigh the cost, particularly for frequent travelers.

- Strong customer support and travel assistance, ensuring that you can easily resolve issues or access help during your trips.

Travel Credit Cards Benefits for Travelers

Travel credit cards offer a range of key benefits that are tailored to make travel more rewarding and convenient. These benefits can significantly enhance your overall travel experience while also helping you save money. Some of the most valuable perks for travelers include:

- Earning points, miles, or cashback on travel-related purchases, which can be redeemed for flights, hotel stays, car rentals, and other travel expenses.

- Access to airport lounges, providing a comfortable place to relax before your flight with amenities like free food, drinks, Wi-Fi, and charging stations.

- Free checked bags, saving you money on airline fees that can add up quickly when traveling with multiple bags.

- Priority boarding or access to early check-in, allowing you to board the plane first and secure overhead bin space.

- Travel insurance, including trip cancellation coverage, baggage loss protection, and emergency medical benefits, offering peace of mind while traveling.

- No foreign transaction fees, making it easier and more affordable to use your card abroad without incurring additional costs.

- Travel concierge services that can assist with booking hotels, making restaurant reservations, or securing tickets to events during your trips.

Top Travel Credit Cards

When it comes to selecting the best travel credit card, the options can be overwhelming, with each card offering unique benefits tailored to different types of travelers. The right travel credit card can make a significant difference in how you earn rewards, access perks, and save money on your travels. Below, we’ll highlight some of the top travel credit cards currently available, based on factors like rewards rates, travel benefits, and overall value.

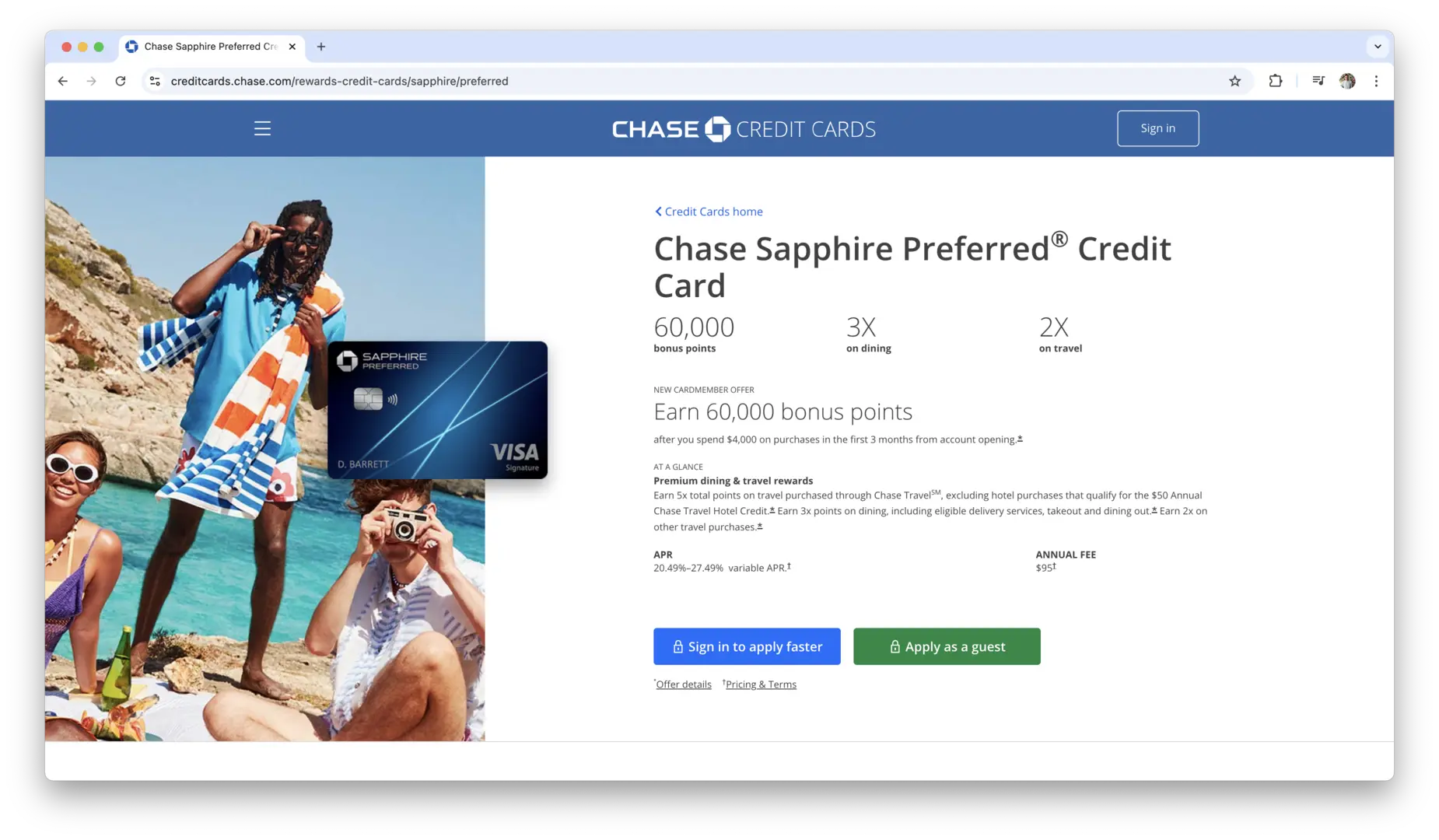

Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card is widely regarded as one of the best all-around travel credit cards due to its generous rewards, strong travel benefits, and flexibility in redeeming points. This card offers 2x points on travel and dining, making it perfect for those who frequently dine out or travel for business or pleasure. The 60,000-point signup bonus is worth up to $750 when redeemed through the Chase Ultimate Rewards program, and cardholders can transfer points to over 13 airline and hotel partners for added flexibility. The card also includes valuable travel protections, such as trip cancellation insurance and primary rental car coverage.

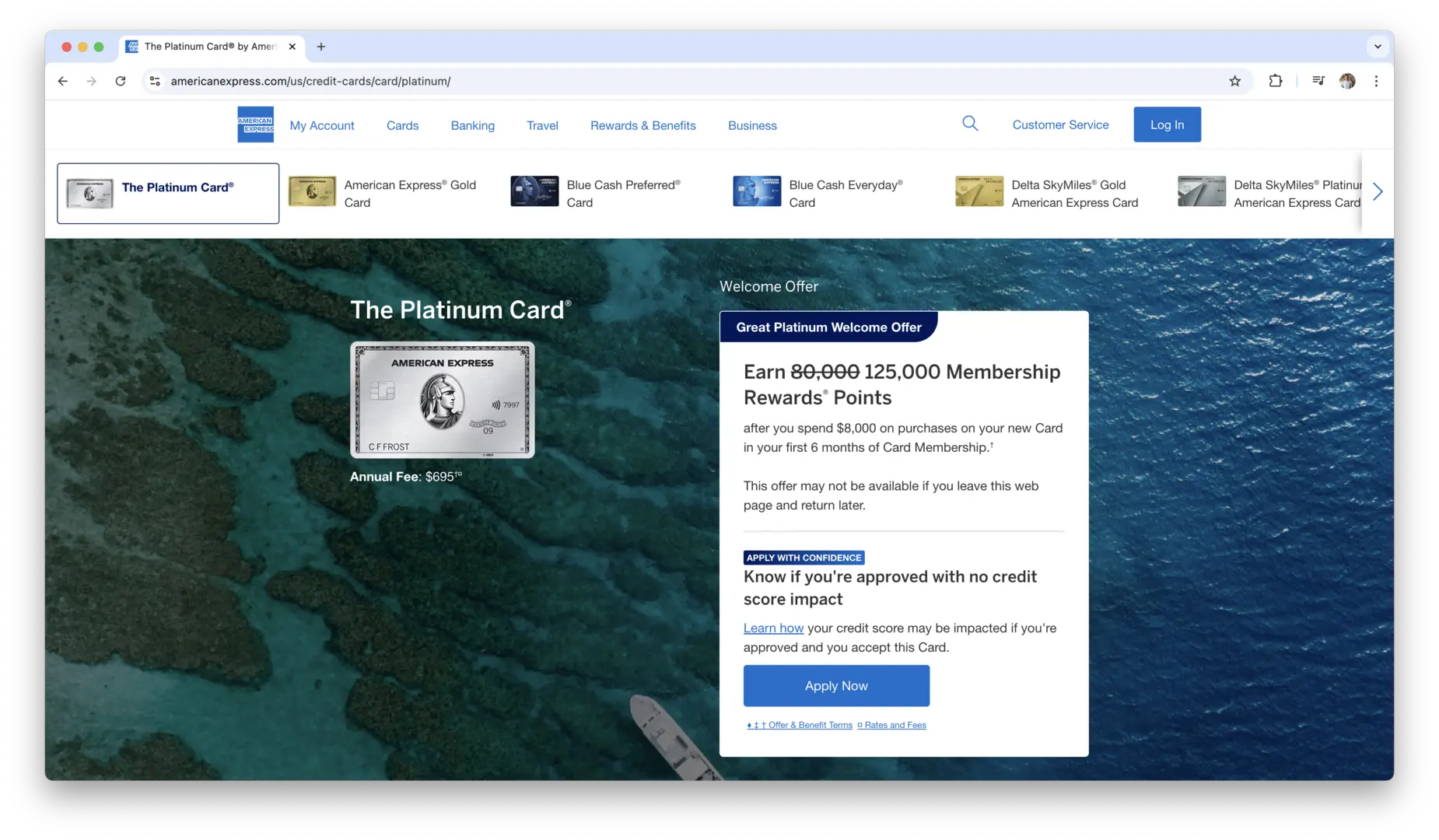

The Platinum Card from American Express

For those who value luxury travel benefits and don’t mind paying a higher annual fee, the Platinum Card from American Express is an excellent choice. It offers access to over 1,200 airport lounges worldwide, including the exclusive Centurion Lounges, and provides 5x points on flights booked directly with airlines or through American Express Travel. Cardholders can also enjoy perks like automatic elite status with hotel loyalty programs (Hilton Honors and Marriott Bonvoy), a $200 annual airline fee credit, and up to $200 in Uber credits each year. Though the card has a high annual fee, the extensive benefits, including comprehensive travel insurance and concierge services, make it ideal for frequent travelers seeking luxury.

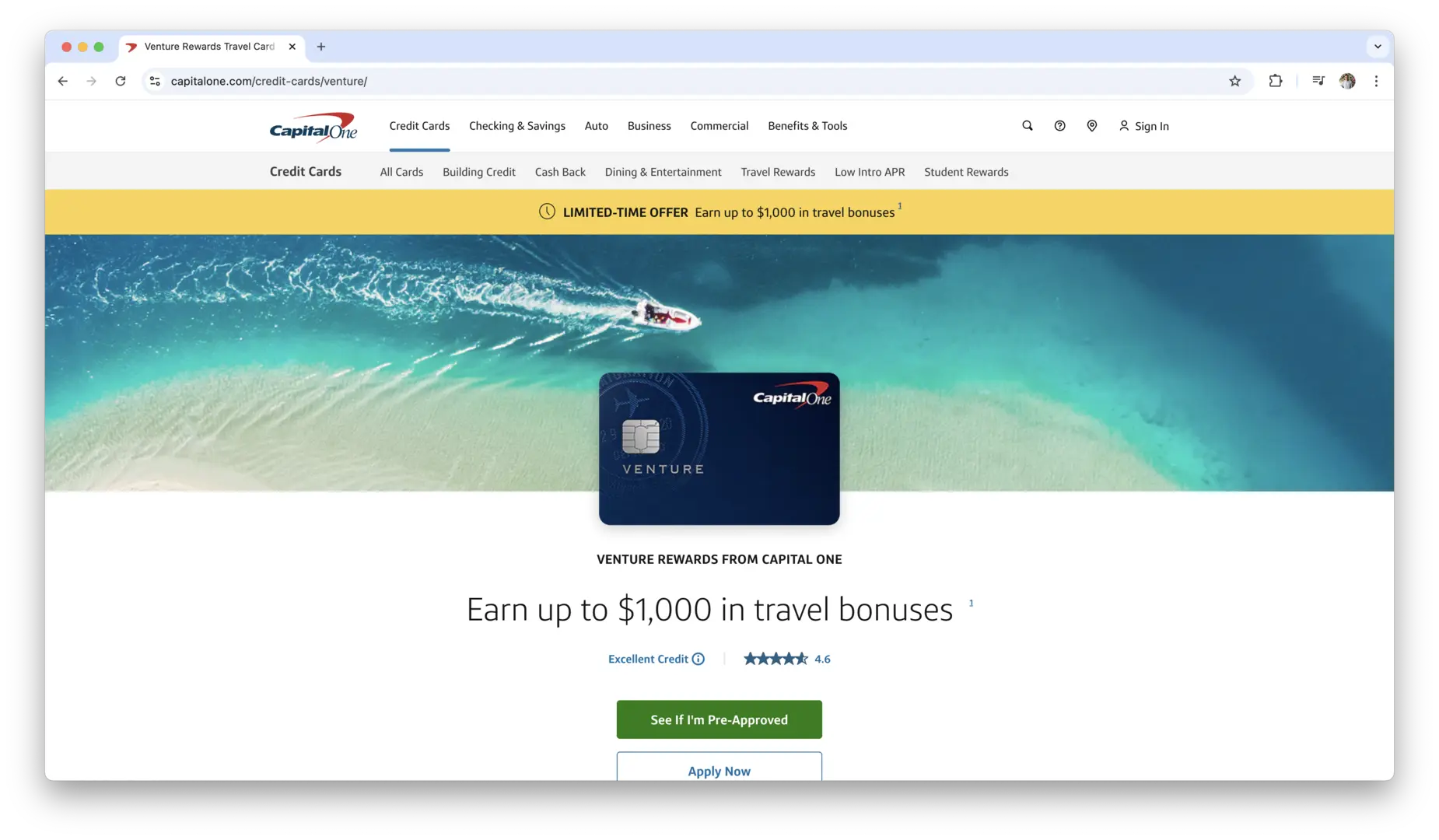

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is a fantastic option for those who want a simple, no-fuss rewards program. It offers 2x miles on every purchase, making it easy to rack up miles without having to worry about specific bonus categories. The card also comes with a generous 75,000-mile signup bonus if you spend $4,000 in the first 3 months, which can be redeemed for travel expenses at a rate of 1 cent per mile. Additionally, the Venture card comes with no foreign transaction fees, making it an excellent choice for international travelers. Cardholders can also redeem miles for hotel stays, car rentals, or flights, either through Capital One’s Travel portal or by using the miles as statement credits for travel purchases.

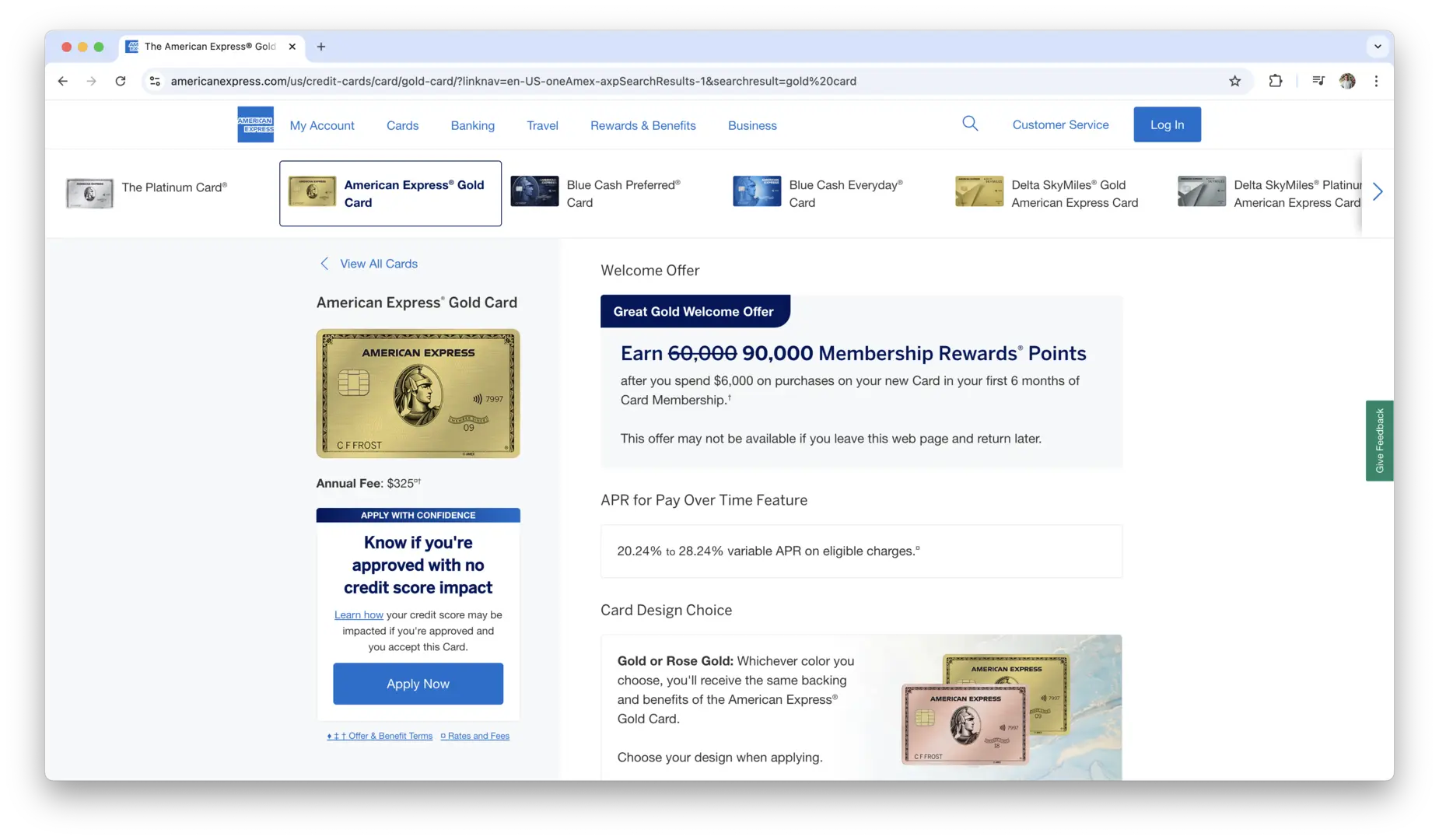

American Express Gold Card

For foodies and travelers who love dining out, the American Express Gold Card is an excellent option. It offers 4x points on restaurants, including takeout and delivery, 3x points on flights booked directly with airlines or on amextravel.com, and 1x point on all other purchases. The card also includes a $120 dining credit at select restaurants and food delivery services each year. While the annual fee is more moderate compared to premium cards, the earning potential in dining categories makes it one of the best choices for those who spend a lot on food. Additionally, the card includes travel protections like trip delay insurance and car rental coverage.

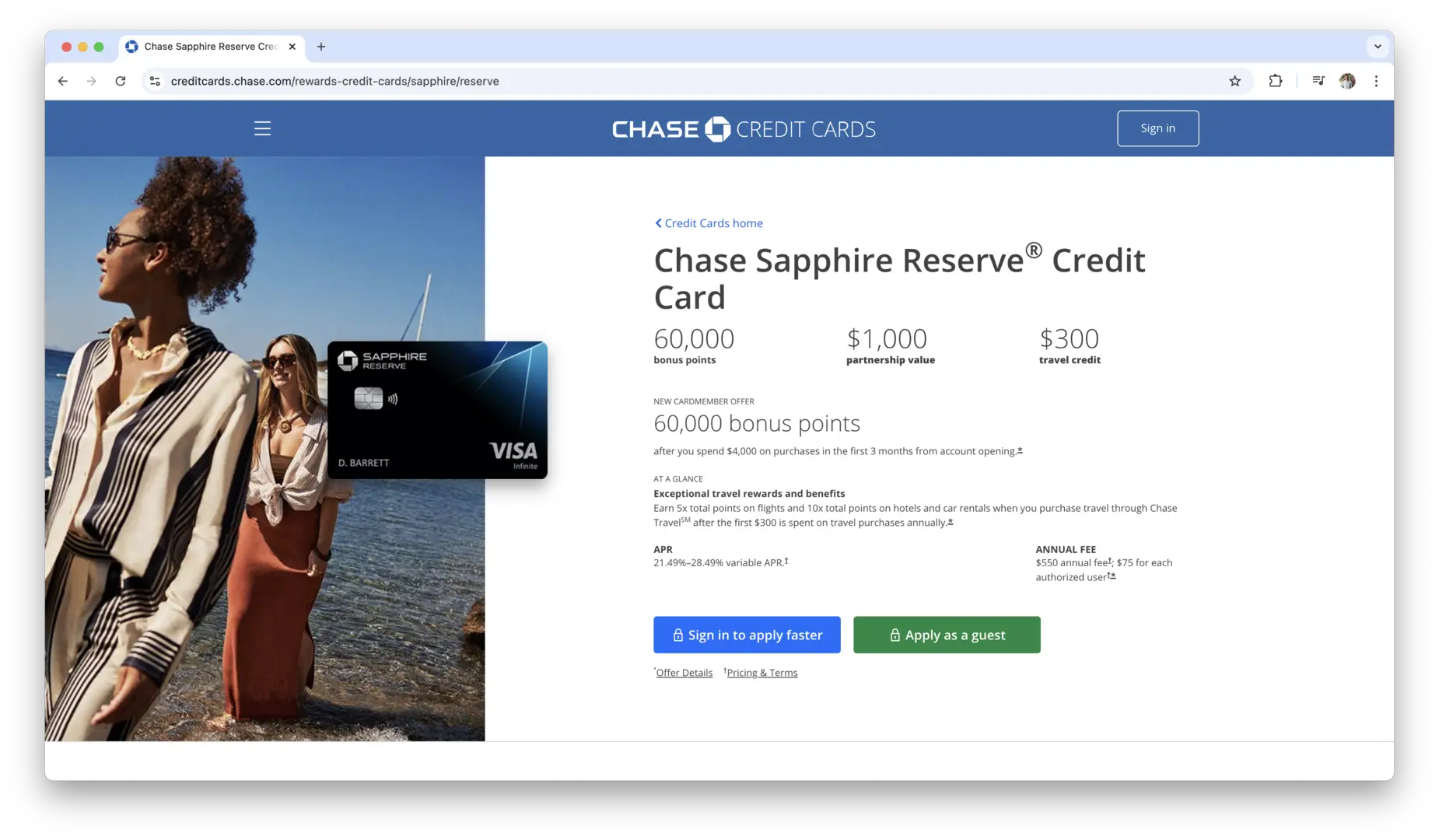

Chase Sapphire Reserve

For those who want to take their travel rewards game to the next level, the Chase Sapphire Reserve offers premium rewards and exclusive perks. With 3x points on travel and dining, a 50% point redemption bonus when booking through Chase Ultimate Rewards, and access to Priority Pass lounges, this card is a solid choice for frequent travelers. Cardholders can earn 60,000 points after meeting the minimum spending requirement, which is worth up to $900 in travel when redeemed through Chase Ultimate Rewards. The card also includes a $300 annual travel credit, travel insurance, and purchase protection benefits. While the annual fee is high, the card’s luxury travel benefits and flexible point redemption options provide exceptional value for frequent flyers and travelers.

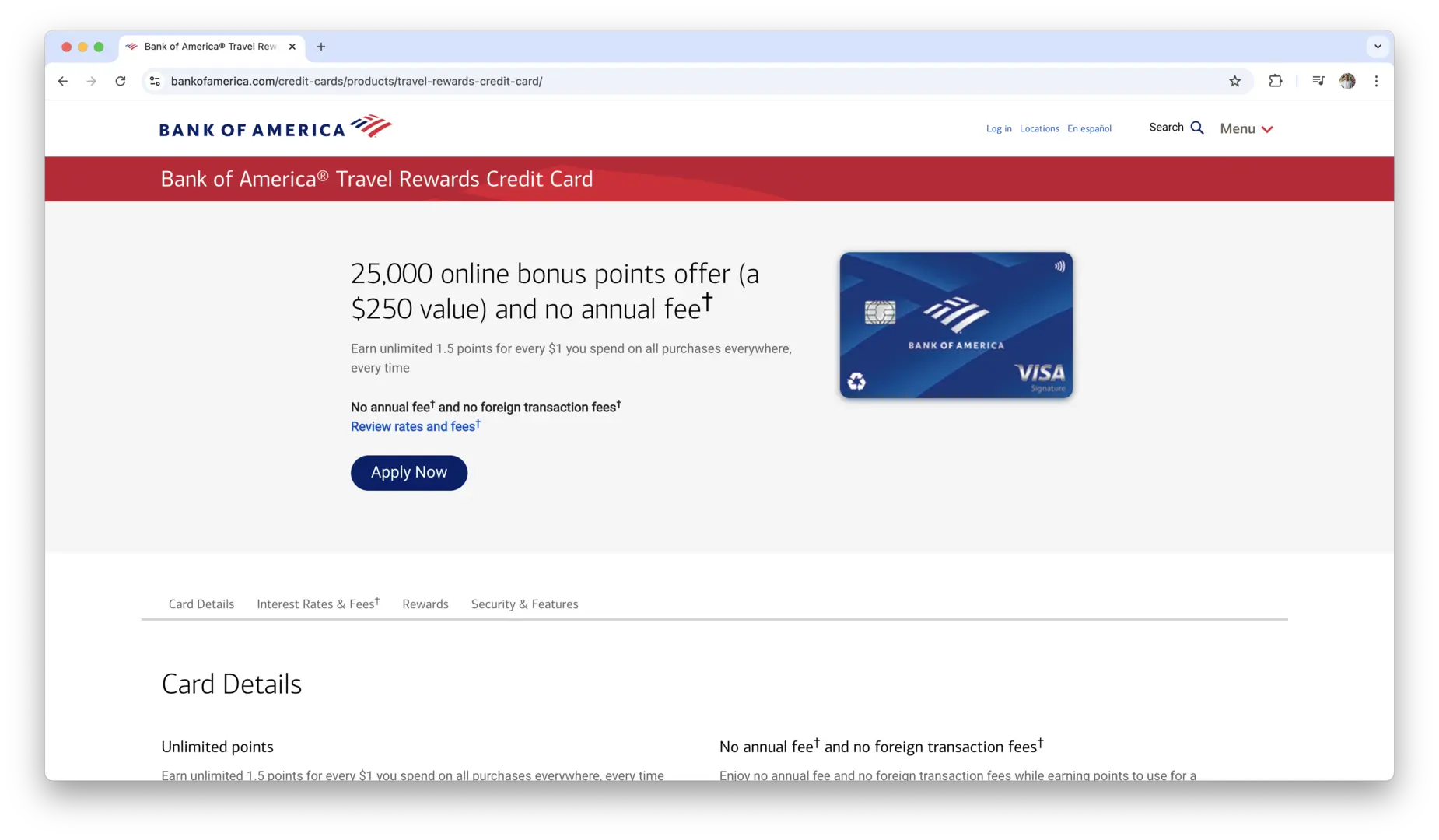

Bank of America Travel Rewards Credit Card

For those looking for a no-annual-fee, straightforward travel credit card, the Bank of America Travel Rewards Credit Card is a strong contender. It offers 1.5x points on every purchase, with no rotating categories or complicated rules to follow. Plus, it offers 25,000 online bonus points if you make at least $1,000 in purchases in the first 90 days of account opening, which is worth $250 in travel. With no foreign transaction fees, it’s an excellent option for international travelers who want to earn rewards without the added cost of foreign fees. This card doesn’t offer as many luxury perks as others, but it’s a solid, simple option for anyone looking to earn travel rewards with minimal hassle.

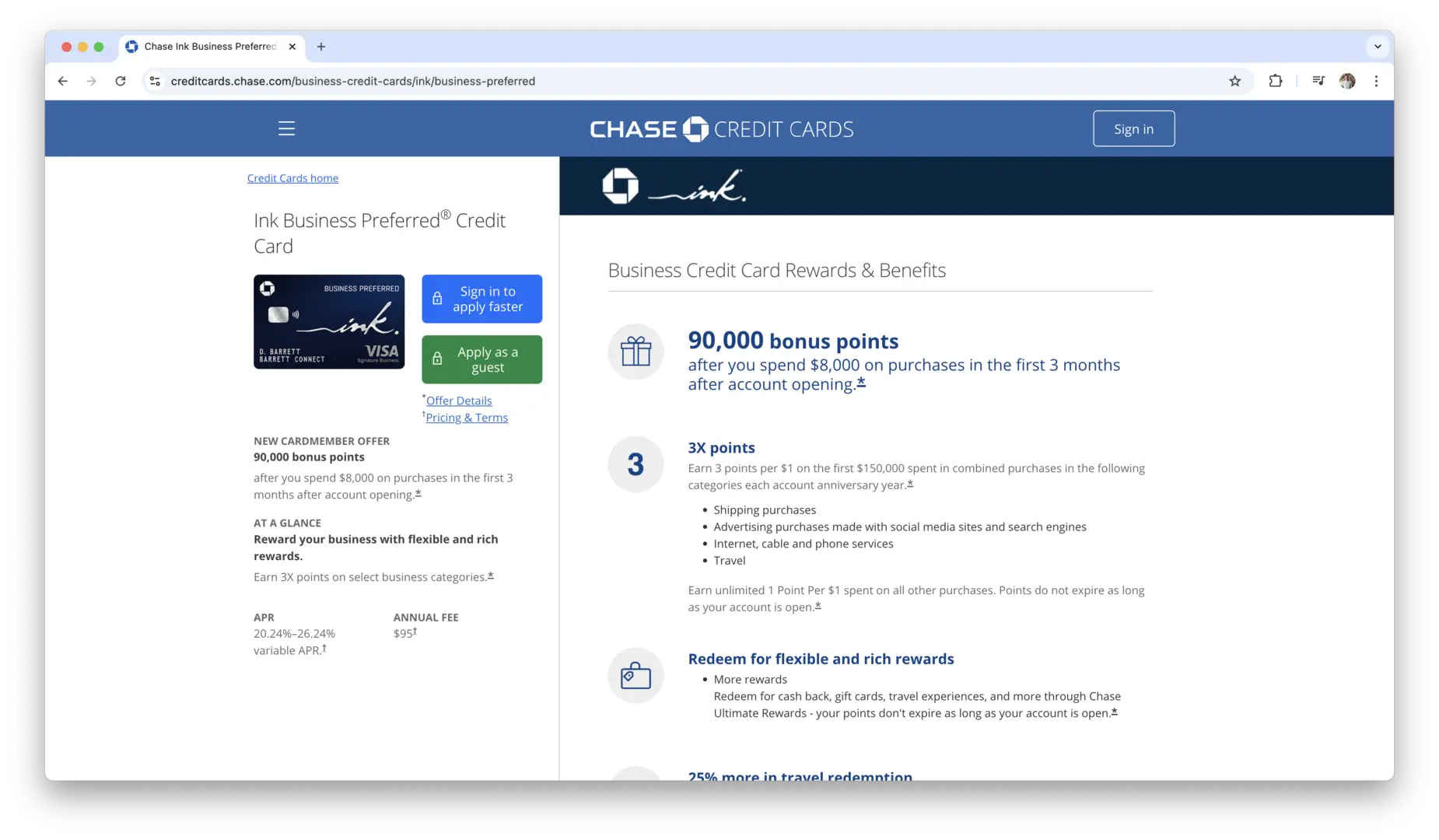

Chase Ink Business Preferred Credit Card

For business travelers, the Chase Ink Business Preferred Credit Card is one of the best options. This card offers 3x points on the first $150,000 spent in combined categories, including travel, advertising purchases, internet, cable, and phone services. With a substantial 100,000-point bonus after meeting the spending requirement, you can redeem these points for travel through Chase Ultimate Rewards, or transfer them to a variety of airline and hotel partners. The card also comes with travel protections like primary car rental insurance, trip cancellation/interruption insurance, and lost luggage reimbursement, making it a great option for business owners on the go.

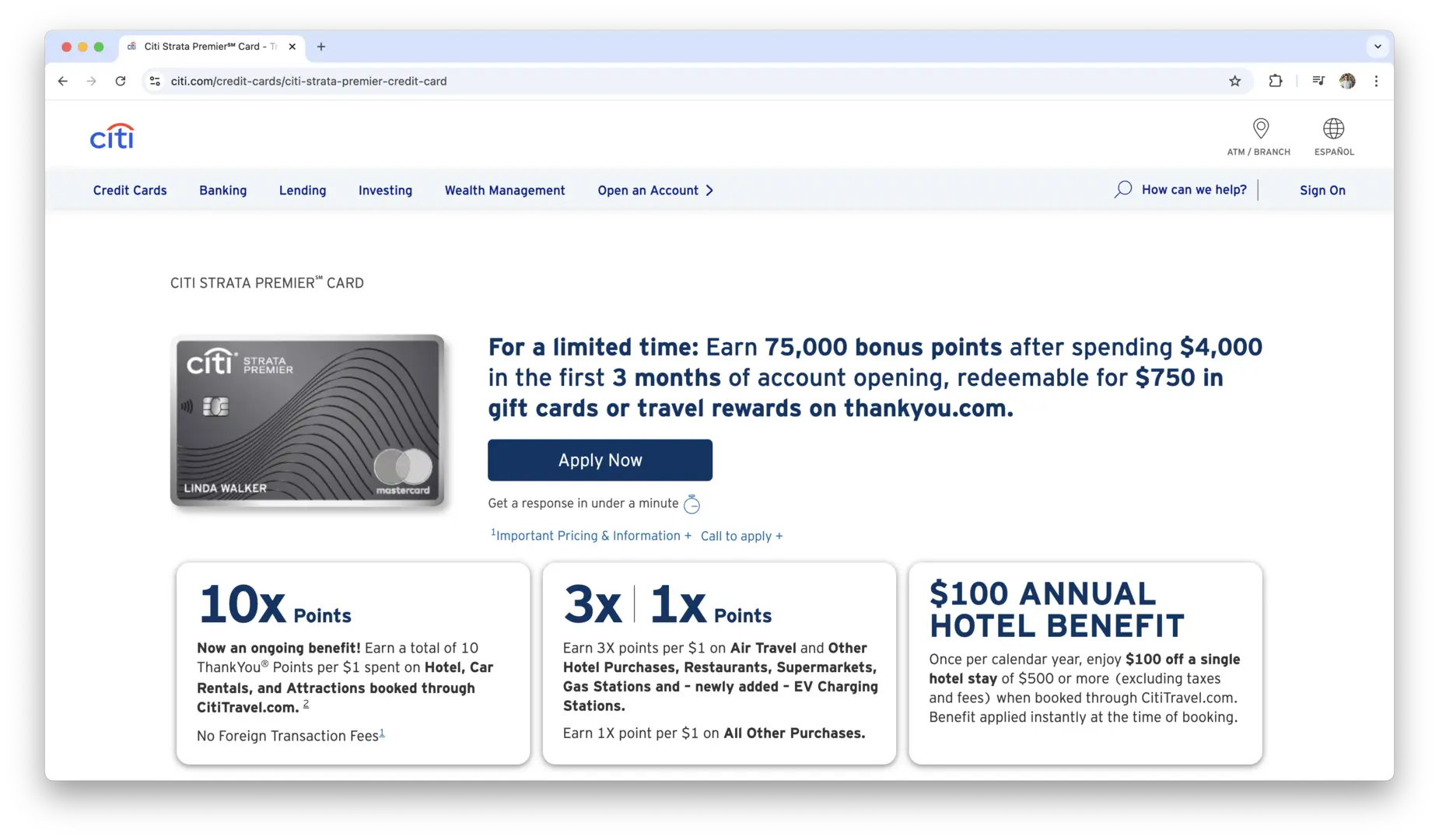

Citi Premier Card

The Citi Premier Card is an excellent choice for frequent travelers who want to earn big rewards across various categories. With 3x points on travel, including gas stations, and 2x points on dining and entertainment, this card offers a rewarding structure for those who spend on a range of travel-related and lifestyle expenses. It also includes a 60,000-point signup bonus, which can be redeemed for up to $750 in travel. Citi’s ThankYou points can be transferred to over 15 airline partners, providing plenty of flexibility when redeeming your rewards. The card also provides travel insurance coverage, including trip cancellation and interruption protection, as well as access to exclusive events.

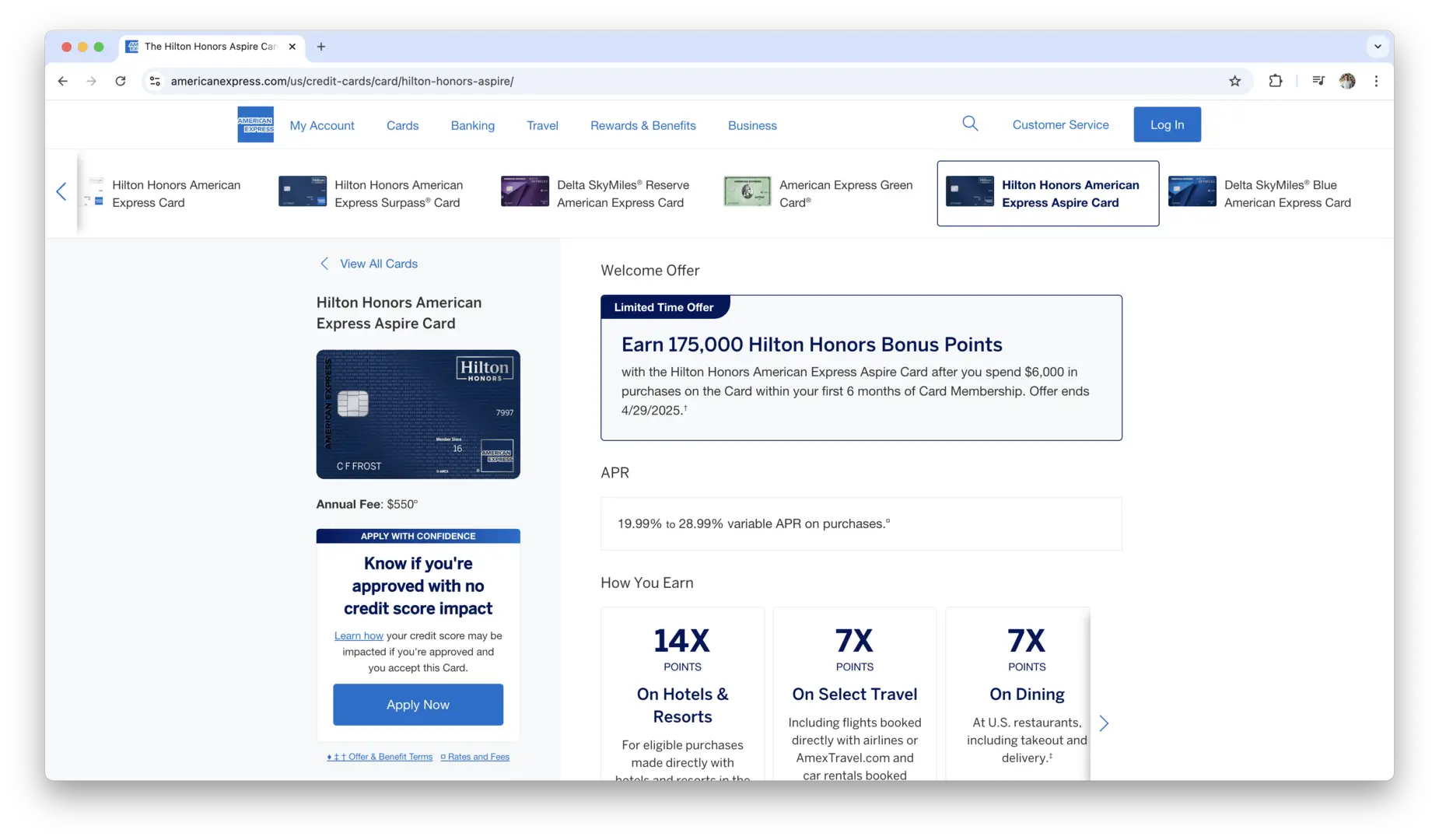

Hilton Honors American Express Aspire Card

For Hilton loyalists, the Hilton Honors American Express Aspire Card is a standout option. This premium card offers 14x points on Hilton hotel stays, 7x points on flights booked directly with airlines, and 3x points on all other purchases. The card’s luxury benefits include complimentary Hilton Diamond status, which provides exclusive perks like room upgrades and access to the Executive Lounge. It also offers an annual free weekend night at participating Hilton properties, a $250 Hilton resort credit, and up to $100 in on-property credit for select properties. Though the annual fee is high, the card’s value is clear for those who frequently stay at Hilton hotels.

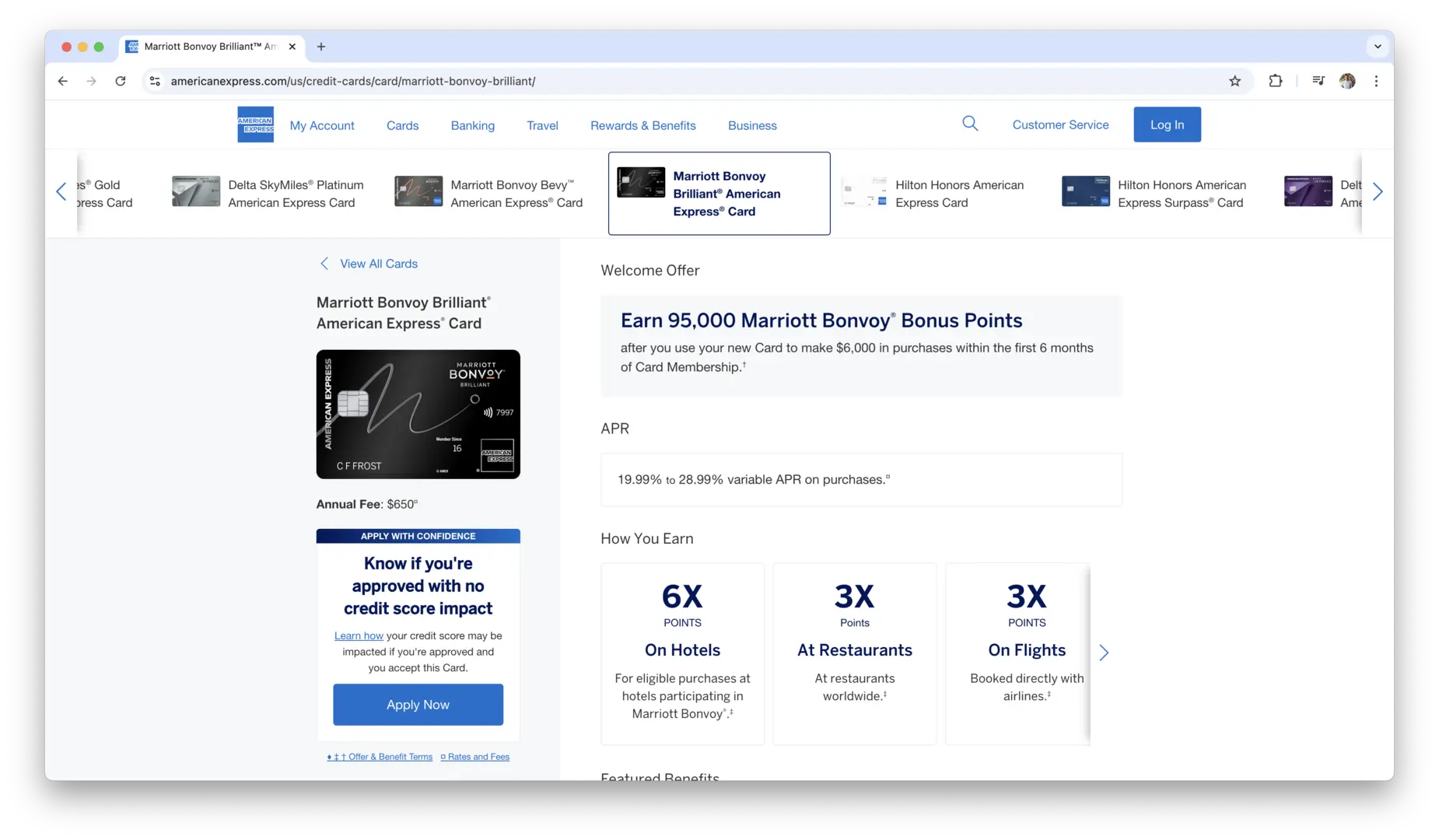

Marriott Bonvoy Brilliant American Express Card

Another top hotel loyalty card is the Marriott Bonvoy Brilliant American Express Card. With this card, you can earn 6x points at Marriott properties, 3x points on dining and flights, and 2x points on all other purchases. The card offers an impressive annual free night award (valued up to 50,000 points) and a $300 Marriott statement credit each year. As a cardholder, you’ll also receive complimentary Marriott Bonvoy Gold Elite status, which includes room upgrades, late checkout, and bonus points on eligible stays. For frequent Marriott guests, this card offers excellent value for both rewards and benefits.

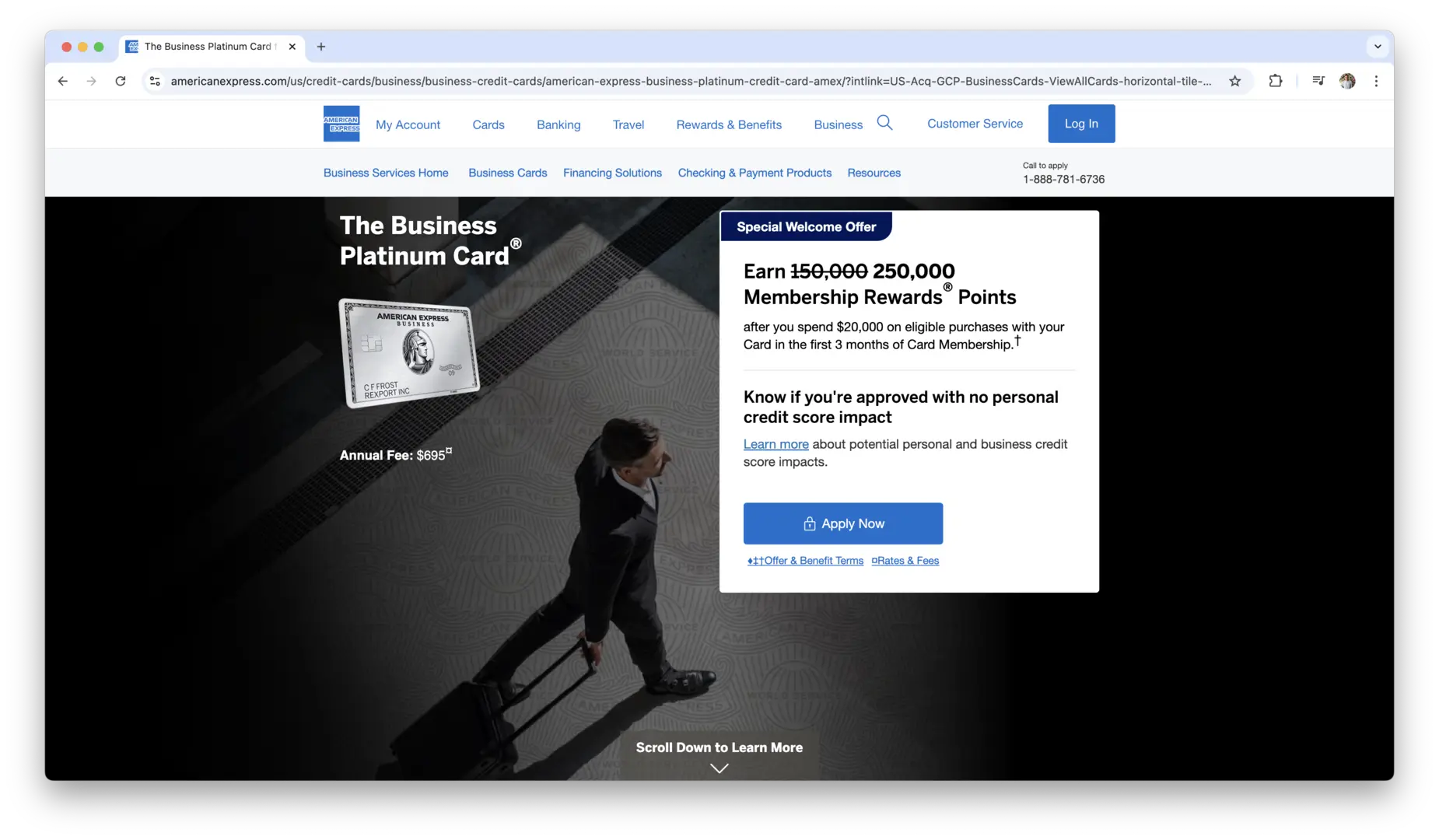

The Business Platinum Card from American Express

For frequent business travelers who want luxury benefits, The Business Platinum Card from American Express is a standout choice. The card offers 5x points on flights and prepaid hotels booked on amextravel.com, as well as 1.5x points on select business categories. You also receive access to over 1,200 airport lounges worldwide, including Centurion Lounges, and an annual $200 airline fee credit. The card includes travel protections, such as trip cancellation insurance and lost baggage reimbursement, along with no foreign transaction fees. If you’re a business owner, the points earned with this card can help offset travel costs, while the premium benefits enhance your travel experience.

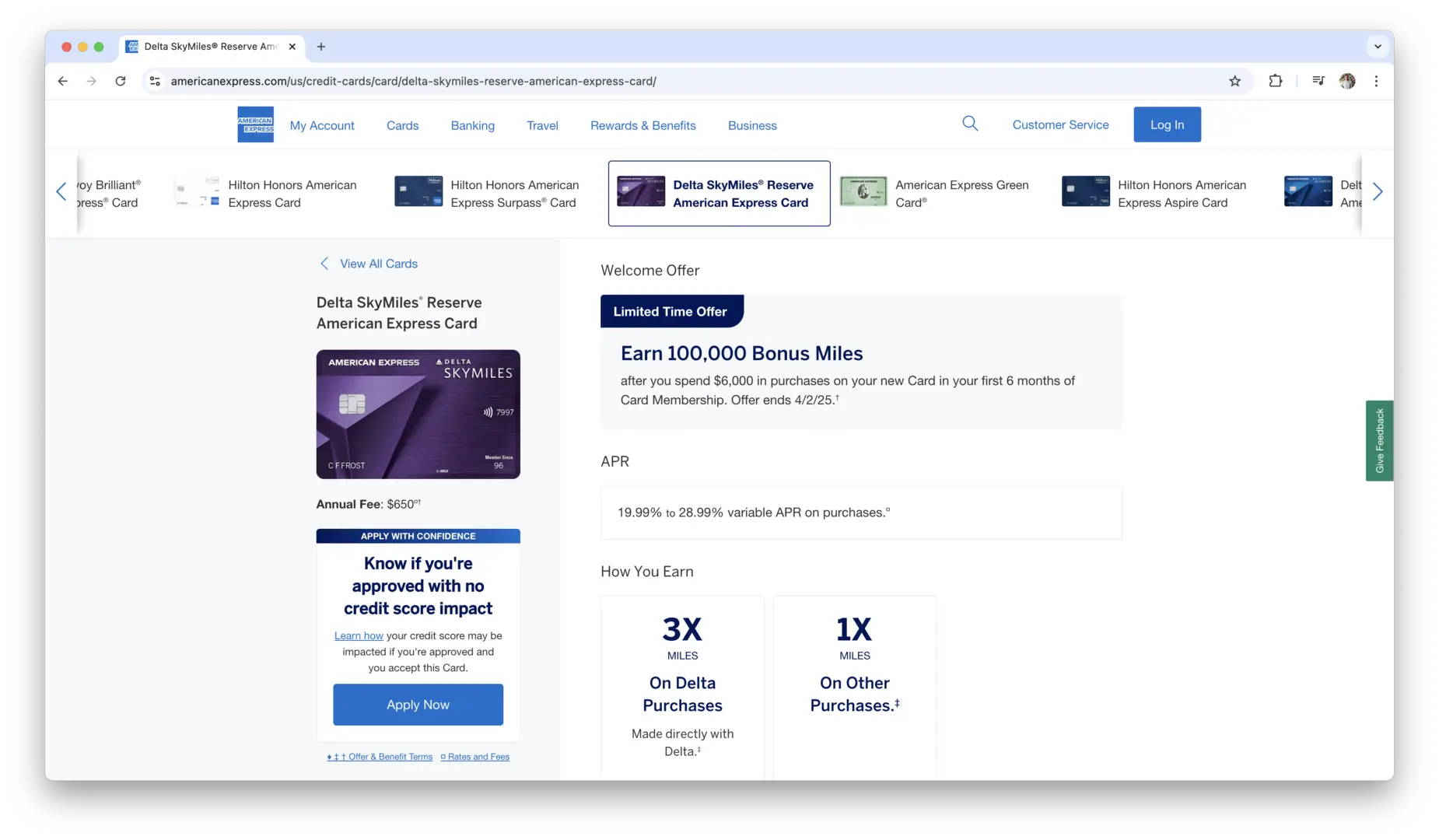

Delta SkyMiles Reserve American Express Card

For Delta Airlines enthusiasts, the Delta SkyMiles Reserve American Express Card is the ultimate co-branded travel credit card. This card earns 3x miles on Delta purchases, 1.5x miles on every eligible purchase after you reach $150,000 in purchases, and 1 mile on all other purchases. The card comes with a number of Delta-specific perks, including access to Delta Sky Club lounges, priority boarding, and an annual companion certificate for discounted travel. Additionally, cardholders enjoy the ability to earn Medallion Qualification Miles (MQMs), which help you achieve higher Delta Medallion status. The card also offers valuable travel protections like trip delay insurance and car rental insurance.

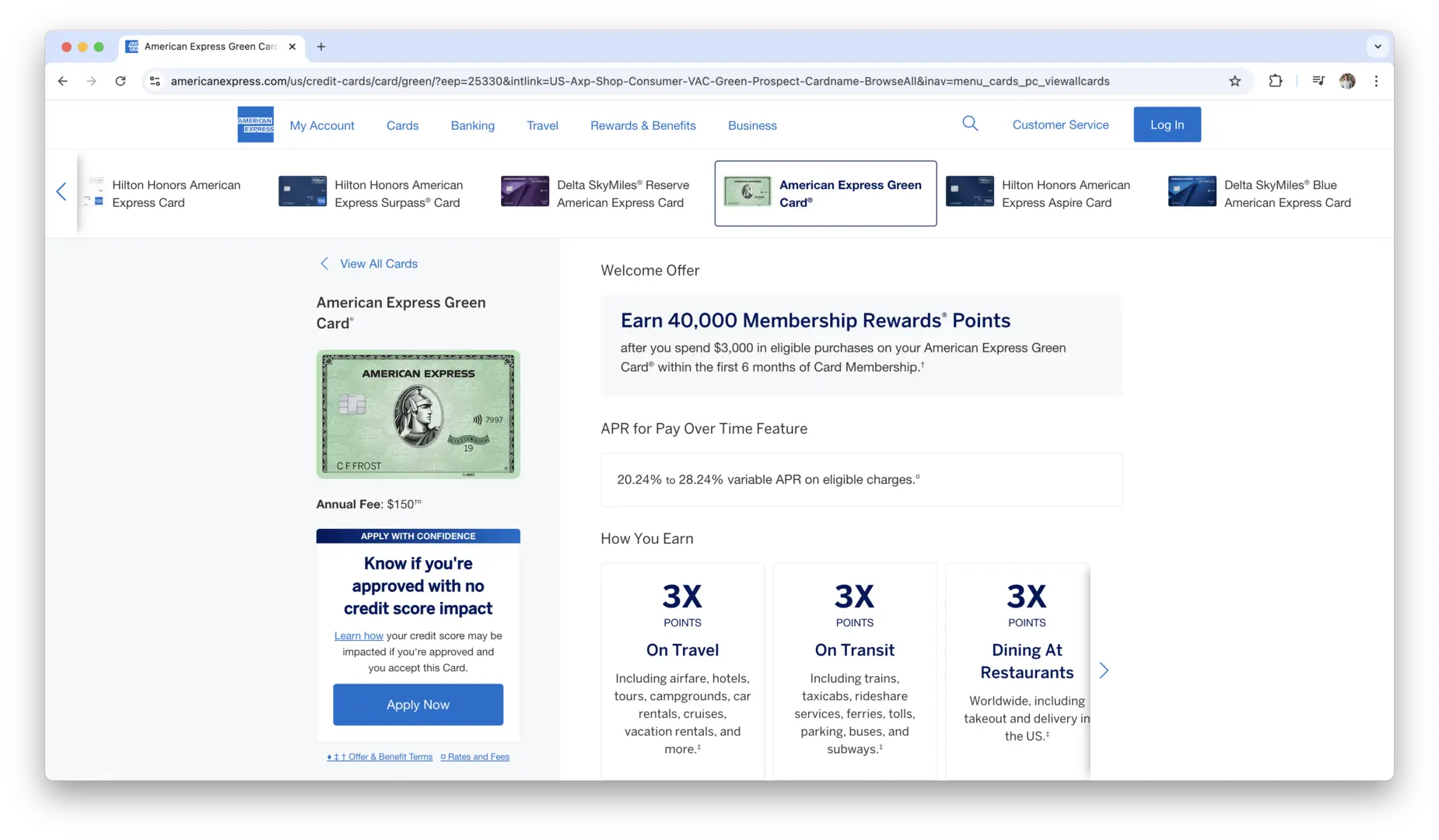

American Express Green Card

For travelers who prefer flexibility, the American Express Green Card offers valuable rewards across a range of categories, including 3x points on travel, dining, and transit purchases. This card stands out for its low annual fee and the ability to earn significant rewards on everyday purchases. It also comes with a number of travel benefits, such as a $100 CLEAR membership credit for expedited airport security, as well as trip delay and baggage insurance. Though it doesn’t come with the luxury perks of higher-tier cards, the Green Card is a great option for those who want to earn rewards while keeping costs low.

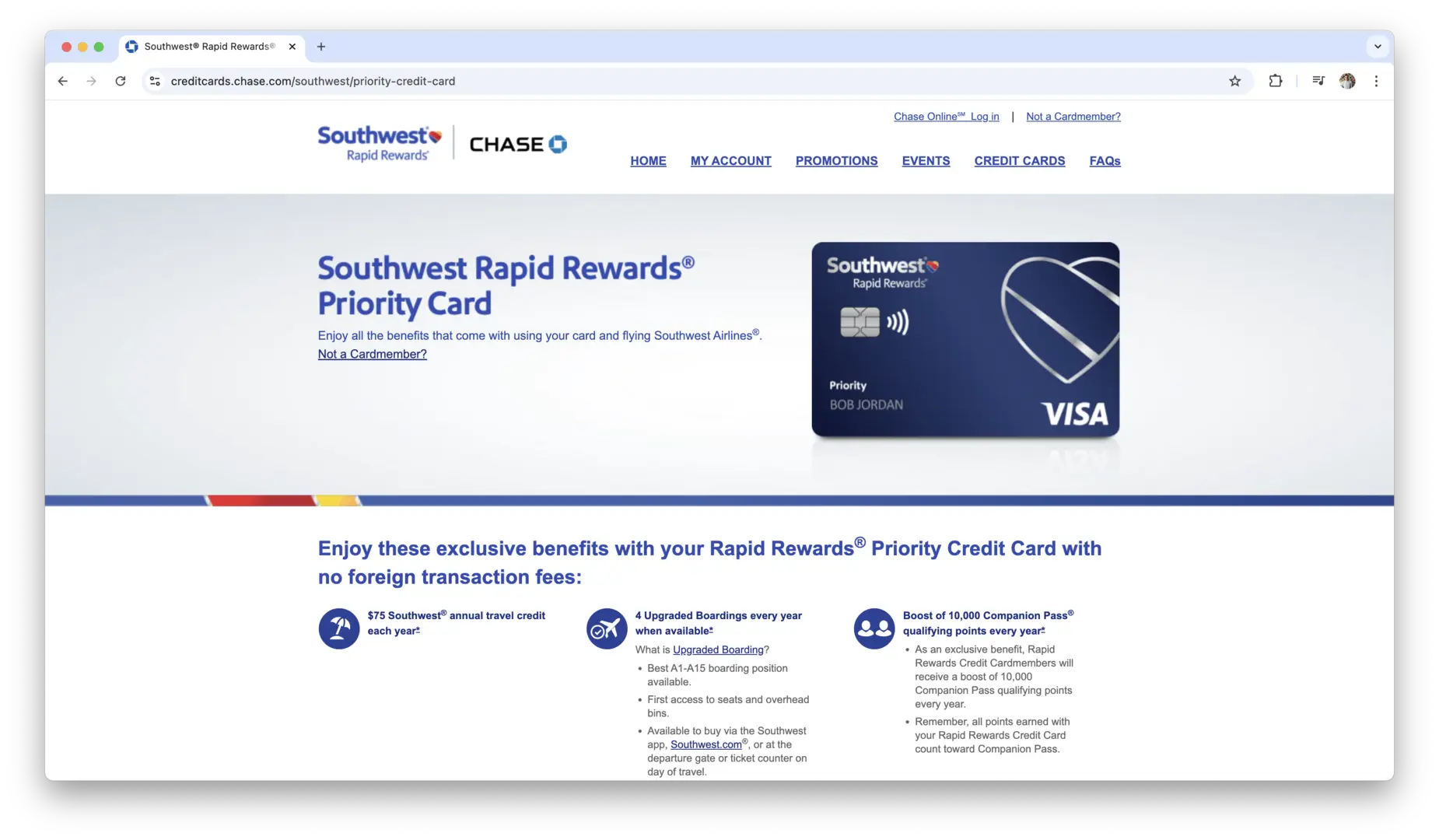

Southwest Rapid Rewards Priority Credit Card

For those who love flying with Southwest Airlines, the Southwest Rapid Rewards Priority Credit Card is a top pick. This card offers 2x points on Southwest purchases and 1 point on all other purchases, with the added benefit of earning 40,000 points after meeting the minimum spending requirement. The card also includes an annual $75 Southwest travel credit, 7,500 anniversary points, and priority boarding benefits. With no blackout dates on flights and an easy-to-use rewards system, the card is perfect for those who frequently fly Southwest and want to earn points for free flights.

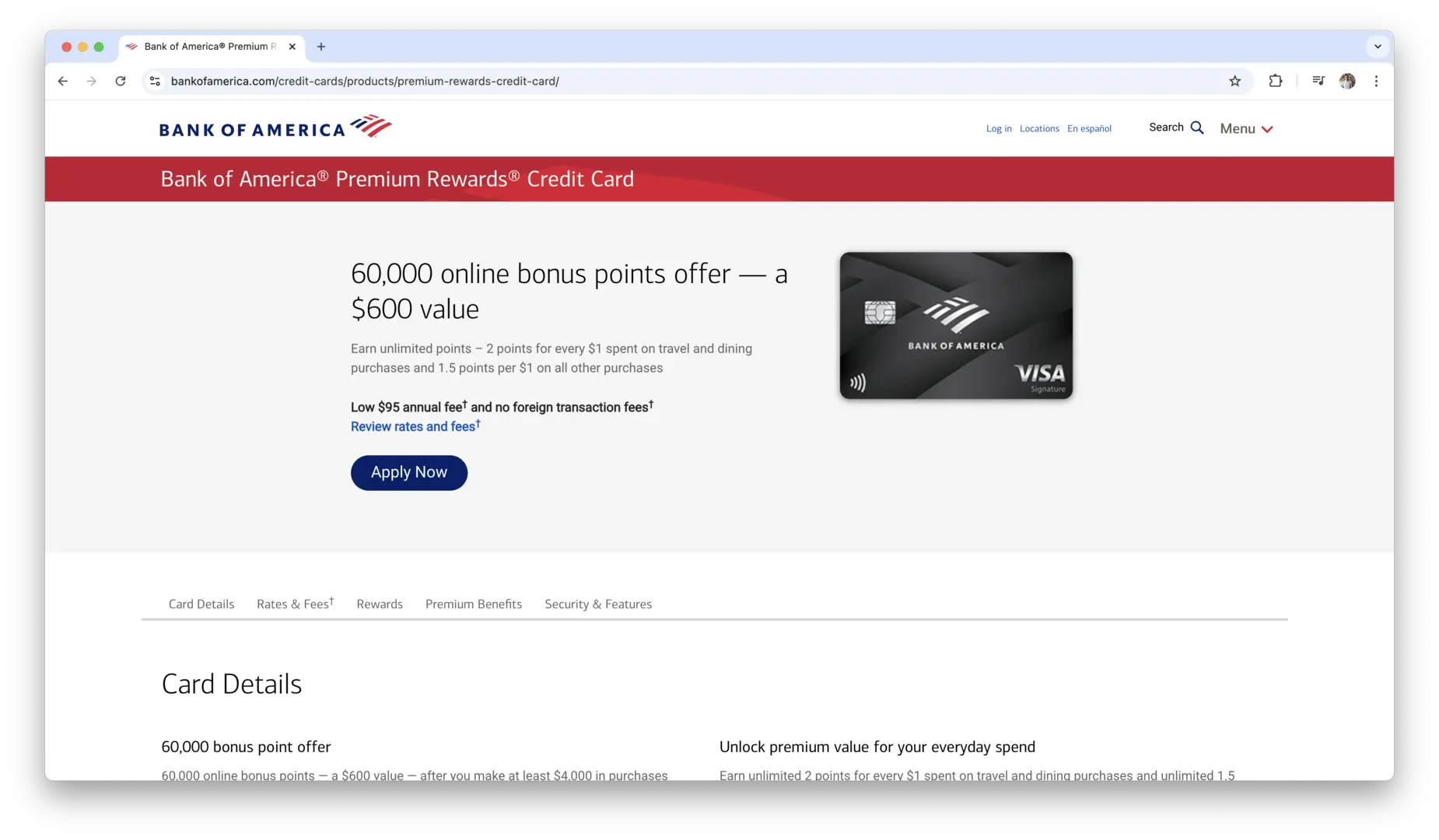

Bank of America Premium Rewards Credit Card

The Bank of America Premium Rewards Credit Card offers 2x points on travel and dining purchases and 1.5x points on all other purchases. The card includes a $100 annual airline incidental credit and up to $100 in TSA PreCheck or Global Entry application fee reimbursement. Cardholders also benefit from no foreign transaction fees and a 50,000-point bonus after meeting the spending requirement, which can be redeemed for $500 in travel statement credits. This card is ideal for individuals who want a well-rounded rewards program with straightforward benefits and no annual fees for foreign transactions.

Each of these cards stands out in its own way, catering to different types of travelers based on their preferences for rewards, perks, and overall travel experience. Whether you’re looking for premium luxury benefits or a straightforward, no-annual-fee card, there’s a travel credit card for everyone.

Travel Credit Cards Features to Look For

When selecting a travel credit card, it’s important to consider several key features that will influence how much value you’ll get out of your card. The right card can offer excellent rewards, perks, and protection, while helping you maximize your travel experiences.

Rewards Structure: Points, Miles, Cashback

The way a credit card rewards your spending is one of the most crucial factors to look at. Travel cards typically reward you with points, miles, or cashback for every dollar you spend. Points and miles are often tied to specific travel brands or alliances, making them ideal for frequent flyers who want to rack up miles with a particular airline or booking platform. Cashback, while less specific to travel, can still be used for travel expenses or redeemed in a variety of ways.

Understanding the rewards structure is essential for ensuring you’re maximizing your earning potential. Some cards offer higher rewards in specific categories, such as dining, gas, or travel bookings, so it’s worth aligning your card choice with your spending habits.

Annual Fees vs. Rewards and Benefits

Many travel credit cards charge annual fees, but the best cards offer a high return on investment through their rewards and benefits. While a card with a $100+ annual fee might seem expensive, it can be worth it if the benefits you receive—such as travel insurance, bonus points, or free hotel stays—exceed that cost. However, cards with no annual fees can still provide substantial rewards, though they often offer fewer perks.

It’s essential to weigh the annual fee against the rewards you’ll earn and the benefits you’ll receive. If a card has a higher fee but offers valuable perks like airport lounge access or priority boarding, the cost may be justified, particularly if you travel frequently.

Signup Bonuses and Introductory Offers

Signup bonuses are a common feature in travel credit cards, and they can be a great way to get a head start on your rewards. These bonuses typically require you to meet a spending threshold within the first few months of having the card, such as $3,000 or $5,000. If you can meet this threshold, you might receive a hefty bonus in points, miles, or cashback.

In addition to traditional signup bonuses, some cards offer special introductory offers like 0% APR on purchases or balance transfers for the first year. This can be a great way to save money if you plan on making large purchases or transferring a balance from a high-interest card.

Travel-Specific Perks

One of the most attractive aspects of travel credit cards are the travel-specific perks they offer. These can include airport lounge access, which provides a comfortable space to relax before your flight, complete with free snacks and beverages. Some cards also offer free checked bags, saving you money on airline fees, as well as priority boarding, which allows you to get on the plane earlier and secure space in the overhead bins.

Cards may also offer discounts on hotel bookings, access to exclusive events, or even concierge services to help you make the most of your trips. When considering these perks, think about the travel experiences you value most. If you travel frequently, these benefits can add significant value to your overall travel experience.

Global Acceptance and No Foreign Transaction Fees

Global acceptance is another critical factor to consider when selecting a travel credit card. Make sure your card is widely accepted internationally, especially if you’re traveling to countries where certain card networks may not be as common. The last thing you want is to arrive in a foreign country only to find that your credit card isn’t accepted at local businesses or services.

Another important feature to look for is the absence of foreign transaction fees. These fees are typically 2% to 3% of the transaction amount and can add up quickly when traveling abroad. Many travel credit cards waive these fees, making them an excellent choice for international travel. This benefit allows you to use your card freely in different currencies without worrying about additional costs.

How to Choose the Best Travel Credit Card for Your Lifestyle?

Selecting the right travel credit card goes beyond just comparing the rewards and fees. It’s important to match the features of the card with your lifestyle and travel habits. Whether you fly frequently or travel occasionally, the right card can make a significant difference in how much value you get from your spending.

For Frequent Flyers vs. Occasional Travelers

Frequent flyers will benefit most from credit cards that offer high rewards for airline-related purchases and loyalty perks like priority boarding, free checked bags, and access to airport lounges. Cards co-branded with airlines often offer the best value for frequent travelers, providing miles that can be used for flights, upgrades, and other travel benefits within the airline’s network. If you’re a frequent flyer, look for cards that give bonus points on flights, as well as additional perks that cater to your flying routine, such as lounge access or special status within airline programs.

Occasional travelers, on the other hand, might prefer a more versatile card that offers general travel rewards rather than focusing on one specific airline or hotel chain. These cards may offer fewer perks like free checked bags, but they allow for greater flexibility with rewards redemption, often through travel portals or point transfers to multiple travel partners. For those who don’t travel as often but still want to earn travel rewards, choosing a card with a more adaptable rewards structure will be beneficial.

Cards with Bonus Categories for Everyday Spending

If you want to maximize the rewards you earn from your everyday spending, look for a travel credit card that offers bonus categories. These cards reward you with higher points or miles for spending in specific categories like dining, groceries, gas, or even entertainment. For example, a card might offer 3x points on dining and 2x points on travel-related purchases, allowing you to earn rewards not just on your trips but also for day-to-day expenses.

When evaluating these bonus categories, think about where you spend the most. If dining out is a significant part of your spending, look for cards that offer enhanced rewards in that area. Similarly, if you drive frequently, a card that gives bonus points on gas purchases might be valuable. These bonus categories can help you build up rewards faster, even when you’re not traveling, and can significantly improve your overall rewards rate.

Evaluating Redemption Flexibility

Redemption flexibility is another key factor to consider when choosing a travel credit card. Some cards allow you to redeem points or miles directly through the card issuer’s travel portal, where you can book flights, hotels, car rentals, and other travel services. This can be a great option for those who like the convenience of booking everything in one place and potentially earning extra rewards for using the portal. However, be aware that travel portals sometimes have higher rates for flights or hotels compared to booking directly with airlines or hotels.

If you prefer more control over how you use your rewards, look for cards that offer point transfers to a variety of travel partners, such as airlines and hotel chains. Many travel cards allow you to transfer your points or miles to frequent flyer programs, which can provide better value and more flexibility in terms of redemption options. For example, transferring points to an airline’s frequent flyer program might allow you to book flights at a better value or earn upgrades, whereas using the points within the travel portal might limit your options.

Having multiple redemption options, including flexible point transfers and access to travel portals, will allow you to choose the best method for your specific travel needs, making your points go further.

How to Maximize Travel Rewards?

To make the most of your travel credit card, it’s essential to optimize how you earn and redeem rewards. Here are some strategies that can help you maximize your travel rewards:

- Leverage bonus categories by using your card for purchases that offer higher rewards, like dining, groceries, or travel bookings.

- Take advantage of signup bonuses by meeting the required spending thresholds to earn large point or mile bonuses quickly.

- Use your card for everyday purchases to build up points or miles faster, especially for recurring expenses like utilities or subscriptions.

- Be strategic with point transfers to travel partners to get better value for your rewards, particularly when transferring to frequent flyer programs.

- Track bonus spending limits to ensure you’re earning the maximum number of points in categories that offer higher rewards.

- Combine multiple cards to maximize the benefits of various rewards categories and earn points at an accelerated rate across different spending areas.

- Pay off your balance in full each month to avoid interest charges, which could negate the value of your rewards.

Travel Insurance and Protection Benefits

Many travel credit cards come with built-in travel insurance and protection benefits that can save you money and provide peace of mind during your trips. These benefits can include:

- Trip cancellation and interruption coverage, which reimburses you for non-refundable costs if your trip is canceled or cut short due to unforeseen circumstances.

- Lost luggage reimbursement, which covers the cost of replacing lost or damaged luggage during your travels.

- Travel accident insurance, providing compensation if you suffer an accident while traveling.

- Rental car insurance, often covering damage or theft when renting a car with your travel credit card.

- Baggage delay reimbursement, which provides compensation for purchases made while your baggage is delayed for an extended period.

- Emergency medical and dental insurance, offering coverage in case you need medical attention while traveling outside your home country.

- Trip delay insurance, which reimburses you for additional expenses like meals and lodging if your flight is delayed by a certain number of hours.

Mistakes to Avoid with Travel Credit Cards

While travel credit cards offer numerous benefits, there are also common pitfalls that can hinder your ability to maximize their value. Here are some mistakes to avoid:

- Not paying your balance in full each month, leading to interest charges that outweigh the rewards earned.

- Overlooking annual fees, especially if the perks don’t outweigh the cost of the fee.

- Failing to track spending in bonus categories, causing you to miss out on higher rewards for certain purchases.

- Not using your points or miles before they expire or become subject to devaluation.

- Using your travel card for non-travel-related purchases that don’t earn bonus rewards or points.

- Ignoring foreign transaction fees, which can add up when traveling abroad with a card that charges these fees.

- Applying for a card without considering your specific travel needs, like loyalty programs or travel insurance benefits that may be essential for your trips.

Conclusion

Choosing the right travel credit card can make a big difference in how you earn rewards and enjoy benefits on your trips. Whether you’re focused on earning points for flights, getting access to exclusive perks like airport lounges, or enjoying added protections like trip insurance, there’s a card out there that suits your needs. By understanding what each card offers, such as bonus categories, travel rewards, and flexibility in redemption, you can find the one that fits your spending habits and travel style. Take the time to evaluate factors like annual fees, rewards rates, and additional benefits to ensure you’re getting the best value from your card.

Remember, the best travel credit card for you is the one that aligns with your lifestyle and travel preferences. It’s not just about earning rewards but also about making your travel experience smoother and more rewarding. Whether you’re looking for a simple, no-annual-fee card or a premium card with luxury benefits, the right card can help you maximize your rewards and minimize travel costs. With so many options available, it’s worth considering what you value most—whether that’s flexible point redemption, exclusive travel perks, or comprehensive travel insurance—and selecting the card that helps you get the most out of every dollar you spend.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.