Are you looking for an easy way to invest in the stock market? Stock apps have made investing more accessible than ever, allowing you to buy, sell, and track stocks right from your phone. Whether you’re new to investing or have been trading for years, these apps offer a range of tools to help you manage your portfolio, stay updated on market trends, and make smarter financial decisions.

With so many options out there, it can be tough to choose the right one for your needs. This guide will break down the best stock apps available today, from those perfect for beginners to those built for active traders, so you can find the app that works best for you.

What are Stock Apps?

Stock apps are mobile platforms that allow users to buy, sell, and track stocks and other financial assets directly from their smartphones or tablets. These apps have revolutionized how individuals approach investing by offering greater accessibility, flexibility, and convenience. Whether you’re a beginner or an experienced trader, stock apps provide the tools needed to manage investments, conduct research, and stay updated on market movements—all from the palm of your hand.

The Importance of Stock Apps in Modern Investing

- Accessibility: Stock apps make investing accessible to anyone with a smartphone and an internet connection, eliminating the need for a traditional brokerage account or a physical office visit.

- Convenience: You can manage your investments on the go, anytime, anywhere, allowing for quick responses to market fluctuations.

- Real-time data: With the ability to track stock prices, news, and market trends in real time, stock apps ensure that you have the latest information at your fingertips.

- Low barriers to entry: Many stock apps offer commission-free trading or fractional shares, making it easier for new investors to enter the market with minimal capital.

- Cost savings: By providing commission-free trades and low-cost options, stock apps reduce fees typically associated with traditional brokerages, saving you money in the long run.

- Educational tools: Many stock apps offer tutorials, investment guides, and demo accounts, helping investors learn and improve their strategies while managing their portfolios.

The Growing Trend of Mobile Trading and Investment

The rise of smartphones has dramatically altered the way people invest. Over the last decade, there’s been an increasing shift toward mobile trading, with more people choosing to manage their investments from their phones instead of through traditional desktop platforms. This mobile-first approach is not only changing who can participate in the stock market, but also how investing is perceived in society.

For many, mobile trading offers unparalleled convenience. People can track the performance of their portfolios, research new stocks, or place trades while commuting, at lunch, or even from the comfort of their homes. The ease of access and constant connectivity allows for quicker decision-making and more frequent interaction with the market, even for investors who only have limited time each day.

Additionally, mobile trading apps have led to the rise of “democratized” investing, where individuals with no prior investment experience can jump into the stock market without needing a financial advisor. This shift has played a role in increasing the number of retail investors—people who trade on their own behalf instead of through professional brokers—especially in the wake of the COVID-19 pandemic, when many people turned to the stock market as a way to secure their financial future.

As mobile trading continues to grow, we’re likely to see more sophisticated tools and features added to stock apps. These might include AI-driven investment advice, personalized trading strategies, or advanced risk management tools, further pushing the evolution of investing into a mobile-first world.

Best Stock Apps for Beginners

Starting your investing journey can feel daunting, but the right app can make all the difference. Stock apps designed for beginners focus on simplicity, education, and low barriers to entry. They offer user-friendly interfaces, educational resources, and low-cost or commission-free trading options, which are ideal for those just getting started with investing.

Robinhood

Robinhood is one of the most popular stock apps for beginners, thanks to its intuitive interface and commission-free trading. The app makes it easy to buy and sell stocks, ETFs, options, and even cryptocurrencies. Its simplicity appeals to beginners who want to dive into the world of investing without being overwhelmed by complex tools.

The app’s streamlined design allows you to view your portfolio, check stock prices, and execute trades with just a few taps. For new investors, Robinhood also offers educational resources, including articles and videos, to help you understand the basics of investing and the stock market.

Webull

Webull is another excellent choice for beginners who want to start investing without paying high fees. Like Robinhood, Webull offers commission-free trading on stocks, ETFs, and options. What sets Webull apart is its slightly more advanced charting tools, which still remain beginner-friendly. These tools help you learn how to read stock trends and spot potential investment opportunities, even as you’re just getting started.

In addition to its trading features, Webull provides educational resources and a virtual trading feature. This allows beginners to practice trading without using real money, so you can get comfortable with the platform before risking your funds.

SoFi Invest

SoFi Invest is a great option for beginners who want to manage their investments as part of a broader financial plan. The app offers commission-free trading on stocks, ETFs, and cryptocurrency, and provides the ability to invest in automated portfolios if you’d rather leave the decision-making to an algorithm. The automated option is especially useful for those who are new to investing and don’t have the time or interest to manage their portfolio actively.

SoFi also provides access to financial advisors for an extra layer of support, which can be extremely helpful when you’re just starting out. The app’s easy-to-navigate interface and educational resources make it an excellent choice for new investors looking to take their first steps in the market.

Acorns

Acorns is an investment app that’s perfect for beginners who want to start investing without making major decisions or risking too much. The app automates investments by rounding up your purchases to the nearest dollar and investing the spare change in a diversified portfolio. This “micro-investing” method makes it easy for beginners to gradually build wealth without worrying about actively managing their investments.

Acorns also provides educational content to help you understand how investing works, along with features like automatic rebalancing to ensure your portfolio stays in line with your goals. For beginners who are intimidated by the idea of picking stocks or choosing investments, Acorns removes the complexity by offering a simple, hands-off approach.

Stash

Stash is designed for beginners who want to get started with investing without committing a large amount of capital upfront. The app allows you to start investing with as little as $5, making it accessible to anyone. Stash offers fractional shares, so you can invest in high-priced stocks like Amazon or Google without needing to buy a full share.

The app also provides educational resources to help you learn about personal finance, investing basics, and strategies for building wealth. It’s ideal for beginners who want to start small and gradually increase their investments over time while learning the ropes.

Best Stock Apps for Active Traders

For active traders, having access to real-time data, advanced tools, and low-cost trading options is essential. Stock apps designed for active traders offer more features, including fast execution speeds, charting capabilities, and customizable alerts to help you make quick decisions. These apps cater to those who trade frequently and need more than just basic features.

E*TRADE

E*TRADE is a strong contender for active traders due to its well-designed mobile app, real-time data, and powerful research tools. The app offers commission-free trading for stocks and ETFs, along with a wide range of investment options, including options and mutual funds.

ETRADE’s mobile platform provides access to in-depth charting, real-time market data, and customizable alerts. Traders can set price alerts, monitor their portfolio, and execute trades quickly. With its robust analysis tools, including streaming quotes and advanced charting, ETRADE is great for those who need to stay on top of market movements at all times.

Charles Schwab

Charles Schwab’s mobile app is known for being intuitive, powerful, and suitable for active traders who need real-time data, fast execution, and advanced research tools. Schwab provides commission-free trading on stocks and ETFs and offers access to futures and options trading for more experienced traders.

Schwab’s mobile app features advanced charting, risk analysis tools, and real-time market updates. With powerful screeners and filtering options, you can quickly narrow down your choices based on technical criteria, helping you make better-informed decisions in a fast-moving market.

Interactive Brokers

Interactive Brokers is a highly regarded trading app for active traders who need low fees and a wide range of investment options. The app offers access to stocks, options, futures, forex, and even cryptocurrency, allowing traders to diversify their portfolios and take advantage of different markets.

Interactive Brokers is known for offering some of the lowest commission fees, making it a popular choice among active traders who execute many trades. The app’s trading platform is robust, providing detailed charts, advanced analytics, and tools for algorithmic trading. For those who need a high level of flexibility and speed in their trades, Interactive Brokers offers unparalleled access to global markets and real-time data.

TradeStation

TradeStation is another powerful app tailored for active traders. It offers a wide range of tools, including advanced charting, real-time market data, and customizable indicators. Whether you trade stocks, options, or futures, TradeStation gives you the tools you need to analyze the market and execute trades quickly.

What sets TradeStation apart is its ability to automate trading strategies. You can program your own algorithms or use pre-built strategies, making it a great choice for traders who want to take advantage of high-frequency trading or automate their trading process for greater efficiency.

Each of these apps provides the powerful tools and real-time data necessary for active traders to stay ahead of market trends. Whether you prefer technical analysis, options trading, or a more hands-off approach with automated trading, these platforms offer everything you need to trade effectively and efficiently.

Best Stock Apps for Long-Term Investors

Long-term investing is a strategy where patience is key. Whether you’re looking to build wealth over time, save for retirement, or achieve long-term financial goals, the best stock apps for long-term investors are designed to help you grow your portfolio steadily. These apps focus on providing tools that emphasize passive investing, tax efficiency, low-cost options, and portfolio management features.

Fidelity Investments

Fidelity is a top choice for long-term investors due to its comprehensive set of tools that cater to a variety of investing styles. The app offers commission-free trades on stocks, ETFs, and mutual funds, making it an excellent option for those who want to keep costs low while investing for the long haul. Fidelity also offers a wide range of index funds, including those with low expense ratios that are perfect for passive investors.

For long-term investors, Fidelity provides detailed retirement planning tools, such as retirement calculators and educational content on IRAs, 401(k)s, and other retirement accounts. The app also helps you track your progress toward your financial goals, making it easier to stay on course and make adjustments as needed.

Vanguard

Vanguard is one of the most trusted names in long-term investing, known for its low-cost index funds and ETFs that are ideal for investors who want to take a buy-and-hold approach. The Vanguard app allows you to buy and sell stocks, bonds, mutual funds, and ETFs, with access to a wide array of tax-efficient investing tools.

The app is great for long-term investors because it offers automated portfolio management through Vanguard’s Personal Advisor Services, which creates a diversified portfolio tailored to your goals. Vanguard also provides access to retirement accounts like IRAs, making it a go-to platform for those focused on building wealth over time for retirement.

Betterment

Betterment is a robo-advisor designed for long-term investors who prefer a hands-off approach to managing their portfolio. The app uses automated investing algorithms to manage your portfolio based on your risk tolerance, financial goals, and time horizon. Betterment is perfect for those who want to focus on long-term growth without actively managing individual investments.

The app automatically rebalances your portfolio as market conditions change, ensuring that it stays aligned with your goals. Additionally, Betterment offers tax-loss harvesting, which helps to reduce your taxable gains by offsetting them with losses. This is particularly beneficial for long-term investors looking to optimize their tax efficiency.

M1 Finance

M1 Finance is an excellent choice for long-term investors who want more control over their portfolio while still benefiting from automation. The app allows you to build a custom portfolio by selecting individual stocks, ETFs, or pre-built expert portfolios called “pies.” Once your portfolio is set, M1 Finance automatically rebalances your investments and reinvests dividends to keep your portfolio in line with your goals.

M1 Finance stands out with its “pie” structure, which makes it easy to diversify your portfolio based on your risk tolerance and time horizon. It’s an ideal platform for hands-off long-term investors who want to ensure their investments are working toward their future wealth-building goals.

Best Stock Apps for Social Trading and Investing Communities

Social trading has become increasingly popular as more investors look to connect with like-minded individuals and share strategies. These apps offer the opportunity to learn from others, copy successful trades, and participate in a vibrant trading community. If you’re looking for an app that enables you to engage with other traders, consider these top options.

eToro

eToro is one of the leading platforms for social trading, allowing users to trade stocks, cryptocurrencies, commodities, and more. What sets eToro apart is its “CopyTrading” feature, which allows you to copy the trades of top investors. By following and mimicking the strategies of experienced traders, you can benefit from their insights without having to spend time analyzing the markets yourself.

In addition to CopyTrading, eToro offers social features like community discussions, blogs, and educational content. These tools allow you to learn from others, share your strategies, and engage in discussions on various market topics. Whether you’re a beginner or an experienced trader, eToro’s social aspects make it easy to stay connected with a global investing community.

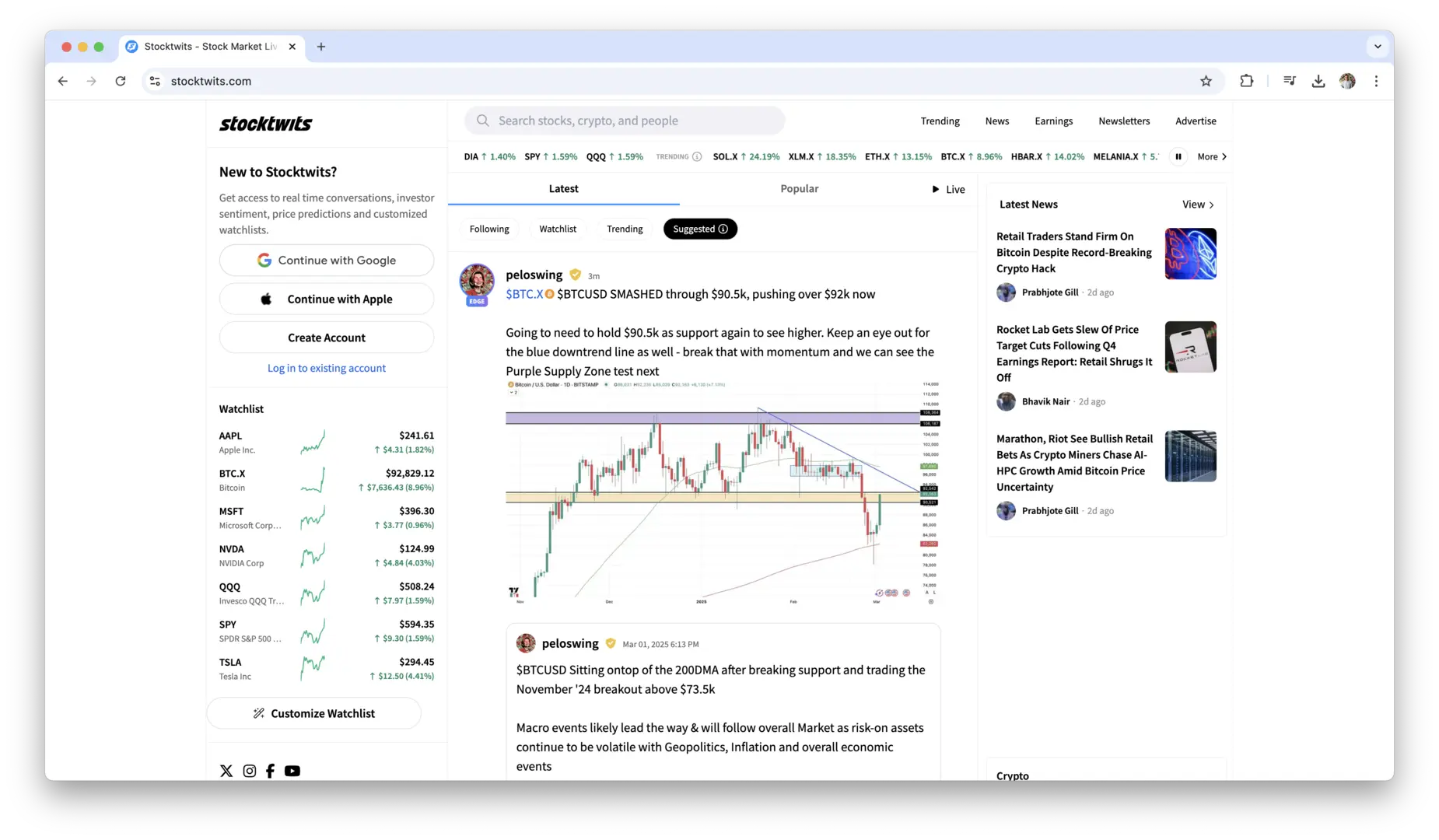

StockTwits

StockTwits is a social media platform specifically designed for investors and traders. While it’s not a trading app itself, it offers real-time sentiment analysis and discussions on individual stocks and market trends. Investors can share their thoughts, ideas, and strategies on specific stocks, creating an active community of traders sharing insights.

StockTwits is especially useful for active traders who want to stay informed about market sentiment and trends. The app also includes trending stocks and hashtags, making it easier to discover new investment opportunities. By participating in the conversations and learning from others, you can gain valuable insights into the market.

ZuluTrade

ZuluTrade is a social trading platform that connects traders with investors looking to copy their strategies. The app allows you to follow and copy the trades of professional traders who have proven success in the markets. ZuluTrade also offers risk management tools, so you can set your preferred risk level when copying other traders’ strategies.

One of the standout features of ZuluTrade is its ability to filter traders based on their performance, strategy, and risk profile. This makes it easier to choose a trader whose style matches your goals, whether you’re focused on short-term gains or long-term wealth-building.

Best Stock Apps for International Trading

If you’re an investor looking to trade stocks from around the world or diversify into international markets, you’ll need an app that gives you access to global markets. These apps provide the ability to invest in foreign stocks, manage currency risk, and navigate the complexities of international trading.

DEGIRO

DEGIRO is a European-based stock app that has expanded to offer international trading opportunities for investors worldwide. DEGIRO allows you to access more than 50 global markets, including exchanges in Europe, the U.S., and Asia. The app is known for its low fees, making it an attractive option for international traders who want to minimize costs.

DEGIRO’s platform is simple and offers essential tools for trading stocks, ETFs, and bonds across a range of global markets. While it doesn’t have as many advanced features as some other platforms, it’s an excellent choice for those who want an affordable, no-frills way to access international markets.

Saxo Bank

Saxo Bank is a Danish investment bank that offers a trading app for international investors who want access to a wide range of global markets. The platform provides access to over 35,000 stocks and bonds, including markets in the U.S., Europe, Asia, and Latin America. Saxo Bank is particularly useful for investors interested in international stocks, futures, and forex trading.

Saxo Bank also provides extensive research and analysis tools, which can help you evaluate global markets and make informed decisions. The app is ideal for active international traders who want a high level of flexibility and access to diverse global markets.

Stock App Features to Look For

When choosing a stock app, it’s essential to consider the features that will make your experience as seamless and efficient as possible. The right app can help you manage your portfolio, make informed trading decisions, and ensure the security of your funds. Here’s what you should keep in mind as you explore your options.

User-friendly Interface and Ease of Use

A stock app’s interface should be intuitive, making it easy to navigate even if you’re new to investing. Look for an app that offers simple navigation and clear options for buying, selling, and tracking stocks. The design should be clean and clutter-free, so you don’t have to waste time trying to figure out where everything is located. The more straightforward the app, the better your experience will be, especially when you need to make quick decisions in a fast-moving market.

Many apps now include tutorials or guidance features to help new users understand how to navigate the platform. It’s also helpful if the app lets you customize your dashboard to display the information that matters most to you. Whether it’s stock prices, charts, or recent news, having everything in one easy-to-reach place can save you time and reduce decision fatigue.

Real-time Market Data and Updates

Having access to real-time market data is essential for making informed trading decisions. Stock prices can change rapidly, and the best apps provide you with up-to-the-minute updates so you can react quickly. Beyond just the price, real-time market data should include detailed information like volume, volatility, and other indicators that can guide your decisions.

For example, if you’re trading a highly volatile stock, you want to know immediately when the price starts moving in an unexpected direction. Many apps allow you to set custom alerts based on your preferred price points or market conditions, so you’re notified when specific criteria are met. This functionality is crucial for active traders who need to act fast to capitalize on market movements.

Security and Privacy Features

Investing your money online requires robust security features to ensure that your personal and financial information stays safe. When choosing a stock app, you should always prioritize platforms with strong security measures. Look for features like two-factor authentication (2FA), which adds an extra layer of protection by requiring a second form of verification (such as a code sent to your phone) when you log in.

Additionally, consider whether the app is insured by a government-backed organization like the Securities Investor Protection Corporation (SIPC). This ensures that your assets are protected in the unlikely event that the brokerage firm faces financial difficulties. You should also review the app’s privacy policy to ensure that your data isn’t being sold or shared without your consent. A trustworthy app will use end-to-end encryption to protect your sensitive information from hackers.

Integration with Financial Accounts and Tools

For a smooth trading experience, it’s essential that your stock app integrates seamlessly with your other financial accounts. The ability to connect your bank account, credit cards, or even other investment platforms to the app allows for easy deposits and withdrawals. This integration simplifies the process and saves you time, ensuring that you can focus more on investing rather than dealing with administrative tasks.

Some apps also allow you to link other financial tools like tax planners, portfolio trackers, or budget apps, helping you stay organized and informed about your overall financial health. This interconnectedness makes it easier to track your investments, manage your spending, and optimize your portfolio.

Research and Analysis Capabilities

Good research tools are vital for successful stock trading. The best stock apps provide access to a variety of research features, including real-time market news, in-depth stock analyses, and technical charting. These tools allow you to conduct thorough research, helping you identify the best investment opportunities based on your goals and risk tolerance.

Many apps feature stock screeners that allow you to filter stocks based on specific criteria such as market cap, P/E ratio, or dividend yield. This makes it easier to narrow down your choices and find investments that align with your strategy. Additionally, access to expert analysis and reports can provide valuable insights into market trends, earnings reports, and broader economic conditions. Apps that provide this type of research can empower you to make smarter, more informed decisions.

Customer Support and Educational Resources

Whether you’re new to investing or a seasoned trader, having access to helpful customer support and educational resources is invaluable. A responsive customer service team can guide you through any issues you encounter with the app, from technical problems to trading inquiries. Many stock apps offer chatbots, email support, or even phone assistance, so you can get help whenever you need it.

For beginners, educational resources are especially important. Some stock apps provide extensive learning libraries with articles, videos, and tutorials that cover the basics of stock trading. These can help you understand key concepts like market orders, technical analysis, or portfolio diversification. Even if you’re experienced, ongoing access to webinars or expert-led discussions can help you stay up to date with the latest market trends and best practices.

By choosing an app with strong customer support and educational tools, you ensure that you have the help you need to maximize your investment potential. Whether you need a refresher on a trading strategy or immediate assistance with a technical issue, these resources will enhance your overall experience.

How to Choose the Best Stock App for Your Needs?

Selecting the right stock app can be overwhelming, especially with so many options available. The ideal app for you will depend on your investment goals, your experience level, and how much you’re willing to pay for tools and services. Here’s a deeper look at the key factors to consider when choosing a stock app that fits your needs.

1. Assess Personal Investment Goals and Experience Level

Your personal investment goals and experience level should be the foundation of your decision-making process. Before you choose an app, take a moment to reflect on your financial goals. Are you looking to build long-term wealth through passive investing, or are you aiming to make quick trades and capitalize on short-term market movements? Different apps cater to different types of investors, so it’s crucial to align your app choice with your investing approach.

If you’re just starting out, you might prefer an app that offers a simple, user-friendly interface, with educational resources to guide you along the way. For beginners, some apps provide virtual trading platforms where you can practice trading without risking real money. This is a great way to get comfortable with the process of buying and selling stocks without the pressure of financial loss.

For more seasoned investors, you’ll likely need more advanced tools, such as technical analysis charts, customizable portfolios, and access to in-depth research reports. Apps that cater to active traders often offer real-time market data, automated trading options, and lower commissions to accommodate frequent trades. Take stock of where you are on your investing journey and choose an app that suits your level of expertise and investment style.

2. Evaluate Fees, Tools, and Security

Fees are a critical consideration when choosing a stock app, especially if you plan to trade regularly. While many stock apps now offer commission-free trading, others charge for certain features, such as accessing premium research tools or using advanced charting. Pay attention to any hidden fees, such as charges for account maintenance, withdrawals, or inactivity. Even small fees can add up over time, so it’s important to assess whether the value you get from the app outweighs the costs.

Beyond fees, the tools and features provided by the app should align with your investing strategy. For example, if you prefer technical analysis, make sure the app offers comprehensive charting tools and indicators. If your goal is long-term wealth accumulation, look for apps that allow you to set up automatic investments, reinvest dividends, or manage tax strategies. The best stock apps offer a variety of tools that can help you track performance, analyze stocks, and make informed decisions.

Equally important is the security of the app. Before you deposit any funds, ensure that the app uses encryption and two-factor authentication (2FA) to protect your personal and financial information. Additionally, check if the app is insured by organizations like the Securities Investor Protection Corporation (SIPC), which safeguards your funds in case of a brokerage firm’s failure. Security should be a top priority to ensure your investments are protected against fraud and cyber threats.

3. Understanding the Importance of Customer Service

When you’re managing your investments, you want to know that help is available if you need it. Customer service is a crucial element to consider, especially if you encounter any technical difficulties or need assistance with trades. Look for stock apps that offer multiple avenues for support, such as phone support, live chat, or email. Many apps now offer chatbots or in-app support, which can resolve basic issues quickly.

However, the quality of customer service matters just as much as availability. Try to find apps that are known for having responsive and helpful customer support. You’ll want a team that can answer your questions promptly and offer guidance if you’re facing challenges. Some apps even offer dedicated support for premium users, ensuring that you have a direct line to knowledgeable advisors.

Customer service should also extend to educational support. Especially for beginners, having access to helpful resources such as tutorials, webinars, or FAQs can make the learning process smoother. Even advanced traders benefit from continuing education in the form of market insights, so choose an app that provides ongoing educational content to keep you informed and improve your investing strategy.

By taking these factors into account—your investment goals, the fees and tools the app offers, the security measures in place, and the quality of customer support—you can choose a stock app that meets your needs and helps you achieve your financial objectives. It’s not just about trading; it’s about finding the platform that aligns with your goals and supports you throughout your investing journey.

Conclusion

Choosing the right stock app comes down to your personal needs and investing goals. Whether you’re looking for a simple, easy-to-use platform to start your investment journey or a more advanced app with powerful tools for active trading, there’s an app out there for you. The best stock apps provide a mix of features, from real-time market data and security to low fees and educational resources, ensuring that you can make informed decisions and manage your investments with ease. Take your time to explore the options, consider what matters most to you, and choose an app that suits your style and goals.

Remember, no matter which stock app you choose, the key to successful investing is staying informed and making decisions based on your financial goals. With the right tools and resources at your fingertips, investing has never been easier or more accessible. Take advantage of the features available on these top stock apps, and make sure you’re continuously learning and adapting your strategy as the market evolves. Investing is all about finding what works best for you, and with the right app, you can feel confident managing your investments.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.