Are you looking for a way to start investing or manage your investments more easily? With the rise of investment apps, it’s never been easier to access the financial markets right from your phone or computer. Whether you’re a complete beginner or someone with experience, investment apps offer a variety of features designed to help you grow your wealth.

From low fees and diverse investment options to real-time tracking and educational resources, these apps provide everything you need to take control of your financial future. In this guide, we’ll walk you through some of the best investment apps out there, helping you find the one that’s right for your needs and goals.

What is an Investment App?

An investment app is a mobile or web-based platform that allows individuals to buy, sell, and manage investments like stocks, bonds, ETFs, cryptocurrencies, and more. These apps are designed to provide a convenient and accessible way for people to invest without needing to rely on traditional brokerage firms or financial advisors. Investment apps typically offer features like real-time data, portfolio tracking, educational resources, and low-cost trading options to help investors of all experience levels participate in the financial markets.

The rise of investment apps has democratized investing, enabling individuals to manage their money with the same tools that professional investors use. The ease of use, coupled with low fees and real-time capabilities, has made investment apps an essential tool for modern-day investing. Whether you’re a beginner or an experienced investor, an investment app can simplify the process of building and growing your wealth.

Importance of Investment Apps

- Accessibility: Investment apps allow anyone with a smartphone or computer to invest in financial markets, breaking down barriers to entry and enabling people to grow their wealth regardless of their financial background.

- Lower Costs: These apps often provide commission-free trades and low fees, making investing more affordable for individuals who may not have large amounts of money to invest.

- Time Efficiency: With the ability to trade and monitor your investments in real time from anywhere, investment apps save you time and give you more flexibility in managing your portfolio.

- Educational Support: Many investment apps offer tools and resources to help beginners learn the basics of investing, providing a way for people to get started without a steep learning curve.

- Convenience: Investment apps enable you to manage your finances on the go. Whether you’re checking your portfolio or making trades, everything you need is at your fingertips, making investing more convenient than ever.

- Diversification: Investment apps often provide access to a wide range of asset types, from stocks to bonds to cryptocurrencies, allowing you to diversify your portfolio easily and manage risk.

Why Using an Investment App is a Smart Choice

- Real-Time Tracking: Investment apps provide live data, allowing you to track your investments and respond to market movements instantly. This gives you the flexibility to make informed decisions based on real-time information.

- Low Minimum Investment: Many apps allow you to start investing with as little as $5 or $10, making it easy for beginners to dip their toes into the market without committing large sums of money upfront.

- Ease of Use: The user-friendly design of most investment apps means that even those with limited financial knowledge can easily navigate and manage their investments. With built-in guidance and easy-to-follow processes, it’s less intimidating to get started.

- Automatic Investing: Many apps offer automated features like recurring deposits or robo-advisors, which can help you stay consistent with your investing strategy, even if you’re too busy to manage your investments actively.

- Access to Advanced Tools: For experienced investors, many apps offer advanced trading tools, including charting, technical analysis, and margin trading, allowing you to make more sophisticated investment decisions.

- Control Over Your Portfolio: Investment apps give you full control over your investment choices, letting you customize your portfolio based on your risk tolerance, goals, and preferences. Unlike traditional brokers, you’re not restricted to limited options or locked into specific investment strategies.

Benefits of Using Investment Apps

Investment apps have become a game-changer for many people who want to take control of their finances. They offer an accessible and flexible way to invest without the barriers associated with traditional brokerage firms. Here are some key benefits of using investment apps:

- Convenience: Investment apps allow you to manage your portfolio and make trades from the comfort of your home or on the go. Whether you’re commuting or waiting for an appointment, you can access your account anytime, which makes it easy to stay on top of your investments.

- Low Costs: Most investment apps offer low fees, with some even offering commission-free trades. This is especially beneficial for beginners or those looking to minimize the impact of fees on their overall returns.

- Diverse Investment Options: Many apps provide access to a variety of investment options, from stocks and ETFs to cryptocurrencies and real estate. This allows you to build a diversified portfolio that matches your financial goals and risk tolerance.

- Educational Resources: Many investment apps include educational features like tutorials, articles, and videos to help you understand the basics of investing. This makes it easier for beginners to learn while they invest.

- Automation: Many apps offer automated investing options, such as robo-advisors, that handle portfolio management for you based on your risk tolerance and goals. This helps take the emotion out of investing and ensures a more disciplined approach.

- Real-Time Data: Investment apps provide real-time updates on the performance of your investments, allowing you to make informed decisions quickly. Whether it’s tracking stock prices or receiving notifications about market movements, these apps keep you up-to-date at all times.

- Customization: Some apps allow you to customize your portfolio based on your preferences, such as choosing socially responsible investments or focusing on a specific industry or asset class. This level of customization can help you align your investments with your values.

How to Get Started with Your Chosen Investment App

Once you’ve decided on the investment app that fits your needs, it’s time to get started. Here are the key steps to take to begin your investing journey:

- Download and Set Up the App: Start by downloading the app from your device’s app store (available on both iOS and Android). After installation, create your account by providing the necessary personal and financial information, such as your name, address, and social security number (or similar identification number).

- Link Your Bank Account: Most apps require you to link a bank account or credit card to fund your investment account. This is typically done by entering your bank account details or connecting through a secure third-party provider.

- Select Your Investment Strategy: Choose your investment approach based on your goals and risk tolerance. If you’re using a robo-advisor, the app will likely ask questions about your preferences and automatically suggest a portfolio. Alternatively, you can manually select stocks, ETFs, or other assets that align with your strategy.

- Fund Your Account: Make an initial deposit to fund your account. Depending on the app, this can be done through a bank transfer, wire, or by depositing funds from a debit/credit card. Some apps also allow you to start with as little as $5, making it easier to begin even with a small budget.

- Start Investing: Once your account is funded, you can start building your portfolio. Depending on the app, you can either use a pre-built portfolio or select individual investments. Monitor your investments regularly, and don’t forget to take advantage of any automated features that can help you maintain your strategy.

Top Investment Apps to Consider

The landscape of investment apps has grown tremendously in recent years, with a wide array of platforms catering to different investing styles, needs, and experience levels. Whether you’re a complete beginner or a seasoned investor, choosing the right investment app is crucial for achieving your financial goals. Below are some of the top investment apps currently available, each with its own unique features and advantages.

Robinhood

Robinhood is perhaps one of the most well-known investment apps, especially for those new to investing. Its main appeal lies in its simplicity and commission-free trading, which makes it accessible for people who want to start investing without incurring significant fees. With Robinhood, users can trade a variety of assets, including stocks, options, and cryptocurrencies, all from a single platform.

The app is designed with ease of use in mind. You don’t need to be a financial expert to navigate Robinhood’s clean interface, and the app provides a streamlined process for buying and selling stocks. One of the standout features of Robinhood is its ability to offer fractional shares, meaning you don’t need a large amount of money to invest in high-priced stocks like Amazon or Tesla. This makes it an excellent choice for beginners with limited capital who still want to diversify their portfolio.

However, while Robinhood is popular for its simplicity, it does lack some of the advanced tools and research features found in other investment apps. For those who want more in-depth analytics or investment advice, Robinhood might not be the best fit.

E*TRADE

ETRADE offers a more comprehensive platform for those looking for a more robust set of tools. Unlike Robinhood, ETRADE caters to both beginner and experienced investors, offering features such as research tools, educational content, and the ability to trade a wider range of securities, including stocks, bonds, ETFs, mutual funds, and options.

What sets E*TRADE apart is its powerful research and charting tools, which are perfect for investors who like to perform their own analysis before making trades. The app also supports a wide range of retirement and investment accounts, such as IRAs, and gives you access to both self-directed trading and professional investment management services. This makes it a great platform for someone who may want to grow with their investment strategy over time.

Although ETRADE’s fees are competitive, they are not as low as Robinhood’s, and the app might be a bit overwhelming for beginners due to its range of features. Still, for those who want a more hands-on, customizable investing experience, ETRADE is a solid choice.

Acorns

Acorns offers a unique approach to investing by helping you automate the process through round-ups. The app links to your bank account and credit cards and rounds up your purchases to the nearest dollar. The spare change is then invested into a portfolio of ETFs based on your risk tolerance. This feature makes it easy for users to passively invest without needing to make conscious decisions or set aside large amounts of money upfront.

Acorns is particularly popular with beginners or those who want to start investing but don’t have much capital to invest. It’s a great app for individuals who might find it challenging to save regularly, as the round-up feature makes investing nearly effortless. The app also offers IRA accounts for retirement savings, and it provides users with portfolio options that are automatically rebalanced.

However, Acorns does charge a monthly fee, which can add up if you don’t have much invested in the app. For small investors, this could eat into your profits over time. Despite this, the automation and simplicity of Acorns make it an excellent choice for those just starting their investing journey.

Stash

Stash is another beginner-friendly investment app that allows you to start investing with as little as $5. One of its main selling points is the ability to build personalized portfolios. It offers a wide range of investment options, including stocks, ETFs, and bonds, and gives you the flexibility to choose investments based on your risk tolerance, goals, and values.

In addition to offering a variety of investment options, Stash includes educational resources to help users understand investing concepts and strategies. It also provides a feature called Smart Portfolio, which automatically builds a portfolio for you based on your goals and risk tolerance. This makes it easier for those who are new to investing to create a diversified portfolio without much effort.

Stash does charge a monthly fee, which can be seen as a drawback for investors just starting out with small amounts of capital. However, the app’s low minimum investment requirement and the added value of its educational content and automatic portfolio management make it a compelling choice for beginners who want to take a more hands-off approach to investing.

Webull

Webull is a commission-free trading platform that appeals to intermediate and experienced investors. Similar to Robinhood, Webull allows you to trade stocks, ETFs, and options, but it offers more advanced features like detailed charting tools, technical indicators, and access to after-hours trading. These features make Webull an appealing option for investors who want more control and flexibility in managing their investments.

One of Webull’s standout features is its extensive set of trading tools. The app provides access to real-time market data, advanced charting options, and in-depth analysis tools, making it a great choice for active traders. Webull also offers a paper trading feature, which allows users to practice trading with virtual money before committing real funds.

While Webull is excellent for more experienced traders, its range of tools can be overwhelming for beginners. If you’re new to investing and prefer a simple, easy-to-navigate platform, Webull may not be the best option. However, if you’re comfortable with trading and want a platform that offers powerful tools and low-cost trades, Webull is a strong contender.

Betterment

Betterment is a robo-advisor investment app designed for individuals who want to take a more passive approach to investing. It automatically creates and manages a diversified portfolio based on your risk tolerance and financial goals. Betterment offers a range of portfolios, including those that focus on socially responsible investing or those that aim to maximize tax efficiency.

Betterment is a great option for people who prefer to set up their investments and let the app do the heavy lifting. The app takes care of portfolio rebalancing, tax-loss harvesting, and dividend reinvestment, allowing you to focus on your long-term financial goals. Additionally, Betterment provides personalized financial advice through its premium service, which makes it suitable for both beginners and individuals looking for more tailored financial guidance.

However, Betterment does charge a management fee, which could reduce your overall returns, especially for smaller accounts. Despite this, the automation and ease of use make it an excellent option for investors who want to save for retirement or other long-term goals without having to actively manage their portfolio.

Fidelity

Fidelity is a well-established name in the investment industry, known for providing a comprehensive platform that caters to both beginners and experienced investors. The app offers commission-free trading on stocks, ETFs, and options, along with a range of account types, such as IRAs, 401(k)s, and more.

One of the key features of Fidelity is its powerful research tools, including detailed market analysis, expert insights, and a wide range of investment options. It also provides access to its educational content, making it easy for beginners to learn while they invest. The app’s strong reputation, coupled with its low fees and high-quality resources, makes Fidelity a great choice for investors who want a full-service platform.

Charles Schwab

Charles Schwab is another leading name in the investment industry, offering a user-friendly app with access to stocks, ETFs, mutual funds, and options. The app provides commission-free trading, low fees, and robust research tools, making it a great option for both beginners and experienced investors.

Schwab’s standout features include its extensive range of no-fee mutual funds and ETFs, as well as its retirement account offerings. It also provides in-depth market research, educational resources, and a mobile-first experience, allowing you to manage your investments seamlessly. Whether you’re saving for retirement or building a diversified portfolio, Charles Schwab’s app provides the tools and support to help you succeed.

SoFi Invest

SoFi Invest offers a simple yet powerful platform for individuals looking to manage their investments with ease. The app allows you to trade stocks, ETFs, and cryptocurrencies, with commission-free trades and no minimum balance requirement, making it accessible for beginners and those looking to start investing with small amounts of money.

One of SoFi’s standout features is its automated investing options, which use a robo-advisor to create a diversified portfolio based on your risk tolerance and financial goals. Additionally, SoFi Invest provides access to retirement accounts and features like tax-advantaged savings, making it a strong option for those looking to grow their wealth long-term.

M1 Finance

M1 Finance offers a hybrid approach to investing, combining automated investing with a high level of customization. The app allows you to create and manage a personalized portfolio, choosing from a wide variety of stocks, ETFs, and pies (pre-built portfolios). M1 Finance offers commission-free trading and the ability to automate your investments, helping you build wealth with ease.

What makes M1 Finance stand out is its “pie” feature, which allows you to group investments into custom portfolios. Whether you’re looking for a retirement portfolio, a socially responsible investing portfolio, or a sector-specific portfolio, M1 makes it easy to tailor your investments to your specific needs and goals. The app also offers fractional shares, so you can invest in high-value stocks with smaller amounts.

Wealthfront

Wealthfront is a robo-advisor that automates the investment process by creating a diversified portfolio based on your risk tolerance and financial goals. The app focuses on long-term wealth-building and provides users with tax-efficient strategies, including tax-loss harvesting and automated rebalancing.

Wealthfront’s robo-advisory service is ideal for individuals who want to take a hands-off approach to investing. It also offers a high-quality financial planning tool that can help you manage other aspects of your financial life, such as saving for college or retirement. While Wealthfront charges a management fee, the ease of use and tax efficiency make it a popular choice for long-term investors.

Public.com

Public.com is a social investing platform that combines the benefits of trading with a community-driven experience. The app allows you to buy and sell stocks, ETFs, and cryptocurrencies, and it offers commission-free trading with no account minimums.

What sets Public.com apart is its social aspect, where users can follow other investors, share investment ideas, and discuss financial strategies. The app also offers fractional shares, allowing you to invest in high-value stocks with as little as $1. Public.com is a great choice for beginners who want to learn more about investing while engaging with a community of like-minded individuals.

Empower

Empower, formerly Personal Capital, offers a unique blend of personal finance management and investment tracking, allowing users to keep track of their spending, savings, and investments all in one place. The app is especially useful for those looking to manage both their day-to-day finances and their investment portfolios.

Empower provides access to a range of investment tools, including retirement planning, asset allocation, and portfolio analysis. It also offers a free financial dashboard, which provides a comprehensive overview of your financial situation. While Empower isn’t a traditional investment platform, its combination of financial tracking and investment management makes it a valuable tool for investors who want to take a more holistic approach to their finances.

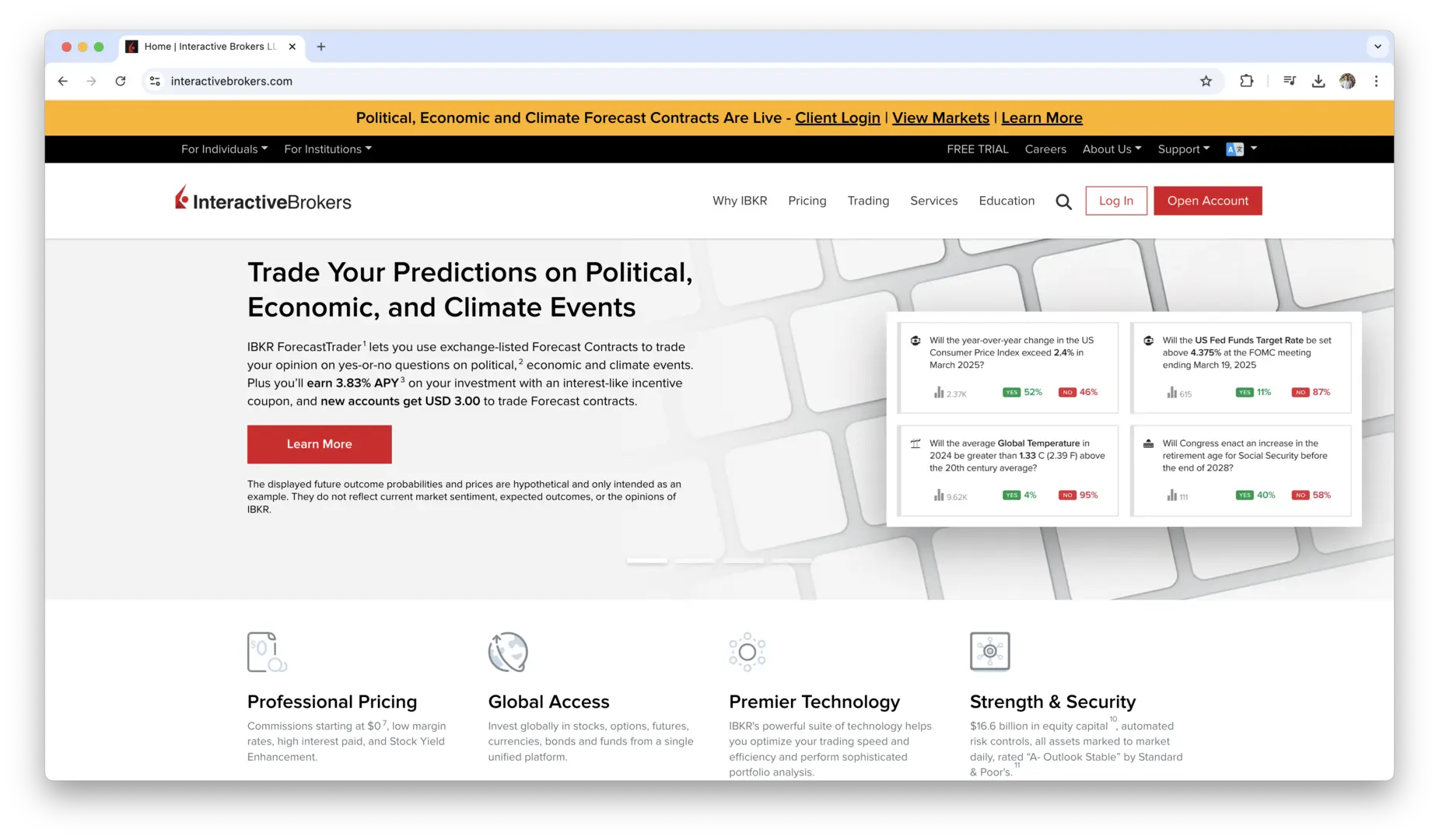

Interactive Brokers

Interactive Brokers is a top choice for active traders and advanced investors who need access to a wide range of securities, including stocks, options, futures, forex, and cryptocurrencies. The app offers advanced trading tools, real-time data, and a variety of research resources, making it ideal for experienced investors who want to make informed decisions.

What sets Interactive Brokers apart is its access to international markets, allowing users to trade a broad range of global securities. The app also provides professional-grade tools like advanced charting, order types, and risk management features, making it a strong option for traders who need a more sophisticated platform.

Each of these investment apps has its unique strengths, so choosing the best one will depend on your individual needs, experience level, and investment goals. Whether you’re just starting out or you’re an experienced investor looking for more sophisticated tools, there’s an app out there that can help you grow your wealth efficiently.

Investment App Features to Look For

When you begin exploring investment apps, the features available to you can significantly impact your experience and success. It’s important to focus on those that best suit your needs, especially as you start managing your money. The right features can make investing more accessible, enjoyable, and efficient. Here are the key aspects you should consider.

User-Friendly Interface

The first thing you’ll notice when using an investment app is how easy or difficult it is to navigate. The interface of the app plays a huge role in how smooth your investing experience is. An intuitive, user-friendly design ensures that you won’t feel overwhelmed by unnecessary complexity, especially if you’re new to investing.

A good app will allow you to quickly access essential features such as your portfolio, recent transactions, stock quotes, and account settings. It will present all of this information in a clean, visually appealing layout. The better the user interface, the more confident you’ll feel about making decisions.

Additionally, some apps provide in-app tutorials or guides, which are particularly helpful for beginners. You want to be able to grasp the app’s key functionalities without spending too much time learning how it works. Also, apps that offer quick and simple navigation between key sections—such as browsing investments, checking balances, or executing trades—allow you to take swift action when needed, saving you time and reducing the risk of missing out on opportunities.

Low Fees and Commissions

The cost of trading is one of the most critical factors when choosing an investment app. High fees can erode your returns over time, especially if you’re a frequent trader or if you’re just starting out and investing smaller amounts. When evaluating an investment app, focus not only on the absence of trading commissions but also on other potential hidden costs.

Some apps may advertise “zero commissions” but charge other fees such as account maintenance fees, withdrawal fees, or inactivity charges. You might also encounter higher fees for advanced features, such as margin trading or premium investment options. Make sure you read through the fee schedule of each app to see how they stack up against your intended trading style.

Apps with low fees are ideal for beginners, as every dollar saved on fees can go towards your investments. Over time, this can make a big difference, especially when you’re investing small amounts regularly. Zero-commission trading is common in many of the leading investment apps today, and it’s definitely something worth looking for to keep your costs down.

Wide Range of Investment Options

A solid investment app should offer a variety of assets to trade. Whether you’re interested in stocks, bonds, ETFs, or even newer alternatives like cryptocurrency or real estate investment trusts (REITs), having options is key to diversifying your portfolio and meeting your financial goals.

Stocks and ETFs are the most common investment options, but if you’re looking to further diversify, some apps also offer options such as commodities, mutual funds, and index funds. Some platforms may even allow you to invest in alternative assets like peer-to-peer lending or venture capital opportunities. For those who want to explore cryptocurrency, certain apps now provide access to trading Bitcoin, Ethereum, and other popular digital currencies.

The more options available, the easier it will be to adjust your investment strategy as your knowledge and comfort level grow. You’ll also have the ability to better diversify your portfolio, which is crucial for mitigating risk. So, when you’re choosing an app, make sure it offers a range of investment choices that aligns with your investment goals.

Security and Regulatory Compliance

Investing always involves a degree of risk, but your financial data and transactions should never be at risk. Security should be a top priority when choosing an investment app. As you store personal financial information and make transactions through an app, you need to ensure that the platform is compliant with regulatory standards and uses the latest security measures.

Look for apps that are regulated by relevant financial authorities in your country, such as the SEC (Securities and Exchange Commission) in the U.S. or the FCA (Financial Conduct Authority) in the UK. Regulatory compliance means the platform adheres to strict rules regarding transparency, fairness, and protecting your interests as an investor.

In addition to regulation, make sure the app uses industry-standard encryption methods to protect your personal and financial data. Two-factor authentication (2FA) is another essential feature, as it adds an extra layer of security when logging into your account or making transactions. Your peace of mind is crucial when managing investments, and security features are vital to safeguarding your information from fraud or theft.

Mobile Accessibility and Ease of Use

Since most investment apps are designed for use on your smartphone, mobile accessibility is a must. The app should be fully functional on both iOS and Android devices, allowing you to trade, monitor your portfolio, and access account details wherever you go. The ability to quickly check your account and react to market changes on the fly is one of the main benefits of using an investment app.

Moreover, mobile accessibility isn’t just about being able to open the app on your phone; it’s about how well the app performs on mobile devices. A responsive app should load quickly, navigate smoothly, and allow you to make trades or review your portfolio with ease. The experience should be seamless across devices, whether you’re using your phone, tablet, or desktop computer.

The best apps are optimized for mobile-first usage. They adapt their layout to ensure that the controls and buttons are easy to use on smaller screens. The app should also provide essential notifications in real time, such as price alerts or news updates about stocks or market conditions, helping you stay ahead of the game.

By making sure your chosen app has mobile accessibility and a high-quality, optimized experience, you can have the flexibility to manage your investments wherever you are, making it easier to stay involved in your financial journey.

How to Choose the Best Investment App for You?

Choosing the right investment app can feel like a daunting task given the variety of options available. Each platform offers a unique set of features, fee structures, and investment opportunities, so it’s crucial to select one that aligns with your personal investment goals and style. Whether you’re just starting or have years of experience under your belt, taking the time to evaluate your needs will help you make a more informed decision.

Factors to Consider Based on Your Investment Goals

Your investment goals play a major role in determining which app is best for you. Before you even start comparing apps, it’s essential to have a clear understanding of what you want to achieve with your investments. Are you saving for retirement, building wealth for the long term, or looking to make short-term gains? Knowing the answer will help you narrow down the apps that are most suited to your objectives.

For example, if you’re focused on long-term wealth-building, you may want an app that offers low-fee, passive investing options, like index funds or ETFs. A platform like Acorns, which automatically invests your spare change in diversified portfolios, is perfect for hands-off, long-term investors. On the other hand, if you’re looking for faster gains or the thrill of active trading, you might lean toward a platform like Robinhood or E*TRADE, which offers more control over individual stock trading, options, and other investment strategies.

If your goal is retirement, you may prefer an app that offers tax-advantaged accounts like IRAs or 401(k)s. Platforms like Wealthfront or Betterment not only provide investment opportunities but also offer features like automatic rebalancing and retirement planning tools. Assessing your goals first will give you a solid starting point to filter out apps that might not align with your investment philosophy.

Risk Tolerance and Investment Strategy

Another important factor to consider is your risk tolerance. This refers to how much volatility or loss you are willing to accept in your portfolio in exchange for potential gains. Different investment apps cater to different levels of risk tolerance, from conservative strategies to more aggressive approaches.

If you have a low tolerance for risk, look for an app that offers more conservative options, such as bonds, index funds, or diversified portfolios with stable returns. Apps like Stash or Betterment offer various portfolios based on your risk profile, and they allow you to choose a level of risk that you’re comfortable with. These apps typically use algorithms to automatically adjust your portfolio in line with your preferences.

If you’re willing to take on more risk for the chance of higher returns, then a platform that offers stock trading, options, or cryptocurrencies may be a better fit. Active traders may prefer apps like Robinhood or Webull, which offer direct access to individual stocks, options, and even margin trading.

Before you select an app, evaluate your risk tolerance by considering both your emotional comfort with market fluctuations and your financial capacity to handle potential losses. This will guide your choice of platform, ensuring you don’t take on more risk than you’re prepared for.

Beginner-Friendly Apps vs. Advanced Tools

Investment apps vary widely in terms of complexity. If you’re a beginner, you’ll want an app that’s easy to understand and offers clear, educational resources. On the other hand, more experienced investors may appreciate advanced tools and features that provide deeper insights and greater customization.

Beginner-friendly apps focus on simplicity, offering intuitive interfaces and educational materials that explain the basics of investing. For example, Acorns and Stash offer user-friendly designs with educational resources to help you understand the different types of investments and how to build a portfolio. These platforms often use automated investing tools that take the guesswork out of portfolio management, so you can focus on long-term growth without needing to constantly manage your investments.

If you’re more advanced and have a solid understanding of investing, you might prefer a platform like E*TRADE, Webull, or TD Ameritrade, which provide more in-depth research tools, charting options, and the ability to trade a variety of assets. These apps also allow for more customization, giving you control over your investment strategies, such as setting up limit orders, margin accounts, or advanced options strategies. Some of these platforms even offer paper trading (a virtual trading feature) so you can test your strategies without using real money.

The key is to choose an app that matches your experience level and provides the features you need. Beginners should prioritize ease of use, educational content, and automated tools, while advanced investors should look for platforms that offer comprehensive research, customizable options, and technical analysis tools to fine-tune their investment strategies.

Investment Apps Drawbacks and Limitations

While investment apps offer a variety of benefits, they come with some limitations that might not suit every investor’s needs. Here are some common drawbacks to consider:

- Limited Personalization: Some investment apps don’t offer a high degree of personalized financial advice. While robo-advisors and automated tools can help manage your portfolio, they may not provide the same level of customization or expertise that a personal financial advisor could offer.

- Lack of Advanced Features: For more experienced investors, some apps may not provide the tools necessary for advanced strategies, such as options trading, futures contracts, or in-depth technical analysis.

- Security Risks: While many investment apps implement strong security measures, the risk of cyberattacks or data breaches is still a concern. It’s important to ensure that the app uses encryption and two-factor authentication (2FA) to safeguard your information.

- Over-Simplification: Some investment apps are designed to be extremely simple, which is ideal for beginners. However, this simplification may leave out important details or tools that could help more experienced investors better manage their portfolios.

- High Fees for Certain Services: Although many apps offer commission-free trades, some charge fees for specific services, like withdrawing funds, transferring assets, or accessing premium features. These fees can add up, especially if you use those features frequently.

- Lack of Human Interaction: Many apps rely on algorithms to suggest investment options and manage portfolios, but this removes the human touch. If you prefer to speak with someone when making investment decisions or need personalized guidance, you may find this lack of interaction a limitation.

Common Mistakes to Avoid When Using Investment Apps

Even though investment apps are designed to make investing easier, there are still several common mistakes that can hinder your success. Avoiding these mistakes will help you stay on track and increase your chances of achieving your financial goals:

- Ignoring Fees: While many apps offer commission-free trading, there may still be hidden fees, such as account maintenance fees or withdrawal fees. Make sure to review the app’s fee structure so you can avoid unnecessary charges.

- Neglecting to Diversify: Putting all your money into a single stock or asset class can expose you to unnecessary risk. Diversifying your portfolio across different assets can help protect your investments from market volatility.

- Chasing Short-Term Gains: Many beginners fall into the trap of trying to time the market or making frequent trades to chase quick profits. This can lead to poor decision-making and emotional investing. Focus on a long-term strategy and avoid getting caught up in short-term fluctuations.

- Failing to Set Clear Goals: If you haven’t defined clear investment goals, it can be easy to get sidetracked. Take the time to set both short-term and long-term goals, and ensure that your investment strategy aligns with those objectives.

- Not Using Available Tools and Resources: Most investment apps come with educational resources, tools, and customer support. Don’t overlook these resources, as they can help you understand your investments and make more informed decisions.

- Overlooking Risk Tolerance: If you’re new to investing, it’s important to choose an investment strategy that matches your risk tolerance. Taking on too much risk too soon can lead to unnecessary stress and financial losses.

- Being Overwhelmed by Options: With so many investment choices available, it’s easy to become overwhelmed. Take your time to research different options, and avoid jumping into unfamiliar assets until you’re comfortable with your understanding of them.

Conclusion

Choosing the right investment app depends on your personal needs and goals. Whether you’re looking for simplicity, low fees, or advanced trading tools, there’s an app out there that fits your preferences. For beginners, apps like Robinhood, Acorns, and Stash offer an easy way to get started with little investment required, while more experienced investors may find platforms like E*TRADE, Interactive Brokers, or TD Ameritrade to be a better fit for their advanced strategies and research needs. The key is to find an app that aligns with your risk tolerance, investment goals, and how much time you want to spend managing your investments.

As you explore different investment apps, remember that the best platform is one that allows you to comfortably grow your wealth over time. Each app has its strengths, whether that’s automated investing, educational resources, or access to advanced trading tools. By understanding what you want from an investment app, you can confidently select one that helps you make the most of your money and achieve your financial goals. With so many great options available, there’s no better time to start investing and take control of your financial future.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.