Are you looking for the best checking account but not sure where to start? With so many options out there, it can be overwhelming to figure out which account fits your needs. Whether you want to avoid fees, earn interest, or manage your money easily through mobile banking, choosing the right checking account is key to keeping your finances in check.

This guide will break down the different types of checking accounts, highlight the best ones for different needs, and help you understand what to look for when making your decision. No matter your financial goals, you’ll find an account that works for you.

What is a Checking Account?

A checking account is a type of bank account that allows you to deposit and withdraw money for everyday transactions. Unlike a savings account, which is meant for long-term savings and earning interest, a checking account is designed for easy access to your funds. It’s a central part of your financial toolkit, allowing you to pay bills, make purchases, and manage cash flow efficiently.

Checking accounts are often linked to a debit card, which allows you to make payments directly from the account. They also provide the ability to write checks (although this is becoming less common) or initiate electronic transfers. Most checking accounts allow you to deposit money directly, either through physical checks or digital means like direct deposit or mobile deposits.

The key feature of a checking account is that you can access your funds frequently and without restrictions, making it an essential tool for managing day-to-day finances. Whether you’re paying for groceries, transferring money, or paying bills, your checking account keeps everything running smoothly.

The Importance of Choosing the Right Checking Account

Selecting the right checking account can have a significant impact on your financial life. When you choose an account that aligns with your spending habits, it can save you time, money, and stress. The right account will make it easier to manage your daily expenses, grow your savings, and access your funds without unnecessary fees or limitations. Here are some key reasons why choosing the right checking account is so important:

- It helps you avoid unnecessary fees and charges, ensuring you keep more of your money.

- It provides the features you need, such as mobile banking or free ATM access, which simplifies managing your finances.

- The right account offers ease of access to your funds when you need them most, such as when traveling or handling emergencies.

- It aligns with your long-term financial goals, whether that’s saving, earning interest, or minimizing debt.

What Makes a Great Checking Account?

A great checking account is more than just a place to store your money—it’s a tool that makes managing your finances easier. Here are some key attributes that make a checking account stand out from the rest:

- Low or No Fees: The best checking accounts have minimal fees. Many banks charge monthly maintenance fees, but the best accounts either waive them or keep them low. Some accounts even have no fees at all if you meet certain conditions, like maintaining a minimum balance or setting up direct deposit.

- Ease of Access: The ability to access your money easily is crucial. A great checking account offers convenient options for withdrawals, whether through ATMs, debit cards, or online transfers. It should also allow you to easily deposit money, whether by check, direct deposit, or through mobile apps.

- Mobile and Online Banking Features: With the increasing reliance on digital banking, the best checking accounts offer a robust mobile app and online platform that let you manage your account anywhere. These features should include things like bill pay, check deposits, fund transfers, and transaction alerts to help you stay on top of your spending.

- Security: Security is a must for any checking account. Look for accounts that offer fraud protection, encryption, and two-factor authentication to keep your funds safe from theft or unauthorized transactions.

- Customer Service: A great checking account comes with responsive customer service options. Whether you prefer phone support, live chat, or in-branch assistance, the bank should be accessible and easy to reach if you need help.

- Interest or Rewards: Some checking accounts offer rewards like cash back or interest on balances, which can make them more beneficial for individuals who use their account frequently. These extra perks can add value to your checking account and help it work harder for you.

Ultimately, a great checking account should align with your specific needs, offering ease of use, minimal fees, and valuable features that help you manage your finances effectively. Whether you’re looking for an account with high-tech features or a simple, no-fee option, the right account will help you handle your financial responsibilities with ease.

How to Open and Manage a Checking Account?

Opening a checking account is a simple process, but managing it effectively requires ongoing attention. Once you’ve selected the account that best fits your needs, it’s important to follow the steps for setting it up and stay on top of managing it regularly. Here’s a straightforward guide to opening and managing your checking account:

- Choose the right checking account by considering fees, interest rates, ATM access, mobile features, and minimum requirements.

- Gather required documents, such as proof of identity, Social Security number, and proof of address, to ensure a smooth application process.

- Open the account through your bank’s website, in person, or by phone, depending on their available options.

- Make an initial deposit, if necessary, and verify the account’s details to confirm everything is set up correctly.

- Set up direct deposit if applicable, ensuring that your paycheck or other income is automatically transferred into your account.

- Download your bank’s mobile app and/or set up online banking so you can easily track and manage your account from your phone or computer.

- Set up alerts for low balances, large transactions, or bill payments to stay on top of your finances and avoid surprises.

- Link the account to other financial accounts as needed for easier transfers, payments, or savings.

- Regularly monitor your account for any unusual activity or errors, and ensure that all transactions match your records.

- Manage your account by reviewing monthly statements and considering ways to reduce fees, such as meeting minimum balance requirements or setting up additional direct deposits.

Types of Checking Accounts

Choosing the right type of checking account is one of the most important steps in managing your finances. With so many different options available, it’s essential to understand the benefits and limitations of each type. Below are the most common types of checking accounts, each catering to different financial needs and lifestyles. Let’s take a closer look at the features and advantages of each.

Traditional Checking Accounts

A traditional checking account is the most common type of checking account, typically offered by banks and credit unions. These accounts are designed to serve the basic needs of everyday banking. With a traditional checking account, you can easily access your funds through checks, debit cards, ATMs, and direct deposits.

One of the main features of a traditional checking account is the ability to write checks, making it an ideal choice for people who still prefer using paper checks for transactions. Traditional checking accounts also offer debit card access, allowing you to make purchases both in stores and online.

However, many traditional checking accounts come with monthly maintenance fees, especially at larger, brick-and-mortar banks. These fees are often waived if you meet certain conditions, such as maintaining a minimum balance or setting up a regular direct deposit.

Another thing to consider is the convenience factor. Traditional checking accounts often come with access to a physical branch where you can speak with a representative in person if needed. While this is great for those who prefer face-to-face banking, it might not be necessary for everyone.

Online-Only Checking Accounts

Online-only checking accounts are becoming increasingly popular due to their low fees and ease of use. These accounts operate entirely online, which means you won’t have access to physical branches, but you’ll enjoy a range of benefits that make online banking appealing.

The biggest advantage of online-only checking accounts is the low or no fees. Since these accounts don’t have the overhead costs associated with maintaining physical branches, banks can pass on those savings to you. Many online-only accounts have no monthly maintenance fees, and you may even earn a higher interest rate on your balance compared to traditional accounts.

Additionally, online-only accounts often come with robust mobile apps that allow you to manage your account, deposit checks, pay bills, transfer money, and more—all from your smartphone. These accounts are also typically integrated with free ATM networks, allowing you to withdraw cash without incurring fees.

The downside is that you may have to rely on ATMs in the bank’s network for free withdrawals. If you need in-person support, online-only banks often offer customer service via phone or chat but won’t have physical branches where you can speak to someone face-to-face. However, for people comfortable with digital banking, online-only accounts are often the most cost-effective choice.

High-Yield Checking Accounts

If you’re looking for a checking account that offers more than just basic services, a high-yield checking account might be the right option for you. These accounts provide a higher interest rate than traditional checking accounts, allowing your money to grow faster. The interest rates are typically much higher than what you’d find in a regular checking account, though they tend to be lower than those offered by savings accounts.

To earn the highest interest rates, you may need to meet certain requirements. For example, you may need to make a certain number of debit card purchases per month or maintain a specific balance in your account. These accounts also tend to come with monthly activity requirements, such as a minimum number of transactions, so they are best for people who use their account frequently.

High-yield checking accounts also often come with no monthly maintenance fees, especially at online banks, and they allow you to earn interest while still maintaining easy access to your funds. While these accounts offer great earning potential, it’s important to read the fine print and understand the conditions you need to meet to earn the advertised interest rate.

Some high-yield checking accounts may also provide cash back on debit card purchases, adding even more value if you use your account for daily expenses. This can be an excellent option for someone who wants to maximize their earnings from a checking account while maintaining access to their money for regular transactions.

Student and Teen Checking Accounts

Student and teen checking accounts are designed for young people who are just starting to manage their finances. These accounts typically have low fees, if any, and offer simple features to help teach financial responsibility.

For students, many checking accounts offer no monthly maintenance fees and low or no minimum balance requirements, which makes them a great option for those just starting out. Some banks may offer free ATM access or allow students to link their checking account with a savings account to help them build a financial safety net.

For teenagers, a student checking account is often the first step in learning how to manage money. Many banks offer these accounts with debit cards that allow teens to make purchases and track their spending. Parents can also add features like account monitoring or set up alerts to keep track of their child’s spending. Some accounts also come with financial education tools to help teach young people about budgeting, saving, and spending wisely.

Although these accounts are typically geared towards younger users, it’s important to know that many student checking accounts are only available to individuals within a certain age range, often between 16 and 24. However, after reaching the age limit, these accounts typically transition into regular checking accounts, and you may need to adjust your account type to avoid fees.

Business Checking Accounts

If you’re a business owner, you’ll likely need a business checking account to separate your personal and business finances. Business checking accounts are essential for managing business expenses, paying employees, and accepting payments from clients. These accounts often come with features tailored to the unique needs of businesses.

Business checking accounts generally offer higher transaction limits, allowing you to handle large volumes of payments and deposits. They also often come with business-specific tools like invoicing, payment processing, and integrations with accounting software such as QuickBooks or Xero.

However, business accounts tend to have higher fees than personal checking accounts. Some accounts charge monthly maintenance fees, and others charge for features like wire transfers or paper checks. It’s essential to choose an account that aligns with your business’s needs, whether you’re just starting out or running a large enterprise.

Many banks also offer merchant services as part of a business checking account, which allows you to accept payments via credit and debit cards, in addition to electronic transfers. These features make it easier for businesses to manage cash flow and grow their operations.

Keep in mind that business checking accounts typically have more stringent requirements, such as business documentation, EIN (Employer Identification Number), and proof of ownership. These accounts are not intended for personal use, and banks will often ask for additional information to verify your business’s legitimacy.

Choosing the right type of checking account depends largely on your financial needs and goals. Whether you’re looking for a simple, no-fee account for daily use, an account that helps your money grow, or an account tailored for a young adult or business, there’s an option out there that’s perfect for you. Take time to evaluate the features of each account type and determine which one aligns best with your lifestyle and financial objectives.

Best Checking Accounts for Different Needs

Choosing the best checking account depends largely on your personal needs and financial habits. Whether you’re looking for low fees, high interest, mobile banking features, or travel-friendly options, there’s a checking account out there designed for you. Here are some of the best options for various financial needs, each offering unique benefits to help you manage your money more effectively.

Best for Low Fees

For many people, avoiding fees is a top priority when choosing a checking account. If you’re someone who wants to minimize the costs associated with your account, the best option for you will be a low-fee or no-fee account. These accounts are designed to keep costs down and typically come with no monthly maintenance fees, no minimum balance requirements, and minimal or no fees for ATM withdrawals within a specific network.

Online banks tend to offer the most fee-friendly checking accounts, thanks to their lack of physical branches. Without the overhead costs of maintaining brick-and-mortar locations, these banks can pass the savings on to you by eliminating or reducing fees. Many online banks offer accounts with zero monthly maintenance fees and free access to a broad network of ATMs.

Chime

Chime is an online-only bank that offers a no-fee checking account with absolutely no monthly maintenance fees or minimum balance requirements. In addition, Chime provides access to over 24,000 ATMs nationwide with no fees. Chime also offers early direct deposit, allowing you to access your paycheck up to two days earlier than traditional banks.

Ally Bank

Ally offers a no monthly maintenance fee checking account with free access to 43,000 ATMs nationwide. With no fees for common services like online bill pay, debit card replacements, and incoming wires, Ally’s checking account is a solid option for fee-conscious users. They also offer interest-bearing accounts with a competitive APY, so you can earn a little on your balance while avoiding fees.

Capital One 360 Checking

Capital One’s 360 Checking offers a no monthly fee checking account with free access to over 39,000 ATMs across the country. Capital One also provides a zero-fee overdraft option through its “Capital One 360 Checking” account, which can be particularly useful if you want to avoid costly overdraft fees.

Some credit unions and smaller regional banks also offer low-fee accounts with fewer restrictions. These accounts may charge small fees for certain services, but they often waive those fees if you meet specific conditions, such as enrolling in direct deposit or maintaining a modest balance. If you’re looking for an account with low costs and minimal fees, focusing on online banks and credit unions will be a great place to start.

Best for High-Yield Interest

If you’re looking to grow your money while keeping it accessible, a high-yield checking account might be the right choice for you. These accounts typically offer higher interest rates than traditional checking accounts, allowing your balance to grow at a faster pace. While interest rates on checking accounts tend to be lower than those on savings accounts, high-yield checking accounts can still provide an opportunity to earn a bit more on your balance.

To access the highest interest rates, you will often need to meet certain requirements, such as making a set number of debit card purchases each month, maintaining a minimum balance, or setting up a direct deposit. Some high-yield accounts may also offer cash-back rewards for regular spending, which adds even more value to the account.

Online banks often provide the best APY (Annual Percentage Yield) on checking accounts. Since they don’t have physical branches to maintain, they can pass along higher interest rates to customers. However, it’s important to be aware of any conditions that come with these high yields, as failing to meet them could result in a lower interest rate or fees.

Discover Cashback Debit

Discover’s Cashback Debit account offers a high-yield interest rate on balances, in addition to providing 1% cash back on up to $3,000 in debit card purchases each month. This account is especially beneficial for those who regularly make purchases with their debit card. Discover also offers free access to over 60,000 ATMs nationwide and no monthly fees.

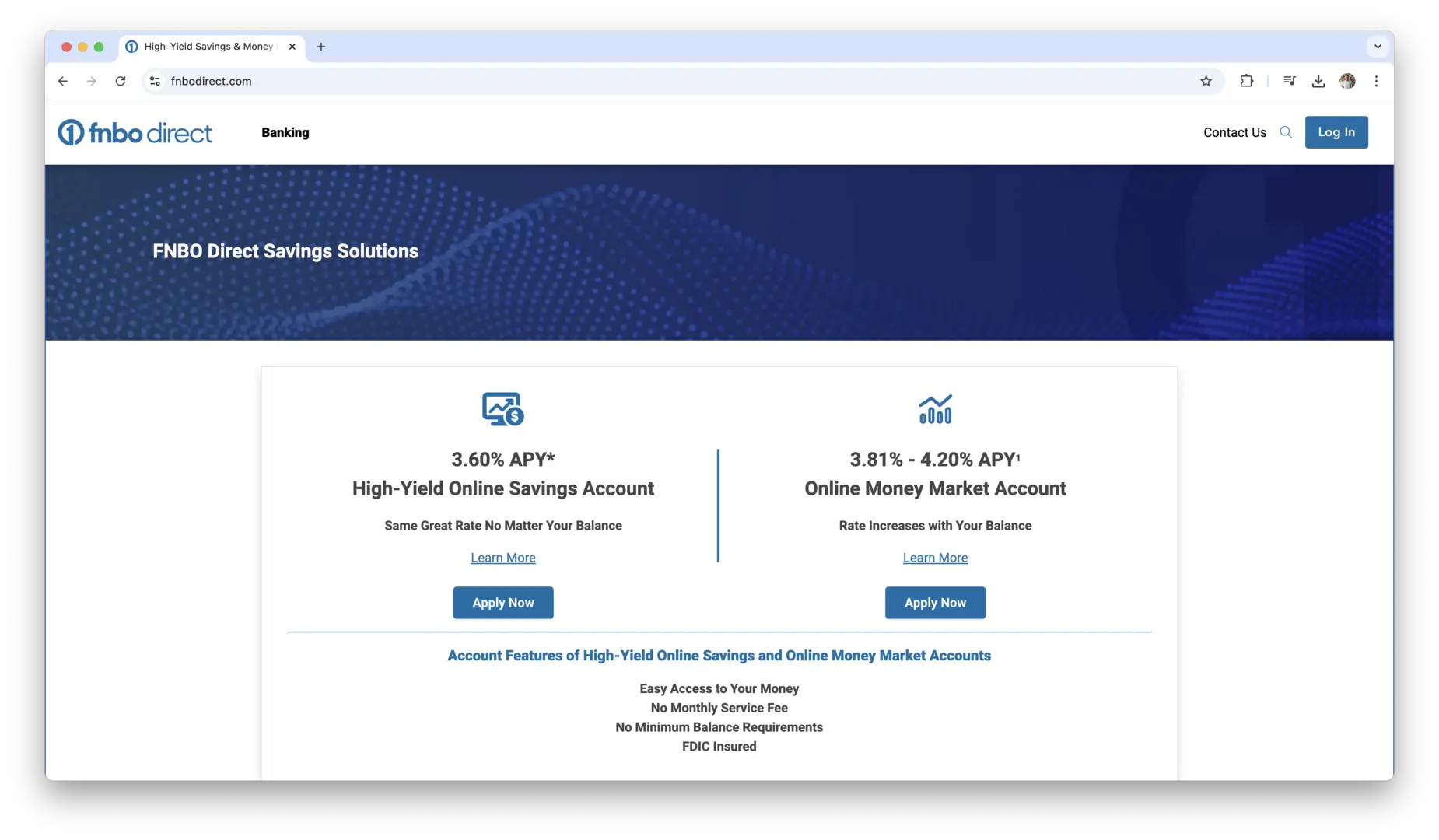

FNBO Direct High-Yield Checking

FNBO Direct offers a High-Yield Checking Account that earns a 0.65% APY on your balance. To qualify for this interest rate, you’ll need to meet a few requirements, such as maintaining a balance of at least $1. However, the rate is significantly higher than what you would find in most standard checking accounts. FNBO also offers no monthly fees and free online bill pay.

In addition to providing competitive interest rates, high-yield checking accounts can help you keep your funds liquid and easily accessible for everyday spending, unlike savings accounts that may limit how often you can withdraw money. This makes high-yield checking accounts an excellent option for those who want to grow their money without sacrificing convenience.

Best for Mobile Banking Features

In today’s fast-paced world, many people want to manage their finances on the go. If you value the ability to access and control your checking account from your smartphone, finding an account with the best mobile banking features is essential. The best mobile banking apps allow you to check your balance, transfer money, deposit checks, and even pay bills—all from the palm of your hand.

When choosing an account with robust mobile banking features, look for a bank that offers an intuitive and secure mobile app with comprehensive capabilities. Leading banks like Chase, Capital One, and Bank of America provide apps that allow for everything from mobile check deposit to real-time transaction notifications. These apps are not only user-friendly but also provide security features like fingerprint authentication and two-factor authentication to keep your financial data safe.

Many online-only banks also offer advanced mobile features, with apps that are often designed to offer the most streamlined and efficient banking experience. These accounts typically offer fee-free banking, robust transaction alerts, and the ability to manage all aspects of your account with ease. Whether you’re transferring money, paying bills, or checking recent activity, a mobile-friendly checking account ensures that you have access to your finances whenever and wherever you need it.

Chase Total Checking

Chase’s Total Checking account is known for its robust mobile banking features. The Chase mobile app offers mobile check deposit, bill pay, fund transfers, and real-time alerts to keep track of your spending. Chase also provides access to over 16,000 ATMs and more than 4,700 branches. This account is a great option if you want both mobile convenience and in-person service.

For people who are always on the go, mobile banking is a game-changer. A checking account with great mobile features means you can manage your money without being tied to a physical branch or desktop computer.

Best for Frequent Travelers

For frequent travelers, whether for business or leisure, a checking account that offers easy access to funds worldwide is a must. The best accounts for travelers provide fee-free access to ATMs both domestically and internationally and have no foreign transaction fees for purchases made abroad.

One of the top features to look for is global ATM access. Certain banks, like Charles Schwab, offer accounts that let you use ATMs worldwide without incurring foreign ATM withdrawal fees. These accounts are especially beneficial for people who travel frequently, as you can access your funds without paying additional fees or worrying about finding a bank in your destination country.

Additionally, no foreign transaction fees are an important feature to look for if you plan to use your debit card internationally. Some checking accounts charge a fee (typically around 3%) for every purchase made outside of the country. To save money while traveling, opt for an account that waives these fees, so you can use your debit card abroad without incurring extra charges.

Many online banks and international banks offer checking accounts that cater to travelers, providing a broad network of fee-free ATMs and no-cost international transactions. These features are not only convenient but can also save you a significant amount of money over time, especially if you travel often.

Charles Schwab High Yield Investor Checking

Charles Schwab’s High Yield Investor Checking account is a top choice for frequent travelers. This account offers free ATM access worldwide and no foreign transaction fees. It also provides a high-yield interest rate and doesn’t charge monthly fees. Schwab even reimburses any ATM fees incurred abroad, making it a great option for those who want to avoid extra charges when traveling internationally.

HSBC Premier Checking

HSBC offers a Premier Checking account with access to fee-free ATMs worldwide. Additionally, the account includes no foreign transaction fees on international purchases, which can save you a lot of money if you use your debit card while traveling abroad. This account also offers 24/7 customer service, which is ideal if you encounter any issues while abroad.

Fifth Third Bank Travel Rewards Checking

Fifth Third’s Travel Rewards Checking account is designed specifically for people who travel regularly. This account offers no foreign transaction fees, unlimited international ATM withdrawals, and the ability to earn travel rewards on debit card purchases. Additionally, the account provides no monthly maintenance fees and access to thousands of fee-free ATMs nationwide.

For travelers who want peace of mind when it comes to banking while abroad, a checking account that offers extensive global access and low fees can make managing your finances while traveling both simple and cost-effective.

By selecting the best checking account for your specific needs, you can optimize your finances and make banking a simpler and more cost-effective part of your life. Whether you’re looking to avoid fees, earn interest, manage your finances on the go, or ensure that your travels are as seamless as possible, there’s an ideal checking account for you. Take your time to evaluate each option carefully and choose the one that works best for your financial goals.

Checking Account Features to Look For

When it comes to selecting a checking account, understanding the key features that will impact your financial life is crucial. Not all checking accounts are created equal, and focusing on the features that matter most to you can help you make the right choice. Below are some of the most important factors to consider when comparing different accounts.

Low or No Fees

One of the primary reasons many people seek out the best checking account options is to avoid fees. Monthly maintenance fees, ATM fees, and overdraft fees are some of the most common charges that can quickly eat away at your balance. When looking at checking accounts, always pay attention to the fee structure.

A lot of traditional banks charge monthly maintenance fees, but many online banks offer checking accounts that don’t carry these fees at all. Even if you do find an account that has a fee, it’s often possible to avoid it by meeting specific criteria, such as maintaining a minimum balance or setting up direct deposit. Some accounts even waive the fee entirely if you make a certain number of debit card purchases or deposit a certain amount monthly. This can be particularly helpful if you’re looking to keep your costs low.

Overdraft fees can be another pitfall to watch out for. Some banks charge hefty fees if you accidentally spend more than what is in your account, which can result in additional financial stress. Many modern checking accounts offer overdraft protection, either automatically or as an optional feature, which can help you avoid fees by transferring funds from a linked savings account or credit card.

Before choosing an account, be sure to understand the full breakdown of all the fees involved. Look for no-fee options and choose accounts that offer flexibility when it comes to avoiding charges. It can make a huge difference in your monthly budgeting.

ATM Access and Network

If you’re someone who frequently withdraws cash, the ATM access and network offered by your bank are essential considerations. Some checking accounts provide access to large networks of fee-free ATMs, while others may charge you every time you use an out-of-network ATM. If you travel often or live in an area where ATM options are limited, it’s a good idea to look for accounts that offer free access to ATMs nationwide, or even globally.

Many online-only banks and credit unions offer checking accounts that give you access to a network of ATMs without charging any withdrawal fees, either at home or abroad. You might also come across accounts that charge a small fee for ATM withdrawals outside their network, so be sure to weigh these costs when deciding.

If you travel internationally, you’ll want an account that either waives international ATM fees or has a large global ATM network. This can save you from paying foreign transaction or withdrawal fees, which can be surprisingly high. Some banks even partner with global ATM networks to offer fee-free withdrawals worldwide.

It’s also helpful to check if your bank provides mobile ATM locator tools in their app, allowing you to easily find ATMs that are within the network when you’re on the go.

Mobile Banking and Online Features

We live in a time when managing your finances through your phone is not only convenient but necessary. The best checking accounts offer robust mobile banking features that enable you to monitor your transactions, transfer money, pay bills, and even deposit checks—all from your smartphone or computer.

Look for accounts with a well-rated mobile banking app that offers a seamless user experience. For instance, many banks now allow you to deposit checks by simply taking a picture of them with your phone’s camera. This can save you time and hassle, especially if you don’t have access to a physical branch or prefer the ease of banking from home.

Other important mobile features include the ability to set up automatic bill payments, transfer funds between accounts, and view transaction history on the go. Many apps also allow you to set up transaction alerts, which send you notifications whenever your account is accessed, a payment is made, or your balance drops below a certain threshold. This real-time monitoring can help you stay on top of your finances and avoid issues like overdrafts or fraudulent charges.

Also, some banks offer additional budgeting tools within their mobile apps. These tools can help you track your spending habits, categorize your expenses, and even set up savings goals. If you value financial planning and want to make smarter decisions with your money, a checking account with these tools can be incredibly beneficial.

Customer Service and Support

No matter how great a checking account might look on paper, customer service is a crucial factor when it comes to handling any problems or questions that may arise. Having access to responsive, helpful support when you need it can make all the difference, especially if something unexpected happens with your account.

Most traditional banks provide a range of support options, from in-person assistance at branches to 24/7 phone support. Some online-only banks may not have physical branches, but they usually provide chat support, email, and phone options. Look for a bank that offers multiple communication channels and is quick to respond to inquiries. It’s important to feel confident that if something goes wrong—whether it’s a disputed transaction or a security issue—you can easily get in touch with someone who can assist you.

Also, keep in mind that the quality of customer support can vary. Some banks offer highly rated support with knowledgeable staff members, while others may be less helpful. Be sure to research customer reviews and satisfaction ratings for any bank you’re considering, especially if customer service is a priority for you. Knowing how responsive a bank is can help you avoid frustrating experiences in the future.

Lastly, many banks offer online help centers with FAQ sections, instructional videos, and troubleshooting guides. These can be useful if you prefer to handle issues on your own without having to contact support directly.

Understanding these key features will help you make an informed decision when choosing the best checking account for your needs. Whether you’re looking for low fees, convenient ATM access, top-notch mobile banking features, or excellent customer service, keeping these factors in mind will ensure that your new checking account serves you well for years to come.

How to Compare Checking Accounts?

When choosing a checking account, it’s essential to compare different options to ensure you’re getting the best deal. There are several factors to consider, from fees to interest rates to minimum requirements. Understanding these elements will help you make a more informed decision and choose an account that fits your needs.

1. Understand Fee Structures

One of the most crucial aspects of comparing checking accounts is understanding the fee structure. Many checking accounts come with fees, but the types and amounts of fees can vary greatly from one account to another. Common fees include monthly maintenance fees, ATM withdrawal fees, overdraft fees, and returned item fees.

When evaluating an account, first take a look at the monthly maintenance fees—these are charges you incur just for having the account open. Some banks charge a flat fee each month, while others may waive it if you meet certain conditions, such as maintaining a minimum balance or having direct deposit. If an account charges monthly fees, try to determine whether the benefits, such as ATM access, customer service, or mobile features, justify the cost.

Next, consider ATM fees. Some accounts charge a fee when you use an ATM outside of their network, while others provide access to fee-free ATMs within a certain network. If you frequently withdraw cash, an account with a broad network of fee-free ATMs could save you money in the long run.

Overdraft fees are another critical consideration. An overdraft fee is charged when you spend more than what is in your account. Some banks offer overdraft protection, which can help you avoid these fees by linking your checking account to a savings account or line of credit.

2. Analyze Interest Rates and Rewards

Interest rates are another factor to weigh when comparing checking accounts, particularly if you plan to keep a significant balance in your account. While most checking accounts offer little to no interest, there are high-yield checking accounts that provide higher interest rates on your balance. These accounts typically require certain conditions to be met, such as a minimum balance or a set number of monthly transactions.

In addition to interest rates, some checking accounts offer rewards programs, such as cash back on debit card purchases. If you’re someone who makes frequent purchases using your debit card, you may want to look for an account that offers cash-back incentives or points that can be redeemed for rewards. Some accounts also provide additional benefits, such as discounts on travel or purchases, further enhancing the value of the account.

When comparing interest rates, always check the APY (annual percentage yield) to see how much you could earn over the course of a year. This will give you a clearer picture of how your money can grow within the account.

3. Evaluate Account Minimums and Requirements

Different checking accounts come with various minimum balance requirements or activity conditions that can affect how much you need to maintain in the account to avoid fees. Some accounts may require a minimum deposit to open the account or require you to maintain a minimum balance in order to avoid fees. Be sure to look for accounts that have a minimum balance requirement that aligns with your financial habits.

Additionally, many accounts have minimum transaction requirements in order to earn rewards or avoid fees. For example, some high-yield checking accounts require you to make a certain number of monthly debit card purchases or have direct deposit to qualify for the highest interest rate. Make sure you’re comfortable with the minimum requirements before committing to an account.

Understanding these terms will help you avoid unexpected charges and ensure that the account you choose is practical for your lifestyle.

Checking Accounts Security and Protection Features

Ensuring that your checking account is secure is a top priority. Banks provide several layers of security to protect your funds and sensitive information from fraud. It’s essential to choose an account that offers robust security features. Here’s what you should look for to ensure your checking account is safe:

- FDIC insurance: Ensures that your deposits are protected up to $250,000, offering peace of mind if your bank fails.

- Fraud detection systems: Many banks use real-time monitoring to detect suspicious activity and alert you immediately.

- Zero-liability policies: Protects you from being held responsible for unauthorized transactions made with your debit card or account.

- Encryption and security protocols: Ensure that all online and mobile banking transactions are encrypted to protect your data.

- Two-factor authentication (2FA): Adds an extra layer of security to your online and mobile banking, requiring you to verify your identity through another device or method.

- Regular monitoring for account breaches: Look for banks that routinely check for signs of security breaches and provide proactive solutions if necessary.

- Secure login methods: Some banks use fingerprint scanning, facial recognition, or other biometric methods to access mobile banking apps, enhancing security.

- Automatic fraud alerts: Receive notifications of suspicious transactions, unauthorized purchases, or attempts to access your account.

- Password protection: Banks often offer guidelines and tools for creating strong, unique passwords and recommend regular password updates.

Conclusion

Choosing the right checking account is an important step in managing your finances, and it all comes down to your individual needs. Whether you’re focused on avoiding fees, earning interest, or making banking easier with mobile features, there are plenty of great options available. It’s essential to take the time to compare accounts based on factors like fees, features, ATM access, and customer service to make sure you find the one that best suits your financial habits. Once you know what you’re looking for, the right checking account can make managing your money easier and more efficient.

Ultimately, the best checking account is the one that helps you stay on top of your finances without unnecessary complications. With so many options to choose from, there’s no need to settle for an account that doesn’t meet your needs. Whether you’re looking to save on fees, earn rewards, or enjoy better access to your funds while traveling, there’s an account out there that can offer exactly what you need. Take the time to evaluate what matters most to you, and you’ll find the perfect fit for managing your day-to-day finances.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.