Are you struggling to manage your loan portfolio efficiently and keep up with the ever-changing regulatory landscape? Finding the right loan servicing software can make a world of difference in streamlining your operations, enhancing customer satisfaction, and ensuring compliance. In today’s fast-paced financial environment, manual loan management is not only time-consuming but also prone to errors that can cost your organization both money and reputation.

This guide explores the best loan servicing software and solutions available, breaking down their key features, benefits, and how they can be tailored to meet your specific needs. Whether you’re a small lender looking to improve your processes or a large financial institution aiming to scale your operations, understanding the right tools and strategies is essential for success.

Understanding Loan Servicing Software

Efficient loan management is the backbone of any financial institution. Loan servicing software plays a pivotal role in ensuring that loans are handled smoothly from initiation to repayment. Let’s delve deeper into what loan servicing entails, the software that supports it, and the benefits it brings to financial institutions.

What is Loan Servicing?

Loan servicing involves the administration of loans after they have been disbursed to borrowers. This process includes collecting and processing payments, managing borrower accounts, handling customer inquiries, and ensuring compliance with relevant regulations. Effective loan servicing ensures that borrowers remain informed and satisfied, while lenders maintain accurate records and minimize risks. Whether it’s a personal loan, mortgage, or business loan, the principles of loan servicing remain consistent, focusing on timely payments, clear communication, and adherence to legal standards.

What is Loan Servicing Software?

Loan servicing software is a specialized application designed to automate and streamline the various tasks involved in managing loans. Its core functions include:

- Payment Processing: Automating the collection, allocation, and tracking of loan payments.

- Account Management: Maintaining detailed records of each borrower’s account, including balance, payment history, and loan terms.

- Customer Communication: Facilitating timely and personalized communication with borrowers through emails, messages, and notifications.

- Compliance Management: Ensuring that all loan servicing activities adhere to relevant laws and regulations, thereby reducing the risk of legal issues.

- Reporting and Analytics: Providing insights through comprehensive reports and data analysis to help lenders make informed decisions.

- Collections Management: Automating the process of handling late payments and managing delinquent accounts.

These functionalities work together to create an efficient, accurate, and user-friendly loan servicing environment, reducing the manual workload and enhancing overall operational efficiency.

Importance of Effective Loan Servicing Software

Implementing effective loan servicing software is crucial for several reasons:

- Efficiency and Accuracy: Automating routine tasks minimizes human errors and speeds up processes, allowing staff to focus on more strategic activities.

- Enhanced Customer Experience: Quick and accurate processing of payments and queries leads to higher borrower satisfaction and retention.

- Regulatory Compliance: Staying compliant with ever-changing regulations is easier with built-in compliance tools, reducing the risk of penalties and legal issues.

- Data Management: Centralized data storage ensures that all loan-related information is easily accessible and securely managed.

- Scalability: As your loan portfolio grows, scalable software can handle increased volumes without compromising performance.

- Cost Savings: Reducing manual processes and improving efficiency can lead to significant cost savings over time.

Effective loan servicing software not only improves operational efficiency but also enhances the overall relationship between lenders and borrowers, fostering trust and reliability.

Types of Loan Servicing Software

Loan servicing software comes in various forms, each tailored to meet specific needs and types of loans. Understanding the different types can help you choose the right solution for your institution:

- Commercial Loan Servicing Software: Designed for businesses managing multiple commercial loans, this software handles complex loan structures, larger transaction volumes, and specialized reporting requirements.

- Consumer Loan Servicing Software: Focused on personal loans, mortgages, auto loans, and other consumer lending products, this type of software emphasizes user-friendly interfaces and robust customer communication tools.

- Specialized Loan Servicing Software: Tailored for specific industries or unique loan types, such as student loans, agricultural loans, or equipment financing. These solutions often include industry-specific features and compliance tools.

- Cloud-Based Loan Servicing Software: Offers flexibility and scalability by leveraging cloud technology. This type of software allows for remote access, easy updates, and seamless integration with other cloud-based tools.

- On-Premises Loan Servicing Software: Installed locally on an institution’s servers, providing greater control over data security and customization options. This is ideal for organizations with stringent data security requirements.

Choosing the right type depends on your specific loan portfolio, operational needs, and technological preferences.

Key Benefits for Financial Institutions

Adopting loan servicing software offers numerous advantages for financial institutions:

- Automation of Routine Tasks: By automating payment processing, account updates, and communications, institutions can reduce manual workload and minimize errors.

- Enhanced Customer Service: Providing timely updates, easy access to account information, and efficient handling of inquiries leads to improved borrower satisfaction and loyalty.

- Regulatory Compliance: Automated compliance checks and comprehensive reporting tools help ensure that all loan servicing activities adhere to relevant laws and regulations, reducing the risk of legal issues.

- Data-Driven Insights: Advanced analytics and reporting capabilities offer valuable insights into loan performance, borrower behavior, and operational efficiency, enabling better decision-making.

- Scalability: As your loan portfolio grows, scalable software solutions can handle increased volumes without compromising performance, allowing for seamless expansion.

- Improved Security: Robust security measures, including data encryption and access controls, protect sensitive borrower information and maintain trust.

- Cost Efficiency: Reducing the need for manual processes and minimizing errors can lead to significant cost savings, improving the institution’s bottom line.

- Competitive Advantage: Implementing advanced loan servicing software can differentiate your institution from competitors by offering superior service and operational efficiency.

These benefits collectively enhance the overall functionality and competitiveness of financial institutions, positioning them for sustained growth and success.

Key Features to Consider in Loan Servicing Solutions

Choosing the right loan servicing software involves evaluating several key features that can significantly impact your operations. These features not only streamline your processes but also enhance customer satisfaction and ensure compliance. Let’s explore the essential features you should look for in a loan servicing solution.

Automated Payment Processing

Automated payment processing is a cornerstone of efficient loan servicing. It ensures that payments are collected, recorded, and applied accurately without manual intervention. This feature typically includes:

- Recurring Payment Schedules: Set up automatic deductions on specific dates, reducing the risk of missed or late payments.

- Multiple Payment Methods: Offer borrowers flexibility by accepting payments via credit cards, bank transfers, ACH, and other methods.

- Payment Reminders and Notifications: Automatically send reminders to borrowers about upcoming payments or notify them of overdue accounts, improving timely repayments.

- Direct Debit and Auto-Pay Options: Enable borrowers to authorize automatic withdrawals from their bank accounts, ensuring seamless and timely payments.

- Integration with Financial Institutions: Connect directly with banks and other financial institutions to streamline payment processing and reconciliation.

By automating these processes, you minimize errors, reduce administrative workload, and enhance the overall efficiency of your loan management.

Customer Relationship Management (CRM) Integration

Integrating Customer Relationship Management (CRM) systems with your loan servicing software can transform how you interact with borrowers. This integration provides a unified platform for managing customer relationships, leading to better service and increased satisfaction. Key aspects include:

- Centralized Customer Data: Access comprehensive borrower profiles that include contact information, payment history, and interaction logs in one place.

- Personalized Communication: Tailor messages and notifications based on borrower behavior and preferences, fostering stronger relationships.

- Automated Follow-Ups: Schedule and automate follow-up communications for payments, renewals, or addressing borrower inquiries.

- Tracking and Monitoring: Keep a detailed record of all interactions, ensuring consistent and informed communication across your team.

- Sales and Marketing Alignment: Align your loan servicing with sales and marketing efforts to identify opportunities for cross-selling or upselling additional financial products.

CRM integration not only enhances borrower interactions but also provides valuable insights into customer behavior and preferences, enabling you to deliver more personalized and effective service.

Compliance and Regulatory Support

Navigating the complex landscape of financial regulations is critical for any lending institution. Loan servicing software with robust compliance and regulatory support helps you stay compliant and avoid costly penalties. Important features include:

- Automated Compliance Checks: Ensure that all loan servicing activities adhere to current laws and regulations through automated checks and validations.

- Audit Trails: Maintain detailed records of all transactions, changes, and communications for easy auditing and reporting.

- Regulatory Reporting: Generate and submit required reports to regulatory bodies with ease, ensuring timely and accurate compliance.

- Policy Management: Implement and manage internal policies to stay aligned with external regulatory requirements.

- Data Privacy Controls: Protect sensitive borrower information in accordance with data protection laws like GDPR and CCPA.

Effective compliance support within your loan servicing software reduces the risk of legal issues and helps maintain the trust of both regulators and borrowers.

Reporting and Analytics Tools

Comprehensive reporting and analytics tools are essential for making informed decisions and optimizing your loan portfolio. These tools provide deep insights into various aspects of your loan operations, including:

- Customizable Reports: Create tailored reports that focus on specific metrics relevant to your business needs, such as loan performance, delinquency rates, and repayment trends.

- Real-Time Analytics: Access up-to-date data that allows you to monitor loan performance and make timely decisions.

- Dashboard Visualization: Utilize intuitive dashboards that present key metrics and trends in an easy-to-understand format, enhancing your ability to quickly grasp important information.

- Predictive Analytics: Leverage advanced analytics to forecast future loan performance, identify potential risks, and implement proactive strategies.

- Performance Metrics Tracking: Monitor essential indicators like default rates, customer retention, and operational efficiency to gauge the health of your loan portfolio.

With robust reporting and analytics, you can gain actionable insights that drive strategic planning, improve operational efficiency, and enhance overall business performance.

Scalability and Customization Options

As your loan portfolio grows, your servicing software needs to scale accordingly. Scalability and customization options ensure that your software can adapt to your evolving needs without compromising performance. Key features include:

- Modular Architecture: Add or remove features as needed, allowing you to customize the software to fit your specific requirements.

- Flexible Configurations: Tailor workflows, user roles, and permissions to match your operational processes and organizational structure.

- Integration Capabilities: Seamlessly connect with other software systems you use, such as accounting, CRM, and ERP systems, to create a unified operational ecosystem.

- User-Defined Fields: Customize data fields to capture information that is unique to your business or industry.

- Performance Scalability: Ensure that the software can handle increasing volumes of transactions and data as your business expands.

Scalable and customizable loan servicing software provides the flexibility to grow with your business, ensuring long-term efficiency and adaptability.

Security Measures and Data Protection

Protecting sensitive borrower information is paramount in loan servicing. Robust security measures and data protection features safeguard your data against breaches and unauthorized access. Essential security features include:

- Data Encryption: Encrypt data both in transit and at rest to protect it from unauthorized access and cyber threats.

- Access Controls: Implement role-based access controls to ensure that only authorized personnel can access sensitive information.

- Multi-Factor Authentication (MFA): Add an extra layer of security by requiring multiple forms of verification for user access.

- Regular Security Audits: Conduct frequent security assessments and vulnerability scans to identify and address potential threats.

- Data Backup and Recovery: Ensure that your data is regularly backed up and can be quickly restored in the event of a breach or data loss.

- Compliance with Security Standards: Adhere to industry-standard security protocols and certifications, such as ISO 27001 and SOC 2, to ensure robust data protection.

Comprehensive security measures not only protect your data but also build trust with your borrowers by demonstrating your commitment to safeguarding their information.

By carefully evaluating these key features, you can select a loan servicing solution that not only meets your current needs but also supports your future growth and ensures the highest levels of efficiency, compliance, and customer satisfaction.

Top Loan Servicing Software Solutions

Choosing the right loan servicing software is pivotal for optimizing your loan management processes and ensuring seamless operations. Below are some of the leading loan servicing solutions available today, each offering unique features and benefits tailored to different types of financial institutions.

Fiserv LoanServ

Fiserv LoanServ stands out as a comprehensive loan servicing platform known for its robust functionality and scalability. It caters to a wide range of loan types, including consumer, mortgage, and commercial loans. LoanServ automates key processes such as payment processing, collections, and compliance management, significantly reducing manual workload and minimizing errors.

One of the key strengths of Fiserv LoanServ is its advanced reporting and analytics tools, which provide deep insights into loan performance and borrower behavior. These tools help financial institutions make informed decisions and optimize their loan portfolios. Additionally, LoanServ offers seamless integration capabilities, ensuring smooth connectivity with other financial systems and enhancing overall operational efficiency.

Fiserv LoanServ is ideal for mid to large-sized financial institutions seeking a reliable and scalable solution to manage diverse loan portfolios. Its strong focus on compliance and reporting makes it a preferred choice for organizations that need to adhere to stringent regulatory requirements while maintaining efficient operations.

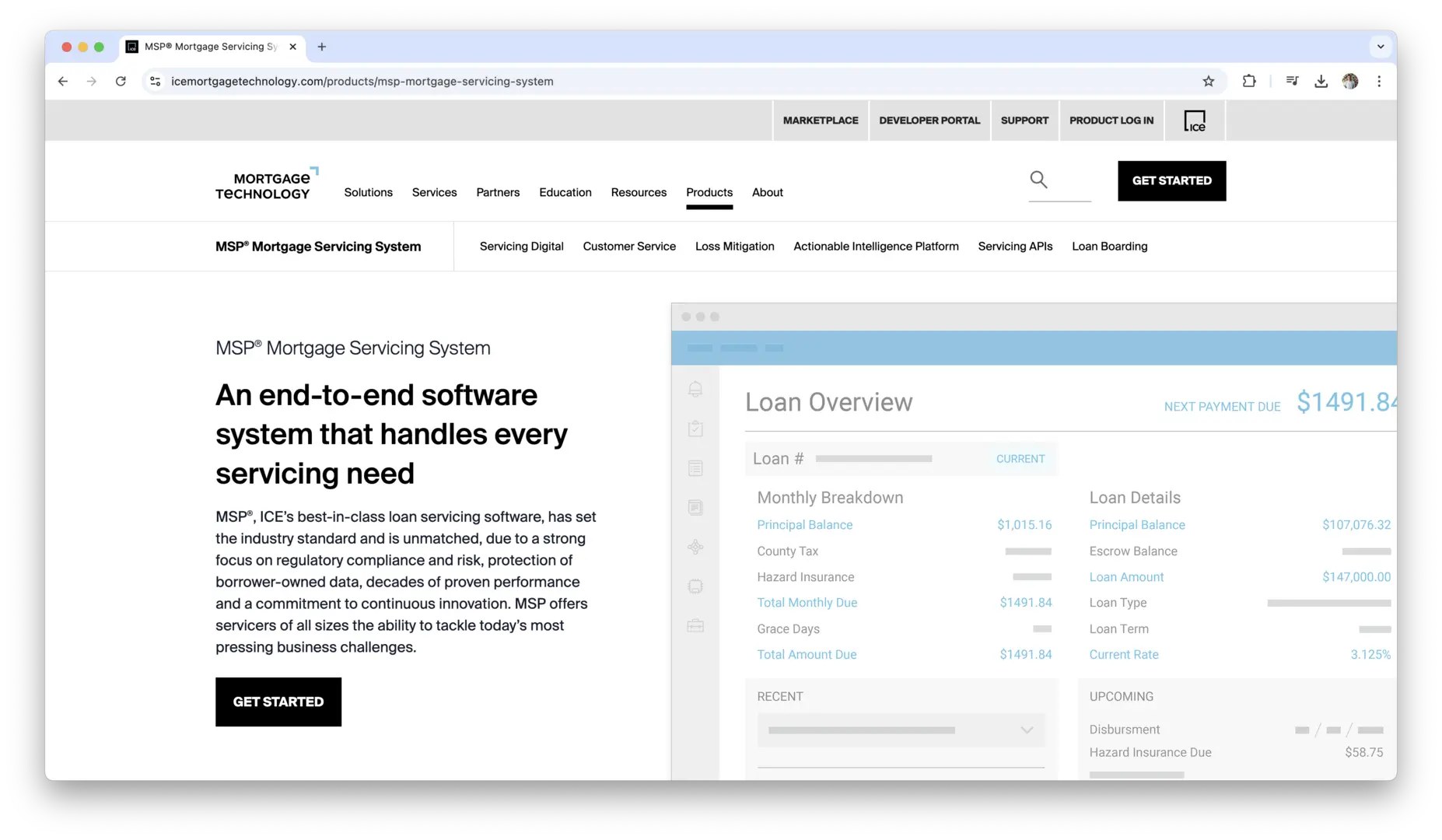

Black Knight MSP

MSP Mortgage Servicing System is a leading loan servicing software solution renowned for its comprehensive features and robust support system. Designed to handle a wide range of loan types, including mortgages, student loans, and consumer loans, MSP offers end-to-end automation of loan servicing tasks. This includes everything from payment processing and escrow management to delinquency handling and investor reporting.

A standout feature of Black Knight MSP is its advanced data analytics and business intelligence capabilities, which enable lenders to make informed decisions based on real-time data. The platform also provides extensive integration options, allowing it to work seamlessly with other financial systems and third-party applications. This ensures that financial institutions can maintain a unified and efficient operational environment.

Black Knight MSP is well-suited for large financial institutions and servicers that manage extensive loan portfolios and require a high level of customization and scalability. Its strong emphasis on data security and compliance ensures that lenders can meet regulatory requirements while maintaining efficient and reliable operations.

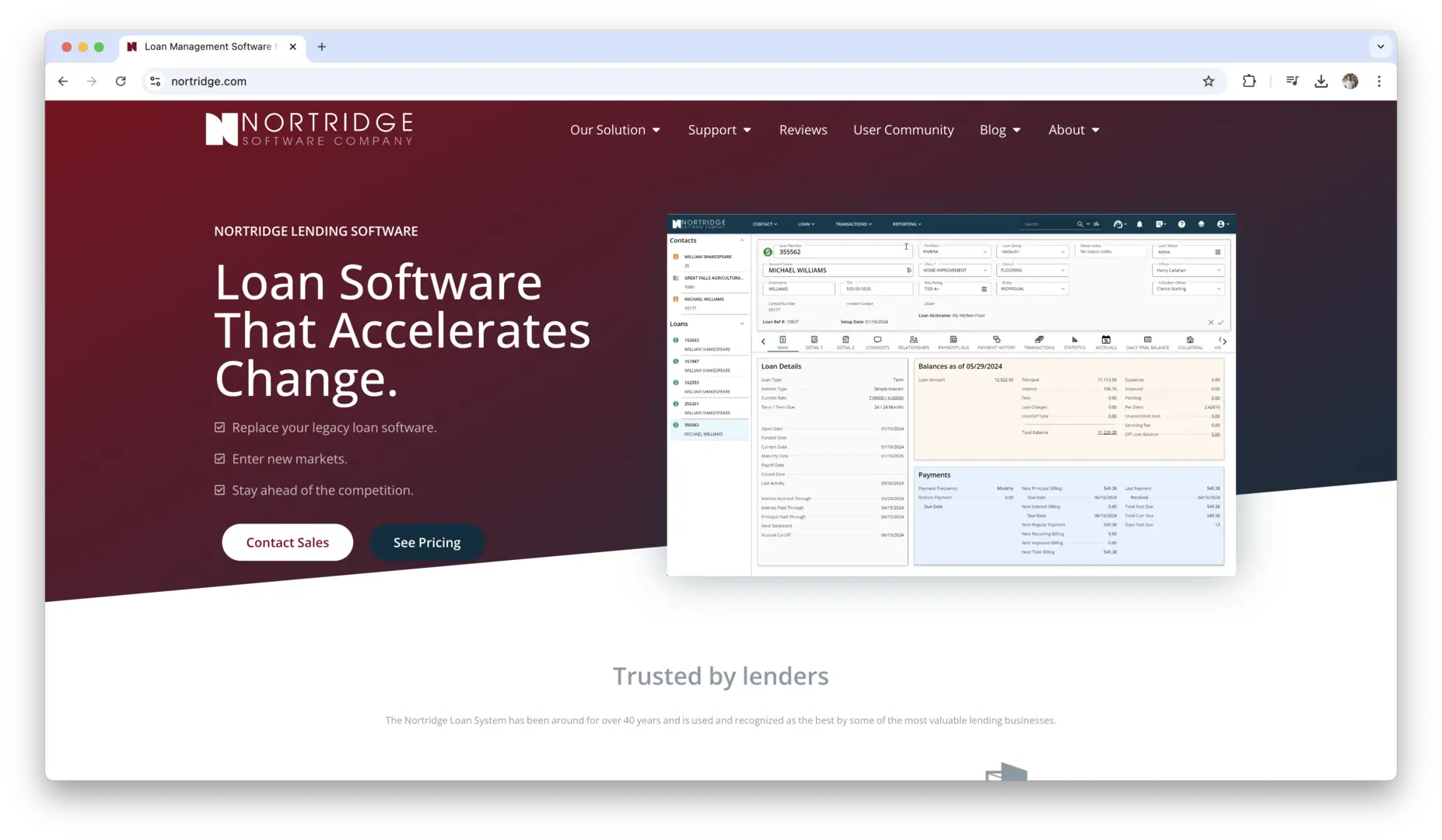

Nortridge Loan Software

Nortridge Loan Software is a versatile loan servicing platform designed to accommodate a variety of lending scenarios, including consumer loans, commercial loans, and equipment financing. Known for its flexibility and customization options, Nortridge allows users to tailor the software to meet specific business needs without extensive coding or technical expertise.

The software features comprehensive payment processing capabilities, detailed account management tools, and robust reporting functions. Its user-friendly interface simplifies the management of complex loan structures and enhances overall operational efficiency. Additionally, Nortridge offers strong integration capabilities, enabling seamless connectivity with other business systems and applications.

Nortridge Loan Software is an excellent choice for small to medium-sized financial institutions and lenders who require a customizable and adaptable loan servicing solution. Its ease of use and flexibility make it ideal for organizations that need to manage a diverse range of loan products and structures, ensuring that they can scale and adapt as their business grows.

LoanPro

LoanPro is a modern loan servicing platform that emphasizes flexibility, scalability, and ease of use. Designed to serve a wide range of loan types, including consumer loans, business loans, and mortgage loans, LoanPro offers a cloud-based solution that provides real-time access to loan data, enabling lenders to manage their portfolios efficiently from anywhere.

The platform includes features such as automated payment processing, comprehensive account management, and advanced reporting and analytics tools. LoanPro’s API-driven architecture allows for extensive customization and integration with other financial systems, providing a seamless and adaptable solution for growing lenders.

LoanPro is ideal for both new and established financial institutions looking for a scalable and flexible loan servicing solution. Its cloud-based infrastructure ensures that it can easily accommodate growth and adapt to changing business needs, making it a suitable choice for organizations aiming for long-term success and operational excellence.

Shaw Systems’ LoanServ

Shaw Systems’ LoanServ is a robust loan servicing software solution tailored for banks, credit unions, and other financial institutions. It offers a comprehensive suite of features designed to streamline loan management processes, including payment processing, account management, collections, and compliance monitoring.

LoanServ excels in its focus on customer service and borrower engagement, providing tools that enhance communication and improve the overall borrower experience. The platform’s advanced reporting and analytics capabilities allow lenders to gain valuable insights into loan performance and operational efficiency, supporting informed decision-making.

Shaw Systems’ LoanServ is well-suited for financial institutions of all sizes that prioritize customer satisfaction and operational efficiency. Its comprehensive feature set and reliable performance make it a trusted choice for lenders seeking a dependable and effective loan servicing solution.

Finastra Loan Management

Finastra Loan Management is a comprehensive loan servicing solution that caters to a wide array of financial institutions, including banks, credit unions, and non-bank lenders. The platform offers robust functionalities such as end-to-end loan lifecycle management, automated payment processing, and advanced compliance features. Finastra’s intuitive interface and user-friendly design make it easy for staff to navigate and manage loan portfolios efficiently.

One of the key advantages of Finastra Loan Management is its powerful integration capabilities, which allow seamless connectivity with other core banking systems and third-party applications. This ensures that financial institutions can maintain a unified and efficient operational environment. Additionally, Finastra provides extensive reporting and analytics tools that offer deep insights into loan performance, borrower behavior, and operational metrics.

Finastra Loan Management is ideal for mid to large-sized financial institutions that require a scalable and flexible loan servicing solution. Its focus on automation, compliance, and integration makes it a valuable tool for organizations aiming to enhance their loan management processes and achieve operational excellence.

Temenos Loan Servicing

Temenos Loan Servicing is a cutting-edge loan management platform designed to meet the needs of modern financial institutions. The platform offers comprehensive features such as loan origination, payment processing, account management, and delinquency management. Temenos Loan Servicing is built on a flexible architecture that supports both on-premises and cloud deployments, providing financial institutions with the flexibility to choose the deployment model that best suits their needs.

One of the standout features of Temenos Loan Servicing is its advanced analytics and reporting capabilities, which provide actionable insights into loan performance and borrower behavior. The platform also offers seamless integration with other Temenos products and third-party applications, ensuring a cohesive and efficient operational environment.

Temenos Loan Servicing is ideal for large financial institutions and lenders that require a robust and scalable solution to manage diverse loan portfolios. Its emphasis on flexibility, integration, and advanced analytics makes it a powerful tool for organizations looking to optimize their loan servicing operations and drive growth.

MeridianLink LoanServ

MeridianLink LoanServ is a comprehensive loan servicing platform designed to streamline the entire loan lifecycle for financial institutions. It caters to a variety of loan types, including consumer, mortgage, and commercial loans. LoanServ automates essential processes such as payment processing, account management, and collections, ensuring efficiency and accuracy in loan servicing operations.

A standout feature of MeridianLink LoanServ is its robust integration capabilities, allowing seamless connectivity with other core banking systems and third-party applications. This ensures that data flows smoothly across different platforms, enhancing operational coherence. Additionally, the platform offers advanced reporting and analytics tools that provide deep insights into loan performance and borrower behavior, enabling informed decision-making.

MeridianLink LoanServ is ideal for mid to large-sized financial institutions that require a scalable and flexible loan servicing solution. Its strong emphasis on integration and comprehensive functionality makes it a preferred choice for organizations seeking to optimize their loan management processes while maintaining high levels of accuracy and compliance.

LoanAssistant

LoanAssistant is a user-friendly loan servicing software designed to simplify the management of various loan types, including personal loans, mortgages, and small business loans. The platform offers essential features such as automated payment processing, detailed account management, and streamlined collections processes, ensuring efficient loan servicing operations.

One of the key strengths of LoanAssistant is its intuitive interface, which makes it easy for users to navigate and manage loan portfolios without extensive training. The software also includes robust reporting and analytics tools that provide valuable insights into loan performance, repayment trends, and portfolio health, enabling lenders to make informed decisions.

LoanAssistant is an excellent choice for small to medium-sized financial institutions and lenders looking for an easy-to-use and cost-effective loan servicing solution. Its user-friendly design and essential functionality make it ideal for organizations seeking to enhance their loan management processes without the complexity of more extensive platforms.

CashVue

CashVue is a specialized loan servicing software designed to streamline the management of consumer loans, including personal loans, auto loans, and credit card debt. The platform offers a range of features such as automated payment processing, detailed account management, and efficient collections processes, ensuring effective loan servicing operations.

One of the key strengths of CashVue is its focus on enhancing borrower engagement through personalized communication tools. The software enables lenders to send targeted messages and notifications, improving borrower satisfaction and retention. Additionally, CashVue provides robust reporting and analytics tools that offer valuable insights into loan performance, repayment trends, and portfolio health, enabling informed decision-making.

CashVue is an excellent choice for small to medium-sized financial institutions and lenders specializing in consumer loans. Its focus on borrower engagement and comprehensive functionality make it an ideal solution for organizations looking to enhance their loan management processes while maintaining high levels of customer satisfaction.

SLI Systems

SLI Systems is a comprehensive loan servicing platform designed to manage a wide variety of loan types, including personal loans, mortgages, and commercial loans. The platform offers features such as automated payment processing, detailed account management, and advanced collections tools, ensuring efficient and accurate loan servicing operations.

A standout feature of SLI Systems is its robust compliance and regulatory support, which helps lenders adhere to evolving laws and regulations. The platform also includes powerful reporting and analytics tools that provide deep insights into loan performance, borrower behavior, and portfolio health, enabling data-driven decision-making and strategic planning.

SLI Systems is ideal for mid to large-sized financial institutions and lenders seeking a scalable and compliant loan servicing solution. Its strong focus on compliance and comprehensive functionality makes it a reliable choice for organizations aiming to optimize their loan management processes while maintaining high levels of accuracy and regulatory adherence.

Finexio Loan Servicing

Finexio Loan Servicing is an advanced platform designed to manage the full lifecycle of loans for financial institutions and lenders. It supports a variety of loan types, including personal loans, mortgages, and commercial loans, offering features such as automated payment processing, detailed account management, and efficient collections processes. Finexio emphasizes operational efficiency and accuracy, ensuring that loan servicing tasks are handled seamlessly.

One of the key strengths of Finexio Loan Servicing is its robust integration capabilities, allowing seamless connectivity with other financial systems and third-party applications. This ensures that data flows smoothly across different platforms, enhancing operational coherence. Additionally, the platform offers powerful reporting and analytics tools that provide deep insights into loan performance, borrower behavior, and portfolio health, enabling informed decision-making.

Finexio Loan Servicing is ideal for mid to large-sized financial institutions and lenders seeking a scalable and flexible loan servicing solution. Its comprehensive functionality and strong integration capabilities make it a preferred choice for organizations aiming to optimize their loan management processes while maintaining high levels of accuracy and compliance.

How to Choose the Best Loan Servicing Software?

Selecting the ideal loan servicing software is a critical decision that can significantly impact your organization’s efficiency, customer satisfaction, and compliance. With numerous options available, it’s essential to approach this choice methodically. Here’s a comprehensive guide to help you navigate the selection process effectively.

Assessing Organizational Needs

Understanding your organization’s specific requirements is the first step in choosing the right loan servicing software. Begin by evaluating the following aspects:

- Loan Types and Complexity: Identify the types of loans you manage, such as personal loans, mortgages, auto loans, or commercial loans. Consider the complexity of these loans, including interest calculations, repayment schedules, and any special terms.

- Volume of Loans: Assess the number of loans you process annually. High-volume institutions may require software that can handle large datasets efficiently without compromising performance.

- Current Processes and Workflows: Map out your existing loan servicing workflows. Determine which processes are manual and could benefit from automation, and identify any bottlenecks or areas needing improvement.

- Integration Requirements: Consider the other systems you use, such as accounting software, CRM platforms, or ERP systems. The loan servicing software should seamlessly integrate with these tools to ensure smooth data flow and operational coherence.

- User Roles and Permissions: Define the different user roles within your organization and their access levels. The software should support role-based access controls to maintain data security and operational integrity.

- Customization Needs: Determine the level of customization you require. Whether it’s customizing reports, workflows, or user interfaces, ensure the software can be tailored to fit your unique needs.

By thoroughly assessing these factors, you can identify the features and functionalities that are most important for your organization, ensuring that the software you choose aligns perfectly with your operational requirements.

Budget Considerations

Budget is a fundamental factor when selecting loan servicing software. It’s essential to balance cost with the features and benefits the software offers. Here’s how to approach budget considerations:

- Initial Costs: Evaluate the upfront costs, including licensing fees, setup charges, and any costs associated with data migration. Some software solutions may offer a one-time purchase price, while others operate on a subscription model.

- Ongoing Expenses: Consider recurring costs such as monthly or annual subscription fees, maintenance charges, and costs for regular updates or upgrades. Additionally, factor in expenses for customer support and training.

- Hidden Fees: Be aware of any hidden costs that may not be immediately apparent, such as fees for additional users, extra features, or integration with other systems.

- Return on Investment (ROI): Analyze the potential ROI by considering how the software can improve efficiency, reduce errors, and enhance customer satisfaction. A higher initial investment might be justified if it leads to significant long-term savings and revenue growth.

- Scalability Costs: Ensure that the software can scale with your business without exorbitant cost increases. As your loan portfolio grows, the software should accommodate the increased demand without substantial price hikes.

- Budget Flexibility: Determine how flexible your budget is and whether you can accommodate unexpected expenses. It’s wise to allocate a portion of your budget for unforeseen costs related to implementation or additional training.

By carefully evaluating these budget aspects, you can choose a loan servicing software that offers the best value for your investment, ensuring that it meets your needs without straining your financial resources.

Evaluating Scalability and Future Growth

Your loan servicing software should not only meet your current needs but also support your organization’s future growth. Here’s what to consider when evaluating scalability and future growth:

- Capacity to Handle Growth: Ensure the software can manage an increasing number of loans and users as your business expands. It should maintain performance levels even as transaction volumes grow.

- Modular Architecture: Look for software with a modular design that allows you to add new features and functionalities as needed. This flexibility ensures that you can adapt the software to evolving business requirements without overhauling your entire system.

- Performance and Reliability: Assess the software’s ability to maintain high performance and reliability under increased loads. Reliable software minimizes downtime and ensures consistent service to your borrowers.

- Future-Proof Features: Choose software that incorporates emerging technologies and trends, such as artificial intelligence, machine learning, and advanced analytics. This ensures that your software remains relevant and can leverage new advancements to enhance your operations.

- Vendor Support and Roadmap: Investigate the software vendor’s commitment to future development and support. A vendor with a clear product roadmap and a history of regular updates is more likely to provide a scalable solution that evolves with your needs.

- Flexible Licensing Options: Consider licensing models that accommodate growth, such as tiered pricing or user-based licenses. This flexibility allows you to scale your usage and costs in line with your business expansion.

- Data Management Capabilities: Ensure the software can efficiently handle larger datasets and more complex data structures as your loan portfolio grows. Robust data management is crucial for maintaining performance and accuracy.

- Customization and Integration: As your business grows, you may need to integrate additional tools or customize workflows further. The software should support extensive customization and seamless integration with other systems to facilitate growth.

By focusing on scalability and future growth, you ensure that your loan servicing software remains a valuable asset, supporting your organization’s expansion and adapting to new challenges and opportunities.

Trial Periods and Demos

Before committing to a loan servicing software, it’s crucial to thoroughly evaluate its capabilities through trial periods and demos. These hands-on experiences can provide invaluable insights into how well the software meets your needs. Here’s how to make the most of trial periods and demos:

- Request a Live Demo: Engage with the software provider to schedule a live demonstration. This allows you to see the software in action, ask questions, and observe how its features work in real-time.

- Use the Trial Period Wisely: If a trial version is available, use it to explore the software’s functionalities extensively. Test key features, simulate typical workflows, and assess the user interface’s intuitiveness.

- Involve Your Team: Include different stakeholders in the trial and demo process, such as loan officers, IT staff, and customer service representatives. Their diverse perspectives can help identify strengths and potential issues that may not be apparent to a single user.

- Evaluate Ease of Use: Assess how easy the software is to navigate and use. A user-friendly interface can reduce training time and increase adoption rates among your team.

- Test Integration Capabilities: During the trial, attempt to integrate the software with your existing systems. Evaluate how smoothly data flows between platforms and identify any compatibility issues.

- Assess Performance: Monitor the software’s performance during the trial. Check for speed, responsiveness, and reliability, especially when handling multiple tasks or large datasets.

- Gather Feedback: Collect feedback from all users involved in the trial. Their experiences and opinions can provide a comprehensive understanding of the software’s effectiveness and suitability for your organization.

- Evaluate Customer Support: Interact with the software provider’s support team during the trial period. Assess their responsiveness, knowledge, and willingness to assist with any issues or questions you may have.

- Compare with Other Options: Use the insights gained from the trial and demo to compare different software options. This comparative analysis can help you make an informed decision based on firsthand experience rather than just theoretical features.

By thoroughly utilizing trial periods and demos, you can gain a clear understanding of how well the loan servicing software fits your organization’s needs, ensuring that you choose a solution that enhances your operations and delivers tangible benefits.

Reading Reviews and Seeking Recommendations

Gathering insights from existing users and industry experts can significantly influence your decision when selecting loan servicing software. Here’s how to effectively use reviews and recommendations in your selection process:

- Online Reviews and Ratings: Explore reviews on reputable platforms like G2, Capterra, and Trustpilot. These reviews provide honest feedback from actual users, highlighting the software’s strengths and weaknesses.

- Case Studies and Testimonials: Read case studies and testimonials on the software provider’s website or third-party sites. These documents offer detailed accounts of how the software has been implemented and the benefits it has delivered to other organizations.

- Industry Forums and Communities: Participate in industry-specific forums, LinkedIn groups, and online communities. Engaging with peers in these spaces can provide valuable recommendations and warnings based on firsthand experiences.

- Peer Recommendations: Reach out to colleagues, partners, or other financial institutions that have implemented loan servicing software. Their personal experiences can offer practical insights and help you avoid common pitfalls.

- Professional Networks: Utilize your professional network to seek advice from industry experts or consultants who specialize in loan servicing software. Their expertise can guide you toward the best solutions tailored to your needs.

- Independent Reviews and Reports: Refer to independent reviews and analyst reports from organizations like Gartner or Forrester. These reports often provide in-depth evaluations and comparisons of different software solutions based on rigorous criteria.

- Social Media Insights: Monitor social media channels for discussions about loan servicing software. Platforms like Twitter, LinkedIn, and Facebook can reveal user sentiments and trending opinions about various software options.

- Ask Specific Questions: When seeking recommendations, ask specific questions about features, support, scalability, and any challenges faced during implementation. Detailed inquiries can elicit more useful and relevant responses.

- Evaluate the Source: Consider the credibility and relevance of the sources providing reviews and recommendations. Focus on feedback from users with similar needs and organizational sizes to yours for the most applicable insights.

Incorporating reviews and recommendations into your decision-making process ensures that you benefit from the collective wisdom and experiences of others, helping you choose a loan servicing software that is reliable, effective, and well-suited to your organization’s unique requirements.

By carefully assessing your organizational needs, considering your budget, evaluating scalability, utilizing trial periods and demos, and leveraging reviews and recommendations, you can make an informed and confident decision when selecting the right loan servicing software. This thorough approach ensures that the software you choose not only meets your current requirements but also supports your organization’s growth and success in the long term.

Loan Servicing Software Implementation Best Practices

Successfully implementing loan servicing software requires strategic planning and meticulous execution. Adhering to best practices ensures a smooth transition, minimizes disruptions, and maximizes the software’s benefits for your organization. Here are key practices to guide you through the implementation process:

- Planning and Strategy Development: Clearly define your implementation goals and objectives. Develop a comprehensive project plan that outlines each phase of the implementation, sets realistic timelines, and assigns responsibilities to team members. Establish clear milestones to track progress and ensure that all stakeholders are aligned with the overall strategy.

- Data Migration and Integration: Prepare your existing data by cleaning and organizing it to eliminate duplicates and errors. Choose reliable data migration tools to transfer your data securely and accurately to the new system. Ensure that the loan servicing software integrates seamlessly with your existing systems, such as accounting, CRM, and ERP platforms, to maintain data consistency and streamline operations.

- Training Staff and Change Management: Invest in thorough training programs to educate your team on how to use the new software effectively. Provide hands-on training sessions, comprehensive user manuals, and access to support resources. Implement change management strategies to address any resistance, communicate the benefits of the new system, and foster a culture of adaptability and continuous improvement.

- Monitoring and Optimization Post-Implementation: After the software is deployed, continuously monitor its performance to identify any issues or areas for improvement. Gather feedback from users to understand their experiences and address any challenges they encounter. Regularly update the software to incorporate new features, security patches, and enhancements. Optimize workflows and processes based on performance data and user input to ensure the system remains efficient and aligned with your organization’s evolving needs.

- Communication and Collaboration: Maintain open lines of communication among all stakeholders throughout the implementation process. Encourage collaboration between IT, loan servicing teams, and other departments to ensure that everyone is informed and involved. Regular meetings and updates can help identify potential problems early and facilitate swift resolution.

- Risk Management: Identify potential risks associated with the implementation, such as data breaches, system downtimes, or budget overruns. Develop contingency plans to mitigate these risks and ensure that you can respond effectively to any unexpected challenges that arise during the implementation process.

- Testing and Quality Assurance: Conduct thorough testing of the loan servicing software before full deployment. Perform functionality tests, stress tests, and user acceptance testing to ensure that the software meets your requirements and operates smoothly under various conditions. Address any issues identified during testing to ensure a reliable and robust system.

- Documentation and Knowledge Management: Create detailed documentation of the implementation process, including configurations, customizations, and integration points. Maintain a knowledge base that users can reference for troubleshooting and best practices. Proper documentation ensures that your team can effectively manage and utilize the software long after the initial implementation.

By following these implementation best practices, you can ensure that your loan servicing software is deployed successfully, operates efficiently, and continues to support your organization’s goals and growth.

Conclusion

Choosing the right loan servicing software is a vital decision that can transform how you manage your loan portfolio. The right software not only streamlines your operations but also enhances customer satisfaction and ensures compliance with ever-evolving regulations. By understanding the key features to look for, such as automated payment processing, CRM integration, compliance support, robust reporting, scalability, and strong security measures, you can make an informed choice that aligns with your organization’s unique needs. Exploring top solutions like Fiserv LoanServ, Black Knight MSP, Nortridge Loan Software, and others provides a clear picture of what each platform offers, helping you identify the best fit for your specific requirements.

As you move forward, remember to thoroughly assess your organizational needs, consider your budget, evaluate scalability for future growth, take advantage of trial periods and demos, and seek out reviews and recommendations from trusted sources. Implementing best practices during the deployment phase will ensure a smooth transition and maximize the benefits of your chosen software. By taking these steps, you can enhance your loan management processes, improve operational efficiency, and deliver exceptional service to your borrowers. Investing in the right loan servicing software is not just about keeping up with the competition; it’s about building a foundation for long-term success and fostering strong, trustworthy relationships with your customers.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.