Are you ready to navigate the complex terrain of venture capital investments with precision and confidence? In this guide, we’ll explore a suite of powerful tools—venture capital templates—that will empower you to make informed decisions, uncover hidden insights, and foster the growth of startups in your portfolio. Whether you’re a seasoned venture capitalist or just beginning your journey in the world of startup investments, these templates are your compass to success in the ever-evolving landscape of innovation and entrepreneurship.

What are Venture Capital Templates?

Venture Capital Templates are specialized tools designed to assist venture capitalists in evaluating startup investment opportunities. These templates are typically spreadsheet-based, offering a structured framework to analyze various aspects of a startup’s potential. From financial projections to customer behavior analysis, venture capital templates provide a systematic approach to assessing the viability and growth potential of startups.

The Components of Venture Capital Templates

Venture Capital Templates encompass a wide range of components, each tailored to address specific aspects of startup evaluation:

- Financial Projections: These templates help you project a startup’s future financial performance, including revenue, expenses, and profitability. They often include income statements, balance sheets, and cash flow projections.

- Customer Metrics: Templates for customer analysis allow you to assess factors like Customer Lifetime Value (CLV), Customer Acquisition Cost (CAC), cohort analysis, and user engagement. They help you understand the sustainability of a startup’s business model.

- Performance Dashboards: Some templates focus on presenting key performance indicators (KPIs) in a visually intuitive format. This makes it easier to track and monitor a startup’s growth, such as Monthly Recurring Revenue (MRR) or user retention rates.

- Workforce Planning: Workforce planning templates assist in managing and optimizing a startup’s human resources. They help in determining hiring needs, budgets, and recruitment timelines.

The Benefits of Using Venture Capital Templates

Venture Capital Templates offer numerous advantages to venture capitalists:

- Efficiency: Templates streamline the evaluation process, saving time and effort that would otherwise be spent on manual calculations and data analysis.

- Data-Driven Decisions: They provide a structured approach to data analysis, enabling you to make informed decisions based on reliable financial projections and metrics.

- Consistency: Templates ensure a consistent evaluation methodology across different startups, reducing subjectivity and enhancing comparability.

- Scenario Analysis: You can experiment with different scenarios by adjusting variables within the templates, allowing for a comprehensive risk assessment.

- Communication: Templates facilitate clear and concise communication of your findings with stakeholders, including other investors and startup founders.

Importance of Using Templates in VC Evaluation

Venture capitalists operate in a high-stakes, data-intensive environment where the accuracy of investment decisions can greatly impact returns. The importance of using templates in venture capital evaluation cannot be overstated. Here are key reasons why templates are integral to the process:

- Structured Analysis: Templates provide a structured framework for assessing startups, ensuring that critical aspects are not overlooked. They guide your evaluation process, from gathering data to drawing conclusions.

- Data Consistency: Consistency is crucial when comparing different investment opportunities. Templates standardize data inputs and calculations, allowing for apples-to-apples comparisons.

- Efficiency: In a fast-paced industry, time is of the essence. Templates automate complex calculations, reducing the time required for due diligence and allowing you to evaluate more opportunities.

- Risk Mitigation: By conducting scenario analysis within templates, you can identify potential risks and their impact on a startup’s financial health. This proactive approach aids in risk mitigation.

- Objective Decision-Making: Templates promote objectivity by relying on data and predefined metrics rather than gut feeling or intuition. This data-driven approach enhances the credibility of your investment decisions.

- Effective Communication: Templates produce visual reports and summaries that are easily understood by stakeholders, enhancing communication and transparency.

Venture capital templates serve as indispensable tools that empower venture capitalists to conduct thorough, consistent, and data-driven evaluations of startup investment opportunities. They enable efficient due diligence, mitigate risks, and contribute to informed decision-making in the dynamic world of venture capital.

Top Venture Capital Templates

In the world of venture capital, having the right tools at your disposal can make all the difference in making sound investment decisions. Let’s delve deeper into some of the top venture capital templates that can empower you to assess startups effectively.

Venture capital is a dynamic and ever-evolving field, and to make well-informed investment decisions, you need the right tools at your disposal. In this section, we’ll delve into some of the top venture capital templates that can be your guiding lights in assessing startup opportunities.

1. Financial Model Template

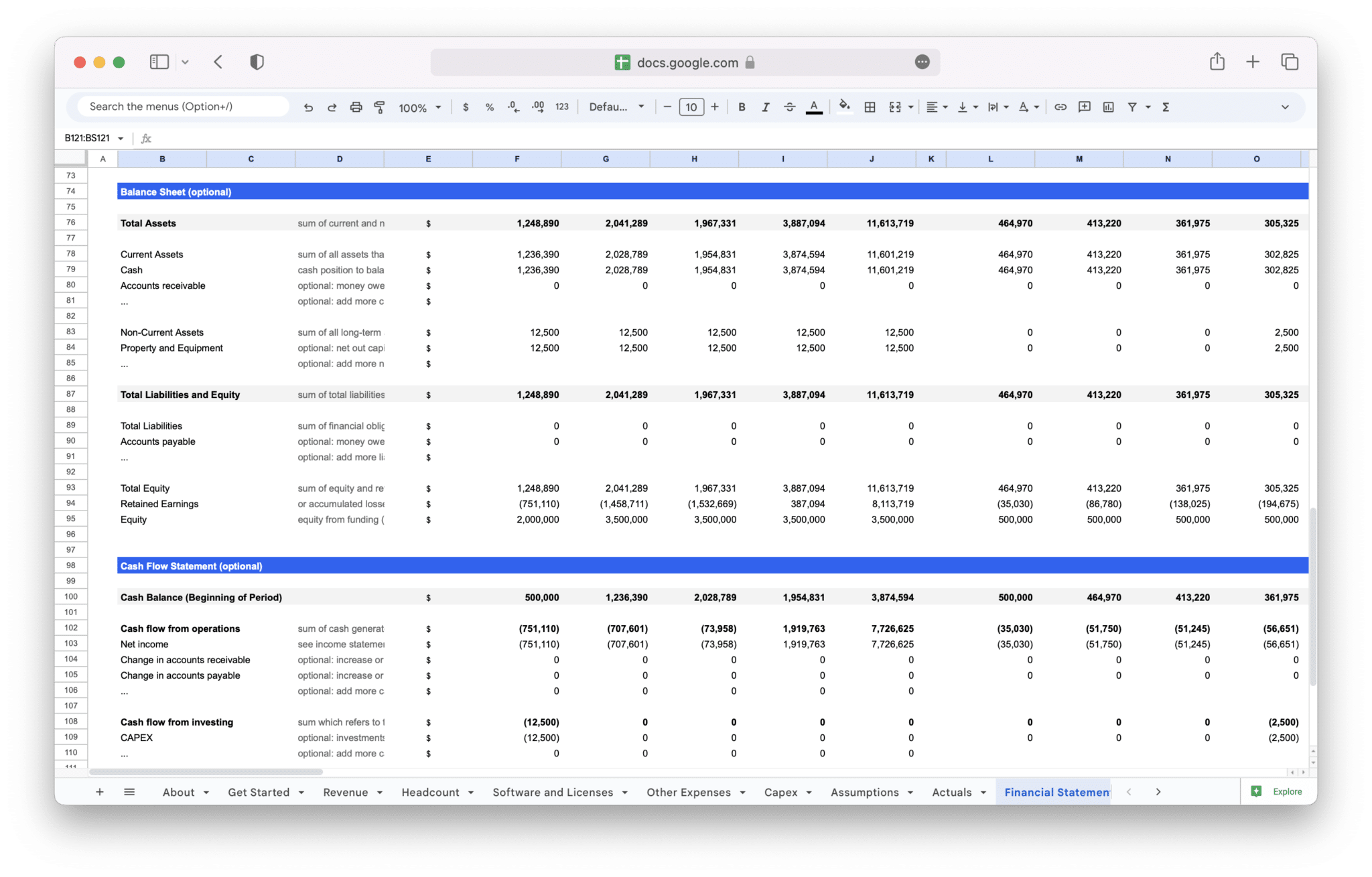

The Financial Model Template is a comprehensive spreadsheet-based tool designed to provide a clear picture of a startup’s financial health and growth potential. It takes historical and projected financial data to create forecasts and projections, enabling venture capitalists to assess the financial viability of an investment.

There are several variations of the Financial Model Template tailored to specific industries or use cases:

- Standard Financial Model Template: This versatile template serves as a powerful financial compass for businesses across various industries. It empowers stakeholders to gain clarity on a company’s financial health, profitability, and growth potential. With historical and projected financial data, it enables investors to make informed decisions and assess the feasibility of investments in standard business contexts.

- Startup Financial Model Template: Designed exclusively for early-stage startups, this template specializes in addressing the challenges faced by emerging businesses. It shines a spotlight on crucial aspects such as runway analysis, burn rate, and funding needs. Venture capitalists can use it to understand the financial viability of startups with limited historical data, making it an invaluable tool for nurturing promising new ventures.

- SaaS Financial Model Template: Tailored for Software as a Service (SaaS) companies, this template hones in on the unique financial dynamics of subscription-based businesses. It delves deep into metrics like Monthly Recurring Revenue (MRR), Customer Acquisition Cost (CAC), and Customer Lifetime Value (CLV). By providing specific insights for SaaS startups, it equips venture capitalists to evaluate the financial stability and scalability of subscription-based models effectively.

- E-Commerce Financial Model Template: For e-commerce ventures, this template is a game-changer. It focuses on aspects critical to online retail, such as inventory management, sales forecasting, and transaction processing costs. By tailoring revenue projections, expense management, and profit analysis to the e-commerce industry, it enables venture capitalists to navigate the complexities of online retail investments with precision.

- Marketplace Financial Model Template: Marketplace businesses have their own set of financial intricacies, and this template is designed to address them comprehensively. It provides insights into commission-based revenue models, user acquisition costs, and marketplace liquidity. Venture capitalists can leverage this template to assess investments in platforms connecting buyers and sellers, facilitating sound decision-making in this distinct sector.

Each of these tailored versions of the Financial Model Template provides a specialized approach to financial analysis, catering to the specific needs and characteristics of different business types, thereby enabling more accurate and relevant assessment by venture capitalists.

Components of the Financial Model Template

- Revenue Projections: This section estimates future revenue streams based on various sources, such as product sales, subscriptions, or advertising income.

- Expense Projections: It outlines all anticipated expenses, including fixed and variable costs, providing a holistic view of the startup’s financial obligations.

- Cash Flow Analysis: This part helps you understand how cash moves in and out of the startup, including operating, investing, and financing activities.

- Profit and Loss Statement: A detailed P&L statement summarizes the startup’s revenue, costs, and overall profitability.

Benefits of the Financial Model Template

- Data-Driven Decision Making: Venture capitalists can rely on concrete financial projections, reducing guesswork in investment decisions.

- Scenario Analysis: By experimenting with different assumptions, you can explore various scenarios and understand the impact on the startup’s financials.

- Investor Communication: The template helps in conveying a startup’s financial potential to stakeholders effectively.

Use Cases of the Financial Model Template

- Early-Stage Startups: Assess the financial viability of startups with limited historical data.

- Due Diligence: Conduct in-depth financial analysis during the due diligence process.

- Portfolio Management: Track and manage the financial health of your existing investments.

2. Profit and Loss (P&L) Statement Template

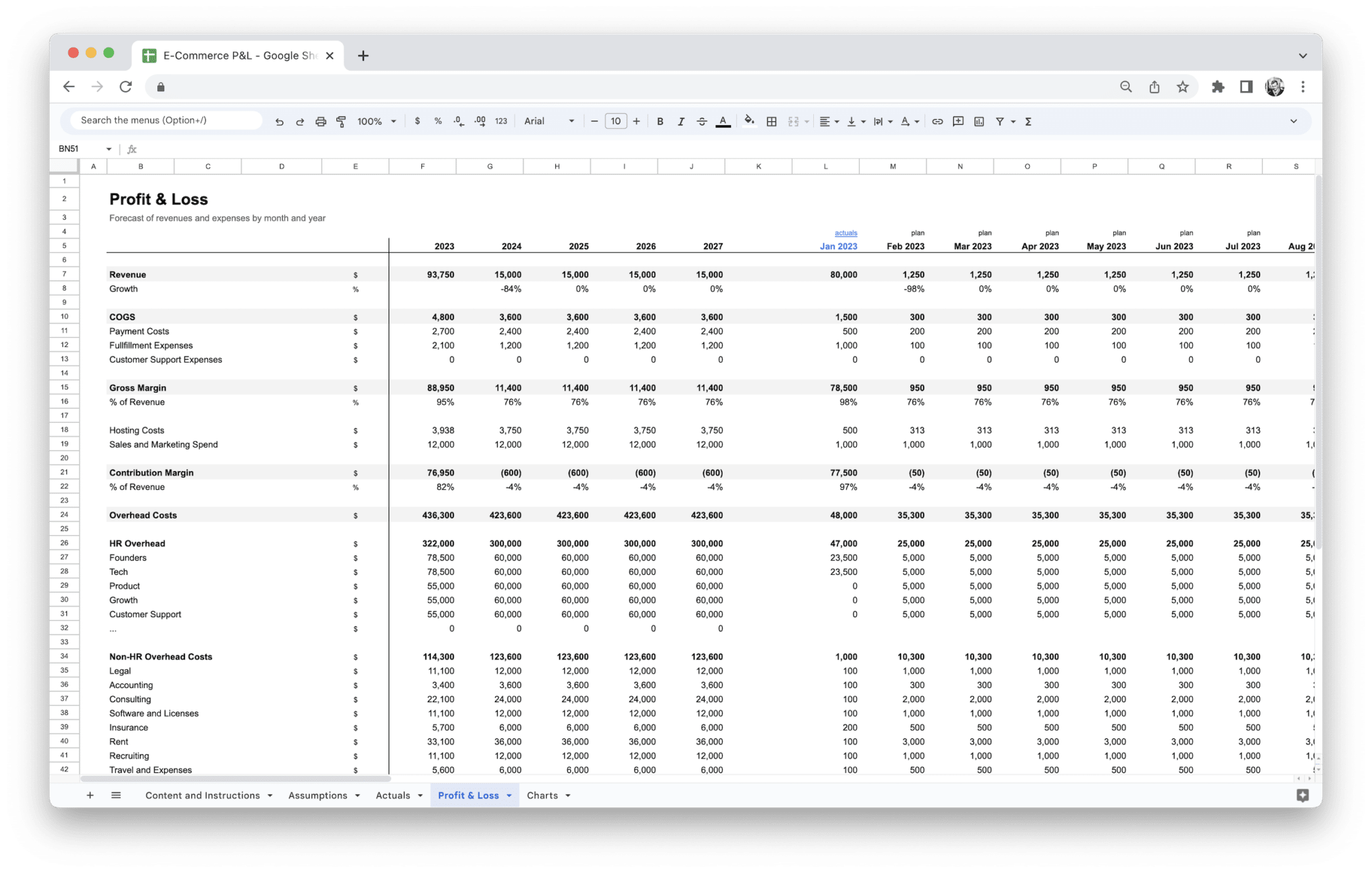

The Profit and Loss (P&L) Statement Template is a fundamental tool for evaluating a startup’s current financial performance. It provides a snapshot of the company’s revenue, costs, and overall profitability during a specific period.

Tailored variations of the Profit and Loss (P&L) Statement Template are available, including:

- Startup Profit and Loss Statement Template: The Startup P&L Statement Template specializes in evaluating the financial performance of early-stage ventures. It places a strong focus on metrics vital to startups, such as burn rate and runway analysis. This template equips venture capitalists to swiftly assess the financial viability of startups with limited historical data, streamlining the investment decision-making process for emerging businesses.

- SaaS Profit and Loss Statement Template: Tailored for Software as a Service (SaaS) companies, this P&L Statement Template delves deep into subscription-based metrics like Monthly Recurring Revenue (MRR) and Customer Acquisition Cost (CAC). It provides insights into the scalability and profitability of SaaS business models. Venture capitalists can leverage this template to assess the unique financial dynamics of subscription-based startups effectively.

- E-Commerce Profit and Loss Statement Template: The E-Commerce P&L Statement Template is designed for online retail ventures. It emphasizes e-commerce-specific metrics, including gross merchandise volume (GMV) and transaction processing costs. This template equips venture capitalists with the tools needed to evaluate the financial performance of e-commerce startups accurately, making it an invaluable resource for online retail investments.

- Marketplace Profit and Loss Statement Template: Marketplace businesses have distinctive financial intricacies, and this P&L Statement Template addresses them comprehensively. It focuses on metrics like commission revenue, user acquisition costs, and marketplace liquidity. Venture capitalists can use this template to assess investments in platforms connecting buyers and sellers, facilitating sound decision-making within the unique marketplace ecosystem.

Each version of the P&L Statement Template offers tailored insights and benefits, aligning with the specific financial dynamics of the industries or use cases they serve. Venture capitalists can leverage these templates to gain a deeper understanding of the startups they are evaluating, enabling more informed investment decisions in diverse sectors.

Components of the P&L Statement Template

- Revenue: This section outlines the startup’s total revenue, encompassing income generated from its core business activities.

- Cost of Goods Sold (COGS): COGS covers the direct costs related to producing goods or delivering services.

- Operating Expenses: This part encompasses all other expenses incurred in running the business, such as salaries, marketing, and rent.

- Net Profit/Loss: The P&L statement calculates the net profit or loss by subtracting expenses from revenue.

Benefits of the P&L Statement Template

- Performance Assessment: You can gauge the startup’s financial health by analyzing its revenue growth, profitability, and cost management.

- Historical Analysis: The template allows you to compare financial data over different periods, helping you identify trends and patterns.

- Decision Making: It aids in making informed investment decisions by providing a clear picture of the startup’s current financial situation.

Use Cases of the P&L Statement Template

- Initial Screening: Quickly assess whether a startup is financially viable before delving into a more detailed analysis.

- Quarterly Reporting: Monitor the financial performance of portfolio companies on an ongoing basis.

- Benchmarking: Compare a startup’s P&L statement with industry benchmarks to determine its competitiveness.

3. Revenue Forecasting Tool

Forecasting a startup’s future revenue is pivotal in venture capital evaluation. The Revenue Forecasting Tool is a specialized template designed to help you analyze and validate revenue projections provided by startups. It aids in assessing the feasibility of their revenue growth strategies.

Here are the available tailored versions of the Revenue Forecasting Tool:

- Agency Revenue Forecasting Tool: The Agency Revenue Forecasting Tool is geared towards marketing and advertising agencies. It caters to the unique dynamics of agencies’ revenue streams, such as retainer-based clients, project-based income, and variable campaign revenues. This tool empowers venture capitalists to evaluate the scalability and growth potential of agencies with precision, making it an invaluable asset for investments in the marketing sector.

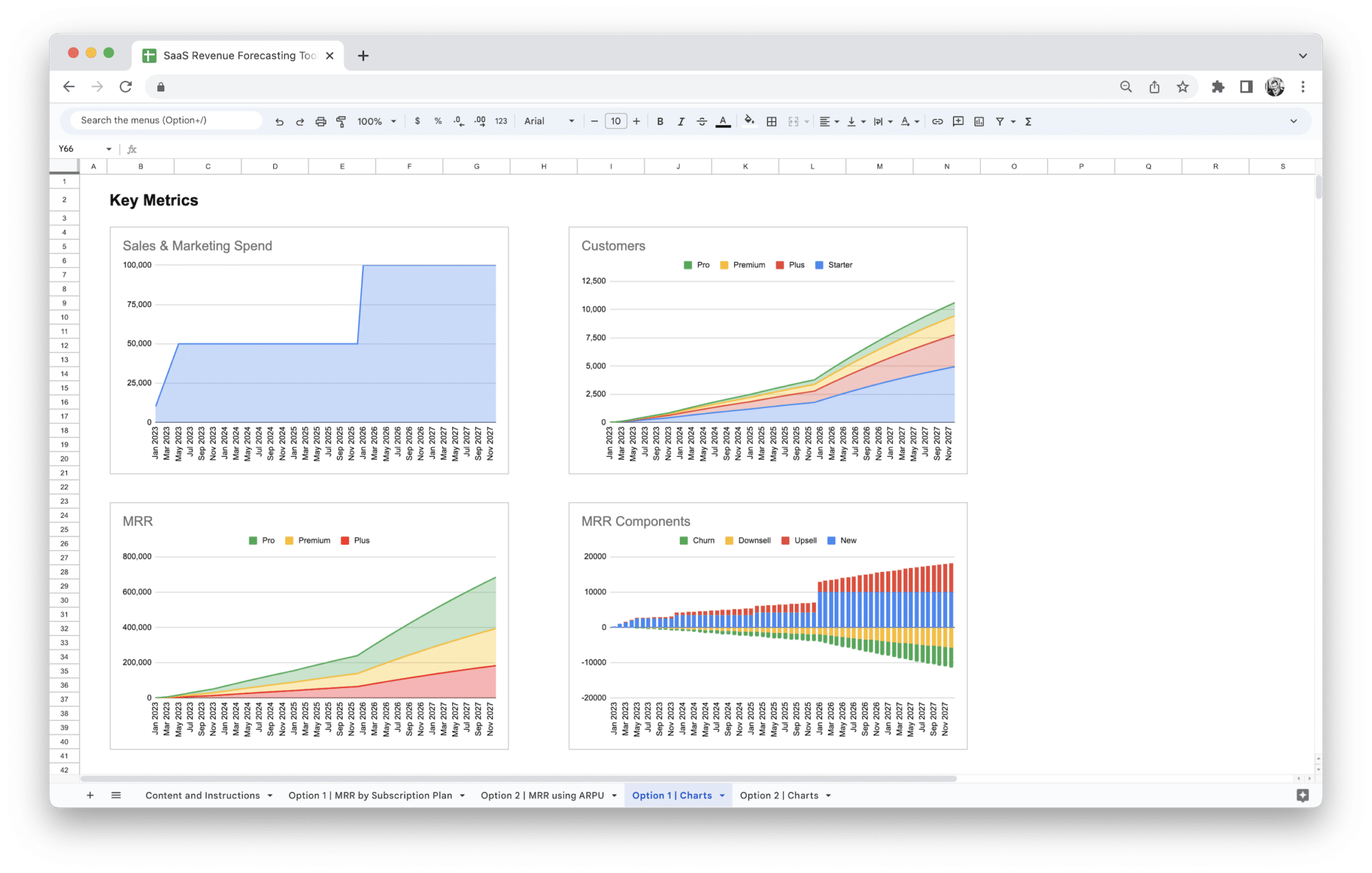

- SaaS Revenue Forecasting Tool: Designed for Software as a Service (SaaS) startups, this version of the Revenue Forecasting Tool focuses on subscription-based revenue models. It provides insights into Monthly Recurring Revenue (MRR), Churn Rate, and Expansion Revenue. Venture capitalists can leverage this tool to assess the sustainability and profitability of SaaS businesses, making it a key asset in evaluating subscription-driven startups.

- E-Commerce Revenue Forecasting Tool: The E-Commerce Revenue Forecasting Tool is tailored to online retail businesses. It considers e-commerce-specific factors, including seasonal sales variations, cart abandonment rates, and average order values. Venture capitalists can use this tool to gain a comprehensive understanding of the revenue potential of e-commerce startups, enabling more accurate assessment and investment decisions in the online retail sector.

- Marketplace Revenue Forecasting Tool: Marketplace startups operate within a distinct revenue ecosystem, and this Revenue Forecasting Tool is designed to address their specific needs. It focuses on commission-based revenue models, user acquisition costs, and marketplace transaction volumes. Venture capitalists can leverage this tool to assess investments in platforms connecting buyers and sellers, facilitating well-informed decision-making within the marketplace industry.

Each version of the Revenue Forecasting Tool caters to the unique revenue dynamics of the industries or use cases they serve. Venture capitalists can utilize these specialized templates to validate revenue projections, assess growth strategies, and make more informed investment decisions across diverse sectors.

Components of the Revenue Forecasting Tool

- Historical Revenue Data: Input the startup’s historical revenue data, including month-by-month or quarter-by-quarter figures.

- Growth Assumptions: Define assumptions that underlie the startup’s revenue projections, such as user acquisition rates, pricing changes, or expansion into new markets.

- Revenue Projections: The tool generates revenue forecasts based on historical data and growth assumptions.

- Sensitivity Analysis: Evaluate how changes in key variables, like customer churn or average transaction value, impact revenue projections.

Benefits of the Revenue Forecasting Tool

- Validation of Projections: Verify the accuracy and realism of a startup’s revenue forecasts to make well-informed investment decisions.

- Scenario Planning: Explore different growth scenarios to understand the startup’s potential performance in various market conditions.

- Risk Mitigation: Identify potential revenue bottlenecks and risks early on, allowing for proactive mitigation strategies.

Use Cases of the Revenue Forecasting Tool

- Early-Stage Startups: Assess the scalability and sustainability of revenue models for startups with limited revenue history.

- Investment Valuation: Determine a startup’s valuation by projecting its future revenue streams.

- Exit Strategy: Aid in planning exit strategies by predicting future revenue potential for acquisition or IPO discussions.

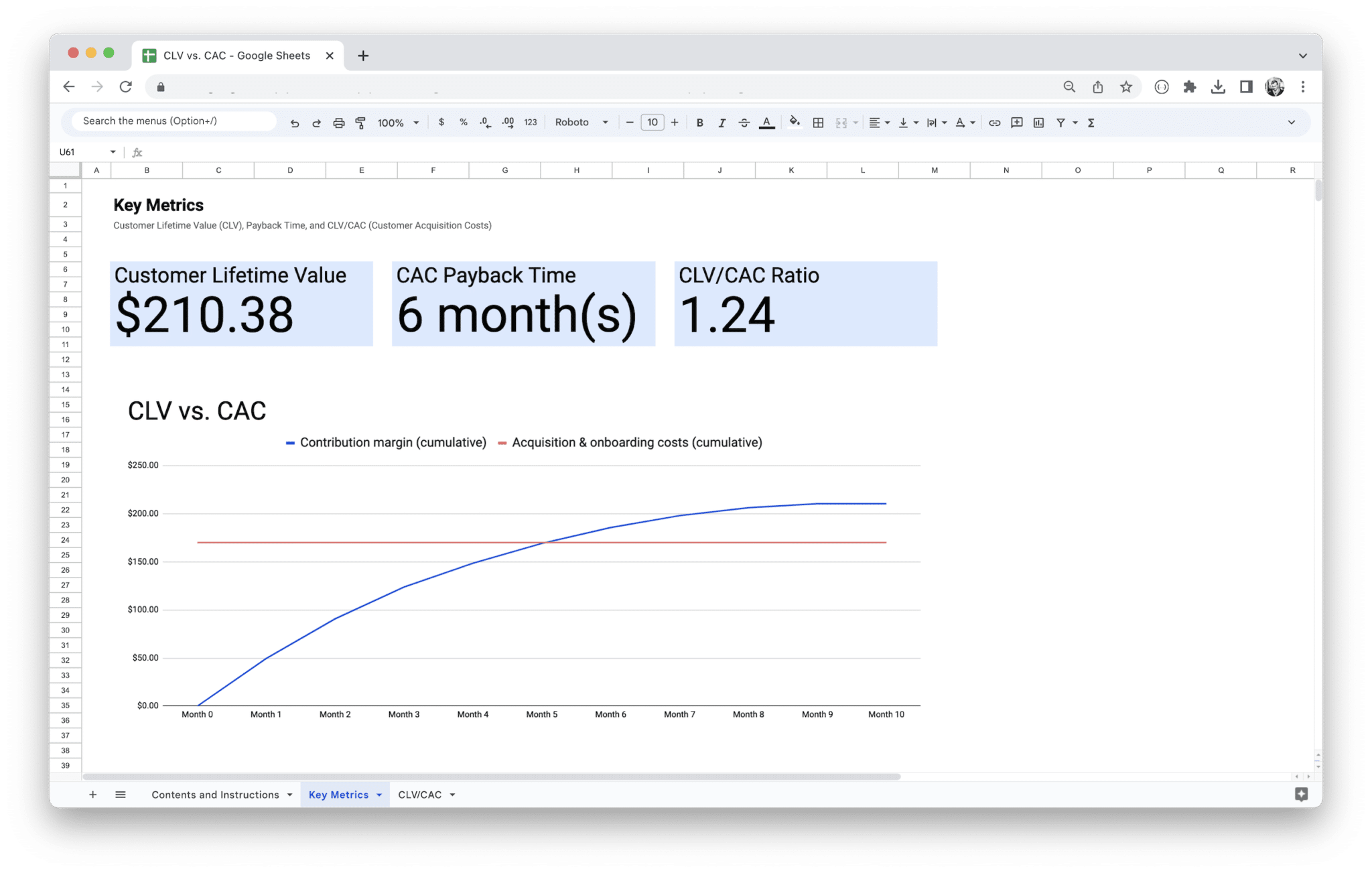

4. CLV vs. CAC Analysis Template

Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC) are critical metrics for evaluating the sustainability of a business model. The CLV vs. CAC Analysis Template provides a framework for assessing these metrics and their implications for your investment decisions.

Components of the CLV vs. CAC Analysis Template

- CLV Calculation: Calculate the Customer Lifetime Value by considering factors such as average purchase value, purchase frequency, and customer retention rate.

- CAC Calculation: Determine the Customer Acquisition Cost by including expenses related to marketing, advertising, and sales.

- CLV:CAC Ratio: Compute the ratio of CLV to CAC, indicating the efficiency of the startup’s customer acquisition strategy.

- Trends Analysis: Examine how CLV, CAC, and the CLV:CAC ratio change over time.

Benefits of the CLV vs. CAC Analysis Template

- Business Model Evaluation: Assess the scalability and profitability of a startup’s business model.

- Risk Assessment: Identify whether the startup is acquiring customers efficiently and whether it can maintain profitable customer relationships.

- Investment Prioritization: Prioritize investments based on the potential for long-term value creation.

Use Cases of the CLV vs. CAC Analysis Template

- SaaS Startups: Evaluate the efficiency of customer acquisition and retention strategies in subscription-based businesses.

- E-Commerce: Assess the profitability of acquiring and retaining customers in online retail ventures.

- Marketplaces: Analyze the economics of connecting buyers and sellers in marketplace business models.

These venture capital templates offer a holistic view of startup performance, enabling you to make informed investment decisions, optimize existing investments, and contribute to the growth and success of the startups in your portfolio.

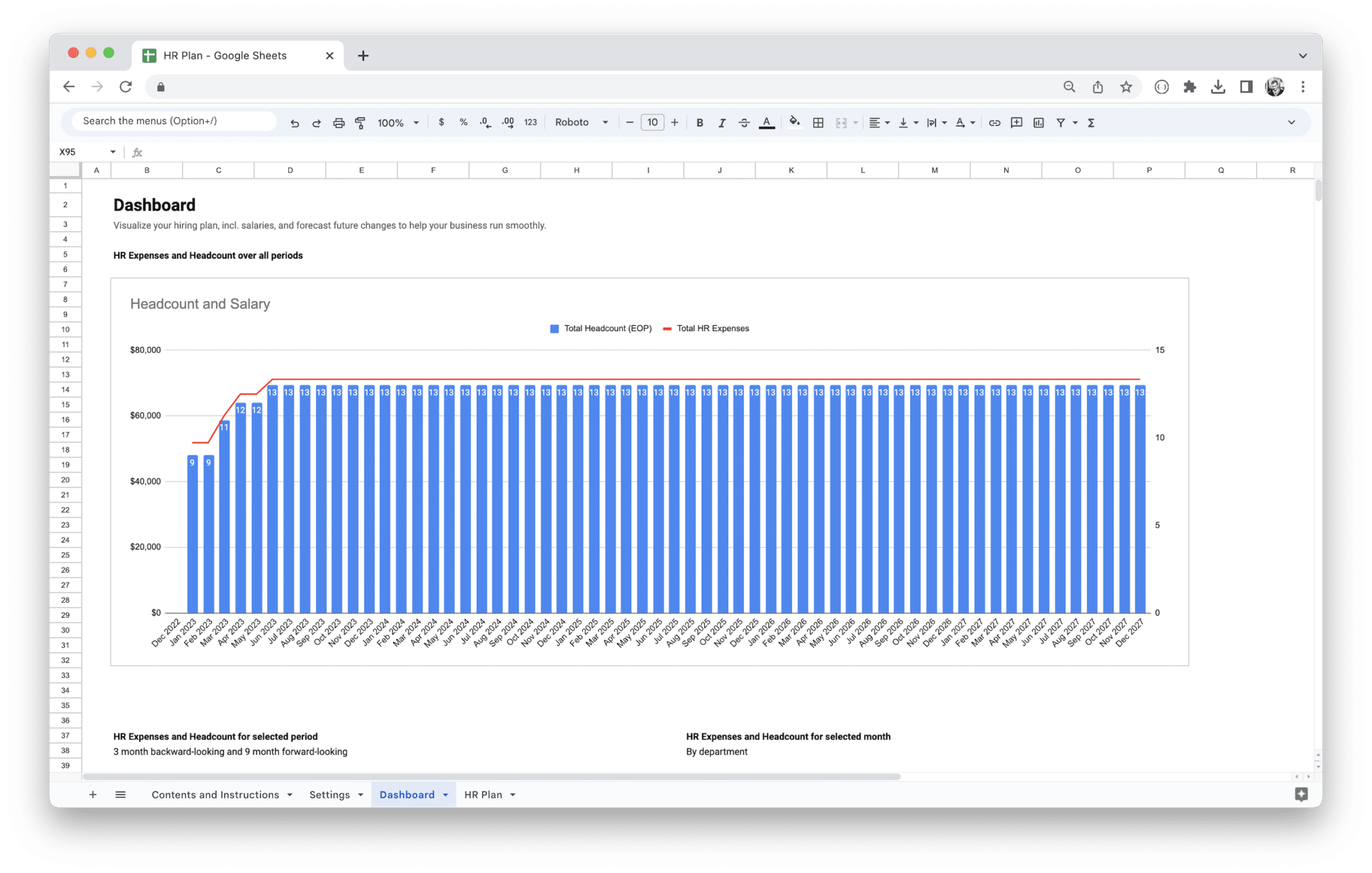

5. Workforce Planning Tool

Effective workforce planning is crucial for startups aiming to execute growth strategies efficiently. The Workforce Planning Tool provides a structured approach to managing human resources, ensuring that startups have the right talent in place. It simplifies the process of workforce planning, allowing venture capitalists to ensure that startups have the talent needed to achieve their growth objectives.

Components of the Workforce Planning Tool

- Current Workforce Overview: Provide an overview of the existing team, including roles, skills, and compensation.

- Future Hiring Needs: Identify the roles and skills required to execute the startup’s growth strategy.

- Budget Allocation: Allocate budget for new hires and determine the impact on the startup’s financials.

- Recruitment Timelines: Create timelines for recruitment and onboarding to ensure a seamless transition.

Benefits of the Workforce Planning Tool

- Talent Optimization: Ensure that startups have the right talent to achieve their growth objectives.

- Financial Planning: Align workforce expansion with budget constraints and revenue projections.

- Scalability: Facilitate the scaling of operations by planning for the timely addition of new team members.

Use Cases of the Workforce Planning Tool

- Early-Stage Startups: Plan for the growth of teams as startups secure funding and expand.

- Portfolio Management: Assist portfolio companies in optimizing their workforce to meet growth targets.

- Resource Allocation: Determine the allocation of human resources based on strategic priorities and market demands.

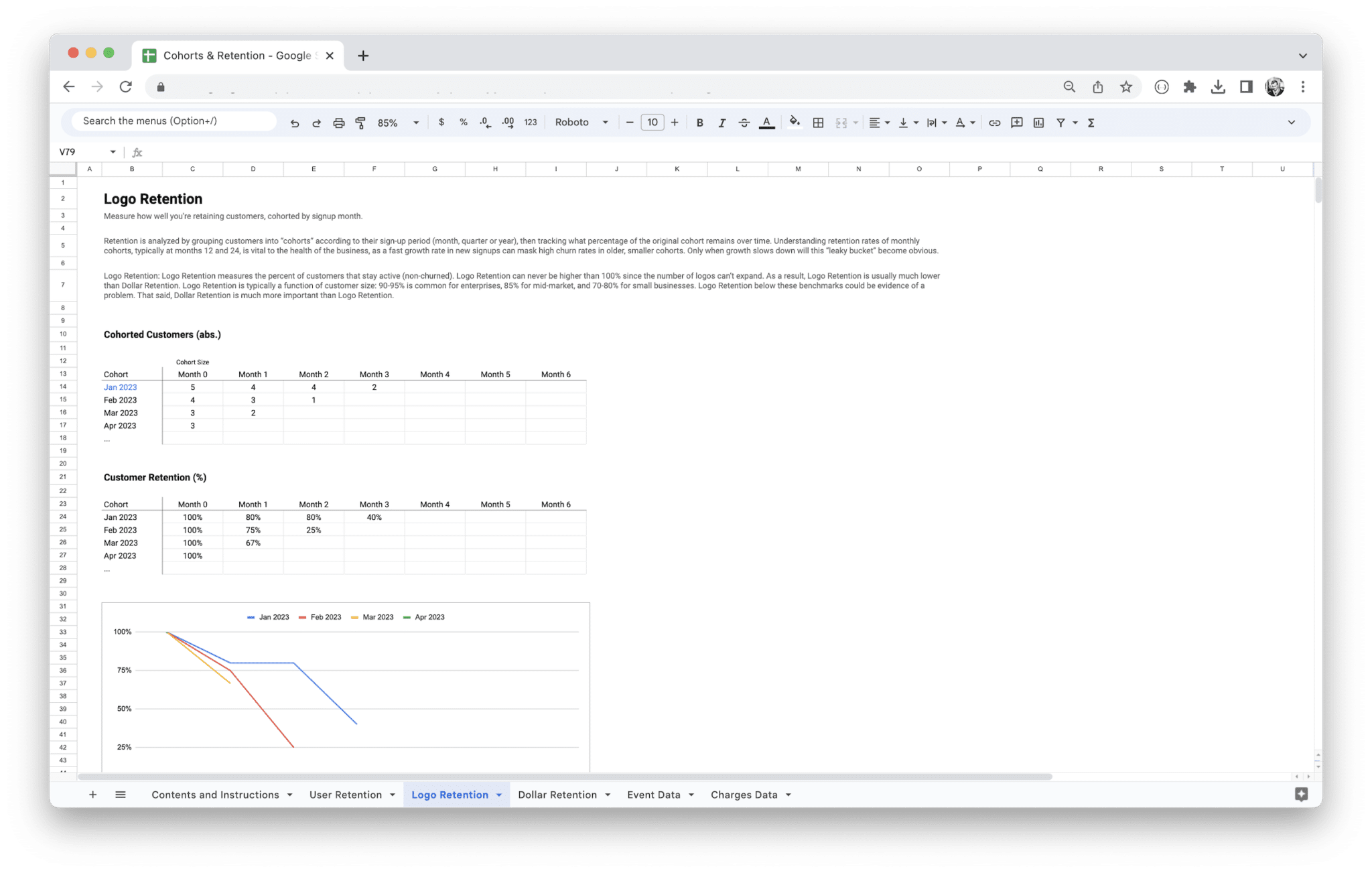

6. Cohort Analysis Template

Venture capitalists understand the importance of analyzing customer behavior to assess a startup’s sustainability and growth potential. The Cohort Analysis Template is your ally in this endeavor, offering valuable insights into how different groups of customers evolve over time.

Cohort analysis involves grouping customers based on shared characteristics like the month they made their first purchase or signed up. The Cohort Analysis Template simplifies this process, providing a structured framework to track and evaluate the performance of these customer cohorts.

Components of the Cohort Analysis Template

- Cohort Segmentation: Define cohorts based on criteria such as acquisition date, location, or any other relevant characteristic.

- Retention Analysis: Assess how well each cohort retains customers over time, shedding light on customer loyalty and churn patterns.

- Behavioral Metrics: Dive into specific metrics for each cohort, such as average transaction value, purchase frequency, and Customer Lifetime Value (CLV).

- Visualizations: Utilize graphs and charts to visualize cohort trends, making it easier to spot patterns and make data-driven decisions.

Benefits of the Cohort Analysis Template

- Customer Behavior Insights: Gain a deeper understanding of how different customer segments evolve and engage with a startup’s products or services.

- Churn Identification: Pinpoint when and why certain cohorts of customers are more likely to churn, allowing for proactive retention strategies.

- Personalized Marketing: Tailor marketing campaigns and product improvements to cater to the unique needs of different customer cohorts.

Use Cases of the Cohort Analysis Template

- SaaS Startups: Analyze user cohorts to understand how feature releases impact user retention.

- E-Commerce: Assess how cohorts of customers respond to seasonal promotions and discounts.

- Marketplaces: Track how cohorts of sellers or buyers engage with the platform and identify areas for improvement.

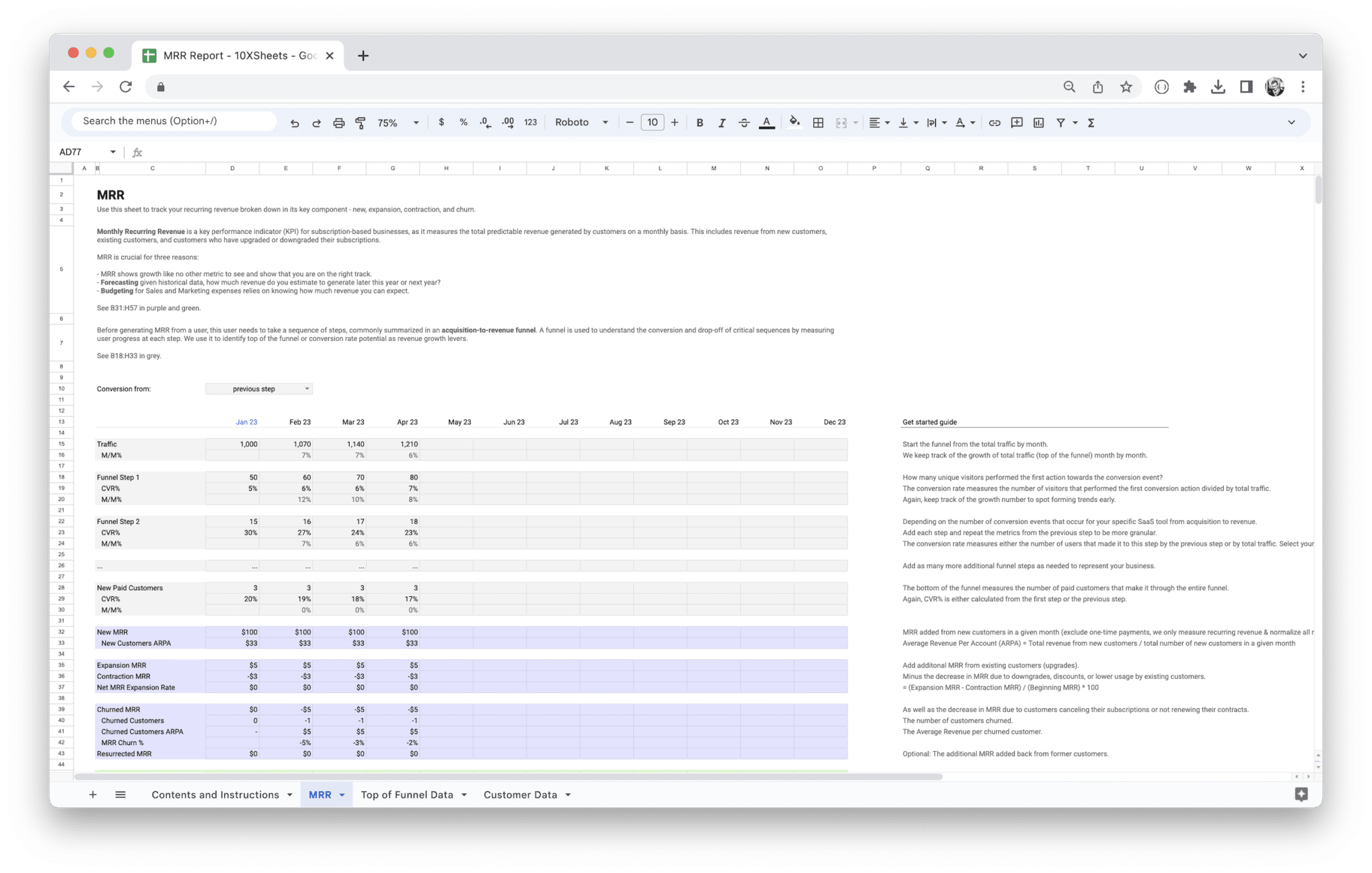

7. MRR Dashboard Template

For venture capitalists investing in Software as a Service (SaaS) startups, Monthly Recurring Revenue (MRR) is a critical metric that reflects the stability and growth of the business. The MRR Dashboard Template is designed to provide a comprehensive overview of MRR trends and performance. It simplifies the process of monitoring and analyzing MRR data, allowing venture capitalists to make data-driven decisions regarding their SaaS investments.

Components of the MRR Dashboard Template

- MRR Metrics: Display key MRR metrics, including Total MRR, New MRR, Expansion MRR, Contraction MRR, and Churned MRR.

- Visualizations: Utilize charts and graphs to visualize MRR trends over time, enabling you to spot anomalies and growth patterns.

- Churn Analysis: Dive into the reasons behind customer churn, whether it’s due to lost customers or downgrades in subscriptions.

- Growth Projections: Use historical data to make informed predictions about future MRR growth and set targets.

Benefits of the MRR Dashboard Template

- MRR Visibility: Gain a real-time view of the startup’s recurring revenue and its components, helping you assess financial stability.

- Churn Analysis: Understand the factors contributing to churn, allowing for targeted retention efforts.

- Growth Planning: Make data-driven decisions regarding scaling the business based on MRR trends.

Use Cases of the MRR Dashboard Template

- SaaS Startups: Monitor and manage the MRR of subscription-based software products.

- Investor Reporting: Provide investors with a clear picture of MRR growth and stability.

- Scaling Strategies: Determine when and how to scale operations based on MRR performance.

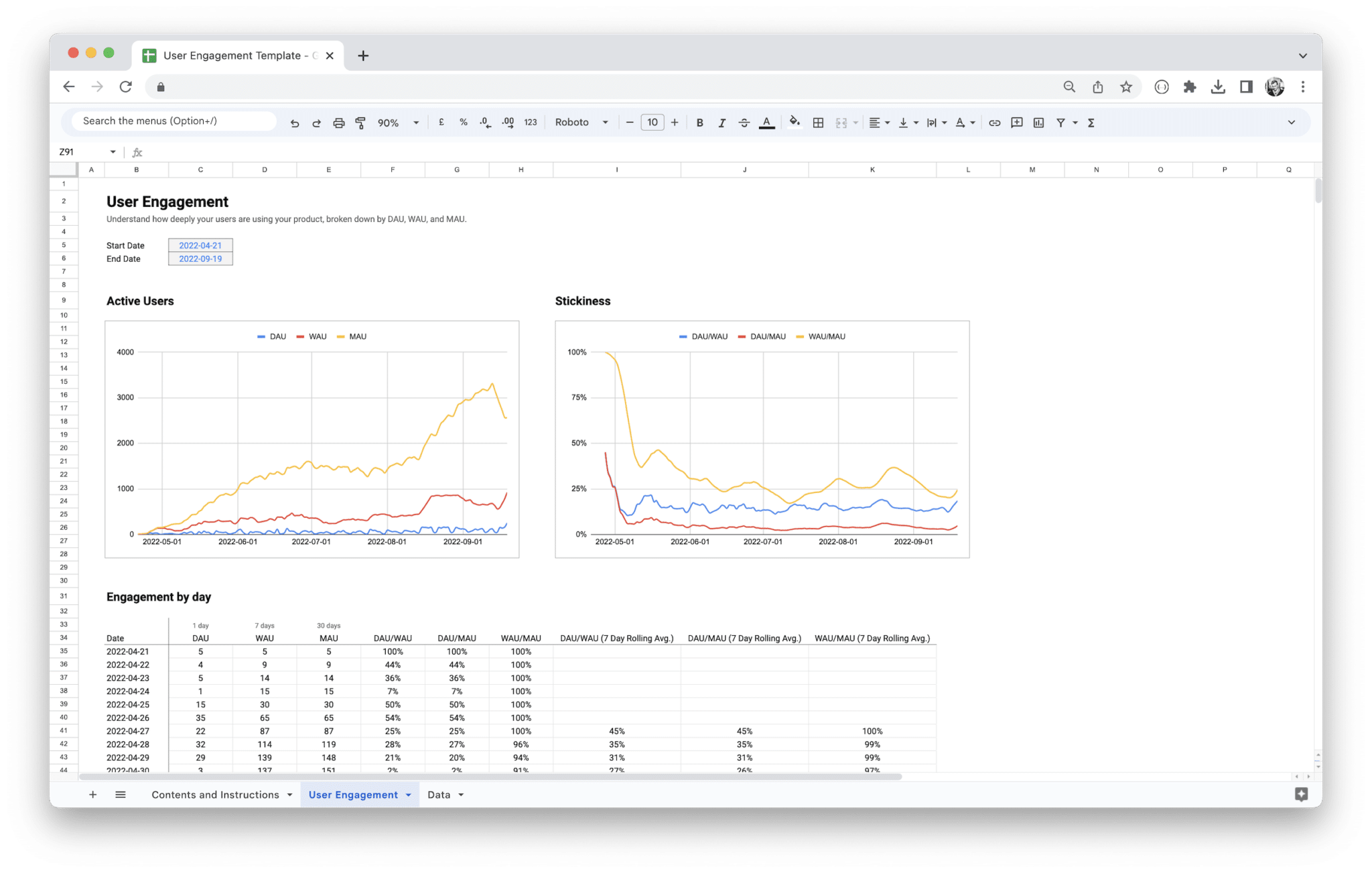

8. User Engagement Dashboard Template

User engagement is a critical factor for venture capitalists evaluating startups, particularly in industries like SaaS, E-Commerce, or Marketplaces. The User Engagement Dashboard Template empowers you to assess how effectively a startup retains and engages its users. It simplifies the process of monitoring and analyzing key user engagement metrics, helping venture capitalists make informed investment decisions.

Components of the User Engagement Dashboard Template

- User Engagement Metrics: Display key engagement metrics, including Monthly Active Users (MAU), Daily Active Users (DAU), User Retention Rate, and Conversion Rates.

- Visualizations: Utilize charts and graphs to visualize user engagement trends, highlighting areas of improvement or success.

- A/B Testing Insights: Incorporate data from A/B tests to understand the impact of product changes on user behavior.

- Segmentation: Segment users based on characteristics such as usage frequency, location, or demographics to tailor engagement strategies.

Benefits of the User Engagement Dashboard Template

- User Retention: Monitor and improve user retention rates by identifying engagement bottlenecks.

- Product Enhancement: Use data-driven insights to prioritize product or service improvements that enhance user engagement.

- Personalized Marketing: Tailor marketing campaigns to specific user segments to boost engagement and conversion.

Use Cases of the User Engagement Dashboard Template

- SaaS Startups: Analyze user engagement to optimize onboarding processes and feature adoption.

- E-Commerce: Identify user behavior patterns that lead to higher conversion rates and repeat purchases.

- Marketplaces: Evaluate the stickiness of the platform by tracking user engagement and retention.

These venture capital templates offer a holistic view of startup performance, enabling you to make informed investment decisions, optimize existing investments, and contribute to the growth and success of the startups in your portfolio.

How to Use Venture Capital Templates?

Now that you’re familiar with the essential venture capital templates, let’s explore how to effectively incorporate them into your investment evaluation process. These templates are powerful tools, but using them correctly is key to deriving meaningful insights.

How to Utilize Venture Capital Templates?

Utilizing venture capital templates can be a straightforward process when you follow a structured approach. Here’s a step-by-step guide to get the most out of these tools:

- Gather Data: Begin by collecting the necessary data for the specific template you plan to use. This may include historical financial data, customer behavior data, or workforce information.

- Input Data Accurately: Ensure that you accurately input all data into the template. Any inaccuracies at this stage can lead to misleading results.

- Customize Assumptions: Templates often allow you to make assumptions about future growth, costs, or other variables. Customize these assumptions based on your analysis and market insights.

- Run Projections: Activate the template’s calculations or formulas to generate projections, metrics, and visualizations. Review the results carefully.

- Interpret Results: Analyze the generated data and insights. Look for trends, anomalies, or areas that require further investigation.

- Scenario Analysis: Explore different scenarios by adjusting key variables within the template. Assess how changes impact the startup’s outlook.

- Benchmarking: Compare the startup’s performance and metrics with industry benchmarks or competitors where applicable.

- Iterate and Refine: Templates are dynamic tools. Use the feedback from your analysis to refine your inputs and assumptions for a more accurate evaluation.

- Communicate Findings: Share the findings and insights with your investment team or stakeholders, using the template’s visualizations and reports for clarity.

- Make Informed Decisions: Finally, use the template-generated insights as part of your overall decision-making process. Templates are tools to aid judgment, not replace it.

Best Practices for Template Implementation

Implementing venture capital templates effectively requires adherence to best practices. Here are some key guidelines to consider:

- Data Quality: Ensure the accuracy and reliability of the data you input into the templates. Garbage in, garbage out applies here.

- Assumption Validation: Continually validate the assumptions used in your templates. Market conditions change, and assumptions should reflect these changes.

- Collaborative Approach: Encourage collaboration among team members when using templates. Different perspectives can lead to more comprehensive evaluations.

- Documentation: Keep a record of your inputs, assumptions, and the rationale behind your choices. This aids in transparency and future reference.

- Regular Updates: Templates should not be static. Update them regularly to reflect changing circumstances and new data.

Common Pitfalls to Avoid

While templates can streamline your analysis, they can also lead to pitfalls if not used carefully. Here are common pitfalls to watch out for:

- Overreliance on Templates: Don’t treat templates as infallible. Always use your judgment and consider the broader context.

- Ignoring Qualitative Factors: Templates focus on quantitative data, but qualitative factors such as team dynamics, market conditions, and competitive landscape are equally important.

- Assumption Neglect: Assumptions in templates should be scrutinized and adjusted when necessary. Ignoring them can lead to flawed conclusions.

- Data Overload: Avoid the temptation to include excessive data points that may not contribute meaningfully to your analysis.

- Lack of Context: Templates provide data, but they don’t always offer context. Make sure to interpret the data in light of the startup’s unique circumstances.

- Static Analysis: Don’t treat your templates as one-time tools. Regularly revisit and update your analysis as new data becomes available.

By following these steps, best practices, and avoiding common pitfalls, you can effectively leverage venture capital templates to make well-informed investment decisions and contribute to the success of the startups in your portfolio.

Conclusion

Venture capital templates are your invaluable allies in the world of startup investments. They offer a structured, data-driven approach that not only saves time but also enhances the quality of your investment decisions. Whether you’re assessing financial projections, customer behavior, or workforce planning, these templates empower you to make informed choices that can shape the future of startups and maximize returns on your investments.

As you embark on your venture capital journey armed with these templates, remember that adaptability is key. The startup landscape is ever-changing, and templates provide a solid foundation for analysis, but they should be complemented by your judgment, industry insights, and a willingness to explore innovative solutions. With these tools in hand, you’re well-equipped to navigate the complexities of venture capital, support the growth of promising startups, and ultimately contribute to the success stories of tomorrow.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.